TIDMDKL

RNS Number : 3785M

Dekel Agri-Vision PLC

21 September 2021

Dekel Agri-Vision Plc / Index: AIM / Epic: DKL / Sector: Food

Producers

Dekel Agri-Vision Plc ('Dekel' or the 'Company')

2021 Interim Results and Shareholder Call

Dekel Agri-Vision Plc, the West Africa-focused agriculture

company, is pleased to announce its interim results for the six

months ended 30 June 2021.

The Company will be hosting a shareholder conference call at 2pm

UK time on 28 September 2021. The call will be hosted by Executive

Director, Lincoln Moore and Deputy CEO Shai Kol, who will discuss

the interim results and provide an update on activity across its

portfolio of projects. Further information about the call can be

found at the end of this announcement, as well as in the

presentation, which will be uploaded to the corporate website prior

to the conference call.

Key Highlight s

Palm Oil Operation

-- Record H1 2021 Revenue of EUR21.7m, an increase of 40.9% compared to H1 2020

-- Record H1 2021 EBITDA of EUR3.9m, an increase of 105.3% compared to H1 2020

-- A near record H1 2021 Net Profit of EUR2.0m, an increase of

400% compared to H1 2020. An excellent result given this included

pre-production cashew operating expenses for the first time, in

addition to timing issues which resulted in a higher than normal

CPO inventory being sold post period end.

Cashew Project

-- Construction of the cashew processing plant has made huge

strides in H1 2021. We are on the cusp of first production within

the next 50 days, with the commissioning phase now also

commenced

Financial Overview

As set out in the table below - the Company's first half

financial performance has been excellent, particularly when set

against the backdrop of COVID-19.

H1 2021 H1 2020 % change

Revenue EUR21.7m EUR15.4m 40.9%

---------- ---------- ---------

Gross Margin EUR4.9m EUR2.6m 88.4%

---------- ---------- ---------

Gross Margin % 22.6% 16.8% 34.5%

---------- ---------- ---------

G&A (EUR1.7m) (EUR1.4m) -21.4%

---------- ---------- ---------

EBITDA EUR3.9m EUR1.9m 105.3%

---------- ---------- ---------

Net profit / (loss)

after tax EUR2.0m EUR0.4m 400.0%

---------- ---------- ---------

Production - palm oil project, Ayenouan Côte d'Ivoire

-- A very strong first-half year of global Crude Palm Oil

('CPO') prices and an improvement in CPO volumes produced and sold

during H1 2021 drove the material improvement in results

-- 35.7% increase in average realised sales price of EUR817 per tonne of CPO (H1 2020: EUR602)

o CPO prices rallied strongly during the first half to around a

10-year high. Current prices post 30 June 2021 remain even higher

than the price average of H1 2021, with current prices being

achieved of over EUR900 per tonne

-- 26,515 tonnes of CPO produced in first half, 11.0% higher

than H1 2020 production of 23,882 tonnes. We believe this is due to

the stabilisation of operations and logistics following the peak

Covid-19 disruption in H1 2020

-- The extraction rate remained solid at 21.4%, although below

H12020 result of 22.5% due to lower oil content in the Fresh Fruit

Bunches ('FFB')

-- 3.7% increase in CPO sales of 24,784 tonnes (H1 2020: 23,906

tonnes). Higher levels of stock on hand at the end of H1 2021

compared to H1 2020 have now been sold post period end

-- ESG milestones achieved included completion of final

pre-audit of the Roundtable on Sustainable Palm Oil (RSPO)

certification process setting us up to deliver our goal of RSPO

certification

Imminent production - cashew processing project at Tiebissou in

Côte d'Ivoire

-- Production on course to commence within the next 50 days at

which point Tiebissou will become Dekel's second producing asset

and provide exposure to the high margin, global cashew market

-- Tiebissou expected to lead to step-up in Dekel's revenue and

profitability as operations ramp up in 2022

New Ventures - proceeding cautiously due to significant focus

upon bringing Tiebissou to production and COVID-19 market

volatility

-- New commodity project - one venture in Côte d'Ivoire being

actively considered as a new project for the Company is currently

undertaking an independent feasibility process

-- Hybrid power project - feasibility study being undertaken by

JV partner Green Enesys on the development of a 30MW solar PV plant

and a 5-6MW biomass plant using feedstock from Ayenouan

Dekel Executive Director Lincoln Moore said, "Following a two to

three year period of challenging trading conditions due to low CPO

prices and more recently, Covid-19, we believe H1 2021's record

results have been an outstanding outcome for the Company and come

at an important moment as we shortly commence production at our

Cashew project. In addition, with global crude palm oil prices

currently trading at cyclical highs, we are extremely confident

that our H2 2021 results will also show material improvement

compared to H2 2020.

