TIDMEQT

RNS Number : 1380N

EQTEC PLC

28 September 2021

28 September 2021

EQTEC plc

("EQTEC", the "Company" or the "Group")

Interim results for the six months ended 30 June 2021

EQTEC plc (AIM: EQT), a world-leading gasification solutions

company building the future of a cleaner waste-to-energy industry,

is pleased to announce its unaudited interim results for the six

months ended 30 June 2021.

Highlights

-- Growing conversion of pipeline opportunities into active development projects

-- Financial Close of first Market Development Centre, with others following

-- Investment in growth platform through Joint Ventures and expert teams

-- Oversubscribed placing for GBP16 million in new development capital

-- Ramp-up in engagement with policy makers, influencers and ESG interest groups

-- On track to achieve seven times revenue growth over previous year

David Palumbo, CEO of EQTEC, commented:

"As we approach the United Nations Climate Change Conference

(COP26) UK 2021 in November, we are pleased to share our Interim

Results for 2021 and outlook for the second half of the year, along

with a broader update about how we are strengthening our efforts to

transform waste into clean energy and biofuels. Our hope for COP26

is that the EU, UK and USA in particular embrace more ambitious and

stringent targets aimed at ultimate outcomes for the environment,

such as increased carbon efficiency and reduced total emissions,

especially of the most hazardous pollutants.

The Company has been increasingly active in 2021 with policy

influencers and policymakers. Early in the year, we joined and

worked closely with a number of industry associations in the EU and

UK. We contributed directly to and co-authored the European Biogas

Association's upcoming whitepaper, Gasification: a sustainable

technology for circular economies - scaling up to reach Net Zero by

2050 , and we made written submissions to consultations opened by

UK Environment Agency and UK Department for Business, Energy and

Industrial Strategy (BEIS).

Policymakers need to know that EQTEC's Advanced Gasification is

not a concept technology for the future - it is a 'now' solution

for 'now' challenges of waste management and clean energy. Through

the projects we are developing right now, EQTEC's innovations are

being aimed at:

-- Preventing forest fires in California;

-- Clearing farming waste and delivering clean energy in Greece, Italy and Croatia;

-- Handling municipal solid waste and delivering clean energy at scale in the UK;

-- Innovating synthetic natural gas ("SNG") solutions in Ireland; and

-- Converting legacy facilities in France to handle industrial and contaminated waste.

Our solutions deliver both a low emissions profile from waste

treatment along with highly efficient production of energy or

biofuel. So, even as we push harder to raise awareness of the

immediate contribution we will make to the goals of COP26, we are

hard at work identifying, qualifying and pursuing new projects in

our target markets, for those who already know.

Throughout the first half of 2021, we focused our efforts on

building out our platform for growth and scale. We converted more

opportunities into active projects, formalised local, joint venture

("JV") partnerships, kicked off acquisition and development of

Market Development Centres ("MDCs") and grew our team of

experienced, project development experts to pursue more

opportunities with quality and pace. As awareness and interest

grows in gasification, we will be prepared to respond.

The Group is growing, making Advanced Gasification Technology

more available to more places for more applications, but we want to

move faster. To accelerate, we need stronger support from public

policy, local authorities and the clean energy sector. EQTEC's

Advanced Gasification Technology was proven long ago, but we need

to increase awareness further with EU, UK, US and others, of the

superior efficiency, emissions profile and sustainability of our

solutions versus legacy alternatives. The ESG strategy and

marketing strategy we are currently developing for 2022 onwards

will contribute to giving gasification a greater profile, and

position EQTEC as the leader of the sector.

We look forward to closer engagement and collaboration with

influencers and policymakers to position EQTEC as a leader in

waste-to-energy for the present and the future. We believe the

greatest proof of our capabilities is in implementing them more

often, in more plants; but we also believe that an increasingly

supportive policy environment, with incentives for superior

cleantech solutions, would accelerate our progress and the benefits

we deliver toward sustainable ecosystems."

OPERATIONAL, COMMERCIAL AND CORPORATE HIGHLIGHTS

Plant construction:

-- In the first half of the year, the Company progressed with

installation of the gasification reactor and associated equipment

inside the primary steel structures at its 2MWe facility at North

Fork, in California, USA. The site was attended for three weeks in

May by CTO Yoel Alemán and another EQTEC expert engineer, following

relaxation of Covid-19 travel restrictions.

-- Additionally, the Company and its partners ewerGy GmbH

("ewerGy") and local partner ECO Hellas ("ECO Hellas") progressed

construction work on the 0.5 MWe Agrigas 1 biomass-to-energy plant

in Larissa, Greece.

Financial close:

-- On 17 May, the Company announced it had formed a consortium

to acquire and recommission a plant in Italy with EQTEC's

gasification technology at its centre. On 21 June, the Company

announced Financial Close of the 1MWe, EQTEC Italia MDC

biomass-to-energy project in Tuscany, Italy, the first of EQTEC's

Market Development Centres ("MDCs"). Once operational, it is

expected that EQTEC will become the O&M contractor for the

plant.

Project development:

-- On 8 January, the Company signed a Memorandum of

Understanding ("MoU") with Nobilis Pro Energy S.A. ("Nobilis"). The

agreement includes the collaborative development of Nobilis's

existing pipeline of opportunities in Thessalia and Central Greece

and for the proposed delivery of these and further projects,

including construction in Nobilis, Almyros, with grid connection

and the land agreement in place.

-- On 27 January, EQTEC received notification of planning

approval from Stockton-on-Tees Borough Council for an improved

waste-to-energy scheme for the Company's RDF-to-energy project at

Billingham, Teesside, which will be the UK's first EQTEC Advanced

Gasification plant ("Billingham"). On 26 February, the Company

announced that the Billingham project Special Purpose Vehicle

("SPV"), Haverton WTV Limited, had signed a conditional Land

Purchase Agreement ("LPA") for the land on which the proposed plant

will be constructed and commissioned. In June, the Company

announced completion of concept design work for the core

gasification process and progress with design on the full

plant.

-- On 9 February, the Company signed a Collaboration Framework

Agreement with Logik Developments Limited ("Logik"), including the

participation by both Parties to develop an RDF-to-energy project

at Deeside, Flintshire, UK, through the Deeside WTV Limited SPV

("Deeside"). On 11 March, the Company announced it had signed a

Collaboration Framework Agreement with Toyota Motor Manufacturing

UK ("Toyota"), effective for three years. Through the Deeside

RDF-to-energy project, the Company and Toyota agreed to collaborate

to explore an innovative, circular and sustainable waste-to-energy

solution for Toyota's engine manufacturing plant in Deeside. This

could include establishing a supply of power and gas to the Toyota

engine manufacturing site and the potential supply of bio-methane

gas and green electricity and conversion of manufacturing waste

through the sharing of cost data, energy usage and other

information. In June, the Company submitted a planning application

for a Phase 2 gasification facility deploying EQTEC technology at

the Deeside site where Phase 1 recycling and anaerobic digestion

facilities are already approved for development. As most planning

conditions have been satisfied for Phase 1, the project is on track

for Financial Close.

Other business development:

-- On 22 March, the Company announced it had entered into a

Framework Partnership Agreement ("FPA") with MetalNRG plc

("MetalNRG"), to develop shovel-ready, biomass-to-energy,

RDF-to-energy and sustainable, clean energy projects in the UK and

Europe through MetalNRG's SPV, MetalNRG Eco Limited. The Company

acquired GBP500,000 in MetalNRG shares through the exchange of the

same value of EQTEC shares with MetalNRG as at 7 May 2021. MetalNRG

has since participated in one EQTEC project, currently under

construction, as a consortium investor, in the recommissioning and

repowering of the Italia MDC project.

