TIDMDPEU

RNS Number : 0270Q

DP Eurasia N.V

25 October 2021

For Immediate Release 25 October 2021

Shareholder Update

DP Eurasia N.V.

(DP Eurasia or the Company, and together with its subsidiaries,

the Group)

On 30 September 2021, Jubilant Foodworks Netherlands B.V.

(Jubilant), a wholly owned subsidiary of Jubilant Foodworks

Limited, announced its intention to buy ordinary shares (Shares) in

the Company from a targeted subset of shareholders that would

result in Jubilant owning up to 49.99% in the Company via a reverse

bookbuild (RBB), which closes at 4.30pm (London) on 29 October

2021. A committee of the board of the Company was formed (the

Committee), comprising the Chairman of the Board of DP Eurasia,

Peter Williams, and the Senior Independent Non-Executive Director,

David Adams, to evaluate the fairness of the terms of the RBB for

all shareholders.

Whilst evaluation of the fairness of the RBB continues, the

Company, acting through the Committee, highlights two risks for

shareholders:

-- The RBB presents a risk, albeit low, but one over which the

Company has no control as to final outcome, that the Company could

be de-listed from the London Stock Exchange's Main Market without

offering an opportunity to all shareholders to exit through the

RBB. The risk of de-listing exists in any circumstance where a

controlling shareholder seeks to increase its shareholding if not

mindful of the free float. In other such circumstances it would be

typical for all shareholders to be offered an exit, albeit there

are currently no assurances from Jubilant that were such a

situation to occur, that they would provide such an opportunity.

Any such de-listing would not be immediate, and there is a course

of events that could transpire that might avoid a de-listing, or

could result in the Company transferring to an alternative market

which has lower free float requirements - but again, none of these

events are ones over which the Company has ultimate control or

certainty as to outcome.

-- Whilst Jubilant has stated its intention not to make any

public offer to all shareholders for the whole of the Company

following the six-month period following completion of the RBB, the

Company notes that this intention is not binding. Neither Jubilant

nor its parent has given any commitment to refrain from making

other purchases, on or off market, at any time, which provides a

pathway for Jubilant to increase its stake to that of a controlling

interest. The Company would like to make it clear to all of its

shareholders that any such further acquisition would offer no

protection for minority investors as would be afforded if the

Company were subject to the UK or Dutch Takeover regime - unless

Jubilant were to agree to this. There is no guarantee that any

further acquisitions would be addressed by way of an offer to all

holders. Any such continued stake-building by Jubilant, magnifies

the risk of de-listing.

As previously notified to the Company's shareholders in its

Annual Report for the years ended 31 December 2019 and 2020, the UK

takeover regime does not apply to the Company and, consequently,

the risk of de-listing, and the prejudice that could be caused to

those who do not tender, or who are scaled back pursuant to the

terms of the RBB, or to whom the RBB is not addressed, is

accentuated.

The Company (through the Committee) have attempted to seek

assurance, for the benefit of all shareholders, from Jubilant to

address these risks, but none has to date been forthcoming. In the

absence of any such reassurance, and given the consequences of any

such risks materialising, the Company (acting through the

Committee) is mindful that shareholders should in this context be

fully informed prior to exercising any right to tender, or indeed

any right to withdraw from the tender as may be available to them

under the terms of the RBB.

The Company (through the Committee) intends to provide a further

update which it expects to provide before the market opens (London)

on 28 October 2021.

In the meantime the Company (through the Committee) continues to

seek both to engage constructively with Jubilant and to act in the

interests of all shareholders.

Enquiries

DP Eurasia N.V.

Selim Kender, Chief Strategy Officer &

Head of Investor Relations +90 212 280 9636

Buchanan (Financial Communications)

Richard Oldworth / Victoria Hayns / Tilly +44 20 7466 5000

Abraham / Verity Parker dp@buchanan.uk.com

Liberum (Financial Adviser and Corporate

Broker)

M&A: Tim Medak/Mark Harrison

Corporate Broking: Andrew Godber/Edward

Thomas +44 20 3100 2000

Notes to Editors

DP Eurasia N.V. is the exclusive master franchisee of the

Domino's Pizza brand in Turkey, Russia, Azerbaijan and Georgia. The

Company was admitted to the premium listing segment of the Official

List of the Financial Conduct Authority and to trading on the main

market for listed securities of the London Stock Exchange plc on 3

July 2017. The Company (together with its subsidiaries, the

"Group") is the largest pizza delivery company in Turkey and the

third largest in Russia. The Group offers pizza delivery and

takeaway/ eat-in facilities at its 789 stores (584 in Turkey, 192

in Russia, nine in Azerbaijan and four in Georgia as at 30 June

2021), and operates through its owned corporate stores (28%) and

franchised stores (72%). The Group maintains a strategic balance

between corporate and franchised stores, establishing networks of

corporate stores in its most densely populated areas to provide a

development platform upon which to promote best practice and

maximise profitability. The Group has adapted the Domino's Pizza

globally proven business model to its local markets.

Important Notices

Liberum Capital Limited (Liberum), which is authorised and

regulated in the United Kingdom by the FCA, is acting as financial

adviser exclusively for the Company and no one else in connection

with the matters set out in this announcement and will not regard

any other person as its client in relation to the matters set out

in this announcement and will not be responsible to anyone other

than the Company for providing the protections afforded to clients

of Liberum, nor for providing advice in relation to the contents of

this announcement or any other matter referred to herein. Neither

Liberum nor any of its subsidiaries, branches or affiliates owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Liberum in

connection with this announcement, any statement contained herein

or otherwise. Neither Liberum nor any of its affiliates nor any of

their respective directors, officers, employees, advisers or agents

accepts any responsibility or liability whatsoever for, or makes

any representation or warranty, express or implied, as to, the

truth, accuracy or completeness of the information in this

announcement (or whether any information has been omitted from the

announcement) or any other information relating to the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDKQBDKBDBAKB

(END) Dow Jones Newswires

October 25, 2021 02:00 ET (06:00 GMT)

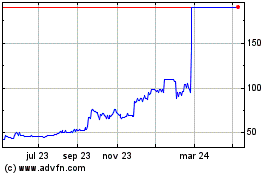

Dp Eurasia N.v (LSE:DPEU)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Dp Eurasia N.v (LSE:DPEU)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024