"Looking forward into 2022, we believe that the Company is well

positioned to enter a period of sustained growth in financial

performance. Together with the current high palm oil prices, the

other key catalyst behind the step-up in performance will be, we

expect, the incorporation of the first full year of Cashew

production, which will diversify and significantly increase our

profitability profile. We look forward to providing further updates

on progress made over what appears to be a very exciting next six

months for the Company."

Conference Call

Lincoln Moore and Shai Kol will provide a live presentation

relating to the Interim results for the six months ended 30 June

2021 via the Investor Meet Company platform on 28th Sep 2021 at

2:00pm BST.

The presentation is open to all existing and potential

shareholders. Questions can be submitted pre-event via your

Investor Meet Company dashboard up until 9am the day before the

meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet DEKEL AGRI-VISION PLC via:

https://www.investormeetcompany.com/dekel-agri-vision-plc/register-investor

Investors who already follow DEKEL AGRI-VISION PLC on the

Investor Meet Company platform will automatically be invited.

An updated presentation will be uploaded to the Company's

website on the morning of the call which will be referred to

throughout the call.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR'). Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

*S*

For further information please visit the Company's website at

www.dekelagrivision.com or contact:

Dekel Agri-Vision Plc

Youval Rasin

Shai Kol

Lincoln Moore +44 (0) 207 236 1177

Arden Partners Plc (Nomad and Joint Broker)

Paul Shackleton / Ruari McGirr /

Akhil Shah (Corporate Finance) +44 (0) 207 614 5900

Optiva Securities Limited (Joint Broker)

Christian Dennis

Jeremy King +44 (0) 203 137 1903

CHAIRMAN'S STATEMENT

For the first half of 2021, Dekel Agri-Vision reported record

revenues and EBITDA for its palm oil operations and is on the cusp

of production for its Tiebissou cashew processing project.

Revenues were up by 40.9% to EUR21.7 million; EBITDA rose by

105.3% to EUR3.9 million; net profits were also up by 400% to

EUR2.0 million: the Company's first half financial performance,

specifically that of our producing project, the crude palm oil

('CPO') operation at Ayenouan, Cote d'Ivoire, together with the

advancement of the Cashew project to imminent production, by a

number of measures represents the strongest H1 interim results we

have reported since joining AIM.

Ayenouan Palm Oil Project

The table below shows the improved first half performance at

Ayenouan compared to H1 2020. It also shows a summary of our

results for the last six years.

H1 2021 H1 2020 H1 2019 H1 2018 H1 2017 H1 2016

EUR19.6

Revenue EUR21.7m EUR15.4m EUR14.6m EUR14.1m m EUR16.0m

--------- --------- ---------- ---------- -------- ---------

EBITDA EUR3.9m EUR1.9m EUR1.4m EUR1.1m EUR3.7m EUR3.1m

--------- --------- ---------- ---------- -------- ---------

Net profit / (loss)

after tax EUR2.0m EUR0.45m (EUR0.1m) (EUR0.5m) EUR2.4m EUR1.8m

--------- --------- ---------- ---------- -------- ---------

FFB collected (tonnes) 123,684 106,188 131,917 96,195 117,706 123,157

--------- --------- ---------- ---------- -------- ---------

CPO production (tonnes) 26,515 23,882 28,934 22,242 26,947 28,550

--------- --------- ---------- ---------- -------- ---------

Average CPO price

per tonne EUR817 EUR602 EUR505 EUR549 EUR707 EUR542

--------- --------- ---------- ---------- -------- ---------

Clearly, the stand-out drivers of Dekel's very strong

performance in H1 2021 are:

- CPO pricing, the highest price achieved since operations commenced; and

- FFB collected, the second highest since operations commenced

Global CPO prices continue to remain strong early in the second

half of 2021, with even higher prices in the range of EUR900-950

per tonne being achieved in Q3 to date. Whilst a host of factors

impact the short-term pricing of CPO at a macro level, global stock

levels remain relatively tight as low stock levels in the key

producing nations pre Covid-19 are coupled together with improving

demand as global markets reopen, resulting in higher CPO

consumption levels. Should prices continue at current levels, we

are well positioned to deliver a strong H2 2021 during the low

season and potentially even a further improvement in results in the

next high season in H1 2022.

