TIDMECHO

RNS Number : 4557N

Echo Energy PLC

30 September 2021

30 September 2021

Echo Energy plc

("Echo" or "the Company")

Interim Results

Echo Energy, the Latin American focused upstream energy company,

announces its unaudited interim results for the six months ended 30

June 2021.

H1 2021 Highlights:

-- Refocus of capex away from high-risk exploration into lower

risk-production opportunities with swift pay back.

-- Gross profit of US $0.4 million (H1 2020: loss of US$ 1.6 million).

-- Revenue increase of 5% to US $5.9 million in H1 2021 (H1 2020: US $5.6 million).

-- Reduction in cost of sales of 33% in H1 2021 compared to equivalent period in H1 2020

-- Total net aggregate H1 2021 production of 304,639 boe

(including 37,159 bbls of oil and condensate and 1,605 MMscf

gas).

-- New gas sales contracts in place from May 2021 with premium

pricing from innovative price auction.

-- Strong domestic gas prices supported enhanced cashflow

generation with a 28% increase in gas price compared to same period

a year ago with premium gas prices only coming into effect in last

two months of the period.

-- Successful completion of the restructuring of both the

Company's EUR 20.0m 8.0% secured notes and the Company's EUR 5.0m

8.0% secured convertible debt facility loan.

-- Echo received a successful VAT cash disbursement from the

Argentine Government of US $0.5 million, a further signal that the

country is progressing towards more regular activity.

Enquiries:

Echo Energy

Martin Hull, Chief Executive Officer via Vigo Communications

Vigo Communications (PR Advisor) +44 (0) 20 7390 0230

Patrick d'Ancona

Chris McMahon

Cenkos Securities (Nominated Adviser) +44 (0) 20 7397 8900

Ben Jeynes

Katy Birkin

Shore Capital (Corporate Broker) +44 (0) 20 7408 4090

Jerry Keen

Certain of the information communicated within this announcement

is deemed to constitute inside information for the purposes of

Article 7 of EU Regulation 596/2014 (as amended), which forms part

of domestic UK law pursuant to the European Union (Withdrawal) Act

2018. Upon the publication of this announcement, this inside

information is now considered to be in the public domain.

Chairman and Chief Executive Officer's Statement

The first six months of 2021 have seen Echo Energy plc ("Echo"

or the "Company") emerge from the previous year's challenges both

operationally and financially stronger. The Company moved swiftly

to successfully restructure its debt, continue to conserve

cashflow, begin to reinstate previously shut in production wells,

and refocus its portfolio on progressing cashflow enhancing rapid

return production opportunities. We have executed our strategy of

moving away from high-risk exploration spend into lower

risk-production opportunities with attractive pay back periods.

These important achievements and the improving macro environment

combined with our commercial successes, including the renegotiation

of gas sale agreements at substantial market premiums during the

period, are reflected in an improved financial performance for the

period.

As Echo continues its return to full liquids production at Santa

Cruz Sur, and improved financial flexibility, we continue to

identify and progress growth options across the existing portfolio,

and the wider region, and work towards overcoming remaining

challenges whilst maintaining our commitment to delivering value

for our shareholders.

COVID-19 recovery and progress on production

At the beginning of the 2020 COVID-19 pandemic, extreme

volatility in the energy markets resulted in the inability of the

Company to sell crude oil and precipitated a decision to preserve

cash through the temporary shut in of a significant number of

Echo's oil producing wells. However, following continued

improvements in market conditions, including a return to regular

oil sales, Echo agreed, together with its Santa Cruz Sur partners,

to upgrade and debottleneck the existing liquid pipelines that were

previously shut in Q2 2020, as a path to returning to full oil

production.

Expenditures of approximately US $0.3 million were injected by

the Company to replace and upgrade parts of the Santa Cruz Sur

infrastructure and reduce maintenance costs. By June 2021, Echo

successfully delivered the project, demonstrating the effectiveness

of the Company's in-country operational capability and enabling

production previously shut in in April 2020 to be systematically

brought back on line. A detailed update on liquid production

increases was provided to the market in August 2021 with around a

50% increase in liquids production. This has enabled the Company to

benefit from the upswing in global oil prices and the improved

macro-outlook, symbolising a strong recovery from the challenges of

the previous year. Whilst overall production, including gas remains

below pre pandemic levels, the company continues to work towards

improving production by undertaking the necessary operational

activities and investments. With improved economic tailwinds and

new infrastructure installed in the field, Echo now has the

capacity to commission incremental enhancement projects within its

portfolio. The reinvestment of available cashflow to drive further

production increases remains an ongoing focus.

These increasing cashflows are expected to enable further

production investments to be funded and demonstrate Echo's

commitment to and confidence in its organic growth strategy within

the Santa Cruz Sur asset base.

Successful execution of sales contracts at premium prices

In March 2021, Echo secured two new gas sales contracts at

significant premiums to both prevailing spot market rates and 2020

contracted rates, with approximately 70% of gross daily gas

production from Santa Cruz Sur allocated to industrial customers

now committed under secured contracts until April 2022.

Following the Company's announcement in March 2021 relating to

new gas sales contracts for 2021-2022, the Company agreed summer

and winter pricing for its annual industrial clients, with the

contracted winter premium providing substantially increased

cashflow in the near term, helping to grow future operations

through production enhancement work activities supported by

infrastructure and compressor maintenance programmes.

In Q2, increasing liquids production represented delivery upon

the Company's strategy to leverage the marked upswing in global

commodity prices. With the additional liquids production expected

to continue to contribute to a material cashflow increase, Echo

continues to benefit from an improving domestic market situation.

In May 2021, the Company sold gas to the spot market at an average

price representing a 151% increase in prices compared to the March

2021 average spot price. All gas production, as of May 2021, was

sold under the new gas sales agreements, reflecting significantly

increased winter pricing. Any gas volumes not sold under the

long-term contracts was sold to the spot market.

