EP Global Opps Tst Publication of Circular

24 Noviembre 2021 - 1:00AM

UK Regulatory

TIDMEPG

THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN OR INTO, CANADA, JAPAN, NEW ZEALAND AND THE REPUBLIC OF SOUTH

AFRICA OR ANY OTHER JURISDICTION WHERE TO DO SO MAY RESULT IN THE CONTRAVENTION

OF ANY REGISTRATION OR OTHER LEGAL REQUIREMENT OF SUCH JURISDICTION

24 November 2021

EP Global Opportunities Trust plc (the "Company")

Legal Entity Identifier: 2138005T5CT5ITZ7ZX58

Further to the announcements made on 25 and 29 October 2021 and following a

review of the strategic direction of the Company, the Board intends to change

the Company's management arrangements by becoming a self-managed investment

trust. The Board will assume overall control of the Company's investment policy

and have overall responsibility for the Company's activities. It is proposed

that the Company's present portfolio manager, Dr Sandy Nairn, will be appointed

as an executive Director and Dr Nairn will have day-to-day responsibility for

investment management. By becoming a self-managed investment trust, the Board

believe it will be able to access a wider range of assets and investment

management expertise, particularly in the private capital market. The Board

believe there will be more flexibility to use third party managers where

appropriate than there is when the manager is a large fund management company.

The Company has entered into heads of terms ("HoT") with Franklin Templeton

Investment Trust Management Limited (the "Investment Manager") and Dr Nairn in

respect of the new management arrangements. The arrangements are subject to

finalisation of full legal documentation and approval of the new investment

objective and policy as set out below. Under the HoT it has been agreed that Dr

Nairn will commit a substantial proportion of his time to the management of the

Company's investment portfolio. He will continue to work part-time for the

Franklin Templeton group ("FT") and as part of this engagement he will be

responsible for a new sub-advisory arrangement which the Company will enter

into with FT.

The change in management structure is subject to the Company being approved by

the FCA as a small registered alternative investment fund manager ("AIFM").

This is expected to take up to six months. Once the Company has been approved

to act as its own AIFM, the current arrangement with the Investment Manager

will cease and the sub-advisory agreement with FT will be entered into. New

administration arrangements will be put in place at this point as well. It is

anticipated that Dr Nairn will join the Board at this point. The Company will

also, by resolution of the Board, change its name to Global Opportunities Trust

plc.

As part of this proposal the Company wishes to make changes to its investment

objective and policy so as to allow the Company to invest in a larger range of

investments. In addition, while the Board believes that most shareholders will

wish to maintain their investment in the Company, it recognises that some may

wish to realise part, or potentially all, of their shareholding. In order that

such shareholders will have the opportunity to do so, the Company intends to

put forward a tender offer for approval by the shareholders (the "Tender Offer

"). Such Tender Offer will be contingent on the new investment objective and

policy (the "New Investment Objective and Policy") being approved by

shareholders. The implementation of the change of management structure is also

subject to the approval of the New Investment Objective and Policy.

The Company has today published a circular providing shareholders with full

details of the proposed management changes, new investment policy and

objectives and the Tender Offer (the "Circular"). A copy of the Circular will

be submitted to the National Storage Mechanism and will shortly be available

for inspection at https://data.fca.org.uk/#/nsm/nationalstoragemechanism. The

Circular will also be available on the Company's website (https://www.epgot.com

/).

Details of the New Investment Objective and Policy

The Board believes that the Company's New Investment Objective and Policy will

provide the Company with the flexibility to seek out value across asset classes

rather than being constrained by a relatively narrow investment policy. The

Company's original investment objective and policy were set in 2003 and

reflected investment conditions that prevailed at that time. The intention then

was to provide sufficient flexibility to avoid artificial constraints that

could effectively force the Company into owning particular assets or classes of

security. For this reason, the Company had the ability to own cash and bonds,

if listed equities were not at appropriate valuations and to also allow some

investment in unlisted equity securities where appropriate.

Following the financial crisis of 2008 and the subsequent extended period of

negative real interest rates, conditions are now very different and many asset

classes are more expensive. As a consequence, the Company has been forced to

hold significant levels of cash where, because of central bank policy, there is

a negligible or negative real return. The Company believes that there are more

profitable opportunities available in private capital investments but, other

than a limited ability to invest in unlisted securities, the current investment

policy does not allow the Investment Manager to access the full range of

private capital investments. The private capital opportunities would primarily

be accessed through delegation to specialist third party managers (including

through investments in investment funds) but it is expected that co-investment

opportunities for direct investment may also be available. As a long-term

capital vehicle with a closed-ended structure, the Company is ideally placed to

take advantage of these opportunities. For these reasons it is important that

some of the existing constraints on the Company's investment objective and

policy be lifted. As such, the Company is seeking to amend its investment

objective and policy so as to allow it to invest up to 30 per cent. of its

total assets in private investments which the Company believes strikes the

correct balance between liquidity and opportunity. This will allow the Company

to adapt to the current investment conditions which are very different from

those at launch.

Further detail on New Investment Objective and Policy

The private investments are likely to be focused on the provision of capital to

boutique private capital managers. Dr Nairn has direct experience in this area

through the creation of Edinburgh Partners, private equity investing and

extensive industry contacts. The investments are likely to be made through

funds which specialise in this area and also potentially through co-investments

and unlisted equity investments. Valuation in such investments is typically

quarterly with ad hoc valuations as required to recognise significant events.

The allocation of resources to private capital will be determined by reference

to the relative attractiveness of the investment whilst considering the

liquidity, likely term of the investment and the associated cash-flow. The NAV

will continue to be published daily.

