TIDMECK

RNS Number : 2973U

Eckoh PLC

02 December 2021

2nd December 2021

Eckoh plc

Unaudited interim results for the six months ended 30 September

2021

Results in line with Board expectations

Growing global Secure Payments opportunity and UK recovery

underpin expectations for FY22 and FY23

Eckoh plc (AIM: ECK) ("Eckoh" or the "Group"), the global

provider of secure payment products and customer contact solutions,

is pleased to announce unaudited results for the six months to 30

September 2021.

GBPm (excluding exited third-party

Support) FY22 H1 FY21 H1 Change

-------------------------------------

Revenue 14.4 13.9 +3%

-------- -------- -------

Adjusted operating profit(1) 2.5 2.2 +18%

-------- -------- -------

Recurring Revenue (2) 10.5 9.8 +7%

-------- -------- -------

Total contracted business(3) 11.2 12.7 (12%)

-------- -------- -------

US Secure Payments ARR ($m)(4) 8.9 6.9 +29%

-------- -------- -------

GBPm (IFRS unless otherwise stated)

------------------------------------- -------- -------- -------

Revenue 14.7 15.7 (6%)

-------- -------- -------

Gross profit 11.9 12.8 (8%)

-------- -------- -------

Adjusted operating profit(1) 2.8 3.4 (19%)

-------- -------- -------

Profit after taxation 1.9 2.0 (6%)

-------- -------- -------

Diluted earnings pence per share 0.73 77p (5%)

-------- -------- -------

Net cash 12.7 12.9 (0.2m)

-------- -------- -------

Strategic highlights

-- Results in line with Board expectations

-- Resilient UK performance with September exit run-rate comparable with pre-pandemic volumes

-- Continued good progress in US Secure Payments which now represents 89% of US revenues

-- Future significant cost savings achieved (more than GBP1m per

annum from FY23) from the move to a global Network Operations

Centre (NOC), the planned and completed exit from third-party

Support and natural staff attrition

-- Cloud deals continue to drive most Secure Payments sales

activity and we won our largest global Cloud contract to date post

period, with a minimum value of $1.5m

-- CallGuard Express, the new SaaS product designed to be resold

through channel partners and typically targeting smaller customers

launched post period, expanding the Group's target market

-- Eckoh's patent portfolio strengthened with two further

grants, meaning a portfolio of 17 international patents now backs

Eckoh's strong IP and product proposition

Financial highlights (excluding exited third-party Support)

-- Profit improved by 18% to GBP2.5m (H1 FY21: GBP2.2m)

-- Revenue increased year on year by 3% to GBP14.4m (H1 FY21: GBP13.9m)

-- Recurring revenue(2) increased by 7% to GBP10.5m, 73% of

total revenues (H1 FY21: GBP9.8m; 71%), reflecting a transition

towards higher growth US Secure Payments

-- US Secure Payments progress continues:

o New KPI of annualised recurring revenue(4) (ARR) introduced,

increasing by 29% to $8.9m in the period

o Revenue increased to $6.8m (H1 FY21: $6.5m); including two

successful renewals and our largest contract, where hardware and

implementation fees do not reoccur

o Recurring revenue grew 26%, with new contracted business of

$3.3m (H1 FY21: $5.9m)

-- UK revenue moved back to growth, increasing 6% to GBP9.0m (H1 FY21: GBP8.5m)

-- Total contracted business(3) was GBP11.2m (H1 FY21 GBP12.7m),

reflecting fewer significant UK renewals in the period and ongoing

challenging conditions for new business due to the pandemic

-- Robust balance sheet with net cash of GBP12.7m (H1 FY21: GBP12.9m)

Outlook

-- With a highly relevant product portfolio, resilient business

model, high recurring revenues and a robust balance sheet, Eckoh is

well placed to continue strong progress in the coming years

-- The evidenced recovery of the UK business in the first half,

allied to the continuing growth of the US Secure Payments activity

and increasing global opportunity, coupled with the GBP1m of

annualised cost savings, gives the Board significant confidence for

the current financial year with double digit revenue and profit

growth expected to return in FY23, subject to no new COVID

developments

1. Adjusted operating profit is the profit before tax adjusted

for finance income, finance expense expenses relating to share

option schemes, acquired intangibles amortisation and restructuring

costs.

2. Recurring revenue is defined as on-going revenue on a

transactional basis, rather than revenue derived from the set-up

and delivery of a new service or hardware.

3. Total contracted business includes new business from new

clients, new business from existing clients as well as renewals

with existing clients.

4. Annualised Recurring Revenue of all signed contracts, whether

live or still to be deployed.

Nik Philpot, Chief Executive Officer, said: "The last 18 months

have highlighted the resilience of our business and we have used

this period as an opportunity to make structural and strategic

changes to our operations that will give us an even stronger

platform for future, profitable growth. We have successfully

concluded the planned exit from our third-party Support activity,

meaningfully reduced direct costs by further optimising our

operations, and continued to progress in enhancing our Secure

Payments offering and extending the reach of our SaaS Cloud

proposition.

With clear signs that our UK business is now very much in

recovery, set alongside the exciting US Secure Payments market

opportunity that is now expanding via the Cloud into a truly global

proposition, the future looks bright for Eckoh to return to

stronger growth next year and beyond, notwithstanding any further

COVID developments."

For more information, please contact:

Eckoh plc

Nik Philpot, Chief Executive Officer Tel: +44 (0) 1442

458 300

Chrissie Herbert, Chief Financial Officer

www.eckoh.com

FTI Consulting LLP Tel: +44 (0) 203

727 1000

Ed Bridges, Jamie Ricketts, Tom Blundell

eckoh@fticonsulting.com

Singer Capital Markets (Nomad & Joint

Broker)

Shaun Dobson, Tom Salvesen, Alex Bond Tel: +44(0) 20 7496

3000

www.singercm.com

Canaccord Genuity Limited (Joint Broker)

Simon Bridges, Andrew Potts Tel: +44(0) 20 7523

8000

www.canaccordgenuity.com

About Eckoh plc

Eckoh is a global provider of Secure Payment products and

Customer Contact solutions, supporting an international client base

from its offices in the UK and US.