Broker appointment:

-- On 29 March, the Company appointed Canaccord Genuity Limited as Joint Broker.

FINANCIAL HIGHLIGHTS

-- Revenue: For the six-month period through to 30 June 2020,

the Company recorded revenue of EUR0.5 million, predominantly from

technology sales.

-- Profit/(loss): For the same period, the Company recorded an

adjusted net loss of EUR2.6 million, impacted by increased,

growth-orientated operational expenditure and before a EUR1.4

million loss arising from a non-cash item relating to share-based

payments.

-- Assets: As at 30 June 2021, the net assets of the Group stood

at EUR42.8 million, which included new capital raised from the

Placing in May 2021.

-- Cash: The cash balances of the Group as at 30 June 2021 were EUR15.3 million.

-- Debt: In January 2021, the Company agreed a new loan facility

of EUR1.25 million with EQTEC shareholder Altair Group Investment

Limited ("Altair"), with a maturity date of 31 December 2021. The

loan, fully drawn down to repay an outstanding debt with another

lender, had a lower interest rate than the previously held debt

facility but was then itself repaid in full to Altair, in June

2021, six months ahead of schedule.

-- Placing: On 28 May 2021, the Company successfully completed a

Placing that raised GBP16 million (EUR19 million), before expenses,

in new investment capital aimed at accelerating the Company's

growth. The capital raised through the Placing has been and will

continue to be deployed to three key areas: (1) project development

of MDCs; (2) project development of larger, RDF-to-energy deals in

the UK; and (3) growth in the Company's capability and capacity.

The Placing generated new interest in the Company and was

oversubscribed.

-- Long-term Incentive Plan ("LTIP"): In February, the Company

announced its LTIP for all directors and employees to link pay with

Company and individual performance and to invest in talent to grow

the business. It also announced the granting of share options for

2021, which would vest over three years starting the following

year, subject to conditions. The Company confirmed that the LTIP is

the Company's sole, long-term incentive programme and that it

therefore has no plans to issue further warrants as remuneration,

as normal business practice. As at 30 June 2021, the Company had a

total of 658,210,979 employee-related warrants and options

outstanding, all of which were issued prior to the introduction of

the LTIP.

POST PERIOD HIGHLIGHTS

July 2021

-- On 12 July, the Company announced it had made a non-binding

proposal to provide requisite funding, as a convertible loan

facility, to take to completion the North Fork, California, USA

project. The proposed facility, if accepted, fully drawn down and

converted, would result in the Company's increasing its current

minority stake to take a controlling interest in the project

project SPV, North Fork Community Power (NFCP). The Company expects

legal execution to be concluded shortly.

-- On 19 July, the Company confirmed that the first shipment of

technology components was received on site at the Agrigas 1 project

in Larissa, Greece.

-- On 19 July, the Company announced that designs for the

Billingham RDF-to-energy project had been reviewed with potential

partners, including French waste-to-energy owner-operator, Groupe

Idex ("Idex"). It also confirmed that the project team had launched

engagement with prospective delivery partners including Tier 1 EPC

companies.

-- On 19 July, Nauman Babar was appointed to the board of directors as Finance Director.

August 2021

-- On 11 August, the Company announced the acquisition, through

Synergy Projects d.o.o. ("Synergy Croatia"), a joint venture

between the Company and its Croatian project development partner

Sense ESCO d.o.o. ("Sense ESCO"), of a 1.2 MWe biomass-to-energy

gasification plant in Belišće, Croatia. The contract value of

EQTEC's technology sales for the plant is expected to be EUR1.7

million in technology and engineering upgrades. Once operational it

will become the second EQTEC Market Development Centre.

Additionally, it is expected that the Company will become the

plant's O&M contractor.

September 2021

-- On 14 September, the Company announced the acquisition,

through Synergy Croatia , of a 1.2 MWe biomass-to-energy

gasification plant in Karlovac, Croatia. The plant, expected to be

updated, recommissioned and repowered for operations towards the

end of 2022, is expected to produce approximately 1.2 MW of

electricity as well as high-quality biochar. The contract value of

EQTEC's technology sales for the plant is expected to be c. EUR4.5

million in technology and engineering. Additionally, is expected

that the Company will become the plant's O&M contractor.

-- On 15 September, the Company confirmed that most technology

components, including the Siemens Jenbacher engine, had arrived on

site at Agrigas 1. The Company can now confirm that the final

shipment of equipment, to include heat exchangers, gasifier,

cyclone, filters and refractory, is expected to be shipped by the

end of September and delivered on site in October.

-- On 16 September, the Company announced it had signed a Heads

of Terms with Kibo Energy plc ("Kibo"), with Kibo expected to

acquire, after finalising a Share Purchase and Shareholders

Agreement and securing of the requisite funding, a 54.54% equity

stake in the Billingham, Teesside, UK project SPV, for a

contribution of GBP3 million.

-- On 24 September, the Company announced the formation of a JV,

EQTEC Synergy Projects Limited ("Synergy Aegean") between EQTEC and

its Greek strategic partners, German EPC ewerGy GmbH ("ewerGy")

operating in Greece via its local partner, ECO Hellas M IKE ("ECO

Hellas") . It was also confirmed that Synergy Aegean had signed an

agreement for the proposed acquisition of a 1MWe biomass-to-energy

gasification project in Livadia, Greece and exclusivity for a

second 1MWe project nearby.

-- On 27 September, the Company announced that its wholly owned

subsidiary, Southport WTV Limited, project SPV for the Southport,

Merseyside, UK RDF-to-energy project, had signed a Share Purchase

Agreement with Rotunda Group Limited ("Rotunda") and its subsidiary

Shankley Biogas Limited, to acquire full ownership of the Southport

Hybrid Energy Park project from Rotunda through the acquisition of

Shankley Biogas Limited.

Outlook

-- The Company remains on track to achieve its previously stated

2021 revenue forecast of approximately EUR15 million, assuming

timely closure of EQTEC projects as planned. This would represent a

700% increase in revenue over the EUR2.2 million in revenue

delivered in 2020.

-- The Company expects to deliver modest EBITDA for the year,

following investments made to accelerate growth. This supports its

aspiration for 2021 to be its first year with positive EBITDA

whilst investing in commercial sustainablility and scale.

Investments include expert support for project development and new

talent to build the growth platform and R&D initiatives to keep

EQTEC technology at the leading edge.

-- The Company expects to continue increasing the number of

pipeline opportunities it converts to projects under active

development. In support of this growth, it expects to invest in

increased engineering capability and capacity, especially in

mechanical, electrical and civil engineering, and grow its

engineering and project management capabilities to undertake more

projects in parallel, in more places, at the same time.

-- Inspired by a highly active and accelerating interest in

cleantech from the French national, regional and local governments

and from potential lenders and development partners, the Company

has identified and is pursuing a number of opportunities in France.

These include potential projects for biomass-to-energy and for

gasification of industrial and contaminated waste, including

retro-fitting of legacy, fossil fuel facilities for reuse as

cleantech businesses.

-- The Company and its Ireland-based partner Carbon Sole Group

Limited ("Carbon Sole") continue to pursue development of two or

more projects in Ireland for biomass-to-bioenergy plants and in

particular sustainable forestry waste for production of synthetic

natural gas ("SNG"). To further support these efforts, EQTEC is

discussing technology collaboration with potential partners for

methanation and other technologies that help convert syngas into

various forms of bioenergy.

