TIDMDWHT

RNS Number : 9811H

Dewhurst PLC

09 December 2020

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Dewhurst PLC

("Dewhurst" or the "Group")

Preliminary Results for the year ended 30 September 2020

Chairman's Statement

Results

I am pleased that the Group has been able to navigate the

difficult market conditions of this year reporting sales only

slightly lower than last year. Group sales for the year to 30

September 2020 decreased 1.5% to GBP55.6 million (2019: GBP56.4

million). Despite the small decline in sales, the Group has

achieved profits ahead of revised management expectations. Adjusted

operating profit before amortisation of acquired intangibles and

exceptional pension costs increased to GBP8.6 million (2019: GBP7.7

million) and profit before tax was GBP6.7 million (2019: GBP5.2

million).

Although sales were broadly flat overall, there were falls and

rises across the Group's divisions. The Lift division was down

approximately 4% with the drop primarily in the UK and Canada.

Keypad sales also dropped significantly, partly due to the Covid-19

pandemic and the reduced use of cash machines and partly from the

expected drop due to the run down in stock of an outgoing product.

Transport and Highways on the other hand achieved significant

growth in the UK, with record sales and profits, boosted by sales

of cycle lane products. Currency movements were responsible for a

GBP0.8 million fall in reported sales, with the pound strengthening

against the Australian and Canadian dollars.

The board recognises the importance of dividend payments to

shareholders, but given the abnormal situation this year is

proposing to maintain the same level of final dividend as last

year.

Operations and People

This year's profit figures include some support from Governments

in the various countries in which the Group has operations. During

the third quarter of our financial year we experienced sharp

contractions in sales in a number of our businesses due to the

pandemic and had to furlough staff in several locations. However,

we found that we made up much of the lost ground from these

reductions more quickly than expected in most businesses. It has,

of course, been an extremely turbulent year and a real challenge

for our people. So I would particularly like to thank all our staff

this year for their dedication and determination in continuing to

do their best to serve our customers. Clearly we have put in

protocols and working practices to try to keep our employees safe

during this period and we will continue to operate in this manner

until it is safe to return to more normal arrangements.

Lift Material Australia (LMA) has been a member of the Dewhurst

Group for 15 years and for all that period has been led by Tony

Pegg. Tony has retired this November. I would like to pay tribute

to his achievements in growing the sales and the breadth of the

company during his long tenure and to thank him for his loyalty and

support over the years. We welcome Halen Brown who is taking over

as LMA general manager and wish him every success in the role.

Halen joins us from a management role in Otis' Melbourne

branch.

Closer to home, we are delighted to welcome Peter Dewhurst to

the business. Peter has taken on responsibility for commercial

operations at Dewhurst UK.

Investment

The major investment of the year is the building of a new

factory for Dupar Controls in Canada. Work started on the building

in January and is well on the way to completion. However, the build

and fit out has inevitably been affected by the pandemic and so is

a little behind schedule. We are still hoping to be able to occupy

the new premises in early 2021. In the meantime, we have secured an

offer to purchase Dupar's current factory, subject to contract.

Outlook

In terms of demand for lift products, we have escaped relatively

lightly from the pandemic this year, but our business tends to lag

behind movements in the economy generally by 1-2 years. Many of the

projects for which we have been providing components this year were

initiated before there was any hint of a pandemic. Market feedback

suggests there is a definite lull in the commissioning of new

projects, so we do have some concerns that demand may soften during

2021. However, at present demand is steady in most of our lift

markets. Some of the current UK demand may be companies stocking up

ahead of Brexit at the end of the year, but we should get a clearer

picture of that impact during the first quarter of 2021.

Keypads were much more seriously affected this year and the weak

demand continues into the new year. We are not expecting to see an

improvement in this division until economies begin to recover.

Highways and transport products may provide an opportunity for

growth. The UK Government is committing more funds to providing

safe cycle lanes, but at this stage it is not clear when these

projects will be open for bidding, so timing for our sales

opportunity is difficult to predict.