Delivery of successful debt restructuring preserving cash

resources

In March 2021, Echo undertook a process of restructuring its

debt to build a solid financial platform for reinvestment of its

increasing cashflows into the Company's assets to deliver growth.

The restructuring was successfully completed in April 2021, when

holders of the Company's publicly listed bonds voted in favour of

the restructuring of those securities. As a result, cash interest

payments on the Company's listed bonds have been deferred until

mid-May 2025. The completion of the bond restructuring also

fulfilled the remaining condition of the Lombard Odier debt

restructuring, which similarly pushed back maturity and preserved

cash resources.

The company's balance sheet remains highly leveraged, and trade

creditor levels are elevated reflecting the challenges presented by

the pandemic, but the restructuring, along with the increased oil

production following the ongoing infrastructure upgrades, provides

a markedly improved and outlook for shareholders.

In May 2021, Echo received a partial VAT repayment from the

Argentine Government as it resumed normal activity following months

of COVID-19 related shut down. This process provided both material

cash funds and further evidence of the normalisation of in-country

activities following delays in 2020 caused by COVID-19.

Growth Opportunities

Campo Limite remains a potentially material well for the Company

which could increase reserves and resources in the Palermo Aike

concession and open up additional commercial options in the area.

Well testing activities remain an operational and commercial focus

and work remains ongoing to optimise commercial arrangements to

enable activities to resume once pandemic constraints (which were

in place throughout H1 2021) are lifted.

At the start of the year, the Company announced a five-year

Cooperation Agreement with GTL International S.A, which has

interests in both the hydrocarbon and renewables sectors. Both

companies continue to collaborate and combine skill-sets to jointly

promote their business development initiatives in the wider region,

and identify and assess new business development opportunities

across the full energy spectrum.

Financial

The six month period ended 30 June 2021 has seen Echo

successfully manage value chains, enabling the Company to improve

efficiencies at both corporate and asset level.

The Group posted a gross profit of US $0.4 million for the first

time since the acquisition of the SCS asset for the six month

period ended June 2021 compared to a loss of US $1.6 million for

the comparable period in 2020, attributable to a decrease in cost

of sales from US $7.3 million in H1 2020 to US $5.5 million in H1

2021, demonstrating enhanced operational efficiency and commodity

prices.

Total revenue for the period was US $5.9 million (H1 2020: US $

5.6 million), and comprised of US $2.1 million of Oil sales and US

$ 3.8 million of Gas sales. Oil prices realised in H1 2021 were on

average 21% higher during the period than in H1 2020. Volume

weighted average realised gas prices increased by 28% compared to

H1 2020.

Financial income of US $3.1 million recognised the interest

gained on the Argentine VAT paid to the Group in May 2021 of US

$0.24 million and net foreign exchange gains of US $2.9 million.

Finance expense of US $ 3.2 million for H1 2021 is on a par with

the prior comparable period (H1 2020: US $ 3.2 million).

Total comprehensive loss for the Group for the 6 month period

ending 30 June 2021 was US $1.5 million (H1 2020: US $ 5.7

million)

The Group's balance sheet and overall financial positioning has

materially strengthened during the period due to the successful

debt re negotiation of its bonds and debt facility and the

reduction in short term loan liabilities from US $2.3 million at 30

December 2020 to $0.14 million at 30 June 2021.

In January 2021, the Company's EUR 5.0m 8% secured convertible

debt facility maturity date was extended to April 2025, with no

furthercash interest payments due until maturity date. In addition,

in April 2021, the Company's Luxembourg listed EUR 20.0m 8% secured

bonds were successfully structured, extending the maturity of the

notes to May 2025, and removing all cash interest payments prior to

maturity date.

The Company's cash balance as at 30 June 2021 was US $ 0.9

million, a substantial increase from the balance as at 31 December

2020.

A 30% reduction of Trade and other payables from 30 December

2020 to 30 June 2021 is primarily due to the renegotiation of the

Bond and debt facilities, but also reduction in joint venture

payables.

Post Period End Highlights

The positive market changes seen in H1 2021 continue post

period, and coupled with the restructuring completed in H1 2021,

enable the Company to operate from a significantly more stable

platform.

At the Santa Cruz Sur asset level, successful commissioning of

the liquids pipeline enabled the Campo Molino oil field to be

brought back online, contributing to an almost 50% increase in

total liquids production in August 2021.

The maturation of the Company's investment in Santa Cruz Sur,

and ongoing careful cost management have increased cashflows,

enabling development in our producing asset, and release of capital

which can be invested into the business to support business growth,

maximising value for shareholders.

James Parsons Martin Hull

Chairman Chie f Executive Officer

Consolidated Statement of Comprehensive Income

Period ended 30 June 2021

Unaudited Unaudited Year to

1 January 1 January 2020 31 December

2021 2020

30 June 2021 30 June 2020 Audited

Notes US $ US $ US $

---------------------------------------- ------- -------------- ---------------- -------------

Continuing operations

Revenue 3 5,891,413 5,656,740 11,126,520

Cost of sales 4 (5,497,993) (7,287,234) (13,437,010)

---------------------------------------- ------- -------------- ---------------- -------------

Gross profit 393,420 (1,630,494) (2,310,490)

Exploration expenses (45,807) (68,554) (215,512)

Administrative expenses (1,492,010) (1,480,136) (3,240,934)

Impairment of intangible assets - - -

Impairment of property, plant and - - -

equipment

Operating loss (1,537,817) (3,179,184) (5,766,936)

Financial income 5 3,140,024 1,847 7,142

Financial expense 6 (3,287,229) (3,212,440) (10,174,047)

Derivative financial income 7 17,575 642,678 666,306

---------------------------------------- ------- -------------- ---------------- -------------

Loss before tax (1,274,027) (5,747,099) (15,267,535)

Taxation 8 -

---------------------------------------- ------- -------------- ---------------- -------------

Loss from continuing operations (1,274,027) (5,747,099) (15,267,535)

Discontinued operations

Profit/(loss) after taxation for

the year from discontinued operations (10,724,108)