Our Secure Payments products help our clients take payments

securely from their customers through all engagement channels. The

products, which include the patented CallGuard and ChatGuard, can

be hosted in the Cloud or deployed on the client's site and remove

sensitive personal and payment data from contact centres and IT

environments. They offer merchants a simple and effective way to

reduce the risk of fraud, secure sensitive data and become

compliant with the Payment Card Industry Data Security Standards

("PCI DSS") and wider data security regulations. Eckoh has been a

PCI DSS Level One Accredited Service Provider since 2010, securing

over GBP5 billion in payments annually.

Eckoh's Customer Contact solutions enable enquiries and

transactions to be performed on whatever device the customer

chooses, allowing organisations to increase efficiency, lower

operational costs and provide a true Omnichannel experience. We

also assist organisations in transforming the way that they engage

with their customers by providing support and transition services

as they implement our innovative customer contact solutions.

Our large portfolio of clients come from a broad range of

vertical markets and includes government departments, telecoms

providers, retailers, utility providers and financial services

organisations.

For more information go to www.eckoh.com or email

MediaResponseUK@eckoh.com .

Introduction and Financial Highlights

Eckoh performed in line with Board expectations, in the first

half of the year, driven by the resilience of our business model, a

recovery underway in the underlying UK business and continued

momentum for the switch to Cloud in our US Secure Payments business

and into other territories, supporting confidence for the year as a

whole.

We have successfully managed our planned transition away from

the third-party Support business and this is now complete, with

revenue in the UK and US from third-party Support only GBP0.3

million in the first half (H1 FY21: GBP1.8 million). Our focus

remains, as previously stated, in becoming the leading provider of

Customer Engagement security solutions, which will provide greater

visibility of our revenues going forward and high recurring

revenues.

The underlying performance of the ongoing activities of the

Group (excluding the exited third-party Support) showed clear

progress, despite the lingering challenges from the impact of the

pandemic. Revenue on this basis improved 3% to GBP14.4 million (H1

FY21: GBP13.9 million) with adjusted profit increasing 18% to

GBP2.5 million from GBP2.2 million in the previous half year.

Recurring revenue increased by 7% to GBP10.5 million representing

73% of total revenues (H1 FY21: GBP9.8 million; 71%), reflecting a

transition towards the higher growth US Secure Payments. This was

also reflected in the new KPI we have introduced of Annualised

Recurring Revenue for Secure Payments in the US, which increased

29% to $8.9 million.

Gross profit excluding the exited third-party Support was

GBP11.6 million, an increase of 2.8% on the same period in the

prior year. (H1 FY21: GBP11.2 million). The US gross profit,

excluding the third-party Support business, was level at GBP4.0

million and 74% in both the first halves of FY21 and FY20. The UK

gross profit, excluding the third-party Support was GBP7.6 million,

increasing by 5.0% (H1 FY21: GBP7.2 million), gross profit margin

decreased marginally by 1% to 84%.

Total contracted business for the Group, excluding the exited

third-party Support, was GBP11.2 million in the period compared to

GBP12.7 million in the prior year. This decline was driven by

ongoing challenges in moving larger new business contracts forward,

particularly in the US, and fewer large renewals naturally arising

in the UK. New business in the first half was GBP4.9 million (H1

FY21: GBP7.9 million).

We have introduced a new metric in these results of Annualised

Recurring Revenue for US Secure Payments, and this was $8.9 million

at the end of the period, an increase of 29% on the previous year.

Payment contracts delivered through the Cloud are all priced on a

SaaS basis and so we would expect to be able to broaden the scope

of this KPI to include Global contracts in due course. UK

contracts, however, have evolved over the last decade and therefore

have a variety of pricing approaches and the fees often cover a

bundled solution, not just payments. We will therefore need to

evaluate how practical it is to include UK contracts in this

metric.

Cash remains strong with a net cash position of GBP12.7 million,

a decrease of GBP0.2 million on the previous year and level with 31

March 2021. The business is currently debt free, with the final

repayments of the loan, taken out in 2015 in part to purchase the

Group's UK head office being made in July 2021.

A Clear Growth Strategy

Our strategic objectives reflect our primary goal to become the

global leader in our areas of expertise, and in particular,

Customer Engagement data and payment security.

Our strategic objectives include:

-- Being the market leader for Customer Engagement data and payment security

-- Capitalise on the fast-growing global market for technology

solutions that help protect customer data

-- Maximise client value and retention through cross-selling to

generate higher levels of recurring income

-- Make Cloud our primary platform and use Cloud technologies to

develop and enhance our proprietary solutions

-- Evaluate acquisition opportunities that can support our

growth strategy in Customer Engagement security

A significant and largely untapped market opportunity

Our target market both in the UK and US for our Secure Payments

proposition has up to now been any sizeable enterprise or

organisation that either transacts or engages with its customers at

scale and at volume. This activity will usually be supported either

by an in-house or outsourced contact centre provider. The greater

the volume of payment transactions or customer engagement activity

that the organisation has, the more attractive they are to Eckoh,

and the larger the contact centre operation supporting the

organisation is likely to be.

The contact centre industry in both the UK and US is extremely

large, representing around 4% of the entire workforce in both

markets, and the industry continues to grow. We have historically

targeted organisations that utilise contact centres with more than

50 agent seats, and this represents 2,510 in the UK and 12,050 in

the US.

The recent development of CallGuard Express, which is

specifically intended to be a solution that services smaller

clients and has almost no additional operational overhead on Eckoh,

will serve to broaden our target market beyond the larger

enterprise. There are a further 27,300 Contact Centres in the US

and 3,525 in the UK that have between 10-50 seats, extending the

market very considerably.

The procurement of security and payment solutions to be deployed

across multiple territories is certainly increasing, and these

solutions would all be delivered through our Cloud platforms that

we continue to invest in and extend. This trend will broaden our

market further and inevitably lead to us having the UK, US and ROW

as geographic revenue streams.

