Dekel Agri-Vision PLC September & Q3 2021 Palm Oil Production Update (4263O)

08 Octubre 2021 - 1:00AM

UK Regulatory

TIDMDKL

RNS Number : 4263O

Dekel Agri-Vision PLC

08 October 2021

Dekel Agri-Vision Plc / Index: AIM / Epic: DKL / Sector: Food

Producers

Dekel Agri-Vision Plc ('Dekel' or the 'Company')

September & Q3 2021 Palm Oil Production Update

Dekel Agri-Vision Plc (AIM: DKL) , the West African agriculture

company focused on building a portfolio of sustainable and

diversified projects, is pleased to provide a September and Q3 2021

production update for its 100% owned Ayenouan palm oil project in

Côte d'Ivoire.

Key Highlight s

-- September and Q3 2021 saw a continuation of the recent run of

improved production, sales and pricing results in our core CPO

business

-- CPO prices continue to remain very strong with average prices

achieved in Q3 2021 of EUR950, a 72.7% increase in average realised

CPO prices compared to August 2020

-- Over the last few days, international CPO prices have been

trading at all time record levels. Should prices remain in this

range we are well positioned to further improve on our 2021 record

financial high season in 2022 which commences in around 3

months

Lincoln Moore, Dekel 's Executive Director , said: "We are

pleased by the continuing growth we have seen in our CPO production

during Q3 2021 . Given global CPO prices are currently trading at

an all time high, we are very well positioned to continue this

strong period of financial growth into 2022"

Sep-21 Sep-20 Change Q3 2021 Q3 2020 Change

FFB processed (tonnes) 10,393 9,274 12.1% 27,157 24,243 12.0%

CPO production (tonnes) 2,035 1,965 3.6% 5,428 5,280 2.8%

CPO Sales (tonnes) 2,046 1,977 3.5% 6,945 5,278 31.6%

Average CPO price

per tonne EUR954 EUR604 57.9% EUR950 EUR550 72.7%

PKO production (tonnes) 137 149 -8.1% 408 422 -3.3%

PKO Sales (tonnes) Nil 204 n/a 1,061 543 95.4%

Average PKO price

per tonne n/a EUR564 n/a EUR817 EUR568 43.8%

PKC production (tonnes) 241 236 2.1% 703 838 -16.1

PKC Sales (tonnes) 260 189 37.6% 685 764 -10.3%

Average PKC price

per tonne EUR80 EUR59 35.6% EUR80 EUR60 33.3%

Crude Palm Oil

-- Production: Like for like CPO production increased 2.8% in Q3

2021 compared to Q3 2020. This resulted from high FFB quantities

offsetting weaker extraction rates

-- Sales: The sale of stock on hand at the end of the high

season, led to a 31.6% increase in sales in Q3 2021 compared to Q3

2020

-- Prices: Local CPO sales prices remained very strong at

EUR950, 72.7% higher than prices achieved in Q3 2021

Palm Kernel Oil ('PKO') and Palm Kernel Cake ('PKC')

-- Production: PKO and PKC production in Q3 2021 slightly down

by 3.3% and 16.1% respectively. We currently hold materially higher

levels of kernels to be processed compared to this time last year,

so we expect a material increase in production during Q4 2021 once

these excess kernels are processed compared to Q4 2020

-- Sales: 95.4% increase in PKO sales quantities in Q3 2021

compared to Q3 2020 as stock on hand post the high season was

sold

-- Prices: 43.8% increase in PKO prices during Q3 2021 compared

to Q3 2020. We are continuing the strategy of managing PKO sales

carefully as the local price remains lower than the international

price

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

** ENDS **

For further information please visit the Company's website

www.dekelagrivision.com or contact:

Dekel Agri-Vision Plc

Youval Rasin

Shai Kol

Lincoln Moore +44 (0) 207 236 1177

Arden Partners Plc (Nomad and Joint Broker)

Paul Shackleton / Ruari McGirr /

Elliot Mustoe (Corporate Finance) +44 (0) 207 614 5900

Optiva Securities Limited (Joint Broker)

Christian Dennis

Jeremy King +44 (0) 203 137 1903

Notes:

Dekel Agri-Vision Plc is a multi-project, multi-commodity

agriculture company focused on West Africa. It has a portfolio of

projects in Côte d'Ivoire at various stages of development: a fully

operational palm oil project in Ayenouan where fruit produced by

local smallholders is processed at the Company's 60,000tpa crude

palm oil mill; a cashew processing project in Tiebissou, which is

due to commence commissioning in November 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLFLFLDIELDIIL

(END) Dow Jones Newswires

October 08, 2021 02:00 ET (06:00 GMT)

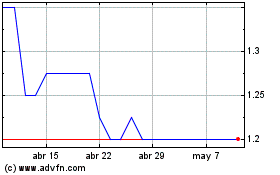

Dekel Agri-vision (LSE:DKL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Dekel Agri-vision (LSE:DKL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024