EP Global Opps Tst Publication of Circular

26 Enero 2022 - 1:00AM

UK Regulatory

TIDMEPG

THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN OR INTO, AUSTRALIA, CANADA, JAPAN, NEW ZEALAND AND THE REPUBLIC

OF SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE TO DO SO MAY RESULT IN THE

CONTRAVENTION OF ANY REGISTRATION OR OTHER LEGAL REQUIREMENT OF SUCH

JURISDICTION

26 January 2022

EP Global Opportunities Trust plc

Legal Entity Identifier: 2138005T5CT5ITZ7ZX58

As detailed in the circular published by EP Global Opportunities Trust plc (the

"Company") on 24 November 2021, the Board is proposing to return up to 20 per

cent. of the issued share capital of the Company to Shareholders by way of a

tender offer (the "Tender Offer")

The Company has today published a circular (the "Circular") providing

shareholders with full details of the Tender Offer. A copy of the Circular will

be submitted to the National Storage Mechanism and will shortly be available

for inspection at https://data.fca.org.uk/#/nsm/nationalstoragemechanism. The

Circular will also be available on the Company's website (https://www.epgot.com

/) Save as otherwise defined in this announcement, terms defined in the

Circular shall bear the same meaning in the announcement.

Details of the Tender Offer

The Tender Offer will enable those Shareholders (other than Restricted

Shareholders and certain Overseas Shareholders) who wish to sell some or all of

their Shares to elect to do so, subject to the overall limits of the Tender

Offer. Shareholders who successfully tender Shares will receive the Tender

Price per Share, being the NAV per Share as at 24 February 2022 less a 2 per

cent. discount and the costs and expenses associated with the Tender Offer.

Under the terms of the Tender Offer, which is being made by Panmure Gordon (UK)

Limited ("Panmure Gordon"), Shareholders (other than Restricted Shareholders

and certain Overseas Shareholders) will be entitled to tender up to their Basic

Entitlement, rounded down to the nearest whole Share. Shareholders may also

tender additional Shares, but any such excess tenders above the Basic

Entitlement will only be satisfied, on a pro rata basis, to the extent that

other Shareholders tender less than their aggregate Basic Entitlement.

The Tender Price will be announced on 28 February 2022 in accordance with the

calculation method set out in the Circular. The maximum number of Shares that

will be purchased under the Tender Offer will be 20 per cent. of the issued

share capital of the Company. The Basic Entitlement will be 20 per cent. of the

shares held by a Shareholder as at the Record Date.

Subject to the satisfaction of the conditions relating to the Tender Offer,

Panmure Gordon will purchase, as principal, Shares validly tendered under the

Tender Offer at the Tender Price. Following completion of those purchases, it

will then sell all the relevant Shares back to the Company pursuant to the

Repurchase Agreement at the Tender Price by way of an on-market transaction on

the main market of the London Stock Exchange. The Shares which the Company

acquires from Panmure Gordon will be held in treasury. The repurchase of Shares

by the Company under the Repurchase Agreement will be funded from the Company's

special reserves.

The Tender Offer is subject to the terms and conditions set out in the

Circular. The Tender Offer may also be terminated in certain circumstances as

set out in the Circular. Shareholders should note that, once tendered, Shares

may not be sold, transferred, charged or otherwise disposed of other than in

accordance with the Tender Offer.

Existing Share buy-back authority

The Company's authority to repurchase its own Shares, which was granted at the

last annual general meeting of the Company held on 21 April 2021, in respect of

up to 14.99 per cent. of the Company's issued share capital as at the date of

that meeting, will remain in force and be unaffected by the Tender Offer.

Due to US regulatory requirements, the Board does not intend to undertake any

Share buy backs between publication of this document and the close of the

Tender Offer at 1.00 p.m. on 24 February 2022.

Estimated costs and expenses

The fixed costs relating to the Tender Offer are expected to be approximately £

193,000 including VAT. The foregoing figure does not include stamp duty or the

commission payable to Panmure Gordon, being an amount equal to 0.2 per cent. of

the value, at the Tender Price, of the Shares purchased by Panmure Gordon

pursuant to the Tender Offer. Assuming the Tender Offer is taken up in full,

the Company estimates that the cost of stamp duty will be approximately £

113,000 and the commission payable to Panmure Gordon will be approximately £

45,000. All costs and expenses relating to the Tender Offer will be borne by

Shareholders participating in the Tender Offer. Assuming the Tender Offer is

taken up in full, and based on the NAV per Share at 24 January 2022, the

aggregate costs and expenses would equate to approximately 1.5 per cent. of the

NAV per Share.

Overseas Shareholders and Restricted Shareholders

The making of the Tender Offer to persons outside the United Kingdom may be

prohibited or affected by the laws of the relevant overseas jurisdictions.

Shareholders with registered or mailing addresses outside the United Kingdom or

the United States who are citizens or nationals of, or resident in, a

jurisdiction other than the United Kingdom or the United States should read

carefully the relevant sections of the Circular.

The Tender Offer is not being made to Shareholders who are resident in, or

citizens of, Restricted Jurisdictions. Restricted Shareholders are being

excluded from the Tender Offer in order to avoid offending applicable local

laws relating to the implementation of the Tender Offer. Accordingly, copies of

the Tender Form are not being and must not be mailed or otherwise distributed

in or into Restricted Jurisdictions.