With regulation tightening and the financial impact of data

breaches and fraud growing, organisations are increasingly looking

for ways to move beyond the requirement of merely being compliant

to secure themselves more comprehensively, leading to broadening

information security budgets and remits. Moreover, the pandemic has

led to a much greater reliance on more contact centre agents

working remotely, that is likely to only accentuate these security

requirements. We see the trend of remote working becoming a

permanent feature, and this can only benefit Eckoh as our payments

proposition enables companies to effectively further reduce or

remove the risk of data breaches arising from one of the most

challenging parts of their businesses.

Operational Review

US Division (38% of group revenues)

In the US, excluding third-party Support, revenue was $7.4

million an increase of 7.8% (H1 FY21 $6.9 million). Total

contracted business was $5.5 million a decrease of 13% (H1 FY21

$6.3 million) and new contracted business was $3.3 million (H1

FY21: $5.9 million). In the period, there were two secure payment

contracts that successfully renewed for the first time, at which

point the original hardware and implementation fees are fully

recognised.

In the US, the Group's focus remains on the US Secure Payments

opportunity, where it has the greatest differentiation and the

least competition. The performance of the Secure Payments business

is summarised below, together with the impact of the Support

business that we have strategically exited, as well as the Coral

business.

-- Secure Payments revenue of $6.8 million, an increase of 5.7%

(H1 FY21: 6.5 million), and this now represents 89% of US revenue

(H1 FY21: 81%). In the second half we expect revenue to be at a

slightly higher level to the first half as new business goes live

with higher proportions of recurring revenue as they are typically

Cloud deals. The revenue increase will be somewhat tempered by the

sizeable hardware and implementation fees that have been fully

recognised following the renewal in July of our largest

contract.

-- Coral had revenues of $0.6 million in the period, compared to

$0.4 million in H1 FY21. In the first half, Coral accounted for 8%

of US revenue (H1 FY20: 6%). As noted previously, the timing of

Coral orders remains hard to forecast and they will be lumpy in

nature.

-- Support revenue declined as expected to $0.3 million, a

decrease of 75% (H1 FY21: $1.1 million) and now represents only 3%

of the US revenue. The managed transition away from Support is now

complete and after this financial year, we will not separately

disclose it. A proportion of the restructuring costs incurred in

the US in the first half relate to this area of the business and

the last stage of the restructuring has taken place in October as

we merge the UK and US Customer Support desks to a global Network

Operations Centre (NOC).

Secure Payments, where we deliver a patented solution that

enables enterprises to take card payments securely within their

Contact Centre operations, continued to grow in the first half,

albeit more slowly than the second half last year. It is a trend we

have seen over the last few years, where the first months of the

year are quieter, with more new business being contracted in the

later months.

Since 2015, when we launched our Secure Payments product in the

US, the total of new contracted business has grown significantly,

as shown below.

Financial FY16 FY17 FY18 FY19 FY20 FY21 H1 FY22

Year

New Contracted

Business $1.6m $8.3m $9.3m $13.7m $10.7m $11.6m $3.2m

------ ------ ------ ------- ------- ------- --------

The Company remains focused on large enterprise contracts,

however, during the first half of the year we continued to see the

sales processes for the largest companies slow to commence or

resume. The impact of the pandemic diminished in the first half of

the year, but its effect on procurement processes and also internal

priority setting remains significant. Consequently, there continues

to be greater emphasis on contracts with medium-sized

organisations, which generally have a lower average contract value

than the $750k previously indicated.

We continue to see, as expected, the general acceleration

towards Cloud deployments and all the Secure Payment deals signed

in the first half have been of this type. However, we still believe

the largest enterprises are likely to take many years to achieve

that goal. Although we have started to see some of these large

organisations re-commence their sales processes, it still remains a

lengthy process and none of these have concluded in the first half.

Contracts secured in the period came from a number of sectors but

notably the increasingly important sector for us in Healthcare.

The launch of CallGuard Express since period end, which is

deliberately designed for smaller customers, will see smaller

contracts being targeted and won for the first time. This product

is extremely quick to deploy, with very limited operational

overhead associated with it, so the conversion of a sale into

revenue will be much faster than on our larger contacts, and margin

higher. We expect most of these deals to be won through partners

and more broadly our sales channels continue to strengthen, so the

share of pipeline and revenue from partners is expected to increase

over time. Partner sales opportunities now represent 30% of our

total pipeline.

The average length of new contracts for Secure Payments is three

years which is comparable to the UK, however, it is more typical in

the US for renewals to be annual, often on an auto-renew. In the

first half of the year there were two contracts that successfully

renewed, one of which was our largest contract signed to date ($7.4

million over 2 years). There was a significant level of one-off

fees in this contract, which have now been fully recognised at the

end of July. With the ongoing revenue stream from this contract

being much lower than previously (although entirely recurring),

this will have the short-term effect of dampening the growth

profile of the Secure Payments revenue stream. In the second half

of the year there is one contract due for renewal, which is on an

annual auto-renew as described above, this is now in its fifth year

showing a similar lifecycle value to our UK clients.

External factors, such as the impending change to version 4 of

the Payment Card Industry Data Security Standard (PCI DSS), the

implementation of new data laws such as US Consumer Privacy Acts

and significant fines levied on US organisations through the GDPR

legislation, are undoubtedly helping raise awareness of the risks

of not protecting sensitive data properly. This will assist us in

continuing to build our pipeline which is substantial and growing.

Our focus on these larger contracts means that in future periods

the timing of contract wins continues to be hard to predict given

the typically longer sales cycle.

Coral is a browser-based agent desktop that increases efficiency

by bringing all the contact centre agent's communication tools into

a single screen. It also enables organisations, particularly those

who have grown by acquisition, to standardise their contact centre

facilities, as Coral can be implemented in environments that

operate on entirely different underlying technology. As noted

previously, the timing of Coral orders remains hard to forecast and

they will be lumpy in nature.