---------------------------------------- ------- -------------- ---------------- -------------

Loss for the period (1,274,027) (5,747,099) (25,991,643)

Other comprehensive income:

To be reclassified to profit or

loss in subsequent periods (net

of tax)

Exchange difference on translating

foreign operations (177,930) - (1,041,995)

---------------------------------------- ------- -------------- ---------------- -------------

Total comprehensive loss for the

period (1,451,957) (5,747,099) (27,033,578)

---------------------------------------- ------- -------------- ---------------- -------------

Loss attributable to: Owners of

the parent (1,451,957) (5,747,099) (27,033,598)

---------------------------------------- ------- -------------- ---------------- -------------

Total comprehensive loss attributable

to: Owners of the parent (1,451,957) (5,747,099 (27,033,598)

---------------------------------------- ------- -------------- ---------------- -------------

Loss per share (cents) 9

Basic (0.10) (0.81) (3.38)

---------------------------------------- ------- -------------- ---------------- -------------

Diluted (0.10) (0.81) (3.38)

---------------------------------------- ------- -------------- ---------------- -------------

Loss per share (cents) for continuing

operations

Basic (0.10) (0.81) (1.99)

---------------------------------------- ------- -------------- ---------------- -------------

Diluted (0.10) (0.81) (1.99)

---------------------------------------- ------- -------------- ---------------- -------------

The notes included below form an integral part of these

financial statements.

Consolidated Statement of Financial Position

Period ended 30 June 2021

Unaudited Unaudited Year to

1 January 1 January 31 December

2021 2020 2020

30 June 2021 30 June 2020 Audited

Notes US $ US $ US $

------------------------------------- ------- -------------- -------------- -------------------------

Non-current assets

Property, plant and equipment 10 2,516,805 986,283 2,552,693

Other intangibles 11 7,773,210 20,725,894 8,511,622

10,290,015 21,712,177 11,064,315

Current Assets

Inventories 438,014 610,522 541,230

Other receivables 5,846,670 7,688,813 7,229,263

Cash and cash equivalents 12 945,488 1,164,408 682,159

------------------------------------- ------- -------------- -------------- -------------------------

7,230,172 9,463,743 8,452,652

Current Liabilities

Trade and other payables (10,075,368) (8,253,260) (13,249,146)

Derivatives and other liabilities (44,885) (86,105) (62,477)

(10,120,253) (8,339,365) (13,311,623)

Net current assets (2,890,081) 1,124,378 (4,858,970)

------------------------------------- ------- -------------- -------------- -------------------------

Total assets less current

liabilities 7,399,934 22,836,555 6,205,345

Non-current liabilities

Loans due in over one year 15 (28,162,903) (24,229,005) (27,276,015)

Provisions (2,959,976) (2,969,400) (2,979,956)

(31,122,879) (27,198,405) (30,255,971)

Total Liabilities (41,243,132) (35,537,770) (43,567,597)

------------------------------------- ------- -------------- -------------- -------------------------

Net Assets (23,722,945) (4,361,850) (24,050,627)

------------------------------------- ------- -------------- -------------- -------------------------

Equity attributable to equity

holders of the parent

Share capital 13 7,135,082 5,190,877 6,288,019

Share premium 14 64,748,942 64,817,662 64,961,905

Warrant reserve 12,188,032 11,153,396 11,373,966

Share option reserve 1,570,827 1,358,132 1,412,285

Foreign currency translation

reserve (3,141,836) (2,277,812) (3,319,797)

Retained earnings (106,223,992) (84,604,105) (104,772,035)

------------------------------------- ------- -------------- -------------- -------------------------

Total Equity (23,722,945) (4,361,850) (24,050,627)

------------------------------------- ------- -------------- -------------- -------------------------

The notes included below form an integral part of these

financial statements.

Consolidated Statement of Changes in Equity

Period ended 30 June 2021

Foreign

Share currency

Retained Share Share Warrant option translation

earnings capital premium reserve reserve reserve Total equity

US $ US $ US $ US $ US $ US $ US $

------------------- -------------- ----------- ----------- ----------- ---------- ------------- ---------------

1 January 2021 (104,772,035) 6,288,019 64,961,905 11,373,966 1,417,285 (3,319,767) (24,050,627)

Loss for the

period (1,274,027) - - - - - (1,274,027)

Exchange Reserve (177,930) - - - - 177,930 -

------------------- -------------- ----------- ----------- ----------- ---------- ------------- ---------------

Total

comprehensive

loss for the

period (1,451,957) - - - - 177,930 (1,274,027)

Warrants issued - (814,066) 814,066 - - -

Warrants exercised - 274,803 86,122 - - - 360,925

Share issue - 572,260 595,153 - - - 1,167,413

Transaction costs (80,171) - - - (80,171)

Share options - - - - - - -

lapsed

Share-based

payments - - - - 153,542 - 153,542

------------------- -------------- ----------- ----------- ----------- ---------- ------------- ---------------

30 June 2021 (106,223,992) 7,135,082 64,748,943 12,188,032 1,570,827 (3,141,837) 23,722,925

------------------- -------------- ----------- ----------- ----------- ---------- ------------- ---------------

1 January 2020 (78,857,006) 5,190,877 64,817,662 11,142,290 1,159,580 (2,277,812) 1,175,591

Loss for the

period (5,747,099) - - - - - (5,747,099)

Exchange Reserve - - - - - - -

Total

comprehensive

loss for the

period (84,604,105) 5,190,877 64,817,662 11,142,290 1,159,580 (2,277,812) (4,571,508)

------------------- -------------- ----------- ----------- ----------- ---------- ------------- ---------------

Warrants issued - - - 11,106 - - 11,106

Share options - - - - - - -

lapsed

Share-based

payments - - - - 198,552 - 198,552

------------------- -------------- ----------- ----------- ----------- ---------- ------------- ---------------

30 June 2020 (84,604,105) 5,190,877 64,817,662 11,153,396 1,358,132 (2,277,812) (4,361,850)

------------------- -------------- ----------- ----------- ----------- ---------- ------------- ---------------

