TIDMCRS

RNS Number : 2012Q

Crystal Amber Fund Limited

26 October 2021

26 October 2021

CRYSTAL AMBER FUND LIMITED

("Crystal Amber Fund" or the "Fund")

Monthly Net Asset Value

Crystal Amber Fund announces that its unaudited net asset value

("NAV") per share at 30 September 2021 was 152.85 pence (31 August

2021: 138.78 pence per share). Over the quarter, NAV per share

increased by 4.1 per cent and by 5.8 per cent. reflecting the

dividend payment. Since 30 September 2020, NAV increased by 42.1

per cent and by 46.8 per cent. reflecting dividend payments.

The proportion of the Fund's NAV at 30 September 2021

represented by the five largest shareholdings, other investments

and cash (including accruals), was as follows:

Five largest shareholdings Pence per share Percentage of investee equity

held

------------------------------------- ---------------- ------------------------------

De La Rue plc 49.0 11.4%

Equals Group plc 29.3 21.4%

*GI Dynamics Inc. 24.6 *

Hurricane Energy plc 21.7 25.9%

Allied Minds plc 11.9 18.5%

Total of five largest shareholdings 136.5

Other investments 15.7

Cash and accruals 0.6

------------------------------------- ----------------

Total NAV 152.8

------------------------------------- ----------------

* GI Dynamics Inc. is a private company and their shares are not

listed on a stock exchange. Therefore, the percentage held is not

disclosed.

Hurricane

Hurricane is an oil exploration and production company targeting

naturally fractured basement reservoirs in the West of Shetland.

The Fund has been an investor in Hurricane since 2013 and has to

date realised profits of GBP43 million.

Following the High Court's refusal to sanction the previous

Hurricane board's attempt to force through a highly dilutive debt

for equity swap, in August 2021, after a further request from

Crystal Amber, Hurricane finally launched a tender offer for up to

50% of its outstanding bonds. Allocating up to $80 million of its

cash, initially the tender was priced at up to 72 cents, but this

was increased to 78 cents. Ultimately, Hurricane purchased just

over one third of the bonds in issue, reducing Hurricane's capital

and interest obligations by approximately $22 million. This

represents an important and material saving. Without the Fund's

successful intervention at the High Court, the Fund believes this

would not have happened.

Production information from Hurricane is that for September

2021, its P6 well produced an average of 10,642 barrels per day.

This compares well with the company's production forecasts

(released in May 2021) estimating production for the month at 9,400

barrels per day. Production for June, July and August were also

ahead of forecast. The Fund estimates that simply beating

production forecasts is now generating approximately $36 million

per annum in additional revenue.

For the six months to 30 June 2021, Hurricane generated $75.9

million of operating cash flow with a cash production cost of $24.8

per barrel. At anticipated production levels, the Fund estimates

that by 30 June 2022, 2.6 million barrels will be produced,

generating more than $200 million in revenue. Based on Hurricane's

management production forecasts, the Fund estimates that the

remaining bonds due for repayment in July 2022 will be redeemed at

par and at that time, net cash will be around $40 million.

Thereafter, by March 2024, the P6 well should yield a further 4.9

million barrels and generate revenues of $350 million. Based on

historic margins, this should generate around $175 million of

operating cash flow to Hurricane.

The Fund notes that Hurricane is evaluating options to bolster

production from the Lancaster field, as well as pathways towards

development of the substantial Lincoln discovery asset. The Fund

believes that in addition to the existing P6 well, substantial

quantities of oil can be recovered from the Hurricane

portfolio.

In September 2021, the Fund wrote to the board of Hurricane to

request under Article 92, that a committee (comprising of the

non-executive directors) be established with the mandate to

investigate what happened as regards the previous board's proposed

financial reconstruction and to engage external advisers (should

that be needed) for that purpose. The committee would then make a

recommendation to the board.

Since September 2020 (when the convertible bond was trading at a

70 per cent. discount), Crystal Amber has urged Hurricane to use a

significant proportion of its cash to buy in bonds. The High Court

of Justice stated that "the possibility of buying back bonds in the

market is, on the face of it, an attractive one, given that the

Bonds have been trading at a substantial discount to face value".

The Fund estimates that had the buyback been carried out in

November 2020 and if two thirds of bond holders had sold at a 55

per cent premium to the prevailing market price, approximately $94

million of capital and interest could have been saved. Together

with the $17 million spent on a restructuring plan that both

Crystal Amber and more importantly the High Court found to be

inappropriate, the Fund estimates that the Company has suffered

losses of approximately $111 million, equivalent to more than 4p a

share. The Fund believes that an investigation should determine

grounds for redress and recoverability of this amount.

The Fund also notes the potential for shareholders to benefit

from Hurricane's taxation position. At 31 December 2020, Hurricane

had ring-fenced trading losses of $468.7 million and supplementary

charge losses and investment allowances of $707.8 million. In

addition, capital allowance pools of $383.5 million were available

to be used against ring-fenced trading profits. The Fund has asked

Hurricane to assess the financial implications of these tax losses

and allowances in the event of a corporate transaction. The Fund

believes that the quantum may be very substantial.

Over the last year, the Fund has increased its shareholding in

Hurricane from 11.6 per cent to more than 27 per cent. 12 months

ago, the price of Brent Crude was $37.50 a barrel. It is now $85 a

barrel. With production now running at more than 3.5 million

barrels per annum, the Fund believes that Hurricane's prospects

have been transformed.

Equals Group plc ("Equals")

Equals is an e-banking and international payment services

provider. It serves retail and business customers mainly in the

United Kingdom under an e-money licence. Equals provides faster,

cheaper and more convenient money management than traditional

banking services with bank-grade UK domestic clearance.

Equals' proposition to SMEs is compelling relative to that

offered by legacy banks. The company's assets include over one

million customers, an upgraded technology platform and licences and

industry relationships built over many years.

The record start to Q3-2021 that Equals reported at the time of

its Interim Results announcement issued on 14 September 2021 was

sustained throughout the remainder of the Period, generating

revenues of GBP11.7 million. This represents a 33% run-rate

increase on the prior quarter (Q2-2021: GBP8.8m); a 62% increase on

the prior year comparative period (Q3-2020 GBP7.2m); and a 47%

increase on the pre-Covid comparative period (Q3-2019.

GBP8.0m).

Revenue growth was broad based across all products augmented by

the strong demand for the 'Equals Solutions' proposition, the new

multicurrency product aimed at larger businesses.

The Fund believes that for the year to December 2022, Equals can

deliver EPS of more than 5p. With GBP10 million of net cash and

operating cash flow now building, Equals is ideally positioned to

be a part of FinTech consolidation.

For further enquiries please contact:

Crystal Amber Fund Limited

Chris Waldron (Chairman)

Tel: 01481 742 742

www.crystalamber.com

Allenby Capital Limited - Nominated Adviser

David Worlidge/Liz Kirchner

Tel: 020 3328 5656

Winterflood Investment Trusts - Broker

Joe Winkley/Neil Langford

Tel: 020 3100 0160

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein

Tel: 020 7478 9080

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVBCBDGBUDDGBU

(END) Dow Jones Newswires

October 26, 2021 02:00 ET (06:00 GMT)

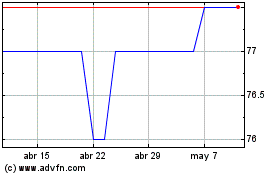

Crystal Amber (LSE:CRS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Crystal Amber (LSE:CRS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024