In Support, as we stated last year, we are transitioning away

from this activity to focus on the high growth Secure Payments

opportunity. As the final phases of the transition away from the

third-party Support have been completed in the first half of the

financial year, we have also reviewed the operational structure for

the on-going Secure Payment clients and as a result have incurred

restructuring costs. The last stage of this has happened in October

after the half year end and we have combined our UK and US Network

Operations Centres into a single a global NOC.

Recurring revenues in the US were 63% in the period compared to

56% for the same period last year. Secure Payments recurring

revenue increased year on year by 26%. We would expect recurring

revenue to continue to increase over time as we successfully renew

the large enterprise clients where their initial hardware and

implementation fees have been fully recognised, continue to deploy

new clients live, but also as more clients' solutions are delivered

in the Cloud, where there is a much lower level of one-off revenue

initially. Recurring revenue for Secure Payments is lower than the

UK operation due to the hardware component. The US operation's

revenues are based on fixed contractual fees which has given us

continued resilience and visibility in the current situation.

UK Division (62% of group revenues)

The UK division has continued to deliver a resilient performance

in the first half, despite the challenging environment that

continued through the first quarter. We have seen a notably

stronger end to the second quarter and at the end of September our

existing like for like clients had a comparable run-rate to

pre-pandemic volumes. This provides us with confidence for the

second half performance, assuming there are no further lockdowns

instigated.

Excluding the discontinued third-party Support activity, revenue

in the period was GBP9.0 million (H1 FY21 GBP8.5 million) an

increase of 6%, showing clear signs of a recovery. Gross profit

increased 5% to GBP7.6 million (H1 FY21: GBP7.2 million) and total

contracted business was GBP7.3 million a 5% decrease on the prior

year (H1 FY21: GBP7.7 million). New contracted business was GBP2.5

million (H1 FY21: GBP3.2 million).

Gross margins in the UK decreased in the period by 1% to 84% (H1

FY21: 85%), and recurring revenue has decreased to 80% from 85% in

H1 FY21 due to the planned exit from third-party Support.

Whilst the UK business is recovering strongly, it did continue

to be impacted by the on-going pandemic, especially in the first

quarter. UK clients are contracted through a range of commercial

models that have evolved over time, unlike the newer US business

which operates entirely on fixed fee contracts. Where the

commercial model is transactional, which remains the most common

model, it is usual for a client to commit to a high percentage of

its expected volumes and in so doing achieve the most competitive

buying rate. However, this is not the case for a few of our most

longstanding clients, some of which are Eckoh's largest. During the

first half as the UK has gradually come out of lockdown, our

clients' transactional volumes have continued to improve, and the

September exit run-rate was at the same level as pre-pandemic.

Notable examples of this recovery in activity are Premier Inn, who

have been able to open their full hotel network, and Transport for

London who have not only extended the Congestion Charge zone but

seen overall volumes increase as more commuters have returned to

work.

Looking at the segmentation of UK revenue, 27% came from Secure

Payment services (H1 FY21: 28%), 34% from Customer Contact

Solutions (H1 FY21: 34%) and the remaining 39% from clients where

we provide a combination of both solutions (H1 FY21: 38%). The

small shift from Secure Payment services to clients with combined

solutions is principally due to the improving volumes from our

larger clients who take both the Secure Payments solution and the

Customer Engagement solution.

Our model of cross-selling to existing clients remains a key

part of the Eckoh strategy, not just to generate incremental

revenue but also to continue the trend of strong client retention

and to further increase the lifetime value of the Group's

customers. GBP2.2 million of the new business secured in the first

half (H1 FY21: GBP2.3 million) was contracted with existing

customers for delivery of new solutions or modifications. Our

strong track record with existing clients has also continued to be

demonstrated through the extremely high proportion of clients that

are successfully renewed. As an illustration, during the period, we

successfully renewed Premier Inn and Rail Delivery Group - who have

both been with Eckoh for well over a decade - on multi-year

renewals.

In the first half last year, we completed a six-year renewal of

our contract with Capita for the provision of services for the

Congestion Charge to Transport for London, at a minimum contract

value of GBP4 million. As part of this contract, from October 2021

the Congestion Charge service was updated for the Ultra Low

Emission Zone (ULEZ), which was extended significantly, and as

anticipated this has brought a large uplift in transactional

volumes. There was only one significant client that was not renewed

in the period, who migrated to a Cloud solution because of the

pandemic, this was the first such non-renewal for many years.

New business wins, consistent renewals of existing clients and

the improved transactional volume from our long-standing clients

give us high revenue visibility and our UK clients are underpinned

by contractual fees or minimum transaction levels. We expect the

improvement in transactional revenues seen in the second quarter to

continue into the second half, subject to no further lockdowns

being implemented.

Cloud Update

Post period, Eckoh has won a significant contract with a leading

global food and drink company to provide Secure Payments services

from its Cloud platforms to the new client's global contact centre

operations.

The three-year contract was won following a successful

competitive tender process and is worth a minimum of $1.5m, but

there is an expectation that the deal will exceed this total value.

The Client's North American operation will deploy the solution

first, before rolling it out to up to 28 other countries over the

contract term. This contract will help support the forecast growth

in the next financial year and beyond.

This contract is Eckoh's largest-ever win for a Cloud solution

delivered into multiple territories. We expect to see more global

procurement contracts like this for Cloud delivery, as major

enterprises seek to uphold rigorous security standards consistently

across all their regions. Consequently, in FY23 we are likely to

implement a Rest of the World (ROW) revenue stream to cover the

activity being generated from outside the UK and US.

As previously highlighted, Eckoh continues to invest in its

global Cloud platforms to capitalise on the growing market

opportunity identified. This contract win underlines Eckoh's

strategic vision and technical expertise in developing a

market-leading solution to leverage that additional capability. The

solution is expected to go live early in the next financial year

and, in line with other Cloud contracts, will deliver higher levels

of recurring revenue and margin.