1 January 2020 (78,857,006) 5,190,877 64,817,662 11,142,290 1,159,580 (2,277,812) 1,175,591

Loss for the year (15,267,535) - - - - - (15,267,535)

Discontinued

operations (3,441,230) - - - - - (10,724,108)

Exchange Reserve - - - - - (1,041,995) (1,041,955)

Total

comprehensive

loss for the year (25,991,643) - - - - (1,041,955) (13,472,062)

New shares issued - 1,0971,142 467,735 - - - 1,565,077

Warrants - - (231,676) 231,676 - - -

Share issue costs - - (92,016) - - - (92,016)

Share options

lapsed 396,935 - - - (76,614) - -

Share-based

payments - - - - 334,319 - 334,319

------------------- -------------- ----------- ----------- ----------- ---------- ------------- ---------------

31 December 2020 (104,772,035) 6,288,019 64,961,906 11,373,966 1,417,285 (3,319.767) (24,050,627)

------------------- -------------- ----------- ----------- ----------- ---------- ------------- ---------------

The notes included below form an integral part of these

financial statements.

Consolidated Statement of Cash Flows

Period ended 30 June 2021

Unaudited Unaudited

1 January 1 January Year to

2021 2020

30 June 2021 30 June 31 December

2020 2020

US $ US $ US $

----------------------------------------- ------------------------ --------------------------------- --------------

Cash flows from operating activities

Loss from continuing operations (1,274,027) (5,747,099) (15,267,535)

Loss from discontinued operations - - (10,724,108)

----------------------------------------- ------------------------ --------------------------------- --------------

(1,274,027) (5,747,099) (25,991,643)

Adjustments for:

Depreciation and depletion of

property, plant and equipment 35,887 102,442 182,211

Depreciation and depletion of

intangible assets 738,412 982,102 1,874,810

(Gain)/Loss on disposal of property,

plant and equipment - - 10,822

(Gain)/Loss on disposal on Right - (66,473) -

of use

Impairment of intangible assets

and goodwill

Impairment of intangible assets -

and goodwill - - 10,383,461

Share-based payments 153,542 209,658 334,319

Right to use liability - - (64,180)

Financial income (3,140,024) (1,845) (7,142)

Financial expense 3,287,229 728,821 10,174,047

Exchange difference (1,656,272) - (2,265,180)

Derivative financial gain (17,575) (642,678) (666,306)

----------------------------------------- ------------------------ --------------------------------- --------------

(598,801) 1,312,027 19,956,865

(Increase) in inventory 103,215 (191,382) (120,386)

Decrease/(Increase) in other receivables 1,700,723 988,467 311,275

(Decrease)/increase in trade and

other payables (1,020,415) 3,354,669 5,844,002

----------------------------------------- ------------------------ --------------------------------- --------------

Cash used in operations 783,523 5,463,781 (6,034,891)

Net cash used in operating activities (1,089,305) (283,318) 112

Cash flows from investing activities

Purchase of intangible assets - (248,092) (470,637)

Purchase of property, plant and

equipment - - (1,644,516)

----------------------------------------- ------------------------ --------------------------------- --------------

Net cash used in investing activities - (248,092) (2,115,153)

Cash flows from financing activities

Interest received 166,820 1,845 7,142

Interest paid (208,900) (1,746) -

Bank Fees and other finance cost (63,136) - (185,520)

Repayment of right of use liability - (2,293) -

Issue of share capital 1,167,413 - 1,565,077

Share issue costs (80,171) - (92,016)

Proceeds from Warrant exercise 360,925 - -

----------------------------------------- ------------------------ --------------------------------- --------------

Net cash from financing activities 1,342,951 (2,194) 1,290,682

----------------------------------------- ------------------------ --------------------------------- --------------

Net (decrease)/increase in cash

and cash equivalents 253,646 (533,604) (824,360)

Cash and cash equivalents at the

beginning of the period 682,159 1,698,012 1,698,012

----------------------------------------- ------------------------ --------------------------------- --------------

Foreign Excahnge gains(losses)

on cash and cash equivalents 9,683 - (191,439)

----------------------------------------- ------------------------ --------------------------------- --------------

Cash and cash equivalents at the

end of the period 945,488 1,164,408 682,159

----------------------------------------- ------------------------ --------------------------------- --------------

The notes included below form an integral part of these

financial statements.

Notes to the Financial Statements

Period ended 30 June 2021

1. Accounting Policies

General Information

These financial statements are for Echo Energy plc ("the

Company") and subsidiary undertakings ("the Group"). The Company is

registered, and domiciled, in England and Wales and incorporated

under the Companies Act 2006.

Basis of Preparation

The condensed and consolidated interim financial statements for

the period from 1 January 2021 to 30 June 2021 have been prepared

in accordance with International Accounting Standards ("IAS") 34

Interim Financial Reporting, and on the going concern basis. They

are in accordance with the accounting policies set out in the

statutory accounts for the year ended 31 December 2020 and are

expected to be applied for the year ended 31 December 2021.

The comparatives shown are for the period 1 January 2020 to 30

June 2021, and 31 December 2020 and do not constitute statutory

accounts, as defined in section 435 of the Companies Act 2006, but

are based on the statutory financial statements for the year ended

31 December 2020.

A copy of the Company's statutory accounts for the year ended 31

December 2020 has been delivered to the Registrar of Companies; the

accounts are available to download from the Company website at

www.echoenergyplc.com.

Going Concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Chairman and Chief Executive Officer's Statement

above. The financial position of the Group, its cash flows and

liquidity position are set out in these Condensed Interim Financial

Statements.

The directors have performed a robust assessment, including

consideration of the principal risks faced by the Group and taking

into account the ongoing impact of the global Covid-19 pandemic on

the macroeconomic situation and any potential impact to

operations.

