TIDMEST

RNS Number : 4593N

East Star Resources PLC

30 September 2021

East Star Resources

("East Star" or "the Company")

Interim Results to 31 May 2021

East Star Resources Plc, a London listed natural resources

company, is pleased to present its interim results for the

six-month period ended 31 May 2021.

Highlights

-- Successfully admitted to trading on the London Stock Exchange ("LSE") as of 4(th) May 2021

-- Cash Balance at period of GBP2,053,719

Chairman Statement

I am pleased to present the interim financial statements to

shareholders for the period from incorporation on 17 November 2020

to 31 May 2021.

During the period under review the Company was primarily

concerned with listing on the standard segment of the London Stock

Exchange. As alluded to above we were successfully able to list the

Company on 4(th) May 2021 and enjoyed 2 months of trading before

entering a temporary suspension to facilitate a potential RTO

transaction.

On 19(th) July we were delighted to announce that East Star had

entered into binding Heads of Terms ("Term Sheet") to acquire 100%

of the share capital by way of a reverse takeover ("the

Transaction") of Discovery Ventures Kazakhstan Limited ("DVK"), a

private Kazakhstan registered company. DVK has negotiated the

rights to certain prospective gold and base metals exploration

licences in the Chu-ili and Rudny Altai mineral belts (the

"Projects") through a joint venture agreement with Kazakhstan

National Mining Company, Tau-Ken Samruk JSC ("TKS").

The Kazakhstan region has been overlooked as a mining

destination for many years, but has a well-established history of

gold and base metals success. Our vision is to build on this

initial transaction and grow a portfolio of near-term production

and high-impact exploration assets in a significant, but

underdeveloped, mining-friendly jurisdiction. We are now conducting

due diligence and hope to conclude the transaction as soon as

possible

In spite of the challenges that have affected the world over the

last 24 months our plans remained uninterrupted and I can confirm

that fantastic progress towards our goals continues to be

maintained.

I look forward to reporting our progress to you in the coming

months and thank all shareholders for their continued support.

Financial Review

For the 6 months to 31 May 2021 the Company reported a net loss

of GBP239,334, mostly relating to administrative expenses involved

with listing. The Company maintained a strong balance sheet

position at 31 May, most notably holding cash at period end of

GBP2,053,719.

Directors

The following directors have held office during the period to 31

May 2021:

Mr Anthony Eastman (Executive Director)

Mr Charles Wood

Mr Sandy Barblett

Corporate Governance

The UK Corporate Governance Code (September 2014) ("the Code"),

as appended to the Listing Rules, sets out the Principles of Good

Corporate Governance and Code Provisions which are applicable to

listed companies incorporated in the United Kingdom. As a standard

listed company, the Company is not subject to the Code, but the

Board recognises the value of applying the principles of the Code

where appropriate and proportionate and has endeavoured to do so

where practicable.

Responsibility Statement

The Directors are responsible for preparing the Unaudited

Interim Condensed Financial Statements in accordance with the

Disclosure and Transparency Rules of the United Kingdom's Financial

Conduct Authority ("DTR") and with International Accounting

Standard 34 on Interim Reporting ("IAS 34"). The directors confirm

that, to the best of their knowledge, this condensed interim report

has been prepared in accordance with IAS 34 as adopted by the

European Union. The interim management report includes a fair

review of the information required by DTR 4.2.7 and DTR 4.2.8,

namely:

-- an indication of important events that have occurred during

the six months ended 31 May 2020 and their impact on the condensed

financial statements for the period, and a description of the

principal risks and uncertainties for the remaining six months of

the financial year; and

-- related party transactions that have taken place in the six

months ended 31 May 2020 and that have materially affected the

financial position of the performance of the business during that

period. On behalf of the board

Charles Wood

Executive Director

29 September 2021

Enquiries

East Star Resources Plc - Charles Wood

Executive Director - +44 (0)20 3918 8792

Peterhouse Capital Limited - Lucy Williams / Duncan Vasey

Brokers to the company - +44 (0) 207 469 0936

EAST STAR RESOURCES PLC - CONDENSED INTERIM FINANCIAL

STATEMENTS

STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIOD FROM INCORPORATION TO 31 MAY 2021

Unaudited

Period ended 31 May 2021

Notes GBP

Administrative expenses (239,334)

Operating loss (239,334)

Finance income/(expense) -

---------------------------

Loss before taxation (239,334)

Income tax 5 -

---------------------------

Loss for the period from continuing operations (239,334)

---------------------------

Total loss for the year attributable to equity holders of the Company

Other comprehensive loss -

---------------------------

Total comprehensive loss attributable to equity holders of the Company (239,334)

---------------------------

Basic earnings per ordinary share (pence) 6 (1.12)

The notes form an integral part of the Unaudited Condensed

Interim Financial Statements.