Richard Dewhurst

Chairman

Strategic Report

Business Review

The Group's principal activity in the year continued to be the

manufacture of electrical components and control equipment for

industrial and commercial capital goods. The Group maintained its

position as a speciality supplier of equipment to lift, transport

and keypad sectors. A business review of the Group's operations is

dealt with below in operating highlights and in the Chairman's

Statement.

Key performance indicators

The directors believe that the key financial performance

indicators relevant to the Group are earnings per share, adjusted

operating profit, profit before tax and return on equity. The key

non-financial performance indicators relevant to the Group are

quality measures and on-time deliveries to our customers.

Operating Highlights

The hundredth and first year in the Company's history has been

exceptional! The first half was business as usual. The second half

was anything but, with the Covid-19 pandemic impacting business

significantly. As a Group, we were extremely fortunate compared to

many other businesses. Only one of our subsidiaries, (Dewhurst UK)

closed for just three weeks. All other businesses remained open

throughout.

Since March we have worked hard to create a safe environment for

all our stakeholders at our various locations around the world.

That all our companies have effectively remained open throughout

the pandemic is a great credit to our management team and staff. I

join with our Chairman in thanking all our employees for their

contributions in this very challenging year. The nature of many of

our businesses is that staff are not able to work effectively from

home, so in particular we thank our colleagues in the UK and

overseas who continued to travel in to work when their respective

countries were in lockdown.

The underlying reduction in demand for office space and for

hotel accommodation is a concern. It has not affected the

construction industry this year but it will likely have an impact

in the future. That in turn will have a negative effect on demand

for some of our products.

UNITED KINGDOM

Dewhurst UK Limited

This financial year has proved to be difficult for Dewhurst UK,

with significantly reduced demand from our Middle East markets

coupled with the impact of the pandemic. The business closed in

late March for three weeks and demand in the following quarter was

well below expectations. In July we took the decision to

restructure the business, which involved a number of

redundancies.

The increased concern about viruses around the world has created

a need for us to seek solutions to improve safety for lift users.

At Dewhurst UK we quickly developed a touchless solution for

calling a lift at a landing and we are in the process of launching

two new products that provide a solution to touchless floor

designation in the lift car.

We received our first significant order for our Train Despatch

Equipment Unit (TDEU) which is for Birmingham New Street station.

We will be fulfilling this order over the next two years. We also

received Network Rail approval for the two critical components of

the TDEU, which will lead to further business in the future.

We are continuing to invest in plant and machinery with the

commissioning of a new semi-automatic studding machine for our

pressel plates. In the coming year there will be significant focus

on reducing waste as we work to minimise our carbon footprint.

Traffic Management Products (TMP)

TMP continued to build on the sales success they had generated

in the second half of last year. Throughout the first half of the

year, we were successful in winning a number of significant orders

for our Traffic Bollards both at home and overseas. The hard work

of the team of TMP to create effective contacts within Local

Authority traffic departments had paid off.

This work perhaps gained even more importance in the second half

of the year. In May, the Government announced that it would create

an emergency GBP250 million fund to create protected cycleways

throughout Britain. TMP have a wide range of traffic separator

products which are ideally positioned to meet the needs of the

Government's desire to make it easier and safer for cyclists to get

around. Helped by this government initiative demand for TMP's cycle

products grew significantly in the second half of the year. This

combined with a very solid first half performance led to record

sales and profits at TMP.

A&A Electrical Distributors (A&A)

A&A completed its second full year within the Group and the

integration of the business is essentially complete.

Sales and profits were down on last year but as with Dewhurst

UK, the business was significantly impacted by the pandemic. Sales

in April and May were around half of normal levels. In June sales

started to recover. The business continued to operate throughout

the whole of the UK lockdown period, providing a vital role for the

industry in the supply of spares items for breakdowns and

repairs.

A&A rose to the challenge to develop products which helped

make the lift environment a safer place. A new range of 'Site

Essentials' was launched which included products such as

anti-bacterial wipes, safe space floor stickers, surface sanitisers

and face masks.

We continue to work to develop our e-Commerce solution and this

project has moved on well. We are looking to launch our new site in

the first quarter of 2021.