The financial information has been prepared assuming the Group

will continue as a going concern. Under the going concern

assumption, an entity is ordinarily viewed as continuing in

business for the foreseeable future with neither the intention nor

the necessity of liquidation, ceasing trading or seeking protection

from creditors pursuant to laws or regulations. Whilst rigorously

pursuing cost control and value maximising strategies, the Group

recognises that in order to pursue organic and inorganic growth

opportunities and fund on-going operations it will require

additional funding. This funding may be sourced through debt

finance, joint venture equity or share issues.

The directors have formed a judgement based on Echo's proven

success in raising capital and a review of the strategic options

available to the Group, that the going concern basis should be

adopted in preparing the Condensed Interim Consolidated Financial

Statements.

Estimates

The preparation of the interim financial information requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing this condensed interim financial information, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those applied to consolidated financial statements

for the year ended 31 December 2020. The key sources of uncertainty

in estimates that have a significant risk of causing material

adjustment to the carrying amounts of assets and liabilities,

within the next financial year, are the Group's going concern

assessment.

Revenue Recognition

Revenue comprises the invoice value of goods and services

supplied by the Group, net of value added taxes and trade

discounts. Revenue is recognised in the case of oil and gas sales

when goods are delivered and title has passed to the customer. This

generally occurs when the product is physically transferred into a

pipeline or vessel. Echo recognised revenue in accordance with IFRS

15. We have a contractual arrangement with our joint venture

partner who markets gas and crude oil on our behalf. Gas is

transferred via a metred pipeline into the regional gas

transportation system, which is part of the national transportation

system, control of the gas is transferred at the point at which the

gas enters this network, this is the point at which gas revenue is

recognised. Gas prices vary from month to month based on seasonal

demand from customer segments and production in the market as a

whole. Our partner agrees pricing with their portfolio of gas

clients based on agreed pricing mechanisms in multiple contracts.

Some pricing is regulated by government such as domestic supply.

Echo receive a monthly average of gas prices attained. Oil

shipments are priced in advance of a cargo and revenue is

recognised at the point at which cargoes are loaded onto a shipping

vessel at termina

2. Business Segments

The Group has adopted IFRS 8 Operating Segments. Per IFRS 8,

operating segments are regularly reviewed and used by the board of

directors being the chief operating decision maker for strategic

decision-making and resources allocation, in order to allocate

resources to the segment and assess its performance.

The Group's reportable operating segments are as follows:

a. Parent Company

b. Eastern Austral Basin

c. Tapi Aike

d. Bolivia

Performance is based on assessing progress made on projects and

the management of resources used. Segment assets and liabilities

are presented inclusive of inter-segment balances. Reportable

segments are based around licence activity, although the reportable

segments are reflected in legal entities, certain corporate costs

collate data across legal entities and the segmental analysis

reflects this.

Information regarding each of the operations of each reportable

segment within continuing operations is included in the following

table.

All revenue, which represents turnover, arises within Argentina

and relates to external parties:

Parent Company Santa Cruz Tapi Aike Bolivia Total

Sur

US $ US $ US $ US $ US $

Period to 30 June 2021

Revenues - 5,891,413 - - 5,891,413

Cost of sales - (5,497,993) - - (5,497,993)

Exploration expense (45,807) - - - (45,807)

Administration expense (1,332,349) (113,839) (48,928) (115,043) (1,610,158)

Impairment of intangible

assets - - - - -

Impairment of property,

plant and equipment - - - - -

Financial income 2,898,300 77,101 164,616 3,140,024

Financial expense (1,823,398) (898,236) (467,375) (61) (3,186,081)

Derivative Financial

Expense 17,592 - - - 17,575

Income tax - - - - -

Loss before tax (285,662) (541,554) (351,687) (115,104) (1,262,545)

Non-current assets 28,792,797 4,740,757 3,362,308 (453,174) 36,442,688

Assets 28,940,599 9,214,984 5,947,869 (413,628) 43,689,824

Liabilities (28,816,764) (7,943,328) (4,421,895) (81,125) (41,263,112)

Parent Santa

Company Cruz Sur Tapi Bolivia Consolidation Total

US $ US $ Aike US $ US $ US $

US $

Period to 30 June 2020

Revenues - 5,656,740 - - - 5,656,740

Cost of sales - (7,656,740) - - - (7,287,740)

Exploration expense (68,554) - - - - (68,554)

Administration expense (1,300,419) (120,701) 56,538 (115,554) - (1,480,136)

Impairment of intangible - - - - - -

assets

Impairment of property, - - - - - -

plant and equipment

Financial income 1,847 - - - - 1,847

Financial expense (2,340,434) (872,069) (1,015) 1,078 - (3,212.440)

Depreciation 642,678 - - - - 642.678

Income tax - - - - - -

Loss before tax (3,064,882) (2,632,263) 55,523 (114,476) - (5,747,099)

Non-current assets 35,265,014 6,822,530 5,935,643 (271,171) (26,032,839) 21,712,177

Assets 45,181,992 (12,916,982) (656,675) (240,370) (26,026,010) 31,175,919

Liabilities (23,073,545) (12,406,577) (2,314) (49,335) - (35,537,770)

Consolidation adjustments in respect of assets relate to the

impairment of intercompany assets .

