TIDMEMIS

RNS Number : 1816L

EMIS Group PLC

09 September 2021

9 September 2021

EMIS Group plc

("EMIS Group" or "the Group")

Half year results for the six months ended 30 June 2021

"A positive first half in line with our strategic focus on

growth."

EMIS Group plc (AIM: EMIS.L), the UK leader in connected

healthcare software and systems, today announces its unaudited

results for the six months ended 30 June 2021.

Financial highlights

2021 H1 2020 H1 Change

Revenue

Total revenue GBP83.5m GBP78.1m +7%

Recurring revenue(1) GBP65.8m GBP63.5m +4%

Operating profit

Adjusted(1) GBP20.0m GBP17.8m +13%

Reported GBP16.3m GBP16.6m -2%

Cash flow and net cash

Cash generated from operations

- adjusted(1) GBP14.9m GBP33.8m -56%

Cash generated from operations

- reported GBP17.0m GBP36.6m -53%

Net cash(1) GBP48.0m GBP44.1m +9%

Earnings per share

Adjusted(1) 25.6p 23.1p +11%

Reported 20.8p 22.9p -9%

Interim dividend 17.6p 16.0p +10%

(1) For an explanation of the alternative performance measures

used in this report, please refer to the appendix.

H1 results - slightly ahead of the Board's expectations

-- A positive H1 with revenue and adjusted operating profit

ahead of both 2020 H1 and 2019 H1's results

-- Building solid foundations for the future with recurring

revenue increasing by 4%, representing 79% of total revenue

-- Cash flow reduced by one-off working capital factors,

including the repayment of GBP7.3m VAT deferred from 2020 H1

-- Good performance from sales, account management and delivery

teams, returning to business as usual

-- EMIS Enterprise boosted by use of the Outcomes4Health

solution to support the Covid-19 vaccination roll-out in

England

-- Dividend growth returns to pre-Covid-19 levels of 10%

Operational highlights - focus on growth

-- EMIS Group is engaged with senior NHS and enterprise business

leaders on the future of the healthcare market post Covid-19

-- Well positioned to meet the emerging integrated care systems'

(ICSs') needs through the investments made in technology,

especially analytics, data integration and interoperability

capabilities

-- Continued focus on improving customer experience with good

progress in the period, particularly with respect to the success of

digital support channels

-- On track to complete the next stage of EMIS-X through

deployment of the fast healthcare interoperability resource (FHIR)

layer as planned

Group outlook - confidence in future performance

-- A clear line of sight to meet Board expectations for the second half of the year*

-- The Group's connected care strategy positively reflects the

needs of the market both now and post Covid-19, working closely

with customers to develop the capabilities they require

-- Focussed on consistent growth in the next stage of the

Group's evolution organically, with strategic partners, as well as

through targeted M&A

Andy Thorburn, Chief Executive Officer of EMIS Group, said:

"It has been a positive first half with good performance from

the business, particularly in the sales, account management and

delivery teams in both EMIS Health and EMIS Enterprise. We are

returning to business as usual following the challenges of the

pandemic during 2020 and we have maintained our investment in, and

focus on, growth.

"We believe our connected care strategy positively reflects the

needs of the healthcare market as it emerges from Covid-19, with an

increased focus on data capabilities. We are working closely with

our customers at both strategic and local levels to address their

priorities.

"We have a clear line of sight to meet Board expectations for

the second half of the year and look forward to the future with

confidence."

There will be a hybrid results presentation today at 9.00am for

analysts, with the option to dial into the webcast and conference

call or to physically attend the presentation. Please contact

Florence Mayo at MHP Communications on 020 3128 8572, or email

emis@mhpc.com for details.

Enquiries:

For further information, contact:

EMIS Group plc Tel: 0113 380 3000

Andy Thorburn, CEO

Peter Southby, CFO

www.emisgroupplc.com

@EMISGroup

Numis Securities Limited (nominated adviser and broker) Tel: 020 7260 1000

Josh Hughes/Simon Willis/James Black

MHP Communications Tel: 020 3128 8572

Reg Hoare/James Bavister/Florence Mayo emis@mhpc.com

* Information for investors, including analyst consensus

forecasts, can be found on the Group's website at

www.emisgroupplc.com/investors .

Notes to editors

EMIS Group is the UK leader in connected healthcare software and

systems. Its solutions are widely used across every major UK

healthcare setting. EMIS Group's aim is to join up healthcare

through innovative technology, helping to deliver better health

outcomes to the UK population, supporting longer and healthier

lives.

EMIS Group has two core business segments: EMIS Health and EMIS

Enterprise.

EMIS Health is a supplier of innovative integrated care

technology to the NHS, including primary, community, acute and

social care.

EMIS Enterprise is focussed on growth in the

business-to-business technology sector within the healthcare

market, including management of medicines, partner businesses,

patient-facing services and analytics.

LEI: 213800K474ZZK76NX913

CHIEF EXECUTIVE OFFICER'S OVERVIEW

EMIS Group has had a positive first half of the year. Trading

for the period has been slightly ahead of the Board's expectations

and recurring revenue continues to grow. We have seen operational

activities return to business as usual despite the continuing

challenges of Covid-19, whilst maintaining a strong market share in

our key business areas and continuing investment for future growth.

Both revenue and adjusted operating profit were ahead of the

comparative period last year and 2019. Reported operating profit

was slightly lower than the comparative period.

The EMIS Health segment reported small increases in both

recurring and non-recurring revenues. The business continues to

deliver the requirements of the GP IT Futures contract to its core

primary care market, meeting the immediate needs of NHS Digital

(NHSD), aligning with GP users' needs for now and the future and

continuing to support the national Covid-19 programme of work.

The EMIS Enterprise segment reported strong growth in both

recurring and non-recurring revenue. This performance was boosted

by a positive contribution from the Pinnacle business (acquired in

March 2020) supporting the Covid-19 vaccination roll-out in

England. The business continues to focus on growth in

patient-facing digital services, analytics and pharmacy and through

the partner programme.

Connected care strategy

The future of the healthcare sector is connected care. We

anticipate that the focus on integrated care systems (ICSs) will

develop over the next few years as policies begin to take shape at

both central and local NHS level.

Initial discussions indicate that data management will be at the

heart of the NHS ICS strategy, which aligns with our investments in

EMIS-X Analytics, FHIR and our connected care capabilities. We also

continue to invest in connecting up our digital, pharmacy and life

sciences capabilities to drive future growth.

The Group's development roadmap continues at pace. We have

detailed development plans for all of our product areas, utilising

an agile development approach to bring new applications and product

enhancements to market more quickly with a combination of in-house

development and partner technology in a composite model. Updated

product roadmaps will be released across all key market settings

during the second half of 2021.

We are on track to complete the next stage of EMIS-X this year

through deployment of the national standard interoperability layer,

FHIR, as planned.

During the first half of 2021 we completed Patient's transition

into the matrix structure of EMIS Group. This enables us to

continue moving forward as one joined-up organisation, reflecting

our connected care strategy in alignment with NHS policy.