EUROPE

Dewhurst Hungary

We have experienced a challenging business environment

throughout the year at Dewhurst Hungary, with significant

variations in production volumes.

Demand for both ATMs and ATM spares was lower primarily due to

the pandemic and this in turn meant that our sales and profits were

down on the previous year.

NORTH AMERICA

Dupar Controls

The year started positively at Dupar with an improvement in the

modernisation market, however as in the UK, Canada was impacted

quite badly by the pandemic. Revenues were hit hard in April, May

and June, which led to full year sales being down on last year.

Good control of overheads however meant that we managed to achieve

profits broadly in line with last year.

Early in 2020 we broke ground on our new facility at Boxwood

Business Park in Cambridge, Ontario, just five miles from our

existing plant. At 57,000 square feet, it is over twice the size of

our current facility. We envisage that it will satisfy our

manufacturing needs in Canada for the foreseeable future.

The building is now close to completion and we anticipate

handover in early 2021, with manufacturing at the new site due to

commence in March. It has been frustrating not to be able to visit

the site during the construction process due to current travel

restrictions. It has meant that additional responsibility for this

project has been borne by George Foleanu. He has done an excellent

job in managing the build and we look forward to visiting the new

plant when restrictions are lifted.

Elevator Research & Manufacturing (ERM)

It has been a turbulent year in the USA and perhaps even more so

in Los Angeles. However, throughout the year the team at ERM have

worked diligently and efficiently, continuing to focus on improving

service levels to their customers. This has led to another year of

sales and profit growth.

AUSTRALIA & ASIA

Australian Lift Components (ALC)

After the excellent growth we achieved last year, sales this

year were broadly flat. In the circumstances that was a very

creditable achievement. Business was well spread across the Eastern

States and with the borders between States shut for much of the

year, we benefitted from our local sales presence.

Towards the end of the year the reliability of our current laser

cutting machine was becoming a concern. We therefore took the

decision to invest in a new Amada Fibre Laser machine, very similar

to the machines that we have at Dupar Controls and Dewhurst UK. The

ALC machine will also benefit from an automated loader/unloader,

which will allow us to operate the machine unmanned after hours.

This will boost our capacity and improve productivity.

P&R Lift Cars (P&R)

P&R have experienced another very busy year, with continued

high demand for their bespoke lift interiors. They have built

specialist lift interiors for a number of high end developments

this year, such as Paramatta Square and the new Crown Casino in

Sydney.

ALC and P&R continue to benefit from joint sales with

virtually all P&R's interiors using lift fixtures supplied by

ALC.

Lift Material

We were unable to recruit a suitable candidate as General

Manager at Lift Material before the pandemic struck, so Tony Pegg

kindly delayed his retirement. He has run the business throughout

the course of this year.

The escalator handrail installation business has been curtailed

by the pandemic and the subsequent closure of State borders. This

has meant that we could only operate this element of the business

in New South Wales. Sales and Profits at Lift Material were reduced

primarily due to these restrictions.

We continue to promote a range of A&A products through Lift

Material and although take up started relatively slowly, we are

beginning to see increased traction for these products.

Lift Material moved into their new premises at the start of the

year. We now have a 20,000 square feet warehouse, which is

sufficient for our needs for the foreseeable future. The warehouse

is located in Matraville which is within easy reach of all the

major lift companies in Sydney.

In the late summer we restarted our search for Tony Pegg's

replacement. We are pleased to welcome Halen Brown as our new

General Manager. He has a wealth of experience in the lift industry

and we wish him every success in his new role.

Dual Engraving

Sales and profits grew at Dual Engraving as the market in

Western Australia continued to be reasonably buoyant.

Dual Engraving have an involvement in many high profile local

projects. One such project is Metronet. This is the West Australian

Government's ongoing plan to invest in public transport in Perth.

The project involves the construction of 18 new stations over the

next few years. Dual Engraving have been working closely with the

lift contractor to supply interiors, fixtures and other components

for the bespoke lift cars required for the stations.