Depreciation is included in administration expenses

The geographical split of non-current assets arises as

follows:

United

Kingdom South America Total

US $ US $ US $

------------------------------- --------- ---------------- -----------

30 June 2021

Property, plant and equipment 2,457 2,514,348 2,516,805

Other intangible assets 326,869 7,446,341 7,773,210

------------------------------- --------- ---------------- -----------

30 June 2020

Property, plant and equipment 19,025 967,258 986,283

Other intangible assets - 20,725,894 20,725,894

------------------------------- --------- ---------------- -----------

3. R evenue

Unaudited Unaudited Year to

1 January 1 January 31 December

2021 - 2020 - 2020

30 June 2021 30 June 2020 Audited -Continued

US $ US $ operations

US $

Oil revenue 2,024,421 2,090,922 2,784,248

Gas revenue 3,833,857 3,565,818 8,279,416

Other Income 33,135 - 62,856

Total Revenue 5,891,413 5,656,740 11,126,520

--------------- -------------- -------------- --------------------

4. Cost of Sales

Unaudited Unaudited Year to

1 January 1 January 31 December

2021 - 2020 - 2020

30 June 2021 30 June 2020

US $ US $ US $

Production costs 3,794,486 5,723,033 10,021,578

Selling and distribution

costs 863,065 764,918 1,567,963

Movement in stock of crude

oil 72,239 (191,382) (89,410)

Depletion 768,203 990,665 1,936,879

Total Costs 5,497,993 7,287,234 13,437,010

---------------------------- -------------- -------------- -------------

5. Finance Income

Period to Period to Year to

30 June 2021 30 June 2020 31 December

US $ US$ 2020

US $

---------------------------- -------------- -------------- -------------------------------

Interest income 241,716 1,847 7,142

Net foreign exchange gains 2,898,308 - -

Total 3,140,024 1,847 7,142

---------------------------- -------------- -------------- -------------------------------

The Interest income principally relates to interest gained on

Argentine VAT balances owed and paid to the Group in May 2021.

6. Financial Expense

Period to Period to Year to

30 June 2021 30 June 2020 31 December

US $ US$ 2020

US $

------------------------------------ -------------- -------------- ----------------------------------

Interest payable 1,299,079 1,191,065 1,991,535

Unwinding of discount on

long term loan 404,081 1,131,249 2,936,831

Amortisation of loan fees 119,526 150,199 614,913

Warrant Valuation expense - 11,106 -

Accretion of right of use

liabilities - 2,293 2,293

Unwinding of abandonment

provision 19,980 - 39,956

Finance cost of holding bonds - - 11,971

Foreign Exchange Losses 1,242,035 660,018 4,409,732

Bank fees and overseas transaction

taxes 202,528 66,510 166,816

------------------------------------ -------------- -------------- ----------------------------------

Total 3,287,229 3,212,440 10,174,047

------------------------------------ -------------- -------------- ----------------------------------

7. Derivative Financial Gain/Loss

Period Period Year to

to to 31 December

30 June 30 June 2021

2021 2020 US $

US $ US $

----------------- --------- --------- -------------

Fair value gain 17,575 642,678 666, 306

----------------- --------- --------- -------------

Total 17,575 642,678 666, 306

----------------- --------- --------- -------------

Represents fair value gain on valuation of derivatives

instruments at period end.

8. Taxation

The Group has tax losses available to be carried forward in

certain subsidiaries and the parent company. Due to uncertainty

around timing of the Group's projects, management have not

considered it appropriate to anticipate an asset value for them. No

tax charge has arisen during the six month period to 30 June 2021,

or in the six months period to June 2020, or the year to 31

December 2020.

9. Loss Per Share

The calculation of basic and diluted loss per share at 30 June

2021 was based on the loss attributable to ordinary shareholders.

The weighted average number of ordinary shares outstanding during

the period ending 30 June 2021 and the effect of the potentially

dilutive ordinary shares to be issued are shown below.

Period to Period to Year to

30 June 2021 30 June 31 December

2020 2020

----------------------------------- -------------- ------------ -------------

Net loss for the year (US $) (1,294,027) (5,747,099) (25,991,664)

----------------------------------- -------------- ------------ -------------

Basic weighted average ordinary

shares in issue during the

year 1,236,231,219 711,717,587 768,598,277

----------------------------------- -------------- ------------ -------------

Diluted weighted average ordinary

shares in issue during the

year 1,236,231,219 711,717,587 768,598,277

----------------------------------- -------------- ------------ -------------

Loss per share (cents)

Basic (0.10) (0.81) (3.38)

----------------------------------- -------------- ------------ -------------

Diluted (0.10) (0.81) (3.38)

----------------------------------- -------------- ------------ -------------

In accordance with IAS 33 and as the entity is loss making,

including potentially dilutive share options in the calculation

would be anti-dilutive. Deferred shares have been excluded from the

calculation of loss per share due to their nature.

10. Property, Plant and Equipment

PPE - O&G CDL Licence Property

Properties Areas Discontinued Fixtures Right-of-Use

US $ US $ & Fittings Assets Total

US $ US $ US $

-------------- --------------------- --------------------------- ------------- -------------- --------------------

30 JUNE 2021

Cost

1 January

2021 2,621,921 - 97,254 - 2,719,175

Additions - - - -

Disposals - - - -

-------------- --------------------- --------------------------- ------------- -------------- --------------------

30 June 2021 2,621,921 - 97,254 - 2,719,175

-------------- --------------------- --------------------------- ------------- -------------- --------------------

Depreciation

1 January

2020 79,941 - 86,542 - 166,483

Charge for

the

period 29,790 - 6,097 - 35,887

Disposals - - - - -

-------------- --------------------- --------------------------- ------------- -------------- --------------------

30 June 2021 109,731 - 92,639 - 202,370

-------------- --------------------- --------------------------- ------------- -------------- --------------------

Carrying

amount

30 June 2021 2,512,190 4,615 - 2,516,805

-------------- --------------------- --------------------------- ------------- -------------- --------------------

30 JUNE 2020

Cost

1 January

2020 979,164 - 131,122 309,804 1,420,090

Additions - - 35 - 35

Disposals - - (33,923) (309,804) (343,727)

-------------- --------------------- --------------------------- ------------- -------------- --------------------

30 June 2020 979,164 - 97,234 - 1,076,398

-------------- --------------------- --------------------------- ------------- -------------- --------------------

Depreciation

1 January

2019 3,338 - 91,366 224,176 318,880

Charge for

the

period 8,568 - 19,828 74,046 102,442

Disposals - - (32,985) (298,222) (331,207)

-------------- --------------------- --------------------------- ------------- -------------- --------------------

30 June 2020 11,906 - 78,209 - 90,115

-------------- --------------------- --------------------------- ------------- -------------- --------------------

Carrying

amount

30 June 2020 967,258 - 19,025 - 986,283

-------------- --------------------- --------------------------- ------------- -------------- --------------------