-- The Company continues to actively pursue its innovation,

research and development ("R&D") programme, especially through

its partnership with the Université de Lorraine ("UoL") in France.

At least three R&D trials are planned at the end of 2021 with

UoL and other partners, toward testing of RDF, plastic residues and

waste wood biomass feedstocks. New projects and a new R&D

agenda for 2022 will be defined by year end with UoL and other

technology partners.

-- Aligned with its mission, the Company is committed to

demonstrating the importance of leading delivery of environmental,

social and governance ("ESG") initiatives. Working with a leading

third-party consultancy, the Company is developing an ESG statement

of intent and incorporation of specific, ESG objectives and

activities into its strategy and business plans. The Company looks

forward to providing an update on its ESG intentions at the end of

the year.

The unaudited interim results for the six months ended 30 June

2021, which are contained below and form part of this announcement,

include further important information and disclosures. The

announcement should be read in its entirety.

The Company will update shareholders in its next planned

quarterly update in early 2022.

This announcement contains inside information as defined in

Article 7 of the EU Market Abuse Regulation No 596/2014 and has

been announced in accordance with the Company's obligations under

Article 17 of that Regulation.

CEO REPORT

The first half of 2021 was formative for EQTEC, and it is my

shared expectation with the Board of Directors that the Group will

see the fruit of these efforts in our 2021 annual results.

We converted more pipeline opportunities into projects focused

on and ready for development, building a platform for growth and

scale from which to launch them and increasing the number of future

projects to Financial Close and beyond. The Group is growing: in

terms of opportunities, projects, relationships, partnerships and

formal channels for establishing our Advanced Gasification

Technology as the core of more business models that address today's

problems of how to reduce waste and generate more energy, more

cleanly, in more markets.

The Board of Directors remains steadfast in our focus on

achieving our revenue target this year. Delivery of c.EUR15 million

in revenue would represent a seven-fold increase over 2020 and

truly indicate the pace of growth we are experiencing. As indicated

in our Q2 Trading Update, the Company entered 2021 with full

knowledge that the second half of the year would see the financial

results of strong efforts in the first half.

With that in mind, the first half of 2021 was focused on:

1. Market growth . It was only one year ago, in our 2020 Interim

Results, that we announced pipeline growth from 15 to 41

opportunities. In our March 2021 Trading Update, we announced

pipeline growth from 41 to 75 opportunities and since then, the

number of opportunities continues to grow. Perhaps more

significantly, and following the closure of two deals in 2020, we

announced in March that 10, specific projects were under

construction or under development, demonstrating our ability to

successfully convert that pipeline into revenue generating

projects. By the end of June, that number was 13, as outlined in

our Q2 Trading Update. As of this report, we have 17 projects under

construction or development, indicating steady growth based on the

strength of our project development teams and our local

partnerships in target markets.

In March, we announced the evolution of some go-to-market

partner relationships into formal, joint ventures. We announced the

first, in Croatia, with formation of Synergy Projects d.o.o.

("Synergy Croatia"). The second, formalised this month, is for

Greece, with the formation of EQTEC Synergy Projects Limited. Both

are led by the Group and link us with local markets through well

established partners, who will lead local development activities,

nurture relationships with local communities and decision-makers

and provide a range of other services from funding management to

commercial negotiation, and from plant engineering and procurement

to construction and commissioning management. We look forward to

announcing JVs in other target markets.

In May, we announced the acquisition of our first MDC in Italy,

later in the year announcing a second in Croatia. We also indicated

our intentions to invest in MDCs in other markets. The MDCs will

showcase EQTEC technology in live, commercial environments and

drive greater awareness and understanding of our contribution to

cleaner, more efficient energy and biofuel production.

2. Platform for sustainable growth . To support the growth in

pipeline and our ability to convert more opportunities into

projects in more markets, without sacrificing the quality or pace

of development, we invested in capabilities and capacity to support

the quality and pace we require as we further grow the business

into the future.

Toward driving high-quality project development at pace, we

invested in onboarding a cadre of veteran project developers and

waste-to-energy commercial experts to work with us on our most

complex projects. We established a framework for EQTEC project

development across commercial, funding, engineering and delivery

readiness activities and we appointed 'integration leads' to drive

project development to a single plan for high-quality, on-time

outcomes. Combined with the experience and expertise of our

strategic partners in target markets, we will combine the 'best of

the best' into standards, methods and tools for consistent use.

We appointed a new Finance Director, who reviewed current

financial management and statutory compliance arrangements and

outlined near-term and longer-term priorities for further building

out financial controls, compliance and reportin g, project finance

standards and financial modelling capabilities. We refined our

financial modelling tools and ran multiple scenarios in various

projects to maximise IRRs and risk mitigation. We continued

identifying and negotiating with prospective offtake customers,

feedstock providers and project investors.

Critically, we built a plan to rapidly scale our engineering

capability alongside our established engineering partners and look

forward to making future announcements about our progress.

3. Market awareness. We improved our engagement with news media

and key stakeholders including policy influencers and

policy-makers.

We joined the Association for Renewable Energy and Clean

Technology (REA) in the UK and Bioenergy Europe and the European

Biogas Association (EBA) in the EU. We joined advanced thermal

conversion technology (ATCT) working groups and we contributed

evidence to the Environment Agency and the UK Department for

Business, Energy and Industrial Strategy (BEIS) Biomass Strategy

call for evidence in The Role of Biomass in Achieving Net Zero.

We responded to Bioenergy Europe's call for case studies to

input to its Study: Bioenergy in 2050. We submitted additional

information to these organisations about the positive impacts of

gasification plants in supporting a circular economy; plants

complementary with other technologies in reducing emissions,

creating employment and stimulating local communities and

economies.

We played a key role in co-authoring the EBA's first

gasification whitepaper, Gasification: a sustainable technology for

circular economies - scaling up to reach Net Zero by 2050 , to be

published in October aimed at growing awareness from EU

policymakers, media and other stakeholders as to the full potential

of gasification as a circular economic model and enabler for

realising Net Zero targets.

To fund the build-out and application of our platform for growth

and scale, we announced in May a successful, over-subscribed

Placing, which raised more than GBP16 million in investment

capital. We have been quick and efficient at deployment of much of

this capital as intended.

The Company feels very different at Interim Results 2021 than it

did at Interim Results 2020, and the Board of Directors shares my

view that it will feel very different again at Interim Results

2022. The growing stability of our platform allows us now to look

for growth as a Group business in multiple markets and

increasingly, with multiple use cases and business models based on

EQTEC technology.

The versatility of EQTEC technology accommodates a wide range of

feedstock and a wide range of applications as well. We are

currently pursuing predominantly power and heat applications from a

range of feedstocks. But we are running trials and tests with our

R&D partners for both feedstock and applications, and we are

growing our relationships with technology partners to work with us

on a more diverse range of applications such as SNG, biofuels and

hydrogen.

I note that hydrogen has been much in the news over recent

weeks. As one of the three major components of the syngas produced

through EQTEC Advanced Gasification Technology, we have long

anticipated the rise of hydrogen as a commercially viable

proposition. A clear hydrogen economy has yet to emerge, due both

to the prohibitive cost of electrolysers and a lack of

quantifiable, commercial demand.