EAST STAR RESOURCES PLC - CONDENSED INTERIM FINANCIAL

STATEMENTS

STATEMENT OF FINANCIAL POSITION

AS AT 31 MAY 2021

Unaudited

As at

Notes 31 May 2021

GBP

ASSETS

CURRENT ASSETS

Cash and cash equivalents 2,053,719

Trade & Other Receivables 7 7,460

-------------

TOTAL ASSETS 2,061,179

-------------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 8 84,054

TOTAL LIABILITIES 84,054

-------------

NET ASSETS 1,977,125

=============

EQUITY

Share Capital 9 608,671

Share Premium 9 1,587,598

Share Based Payment Reserves 10 20,190

Retained Earnings (239,334)

TOTAL EQUITY 1,977,125

=============

The notes form an integral part of the Unaudited Condensed

Interim Financial Statements.

EAST STAR RESOURCES PLC - CONDENSED INTERIM FINANCIAL

STATEMENTS

STATEMENT OF CASHFLOW

FOR THE PERIOD FROM INCORPORATION TO 31 MAY 2021

Unaudited

Period to 31 May 2021

GBP

Cash flow from operating activities

Loss before income tax (239,334)

Adjustments for:

Share based payment 20,190

Changes in working capital:

Decrease / (increase) in other receivables (7,460)

Increase / (decrease) in payables 77,912

Decrease / (increase) in other payables 6,142

Net cash used in operating activities (142,550)

Cashflows from financing activities

Proceeds from issue of ordinary shares 2,282,999

Share issue costs (86,730)

Net cash used in financing activities 2,196,269

Net increase in cash and cash equivalents

Net (decrease) / increase in cash held 2,053,719

Cash and cash equivalents at beginning of financial year -

Cash and cash equivalents at end of financial year 2,053,719

-----------------------

EAST STAR RESOURCES PLC - CONDENSED INTERIM FINANCIAL

STATEMENTS

STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD FROM INCORPORATION TO 31 MAY 2021

Ordinary Share Share Based

capital Share Premium Payment Reserves Retained earnings Total equity

GBP GBP GBP GBP GBP

Comprehensive

income for the

period

Profit for the

period - - - (239,334) (239,334)

------------------- ---------------- ------------------- ------------------- ---------------

Total comprehensive

income for the

period - - - (239,334) (239,334)

Transactions with

owners

Ordinary Shares

issued on

incorporation (17

November 2020) 1,000 - - - 1,000

Ordinary Shares

Issued (8 March

2021) 297,502 - - 297,502

Ordinary Shares

Issued (4 May

2021) 396,899 1,587,598 - - 1,984,497

Broker Warrants

Issued (4 May

2021) - - 20,190 - 20,190

Share Issue Costs (86,730) - - - (86,730)

------------------- ---------------- ------------------- ------------------- ---------------

Total transactions

with owners 608,671 1,587,598 20,190 (239,334) 1,977,125

------------------- ---------------- ------------------- ------------------- ---------------

As at 31 May 2021 608,671 1,587,598 20,190 (239,334) 1,977,125

------------------- ---------------- ------------------- ------------------- ---------------

EAST STAR RESOURCES PLC - CONDENSED INTERIM FINANCIAL

STATEMENTS

NOTES TO THE INTERIM FINANCIAL INFORMATION

FOR THE PERIOD FROM INCORPORATION TO 31 MAY 2021

1 General information

The Company was incorporated on 17 November 2020 in England and

Wales with Registered Number 13025608 under the Companies Act 2006,

under the name Cawmed Resources Limited. The Company subsequently

changed its name to East Star Resources Limited on 27 January 2021

and on 3(rd) March 2021 re-registered as a plc.

The address of its registered office is Eccleston Yards, 25

Eccleston Place, London SW1W 9NF, United Kingdom.

The principal activity of the Company is to seek suitable

investment opportunities primarily in the natural resources

sector.

The Company listed on the London Stock Exchange ("LSE") on

19(th) April 2021.

2 Accounting Policies

IAS 8 requires that management shall use its judgement in

developing and applying accounting policies that result in

information which is relevant to the economic decision-making needs

of users, that are reliable, free from bias, prudent, complete and

represent faithfully the financial position, financial performance

and cash flows of the entity.