Focussed on growth

The Group is focussed on delivering consistent growth in the

coming years. EMIS Health is formally approved on 15 NHS

frameworks, meaning we are well placed to serve the requirements of

ICSs for interoperable technology systems that not only serve

frontline clinicians but are capable of supporting healthcare

analytics at scale for risk stratification, resource planning and

machine learning to support clinical decision making. Data

management will be at the heart of this and our investments in

EMIS-X Analytics and EMIS-X interoperability capabilities position

us well for the emerging ICS market.

In EMIS Enterprise we are focussed on four key areas for

growth:

-- increasing our digital patient-facing services;

-- expanding the partner programme;

-- growth and investment into pharmacy; and

-- developing the life sciences market with EMIS-X Analytics.

There are opportunities in community pharmacy as this sector

takes on increased responsibility for frontline care under the

patient group directions (PGD) initiative, which will see an

increasing range of healthcare services provided in a pharmacy

setting. This will lead to growth in the number and breadth of

patient-facing services that are available to book via Patient

Access. The EMIS partner programme is expected to drive growth

through the creation of a complete technology ecosystem for

customers.

Working effectively during the pandemic

I continue to be impressed by the dedication and commitment of

our employees in the UK and India, particularly during successive

lockdowns. Our people are passionate about supporting the NHS in

its delivery of patient care, and we continued to see our

high-performing teams fulfil this despite the challenges of the

pandemic. In recognition of the exceptional efforts to support our

customers through the pandemic, we rewarded all team members with a

one-off cash bonus in the first half of this year.

We continued to make employee wellbeing a priority during the

first half of 2021, with a focus on internal communications and on

promoting our established mental health first aider programme. We

encourage a strong ethos of supporting each other and this is a

cornerstone of EMIS's flexible working culture. An employee survey

in June 2021 showed that 86% agree or strongly agree that as part

of a remote workforce they feel engaged with the business.

Another important focus for the first half of 2021 has been

developing our environmental, social and governance (ESG)

proposition, drawing together a number of existing initiatives

already underway in the Group. The Board has approved the plan and

we will shortly create a formal committee to strengthen and develop

our ESG strategy.

Summary and outlook

EMIS Group continues to be well positioned for growth, with

rapidly evolving technology and data platforms that are aligned

with the evolution of the healthcare market.

With our connected care strategy and focus on the areas of

analytics, data integration and interoperability, we are well

positioned to deliver the connected care solutions that will be

required by the emerging ICSs.

The Pinnacle acquisition in 2020 has strengthened our community

pharmacy proposition; we will continue to grow the Group

organically through and with partners and, additionally, with

targeted acquisitions.

EMIS Group continues to increase its strong recurring revenue as

a foundation for investment for growth. We are engaged with senior

NHS and enterprise business leaders on the future of the healthcare

market following the pandemic. Our clinical systems have been

central to the UK's testing and vaccination programmes and, just as

we are able to deliver the NHS's digital requirements for the

national Covid-19 programme of work, our strategic roadmap aims to

do the same for the NHS's long-term modernisation agenda.

EMIS Group retains significant cash resources and bank

facilities to consider further acquisitions to build both the scale

and capabilities of the Group in existing and adjacent markets.

We have a clear line of sight to meet Board expectations for the

second half of the year and look forward to the future with

confidence.

OPERATIONAL REVIEW

EMIS Health

The EMIS Health segment comprises business areas where revenue

is generated from NHS organisations. This includes the primary,

community and emergency care markets as well as specialist ICT

infrastructure, hardware and engineering services and non-clinical

software. There have been no material changes to market shares in

key markets.

Supporting NHS Digital

The Group is working in close partnership with NHSD as it

continues to develop its national interoperability strategy, with

EMIS enabling the technical delivery of plans. The clinical coding

standard, SNOMED CT, is now aligned to international standards

under NHSD's direction and EMIS is an early phase partner for new

GP Connect capabilities, focussed on the FHIR standard for

exchanging healthcare information.

As well as delivering against the GP IT Futures framework, the

business continued to support NHSD with Covid-19-related projects.

Its online test results system, Keystone, was scaled up to manage

the transmission of up to 10 million test results per day into GP

records through interoperability. EMIS released new technology to

support GPs through the vaccination programme and supported NHS

England with its daily Covid-19 reporting requirements.

Regional update

EMIS Health continues to compete successfully across its estate.

The Group is well placed for the framework mini-tender processes

that are anticipated to occur through the coming years in both

Scotland and England.

In Scotland, as an approved supplier on the NHS National

Services Scotland (NSS) framework, EMIS Health continues to work

closely with NSS to deliver the technology to support its health

and care strategy.

In Northern Ireland, EMIS Health continues to supply EMIS Web to

GP customers, who are now benefiting from GP2GP functionality,

which allows patients' electronic health records to be transferred

securely and quickly between their old and new practices when they

change GPs.

EMIS Health continues to support its customers in Wales, pending

the outcome of the new Digital Health and Care Wales primary care

framework tender process. No end users have moved away from EMIS

systems since the framework altered in early 2018.

Strong performance in support and service

EMIS continues to prioritise customer experience and has

dedicated teams working to take the performance to the next level.

The use of digital support channels continued to increase, with 70%

of tickets received and resolved digitally (2020: 50%), following

the Group's 2019 investment into ServiceNow.

During the period the Group accelerated the pace of end user

software update releases, to deploy new functionality to customers

in a faster timeframe. The business also began to use the advanced

data science technology of EMIS-X Analytics to analyse reporting

trends and spot potential problems at an early stage, to be able to

speed up resolving or preventing unexpected issues.

EMIS Enterprise

The EMIS Enterprise segment comprises business areas where

revenue is predominantly from private sector sources, including

medicines management across both community and hospital pharmacies,

life sciences, the partner programme and patient-facing digital

services.

There have been no material changes in the market shares of any

key markets in which EMIS Enterprise operates.

Supporting the Covid-19 vaccination programme

In late 2020 EMIS adapted the Outcomes4Health system (acquired

with the Pinnacle business) to build a national vaccination system

at an unprecedented pace.

During the first half of the year, Outcomes4Health was the only

point of care system able to record vaccinations in a non-hospital

setting. To date, 66 million vaccinations have been recorded in

Outcomes4Health, transferred through interoperability to the

National Immunisation Management System (NIMS) and then into GP

clinical systems the next day. This enables crucial vaccination

status information to be shared with GP records and patients via

the NHS App or Patient Access.

Continued use of the platform is expected as the UK moves into

the next phases of the vaccination programme, with developments

planned to support the delivery of both flu and Covid-19

vaccinations.

Community pharmacy

The community pharmacy area of the business continued to perform

well during the first half of 2021.

The NHS Long Term Plan, published in January 2019, outlined the

intention for a greater range of clinical services to be provided

in a community pharmacy setting to alleviate pressure on primary

care. Secure exchange of data between systems will be key and EMIS

has boosted its capacity to develop and deliver interoperability

features into its pharmacy systems.