Whilst CPO prices are supportive, we continue to work hard to

maximise our production levels. As previously reported, 2012 saw

the start of a major multi-year planting programme in the region.

It takes on average 6-8 years for plants to mature, so we are now

entering a period where this planting should start to bear fruit.

With strong local community relationships, critical infrastructure

in place and proven logistics networks established, Ayenouan is in

a strong position to capitalise on any increase in local fruit

production. We also continue to work hard to foster close

relationships with the local community to secure supplies -

supplying discounted plants from our nursery; setting up logistics

hubs to facilitate delivery of fruit to the mill, and rolling out

fertiliser programmes with innovative funding mechanisms to

encourage the use of fertiliser at a manageable cost to the farmer.

In 2021, we added a health insurance initiative for our small

farmers and their families, which has been very well received by

the community at a challenging time during Covid-19.

Tiebissou Cashew Project

While COVID-19 led to a delay in the commencement of

construction work and later in the process also hampered

international shipping logistic timetables, first production

remains on course for Q4 2021. This is a challenging yet exciting

period with the major initial goal being to stabilise operations by

year end 2021, before striving to ramp up production considerably

in 2022, the first full year of production. It is expected that

after stabilising operations the Cashew project can quickly become

cash generative for the Company.

We believe in time, the Cashew project could potentially exceed

the Palm Oil project in terms of profit contribution to the Group.

The Cashew project is being developed in such a way that capacity

can be increased significantly in short order. With a nameplate

capacity of 15,000 tonnes per annum (tpa), production at the plant

can be ramped up by 50% at no extra cost by simply increasing the

number of shifts from two to three. From 15,000tpa and at a cost of

EUR5-6 million, the mill's capacity can be doubled to 30,000tpa,

which we estimate could generate revenues in the region of EUR40

million per annum based on today's prices.

Other projects

With Ayenouan firmly established and Tiebissou set to commence

production within the next 50 days low-cost work continues to be

carried out to establish a pipeline of projects in line with our

objective to build Dekel into a major West Africa-focused,

agro-industrial business. Proceeding cautiously is the order of the

day with regards to these plans given the current uncertain macro

environment.

Our ambitions in clean energy remain and we continue low-cost

work in the background as part of our medium-term strategy to

develop a biomass project utilising the empty fruit bunch waste

materials and we have similar aspirations with the Cashew

processing plant, where cashew shells can underpin a biomass

project at the Cashew project site.

Also, as previously disclosed, we have identified a third

commodity which is now in external feasibility where we believe we

can leverage our existing infrastructure, logistics network and

technical expertise. As with the clean energy joint venture,

current work is low cost and will remain so, at least until

Tiebissou is up and running.

Environment, Social, and Governance ("ESG")

During H1, RSPO certification pre-audit work was conducted by

Proforest, an Oxford-based environmental consultancy. Over the past

few months, we have been working on the audit points which are

primarily of an administrative nature and we believe will be ready

for the final audit process in H2 this year. Organising consultant

visits to complete both internal work and external audits has been

and remains challenging due to Covid-19 but we can now see a

pathway to completion for this project which remains one of our top

priorities. The main unknown at this stage is booking the timing of

the final RSPO certification process review, which we are

coordinating and will update the market once set dates are put in

place. Once certified, Ayenouan will be one of the few operations

in the region with the RSPO stamp of approval. Together with the

clear social benefits our palm oil project, as well as our cashew

project will deliver, we believe the Company can be proud of its

ESG credentials.