It is anticipated that if the New Investment Objective and Policy is approved

that the portfolio will initially be weighted as follows:

* Global equities: 40 - 60 per cent.;

* Specialist funds: 8-10 per cent. (including the existing investment in the

Templeton European Long-Short Equity SIF);

* Private capital: 10 per cent.; and

* Bonds: 5 to 10 per cent.;

* Cash and cash-like instruments: 20-30 per cent.

Please note that these proportions will change over time to reflect shifts and

valuations that create new opportunities. The use of third party advisors and

managers is envisaged to take advantage of valuation anomalies that arise in

specific niche areas of asset markets where the key to success and accessing

these opportunities is specialist knowledge and experience. It is anticipated

that the initial sub-advisory agreement with FT will cover equities, cash and

bonds.

The Board acknowledges that the New Investment Objective and Policy increases

the Company's exposure to private markets which are historically less liquid

assets than those traded on the public markets. The Board believes that these

are appropriate investments for the Company, particularly given the

closed-ended nature of the Company and that such change in investment focus is

in the best interests of the Company. The private holdings will be

significantly less liquid than other holdings and as such the balance of the

portfolio will be in holdings with high liquidity to ensure that the portfolio

has the ability to take advantage of any new opportunities that may arise.

Details of the Tender Offer

While the Board believes that the proposals are in the best interests of the

shareholders, it understands that some may wish to sell some, or all, of their

shares. Subject to the approval of the New Investment Objective and Policy, it

is proposed that the Tender Offer will be for up to 20 per cent. of the shares

and will be at a discount of 2 per cent. to the NAV per share (plus costs and

expenses of the Tender Offer). Shareholders (other than those shareholders

identified in the Tender Documentation as restricted shareholders and certain

overseas shareholders) will be entitled to tender up to 20 per cent. of their

holding of shares (the "Basic Entitlement") and to apply to tender more than

their Basic Entitlement.

The required shareholder authorities are being sought at the general meeting

but the formal Tender Documentation will follow in early January 2022. It is

anticipated that the Tender Offer will take place in late January or February

2022.

Share buyback authority

The Company's authority to repurchase its own Shares, which was granted at the

last annual general meeting of the Company held on 21 April 2021, in respect of

up to 14.99 per cent. of the Company's issued share capital as at the date of

that meeting, will remain in force and be unaffected by the Tender Offer.

The increased investment flexibility will allow the Company to take advantage

of a broader range of opportunities which should make the Company an attractive

vehicle for a wider range of potential investors than the existing shareholder

base. In particular, the Board believes that the different types of assets

available will attract those investors who are looking for exposure to assets

that may typically be reserved for institutional investors. Gaining new

investors is an important component in ongoing discount control, which cannot

solely rely on share buybacks, and the Board believes this will be assisted by

the change in investment policy. The Board may use share buybacks, when

appropriate, to narrow the discount to NAV at which the Shares trade. This will

be done in conjunction with creating new demand and being aware of the

liquidity of the Shares.

The Company's share buyback policy will no longer aim to keep the share price

at close to NAV. The Board is offering Shareholders the opportunity to

participate in a Tender Offer at this point which will give the Shareholders

the chance to sell some or all of their shares at the Tender Price.

General meeting

The Proposals are subject to shareholder approval at a general meeting which is

to be held at the offices of Dickson Minto W.S., 16 Charlotte Square, Edinburgh

EH2 4DF on 17 December 2021 at 10.00 a.m.

At this meeting an ordinary resolution ("Resolution 1") will be proposed to

adopt the New Investment Objective and Policy to the exclusion of all previous

investment objectives and policies.

A special resolution, which is conditional on the passing of Resolution 1, will

be proposed to approve the Tender Offer on the terms set out in the Circular

and to give the Company authority to make market purchases pursuant to the

Tender Offer.

The Board has chosen to seek authority to purchase a maximum of 8,500,00

shares, representing approximately 23 per cent. of the issued Share capital as

at the date of this document. The maximum number of shares to be purchased

under the Tender Offer will not be known until the Tender Price has been

calculated. The Board and Dr Nairn do not intend to tender their Shares.

The Board considers that the resolutions to be proposed at the general meeting

are in the best interests of the Company and its shareholders as a whole.

Accordingly, the Board unanimously recommends that you vote in favour of the

resolutions, as the Directors and Dr Nairn intend to do in respect of their own

beneficial shareholdings. As of the latest practical date prior to the

publication of this document the Directors hold 32,000 (which represent 0.09

per cent. of the Shares) and Dr Nairn holds 3,805,615 Shares (which represent

10.43 per cent. of the Shares.

Expected timetable

2021/2022

Publication of this document 24 November

Latest time and date for receipt of Forms of 10.00 a.m. on 15 December

Proxy from shareholders

General meeting 10.00 a.m. on 17 December

Tender Offer Documentation circulated Early January

Tender Offer End of January/February

Defined terms used in this announcement have the meanings given in the Circular

unless the context otherwise requires

For further information, please contact:

Dr Sandy Nairn 0131 270 3800

Kenneth J Greig 0131 270 3800

Franklin Templeton Investment Trust Management Limited

5 Morrison Street, Edinburgh EH3 8BH

24 November 2021

END

(END) Dow Jones Newswires

November 24, 2021 02:00 ET (07:00 GMT)

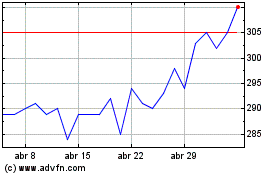

Global Opportunities (LSE:GOT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

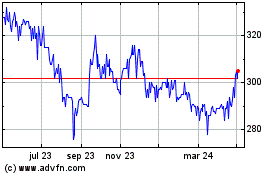

Global Opportunities (LSE:GOT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024