EMIS continues to integrate Pinnacle systems with its flagship

clinical systems for GPs and community pharmacies. This includes

functionality to support the NHS GP Community Pharmacist

Consultation Service (GP CPCS), supporting triage from primary care

into community pharmacy for minor illnesses.

The business also launched a new solution to support the

national Discharge Medicines Service (DMS) across England,

supporting secure transfer of clinical information at the point of

patient discharge from hospital clinical systems to their chosen

community pharmacy.

Moving forwards with digital patient-facing services

Patient Access remains the number one app for primary care

patient-facing services in England and increased its registered

users to 13.0 million during the period (31 December 2020: 11.7

million ) . Patients continue to utilise digital solutions to

access primary care services, with 11.5 million repeat

prescriptions ordered in the first half of 2021, in line with the

comparative period (2020: 11.7 million).

Patient Access is evolving from its strong foundations as the

leading provider of primary care digital services into a healthcare

ecosystem app with a broader range of services. This includes a new

opt-in service for personalised healthcare content to support

medication compliance through increased knowledge. Smart Pharmacy,

a new pilot service, enables patients to order, track and opt for

home delivery of their medications from their local pharmacy.

Community pharmacy appointment booking continues to develop,

with the service now live in 1,600 branches of 248 pharmacy

organisations. The business continues to expand the range of

bookable services through the Patient Access marketplace, including

blood and Covid-19 testing, and to increase the network of service

providers.

The evolution of the partner programme

To offer customers a greater range of functionality, the

business continues to proactively seek third party partners to add

new and different capabilities to the overall ecosystem.

As a focus area of growth, EMIS has evolved the programme into

two different types of partner relationships. Elite partners will

bring strategically important core capabilities such as document

management, video consulting and referral functionality to "plug

into" in-house technology and provide the fully rounded EMIS

solution.

Resale partners continue to offer a wide range of products and

services that interoperate and exchange data seamlessly with EMIS

clinical systems, including clinical devices such as spirometry and

ECG monitors. The partner programme will continue to grow in line

with end user requirements and NHS strategy, to drive business

growth and promote core customer retention.

EMIS-X Analytics

We believe that the future of preventative healthcare will be

driven through analysis of data. National and local strategy will

be informed by proactively identifying patients most at risk, to

focus resources where they are most needed.

EMIS-X Analytics technology generates insights from data, which

can be integrated back into the clinical workflow, to build in

artificial intelligence (AI) that can help improve patient outcomes

on both a national level and at the point of care.

EMIS continues to work on a pilot programme with one of the top

five global pharmaceutical companies to implement AI into EMIS Web

via EMIS-X Analytics technology. The collaboration aids early

detection of atrial fibrillation to reduce occurrence of strokes

across the UK population and is an example of how EMIS-X Analytics

technology can identify conditions that have not yet been

detected.

EMIS's strategy for EMIS-X Analytics is in alignment with

policy: two recently released policy papers from the Department of

Health and Social Care and the Department for Business, Energy and

Industrial Strategy highlight the requirement for the integration

of clinical research into the healthcare industry and provision of

secure access for healthcare professionals.

The positive customer response to EMIS-X Analytics continues

since its launch in October 2020. Following completion of a

successful six-month pilot, many pilot customers have moved to the

next stage of adopting the technology, ranging from simplified

access to data for population health to appointment planning during

the pandemic. We have closed two EMIS-X Analytics deals in the

first half of 2021 and we expect more to follow.

Supporting research into Covid-19 with EMIS-X Analytics

technology

A collaboration between EMIS and the national open-source

research platform OpenSAFELY is delivering important new insights

into Covid-19, including findings on the underreporting of long

Covid. EMIS and OpenSAFELY have created a secure, trusted research

environment within EMIS-X Analytics to support this.

Other research projects in this collaboration are investigating

the uptake of the UK Covid-19 vaccination programme, including

analysis of regional and demographic coverage.

FINANCIAL REVIEW

It was pleasing to see the improved momentum of the latter part

of 2020 maintained into the first half of 2021, despite the further

lockdown in the early months of this year. The Group's revenue,

recurring revenue, adjusted operating profit and margin were all

higher compared to both the comparative period and 2019 H1. As

expected, reported operating profit and margin were slightly lower

and cash flow was less strong than the comparative period as

Covid-19-related VAT deferrals unwound and investment in the

business to deliver future growth was maintained.

Group revenue increased by 7% to GBP83.5m (2020 H1: GBP78.1m),

including revenue of GBP3.3m (2020 H1: GBP0.7m) from the March 2020

Pinnacle acquisition. Recurring revenue grew by 4% to GBP65.8m

(2020 H1: GBP63.5m), representing 79% (2020 H1: 81%) of the Group's

total revenue.

Adjusted operating profit for the period was GBP20.0m (2020 H1:

GBP17.8m), with increases in both recurring and non-recurring

revenue and a more normalised gross margin sales mix partly offset

by higher staff costs and increased operating expenses. With a

lower level of development costs capitalised, reported operating

profit reduced to GBP16.3m (2020 H1: GBP16.6m).

Segmental performance

In EMIS Health, revenue reflected a more normalised trading

period for the segment with the comparative period having included

higher than usual hardware sales. Overall revenue was marginally

higher at GBP54.3m (2020 H1: GBP54.0m) but within this recurring

revenue increased by 3%. This higher quality revenue mix resulted

in an increased adjusted operating profit of GBP12.5m (2020 H1:

GBP11.9m), delivered while continuing to invest in developing the

strategic roadmap. Conversely, reported divisional operating profit

was lower at GBP10.6m (2021 H1: GBP13.1m) due to a reduction in the

level of capitalised development costs.

In EMIS Enterprise, revenue increased by 21% to GBP29.3m (2020

H1: GBP24.1m) and recurring revenue increased by 6%, reflecting an

improved market and a relatively weak comparative period which was

affected by the first lockdown. With the segment focussed on

executing in the areas of patient-facing services, analytics and

pharmacy, including supporting the NHS Covid-19 vaccination

programme through its Pinnacle software, adjusted operating profit

increased by 28% to GBP8.4m (2020 H1: GBP6.5m) and reported

operating profit also increased to GBP6.6m (2020 H1: GBP4.2m).

Revenue

The analysis of revenue is summarised below with full segmental

revenue analysis set out in note 9 .

-- software subscription and support revenue increased to

GBP50.9m (2020 H1: GBP48.9m), reflecting higher revenue from the

Group's existing customers;

-- interface and connectivity charges increased to GBP12.1m

(2020 H1: GBP9.7m), as a result of increased on-boarding within the

partner programme;

-- other services revenue was higher at GBP7.9m (2020 H1:

GBP6.7m), principally due to increased activity in digitisation

projects and growth in analytics;

-- hardware and related services revenue reduced to a more

normal level at GBP6.4m (2020 H1: GBP9.6m), after the pandemic had

driven higher short-term demand in the primary care market in the

comparative period; and

-- perpetual licences, training, consultancy and implementation

revenue was higher at GBP6.2m (2020 H1: GBP3.2m), with an

increasing level of project work across the business including

one-off revenues in relation to the NHS Covid-19 vaccination

programme.