However, because we see resolution of these challenges on the

horizon, EQTEC will be ready. Our technology is exceptionally

well-positioned by the ultra-pure, intermediate fuel it produces

for a range of applications, including hydrogen via water-gas shift

("WGS") reaction. We are actively exploring certification with TÜV

for hydrogen-linked technologies. In parallel, we are actively

developing agreements with leading technology partners for joint,

go-to-market solution development based on hydrogen and other

applications. For at least one project under development where

there is qualified commercial demand for hydrogen, we are

considering proposal of syngas-based alternatives to the proposed

electroloysis solution. We expect to make announcements on these

points shortly.

As the global community turns its attention towards COP 26 in

Glasgow this November, I am pleased to reaffirm that the Company is

taking a greater role in more places, with more partners and with

increasing impact to define our place in the Net Zero economy and

make a meaningful contribution to sustainable, cleantech businesses

around the world.

David Palumbo

Chief Executive Officer

UNAUDITED INTERIM FINANCIAL STATEMENTS

EQTEC plc

Unaudited condensed consolidated statement of profit or loss

for the six months ended 30 June 2021

Notes 6 months ended 6 months ended

30 June 2021 30 June 2020

EUR EUR

Revenue 6 481,720 770,308

Cost of sales (414,549) (690,166)

Gross profit 67,171 80,142

Operating income/(expenses)

Administrative expenses (2,277,559) (1,489,373)

Impairment of financial investments - (17,324)

Other income - 45,810

Other gains/(losses) 7 (1,404,755) -

Change in fair value of investments (52,846) -

Foreign currency gains/(losses) 123,044 74,470

Operating loss (3,544,945) (1,306,275)

Share of loss from equity (2,914) -

accounted investments

Finance income 21,711 -

Finance costs (512,414) (540,135)

Loss before taxation 6 (4,038,562) (1,846,410)

Income tax 8 - -

Loss for the financial period

f rom continuing operations (4,038,562) (1,846,410)

Profit for the financial period

from discontinued operations 21 - 24,827

LOSS FOR THE FINANCIAL PERIOD (4,038,562) (1,821,583)

Loss/(Profit) attributable

to:

Owners of the company (4,037,800) (1,819,363)

Non-controlling interest (762) (2,220)

(4,038,562) (1,821,583)

6 months ended 6 months ended

30 June 2021 30 June 2020

EUR per share EUR per share

Basic loss per share:

From continuing operations 9 (0.0005) (0.0005)

From continuing and discontinued

operations 9 (0.0005) (0.0005)

Diluted loss per share:

From continuing operations 9 (0.0005) (0.0005)

From continuing and discontinued

operations 9 (0.0005) (0.0005)

EQTEC plc

Unaudited condensed consolidated statement of other

comprehensive income

for the six months ended 30 June 2021

6 months ended 6 months

30 June 2021 ended

30 June

2020

EUR EUR

Loss for the financial period (4,038,562) (1,821,583)

Other comprehensive income/(loss)

Items that may be reclassified

subsequently to profit or loss

Exchange differences arising on

retranslation

of foreign operations 88,473 (141,181)

88,473 (141,181)

Total comprehensive loss for the

financial period (3,950,089) (1,962,764)

Attributable to:

Owners of the company (3,843,401) (2,009,617)

Non-controlling interests (106,688) 46,853

(3,950,089) (1,962,764)

EQTEC plc

Unaudited condensed consolidated statement of financial

position

At 30 June 2021

Notes 30 June 2021 31 December

2020

ASSETS EUR EUR

Non-current assets

Property, plant and equipment 10 344,810 187,792

Goodwill 11 15,283,459 15,283,459

Other intangible assets 12 2,443,832 -

Financial assets 13,14 6,930,938 5,950,513

Total non-current assets 25,003,039 21,421,764

Current assets

Development costs 15 2,433,006 503,653

Loans receivable from project

development 15 1,809,746 482,537

Trade and other receivables 16 1,741,975 894,531

Cash and cash equivalents 15,341,569 6,394,791

Total current assets 21,326,296 8,275,512

Total assets 46,329,335 29,697,276

EQTEC plc

Unaudited condensed consolidated statement of financial

position

At 30 June 2021 - continued

Notes 30 June 2021 31 December

2020

EQUITY AND LIABILITIES EUR EUR

Equity

Share capital 17 25,805,877 24,355,545

Share premium 82,859,049 62,896,521

Other reserves 2,148,220 2,148,220

Accumulated deficit (65,718,962) (61,875,561)

Equity attributable to the owners

of the company 45,094,184 27,524,725

Non-controlling interests (2,330,674) (2,223,986)

Total equity 42,763,510 25,300,739

Non-current liabilities

Lease liabilities 19 154,799 106,465

Total non-current liabilities 154,799 106,465

Current liabilities

Trade and other payables 20 3,217,177 3,183,979

Borrowings 18 - 1,020,851

Lease liabilities 19 193,849 85,242

Total current liabilities 3,411,026 4,290,072

Total equity and liabilities 46,329,335 29,697,276

EQTEC plc

Unaudited condensed consolidated statement of changes in

equity

for the six months ended 30 June 2021 and the six months ended

30 June 2020

Equity

attributable

Share Accumulated to owners of Non-controlling

Capital Share premium Other reserves deficit the company interests Total

EUR EUR EUR EUR EUR EUR EUR

Balance at 1

January 2020 21,317,482 52,487,278 - (56,011,538) 17,793,222 (2,326,274) 15,466,948

Issue of ordinary

shares 300,400 796,144 - - 1,096,544 - 1,096,544

Reclassification

on

non-controlling

interests - - - (15,760) (15,760) 15,760 -

Share issue

costs - (3,897) - - (3,897) - (3,897)

Transactions

with owners 300,400 792,247 - (15,760) 1,076,887 15,760 1,092,647

Loss for the

financial period - - - (1,819,363) (1,819,363) (2,220) (1,821,583)

Unrealised foreign

exchange

gains/(losses) - - - (190,254) (190,254) 49,073 (141,181)

Total

comprehensive

loss for the

financial period - - - (2,009,617) (2,009,617) 46,853 (1,962,764)

Balance at 30

June 2020 21,617,882 53,279,525 - (58,036,915) 16,860,492 (2,263,661) 14,596,831

Balance at 1

January 2021 24,355,545 62,896,521 2,148,220 (61,875,561) 27,524,725 (2,223,986) 25,300,739

Issue of ordinary

shares 1,403,448 21,344,046 - - 22,747,494 - 22,747,494

Issue of share

capital on

exercise

of employee

share warrants 46,884 89,351 - - 136,235 - 136,235

Share issue

costs - (1,470,869) - - (1,470,869) - (1,470,869)

Transactions

with owners 1,450,332 19,962,528 - - 21,412,860 - 21,412,860

Loss for the

financial period - - - (4,037,800) (4,037,800) (762) (4,038,562)

Unrealised foreign

exchange losses - - - 194,399 194,399 (105,926) 88,473

Total

comprehensive

loss for the

financial period - - - (3,843,401) (3,843,401) (106,688) (3,950,089)

Balance at 30

June 2021 25,805,877 82,859,049 2,148,220 (65,718,962) 45,094,184 (2,330,674) 42,763,510

EQTEC plc

Unaudited condensed consolidated statement of cash flows

for the six months ended 30 June 2021

Notes 6 months ended 6 months ended

30 June 2021 30 June 2020

EUR EUR

Cash flows from operating

activities

Loss for the financial period (4,038,562) (1,846,410)

Adjustments for:

Depreciation of property,

plant and equipment 59,596 41,732

Write off of financial liability - (5,691)