Financial

During the six-month period under review, total revenues at

Ayenouan were EUR21.7 million, a 40.9% increase on the EUR15.4

million reported for H1 2020. A 35.7% increase in CPO prices

achieved and a 11.0% increase in CPO production were the key

drivers of the increase in Revenue. This also flowed through to the

profit lines where EBITDA increased by 105.3% to EUR3.9m and net

profit after tax increased by 400% to EUR2.0m.

While Ayenouan has always been a low-cost and efficient

operation, with like-for-like group overheads related to the Palm

Oil operation remaining at EUR1.4m. An additional EUR0.3m relates

to new overheads associated with the Cashew operation. Whilst the

cashew overheads will increase as production commences there are

substantial synergies in the overhead line meaning the majority of

gross profit delivered from the Cashew project is expected to fall

direct to the bottom line.

Outlook

In spite of the challenges posed by the Covid-19 pandemic, the

Company was still able to achieve record H1 results and the outlook

for Dekel is looking very positive. The Ayenouan palm oil project

is firmly established and moving from strength to strength; the

Tiebissou cashew project is set to commence production within the

next 50 days and there is a healthy pipeline of possible new

projects under review in line with our objective to build Dekel

into a major West Africa-focused, agro-industrial business. As

always, I would like to thank the Board, management, our employees

and advisers for their support and hard work over the course of H1

and I look forward to continuing working with them closely during

what promises to be an exciting period for Dekel.

Andrew Tillery

Non-Executive Chairman Date: 20 September 2021

DEKEL AGRI-VISION PLC.

INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF 30 JUNE 2021

EUROS IN THOUSANDS

UNAUDITED

INDEX

Page

-------

Interim Condensed Consolidated Statements of Financial

Position 2-3

Interim Condensed Consolidated Statements of Comprehensive

Income 4

Interim Condensed Consolidated Statements of Changes

in Equity 5-6

Interim Condensed Consolidated Statements of Cash Flows 7- 8

Notes to the Interim Condensed Consolidated Financial

Statements 9 - 10

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

-

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

30 June 31 December

2021 2020

--------- -----------

Unaudited Audited

--------- -----------

Euros in thousands

----------------------

ASSETS

CURRENT ASSETS:

Cash and cash equivalents 2,341 202

Trade receivables 538 -

Inventory 4,323 1,283

Accounts and other receivables 186 292

--------- -----------

Total current assets 7,388 1,777

--------- -----------

NON-CURRENT ASSETS:

Deposits in banks 752 282

Property and equipment, net 43,658 41,249

Total non-current assets 44,410 41,531

--------- -----------

Total assets 51,798 43,308

========= ===========

The accompanying notes are an integral part of the consolidated

financial statements.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

30 June 31 December

2021 2020

--------- -----------

Unaudited Audited

--------- -----------

Euros in thousands

----------------------

EQUITY AND LIABILITIES

CURRENT LIABILITIES:

Short-term loans and current maturities of

long-term loans 4,985 5,676

Trade payables 1,177 893

Advance payments from customers - 1,971

Other accounts payable and accrued expenses 1,767 1,824

--------- -----------

Total current liabilities 7,929 10,364

--------- -----------

NON-CURRENT LIABILITIES:

Long-term lease liabilities 186 192

Accrued severance pay, net 355 283

Long-term loans 24,984 20,052

Loan from Non-controlling interests 661 -

--------- -----------

Total non-current liabilities 26,186 20,482

--------- -----------

Total liabilities 34,115 30,846

--------- -----------

EQUITY

Share capital 143 142

Additional paid-in capital 39,864 35,570

Accumulated deficit (16,656) (18,728)

Capital reserve 2,532 2,532

Capital reserve from transactions with non-controlling

interests (8,711) (7,754)

--------- -----------

Non-controlling interests 511 700

--------- -----------

Total equity 17,683 12,462

--------- -----------

Total liabilities and equity 51,798 43,308

========= ===========

The accompanying notes are an integral part of the interim

consolidated financial statements.