Profitability and dividend

Adjusted operating profit increased by 13% to GBP20.0m (2020 H1:

GBP17.8m) with the adjusted operating margin increasing to 24.0%

(2020 H1: 22.8%), reflecting the stronger sales mix.

The Group employed 1,515 staff at 30 June 2021, with the

decrease from 1,591 at 31 December 2020 principally as a result of

vacancies in the Indian development team which are expected to be

filled in the second half of the year. Average staff costs

increased with the timing and quantum of bonus and share scheme

charges. Other operating expenses increased with additional costs

associated with the technology transformation programme, including

Microsoft and AWS.

With a lower level of capitalisation of development costs due to

teams focussing more on improving customer experience, and with

amortisation overall remaining broadly consistent, reported

operating profit was lower at GBP16.3m (2020 H1: GBP16.6m).

The tax charge for the period was GBP3.3m (2020 H1: GBP3.4m),

including GBP0.3m resulting from the recalculation of deferred tax

at the increased future rate of 25%. The tax charge represented an

effective rate of tax before the deferred tax rate change, other

income and share of result of joint venture and associate of 19.1%

(2020 H1: 19.2%).

Adjusted basic and diluted EPS increased by 11% and 10% to 25.6p

and 25.3p respectively (2020 H1: 23.1p and 22.9p). The reported

basic and diluted EPS were both lower at 20.8p and 20.6p

respectively (2020 H1: 22.9p and 22.8p).

The Board has carefully considered the more encouraging trading

environment experienced in 2021, together with the consistent

underlying growth of the Group and its future prospects, and has

declared a 10% increase in the interim dividend to 17.6p per share

(2020 H1: 16.0p), payable on 4 November 2021 to shareholders on the

register at the close of business on 8 October 2021.

Cash flow, net cash and financing

Cash generated from operations was GBP17.0m (2020 H1: GBP36.6m),

with the decrease due principally to working capital movements. In

particular, this reflected the repayment of GBP7.3m of VAT, the

deferral of which had benefitted the comparative period, and also

some short-term delayed debtor payments which were received in

early July. Adjusted cash from operations, stated after deducting

capitalised development costs and adjusting for the cash impact of

any exceptional items where appropriate, decreased to GBP14.9m

(2020 H1: GBP33.8m).

Gross capital expenditure on property, plant and equipment and

purchased software excluding capitalised development costs remained

tightly controlled at GBP1.6m (2020 H1: GBP0.9m).

The Group paid GBP2.0m of deferred consideration in respect of

the 2020 acquisition of the Pinnacle business and GBP2.4m to

acquire shares to satisfy future requirements of employee share

schemes, partially offset by GBP0.6m received for shares

transferred to employees.

After finance costs, lease payments, tax, and dividends, the

Group ended the period with net cash of GBP48.0m (31 December 2020:

GBP53.0m; 2020 H1: GBP44.1m).

As at 30 June 2021, the Group had available undrawn bank

facilities of GBP15.0m in place until 30 June 2022. An accordion

arrangement is in place to increase the quantum up to GBP30.0m if

required.

INDEPENT REVIEW REPORT TO EMIS GROUP PLC

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly results for the six

months ended 30 June 2021 which comprises the group statement of

comprehensive income, group balance sheet, group statement of cash

flows, group statement of changes in equity and the related

explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly report for the six months ended 30 June 2021 is

not prepared, in all material respects, in accordance with IAS 34

Interim Financial Reporting as adopted for use in the UK and the

AIM Rules.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. We read the other information contained in the

half-yearly report and consider whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Directors' responsibilities

The half-yearly report is the responsibility of, and has been

approved by, the directors. The directors are responsible for

preparing the half-yearly report in accordance with the AIM

Rules.

As disclosed in note 2, the latest annual financial statements

of the group were prepared in accordance with international

accounting standards in conformity with the requirements of the

Companies Act 2006 and the next annual financial statements will be

prepared in accordance with UK-adopted international accounting

standards. The directors are responsible for preparing the

condensed set of financial statements included in the half-yearly

report in accordance with IAS 34 as adopted for use in the UK.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly report

based on our review.

The purpose of our review work and to whom we owe our

responsibilities

This report is made solely to the company in accordance with the

terms of our engagement. Our review has been undertaken so that we

might state to the company those matters we are required to state

to it in this report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the company for our review work, for this

report, or for the conclusions we have reached.

Francis Simpson

for and on behalf of KPMG LLP

Chartered Accountants

1 Sovereign Square, Sovereign Street, Leeds, LS1 4DA

8 September 2021

Group statement of comprehensive income

for the six months ended 30 June 2021

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

----------------------------------- ----- ---------- ---------- -----------

Revenue 9 83,512 78,118 159,453

Costs:

Changes in inventories 51 940 (47)

Cost of goods and services (8,159) (12,426) (20,288)

Staff costs (36,864) (29,680) (63,374)

Other operating expenses (13,662) (12,002) (22,628)

Depreciation of property, plant

and equipment (2,173) (2,601) (5,089)

Amortisation of intangible assets (6,391) (5,718) (12,251)

----------------------------------- ----- ---------- ---------- -----------

Adjusted operating profit 20,011 17,772 39,266

Development costs capitalised 2,112 4,096 6,590

Amortisation of intangible assets1 (5,809) (5,237) (11,100)

Release of contingent acquisition

consideration - - 1,020

----------------------------------- ----- ---------- ---------- -----------

Operating profit 16,314 16,631 35,776

Finance income 11 201 89

Finance costs (241) (322) (590)

Share of result of joint venture

and associate 361 424 858

Other income2 - 782 782

----------------------------------- ----- ---------- ---------- -----------

Profit before taxation 16,445 17,716 36,915

Income tax expense 10 (3,335) (3,384) (6,794)

----------------------------------- ----- ---------- ---------- -----------

Profit for the period 13,110 14,332 30,121

----------------------------------- ----- ---------- ---------- -----------

Other comprehensive income

Items that may be reclassified

to profit or loss:

Currency translation differences (120) 76 (41)

----------------------------------- ----- ---------- ---------- -----------

Other comprehensive income (120) 76 (41)

----------------------------------- ----- ---------- ---------- -----------

Total comprehensive income for

the period 12,990 14,408 30,080

----------------------------------- ----- ---------- ---------- -----------

Attributable to:

- equity holders of the parent 12,990 14,479 30,207

- non-controlling interest in

subsidiary company - (71) (127)

----------------------------------- ----- ---------- ---------- -----------

Total comprehensive income for

the period 12,990 14,408 30,080

----------------------------------- ----- ---------- ---------- -----------

Earnings per share attributable

to equity holders of the parent Pence Pence Pence

--------------------------------- ----- ----- -----

Basic 11 20.8 22.9 48.1

Basic diluted 11 20.6 22.8 47.6

Adjusted 11 25.6 23.1 51.0

Adjusted diluted 11 25.3 22.9 50.4

--------------------------------- ----- ----- -----

1 Excluding amortisation of computer software used internally of

GBP582,000 (2020 H1: GBP481,000; 2020 FY: GBP1,151,000).