3 Basis of preparation

The Condensed Interim Financial Statements have been prepared in

accordance with the Prospectus Rules and International Accounting

Standards in conformity with the requirements of the Companies Act

2006 and the Companies Act 2006 applicable to companies reporting

under IFRS. The Condensed Interim Financial Statements have been

prepared in accordance with IAS 34 "Interim Financial Statements."

The Condensed Interim Financial Statements do not include all

disclosures that would otherwise be required in a complete set of

financial statements but have been prepared in accordance with the

existing accounting policies of the Company.

The Interim Financial Statements for the period ended 31 May

2021 are unaudited.

The Company Financial Information has been prepared using the

measurement bases specified by IFRS for each type of asset,

liability, income and expense.

The Historic Financial Information does not constitute statutory

accounts within the meaning of section 434 of the Companies Act

2006.

The Historic Financial Information is presented in GBP unless

otherwise stated, which is the Company's functional and

presentational currency.

No comparative figures have been presented as the Interim

Financial Information covers the full period from incorporation on

17 November 2020.

Going concern

The Directors have made an assessment of the Company's ability

to continue as a going concern and are satisfied that the company

has the adequate resources to continue in operational existence for

the foreseeable future. The Company, therefore, continues to adopt

the going concern basis in preparing its interim financial

statements.

Accounting policies

The same accounting policies, presentation and methods of

computation have been followed in these Condensed Interim Financial

Statements as were applied in the preparation of the Company's

historic financial information for the year period ended 31

December 2020, as included in the Prospectus dated 27 April 2021,

except for the impact of the adoption of the Standards and

interpretations described below and new accounting policies adopted

as a result of changes in the Company.

Standards and interpretations adopted in the period

There were no new standards or interpretations adopted by the

Company in the period.

Standards and interpretations issued and not yet effective:

Standards, amendments and interpretations that are not yet

effective and have not been early adopted are as follows:

Standard Impact on initial application Effective date

------------------- --------------------------------- --------------

IFRS 3 Reference to Conceptual Framework 1 January 2022

--------------------------------- --------------

IAS 37 Onerous contracts 1 January 2022

--------------------------------- --------------

IAS 16 Proceeds before intended use 1 January 2022

--------------------------------- --------------

Annual improvements 2018-2020 Cycle 1 January 2022

--------------------------------- --------------

IFRS 17 Insurance contracts 1 January 2023

--------------------------------- --------------

IAS 8 Accounting estimates 1 January 2023

--------------------------------- --------------

IAS 1 Classification of Liabilities 1 January 2023

as Current or Non-Current.

--------------------------------- --------------

4 Critical accounting estimates and judgments

In preparing the Condensed Interim Financial Statements, the

Directors have to make judgments on how to apply the Company's

accounting policies and make estimates about the future. Estimates

and judgements are continuously evaluated based on historical

experiences and other factors, including expectations of future

events that are believed to be reasonable under the circumstances.

In the future, actual experience may deviate from these estimates

and assumptions.

The key assumptions concerning the future and other key sources

of estimation uncertainty at the reporting date that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the next financial year,

are described below.

5 Income Tax

31 May

2021

GBP

------------------- ---------

Current tax -

Deferred tax -

------------------- ---------

Income tax expense -

------------------- ---------

Income tax can be reconciled to the loss in the statement of

comprehensive income as follows:

Period ended 31 May 2021 GBP

----------------------------------------------------------------- --------------------------------------

Loss before taxation (239,334)

--------------------------------------

Tax at the UK corporation tax rate of 19% (45,473)

Tax losses on which no deferred tax asset has been recognised 45,473

--------------------------------------

-

--------------------------------------

6 Earnings per Ordinary Share

There were no potentially dilutive instruments in issue at the

period end.

As at 31 May 2021

Earnings Per-share amount

GBP Weighted average number of Ordinary Shares (pence)

---------- ------------------------------------------- -----------------

Basic earnings per Ordinary Share

Earnings attributable to Shareholders (239,334) 21,464,082 (1.12)

---------- ------------------------------------------- -----------------

7 Trade and Other Receivables

31 May 2021

GBP

Prepayments 7,460

7,460

------------

8 Trade & Other Payables

31 May 2021

GBP

Trade Creditors 77,912

Other Payables 6,142

------------

84,054

------------

9 Share Capital & Share Premium

Ordinary Shares Share Capital Share Premium Total GBP

# GBP GBP GBP

Issue of ordinary shares on incorporation(1) 100,000 1,000 - 1,000

Issue of ordinary shares (2) 5,900,000 59,000 - 59,000

Issue of ordinary shares (3) 23,850,217 238,502 - 238,502

Issue of ordinary shares (4) 39,689,947 396,899 1,587,598 1,984,498

Share issue costs - (86,730) - (86,730)

At 31 May 2021 69,540,154 608,671 1,587,598 2,196,269

================ ============== ============== ==========

(1) On incorporation on 17 November 2020, the Company issued

100,000 ordinary shares of GBP0.01 at their nominal value of

GBP0.01.