Dewhurst Hong Kong

Good progress has been made at Dewhurst Hong Kong over the last

year. Although sales have fallen slightly, which is not surprising

in the current economic environment, profits have remained more or

less on a par with last year.

We continue to strengthen our relations with our customers in

Hong Kong and South East Asia and are looking to introduce a number

of new products to the market over the next twelve months.

David Dewhurst

Group Managing Director

Financial Review

Trading results

It is pleasing to report strong trading results despite an

extremely difficult year due to the Covid-19 pandemic impacting

operations from the start of 2020 onwards. With local shutdowns and

travel restrictions the Group and its staff, to their testament,

adjusted very quickly to the new 'Covid safe' working arrangements

to continue to manufacture products and deliver to customers in

what can only be described as challenging times. Keypad sales saw

the biggest impact being 36% down on last year whereas we saw a

relatively modest 4% reduction in Lift sales. However, with the UK

Government looking to 'build back greener' TMP saw a 143% increase

in Transport sales in the latter part of the year through cycle

lane delineators.

Jobs and salaries were maintained as much as possible during

shutdowns with some staff furloughed but supported by the Company

and various Governments' schemes around the world. The total

support from all Governments was GBP1.5 million of which GBP0.5

million was received in the UK.

Overall revenue decreased by 1.5% to GBP55.6 million (2019:

GBP56.4 million) but adjusted operating profit increased by 12.1%

to GBP8.6 million (2019: GBP7.7 million).

Although a significant proportion of the Group's revenue and

profits are generated and held in foreign currency, foreign

exchange retranslation had a negligible impact on the reporting

performance of the Group this year with like-for-like revenue and

profit before tax decreasing by 2% each.

Solid cash position

At the start of the pandemic any Group cash 'on notice' was

drawn back into instant access accounts to be available to support

our trading subsidiaries. Equally, the funding of the Dupar

building construction was switched from an intended Group loan to a

local line of credit with our Canadian Bank in Toronto to maximise

available Group cash if support were needed. Despite our initial

concerns, it is pleasing to look back now, and report Group support

was not needed as our customers and their orders returned shortly

after lockdowns were lifted for construction and manufacturing. We

started the year with no borrowing or bank overdraft facility and

finished the year with only a small bank borrowing of GBP69k in

Canada.

During the year, the Group spent GBP3.4 million (C$5.8 million)

on the Dupar building construction, GBP1.6 million on a share

repurchase as well as GBP0.6 million as result of the first

12-month deferred consideration payment to the former owners of

A&A Electrical Distributors Ltd (A&A). A second and final

12-month deferred consideration to the former owners of A&A is

still to be made in 2021. The Group ended the year with cash of

GBP18.1 million, up GBP1.1 million from GBP17.0 million in

2019.

Pension scheme deficit

The Company paid in a total of GBP1.4 million contributions into

the pension scheme during the year and despite significant

volatility in the equity markets the pension scheme assets

outperformed expectations by GBP0.7 million. Nevertheless, the

scheme deficit still increased by GBP0.7 million to GBP11.3 million

in 2020 (2019: GBP10.6 million) as a result of the liability

discount rate dropping and mortality assumptions improving which

both negatively impacted the scheme deficit.

All recommendations made by the scheme's actuary to eliminate

the scheme deficit within an agreed timeframe have been fully

implemented.

Capital management and treasury policy

The Group defines capital as total equity plus net debt. The

objective is to maintain a strong and efficient capital base to

support the Group's strategic objectives, provide optimal returns

for shareholders and safeguard the Group's assets and status as a

going concern. The Group is not subject to externally imposed

capital requirements and the Group's philosophy is to have minimal

or no borrowing where possible.

The Group seeks to reduce or eliminate financial risk to ensure

sufficient liquidity is available to meet foreseeable needs and to

invest cash assets safely and profitably. The policies and

procedures operated are regularly reviewed and approved by the

Board. By varying the duration of its fixed and floating cash

deposits, the Group maximises the return on interest earned.

The Group continues to hedge foreign currencies internally where

possible and does not use derivatives in the form of foreign

exchange contracts to manage its currency risk.

