TIDMDGI9

RNS Number : 2969N

Digital 9 Infrastructure PLC

29 September 2021

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR

INDIRECTLY, IN OR TO THE UNITED STATES, CANADA, AUSTRALIA, THE

REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY MEMBER STATE OF THE EUROPEAN

ECONOMIC AREA ("EEA") (OTHER THAN ANY MEMBER STATE OF THE EEA WHERE

SECURITIES MAY BE LAWFULLY MARKETED) OR ANY OTHER JURISDICTION

WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS ANNOUNCEMENT. THE

INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE OR FORM PART OF

ANY OFFER TO ISSUE OR SELL, OR ANY SOLICITATION OF ANY OFFER TO

SUBSCRIBE OR PURCHASE, ANY INVESTMENTS IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED UNDER

THE MARKET ABUSE REGULATION (EU) NO. 596/2014, AS IT FORMS PART OF

DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018.

PLEASE SEE THE SECTION ENTITLED "IMPORTANT LEGAL INFORMATION"

TOWARDS THE OF THIS ANNOUNCEMENT.

LEI: 213800OQLX64UNS38U92

29 September 2021

DIGITAL 9 INFRASTRUCTURE PLC

Results of Oversubscribed Fundraise

Further to the announcement on 13 September 2021, the Board of

Digital 9 Infrastructure plc (the "Company" or "D9") is pleased to

announce the results of the Placing of new Ordinary Shares pursuant

to the Placing Programme (the "Placing").

The Placing was significantly over-subscribed, with strong

support from both existing and new investors. The Board, therefore,

has agreed to increase the amount raised from the original target

of GBP200 million to GBP275 million in light of the Company's

investment pipeline. Notwithstanding the increased size of the

Placing, applications for the new Ordinary Shares significantly

exceeded the total number of shares to be issued and accordingly a

scaling back exercise has been undertaken.

Certain Directors, namely Jack Waters, Keith Mansfield and Lisa

Harrington, have subscribed for, in aggregate, 57,208 new Ordinary

Shares. In addition, Thor Johnsen and Andre Karihaloo, members of

the Investment Manager's team, have subscribed for, in aggregate,

209,301 new Ordinary Shares. These respective subscriptions have

been made either via the Placing or via a direct subscription with

the Company at the Placing Price (the direct subscriptions and

Placing, together, comprising the "Fundraise").

255,813,953 new Ordinary Shares will be issued pursuant to the

Fundraise at 107.5p per share (the "Placing Price"), raising gross

proceeds of GBP275 million, which will be used to acquire further

assets in line with the Company's investment objective, identified

in the Company's pipeline of investment opportunities at IPO, as

set out in the Prospectus.

Jack Waters, Chair of Digital 9 Infrastructure plc, said:

"The drivers of digital infrastructure are increasing rapidly as

more of our lives move online, fundamentally changing the way we

work, shop and socialise. These long-term changes in behaviour have

been accelerated by, or result from, the Covid-19 pandemic as well

as more fundamental trends in data usage. Our existing shareholders

and new investors have identified the opportunity that investing in

D9 represents - a means for them to participate in this exciting

sector at a critical point in time. We welcome their support and

look forward to the next step of D9's journey as it continues to

invest in a diversified portfolio of digital infrastructure

assets."

Application for admission

Application has been made for 255,813,953 new Ordinary Shares to

be admitted to trading on the Specialist Fund Segment of the Main

Market of the London Stock Exchange. It is expected that admission

in respect of the new Ordinary Shares will become effective, and

that dealings in the new Ordinary Shares will commence, at 8.00

a.m. on 1 October 2021.

Total Voting Rights

On Admission, the Company's issued share capital will consist of

722,480,620 Ordinary Shares with voting rights. This figure may be

used by Shareholders in determining the denominator for the

calculation by which they will establish if they are required to

notify their interest in, or a change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

The new Ordinary Shares issued in connection with the Fundraise

will be fully paid and will rank pari passu in all respects with

each other and with the existing ordinary shares of the Company,

including, without limitation, the right to receive all dividends

and other distributions declared, made or paid after the date of

issue.

Capitalised terms will have the meanings given to them in the

Prospectus published by the Company on 8 March 2021 in relation to

the Placing Programme (which is available on the Company's website)

unless otherwise defined in this announcement.

Akur Limited (trading as Akur Capital) ("Akur"), is acting

exclusively as Financial Adviser to the Company and J.P. Morgan

Securities PLC (which conducts its UK investment banking activities

as J.P. Morgan Cazenove) ("J.P. Morgan Cazenove") is acting as

Global Coordinator and Sole Bookrunner on the Placing.