Product Update

As organisations adapt their customer engagement strategy to

reflect the increase in remote working that is now set to become a

permanent feature, we have seen improved interest in and sales for

our CallGuard Remote product, which facilitates the taking of

payments securely in remote working environments. Furthermore, we

are seeing the number of companies who are looking to migrate to

Cloud-based solutions accelerating. A key initiative in

development, to assist new and existing clients in responding to

these changes, is delivering 'stack solutions' incorporating Amazon

Connect, and Eckoh services (Omnichannel, Secure Payments and

advanced voice self-service). This will take the flexibility of

Amazon Connect but combine it with the depth and sophistication of

Eckoh's services, to provide an overall solution that is more

suited to the demands of larger enterprises and can be charged in a

more cost-effective manner.

Alongside this we are currently migrating our market-leading

omnichannel solution, including our web chat product that has the

largest single deployment of web chat in the UK, to a new Cloud

platform in Amazon Web Services. This will enable us to deploy

these services more easily and quickly across the globe and enable

cross-selling of the services to our Secure Payment customers

outside of the UK.

In October, we soft launched our new product CallGuard Express,

which is designed to target those customers that wish to protect

their operations and are happy to take a 'vanilla' version of

CallGuard with no bespoke alteration of the solution. These

customers are typically smaller than those that would have been

targeted by Eckoh previously, so to ensure that delivery of the

solution is operationally efficient we have designed the product to

be able to be deployed with almost no overhead and in a matter of

hours. The SaaS nature of the product lends itself to being sold

through channel partners, and it is anticipated that this will

largely be the sales model in both the UK and US.

Patent Update

During the period Eckoh's patent portfolio was further

strengthened with two more grants, meaning a portfolio of 17

international patents now backs Eckoh's strong IP and product

proposition, with the earliest expiry date in 2031.

The new patents granted are for Reverse Contact Centre

Authentication, which is now patented in the UK, Canada, and the

USA . This new technology dramatically improves security and

convenience for end customers when receiving unsolicited calls from

organisations, helping to prevent them from becoming fraud victims.

When a customer receives such a call, they cannot know whether the

call is legitimate or a scam. With Eckoh's newly patented solution,

the caller can verify the representative's identity instantly by

clicking on a link, either on the organisation's publicly available

website or their app. If the customer is already logged in or

chooses to do so, the page will immediately confirm that an agent

is on a call with them based on their registered contact details.

This confirmation also validates the customer to the agent and

provides a secure channel to share information.

These patents will complement the existing IP in these same

regions for inbound Contact Centre Authentication . This solution

comprises sending the customer a message to their mobile device

when they phone a contact centre. To save time and increase

security, the caller can confirm their identity before connecting

to an agent through an existing mainstream authentication method,

such as PayPal, Facebook, or Amazon. Once connected to an available

agent, the caller's relevant and verified information can be

immediately seen by the agent, usually without further security

checks, and they can greet the customer appropriately. Billing and

mailing addresses retained by these methods can prepopulate contact

centre CRM systems, saving the agent time and increasing data

accuracy. Because the caller has already authenticated themselves

the contact centre agent (and the organisation they represent) can

be sure that they are talking with the actual person the caller

claims to be.

Patents play a critical role in Eckoh's data and payment

security portfolio. The secure proxy patents underpin Eckoh's

unique approach to customer engagement security used in CallGuard,

our market-leading secure payment solution. CallGuard automatically

replaces payment data or other sensitive data such as Social

Security Numbers with 'placeholders' or 'tokens' before entering an

organisation's contact centre or IT environment.

The solution neutralises sensitive data and deploys over

existing IT infrastructure and payment systems without disruption.

Eckoh's ChatGuard product uses this same method to secure payments

within any Chat software conversation; and can also be applied to

Chatbot or messaging apps such as WhatsApp for secure compliant

payments.

Current Trading and Outlook

Eckoh performed in line with Board expectations for the first

half and is on track to deliver revenue and profit for the

financial year 2022 that is comparable to the financial year 2021,

with double digit year-on-year revenue and profit growth expected

in the financial year 2023. These expectations are subject to no

further lockdowns in the UK and US, and ongoing uncertainty in the

macro-economic climate because of the COVID-19 pandemic.

With a highly relevant product portfolio, resilient business

model and high levels of recurring revenues, Eckoh is well placed

to continue strong progress in the coming years. The future

significant cost savings that have been achieved (more than GBP1m

per annum), alongside long-term structural growth drivers, Cloud

adoption and Eckoh's strengthening partner offering support FY23

growth expectations.

The anticipated recovery of the UK business in the first half,

allied to the continuing growth of the US Secure Payments activity

and increasing global opportunity, supported by a robust balance

sheet gives the Board significant confidence for the future

performance of the Group.

Financial Review

Last year the results of the UK and US operations included the

planned exited third-party Support business. During the first half

of this year the managed transition exit from the third-party

Support business in both the UK and US business was completed. In

the below financial review performance has been covered both at a

total basis and excluding the third-party Support business in both

this year and last year to assist the understanding of the

go-forward Customer Engagement Secure Payments business.

Revenue

Revenue for the period decreased by 6.1% to GBP14.7 million (H1

FY21: GBP15.7 million) and at constant exchange rates by 2.9%, the

underlying performance for the continuing business, excluding the

third-party Support business, in the first half was an increase in

revenue of 3.4% to GBP14.4 million (H1 FY21: GBP13.9 million).

Revenue in the UK, which represents 62% (H1 FY21: 60%) of total

group revenues, decreased by 2.6% to GBP9.2 million (H1 FY21:

GBP9.4 million). UK Revenue, excluding the third-party Support

business, increased by 6.2% to GBP9.0 million (H1 FY21: GBP8.5

million).

The US revenue represented 38% (H1 FY21: 40%) of total group

revenues and revenues decreased in the period to GBP5.6 million (H1

FY21: GBP6.3 million), revenues in local currency fell by 3.3% year

on year and in sterling by 11.2%. US Revenue, excluding the

third-party Support business, increased by 7.8% to $7.4 million (H1

FY21: $6.9 million).