Dividends

Dividends are accounted for when paid or approved by

shareholders, and not when proposed, therefore the proposed final

dividend for 2020 has not been accrued at the end of the reporting

period. The total dividend for 2020 of 13.0p per share is the same

as 2019 and is covered 4.4 times by earnings.

Following a share repurchase, there was a reduction in the

number of allotted shares during the year.

Jared Sinclair

Finance Director

Consolidated statement of comprehensive income

For the year ended 30 September 2020

-----------------------------------------------------------------------------

2020 2019

GBP(000) GBP(000)

--------- ---------

Continuing operations

Revenue 55,617 56,446

Operating costs (48,654) (51,052)

---------------------------------------------------- --------- ---------

Adjusted operating profit* 8,630 7,700

Pension charge - GMP equalisation - (639)

Amortisation of acquired intangibles (1,667) (1,667)

Operating profit 6,963 5,394

Finance income 58 34

Finance costs (281) (184)

----------------------------------------------------- --------- ---------

Profit before taxation 6,740 5,244

Taxation (2,061) (2,149)

---------------------------------------------------- --------- ---------

Profit from continuing operations 4,679 3,095

Discontinued operations

Profit and gain from discontinued operations

(net of tax)(^) - 7,079

Profit for the period 4,679 10,174

Other comprehensive income:

Actuarial gains/(losses) on the defined benefit

pension scheme (1,886) (4,559)

Deferred tax effect 358 775

Tax on items taken directly to equity 226 314

------------------------------------------------------ -------- --------

Total that will not be subsequently reclassified

to income statement (1,302) (3,470)

Exchange differences on translation of foreign

operations (215) 308

Total that may be subsequently reclassified

to income statement (215) 308

------------------------------------------------------ -------- --------

Other comprehensive income/(expense) for the

year, net of tax (1,517) (3,162)

------------------------------------------------------ -------- --------

Total comprehensive income for the year 3,162 7,012

------------------------------------------------------ -------- --------

Profit for the year attributable to:

Equity Shareholders of the Company 4,312 9,780

Non-controlling interests 367 394

------------------------------------------------------ -------- --------

4,679 10,174

------------------------------------------------------ -------- --------

Total comprehensive income for the year attributable

to:

Equity Shareholders of the Company 2,783 6,620

Non-controlling interests 379 392

------------------------------------------------------ -------- --------

3,162 7,012

------------------------------------------------------ -------- --------

Basic and diluted earnings per share 51.78p 116.23p

Basic and diluted earnings per share

- continuing operations 51.78p 32.09p

--------------------------------------- ------- --------

* Operating profit before amortisation of acquired intangibles

and pension GMP equalisation (see Financial review)

^ Thames Valley Controls Ltd was disposed of on 30/09/19 and the

comparative profit and gain was fully reported in the 2019 annual

report and accounts.

Consolidated statement of financial position

At 30 September 2020

--------------------------------------------------------

2020 2019

GBP(000) GBP(000)

------------------------------- --------- ---------

Non-current assets

Goodwill 9,743 9,719

Other intangibles 1,139 2,831

Property, plant and equipment 16,947 13,225

Right-of-use assets 3,273 -

Deferred tax asset 2,621 2,198

33,723 27,973

Current assets

Inventories 6,208 6,010

Trade and other receivables 9,553 10,993

Cash and cash equivalents 18,139 16,980

---------------------------------- --------- ---------

33,900 33,983

------------------------------- --------- ---------

Total assets 67,623 61,956

---------------------------------- --------- ---------

Current liabilities

Trade and other payables 9,433 8,180

Borrowings 69 -

Current tax liabilities 268 249

Short-term provisions 343 277

Lease liabilities 443 -

------------------------------- --------- ---------

10,556 8,706

Non-current liabilities

Retirement benefit obligation 11,268 10,570

Lease liabilities 2,973 -

------------------------------- --------- ---------

Total liabilities 24,797 19,276

Net assets 42,826 42,680

---------------------------------- --------- ---------

Equity

Share capital 808 841

Share premium account 157 157

Capital redemption reserve 329 296

Translation reserve 2,047 2,274

Retained earnings 38,042 37,847

---------------------------------- --------- ---------

Total attributable to

equity Shareholders of

the Company 41,383 41,415

---------------------------------- --------- ---------

Non-controlling interests 1,443 1,265

---------------------------------- --------- ---------

Total equity 42,826 42,680

---------------------------------- --------- ---------

The financial statements were approved by the Board of Directors

and authorised for issue on 7 December 2020 and were signed on its

behalf by:

Richard Dewhurst Chairman

Jared Sinclair Finance Director

Company Registration Number: 160314

Consolidated statement of changes in equity

For the year ended 30 September 2020

Share Share Capital Translation Retained Non Total

capital premium redemption reserve earnings controlling equity

account reserve interest

GBP(000) GBP(000) GBP(000) GBP(000) GBP(000) GBP(000) GBP(000)

------------------- --------- --------- ----------- ------------ ---------- ------------ ----------

At 30 September

2018 842 157 295 1,964 32,693 1,057 37,008

Share repurchase (1) - 1 - (82) - (82)

Exchange

differences

on

translation of

foreign

operations - - - 310 - (2) 308

Actuarial

gains/(losses)

on defined

benefit pension

scheme - - - - (4,559) - (4,559)

Deferred tax

effect - - - - 775 - 775

Tax on items taken

directly

to equity - - - - 314 - 314

Dividends paid - - - - (1,074) (184) (1,258)

Profit for the

year - - - - 9,780 394 10,174

At 30 September

2019 841 157 296 2,274 37,847 1,265 42,680

Impact from IFRS

16 'leases' - - - - (85) (11) (96)

------------------- --------- --------- ----------- ------------ ---------- ------------ ----------

At 30 September

2019

(restated) 841 157 296 2,274 37,762 1,254 42,584

Share repurchase (33) - 33 - (1,637) - (1,637)

Exchange

differences

on

translation of

foreign

operations - - - (227) - 12 (215)

Actuarial

gains/(losses)

on defined

benefit pension

scheme - - - - (1,886) - (1,886)

Deferred tax

effect - - - - 358 - 358

Tax on items taken

directly

to equity - - - - 226 - 226

Dividends paid - - - - (1,093) (190) (1,283)

Profit for the

year - - - - 4,312 367 4,679

At 30 September

2020 808 157 329 2,047 38,042 1,443 42,826

------------------- --------- --------- ----------- ------------ ---------- ------------ ----------

Consolidated cash flow statement

For the year ended 30 September 2020

-----------------------------------------------------------------------

2020 2019

GBP(000) GBP(000)

-------------------------------------------- ---------- ----------

Cash flows from operating activities

Operating profit - continuing operations 6,963 5,394

Operating profit - discontinued operations - 1,077

----------------------------------------------- ---------- ----------

Operating profit 6,963 6,471

Depreciation and amortisation 2,663 2,857

Right-of-use asset depreciation 351 -

Contributions to pension scheme, net

of administration fee & GMP equalisation

costs (1,366) (1,800)

Exchange adjustments (33) 111

(Profit)/loss on disposal of property,

plant and equipment 64 (13)

----------------------------------------------- ---------- ----------

8,642 7,626

(Increase)/decrease in inventories (198) (838)

(Increase)/decrease in trade and other

receivables 1,385 888

Increase/(decrease) in trade and other

payables 1,243 617

Increase/(decrease) in provisions 66 46

----------------------------------------------- ---------- ----------

Cash generated from operations 11,138 8,339

Interest paid (2) (1)

Tax paid - continuing operations (1,871) (1,921)

Tax paid - discontinued operations - 10

----------------------------------------------- ---------- ----------

Tax paid (1,873) (1,912)

----------------------------------------------- ---------- ----------

Net cash from operating activities 9,265 6,427

----------------------------------------------- ---------- ----------

Cash flows from investing activities

Acquisition of subsidiary undertaking (624) -

Proceeds on disposal of a subsidiary

(net of cash disposed) 55 7,514

Proceeds from sale of property, plant

and equipment 35 57

Purchase of property, plant and equipment (4,257) (5,233)