31 DECEMBER

2020

Cost

1 January

2020 979,164 - 131,122 309,804 1,420,090

Additions 1,644,460 - 56 - 1,644,516

Disposals (1,703) - (33,923) (309,804) (345,430)

-------------- --------------------- --------------------------- ------------- -------------- --------------------

31 December

2020 2,621,921 - 97,255 - 2,719,176

-------------- --------------------- --------------------------- ------------- -------------- --------------------

Depreciation

1 January

2020 3,338 - 91,366 224,176 318,880

Exchange - - - - -

differences

Charge for

the

year 76,603 - 19,980 85,628 182,211

Impairment - - - - -

charge

Disposals - - (24,804) (309,804) (334,608)

-------------- --------------------- --------------------------- ------------- -------------- --------------------

31 December

2020 79,941 - 86,542 - 166,483

-------------- --------------------- --------------------------- ------------- -------------- ------------------

Carrying

amount

31 December

2020 2,541,980 10,713 2,552,693

-------------- --------------------- --------------------------- ------------- -------------- ------------------

31 December

2019 975,826 - 39,756 85,628 1,101,210

-------------- --------------------- --------------------------- ------------- -------------- ------------------

11. Other Intangible Assets

Exploration and Evaluation

Argentina Ksar Hadada

Exploration CDL Licence Exploration

& Evaluation Areas Discontinued Acreage Total

US $ US $ US $ US $

------------------------------ -------------- --------------------- -------------------------------- -------------

30 June 2021

Cost

1 January 2021 10,756,306 - - 10,756,306

Disposals - - -

Decommissioning assets - - -

Additions - - -

30 June 2021 10.756,306 - - 10,756,306

------------------------------ -------------- --------------------- -------------------------------- -------------

Impairment

1 January 2020 2,244,684 - - 2,244,684

Depletion 415,912 - - 415,912

Depreciation decommissioning

assets 322,500 - - 322,500

Impairment charge for - - - -

the period

30 June 2021 2,983,096 - - 2,983,096

------------------------------ -------------- --------------------- -------------------------------- -------------

Carrying amount

30 June 2021 7,773,210 - - 7,773,210

------------------------------ -------------- --------------------- -------------------------------- -------------

31 December 2020 8,511,622 8,511,622

------------------------------ -------------- --------------------- -------------------------------- -------------

30 JUNE 2020

Cost

1 January 2020 20,943,460 - - 20,943,460

Discontinued operations 29,401 - - 29,401

Additions 1,105,009 - - 1,105,009

Transfer to PP&E

------------------------------ -------------- --------------------- -------------------------------- -------------

30 June 2020 22,077,870 - - 22,077,870

------------------------------ -------------- --------------------- -------------------------------- -------------

Impairment

1 January 2020 369,874 - - 369,874

Discontinued operations 982,102 982,102

------------------------------ -------------- --------------------- -------------------------------- -------------

Impairment charge for

the period

------------------------------ -------------- --------------------- -------------------------------- -------------

30 June 2020 1,351,976 - - 1,351,976

------------------------------ -------------- --------------------- -------------------------------- -------------

Carrying amount

30 June 2020 20,725,894 - - 20,725,894

------------------------------ -------------- --------------------- -------------------------------- -------------

31 DECEMBER 2020 20,573,587 - - 20,573,587

Cost

1 January 2020 10,802,524 10,140,936 - 20,943,460

Additions 228,112 242,525 - 470,6537

Disposals - (10,383,461) - (10,383,341)

Decommissioning assets - - - -

Transfers (274,330) - - (274,330)

------------------------------ -------------- --------------------- -------------------------------- -------------

31 December 2020 10,756,306 - - 10,756,306

------------------------------ -------------- --------------------- -------------------------------- -------------

Impairment

1 January 2020 36,874 - - 369,874

Disposals - (10,383,461) - 10,383,461)

Depletion 1,874,810 - - 1,874,810

Impairment charge for

the year - 10,383,461 - 10,383,461

31 December 2019 2,244,686 - - 2,244,686

------------------------------ -------------- --------------------- -------------------------------- -------------

Carrying amount

31 December 2020 8,511,622 - - 8,511,622

------------------------------ -------------- --------------------- -------------------------------- -------------

31 December 2019 20,575,586 - - 20,573,586

------------------------------ -------------- --------------------- -------------------------------- -------------

On 22 December 2020 the Company announced that it had allowed

the lapse of the option to re enter the Tapi aike asset. This

resulted in Echo withdrawing its interest and liabilities under the

Tapi Aike concessions prior to the drilling of the next exploration

well in the Tapi Aike Western Cube.

12. Cash and Cash Equivalents

Six months Six months

to to 31 December

30 June 30 June 2020

2021 2020

US $ US $ US $

------------------------------------- ----------- ----------- --------------

Cash held by joint venture partners 190,974 194,973 24,749

Cash and cash equivalents 754,514 969,435 654,680

------------------------------------- ----------- ----------- --------------

Total 945,488 1,164,408 682,159

------------------------------------- ----------- ----------- --------------

Echo has advanced cash to its joint venture partner. The equity

share of the balance held is recognised

13. Share Capital

Six months Six months Year to

to to 31 December

30 June 30 June 2020

2021 2020

US $ US $ US $

----------------------------------------- ----------- ----------- -------------

Issued, Called Up and Fully Paid

1,298,813 0.32c (June 2020: 711,717,587

0.32c) ordinary shares

1 January 2021 6,288,019 5,190,877 5,190,877

Equity shares issued 847,063 - 745,878

----------------------------------------- ----------- ----------- -------------

30 June / 31 December 7,135,082 5,190,877 6,288,019

----------------------------------------- ----------- ----------- -------------

The holders of 0.32c (0.25p) ordinary shares are entitled to

receive dividends from time to time and are entitled to one vote

per share at meetings of the Company.

During the six month period to 30 June 2021, 258,762,165 share

were issued.