Further explanations of movements in revenue between the US and

UK divisions have been addressed in the Operational Review

above.

H1 FY22 H1 FY22 H1 FY22 H1 FY21 H1 FY21 H1 FY21

(UK) (US) Total (UK) (US) Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------- -------- -------- -------- -------- -------- --------

Revenue 9,154 5,576 14,730 9,401 6,281 15,682

Gross Profit 7,728 4,123 11,851 8,028 4,723 12,751

Gross margin 84% 74% 81% 85% 75% 81%

-------------- -------- -------- -------- -------- -------- --------

Gross profit margin was 81% for the first half of the financial

year 2022 and 2021. In the UK, the gross profit margin decreased by

1% to 84%. The Gross profit margin in the US business decreased by

1% to 74% in the first half of the financial year 2022, as new

Secure Payment clients continue to go-live. Previously we have

indicated the gross profit margin would decrease towards 70%, but

with the continued adoption of the Secure Payments solutions in the

Cloud, the gross profit margin is expected to be stronger than

previously indicated.

In the UK, as the service is hosted on an Eckoh platform there

is typically no hardware provided to clients and gross profit

margin is expected to remain level at 83% to 85%. In the US, due to

the impact of IFRS 15 and the growth in the Secure Payments

activities being deployed in the Cloud, we would expect gross

profit margin to gradually decrease to a range of approximately 72%

to 75%, (prior to the Cloud adoption seen towards the end of last

financial year this had been indicated as 70% to 75%). As new

Secure Payment business continues to be adopted in the Cloud and

the existing clients with on-site solutions renew their contracts

without significant hardware, the gross profit margin should

gradually start to increase.

Administrative expenses

Total administrative expenses were GBP9.4 million in the period,

compared to GBP10.2 million for the same period last year, an

improvement of 10%. Adjusted administrative expenses were GBP9.1

million compared to GBP9.3 million for the same period last year,

as a result of the restructuring measures taken in the first half

to adopt to the changing environment we operate in post the

pandemic. Restructuring costs incurred in the first half were

GBP233k (H1 FY21: GBPnil). Included in administrative expenses is a

trading foreign currency loss of GBP44k (H1 FY21: GBP55k loss).

Profitability Measures

Adjusted Operating profit for the period was GBP2.8 million a

decrease of 19.4% on a total basis (H1 FY21: GBP3.4 million).

Adjusted Operating Profit excluding the closed third-party Support

business was GBP2.5 million (H1 FY21: GBP2.2 million), a

year-on-year improvement of 18%. Included in the first half profit

for the current period was a foreign currency loss of GBP44k (H1

FY21: GBP55k loss).

Six months Year

ended Six months ended

30 Sept ended 31 March

2021 30 Sept 2020 2021

GBP'000 GBP'000 GBP'000

---------------------------------- ----------- -------------- ----------

Profit from operating activities 2,405 2,538 3,550

Amortisation of acquired

intangible assets 73 486 663

Expenses relating to share

option schemes 42 392 536

Restructuring costs 233 - -

Adjusted operating profit(1) 2,753 3,416 4,749

----------- -------------- ----------

Amortisation of intangible

assets 184 164 398

Depreciation of owned assets 329 363 704

Depreciation of leased assets 230 254 505

---------------------------------- ----------- -------------- ----------

Adjusted EBITDA 3,496 4,197 6,356

---------------------------------- ----------- -------------- ----------

Finance charges

For the financial period ended 30 September 2021, the net

interest charge was GBP22k (H1 FY21: GBP10k).

Taxation

For the financial period ended 30 September 2021, there was a

tax charge of GBP461k (H1 FY21: GBP484k), an effective tax rate of

19% (H1 FY20: 20%).

Earnings per share

Basic earnings per share was 0.75 pence per share (H1 FY21: 0.80

pence per share). Diluted earnings per share was 0.73 pence per

share (H1 FY21: 0.77 pence per share).

Contract liabilities and assets

Contract liabilities and contract assets relating to IFRS 15

Revenue from Contracts with Customers are revenue and costs

relating to the implementation of our solutions which are deferred

onto the balance sheet until our solution is accepted by the client

and then they are released evenly over the initial term of the

contract. Total contract liabilities were GBP10.8 million a

decrease from the March 2021 contract liabilities of GBP12.5

million (H1 FY21: GBP14.0 million). Included in this balance are

contract liabilities relating to the Secure Payments product or

hosted platform product of GBP9.6 million compared to GBP11.1

million at March 2021 (H1 FY21: GBP12.7 million). Deferred assets

as at 30 September were GBP3.9 million compared to GBP4.4 million

at March 2021 (H1 FY21: GBP5.2 million). The amounts held on the

balance sheet have decreased from the year end due to the switch of

clients choosing Cloud solutions compared to on-premise solutions

and the timing of new business and their deployments.

Cashflow and liquidity

Net cash at 30 September 2021 was GBP12.7 million, a decrease of

GBP0.2 million to the previous year and level with the year end at

31 March 2021. There has been a net cash outflow for trade debtors,

trade creditors, inventory and tax of GBP1.8 million (H1 FY21: cash

inflow GBP1.7 million), in principle due to the unwinding of

deferred revenue on the large enterprise on-premise solutions.