Impairment of financial assets - 17,324

Share of loss from equity 2,914 -

accounted investments

Change in fair value of investments 52,846 -

Loss/(gain) on debt for equity 1,404,755 -

swap

Unrealised foreign exchange

movements 328,535 247,712

Operating cash flows before

working capital changes (2,189,916) (1,545,333)

(Increase)/decrease in:

Development costs (1,929,353) (60,643)

Trade and other receivables (840,758) (45,050)

Increase/(decrease) in Trade

and other payables 87,226 1,258,709

Cash used in operating activities

- continuing operations (4,872,801) (392,317)

Finance income (21,711) -

Finance costs 512,414 540,135

Net cash (used in)/generated

from operating activities

- continuing operations (4,382,098) 147,818

Net cash generated from operating

activities - discontinued

operations 21 - 84,821

Cash (used in)/ generated

from operating activities (4,382,098) 232,639

Cash flows from investing

activities

Proceeds from the disposal

of property, plant and equipment - 300,000

Additions to intangible assets (1,000,000) -

Additions to equity accounted (492,000) -

investments

Loans advanced to project (1,283,801) -

development undertakings

Net cash (used in) generated

from investing activities

- continuing operations (2,775,801) 300,000

Net cash generated from investing

activities - discontinued

operations 21 - 3

Net cash (Used in)/generated

from investing activities (2,775,801) 300,003

EQTEC plc

Unaudited condensed consolidated statement of cash flows

for the six months ended 30 June 2021 - continued

Notes 6 months ended 6 months ended

30 June 2021 30 June 2020

EUR EUR

Cash flows from financing activities

Proceeds from borrowings and 1,391,174 -

lease liabilities

Repayment of borrowings and

lease liabilities (2,929,858) (182,232)

Proceeds from issue of ordinary

shares 19,034,484 1,031,274

Share issue costs (1,266,913) (16,207)

Loan issue costs - (30,944)

Interest paid - (7,783)

Net cash generated from financing

activities - continuing operations 16,228,887 794,108

Net cash generated from/(used

in) financing activities - discontinued

operations 21 - (61,861)

Net cash generated from financing

activities 16,228,887 732,247

Net increase/ (decrease) in

cash and cash equivalents 9,070,988 1,264,889

Cash and cash equivalents at

the beginning of the financial

period 6,270,581 608,194

Cash and cash equivalents at

the end of the financial period 15,341,569 1,873,083

Cash and cash equivalents included

in disposal group 21 - (148,765)

Cash and cash equivalents for

continuing operations 15,341,569 1,724,318

EQTEC plc

Notes to the unaudited condensed consolidated financial

statements

1. GENERAL INFORMATION

The unaudited interim condensed consolidated financial

statements of EQTEC plc ("the Company") and its subsidiaries ("the

Group") for the six months ended 30 June 2021 were authorised for

issue in accordance with a resolution of the directors on 27

September 2021.

EQTEC plc ("the Company") is a company domiciled in Ireland. The

Company's registered office is at Building 1000, City Gate, Mahon,

Cork T12 W7CV, Ireland. The Company's shares are quoted on the AIM

market of the London Stock Exchange plc.

The Group is a waste-to-value group, which uses its proven

proprietary Advanced Gasification Technology to generate safe,

green energy from over 50 different kinds of feedstock such as

municipal, agricultural and industrial waste, biomass, and

plastics. The Group collaborates with waste operators, developers,

technologists, EPC contractors and capital providers to build

sustainable waste elimination and green energy infrastructure.

Our income currently comes from the following streams:

gasification technology sales including software, engineering &

design and other related services; maintenance income from

operating plants; and we receive development fees from projects

where we invest development capital. In the future we expect to

receive potential revenue from licensing opportunities and revenue

from live operations where EQTEC has an equity stake in a

plant.

2. BASIS OF PREPERATION

The unaudited interim condensed consolidated financial

statements are for the six months ended 30 June 2020 and are

presented in Euro, which is the functional currency of the parent

company. They have been prepared on a going concern basis in

accordance with International Accounting Standard (IAS) 34 Interim

Financial Reporting.

The annual financial statements of the group are prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the EU. The condensed set of financial statements has

been prepared applying the accounting policies and presentation

that were applied in the preparation of the Company's published

consolidated financial statements for the financial year ended 31

December 2020, except for the adoption of new standards effective

as of 1 January 2021. The Group has not early adopted any other

standard, interpretation or amendment that has been issued but is

not yet effective.

The financial information contained in this interim statement,

which is unaudited, does not constitute statutory accounts as

defined by the Companies Act, 2014. The interim condensed

consolidated financial statements do not include all the

information and disclosures required in the annual financial

statements and should be read in conjunction with the Group's

financial statements for the financial year ended 31 December 2020.

The financial statements of the Group were prepared in accordance

with IFRSs as adopted by the European Union and can be found on the

Group's website at www.eqtec.com .

The financial information for the six months ended 30 June 2021

and the comparative financial information for the six months ended

30 June 2020 have not been audited or reviewed by the Company's

auditors pursuant to guidance issued by the Auditing Practices

Board. The comparative figures for the financial year ended 31

December 2020 are not the Group's statutory accounts for that

financial year. Those accounts have been reported on by the

Company's auditor and will be delivered to the Company's

Registration Office in due course. The audit report on those

statutory accounts

was unqualified.

The Group incurred a loss on continuing operations of

EUR4,038,562 (1H 2020: EUR1,846,410) during the six-month period

ended 30 June 2021 and had net current assets of EUR17,915,270 (31

December 2020: EUR3,985,440) and net assets of EUR42,763,510 (31

December 2020: EUR25,300,739) at 30 June 2021.

Going concern

The unaudited interim financial statements have been prepared on

the going concern basis, which assumes that the Company will have

sufficient funds available to enable them to continue to trade for

the foreseeable future.

During June 2021 the Company raised GBP16 million (before

expenses) by way of a Placing and Retail Offer. The directors

consider that this is sufficient funding for the Company to

continue as a going concern beyond the twelve months of the date of

this report.

The directors are confident that the funding received by the

Company in June 2021 will ensure that it will continue as a going

concern and that there will be sufficient funding in the Company to

continue to support its activities for the foreseeable future being

not less than twelve months from the date of approval of these

financial statements. The directors have therefore prepared the

financial statements on a going concern basis.

The financial statements do not include any adjustments that

would arise if the Company were unable to continue as a going

concern.

3. BASIS OF CONSOLIDATION

The unaudited interim condensed consolidated financial

statements include the financial statements of the Group and all

subsidiaries. The financial period ends of all entities in the

Group are coterminous.

4. SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies used in preparing the

unaudited interim condensed consolidated financial information are

consistent with those disclosed in the Annual Report and Accounts

of EQTEC plc for the financial year ended 31 December 2020, except

for the adoption of new standards and interpretations and revisions

of existing standards as of 1 January 2021 noted below:

New/revised standards and interpretations adopted in 2021

The following amendments to existing standards and

interpretations were effective in the period to 30 June 2021, but

were either not applicable or did not have any material effect on

the Group:

-- Amendments to IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16:

Interest Rate Benchmark Reform Phase 2;

-- Amendments to IFRS 16: COVID-19 Rent Related Concessions;

The directors do not expect the adoption of the above amendments

and interpretations to have a material effect on the interim

condensed financial statements in the period of initial

application.

Development assets

Development assets are stated at the lower of cost and net

realisable value. Costs represent expenses associated with

engineering, project management, permitting, planning, financing

and other services, incurred in furthering the development of a

project towards financial close. Net realisable value is based on

estimated revenue to be recognized for development services less

further costs expected to be incurred to the financial close of a

project.

