TIDMECR

ECR MINERALS plc

("ECR Minerals", "ECR" or the "Company")

Update on Drilling Progress at (HR4) 'Cherry Tree'

ECR Minerals plc (LON: ECR), the gold exploration and

development company focussed on gold exploration in Australia, is

pleased to update shareholders on drilling progress at historic

reserve number 4, otherwise known as 'Cherry Tree', which is part

of the Company's Bailieston Project.

ECR Minerals plc has 100% ownership of the Bailieston Project

(EL5433), which is operated under its Australian wholly owned

subsidiary Mercator Gold Australia Pty Ltd ("MGA").

Craig Brown, Chief Executive Officer of ECR Minerals plc,

commented: "I am delighted to announce a significant step forward

for the Bailieston project, with the near completion of drilling at

HR4 (Cherry Tree). With 1545 metres of diamond drilling completed

as shown in Fig 1, MGA now have a more detailed understanding of

the prospect, proving up the historic percussion drilling results

that showed broad low-grade mineralisation zones with occasional

high-grade intercepts."

"Once the final HR4 drill hole has been completed, MGA will

return to complete drilling at the HR3 'Byron' area. In addition

MGA are awaiting the final drill results from our recently

completed diamond drilling at Creswick (EL6184). The final four

drill holes are adjacent to the high-grade intercepts already

reported from CSD003 (0.95m @ 9.93 g/t Au from 84.2m and 0.95m @

23.58 g/t Au from 89.05m) (see announcement dated July 19(th)

2021). I look forward to reporting further drilling results from

HR3 and Creswick in the coming weeks."

SUMMARY:

-- A total of 1545 metres of diamond drilling has been completed to date at

the Cherry Tree prospect. The company is currently drilling the final

drillhole (BCTDD010) before moving back to complete drilling of the HR3

'Byron' area.

-- Visual examination of drill core BCTDD009 shows the most intense

quartz-sulphidic vein drilled to date at Cherry Tree.

-- Orientated diamond core has delineated sulphidic fault zones containing

broad low-grade gold mineralisation emanating from a central anticlinal

hinge zone.

DRILLING TO DATE

A total of 1545 metres of diamond drilling has been undertaken

to date at Cherry Tree. Drilling has been completed using the

Company's owned and operated drill rig named 'Midas'. This is the

first time that diamond drilling has been done within this deposit.

Previous shallow percussion drilling was done in the late 1980's by

earlier explorers where results showed broad low-grade zones of

mineralisation accompanied by occasional high-grade (> 7 g/t Au)

intercepts are present. The aim of the recent drilling by 'MGA' was

to test the structural trends associated with the historic

percussion drilling. For this aim, MGA has been successful.

Refer to figure 1 link below for locations described in the

following paragraphs.

https://www.ecrminerals.com/images/fig1_plan_bct_update_211021.png

GEOLOGICAL OVERVIEW

The Cherry Tree prospect was the subject of intense, shallow

hard-rock mining from the 19(th) Century where miners selectively

took out the narrow quartz filled fault veins. Historic records

show these veins can often grade over 50 g/t Au. Mapping of

historic workings at surface show a system of faults to strike in a

WNW direction from a centralised anticlinal fold. This anticline

links the HR3 (Byron) prospect, 2km to the NNW where first-pass

drilling was undertaken by MGA in the first half of the current

year. The Cherry Tree mines are located at a bend within this

anticline (refer to fig1). It is likely that brittle deformation in

fine grain sandstones within this bend led to development of the

WNW fault zones and subsequent gold mineralisation. Gold is closely

associated with arsenopyrite, thus arsenic is a good local

pathfinder element for gold mineralisation.

DRILL HOLE SUMMARY

Drilling of the first diamond holes in Cherry Tree (BCTDD001,

BCTDD002 and BCTDD003) have been reported previously (see

announcements dated August 10(th) 2021). In summary, BCTDD001 was

successfully drilled to identify the central anticline position.

BCTDD002 and BCTDD003 were drilled to test the down-dip of a WNW

fault system located in the central portion of the goldfield. Best

results were from BCTDD003 (0.5m @ 11.02 g/t Au from 98.85m).