Consolidated statement of comprehensive income

for the six months ended 30 September 2021

Six months Six months

ended 30 ended 30 Year ended

September September 31 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 14,730 15,682 30,486

Cost of sales (2,879) (2,931) (6,291)

----------------------------------------------- ----------- ----------- -----------

Gross profit 11,851 12,751 24,195

Administrative expenses (9,446) (10,213) (20,645)

----------------------------------------------- ----------- ----------- -----------

Operating profit 2,405 2,538 3,550

----------------------------------------------- ----------- ----------- -----------

Adjusted operating profit 2,752 3,416 4,749

Amortisation of acquired intangible

assets (72) (486) (663)

Expenses relating to share option

schemes (42) (392) (536)

Restructuring costs (233) - -

---------------------------------------------- ----------- ----------- -----------

Profit from operating activities 2,405 2,538 3,550

----------------------------------------------- ----------- ----------- -----------

Finance charges (87) (22) (87)

Finance income 65 12 48

----------------------------------------------- ----------- ----------- -----------

Profit before taxation 2,383 2,528 3,511

Taxation (461) (484) (717)

-----------

Profit for the period 1,922 2,044 2,794

=============================================== =========== =========== ===========

Other comprehensive income/(expense)

---------------------------------------------- ----------- ----------- -----------

Items that will be reclassified subsequently

to profit or loss:

Foreign currency translation differences

- foreign operations 56 (74) 134

----------------------------------------------- ----------- ----------- -----------

Other comprehensive income/ (expense)

for the period, net of income tax 56 (74) 134

----------------------------------------------- ----------- ----------- -----------

Total comprehensive income for the

period attributable to the equity

holders of the parent company 1,977 1,970 2,928

=============================================== =========== =========== ===========

Profit per share expressed in pence

---------------------------------------------- ----------- ----------- -----------

Basic earnings per 0.25p share 0.75 0.80 1.09

Diluted earnings per 0.25p share 0.73 0.77 1.06

----------------------------------------------- ----------- ----------- -----------

Consolidated statement of financial position

as at 30 September 2021

30 September 30 September 31 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

------------------------------- ------------- ------------- ---------

Assets

Non-current assets

Intangible assets 6,508 6,709 6,527

Property, plant and equipment 4,074 3,774 4,307

Right -of-use leased assets 1,086 404 1,310

Deferred tax asset 2,761 3,786 3,211

-------------------------------- ------------- ------------- ---------

14,429 14,673 15,355

------------------------------- ------------- ------------- ---------

Current assets

Inventories 218 258 174

Trade and other receivables 11,909 12,333 13,277

Cash and cash equivalents 12,672 14,808 12,706

-------------------------------- ------------- ------------- ---------

24,799 27,399 26,157

------------------------------- ------------- ------------- ---------

Total assets 39,228 42,072 41,512

-------------------------------- ------------- ------------- ---------

Liabilities

Current liabilities

Trade and other payables (15,382) (18,502) (18,482)

Other interest-bearing loans

and borrowings - (975) (975)

Lease liabilities (516) (380) (517)

-------------------------------- ------------- ------------- ---------

(15,898) (19,857) (19,974)

------------------------------- ------------- ------------- ---------

Non-current liabilities

Other interest-bearing loans

and borrowings - (975) -

Lease liabilities (618) (17) (825)

Deferred tax liabilities (302) (281) (296)

-------------------------------- ------------- ------------- ---------

(920) (1,273) (1,121)

------------------------------- ------------- ------------- ---------

Net assets 22,410 20,942 20,417

-------------------------------- ------------- ------------- ---------

Shareholders' equity

Called up share capital 654 638 638

Share premium account 2,663 2,663 2,663

Capital redemption reserve 198 198 198

Merger reserve 2,697 2,697 2,697

Currency reserve 1,038 848 982

Retained earnings 15,160 13,898 13,239

-------------------------------- ------------- ------------- ---------

Total Shareholders' equity 22,410 20,942 20,417

-------------------------------- ------------- ------------- ---------

Consolidated interim statement of changes in equity

as at 30 September 2021

Called Capital

up share Share redemption Merger Currency Retained Total Shareholders'

capital premium reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 April

2021 638 2,663 198 2,697 982 13,239 20,417

Total comprehensive

income for the period

Profit for the period - - - - - 1,922 1,922

Other comprehensive

expense for the period - - - - 56 - 56

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Contributions by and

distributions to owners 56 1,922 1,979

Shares transacted

through

Employee Benefit Trust - - - - - (126) (126)

Shares issued under

the share option scheme 16 - - - - - 16

Shares purchased for

share ownership plan - - - - - (72) (72)

Share based payment

charge - - - - - 197 197

Total contributions

by and distributions

to owners 16 - - - 56 - -

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Balance as at 30

September

2021 654 2,663 198 2,697 1,038 15,160 22,410

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Called Capital

up share Share redemption Merger Currency Retained Total Shareholders'

capital premium reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Balance at 1 April

2020 638 2,663 198 2,697 848 11,965 19,009

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Total comprehensive

income for the period

Profit for the period - - - - - 2,044 2,044

Other comprehensive

expense for the period - - - - - (74) (74)

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Contributions by and

distributions to owners - - - - - 1,970 1,970

Shares transacted

through

Employee Benefit Trust - - - - - (41) (41)

Shares issued under

the share option

schemes - - - - - (173) (173)

Share based payment

charge - - - - - 177 177

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Total contributions

by and distributions

to owners - - - - - (37) (37)

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Balance at 30 September

2020 638 2,663 198 2,697 848 13,898 20,942

------------------------- ---------- --------- ------------ --------- --------- ---------- --------------------

Consolidated statement of cash flows

for the six months ended 30 September 2021

Six months Six months

ended ended Year ended

30 September 30 September 31 March

2020 2020 2021

GBP'000 GBP'000 GBP'000

----------------------------------------- -------------- -------------- -----------

Profit after taxation 1,921 2,044 2,794

Interest income (65) (12) (48)

Interest payable 87 22 87

Taxation 461 484 717

Depreciation of property, plant

and equipment 329 363 704

Depreciation of leased assets 230 254 505

Amortisation of intangible assets 256 650 1,061

Share based payments 197 177 522

Exchange differences 9 51 303

----------------------------------------- -------------- -------------- -----------

Operating profit before changes

in working capital and provisions 3,425 4,033 6,645

----------------------------------------- -------------- -------------- -----------

(Increase)/ Decrease in inventories (44) 54 138

Decrease in trade and other receivables 568 1,161 217

(Decrease) in trade and other payables (2,300) (2,592) (2,615)

----------------------------------------- -------------- -------------- -----------

Net cash generated from operating

activities 1,649 2,656 4,385

----------------------------------------- -------------- -------------- -----------