(2) On 8 March 2021, the Company issued 5,900,000 ordinary

shares at their nominal value of GBP0.01.

(3) On 8 March 2021, the Company issued 23,850,217 ordinary

shares at their nominal value of GBP0.01

(4) On admission to the Standard List of the LSE on 4 May 2021,

39,689,947 shares were issued at a placing price of GBP0.05.

10 Share Based Payment Reserves

Total GBP

Broker placing warrants Issued (1) 20,190

At 31 May 2021 20,190

==========

(1) On admission to LSE on 4 May 2021 1,200,000 brokers warrants

were issued that entitle the warrant holder to subscribe for one

Ordinary Share at GBP0.05 per ordinary share. The estimated fair

values of options which fall under IFRS 2, and the inputs used in

the Black-Scholes model to calculate those fair values are as

follows:

Date of grant Risk

Number Share Exercise Expected Expected free Expected

of warrants Price Price volatility life rate dividends

--------------- ------------- -------- --------- ------------ --------- ------ -----------

4 May2021 1,200,000 GBP0.05 GBP0.05 50.00% 3 0.15% 0.00%

Warrants

Number of Warrants Exercise Expiry date

Price

On incorporation

Issued on 16 March 2021 6,000,000 GBP0.05 4 May2023

Issued on 23 April 2020 1,200,000 GBP0.05 4 May2024

At 31 May 2021 7,200,000 GBP0.05

=================== =========

The weighted average exercise price of the warrants exercisable

at 31 May 2021 is GBP0.05.

The weighted average time to expiry of the warrants as at 31 May

2021 is 2.05 years.

The 6,000,000 warrants issued on 16 March 2021 were issued

alongside the placing of ordinary shares and as such are not fair

valued separately.

11 Related Party Transactions

On incorporation, the Company issued 100,000 Ordinary Shares of

GBP0.01 at GBP0.01 per Ordinary Share for cash consideration of

GBP1,000 to Orana Corporate LLP, an entity of which Directors

Charlie Wood and Anthony Eastman are Partners. Subsequently these

shares were transferred to Director Charlie Wood.

On 24 December 2020, Directors Ainslie Capital Limited and

Tournesol Consulting Limited (entities associated with Directors

Charlie Wood and Anthony Eastman respectively) each subscribed for

400,000 Ordinary Shares of GBP0.01 at GBP0.01 per Ordinary share

(total of 800,000) for cash consideration, of which Charlie Wood

had already received the 100,000 shares as referred above.

All of these shares are paid up subsequent to period end.

12 Ultimate Controlling Party

As at 31 May 2021, there was no ultimate controlling party of

the Company.

13 Post Balance Sheet Events

Subsequent to period end, the Company announced it has entered

into a binding Heads of Terms to acquire 100% of the share capital

by way of a reverse takeover of Discovery Ventures Kazakhstan

("DVK"), a private Kazakhstan registered company. DVK has

negotiated the rights to certain prospective gold and base metals

exploration licences in the Chu-ili and Rudny Altai mineral belts

(the "Projects") through a joint venture agreement with Kazakhstan

National Mining Company, Tau-Ken Samruk JSC ("TKS"). As a result of

this the Company has suspended trading on share since 19 July

2021.

The Company has also subscribed for four, 12-month convertible

loan notes of US$175,000 each issued by DVK, with the proceeds of

which will be used to continue exploration on the Projects. As of

29 September 2021 the first 3 payments of $US175,000 (totalling

$525,000 USD) have been transferred.

Other than above, there has been no significant change in either

the financial performance or the financial position of the Company

since 31 May 2021.

14 Approval of the Condensed Interim Financial Statements

The Condensed Interim Financial Statements were approved by the

Board of Directors on 29 September 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KKLFLFKLFBBL

(END) Dow Jones Newswires

September 30, 2021 02:00 ET (06:00 GMT)

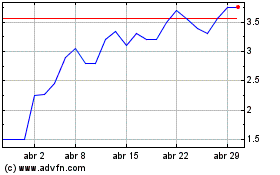

East Star Resources (LSE:EST)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

East Star Resources (LSE:EST)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024