Development costs capitalised (12) (41)

Interest received 58 34

----------------------------------------------- ---------- ----------

Net cash generated from/(used in)

investing activities (4,745) 2,331

----------------------------------------------- ---------- ----------

Cash flows from financing activities

Dividends paid (1,283) (1,258)

Purchase of own shares (1,637) (82)

Repayment of lease liabilities including (381) -

interest

Proceeds from bank borrowings 69 -

Net cash used in financing activities (3,232) (1,340)

----------------------------------------------- ---------- ----------

Net increase/(decrease) in cash and

cash equivalents 1,288 7,418

----------------------------------------------- ---------- ----------

Cash and cash equivalents at beginning

of year 16,980 9,440

Exchange adjustments on cash and cash

equivalents (129) 122

----------------------------------------------- ---------- ----------

Cash and cash equivalents at end of

year 18,139 16,980

----------------------------------------------- ---------- ----------

Notes

1. AGM, results and dividends

The profit for the year, after taxation, amounted to GBP4.7

million (2019: GBP10.2 million).

A final dividend on the Ordinary and 'A' non-voting ordinary

shares of 9.25p per share (2019: 9.25p) for the financial year

ended 30 September 2020 will be proposed at the Annual General

Meeting (AGM) to be held on 16 February 2021. If approved, this

dividend will be paid on 24 February 2021 to members on the

register at 22 January 2021. The ex-dividend date will be 21

January 2021.

An interim dividend of 3.75p per share (2019: 3.0) was paid on

18 August 2020.

2. Earnings per share and dividend per share

2020 2019

Weighted average number of shares No. No.

------------------------------------------ ---------- ----------

For basic and diluted earnings per share 8,328,365 8,413,983

------------------------------------------ ---------- ----------

The calculation of basic and diluted earnings per share is based

on the profit for the financial year of GBP4,312,233 and on

8,328,365 Ordinary 10p and 'A' non-voting ordinary 10p shares,

being the weighted average number of shares in issue throughout the

financial year. There are no share options issued.

2020 2019

Paid dividends per 10p Ordinary share GBP(000) GBP(000)

--------------------------------------------- --------- ---------

2019 final paid of 9.25p (2018: 9.00p) (778) (758)

2020 interim paid of 3.75p (2019: 3.75p) (315) (316)

Dividends paid - The Company (1,093) (1,074)

Dividends paid to non-controlling interests

- Dual Engraving Pty Ltd

& P&R Liftcars Pty Ltd (190) (184)

--------------------------------------------- --------- ---------

Dividends paid - The Group (1,283) (1,258)

The final proposed dividend is based on 3,309,200 Ordinary 10p

shares and 4,772,198 ' A' non-voting ordinary 10p shares, being the

latest number of shares in issue. The Directors are proposing a

final dividend of 9.25p (2019: 9.25p) per share, totalling GBP748k

(2019: GBP778k). This dividend has not been accrued at the end of

the reporting period.

3. Accounting policies

The accounting policies applied to the 2020 accounts have been

consistent with 2019 in all manners apart from IFRS 16 'Leases' as

stated below. With effect from 1 October 2019 the Group has adopted

the new accounting standard IFRS 16 'Leases' and applied the

modified retrospective approach. IFRS 16 provides a single

on-balance sheet accounting model for lessees which recognises a

right-of-use asset, representing its right to use the underlying

asset, and a lease liability, representing its obligations to make

payment in respect of the use of the underlying asset. The

distinction between finance and operating leases for lessees is

removed. Comparatives for the prior year have not been restated and

the reclassifications and adjustments arising from the new leasing

standard are therefore recognised in the opening balance sheet on 1

October 2019 as follows:

1 Oct 2019

GBP(000)

---------------------------------------------------------- -----------

Non-current assets

Right-of-use assets 2,764

---------------------------------------------------------- -----------

Total assets 2,764

---------------------------------------------------------- -----------

Current liabilities

Lease liabilities (274)

