EPE Special Opportunities Limited Investment (3513U)

02 Diciembre 2021 - 1:15AM

UK Regulatory

TIDMESO TIDMEO.P TIDMEC.P TIDMEL.P

RNS Number : 3513U

EPE Special Opportunities Limited

02 December 2021

EPE Special Opportunities Limited

Investment

EPE Special Opportunities Limited ("ESO" or the "Company") is

pleased to announce that ESO Alternative Investments LP (an

undertaking of ESO, in which it is the sole investor) ("ESO AI")

has committed to invest a total of EUR10 million into EPIC

Acquisition Corp ("EAC"), a newly incorporated special purpose

acquisition company ("SPAC") and EAC's sponsor, EAC Sponsor Limited

(the "Sponsor").

EAC today announced its intention to raise up to EUR150 million

and its expected admission to listing and trading on Euronext

Amsterdam on or around 6 December 2021 (the "IPO").

EAC intends to leverage the experience of EPIC Investment

Partners LLP ("EPIC"), TT Bond Partners ("TTB") and their

respective affiliates to identify, acquire and develop an

innovative company operating in the consumer sector in the European

Economic Area (the "EEA") or the United Kingdom which has the

potential for significant growth in Asian markets (the "Business

Combination"). EAC is targeting companies with an enterprise value

of between EUR500 million and EUR1 billion.

The Sponsor is jointly led by EPIC, a UK-headquartered

investment, advisory and administration firm which has 20 years'

experience of using publicly-listed vehicles to make private equity

investments, and TTB, a Hong Kong-based investment and advisory

business which has extensive local relationships across Asia and a

strong track record of helping global brands access and develop in

Asian markets. EPIC is the Investment Advisor to ESO.

EAC will be supported by dedicated teams within EPIC and TTB.

The combined platforms of EPIC and TTB span the UK, Hong Kong,

Guernsey, Ireland and India and include c.250 employees, with 30

investment and advisory professionals.

The Sponsor has been formed to provide EAC with institutional

leadership and resources, combining private equity and public

markets investing experience, broad and highly active deal sourcing

networks in Europe and Asia, operational leadership in the consumer

sector and a deep and proven understanding of how global companies

can succeed in Asian markets.

EAC will also benefit from the appointment of three independent

non-executive directors with outstanding operating and financial

track records. Stephan Borchert and Jan Zijderveld are both

experienced public markets chief executive officers (CEOs),

responsible for generating a collective c.$4 billion in shareholder

value in the last three years through the sale of GrandVision (of

which Mr Borchert is CEO) to EssilorLuxottica and the exit of Avon

Products (of which Mr Zijderveld was CEO) to Natura & Co. Prior

to his role at Avon Products, Mr Zijderveld was President and CEO

of Unilever Europe. They are complemented by Nisha Kumar, an

experienced CFO who will be the chair of EAC's Audit Committee. Ms

Kumar has deep expertise in financial leadership, operations and

corporate finance across public and private companies and private

equity.

In combination, the Sponsor's investing, advisory and operating

track record in Europe and Asia is expected to help EAC identify

and successfully complete a Business Combination with a

high-quality company in the EEA or the United Kingdom attracted by

the unusual combination of investment capital and a track record of

Asian market access and growth.

Subsequent to the Business Combination, the Sponsor will

continue to actively support the growth of EAC, both through the

implementation of organic initiatives and strategic acquisitions,

most notably in local Asian markets where such acquisitions offer

the potential to accelerate growth. The longer-term objective of

both EAC and the Sponsor is to build a business at the forefront of

consumer innovation, recognised in both its home markets and in

Asia.

Further information on EAC can be found on the company's

website, www.epicacquisitioncorp.com .

ESO's Investment

ESO is investing in both EAC and the Sponsor, which allows it to

access potentially enhanced returns versus an investment solely in

the IPO, as a result of the Sponsor's ownership of Class B ordinary

shares ("Founder Shares") and warrants ("Founder Warrants") in

EAC.

The Board of ESO believes that the potentially enhanced returns

profile, combined with the opportunity to access larger and more

geographically diverse companies through a liquid investment

structure, means that the investment in EAC is attractive for the

Company's shareholders.

Related Party Transaction

The transaction constitutes a related party transaction under

Rule 13 of the AIM Rules.

The Board of ESO considers, having consulted with Numis as the

Company's nominated adviser, that the terms of the transaction are

fair and reasonable in so far as the Company's shareholders are

concerned.

Inside Information

This announcement is made in accordance with Article 19 of the

EU Market Abuse Regulation 596/2014.

The person responsible for releasing this information on behalf

of the Company is Amanda Robinson of Langham Hall Fund Management

(Jersey) Limited.

Enquiries:

EPIC Investment Partners LLP +44 (0) 207 269 8860

James Henderson

Langham Hall Fund Management (Jersey) +44 (0) 153 488 5200

Limited Amanda Robinson

Cardew Group Limited +44 (0) 207 930 0777

Richard Spiegelberg

Numis Securities Limited +44 (0) 207 260 1000

Nominated Advisor: Stuart Skinner

Corporate Broker: Charles Farquhar

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQTTBRTMTBMMBB

(END) Dow Jones Newswires

December 02, 2021 02:15 ET (07:15 GMT)

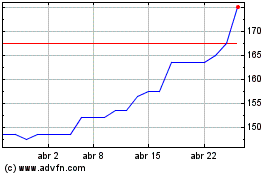

Epe Special Opportunities (LSE:ESO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

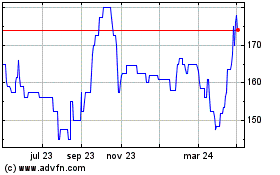

Epe Special Opportunities (LSE:ESO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024