FOR FURTHER INFORMATION, PLEASE CONTACT

Triple Point Investment Management LLP Via Sapience Communications

Thor Johnsen / Andre Karihaloo

J.P. Morgan Cazenove

William Simmonds / Jérémie

Birnbaum (Corporate Finance)

James Bouverat / Liam MacDonald-Raggett

(Sales) +44 (0) 207 742 4000

Akur Capital

Tom Frost / Anthony Richardson / Siobhan

Sergeant +44 (0) 207 493 3631

Sapience Communications +44 (0) 203 195 3240/

Richard Morgan Evans / Sasha Johnson +44 (0) 775 108 7291

triplepoint@sapiencecomms.co.uk

NOTES:

Digital 9 Infrastructure plc is a newly established, externally

managed investment trust which invests in a range of digital

infrastructure assets which deliver a reliable, functioning

internet.

"Digital infrastructure" refers to the critical infrastructure

required for the internet to operate and, essentially, refers to

everything from fibre networks that connect continents, businesses

and homes (the very "backbone" of the internet), to the data

centres that organisations use to house their critical networks of

computer and storage resources, and to the towers and small cells

that carry data traffic wirelessly to the end user.

The Company is focused on the provision of Digital

Infrastructure integrated with green and cleaner power in line with

UN Sustainable Development Goal 9: "Build resilient infrastructure,

promote inclusive and sustainable industrialization and foster

innovation".

The Company's portfolio will comprise future proofed,

non-legacy, scalable platforms and technologies including (but not

limited to) subsea fibre, data centres, terrestrial fibre, tower

infrastructure and small cell networks (including 5G).

The Investment Manager is Triple Point Investment Management LLP

("Triple Point") which is authorised and regulated by the Financial

Conduct Authority, with extensive experience in asset and project

finance, portfolio management and structured investments. The

Investment Manager's digital infrastructure team has a proven track

record of over US$2 billion of infrastructure investments and, in

addition, will benefit from a panel of digital infrastructure

industry experts, with deep knowledge, relationships and

involvement in a combined US$250 billion of digital infrastructure

transactions.

The Company's Ordinary Shares were admitted to trading on the

Specialist Fund Segment of the Main Market of the London Stock

Exchange on 31 March 2021.

For more information, please visit www.d9infrastructure.com

Important Legal Information

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

Market Abuse Regulation (Regulation 596/2014), as it forms part of

domestic law by virtue of the European Union (Withdrawal) Act 2018.

Upon the publication of this Announcement via a Regulatory

Information Service this inside information is now considered to be

in the public domain.

The Company is a Jersey registered alternative investment fund,

and it is regulated by the Jersey Financial Services Commission as

a 'listed fund' under the Collective Investment Funds (Jersey) Law

1988 (the "Funds Law") and the Jersey Listed Fund Guide published

by the Jersey Financial Services Commission. The Jersey Financial

Services Commission is protected by the Funds Law against liability

arising from the discharge of its functions thereunder.

This announcement does not constitute, and may not be construed

as, an offer to sell or an invitation to purchase investments of

any description or a recommendation regarding the issue or the

provision of investment advice by any party. No information set out

in this announcement is intended to form the basis of any contract

of sale, investment decision or any decision to purchase shares in

the Company. The merits or suitability of any securities must be

independently determined by each investor on the basis of its own

investigation and evaluation of the Company.

Nothing in this announcement constitutes investment advice and

any recommendations that may be contained herein have not been

based upon a consideration of the investment objectives, financial

situation or particular needs of any specific recipient. No

information in this announcement should be construed as providing

financial, investment or other professional advice and each

prospective investor should consult its own legal, business, tax

and other advisers in evaluating the investment opportunity. No

reliance may be placed for any purposes whatsoever on this

announcement (including, without limitation, any illustrative

modelling information contained herein), or its completeness.

This announcement is not an offer to sell or a solicitation of

any offer to buy any securities in the Company in the United

States, Australia, Canada, New Zealand or the Republic of South

Africa, Japan, or in any other jurisdiction where such offer or

sale would be unlawful.

This communication is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This communication is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States,

except pursuant to an applicable exemption from registration. No

public offering of securities is being made in the United

States.

The Company has not been and will not be registered under the US

Investment Company Act of 1940 (the "Investment Company Act") and,

as such, holders of the Company's securities will not be entitled

to the benefits of the Investment Company Act. No offer, sale,

resale, pledge, delivery, distribution or transfer of the Company's

securities may be made except under circumstances that will not

result in the Company being required to register as an investment

company under the Investment Company Act.