Taxation - (466) (10)

Interest paid (63) (16) (54)

Interest paid on lease liability (24) (6) (33)

----------------------------------------- -------------- -------------- -----------

Net cash from continuing operating

activities 1,562 2,168 4,288

----------------------------------------- -------------- -------------- -----------

Cash flows from investing activities

Purchase of property, plant and

equipment (89) (294) (1,175)

Purchase of intangible fixed assets (187) (157) (573)

Proceeds from sale of tangible

fixed assets - 3 -

Interest received 65 12 48

Net cash utilised in continuing

investing activities (210) (436) (1,700)

----------------------------------------- -------------- -------------- -----------

Cash flows from financing activities

Dividends paid - - (1,558)

Repayment of borrowings (975) - (975)

Principal elements of lease payments (209) (251) (461)

Shares purchased for share ownership

plan (72) (173) (241)

Issue of shares 16 - -

Shares acquired by Employee Benefit

Trust (126) (41) (138)

----------------------------------------- -------------- -------------- -----------

Net cash utilised in continuing

investing activities (1,366) (465) (3,373)

(Decrease) / increase in cash and

cash equivalents (14) 1,267 (785)

Cash and cash equivalents at the

start of the period 12,706 13,541 13,541

Effect of exchange rate fluctuations

on cash held (21) - (50)

----------------------------------------- -------------- -------------- -----------

Cash and cash equivalents at the

end of the period 12,671 14,808 12,706

----------------------------------------- -------------- -------------- -----------

Notes to the condensed consolidated interim financial

statements

For the six months ended 30 September 2021

GENERAL INFORMATION

Eckoh plc is a public limited company and is incorporated and

domiciled in the UK under the Companies Act 2006 (Company

Registration number 03435822). The address of the Company's

registered office is Telford House, Corner Hall, Hemel Hempstead,

HP3 9NH.

Eckoh plc is a global provider of Secure Payment products and

Customer Contact solutions.

These condensed consolidated interim financial statements for

the six months ended 30 September 2021 comprise the Company and its

subsidiaries (together the "Group").

1. Basis of preparation

These condensed consolidated interim financial statements for

the six months ended 30 September 2021 have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union. This report does not include all of the

information required for full annual financial statements and

should be read in conjunction with the consolidated financial

statements of the Group as at and for the year ended 31 March 2021,

which have been prepared in accordance with International Financial

Reporting Standards (IFRS) as adopted by the European Union and

applicable law.

The unaudited condensed consolidated interim financial

information for the period ended 30 September 2021 does not

constitute statutory accounts as defined in Section 435 of the

Companies Act 2006. The comparative figures for the year ended 31

March 2021 are extracted from the statutory financial statements

which have been filed with the Registrar of Companies, on which the

auditor gave an unqualified report, which made no statement under

section 498(2) or (3) respectively of the Companies Act 2006 and

did not draw attention to any matters of emphasis.

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing these condensed consolidated interim financial

statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements as at and for the year ended 31

March 2021.

In reporting financial information, the Group presents

alternative performance measures ("APMs") which are not defined or

specified under the requirements of IFRS. The Directors consider

that disclosing alternative performance measures enhances

Shareholders' ability to evaluate and analyse the underlying

financial performance of the Group. They have identified adjusted

operating profit and adjusted EBITDA as measures that enable the

assessment of the performance of the Group and assists in

financial, operational and commercial decision-making. In adjusting

for these measures, the Directors have sought to eliminate those

items of income and expenditure that do not specifically relate to

the normal operational performance of the Group in a specific

year.

These condensed consolidated interim financial statements were

approved by the Board of Directors on 1 December 2021.

The accounting policies adopted in these interim financial

statements are consistent with those of the previous financial year

and the corresponding interims period.

Going concern

The Directors have, at the time of approving the condensed

consolidated interim financial statements, a reasonable expectation

that the Company and the Group have adequate resources to continue

in operational existence for the foreseeable future. Thus, they

continue to adopt the going concern basis of accounting in

preparing the financial statements.

New standards and interpretations not yet adopted

Amended standards and interpretations not yet effective are not

expected to have a significant impact on the Group's consolidated

financial statements.

2. Dividends

The proposed dividend of GBP1.6m for the year ended 31 March

2021 of 0.61p per share was paid on 22 October 2021.

3. Earnings per share

The basic and diluted earnings per share are calculated on the

following profit and number of shares. Earnings for the calculation

of earnings per share is the net profit attributable to equity

holders of the parent.

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2021 2020 2021

GBP000 GBP000 GBP000

------------------------------------ -------------- -------------- ----------

Earnings for the purposes of basic

and diluted earnings per share 1,922 2,044 2,794

------------------------------------ -------------- -------------- ----------

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2021 2020 2021

Denominator '000 '000 '000

-------------------------------------- -------------- -------------- ----------

Weighted average number of shares

in issue in the period 255,500 255,852 255,351

Shares held by employee ownership

plan (1,908) (1,717) (1,862)

Number of shares used in calculating

basic earnings per share 253,592 254,135 253,489

Dilutive effect of share options 9,121 9,678 9,426

-------------------------------------- -------------- -------------- ----------

Number of shares used in calculating

diluted earnings per share (where

applicable) 262,713 263,813 262,915

-------------------------------------- -------------- -------------- ----------

4. Subsequent events to 30 September 2021

As at the date of these statements there were no such events to

report.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BFLLBFLLFFBL

(END) Dow Jones Newswires

December 02, 2021 02:00 ET (07:00 GMT)

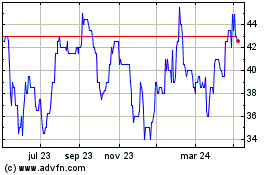

Eckoh (LSE:ECK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

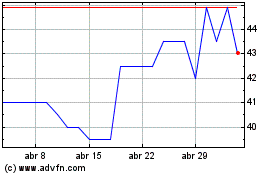

Eckoh (LSE:ECK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024