It is the responsibility of all Overseas Shareholders to satisfy themselves as

to the observance of any legal requirements in their jurisdiction, including,

without limitation, any relevant requirements in relation to the ability of

such holders to participate in the Tender Offer.

Action to be taken for Tender Offer

Only Shareholders whose names appear on the Register on the Record Date, being

6.00 p.m. on 24 February 2022, are able to participate in the Tender Offer in

respect of the Shares held as at that time.

Shareholders should refer to the relevant sections of the Circular for further

information on the tendering options available. Shareholders who hold their

Shares in certificated form should note that they should return their share

certificate(s) and/or other document(s) of title in respect of the Shares

tendered with their Tender Form. A Tender Form submitted without the related

share certificate or other document(s) of title representing the amount of

Shares to be tendered will be treated as invalid.

Recommendation

The Board considers that the Tender Offer as set out in the Circular is in the

best interests of the Company and its Shareholders as a whole.

The Board makes no recommendation to Shareholders as to whether or not they

should tender all or any of their Shares in the Tender Offer. Whether or not

Shareholders decide to tender their Shares will depend, amongst other factors,

on their view of the Company's prospects and their own individual

circumstances, including their own tax position.

The Directors and Dr Nairn do not intend to tender their Basic Entitlement in

the Tender Offer.

EXPECTED TIMETABLE

2022

Publication of the Circular and Tender Offer 26 January

opens

Latest time and date for receipt of Tender 1.00 p.m. on 24 February

Forms and submission of TTE Instructions

from Shareholders

Record Date for the Tender Offer 6.00 p.m. on 24 February

Calculation Date for Tender Offer 24 February

Results of Tender Offer elections announced 28 February

and Tender Price announced

CREST accounts credited for revised By 7 March

uncertificated shareholdings of Shares (or,

in the case of unsuccessful tenders, for

entire holdings of Shares)

CREST Settlement Date: payments through By 7 March

CREST made and CREST accounts settled

Balancing share certificates and cheques By 7 March

despatched to certificated Shareholders

Notes

1. References to times in the Circular are to London time.

2. The dates set out in the expected timetable may be adjusted by Panmure

Gordon, with the consent of the Company, in which event details of the

new dates will be notified to Shareholders by an announcement made by the

Company through a Regulatory Information Service.

Notice to U.S. shareholders

The Tender Offer relates to securities in a non-U.S. company registered in

Scotland with a listing on the London Stock Exchange and is subject to the

disclosure requirements, rules and practices applicable to companies listed in

the United Kingdom, which differ from those of the United States in certain

material respects. This document has been prepared in accordance with U.K.

style and practice for the purpose of complying with the laws of England and

Wales and the rules of the London Stock Exchange. U.S. shareholders should read

this entire document. Any financial information relating to the Company has

been prepared in accordance with IFRS and has not been prepared in accordance

with generally accepted accounting principles in the United States; thus it may

not be comparable to financial information relating to U.S. companies. The

Tender Offer is being made in the United States pursuant to Section 14(e) of,

and Regulation 14E under, the U.S. Securities Exchange Act of 1934, as amended,

subject to the exemptions provided by Rule 14d-1 thereunder and otherwise in

accordance with the requirements of the Listing Rules. Accordingly, the Tender

Offer will be subject to disclosure and other procedural requirements that are

different from those applicable under U.S. domestic tender offer procedures.

U.S. shareholders should note that the Company is not listed on a U.S.

securities exchange, subject to the periodic reporting requirements of the

Exchange Act or required to, and does not, file any reports with the SEC

thereunder.

To the extent permitted by applicable law and in accordance with normal U.K.

practice, the Company, Panmure Gordon or any of their affiliates may make

certain purchases of, or arrangements to purchase, Shares outside the United

States during the period in which the Tender Offer remains open for acceptance,

including sales and purchases of Shares effected by Panmure Gordon acting as

market maker in the Shares. These purchases, or other arrangements, may occur

either in the open market at prevailing prices or in private transactions at

negotiated prices. In order to be excepted from the requirements of Rule 14e-5

under the U.S. Securities Exchange Act of 1934, as amended, by virtue of relief

granted by the SEC Rule 14e-5(b)(12) thereunder, such purchases, or

arrangements to purchase, must comply with applicable English law and

regulation, including the listing rules of the Financial Conduct Authority, and

the relevant provision of the Exchange Act. Any information about such

purchases will be disclosed as required in the United Kingdom and the United

States and, if required, will be reported via the Regulatory Information

Service of the London Stock Exchange and available on the London Stock Exchange

website at www.londonstockexchange.com. To the extent that such information is

made public in the United Kingdom, this information will also be publicly

available to Shareholders in the United States.

For further information, please contact:

Dr Sandy Nairn 0131 270 3800

Kenneth J Greig 0131 270 3800

Franklin Templeton Investment Trust Management Limited

5 Morrison Street, Edinburgh EH3 8BH

26 January 2022

END

(END) Dow Jones Newswires

January 26, 2022 02:00 ET (07:00 GMT)

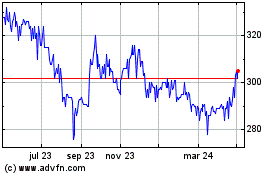

Global Opportunities (LSE:GOT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

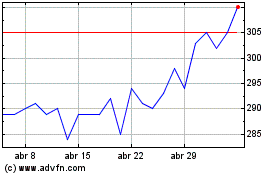

Global Opportunities (LSE:GOT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024