14. Share Premium Account

Six months Six months Year to

to to

30 June 2021 30 June 31 December

US $ 2020 2020

US $ US $

------------------------------------ ------------- ----------- ------------

1 January 64,961,905 64,817,662 68,817,662

Premium arising on issue of equity

shares 595,153 - 467,934

Premium arising on exercise of

warrants 86,122

Warrants lapsed or exercised (814,066) - (231,675)

Transaction costs (80,171) - (92,016)

------------- ----------- ------------

30 June 64,748,942 64,817,662 64,961,905

------------------------------------ ------------- ----------- ------------

15. Loans

30 June 30 June 31 December

2021 2020 2020

US $ US$ US $

---------------------- -------------- -------------------------- ------------------- -------------- -------------

Five-year secured

bonds (20,907,802) (18,429,737) (22,167,419)

Additional net

funding (5,940,825) - (5,766,544)

Other loans (1,452,341) (5,799,268) (1,640,693)

---------------------- -------------- -------------------------- ------------------- -------------- -------------

Total (28,300,968) (24,229,005) (29,574,656)

---------------------- -------------- -------------------------- ------------------- -------------- -------------

Amortised Repayment

Balance as finance charges of principle Exchange

at less cash adjustments 30 June

31 December interest US$ US $ 2021

2020 paid US$

US $ US $

---------------------- -------------- -------------------------- ------------------- -------------- -------------

EUR 20 million

five-year secured

bonds 22,836,146 1,246,109 (2,583,675) 21,498,580

EUR5 million Lombard

Odier debt 5,987,801 311,220 (178,515) 6,120,506

Other loans 1,640,692 145,831 (208,900) (125,282) 1,452,341

Loan fees (668,726) 77,948 - (590,778)

Incremental loan

fees (221,257) 41,576 - (179,681)

---------------------- -------------- -------------------------- ------------------- -------------- -------------

Total 29,574,656 1,822,684 (208,900) (2,887,472) 28,300,968

---------------------- -------------- -------------------------- ------------------- -------------- -------------

US $ 138,065 of the total loan balance is shown in current

liabilities and US $28,162,903 is shown non-current

liabilities.

Bond restructure

On 22 February 2021, Echo announced further to the Company's

announcement of 1 December 2020, its proposals in respect of a

restructuring of the Company's Bonds, it proposed to:

-- Extend the maturity of the Bonds by three years to 15 May

2025 (the "Maturity Date"); and

-- Remove all cash interest payments on the Notes prior to the

Maturity Date.

On approval, all interest on the Bonds accruing from 31 December

2019 shall be paid in cash on the Maturity Date save that

Noteholders will be provided with the ability, from 30 September

2021, to elect to receive Bond interest payments in respect of the

immediately preceding quarter in new ordinary Shares in the Company

("Elections"), subject inter alia to the Company having the

required share issuance authorities in place from time to time to

satisfy elections and to Noteholders holding at least 50 per cent

of the Bonds having made Elections in respect of the relevant

quarter. Any new ordinary shares issued as a result of elections

would be issued at an effective issue price equal to the volume

weighted average price of an Echo ordinary share for the 10

Business Days before the relevant interest conversion date.

As part of the Proposals, the Company agreed that it will not,

without the prior consent of Noteholders, drill an exploration well

with a budgeted cost to the Company of in excess of EUR 5.0 million

for so long as the Bonds are outstanding and that it will not, in

the last 18 months prior to the Maturity Date, make an acquisition

of an interest in an oil and gas property, lease or licence if the

cash consideration for such acquisition exceeds EUR 10.0

million.

A payment of EUR 100,000, payable to Bondholders, was satisfied

by the issue of new ordinary shares in the Company at an issue

price equal to the average mid-market closing price per Echo

ordinary share for the five days ending, and including, 18 February

2021.

Subsequently on 30 March 2021, a requisite majority of

Bondholders approved the Debt restructuring proposals. Echo issued

a total of 11,473,929 new ordinary shares in the Company

(representing c.0.9% of the Company's current issued ordinary share

capital) to Bondholders.

16. Subsequent Events

Operational Update

On 26 August 2021, following installation of the pipeline

required to bring back online the liquids production which was shut

in April 2020, the infrastructure was successfully commissioned for

operation and shut-in wells are being brought online. This follows

an upgrade of the electrical infrastructure, which was designed to

support the first tranche of production from the Campo Molino and

Chorillos oil fields to provide sufficient power to support

sustained production from the associated ten wells.

To date, the Campo Molino oil field has been brought back online

with four of the shut-in wells now back in operation and producing

from the Springhill reservoir. This first tranche of restored

production will increase the number of active producing oil wells

at Santa Cruz Sur to 18.

As of 23 August 2021, the recently reactivated wells have

contributed to an almost 50% increase in total liquids production

at Santa Cruz Sur compared to the period immediately prior to this

(281 bopd gross, 197 bopd net to Echo - during the period 1 -17

August 2021). This represents an increase of 137 bopd gross, 95

bopd net to Echo and work continues to bring the remainder of the

first tranche of shut-in production back online. The production

levels from the initial reactivated wells indicate that the shut-in

period has not had a detrimental impact on reservoir behaviour in

the Campo Molino oil field. Prior to shut-in, the combined gross

production from the ten oil wells was approximately 138 bopd gross,

96 bopd net to Echo, approximately the same level now being

achieved from the initial four wells, with the associated upgraded

infrastructure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LLMRTMTITBLB

(END) Dow Jones Newswires

September 30, 2021 02:00 ET (06:00 GMT)

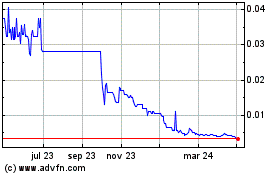

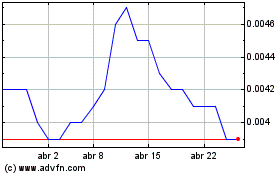

Echo Energy (LSE:ECHO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Echo Energy (LSE:ECHO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024