2 During the prior period the Group received GBP782,000 of

previously unrecognised additional consideration in relation to the

2019 disposal of the Specialist & Care business.

Group balance sheet

as at 30 June 2021

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

-------------------------------- ----- --------- --------- -----------

Non-current assets

Goodwill 52,177 52,146 52,177

Other intangible assets 13 28,914 36,801 33,118

Property, plant and equipment 18,959 20,591 19,870

Investment in joint venture and

associate 714 769 353

-------------------------------- ----- --------- --------- -----------

100,764 110,307 105,518

-------------------------------- ----- --------- --------- -----------

Current assets

Inventories 664 1,600 613

Current tax assets 3,274 247 3,556

Trade and other receivables 45,343 32,414 29,993

Cash and cash equivalents 48,044 44,122 53,008

-------------------------------- ----- --------- --------- -----------

97,325 78,383 87,170

-------------------------------- ----- --------- --------- -----------

Total assets 198,089 188,690 192,688

-------------------------------- ----- --------- --------- -----------

Current liabilities

Trade and other payables (26,810) (26,050) (31,219)

Deferred income (39,836) (37,017) (29,161)

Other financial liabilities 14 (2,000) (2,480) (2,000)

Lease liabilities 15 (867) (973) (990)

-------------------------------- ----- --------- --------- -----------

(69,513) (66,520) (63,370)

-------------------------------- ----- --------- --------- -----------

Non-current liabilities

Deferred tax liability (2,245) (1,711) (2,289)

Other financial liabilities 14 - (5,268) (2,000)

Lease liabilities 15 (5,398) (6,307) (5,891)

-------------------------------- ----- --------- --------- -----------

(7,643) (13,286) (10,180)

-------------------------------- ----- --------- --------- -----------

Total liabilities (77,156) (79,806) (73,550)

-------------------------------- ----- --------- --------- -----------

Net assets 120,933 108,884 119,138

-------------------------------- ----- --------- --------- -----------

Equity

Ordinary share capital 633 633 633

Share premium 51,045 51,045 51,045

Own shares held in trust (5,434) (4,810) (3,594)

Retained earnings 73,015 61,948 69,260

Other reserve 1,674 (137) 1,794

-------------------------------- ----- --------- --------- -----------

Equity attributable to owners

of the parent 120,933 108,679 119,138

Non-controlling interest - 205 -

-------------------------------- ----- --------- --------- -----------

Total equity 120,933 108,884 119,138

-------------------------------- ----- --------- --------- -----------

Group statement of cash flows

for the six months ended 30 June 2021

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

Profit before taxation 16,445 17,716 36,915

Finance income (11) (201) (89)

Finance costs 241 322 590

Share of result of joint venture (361) (424) (858)

Other income - (782) (782)

-------------------------------------- ----- ---------- ---------- -----------

Operating profit 16,314 16,631 35,776

Adjustment for non-cash items

Amortisation of intangible assets 6,391 5,718 12,251

Depreciation of property, plant

and equipment 2,173 2,601 5,089

(Profit)/loss on disposal of

property, plant and equipment (7) 32 43

Share-based payments 824 230 1,440

-------------------------------------- ----- ---------- ---------- -----------

Operating cash flow before changes

in working capital 25,695 25,212 53,579

Changes in working capital

(Increase)/decrease in inventory (51) (940) 47

(Increase)/decrease in trade

and other receivables (13,857) 2,619 3,197

(Decrease)/increase in trade

and other payables (4,407) 2,508 7,751

Increase/(decrease) in deferred

income 9,637 7,169 (436)

-------------------------------------- ----- ---------- ---------- -----------

Adjusted cash generated from

operations 14,905 33,775 58,851

Development costs capitalised 2,112 4,096 6,590

Cash costs of exceptional items - (1,303) (1,303)

-------------------------------------- ----- ---------- ---------- -----------

Cash generated from operations 17,017 36,568 64,138

Finance costs (42) (82) (141)

Finance income 10 86 87

Tax paid (3,789) (7,723) (11,684)

-------------------------------------- ----- ---------- ---------- -----------

Net cash generated from operating

activities 13,196 28,849 52,400

-------------------------------------- ----- ---------- ---------- -----------

Cash flows from investing activities

Purchase of property, plant and

equipment (1,501) (850) (2,449)

Proceeds from sale of property,

plant and equipment 7 2,478 2,500

Development costs capitalised (2,112) (4,096) (6,590)

Purchase of software (75) (96) (452)

Dividends received - - 850

Business combination - (2,880) (2,880)

Disposal of discontinued operation,

net of cash disposed of - 782 782

-------------------------------------- ----- ---------- ---------- -----------

Net cash used in investing activities (3,681) (4,662) (8,239)

-------------------------------------- ----- ---------- ---------- -----------

Cash flows from financing activities

Transactions in own shares held

in trust (1,840) 211 474

Payment of lease liabilities 15 (573) (777) (1,511)

Contingent consideration (2,000) (800) (800)

Dividends paid 12 (10,066) (9,798) (19,860)

Acquisition of non-controlling

interest - - (555)

-------------------------------------- ----- ---------- ---------- -----------

Net cash used in financing activities (14,479) (11,164) (22,252)

-------------------------------------- ----- ---------- ---------- -----------

Net (decrease)/increase in cash

and cash equivalents (4,964) 13,023 21,909

Cash and cash equivalents at

beginning of period 53,008 31,099 31,099

-------------------------------------- ----- ---------- ---------- -----------

Cash and cash equivalents at

end of period 48,044 44,122 53,008

-------------------------------------- ----- ---------- ---------- -----------

Group statement of changes in equity

for the six months ended 30 June 2021

Own shares Non-

held

Share Share in Retained Other controlling Total

capital premium trust earnings reserve interest equity

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ----- ------- ------- ---------- -------- ------- ----------- --------

At 1 January 2020 633 51,045 (5,021) 57,118 147 276 104,198

Profit for the period - - - 14,403 - (71) 14,332

Transactions with owners

Share acquisitions less

sales - - 211 - - - 211

Share-based payments - - - 230 - - 230

Deferred tax in relation

to share-based payments - - - (5) - - (5)

Dividends paid - - - (9,798) - - (9,798)

Contingent acquisition

consideration - - - - (320) - (320)

Option over non-controlling

interest - - - - (40) - (40)

Other comprehensive income

Currency translation differences - - - - 76 - 76

--------------------------------- ----- ------- ------- ---------- -------- ------- ----------- --------

At 30 June 2020 633 51,045 (4,810) 61,948 (137) 205 108,884

Profit for the period - - - 15,845 - (56) 15,789

Changes in ownership interest

Non-controlling interest

acquisition - - - (406) - (149) (555)