Moreover, the Company's securities will not be registered under

the applicable securities laws of Australia, Canada, the Republic

of South Africa, Japan or any member state of the European Economic

Area ("EEA") (other than any member state of the EEA where the

Company's securities may be lawfully marketed). Subject to certain

exceptions, the Company's securities may not be offered or sold in

Australia, Canada, the Republic of South Africa, Japan or any

member state of the EEA (other than any member state of the EEA

where the Company's securities may be lawfully marketed) or to, or

for the account or benefit of, any national, resident or citizen

of, Australia, Canada, the Republic of South Africa, Japan or any

member state of the EEA (other than to professional investors in

certain EEA member states for which marketing approval has been

obtained in accordance with the requirements of Directive

2011/61/EU of the European Parliament and of the Council of 8 June

2011 on Alternative Investment Fund Managers (the "AIFM

Directive"), as implemented in the relevant jurisdiction).

This announcement must not be acted on or relied on in any

member state of the EEA by persons: (a) who are not "professional

investors", as defined in the AIFM Directive; or (b) (if they are

domiciled, resident or have a registered office in the EEA) that

are located in a member state of the European Economic Area in

which the Company has not been appropriately registered or has not

otherwise complied with the requirements under the AIFM Directive

(as implemented in the relevant EEA Member State) necessary for the

lawful marketing of the Ordinary Shares.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk of

investing in companies admitted to the Specialist Fund Segment.

Further, the Ordinary Shares are only suitable for investors: (i)

who understand and are willing to assume the potential risks of

capital loss and understand that there may be limited liquidity in

the underlying investments of the Company; (ii) for whom an

investment in the Ordinary Shares is part of a diversified

investment programme; and (iii) who fully understand and are

willing to assume the risks involved in such an investment. If any

investor is in any doubt about the contents of this announcement,

it should consult its accountant, legal or professional adviser or

financial adviser.

The information in this announcement is for background purposes

only and does not purport to be full or complete. No reliance may

be placed for any purpose on the information contained in this

announcement or its accuracy or completeness. No representation or

warranty, express or implied, is given by the directors of the

Company or any other person as to the accuracy of information or

opinions contained in this announcement and no responsibility is

accepted for any such information or opinions. The material

contained in this announcement is given as at the date of its

publication (unless otherwise marked) and is subject to updating,

revision and amendment. In particular, any proposals referred to

herein are subject to revision and amendment.

The Company has a limited operating history. Potential investors

should be aware that any investment in the Company is speculative,

involves a high degree of risk, and could result in the loss of all

or substantially all of their investment. Results can be positively

or negatively affected by market conditions beyond the control of

the Company, the Investment Manager or any other person.

Prospective investors are advised to seek expert legal, financial,

tax and other professional advice before making any investment

decision in respect of the Company. The value of investments may

fluctuate. Information in this announcement or any of the documents

relating to the Issue cannot be relied upon as a guide to future

performance.

Each of Akur (which is regulated in the UK by the FCA) and J.P.

Morgan Cazenove (which is authorised by the Prudential Regulation

Authority (the "PRA") and regulated in the UK by the FCA and the

PRA), is acting exclusively for the Company and for no--one else in

connection with the matters described in this announcement and will

not regard any other person as its client in relation thereto and

will not be responsible to anyone for providing the protections

afforded to its clients or providing any advice in relation to the

matters contained herein. Neither Akur nor J.P. Morgan Cazenove,

nor any of their respective directors, officers, employees,

advisers or agents accepts any responsibility or liability

whatsoever for this announcement, its contents or otherwise in

connection with it or any other information relating to the

Company, whether written, oral or in a visual or electronic

format.

This announcement may include statements that are, or may be

deemed to be, "forward--looking statements". These forward--looking

statements can be identified by the use of forward--looking

terminology, including the terms "believes", "estimates",

"anticipates", "expects", "intends", "may", "might", "will" or

"should" or, in each case, their negative or other variations or

similar expressions. All statements other than statements of

historical facts included in this announcement, including, without

limitation, those regarding the Company's financial position,

strategy, plans, proposed acquisitions and objectives, are

forward--looking statements. These forward-looking statements speak

only as at the date of this announcement and cannot be relied upon

as a guide to future performance.

None of the Company, the Investment Manager, Akur and/or J.P.

Morgan Cazenove, or any of their respective affiliates, accepts any

responsibility or liability whatsoever for, or makes any

representation or warranty, express or implied, as to this

announcement, including the truth, accuracy or completeness of the

information in this announcement (or whether any information has

been omitted from the announcement) or any other information

relating to the Company or associated companies, whether written,

oral or in a visual or electronic form, and howsoever transmitted

or made available or for any loss howsoever arising from any use of

the announcement or its contents or otherwise arising in connection

therewith. The Company, the Investment Manager, Akur and J.P.