Non-current liabilities

Lease liabilities (2,586)

---------------------------------------------------------- -----------

Total liabilities (2,860)

---------------------------------------------------------- -----------

Total movement in retained earnings as at 1 October 2019 (96)

---------------------------------------------------------- -----------

On adoption of IFRS 16, the Group recognised liabilities for

leases which had been classified as operating leases under previous

accounting standards. The lease liability has been measured at the

present value of the remaining lease payments, discounted using the

incremental borrowing rate as at 1 October 2019. The weighted

average lessee's incremental borrowing rate applied to the lease

liabilities on 1 October 2019 was between 3.5%-4.3%.

Practical expedients applied

In applying IFRS 16 for the first time, the Group has used the

following practical expedients permitted by the standard:

- Relied on previous assessments of whether leases are

onerous.

- Excluded initial direct costs for the measurement of

right-of-use assets at the date of the initial application.

- Applied the transition relief to long-term leases ending

within 12 months of the date of initial application of the

standard.

- Applied the transition relief exempting short-term leases and

low value leases.

- Used hindsight in determining the lease term where the

contract contains options to extend or terminate the lease.

1 Oct 2019

GBP(000)

---------------------------------------------------------- -----------

Operating lease commitments as disclosed at 30 September

2019 1,747

Reconciling items

- Low-value leases recognised on a straight-line basis

as expense (40)

- Long-term leases ending within 12 months recognised on

a straight-line basis as expense (389)

- Recognition difference on lease changes and extension

assumptions 1,991

- Effect of discounting (at incremental borrowing rate

as at 1 October 2019) (449)

Lease Liability recognised as at 1 October 2019 2,860

---------------------------------------------------------- -----------

Impact on the income statement

The impact on the income statement for the twelve months ended

30 September 2020 is to increase operating profit by GBP30k but

increase finance costs by GBP101k resulting in a decrease in profit

before tax of GBP71k.

Impact on the cash flow statement

There has been a change to the classification of cash flows in

the cash flow statement with operating lease payments previously

categorised as net cash used in operations now reported within

financing activities as repayment of lease liabilities including

interest. In the twelve months to 30 September 2020 there are

GBP381k of lease repayments comprising GBP280k of capital

repayments of lease liabilities and GBP101k of interest paid.

4. Basis of preparation

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 30 September 2020

or 2019. Statutory accounts for 2019 have been delivered to the

Registrar of Companies. The statutory accounts for 2020 which are

prepared under IFRS as adopted by the EU will be delivered to the

Registrar of Companies following the Company's Annual General

Meeting.

The preliminary statement of results has been reviewed by and

agreed with the Company's auditor, Jeffreys Henry LLP, who have

indicated that they will be giving an unqualified opinion in their

report on the statutory financial statements for 2020.

Dewhurst plc has prepared its consolidated and Company financial

statements in accordance with International Financial Reporting

Standards (IFRS) as adopted by the European Union (EU) from 1

October 2005. The Group and Company financial statements have been

prepared in accordance with those parts of the Companies Act 2006

that are applicable to companies adopting IFRS. The company is

registered and incorporated in the United Kingdom; and quoted on

AIM.

It is expected that the audited Report and Accounts for the year

ended 30 September 2020 will be sent to shareholders and will also

be available on the Company's website www.dewhurst.plc.uk on 15

January 2021.

- Ends -

For further details please contact:

Dewhurst Plc Tel: +44 (0) 208 744 8200

Richard Dewhurst, Chairman

Jared Sinclair, Finance Director

N+1 Singer Tel: +44 (0) 207 496 3089

Will Goode / Rick Thompson

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR KKFBKOBDDABK

(END) Dow Jones Newswires

December 09, 2020 02:00 ET (07:00 GMT)

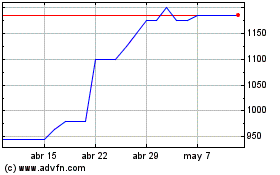

Dewhurst (LSE:DWHT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Dewhurst (LSE:DWHT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024