Drilling has continued across WNW fault zones at different points

along the anticline, with the current hole (BCTDD010) being near

complete. Drilling shows broad zones of low-grade

mineralisation.

Summary of all drill intercepts containing reportable levels of

gold greater than 1 g/t Au for holes BCTDD004 - BCTDD008.

BCTDD004

From (m) To (m) Grade (g/t Au) Interval (m) Comment

63 64 0.12 1

125 126 0.17 1 Fault Zone

130 131 0.12 1 Arsenopyrite

144.5 145.5 0.18 1 Perpendicular QV

177 178 0.18 1 QV

198 199.1 0.13 1.1 Fault Zone

BCTDD005

From (m) To (m) Grade (g/t Au) Interval (m) Comment

30.6 32 0.14 1.4 0.6m of core loss

41.35 42.3 0.13 0.95 100ppm As pXRF*

55.4 57.1 0.11 1.7 0.8m core loss

80 81.1 0.13 1.1

103.2 104.2 0.12 1 QV

127 128 0.21 1 QV with disseminated pyrite

*pXRF (portable x-ray fluorescence-in house analysis)

BCTDD006

*Currently awaiting the results from the last 24 samples of this

hole*

There are two broad zones of mineralisation within this

hole.

1. 42.1m - 48.6m (6.1m @ 0.63 g/t Au) or 3.89 grams over 6.1m (gram x

length)

2. 49.6m -- 52m (2.4m @ 1.49 g/t Au) or 3.57 grams over 2.4m (gram x length)

From (m) To (m) Grade (g/t Au) Interval (m) Comment

32.3 33.1 0.13 0.8 QV (Fault)

42.1 43 0.27 0.9 Fault Zone 1

43 43.9 0.12 0.9 Fault Zone 1

44.3 45.4 0.13 1.1 Fault Zone 1

45.4 46.5 1.74 1.1 Fault Zone 1

46.5 47.5 1.24 1 Fault Zone 1

47.5 48.6 0.22 1.1 Fault Zone 1

49.6 50.5 3.39 0.9 Fault Zone 2

50.5 51.1 0.48 0.6 Fault Zone 2

51.1 52 0.26 0.9 Fault Zone 2

59 60 0.13 1

60 61 0.4 1

89 89.8 0.15 0.8 QV (Fault)

131 132 0.29 1

159 160 0.12 1

The following holes were drilled around the highest grade and

broad mineralised intercepts found in BCTDD003. The mineralisation

is associated with a fault zone that has been mined near surface at

1m wide).

BCTDD007

*Currently awaiting 17 assay results for this hole*

From (m) To (m) Grade (g/t Au) Interval (m) Comment

50.6 51.1 0.11 0.5

51.1 52.1 0.15 1

58.2 59 0.14 0.8

64 65.6 0.24 1.2

BCTDD008

*Only the first 17m of this hole has been assayed to date*

Another Fault zone present at the top of this hole: 5.4m @ 0.69

g/t Au or (3.71 gram metres)

From (m) To (m) Grade (g/t Au) Interval (m) Comment

0.3 1.1 1.14 0.8 Near surface faulting

4.8 6 0.13 1.2

8.2 9.1 0.14 0.9 Fault Zone 1

9.1 10 0.14 0.9 Fault Zone 1

13.6 15.3 0.17 1.7 Fault Zone 1

15.3 16.3 2.92 1 Fault Zone 1

16.3 17.2 0.28 0.9 Fault Zone 1

BCTDD009

Drilling of BCTDD002, BCTDD003, BCTDD007 and BCTDD008 showed

that the WNW fault is more open (dilated) as we drill further west

away from the anticline. A solid sulphidic quartz vein over 2m wide

was drilled through at 146.5m depth. Geological logging and

sampling of BCTDD009 is currently in progress, see figure 2 link

below for detailed image of BCTDD009 core samples.

https://www.ecrminerals.com/images/fig2_bctdd009_quartz.jpg

FORWARD LOOKING STATEMENTS

Whilst drill results to date at Cherry Tree have been

disappointing of late, it must be emphasised that structural

interpretation of the Cherry Tree deposit has only been achieved

through completing diamond drilling across multiple fault zones.