5. ESTIMATES

The preparation of the interim condensed consolidated financial

statements requires management to make judgements, estimates and

assumptions that affect the application of policies and reported

amounts of certain assets, liabilities, revenues and expenses

together with disclosure of contingent assets and liabilities.

Estimates and underlying assumptions are reviewed on an on-going

basis. Revisions of accounting estimates are recognised in the

period in which the estimate is revised.

The judgements, estimations and assumptions applied in the

interim financial statements, including the key sources of

estimation uncertainty, were the same as those applied in the

Group's last annual financial statements for the financial year

ended 31 December 2020.

6. SEGMENT INFORMATION

Information reported to the chief operating decision maker for

the purposes of resource allocation and assessment of segment

performance focuses on the products and services sold to customers.

The Group's reportable segments under IFRS 8 Operating Segments are

as follows:

Technology Sales: Being the sale of Gasification Technology and

associated Engineering and Design Services;

Power Generation: Being the development and operation of

renewable energy electricity and heat generating plants.

The chief operating decision maker is the Chief Executive

Officer. Information regarding the Group's current reportable

segment is presented below. The following is an analysis of the

Group's revenue and results from continuing operations by

reportable segment:

Segment Revenue Segment Profit/(Loss)

6 months ended 6 months ended

30 June 2021 30 June 2020 30 June 30 June

2021 2020

EUR EUR EUR EUR

Technology Sales 481,720 770,308 (427,114) (407,482)

Power Generation - - (185) (4,565)

Total from continuing

operations 481,720 770,308 (427,299) (412,047)

Central administration costs and directors'

salaries (1,783,089) (997,184)

Impairment of financial investments - (17,324)

Other income - 45,810

Change in fair value of investments (52,846) -

Other gains and losses (1,404,755) -

Foreign currency gains/(losses) 123,044 74,470

Share of loss of equity accounted (2,914) -

investments

Finance income 21,711 -

Finance costs (512,414) (540,135)

Loss before taxation (continuing operations) (4,038,562) (1,846,410)

6. SEGMENT INFORMATION - continued

Revenue reported above represents revenue generated from

associated undertakings and external customers. Inter-segment sales

for the financial period amounted to EURNil (2020: EURNil).

Included in revenues in the Technology Sales Segment are revenues

of EURNil (2020: EUR691,163) which arose from sales to North Fork

Community Power LLC,, an associate undertaking of EQTEC plc.

Segment profit or loss represents the profit or loss earned by

each segment without allocation of central administration costs and

directors' salaries, other operating income, share of losses of

jointly controlled entities, investment revenue and finance costs.

This is the measure reported to the chief operating decision maker

for the purposes of resource allocation and assessment of segment

performance.

Other segment information:

Depreciation and amortisation Additions to non-current

assets

6 months ended 6 months ended

30 June 30 June 30 June 30 June

2021 2020 2021 2020

EUR EUR EUR EUR

Technology sales 41,732 41,732 - 14,878

Power Generation - - - -

Head Office 17,864 - 2,658,570 5,119

59,596 41,732 2,658,570 19,997

The Group operates in four principal geographical areas:

Republic of Ireland (country of domicile), Spain, United States and

the United Kingdom. The Group's revenue from continuing operations

from external customers and information about its non-current

assets* by geographical location are detailed below:

Revenue from Associates Non-current assets*

and External Customers

6 months 6 months

ended ended As at As at

30 June 30 June 2020 30 June 2021 31 December

2021 2020

EUR EUR EUR EUR

Republic of - - 2,443,832 -

Ireland

Spain 481,720 79,145 146,061 187,792

United States - 691,163 - -

United Kingdom - - 198,750 -

481,720 770,308 2,788,643 187,792

*Non-current assets excluding goodwill, financial instruments,

deferred tax and investment in jointly controlled entities and

associates.

The management information provided to the chief operating

decision maker does not include an analysis by reportable segment

of assets and liabilities and accordingly no analysis by reportable

segment of total assets or total liabilities is disclosed.

7. OTHER GAINS AND LOSSES 6 months 6 months ended

ended

30 June 30 June 2020

2021

EUR EUR

(Loss)/Gain on debt for equity swap (1,404,755) -

During the financial year the Group extinguished some of its

borrowings by issuing equity instruments. In accordance with IFRIC

19 Extinguishing Financial Liabilities with Equity Instruments, the

loss recognised on these transactions was EUR1,404,755 (H1 2020:

gain of EURNil).

8. INCOME TAX 6 months 6 months ended

ended

30 June 30 June 2020

2021

EUR EUR

Income tax expense comprises:

Current tax expense - -

Deferred tax credit - -

Adjustment for prior financial periods - -

Tax expense - -

An income tax charge does not arise for the six months ended 30

June 2021 or 30 June 2020 as the effective tax rate applicable to

expected total annual earnings is Nil as the Group has sufficient

tax losses coming forward to offset against any taxable profits. A

deferred tax asset as not been recognised for the losses coming

forward.

9. LOSS PER SHARE 6 months 6 months

ended ended

30 June 2021 30 June 2020

EUR per share EUR per share

Basic loss per share

From continuing operations (0.0005) (0.0005)

From discontinued operations - -

Total basic loss per share (0.0005) (0.0005)

Diluted loss per share

From continuing operations (0.0005) (0.0005)

From discontinued operations - -

Total diluted loss per share (0.0005) (0.0005)

The loss and weighted average number of ordinary shares used in

the calculation of the basic and diluted loss per share are as

follows:

6 months ended 6 months ended

30 June 2021 30 June 2020

EUR EUR

Loss for period attributable to

equity holders of the parent (4,037,800) (1,819,363)

Profit for the period from discontinued

operations used in the calculation

of basic earnings per share from

discontinued operations - 24,827

Losses used in the calculation

of basic loss per share from continuing

operations (4,037,800) (1,844,190)

No. No.

Weighted average number of ordinary

shares for

the purposes of basic loss per

share 7,358,418,295 3,989,442,933

Weighted average number of ordinary

shares for

the purposes of diluted loss per

share 7,358,418,295 3,989,442,933

Dilutive and anti-dilutive potential ordinary shares

The following potential ordinary shares were excluded in the

diluted earnings per share calculation as they were

anti-dilutive.

30 June 2021 30 June 2020

Share warrants in issue 663,310,335 576,876,933

Convertible loans in issue - 235,991,940

Total anti-dilutive shares 663,310,355 812,868,873

Events after the balance sheet date

128,380,000 ordinary shares were issued after the period end. If

these shares were in issue prior to 30 June 2021, they would have

affected the calculation of the weighted average number of shares

in issue for the purposes of calculating both the basic loss per

share and diluted loss per share by 21,396,667.

10. PROPERTY, PLANT AND EQUIPMENT

During the six-month period ended 30 June 2021, the Group acquired

right-to-use assets financed through leases to the value of EUR214,378.

11. GOODWILL

Included are the following amounts relating to goodwill:

30 June 2021 31 December

2020

Cost EUR EUR

At start and at end

of the financial period 16,710,497 16,710,497

Accumulated impairment

losses

At start of the financial

period 1,427,038 1,427,038

Impairment losses - -

At end of the

financial period 1,427,038 1,427,038

Carrying value

At start and at end

of the financial period 15,283,459 15,283,459

12. OTHER INTANGIBLE ASSETS

During the six-month period ended 30 June 2021, the Group

acquired intellectual property rights valued at EUR2,443,832 as

part of a settlement with Syngas Technology Engineering, S.L., a

company wholly owned and controlled by Dr. Yoel Alemán, a director

of the Company.