Transactions with owners

Share acquisitions less

sales - - 1,216 - - - 1,216

Share-based payments - - - 1,210 - - 1,210

Deferred tax in relation

to share-based payments - - - 45 - - 45

Dividends paid 12 - - - (10,062) - - (10,062)

Contingent acquisition

consideration - - - 680 (680) - -

Option over non-controlling

interest - - - - 2,728 - 2,728

Other comprehensive income

Currency translation differences - - - - (117) - (117)

--------------------------------- ----- ------- ------- ---------- -------- ------- ----------- --------

At 31 December 2020 633 51,045 (3,594) 69,260 1,794 - 119,138

Profit for the period - - - 13,110 - - 13,110

Transactions with owners

Share acquisitions less

sales - - (1,840) - - - (1,840)

Share-based payments - - - 824 - - 824

Deferred tax in relation

to share-based payments - - - (113) - - (113)

Dividends paid 12 - - - (10,066) - - (10,066)

Other comprehensive income

Currency translation differences - - - - (120) - (120)

--------------------------------- ----- ------- ------- ---------- -------- ------- ----------- --------

At 30 June 2021 633 51,045 (5,434) 73,015 1,674 - 120,933

--------------------------------- ----- ------- ------- ---------- -------- ------- ----------- --------

Notes to the half year financial statements

1. General information

The financial statements for the six months ended 30 June 2021

and the six months ended 30 June 2020 do not constitute statutory

accounts within the meaning of Section 434 of the Companies Act

2006. Statutory accounts for the year ended 31 December 2020 were

approved by the Board of Directors on 17 March 2021 and delivered

to the Registrar of Companies. The auditor's report on those

accounts was unqualified, did not contain an emphasis of matter

paragraph and did not contain any statement under Section 498 (2)

or (3) of the Companies Act 2006.

These condensed half year financial statements were approved for

issue by the Board of Directors on 8 September 2021.

2. Basis of preparation

These condensed half year financial statements for the half year

ended 30 June 2021 have been prepared in accordance with the AIM

Rules for Companies, comply with IAS 34 Interim Financial Reporting

and should be read in conjunction with the annual financial

statements for the year ended 31 December 2020, which have been

prepared in accordance with international accounting standards in

conformity with the requirements of the Companies Act 2006

("adopted IFRS").

The financial information is presented in sterling, which is the

functional currency of EMIS Group. All financial information

presented has been rounded to the nearest thousand.

Going concern

The Group is profitable and cash generative and it is

anticipated that this will continue. There is a high and continuing

level of recurring revenue and high cash conversion.

The Directors have prepared cash flow forecasts covering a

period of at least twelve months from the date of approval of these

condensed half year financial statements. These forecasts,

including consideration of reasonably possible downside scenarios

linked to the principal risks and uncertainties set out in the

strategic report of the Group's annual report and accounts for the

year ended 31 December 2020, show that the Group will continue to

operate with significant cash reserves and would not need to

utilise the facility in place under any of the scenarios

considered. Based on this assessment the Directors have a

reasonable expectation that the Group has adequate resources to

continue in existence for at least twelve months from the date of

approval of these half year financial statements and therefore

continue to adopt the going concern basis of accounting in

preparing these condensed half year financial statements.

3. Accounting policies

The accounting policies applied in these interim financial

statements are the same as those applied in the Group's annual

report and accounts for the year ended 31 December 2020.

Current taxes on income in the half year period are accrued

using the tax rates that would be applicable to expected total

annual profits. Deferred taxes on income are calculated based on

the standard rates that are enacted as at the balance sheet

date.

4. Critical accounting judgements and key sources of estimation

uncertainty

In preparing the 2021 half year financial statements no

significant judgements have been made in the process of applying

the Group's accounting policies, and no significant estimations

have been made that could have a material effect on the amounts

recognised in the financial statements.

5. Principal risks and uncertainties

The 2020 Group annual report and accounts describes the

principal risks and uncertainties that could impact the Group's

performance. These risks relate to healthcare structure and

procurement changes, software (product) development, people and

culture, information governance and cyber security, and clinical

safety. These remain unchanged since the annual report was

published and are not expected to change for the remaining six

months of the financial year. The Group operates a structured risk

management process, which identifies and evaluates risks and

uncertainties and reviews mitigation activity.

Covid-19 was described as an emerging risk in the 2020 Group

annual report; however, the Board no longer regards this as an

emerging risk which could materially impact the business, as the

Group has proven its ability to continue to operate normally over

an extended period of time including homeworking and video

conferencing.

6. Financial risk management

The Group's activities expose it to financial risks including

credit risk, liquidity risk, interest rate risk and price risk.

These condensed consolidated half year financial statements do

not include all financial risk management information and

disclosures required in the annual financial statements and

therefore should be read in conjunction with the 2020 Group annual

report and accounts.

7. Forward-looking statements

Certain statements in this half year report are forward-looking.

Although the Group believes that the expectations reflected in

these forward-looking statements are reasonable, it can give no

assurance that these expectations will prove to have been correct.

Because these statements involve risks and uncertainties, actual

results may differ materially from those expressed or implied by

these forward-looking statements.

8. Segmental reporting

IFRS 8 Operating Segments provides for segmental information

disclosure on the basis of information reported internally to the

chief operating decision-maker for decision-making purposes. The

Group considers that this role is performed by the main Board.

The Directors have presented segmental information to reflect

the Group's structure, activities and the markets being served. The

Group has two operating and reportable segments, both involved with

the supply and support of connected healthcare software and

systems:

-- EMIS Health; and

-- EMIS Enterprise.

Each operating segment is assessed by the Board based on an

adjusted measure of operating profit, as defined in the appendix.

Group operating expenses, finance income and costs, cash and cash

equivalents, and current and deferred taxes are not allocated to

segments, as income tax, group and financing activities are not

segment-specific.

Six months ended Six months ended

30 June 2021 30 June 2020

Unaudited Unaudited

----------------------------- -----------------------------

EMIS EMIS EMIS EMIS

Health Enterprise Total Health Enterprise Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ------- ----------- ------- ------- ----------- -------

Revenue 54,254 29,258 83,512 54,003 24,115 78,118

------------------------------------ ------- ----------- ------- ------- ----------- -------

Segmental operating profit

as reported internally 12,484 8,367 20,851 11,929 6,521 18,450

Development costs capitalised 1,286 826 2,112 3,737 359 4,096

Amortisation of development

costs (1,555) (991) (2,546) (844) (880) (1,724)

Amortisation of acquired intangible

assets (1,633) (1,630) (3,263) (1,717) (1,796) (3,513)

------------------------------------ ------- ----------- ------- ------- ----------- -------

Segmental operating profit 10,582 6,572 17,154 13,105 4,204 17,309

Group operating expenses (840) (678)

------------------------------------ ------- ----------- ------- ------- ----------- -------

Operating profit 16,314 16,631

Net finance costs (230) (121)

Share of result of joint venture

and associate 361 424

Other income - 782

------------------------------------ ------- ----------- ------- ------- ----------- -------

Profit before taxation 16,445 17,716

------------------------------------ ------- ----------- ------- ------- ----------- -------

Revenue excludes intra-group transactions on normal commercial

terms from the EMIS Health segment to the EMIS Enterprise segment

totalling GBP1,185,000 (2020 H1: GBP1,399,000).