20 September,

2021

-------------------- ------------------ ------------------ ------------------

Date of approval Youval Rasin Yehoshua Shai Kol Lincoln John Moore

of the

financial statements Director and Chief Director and Chief Executive Director

Executive Officer Finance Officer

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Six months ended Year ended

30 June 31 December

--------------------------

2021 2020 2020

------------ ------------ -------------

Unaudited Unaudited Audited

------------ ------------ -------------

Euros in thousands

(except share and per share amounts)

Revenues 21,691 15,423 22,546

Cost of revenues (16,841) (12,794) (20,207)

------------ ------------ -------------

Gross profit 4,850 2,629 2,339

General and administrative 1,745 1,413 2,761

------------ ------------ -------------

Operating profit (loss) 3,105 1,216 (422)

Other expenses - 7 -

Share of loss of associate - 47 167

Finance expense 1,069 706 1,582

------------ ------------ -------------

Income (loss) before taxes on income 2,036 456 (2,171)

Taxes on income 15 53 55

------------ ------------ -------------

Net income (loss) and total comprehensive

income (loss) 2,021 403 (2,226)

============ ============ =============

Attributed to :

Equity holders of the Company 2,072 403 (2,226)

Non-controlling interest (51) - -

2,021 403 (2,226)

Income (loss) per share (in Euros):

Basic and diluted income (loss)

per share 0.00 0.00 (0.01)

============ ============ =============

Weighted average number of shares

used in computing basic and diluted

income (loss) per share 520,302,349 423,895,851 428,930,844

The accompanying notes are an integral part of the interim

consolidated financial statements.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Capital

reserve

from

transactions

Additional with Non -

Share paid-in Accumulated Capital non-controlling controlling Total

capital capital deficit reserve interests Total interest Equity

------- ---------- ----------- ------- --------------- ------ ----------- ------

Euros in thousands

---------------------------------------------------------------------------------------

Balance as of 1

January 2021

(audited) 142 35,570 (18,728) 2,532 (7,754) 11,762 700 12,462

Net income and

total

comprehensive

income - - 2,072 - - 2,072 (51) 2,021

Issuance of

shares 1 3,743 - - 3,744 - 3,744

Transaction with

minority holders - 404 - - (957) (553) (254) (807)

Contribution to

equity by

non-controlling

interest - - - - - - 116 116

Share-based

compensation - 147 - - - 147 - 147

Balance as of 30

June 2021

(unaudited) 143 39,864 (16,656) 2,532 (8,711) 17,172 511 17,683

======= ========== =========== ======= =============== ====== =========== ======

Attributable to equity holders of the Company

---------------------------------------------------------------------------

Capital

reserve

Additional from transactions

Share paid-in Accumulated Capital with non-controlling Total

capital capital deficit reserve interests Equity

-------- ---------- ----------- -------- --------------------- -------

Euros in thousands

---------------------------------------------------------------------------

Balance as of 1 January

2020 (audited) 141 34,368 (16,502) 2,532 (7,754) 12,785

Net income and total

comprehensive

income - 403 403

Issuance of shares - 15 15

Share-based compensation 147 147

Balance as of 30 June

2020 (unaudited) 141 34,530 (16,099) 2,532 (7,754) 13,350

======== ========== =========== ======== ===================== =======

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Attributable to equity holders of the Company

------------------------------------------------------------------------------------------------------

Capital Non-controlling Total Equity

reserve interests

from

transactions

Additional with

Share paid-in Accumulated Capital non-controlling

capital capital deficit reserve interests Total

------- ---------- ----------- ------- --------------- ----------- --------------- ------------

Euros in thousands

Balance as of 1

January

2020 141 34,368 (16,502) 2,532 (7,754) 12,785 - 12,785

Loss and total

comprehensive

loss - - (2,226) - - (2,226) - (2,226)

Issuance of

shares 1 907 - - - 908 - 90 8

Non-controlling

interests

arising from

initially

consolidated

subsidiary - - - - - - 700 700

Share-based

compensation - 295 - - - 295 - 295

------- ---------- ----------- ------- --------------- ----------- --------------- ------------

Balance as of 31

December

2020 142 35,570 (18,728) 2,532 (7,754) 11,762 700 12,462

======= ========== =========== ======= =============== =========== =============== ============

The accompanying notes are an integral part of the interim

consolidated financial statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Six months ended Year ended

30 June 31 December

-------------------------

2021 2020 2020

------------ ----------- --------------

Unaudited Unaudited Audited

------------ ----------- --------------

Euros in thousands

(except share and per share amounts)

Cash flows from operating activities:

Net income (loss) 2,021 403 (2,226)