Morgan Cazenove, and their respective affiliates, accordingly

disclaim all and any liability whether arising in tort, contract or

otherwise which they might otherwise have in respect of this

announcement or its contents or otherwise arising in connection

therewith.

Information to distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("Directive 2014/65/EU"); (b)

Articles 9 and 10 of Commission Delegated Directive (EU) 2017/593

supplementing Directive 2014/65/EU; (c) local implementing

measures; and/or (d) (where applicable to UK investors or UK firms)

the relevant provisions of the UK statutory instruments

implementing Directive 2014/65/EU and Commission Delegated

Directive (EU) 2017/593, Regulation (EU) No 600/2014 of the

European Parliament, which is part of UK law by virtue of the

European Union (Withdrawal) Act 2018, as amended (together, the "UK

MiFID Laws") (together, the "MiFID II Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any "manufacturer"

(for the purposes of the MiFID II Product Governance Requirements)

may otherwise have with respect thereto, the Ordinary Shares have

been subject to a product approval process, which has determined

that the Ordinary Shares to be issued pursuant to the initial issue

are: (i) compatible with an end target market of retail investors

who understand, or have been advised of, the potential risk of

investing in companies admitted to the Specialist Fund Segment and

investors who meet the criteria of professional clients and

eligible counterparties, each as defined in Directive 2014/65/EU or

the UK MiFID Laws (as applicable); and (ii) eligible for

distribution through all distribution channels as are permitted by

Directive 2014/65/EU or the UK MiFID Laws, as applicable (the

"Target Market Assessment").

Notwithstanding the Target Market Assessment, distributors

should note that: (a) the price of the Ordinary Shares may decline

and investors could lose all or part of their investment; (b) the

Ordinary Shares offer no guaranteed income and no capital

protection; (c) an investment in the Ordinary Shares is compatible

only with investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources

to be able to bear any losses that may result therefrom; and (d)

the Ordinary Shares will be admitted to the Specialist Fund

Segment, which is intended for institutional, professional,

professionally advised and knowledgeable investors who understand,

or who have been advised of, the potential risk from investing in

companies admitted to the Specialist Fund Segment. The Target

Market Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the issue. Furthermore, it is noted that, notwithstanding the

Target Market Assessment, J.P. Morgan Cazenove will only procure

investors who meet the criteria of professional clients and

eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of Directive 2014/65/EU or the UK MiFID Laws, as

applicable; or (b) a recommendation to any investor or group of

investors to invest in, or purchase, or take any other action

whatsoever with respect to the Ordinary Shares.

Each distributor (including any intermediary) is responsible for

undertaking its own Target Market Assessment in respect of the

Ordinary Shares and determining appropriate distribution

channels.

PRIIPS Regulation

In accordance with the UK version of Regulation (EU) No

1286/2014 of the European Parliament and of the Council of 26

November 2014 on key information documents for packaged retail and

insurance-based investment products (PRIIPs), which forms part of

UK law by virtue of the European Union (Withdrawal) Act 2018, as

amended (the "UK PRIIPs Laws"), a key information document in

respect of the Ordinary Shares is available to investors on the

Company's website.

If you are distributing any class of shares in the Company, it

is your responsibility to ensure that the relevant key information

document is provided to any clients that are "retail clients".

The Investment Manager is the only manufacturer of the Ordinary

Shares for the purposes of the UK PRIIPs Laws and none of the

Company, Akur nor J.P. Morgan Cazenove is a manufacturer for these

purposes. None of the Company, the Akur nor J.P. Morgan Cazenove

makes any representations, express or implied, or accepts any

responsibility whatsoever for the contents of the KID prepared by

the Investment Manager nor accepts any responsibility to update the

contents of the KID in accordance with the UK PRIIPs Laws, to

undertake any review processes in relation thereto or to provide

the KID to future distributors of Ordinary Shares. Each of the

Company, Akur and J.P. Morgan Cazenove and their respective

affiliates accordingly disclaims all and any liability whether

arising in tort or contract or otherwise which it or they might

have in respect of any key information documents prepared by the

Investment Manager from time to time.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIFFFLIAAITFIL

(END) Dow Jones Newswires

September 29, 2021 02:00 ET (06:00 GMT)

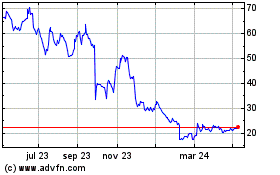

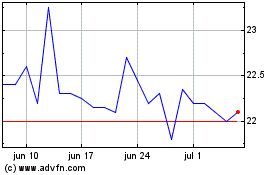

Digital 9 Infrastructure (LSE:DGI9)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Digital 9 Infrastructure (LSE:DGI9)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024