Revenue of GBP54,173,000 (2020 H1: GBP55,826,000) is derived

from the NHS and related bodies. Revenue of GBP1,765,000 (2020 H1:

GBP1,861,000) is derived from customers outside the United

Kingdom.

9. Revenue analysis

Revenue is analysed as follows:

Six months ended Six months ended

30 June 2021 30 June 2020

Unaudited Unaudited

----------------------------- -----------------------------

EMIS EMIS EMIS EMIS

Health Enterprise Total Health Enterprise Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- ------- ----------- ------- ------- ----------- -------

Software subscription and

support 38,909 11,975 50,884 38,075 10,794 48,869

Interface and connectivity

charges 3,007 9,088 12,095 2,234 7,483 9,717

Other services 5,124 2,788 7,912 4,168 2,582 6,750

Hardware and related services 3,693 2,692 6,385 7,607 2,013 9,620

Perpetual licences, training,

consultancy and implementation 3,521 2,715 6,236 1,919 1,243 3,162

-------------------------------- ------- ----------- ------- ------- ----------- -------

54,254 29,258 83,512 54,003 24,115 78,118

-------------------------------- ------- ----------- ------- ------- ----------- -------

10. Income tax expense

The tax expense recognised reflects management estimates of the

tax charge for the period and has been calculated using the

estimated average tax rate of UK corporation tax for the financial

year of 19% (2020: 19%). In March 2021 the UK government announced

that the UK corporation tax rate for large companies would rise to

25% from 1 April 2023. This resulted in a one-off deferred tax

charge of GBP261,000 in the period, with a corresponding increase

in the Group's net deferred tax liability.

11. Earnings per share (EPS)

The calculation of basic and diluted EPS is based on the

following earnings and numbers of shares:

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Earnings GBP'000 GBP'000 GBP'000

------------------------------------------------ ---------- ---------- -----------

Profit for the period 13,110 14,332 30,121

Total comprehensive income attributable to

non-controlling interest - 71 127

------------------------------------------------ ---------- ---------- -----------

Basic earnings attributable to equity holders 13,110 14,403 30,248

Development costs capitalised (2,112) (4,096) (6,590)

Amortisation of development costs and acquired

intangible assets 5,809 5,237 11,100

Release of contingent acquisition consideration - - (1,020)

Other income - (782) (782)

Tax and non-controlling interest effect of

above items (703) (258) (925)

------------------------------------------------ ---------- ---------- -----------

Adjusted earnings attributable to equity

holders 16,104 14,504 32,031

------------------------------------------------ ---------- ---------- -----------

Number Number Number

Weighted average number of ordinary shares '000 '000 '000

------------------------------------------------ ---------- ---------- -----------

Total shares in issue 63,311 63,311 63,311

Shares held by Employee Benefit Trust (346) (479) (447)

------------------------------------------------ ---------- ---------- -----------

For basic EPS calculations 62,965 62,832 62,864

Effect of potentially dilutive share options 582 368 634

------------------------------------------------ ---------- ---------- -----------

For diluted EPS calculations 63,547 63,200 63,498

------------------------------------------------ ---------- ---------- -----------

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

EPS Pence Pence Pence

----------------- ---------- ---------- -----------

Basic 20.8 22.9 48.1

Basic diluted 20.6 22.8 47.6

Adjusted 25.6 23.1 51.0

Adjusted diluted 25.3 22.9 50.4

----------------- ---------- ---------- -----------

12. Dividends

In relation to the 2020 financial year, an interim dividend of

16.0p was paid on 5 November 2020 amounting to GBP10,062,000,

followed by a final dividend of 16.0p on 14 May 2021 amounting to

GBP10,066,000.

For the 2021 financial year, the Directors are proposing an

interim dividend of 17.6p, which will be payable on 4 November 2021

to shareholders on the register at 8 October 2021. This interim

dividend, which will amount to approximately GBP11,085,000, has not

been recognised as a liability in these half year financial

statements.

13. Other intangible assets

Computer Computer

Computer software software

software developed acquired

used for external on business Customer

internally sale combinations relationships Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- ---------- ------------ ------------ ------------- -------

Cost

At 1 January 2020 7,798 58,098 40,341 30,984 137,221

Additions 96 4,096 - - 4,192

Acquisition of business - - 2,989 962 3,951

---------------------------------------- ---------- ------------ ------------ ------------- -------

At 30 June 2020 7,894 62,194 43,330 31,946 145,364

Additions 356 2,494 - - 2,850

---------------------------------------- ---------- ------------ ------------ ------------- -------

At 31 December 2020 8,250 64,688 43,330 31,946 148,214

Additions 75 2,112 - - 2,187

---------------------------------------- ---------- ------------ ------------ ------------- -------

At 30 June 2021 8,325 66,800 43,330 31,946 150,401

---------------------------------------- ---------- ------------ ------------ ------------- -------

Accumulated amortisation and impairment

At 1 January 2020 5,167 43,676 31,281 22,721 102,845

Charged in period 481 1,724 2,202 1,311 5,718

---------------------------------------- ---------- ------------ ------------ ------------- -------

At 30 June 2020 5,648 45,400 33,483 24,032 108,563

Charged in period 670 2,552 2,210 1,101 6,533

---------------------------------------- ---------- ------------ ------------ ------------- -------

At 31 December 2020 6,318 47,952 35,693 25,133 115,096

Charged in period 582 2,546 2,210 1,053 6,391

---------------------------------------- ---------- ------------ ------------ ------------- -------

At 30 June 2021 6,900 50,498 37,903 26,186 121,487

---------------------------------------- ---------- ------------ ------------ ------------- -------

Net book value

At 30 June 2021 1,425 16,302 5,427 5,760 28,914

At 31 December 2020 1,932 16,736 7,637 6,813 33,118

At 30 June 2020 2,246 16,794 9,847 7,914 36,801

At 1 January 2020 2,631 14,422 9,060 8,263 34,376

---------------------------------------- ---------- ------------ ------------ ------------- -------

14. Other financial liabilities

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------------------ ---------- ---------- -----------

Current

Contingent acquisition consideration - Pinnacle 2,000 2,000 2,000

Contingent acquisition consideration - Dovetail - 480 -

------------------------------------------------ ---------- ---------- -----------

Total 2,000 2,480 2,000

------------------------------------------------ ---------- ---------- -----------

Non-current

Contingent acquisition consideration - Pinnacle - 2,000 2,000

Contingent acquisition consideration - Dovetail - 540 -

Option over non-controlling interest - 2,728 -

------------------------------------------------ ---------- ---------- -----------

Total - 5,268 2,000

------------------------------------------------ ---------- ---------- -----------

In respect of the Pinnacle contingent acquisition consideration,

a payment of GBP2,000,000 was made during the period, and a

liability of GBP2,000,000 was reclassified from non-current to

current liabilities.