13. FINANCIAL ASSETS

During the six-month period ended 30 June 2021, the Group

acquired the following financial assets:

a) Investment in MetalNRG plc

On 17 May 2021, the Company acquired 60,606,061 shares in

MetalNRG plc in exchange for 27,932,961 Ordinary Shares of the

Company.

b) Investment in EQTEC Italia MDC srl

During the six-month period ended 30 June 2021, the Group

acquired a 20.02% share in an associate company, EQTEC Italia MDC

srl. In addition, the Group advanced a loan of EUR482,000 to EQTEC

Italia MDC srl. The loan is for a term of 36 months and the

principal and any accrued interest are repayable in full on 18 June

2026, but EQTEC Italia MDC srl can repay the loan early without

penalty. The loan is unsecured and has a coupon rate of 4% per

annum, payable on termination of the loan.

14. INVESTMENT IN ASSOCIATED UNDERTAKINGS

Details of the Group's interests in associated undertakings at

30 June 2020 is as follows:

Name of associated Country of Shareholding Principal activity

undertaking incorporation

North Fork Community United States 19.99% Operator of biomass

Power LLC of America gasification power project

EQTEC Italia Italy 20.02% Operator of biomass

MDC srl gasification project

For the first five years of operation, the share of profits

from North Fork Community Power LLC is limited to 0.1999%

rising to 19.99% thereafter.

Summarised financial information in respect of the Group's

interests in associated undertakings is as follows:

30 June 31 December

2021 2020

EUR EUR

Non-current assets 699,829 44,552

Current assets 20,738,537 17,686,647

Non-current liabilities (19,298,707) (16,213,836)

Current liabilities (422,135) (263,150)

Net assets 1,717,524 1,254,213

Group's share of net assets of associated

entities 343,344 250,717

6 months ended 6 months ended

30 June 2021 30 June 2020

EUR EUR

Total revenues 18,567 12,721

Total expenses (31,664) (2,461)

Total (loss)/profit for the financial

period (13,097) 10,260

Group's share of (losses)/profits (2,914) -

of associated entities

The investments in North Fork Community Power LLC and EQTEC

Italia MDC srl are accounted for using the equity method in

accordance with IAS 28.

The associates have not yet commenced to fully trade.

15. DEVELOPMENT ASSETS

30 June 31 December

2021 2020

EUR EUR

Costs associated with project development

2,433,006 503,653

Loan receivable from project development

undertakings 1,809,746 482,537

The Group uses its expertise in engineering, project management,

permitting, planning and financing to develop waste to value

projects. Once the projects reach a certain level of maturity,

third party investors are allowed invest in the project SPV. The

Group charges a premium to the project SPV for the development

services over and above the costs incurred in developing the

project.

Costs associated with project development, including loans

advanced to project undertakings (together "Total Project Costs")

comprise expenses associated with engineering, project management,

permitting, planning, financing and other services, incurred in

furthering the development of a project towards financial close.

Total Project Costs set out above represent the cost of delivery of

project development services and are transferred to cost of sales

when the project SPV is invoiced by the Group for project

development work.

Included in loans receivable from project development

undertakings is an amount of EUR200,000 which is receivable, along

with accrued interest, 12 months from the date of drawdown.

Interest is charged at 15% per annum. At 30 June 2021, the loan is

valued at EUR228,274 (31 December 2020: EUR213,297).

The remaining loans receivables were issued with no interest and

no fixed repayment date.

16. TRADE AND OTHER RECEIVABLES 30 June 31 December

2021 2020

EUR EUR

Trade receivables - gross 615,407 638,602

Allowance for credit losses (475,687) (475,687)

Trade receivables - net 139,720 162,915

VAT receivable 456,121 172,405

Deferred consideration for the disposal of

Pluckanes Windfarm Limited 126,572 120,424

Advances to related undertakings 60,100 60,000

Allowance for credit losses (60,000) (60,000)

Prepayments 241,798 133,403

Corporation tax 2,376 6,841

Payments on account 400,023 120,798

Other receivables 375,265 177,745

1,741,975 894,531

Included in other receivables is an amount of EUR302,871 (31

December 2020: EUR11,294) being a deposit towards the purchase of

land on which the proposed up to 25 MWe Billingham waste

gasification and power plant at Haverton Hill, Billingham, UK, will

be constructed.

17. EQUITY

During the 6-month period ended 30 June 2021, 1,450,322,620

shares (6 months ended 30 June 2020: 300,400,000 shares) were

issued

as follows:

Amounts of shares 6 months ended 6 months ended

30 June 2021 30 June 2020

Ordinary Shares of EUR0.001 each issued

and fully paid

* Beginning of the period 6,977,439,598 3,939,376,266

* Issued on exercise of warrants for cash 156,773,543 300,400,000

46,884,149 -

* Issued on exercise of employee share warrants for

cash

152,075,311 -

* Issued in settlement of suppliers and other creditors

27,932,961 -

* Issued in exchange for shares in other entity

1,066,666,656 -

* Share issue for cash - public and private placement

Total Ordinary shares of EUR0.001 each

authorised, issued and fully paid at

the end of the period 8,427,772,218 4,239,776,266

18. BORROWINGS

During the six months ended 30 June 2021, the following occurred

in relation to debt securities:

On 4 January 2021, the Company announced that it had agreed an

unsecured loan facility of GBP1.25 million with Altair Group

Investment Limited, a substantial shareholder in the Company. The

Loan Facility was for a term of 12 months and the principal and any

accrued interest were repayable in full on 31 December 2021. The

Loan Facility was unsecured and had a coupon rate of 6% per annum,

payable quarterly in arrears. The Loan Facility was used to pay all

sums due under the previous Secured Loan Facility that was in place

at that time releasing and discharging any secured assets and

obligations.

During the period all amounts due and owing under the unsecured

loan facility were repaid in full.

19. LEASES

During the six-month period ended 30 June 2021, the Group

acquired right-to-use assets financed through leases to

the value of EUR214,378.

Lease liabilities are presented in the statement of financial

position as follows:

30 June 31 December

2021 2020

Group EUR EUR

Current 193,849 85,242

Non-current 154,799 106,465

348,648 191,707

The Group has a lease for its offices in Iberia, Spain and

London, United Kingdom. The lease liabilities are secured by the

related underlying asset. Further minimum lease payments at 30 June

2021 were as follows:

Minimum lease payments due

Within 1-2 years 2-3 years 3-4 4-5 After Total

1 year years years 5 years

EUR EUR EUR EUR EUR EUR EUR

30 June 2021

Lease payments 201,657 156,819 - - - - 358,476

Finance charges (7,808) (2,020) - - - - (9,828)

Net Present

Values 193,849 154,799 - - - - 348,648

31 December

2020

Lease payments 89,828 89,828 18,714 - - - 198,370

Finance charges (4,586) (1,993) (84) - - - (6,663)

Net Present

Values 85,242 87,835 18,630 - - - 191,707

20. TRADE AND OTHER PAYABLES

Included in trade and other payables at 30 June 2021 is an

amount of EUR2,341,427 (GBP2,010,000) (31 December

2020:EUR2,237,006) relating to consideration payable under the

share purchase contract to acquire Logik WTE Limited.

21. DISPOSAL GROUP CLASSIFIED AS HELD FOR RESALE AND DISCONTINUED OPERATIONS

The amounts presented in the condensed consolidated statement of

profit or loss and the condensed consolidated statement of cash

flows under discontinued operations relates to its former subsidiary,

Pluckanes Windfarm Limited, which was disposed of on 24 August 2020.