------------ ----------- --------------

Adjustments to reconcile net income

(loss) to net cash provided by (used

in) operating activities:

Adjustments to the profit or loss

items:

Depreciation 747 669 1,369

Share-based compensation 147 147 295

Accrued interest on long-term loans

and non-current liabilities 891 618 1,141

Change in employee benefit liabilities,

net 117 27 205

Share of loss of associate - 47 167

Changes in asset and liability items:

increase in inventories (3,040) (35) (366)

increase in accounts and other receivables (432) (602) (39)

Decrease in short-term deposit (470) - (18)

Increase in trade payables 301 522 83

decrease in advance payments from

customers (1,971) (1,169) (802)

Increase (decrease) in accrued expenses

and other accounts payable (57) 710 325

------------ ----------- --------------

(3,767) 1,278 3,964

------------ ----------- --------------

Cash paid during the year for:

Income tax - - (9)

Interest (693) (729) (1,296)

------------ ----------- --------------

(693) (729) (1,053)

------------ ----------- --------------

Net cash provided by (used in) operating

activities (2,439) 608 433

============ =========== ==============

The accompanying notes are an integral part of the interim

consolidated financial statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Six months ended Year ended

30 June 31 December

-------------------------

2021 2020 2020

------------ ----------- --------------

Unaudited Unaudited Audited

------------ ----------- --------------

Euros in thousands

(except share and per share amounts)

Cash flows from investing activities:

Cash acquired upon acquisition of

subsidiary - - 89

Investment in Pearlside - - (378)

Purchase of property and equipment (3,156) (58) (118)

------------ ----------- --------------

Net cash provided by (used in) investing

activities (3,156) (58) (407)

------------ ----------- --------------

Cash flows from financing activities:

Issue of shares (offering net proceeds) 3,726 - -

Long-term lease, net (6) (12) (12)

Repurchase of shares from non-controlling

interests by subsidiaries (807) - -

Receipt of short-term loans, net (670) 756 945

Receipt of long-term loans 5,991 - 1,220

Receipt of Loan from Non-controlling

interest in subsidiary 765 - -

Repayment of long-term loans (1,265) (1,250) (2,250)

------------ ----------- --------------

Net cash provided by (used in) financing

activities 7,734 (506) (97)

------------ ----------- --------------

Increase in cash and cash equivalents 2,139 44 (71)

Cash and cash equivalents at beginning

of period 202 273 273

------------ ----------- --------------

Cash and cash equivalents at end

of period 2,341 317 202

============ =========== ==============

Supplemental disclosure of non-cash

activities:

Issuance of shares in consideration

for investment in Pearlside 404 - 884

============ =========== ==============

The accompanying notes are an integral part of the interim

consolidated financial statements.

NOTE 1:- GENERAL

a. These financial statements have been prepared in a condensed

format as of June 30, 2021, ("interim consolidated financial

statements"). These financial statements should be read in

conjunction with the Company's annual financial statements as of

December 31, 2020, and for the year then ended and accompanying

notes ("annual consolidated financial statements").

b. Dekel Agri-Vision PLC ("the Company") is a public limited

company incorporated in Cyprus on 24 October 2007. The Company's

Ordinary shares are admitted for trading on the AIM, a market

operated by the London Stock Exchange. The Company is engaged

through its subsidiaries in developing and cultivating palm oil

plantations in Cote d'Ivoire for the purpose of producing and

marketing Crude Palm Oil ("CPO"). The Company's registered office

is in Limassol, Cyprus.

c. CS DekelOil Siva Ltd. ("DekelOil Siva") a company

incorporated in Cyprus, is a wholly-owned subsidiary of the

Company. DekelOil CI SA, a subsidiary in Cote d'Ivoire currently

held 99.85% by DekelOil Siva, is engaged in developing and

cultivating palm oil plantations for the purpose of producing and

marketing CPO. DekelOil CI SA constructed and is currently

operating its first palm oil mill.

d. Pearlside Holdings Ltd. ("Pearlside") a company incorporated

in Cyprus, is a subsidiary of the Company since December 2020 (see

also note 3). The assets and liabilities of Pearlside are included

for the first time by the Company in the consolidated statement of

financial position as at 31 December 2020. Pearlside has a

wholly-owned subsidiary in Cote d'Ivoire, Capro CI SA ("Capro").

