DuPont 2Q Sales, Profit Grow on Broad Industrial Recovery

03 Agosto 2021 - 5:41AM

Noticias Dow Jones

By Matt Grossman

DuPont de Nemours Inc. Tuesday recorded greater sales and

earnings in its latest quarter as greater demand in the end markets

it serves pushed revenue higher.

The Wilmington, Del.-based chemicals company posted earnings of

90 cents a share, an improvement from a loss of $3.37 a share 12

months earlier. The net income available for common shareholders

was $478 million, rebounding from a loss of $2.48 billion in 2020's

second quarter.

Stripping out one-time items, DuPont's adjusted earnings were

$1.06 a share. Analysts polled by FactSet were forecasting adjusted

earnings of 94 cents a share.

Revenue rose 26% to $4.14 billion. Analysts were anticipating

revenue of $3.99 billion.

Stronger demand from end-market industries such as

semiconductors, smartphones, cars and residential construction

contributed to the rise in sales, Chairman and chief Executive Ed

Breen said.

Demand from areas such as displays, electronics and healthcare

helped boost DuPont's electronics and industrial segment, where

sales climbed 19% year over year to $1.3 billion. Residential

construction and do-it-yourself project activity by consumers

lifted DuPont's water and protection segment to sales of $1.4

billion, a 14% increase.

The recovery of the automotive market compared with earlier

stages of the Covid-19 pandemic helped DuPont's mobility and

materials sales rise 61% to $1.3 billion.

Write to Matt Grossman at matt.grossman@wsj.com

(END) Dow Jones Newswires

August 03, 2021 06:29 ET (10:29 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

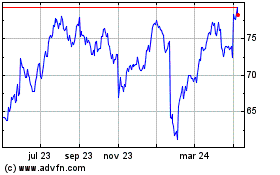

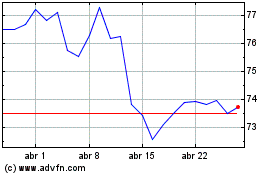

DuPont de Nemours (NYSE:DD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

DuPont de Nemours (NYSE:DD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024