22. RELATED PARTY TRANSACTIONS

The Group's related parties include Altair Group Investment

Limited ("Altair"), who at 30 June 2020 held 20% of the shares in

the Company, the associate companies and key management.

Transactions with Altair

During the six-month period ended 30 June 2021, Altair advanced

EUR1,391,173 (H1 2020: EURNil) by way of borrowings; this loan was

repaid in the period. Interest payable to Altair for the six-month

period ended 30 June 2021 amounted to EUR28,571 (H1 2020:

EUR167,783); this includes a reprofiling fee of EURNil (H1 2020:

EUR106,321) regarding the reprofiling of the debt facility that

took place on 1 June 2020.

22. RELATED PARTY TRANSACTIONS - Continued

Transactions with associate undertakings

During the six-month period ended 30 June 2021, the Company

booked in revenue EURNil (Six months ended 30 June 2020:

EUR691,163) from its associated undertaking, North Fork Community

Power LLC, on the sale of equipment and the supply of engineering

and design services. During the six-month period ended 30 June

2021, the Group advanced EUR202,169 (H1 2020: EURNil) to North Fork

Community Power LLC by way of a loan. Included in loans receivable

from project undertakings is an amount of EUR237,436 (31 December

2020: EUR30,201) due from North Fork Community Power LLC.

During the six-month period ended 30 June 2020, the Company

recharged costs of EUR93,148 (H1 2020: EURNil) to its associated

undertaking, EQTEC Italia MDC srl. Included in trade and other

receivables at 30 June 2021 is EUR93,148 due from EQTEC Italia MDC

srl (31 December 2020: EURNil).

During the six-month period ended 30 June 2020, the Company

advanced a loan of EUR482,000 (H1 2020: EURNil) to its associated

undertaking, EQTEC Italia MDC srl, and accrued interest income of

EUR687 (H1 2020: EURNil). Included in financial assets at 30 June

2021 is EUR482,687 due from EQTEC Italia MDC srl (31 December 2020:

EURNil).

Transactions with key management

A company controlled by a director, Mr. D Palumbo, provided

office space for the Group in London. The cost of these services

for the six-month period ended 30 June 2021 amounted to EUR12,566

(H1 2020: EUR9,091). At 30 June 2021, an amount of EURNil (31

December 2020: EUR3,172) is included in trade and other payable

with respect to payments due to this company.

A company controlled by a director, Mr J Vander Linden, had

provided advisory services to the Group prior to being appointed

director. The cost of the services for the six-month period ended

30 June 2021 amounted to EURNil. Included in trade and other

payables at 30 June 2021 is an amount of EURNil (31 December 2020:

EUR63,883) with respect to payments due to this company. The

balance at 31 December 2020 was settled through the issue of new

ordinary shares of EUR0.001 each in the capital of the Company on 1

February 2021.

During the six-month period ended 30 June 2021, the Group

entered into a royalty settlement arrangement, to the tune of

EUR2,443,832, with Syngas Technology Engineering, S.L. (a company

controlled by Dr. Yoel Alemán, the Group's CTO and current Board

Director). This balance was settled through a cash payment of

EUR1,000,000 with the remainder through the issue of new ordinary

shares of EUR0.001 each in the capital of the Company on 3 June

2021.

Mr I Pearson, provided consultancy services to the Group during

H1 2021 amounting to EUR116,261 (H1 2020: EURNil). Included in

trade and other payables at 30 June 2021 is an amount of EURNil (31

December 2020: EURNil) with respect to payments due to him.

23. CONTINGENT LIABILITIES

On 13 July 2020, the Group announced that lawyers acting for Aries

Clean Energy LLC of Franklin, Tennessee, USA ("Aries") filed a

complaint in a Californian court on 9 July 2020 against the Company

and others, alleging patent infringement through the use of the

Group's Advanced Gasification Technology in the North Fork Community

Power plant in California USA.

On 22 March 2021 the Company announced the Aries had withdrawn

its patent infringement complaint. The joint stipulation that

the action be voluntarily dismissed with prejudice was filed in

the United States District Court Eastern District of California

on 19 March 2021 and operates as a final determination on the

merits of the case, forbidding Aries from filing another lawsuit

on the same grounds.

24. EVENTS AFTER THE BALANCE SHEET DATE

No adjusting or significant non-adjusting events have occurred

until the date of authorisation of these financial statements.

25. APPROVAL OF FINANCIAL STATEMENTS

The condensed consolidated financial statements for the six

months ended 30 June 2021, which comply with IAS 34, were approved

by the Board of Directors on 27 September 2021.

ENQUIRIES

EQTEC plc +44 203 883 7009

David Palumbo / Nauman Babar

-----------------------

Strand Hanson - Nomad & Financial Adviser +44 20 7409 3494

-----------------------

James Harris / James Dance

-----------------------

Arden Partners - Joint Broker +44 20 7614 5900

-----------------------

Paul Shackleton (Corporate) / Simon Johnson

(Sales)

-----------------------

Canaccord Genuity - Joint Broker +44 20 7523 8000

-----------------------

Henry Fitzgerald-O'Connor / James Asensio

/ Patrick Dolaghan

-----------------------

Alma PR - Financial Media & Investor Relations +44 20 3405 0205

-----------------------

Josh Royston / Sam Modlin EQTEC@almapr.co.uk

-----------------------

+44 7554 014 188 / +44

BECG - General Media Enquiries 7867 452 269

-----------------------

Carrie Lowe / Tom Gosschalk EQTEC@BECG.com

-----------------------

About EQTEC plc

As one of the world's most experienced gasification technology

and engineering companies, with a growing track record of

delivering operational and commercial success for transforming

waste-to-energy through best-in-class technology innovation,

engineering and project development , EQTEC brings together design

innovation, project delivery discipline and solid commercial

experience to add momentum to the global energy transition. EQTEC's

proven, proprietary and patented technology is at the centre of

clean energy projects, sourcing local waste, championing local

businesses, creating local jobs and supporting the transition to

localised, decentralised and resilient energy systems.

EQTEC designs, supplies and builds advanced gasification

facilities in the UK, EU and US, with highly efficient equipment

that is modular and scalable from 1MW to 30MW. EQTEC's versatile

solutions process over 50 varieties of feedstock, including

forestry wood waste, vegetation and other agricultural waste from

farmers, industrial waste and sludge from factories and municipal

waste, all with no hazardous or toxic emissions . EQTEC's solutions

produce a pure, high-quality synthesis gas ("syngas") that can be

used for the widest range of applications, including the generation

of electricity and heat, production of synthetic natural gas

(through methanation) or biofuels (through Fischer-Tropsch,

gas-to-liquid processing) and reforming of hydrogen.

EQTEC's technology integration capabilities enable the Group to

lead collaborative ecosystems of qualified partners and to build

sustainable waste reduction and green energy infrastructure around

the world.

The Company is quoted on AIM (ticker: EQT) and the London Stock

Exchange has awarded EQTEC the Green Economy Mark, which recognises

listed companies with 50% or more of revenues from

environmental/green solutions.

Further information on the Company can be found at www.eqtec.com

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KDLFLFKLXBBV

(END) Dow Jones Newswires

September 28, 2021 02:00 ET (06:00 GMT)

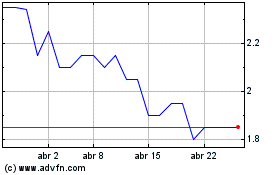

Eqtec (LSE:EQT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Eqtec (LSE:EQT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024