Capro is currently constructing a Raw Cashew Nut (RCN) processing

plant in Cote d'Ivoire near the village of Tiebissou.

e. DekelOil Consulting Ltd. a company located in Israel and a

wholly-owned subsidiary of DekelOil Siva and is engaged in

providing services to the Company and its subsidiaries.

f. The recent outbreak of Coronavirus, a virus causing

potentially deadly respiratory tract infections originating in

China and spreading in various jurisdictions, had a significant

effect on the global economic conditions and CPO prices but it had

no significant effect on the Company's operations during the

reported year. The outbreak of Coronavirus may resume its negative

affect on economic conditions regionally as well as globally,

disrupt operations situated in countries particularly exposed to

the contagion, affect the Company's customers and suppliers or

business practices previously applied by those entities, or

otherwise impact the Company's activities. Governments in affected

countries are imposing travel bans, quarantines and other emergency

public safety measures. Those measures, though apparently temporary

in nature, may continue and increase depending on developments in

the virus' outbreak. The ultimate severity of the Coronavirus

outbreak is uncertain at this time and therefore the Company cannot

reasonably estimate the impact it may have on its end markets and

its future revenues, profitability, liquidity and financial

position.

NOTE 1:- GENERAL (Cont.)

g. Working capital deficiency.

As of 30 June 2021, the Group's working capital position has

significantly improved from a deficit of EUR8.6m as at 31 December

2020 to a deficit of approximately EUR 0.5 million. The Company's

management believes it will have sufficient funds necessary to

continue its operations and meets its obligations as they become

due for at least a period of twelve months from the date of

approval of the financial statements.

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES

a. Basis of preparation of the interim consolidated financial statements:

The interim consolidated financial statements have been prepared

in accordance with IAS 34, "Interim Financial Reporting", and in

accordance with the disclosure requirements of Chapter D of the

Securities Regulations (Periodic and Immediate Reports), 1970.

The significant accounting policies applied in the preparation

of the interim consolidated financial statements are consistent

with those followed in the preparation of the annual consolidated

financial statements for the year ended 31 December, 2020.

c. Fair value of financial instruments:

The carrying amounts of the Company's financial instruments

approximate their fair value.

NOTE 3:- SIGNIFICANT EVENTS DURING THE PERIOD

On 25 January 2021 a subsidiary of the company, DekelOil CI SA

completed a bond raise totaling approximately EUR6 million pursuant

to an Ivorian regulator approved bond facility of approximately

EUR15.2 million. The key bond terms are: 7 year tenure, 3 years

principal grace and interest rate of 7.75%

On 28 January 2021 the Company raised GBP3.27 million (app.

EUR3.69 million after deducting fund raising costs of EUR258

thousands) via the placement of 70,000,000 new Ordinary Shares at

an Issue Price of 5 pence per share.

On 6 February 2021 the Company entered into an agreement to

purchase an additional 16.7% interest in Pearlside Holdings Ltd

("Pearlside") from a minority holder for a total consideration of

GBP1,062,000 approximately EUR1,210,000. Consideration consisted of

GBP708,000 (app. EUR807,000) cash and GBP354,000 app. EUR404,000)

in ordinary shares settled by issuing 7,080,000 of the Company's

shares to the seller. The transaction was completed, and the

Company increased its interest in Pearlside from 54% to 70.7%.

On 8 February 2021 the shareholders of Pearlside held an AGM and

agreed to provide a pro rata shareholders loan to Pearlside. The

loan will not bear interest, not secured subordinated to the bank

loans of Pearlside,its repayment will be upon the decision board of

director decision.

According to this decision the non-controlling interest provided

a loan of EUR765 thousands. The loan is presented at its estimated

fair value.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPURPBUPGGRU

(END) Dow Jones Newswires

September 21, 2021 02:00 ET (06:00 GMT)

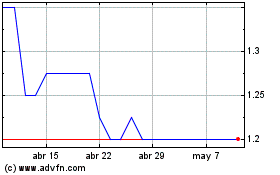

Dekel Agri-vision (LSE:DKL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Dekel Agri-vision (LSE:DKL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024