15. Leases

Set out below are the carrying amounts of the Group's

right-of-use assets and lease liabilities and the movements during

the period:

Lease

Right-of-use assets liabilities

--------------------------------------- -----------

Fixtures,

Land fittings

and and Motor

buildings equipment vehicles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- --------- --------- -------- ------- -----------

As at 1 January 2020 2,639 46 886 3,571 (3,934)

Additions 3,391 - 389 3,780 (3,780)

Acquisition of business 151 - - 151 (156)

Depreciation expense (367) (16) (294) (677) -

Interest expense - - - - (191)

Payments - - - - 777

Effect of movements in exchange

rates (6) - - (6) 4

--------------------------------- --------- --------- -------- ------- -----------

As at 30 June 2020 5,808 30 981 6,819 (7,280)

Additions 31 - 270 301 (301)

Depreciation expense (491) (16) (269) (776) -

Interest expense - - - - (195)

Payments - - - - 731

Effect of movements in exchange

rates (134) - - (134) 164

--------------------------------- --------- --------- -------- ------- -----------

As at 31 December 2020 5,214 14 982 6,210 (6,881)

Additions - - 10 10 (10)

Remeasurement of lease asset and

liability - - (154) (154) 154

Depreciation expense (315) (14) (198) (527) -

Interest expense - - - - (180)

Payments - - - - 573

Effect of movements in exchange

rates (66) - - (66) 79

--------------------------------- --------- --------- -------- ------- -----------

As at 30 June 2021 4,833 - 640 5,473 (6,265)

--------------------------------- --------- --------- -------- ------- -----------

Appendix: Alternative performance measures (APMs)

This report contains certain financial measures (APMs) that are

not defined or recognised under IFRS but are presented to provide

readers with additional financial information that is evaluated by

management and investors in assessing the performance of the

Group.

This additional information presented is not uniformly defined

by all companies and may not be comparable with similarly titled

measures and disclosures by other companies. These measures are

unaudited and should not be viewed in isolation or as an

alternative to those measures that are derived in accordance with

IFRS.

Recurring revenue

Recurring revenue is the revenue that annually repeats either

under contractual arrangement or by predictable customer habit. It

highlights how much of the Group's total revenue is secured and

anticipated to repeat in future periods, providing a measure of the

financial strength of the Group. It is a measure that is well

understood by the Group's investor and analyst community and is

used for internal performance reporting.

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

---------------------- ---------- ---------- -----------

Reported revenue 83,512 78,118 159,453

Non-recurring revenue (17,690) (14,640) (29,410)

---------------------- ---------- ---------- -----------

Recurring revenue 65,822 63,478 130,043

---------------------- ---------- ---------- -----------

Adjusted operating profit, adjusted operating margin, and

adjusted earnings per share

Adjusted operating profit is operating profit from continuing

operations excluding exceptional items, the effect of

capitalisation and amortisation of development costs, and the

amortisation of acquired intangible assets. The same adjustments

are also made in determining the adjusted operating margin of the

Group and its segments and in determining adjusted earnings per

share (EPS). The EPS calculation further adjusts for the profit

impacts of discontinued operations and the related tax and

non-controlling interest impacts of the operating profit

adjustments.

The Board considers this adjusted measure of operating profit to

provide the best metric of assessing underlying performance,

as:

-- it excludes exceptional items (items are only classified as

exceptional due to their nature or size);

-- it excludes any one-off goodwill impairment;

-- by expensing capitalised development costs (and also not

amortising these costs) it reflects the underlying in-year cash

cost of development of software for external sale, as development

is considered to be a core ongoing operating function of the

business; and

-- it excludes the amortisation of acquired intangibles arising

from business combinations which varies year on year dependent on

the timing and size of any acquisitions. This is consistent with

the presentation of the amortisation of the Group's own software

intangibles.

These metrics are used internally for reporting business unit

performance and in determining management and executive

remuneration. They are commonly used by other software companies,

and are also well understood by the Group's investor and analyst

community.

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

---------------------------------------------- ---------- ---------- -----------

Reported operating profit 16,314 16,631 35,776

Development costs capitalised (2,112) (4,096) (6,590)

Amortisation of computer software developed

for external sale 2,546 1,724 4,276

Exceptional release of contingent acquisition

consideration - - (1,020)

Amortisation of intangible assets arising

on business combinations 3,263 3,513 6,824

---------------------------------------------- ---------- ---------- -----------

Adjusted operating profit 20,011 17,772 39,266

---------------------------------------------- ---------- ---------- -----------

A reconciliation of adjusted earnings used in the adjusted EPS

calculations is shown below:

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

----------------------------------------------- ---------- ---------- -----------

Profit attributable to equity holders 13,110 14,403 30,248

Development costs capitalised (2,112) (4,096) (6,590)

Amortisation of computer software developed

for external sale 2,546 1,724 4,276

Amortisation of intangible assets arising

on business combinations 3,263 3,513 6,824

Exceptional release of contingent acquisition

consideration - - (1,020)

Other income - (782) (782)

Tax and non-controlling interest effect of

above items (703) (258) (925)

----------------------------------------------- ---------- ---------- -----------

Adjusted profit attributable to equity holders 16,104 14,504 32,031

----------------------------------------------- ---------- ---------- -----------

Adjusted cash generated from operations

The Group's adjusted cash generated from operations adjusts for

capitalised development cost expenditure and the cash costs of

exceptional items, consistent with the adjusted operating profit

metric used by the Group. This provides a meaningful metric for the

underlying cash the Group generates having accounted for the cash

cost of all development expenditure and adding back the cash cost

of non-recurring exceptional items.

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

---------------------------------------- ---------- ---------- -----------

Reported cash generated from operations 17,017 36,568 64,138

Development costs capitalised (2,112) (4,096) (6,590)

Cash cost of exceptional items - 1,303 1,303

---------------------------------------- ---------- ---------- -----------

Adjusted cash generated from operations 14,905 33,775 58,851

---------------------------------------- ---------- ---------- -----------

Net cash/(debt)

The Group uses net cash/(debt), defined as cash and cash

equivalents less total borrowings (excluding IFRS 16 lease

liabilities), as a supplementary measure in evaluating its

liquidity, as it indicates the level of cash available to the Group

and provides an indicator of the overall balance sheet strength. It

is used in the calculation of the leverage ratio under its bank

facility arrangements. For the six months ended 30 June 2021 the

Group was in a net cash position, with no borrowings.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKFBPABKDACK

(END) Dow Jones Newswires

September 09, 2021 02:00 ET (06:00 GMT)

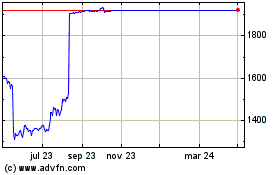

Emis (LSE:EMIS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Emis (LSE:EMIS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024