Drilling of the last hole (BCTDD009) is showing a remarkable

improvement in vein quality and size as we drill west of the

anticline. For the time being, pending results, the drill rig will

be moved to more promising sites at the north end of the HR3

(Byron) reserve where soil sampling is revealing strong

arsenic-antimony anomalies on surface.

MGA are also awaiting the final drill results from our recently

completed diamond drilling at Creswick (EL6184). The final four

holes were drilled adjacent to the high-grade intercepts in CSD003

(0.95m @ 9.93 g/t Au from 84.2m and 0.95m @ 23.58 g/t Au from

89.05m). MGA staff have begun to sample the soils surrounding the

projected outcrop of this quartz vein. If the results are positive,

it will assist in delineating the plunge of mineralisation, which

it is hoped will provide MGA with a better selection of future

drill targets.

REVIEW OF ANNOUNCEMENT BY QUALIFIED PERSON

This announcement has been reviewed by Adam Jones, a director of

ECR Minerals plc. Adam Jones is a professional geologist and is a

Member of the Australian Institute of Geoscientists (MAIG). He is a

qualified person as that term is defined by the AIM Note for

Mining, Oil and Gas Companies.

MARKET ABUSE REGULATIONS (EU) No. 596/2014

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR). Upon the

publication of this announcement via Regulatory Information Service

(RIS), this inside information is now considered to be in the

public domain.

FOR FURTHER INFORMATION, PLEASE CONTACT:

ECR Minerals plc Tel: +44 (0) 20 7929 1010

David Tang, Non-Executive Chairman

Craig Brown, Director & CEO

Email:

info@ecrminerals.com

Website: www.ecrminerals.com

WH Ireland Ltd Tel: +44 (0) 207 2201666

Katy Mitchell/Andrew de Andrade

Nominated Adviser

SI Capital Ltd Tel: +44 (0) 1483 413500

Broker

Nick Emerson

Novum Securities Limited Tel: +44 (0) 20 7399 9425

Broker

Jon Belliss

Blytheweigh Tel: +44 (0) 207 138 3204

Public Relations

Tim Blythe

ABOUT ECR MINERALS PLC

ABOUT ECR MINERALS PLC

ECR Minerals is a mineral exploration and development company.

ECR's wholly owned Australian subsidiary Mercator Gold Australia

Pty Ltd ("MGA") has 100% ownership of the Bailieston and Creswick

gold projects in central Victoria, Australia, has eight licence

applications outstanding including two licence applications lodged

in eastern Victoria. (Tambo gold project). MGA is currently

drilling at both the Bailieston and Creswick projects and has an

experienced exploration team with significant local knowledge in

the Victoria Goldfields and wider region.

https://mercatorgold.com.au/

ECR also owns 100% of an Australian subsidiary LUX Exploration

Pty Ltd ("LUX") which has three licence applications covering 900

km2 covering a relatively unexplored area in Queensland,

Australia.

https://luxexploration.com/

Following the sale of the Avoca, Moormbool and Timor gold

projects in Victoria, Australia to Fosterville South Exploration

Ltd (TSX-V: FSX) and the subsequent spin-out of the Avoca and Timor

projects to Leviathan Gold Ltd (TSX-V: LVX), Mercator Gold

Australia Pty Limited has the right to receive up to A$2 million in

payments subject to future resource estimation or production from

projects sold to Fosterville South Exploration Limited.

ECR has earned a 25% interest in the Danglay gold project; an

advanced exploration project located in a prolific gold and copper

mining district in the north of the Philippines, which has a 43-101

compliant resource. ECR also holds a royalty on the SLM gold

project in La Rioja Province, Argentina and can potentially receive

up to US$2.7 million in aggregate across all licences.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20211025005323/en/

CONTACT:

ECR Minerals plc

SOURCE: ECR Minerals plc

Copyright Business Wire 2021

(END) Dow Jones Newswires

October 25, 2021 03:10 ET (07:10 GMT)

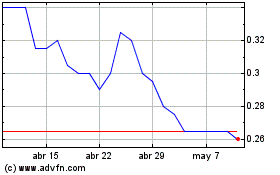

Ecr Minerals (LSE:ECR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ecr Minerals (LSE:ECR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024