TIDMEAH

RNS Number : 9854N

Eco Animal Health Group PLC

04 February 2021

ECO Animal Health Group plc ("ECO")

(AIM: EAH)

Results for the six months ended 30 September 2020

ECO REPORTS A BUOYANT FIRST HALF AND POSITIVE FULL YEAR

INDICATIONS

HIGHLIGHTS

Financials

-- Sales at GBP42.5m (2019 restated*: GBP28.3m)

-- EBITDA at GBP6.7m (2019 restated*: GBP1.7m)

-- Profit before taxation of GBP4.5m (2019 restated profit*: GBP1.1m)

-- Profit after taxation of GBP3.9m (2019 restated profit*: GBP1.3m)

-- Earnings per share of 3.13p (2019: restated Earnings per share*: 1.68p)

-- Cash generated by operations of GBP3.5m (2019 restated*: GBP1.3m)

-- Net cash at 30th September 2020 of GBP12.9m (2019: GBP13.4m)

* Prior period figures have been restated to reflect adjustments

arising from the March 2020 audit.

Operations

-- Exceptionally strong recovery in China following the African Swine Fever impact in 2019

-- USA recovery following the easing in geopolitical trade tensions between China and the USA

-- Latin America performing strongly, led by Brazil

-- New marketing authorisation from the European Medicines

Agency for the use of Aivlosin(R) 625 mg/g Water Soluble Granules

in pigs for the treatment of Mycoplasma hyopneumoniae

-- Strong trading in the third quarter

Dr Andrew Jones, Non-executive Chairman of ECO Animal Health

Group plc, commented:

"This set of results for the first half builds upon the strong

trading seen in China during the latter part of last year with an

acceleration in sow restocking and an appreciation of the benefits

that Aivlosin(R) brings to animal health and productivity. We are

pleased to be releasing these Interim results at the same time as

the audited final results for March 2020 and together they mark a

turning point in the reassessment of the Group's prior accounting.

We are experiencing strong forward trading as evidenced by the

successive trading updates and we are also excited with the

continued new product development successes. The Directors are

confident and excited about the future prospects for the

business."

The information contained within this announcement is deemed by

the Group to constitute inside information as stipulated under the

Market Abuse Regulations (EU) No. 596/2014 ("MAR"). Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

Contacts:

ECO Animal Health Group plc

Marc Loomes (CEO)

Christopher Wilks (CFO)

Andrew Jones (Chairman) 020 8447 8899

IFC Advisory

Graham Herring

Zach Cohen 020 3934 6630

N+1 Singer (Nominated Adviser & Joint Broker)

Mark Taylor

Iqra Amin 020 7496 3000

Peel Hunt LLP (Joint Broker)

James Steel

Dr Christopher Golden 020 7418 8900

ECO Animal Health Group plc ("ECO" or "the Group") researches,

develops and commercialises products for livestock. Our business

strategy is to generate shareholder value by achieving the maximum

sales potential from the existing product portfolio whilst

investing in Research and Development ("R&D") for new products,

particularly vaccines, and seeking to in-license new products.

Chairman's statement

I am pleased to report that despite the considerable challenges

presented by Covid-19 we report a set of interim results which

demonstrate considerable strength in revenue and profitability.

We welcome Dr Frank Armstrong to our Board. Frank joined us on

the 1(st) May 2020 and he brings a wealth of experience in life

sciences - businesses large and small - and in particular around

the areas of management of Research and Development. This is an

increasing feature of our business and his experience will add

greatly to our future endeavours.

Audit of the Group's results for the Year ended 31st March

2020

We are releasing this Interim statement on the same day as the

delayed release of the Annual report for the year ended 31st March

2020. We are pleased that the first audit by our new auditors, BDO,

is complete and the thorough review undertaken, together with the

comprehensive prior year restatements sets the Group on a positive

footing for future periods.

Covid-19

This trading period has coincided with the primary outbreak of

Covid-19 in Europe and the USA and necessary transition to remote

working and social distancing has by and large been a smooth and

uninterrupted process. Certainly in terms of order volumes,

reaching customers and the logistics of order fulfilment we could

not have hoped for a better process. The adoption of new ways of

working and utilising all that modern on-line communication offers

has been a great credit to the skills of our staff members,

customers and suppliers and on behalf of the Board I would like to

express our gratitude to them.

Financial Performance

Revenue was sharply higher in the first six months to 30th

September 2020 at GBP42.5 million (30th September 2019 - GBP28.3

million, driven in the main by a resurgence in China. This is

further discussed in the Business Performance comments below. At

GBP42.5 million this first half period is at roughly the same

run-rate with the GBP43.8 million revenue recorded in the second

half of the year ended 31st March 2020. Given the historical

pattern of second half weighting to revenue this underlines the

strength of the revenue performance in this period.

The gross margin in the first six months has been an average of

48%. This is ahead of the full year ended 31st March 2020 (46%) and

considerably stronger than that recorded in the six months ended

30th September 2019 (43%). As reported last year the gross margins

were negatively impacted in the USA and as a result of the stronger

pork market in the USA the margins have recovered to previously

seen levels.

Administrative expenses of GBP10.5 million (2019 - GBP7.2

million) were incurred, the increase being associated with variable

costs such as performance related bonus accruals, investment in new

members of staff and certain exceptional costs.

Research and development expenditure shown on the income

statement and together with the amount capitalised represented a

cash investment of 10% of revenue in the six months ended 30

September 2020 (17% in the six month period ended 30th September

2019 restated). In response to the Covid-19 pandemic the Board

instigated a prioritisation exercise in the R&D portfolio to

conserve cash. Additionally, the revenue in the period was ahead of

budget which also results in a slightly lower ratio for a budgeted

amount of R&D expenditure.

Earnings before interest, tax, depreciation, amortisation, share

based payments and foreign exchange movements ("Adjusted EBITDA")

were GBP6.7 million (2019 restated: GBP1.7 million). This increase

in profitability was directly a result of the higher revenue at

greater gross margins and partially offset by increased R&D

investment and overheads.

Cash generated from operations was GBP3.5 million (2019: GBP1.3

million). This was a particularly strong performance which was

inline with the cash generated in 2019 allowing for an element of

inventory build which was planned ahead of Brexit.

Net cash at 30th September 2020 was GBP12.9 million (31st March

2020: GBP9.8 million). The higher cash position arose from stronger

trading and judicious control of cash expenditure in the midst of

uncertainty surrounding Covid-19 and its impact on world economies.

This consolidated cash position at 30th September 2020 includes

GBP9.7 million (March 2020 - GBP5.3 million) which is held in the

Group's subsidiary in China. A portion of this cash is repatriated

from China once per annum by dividend declaration; the Group's

share which is received in the UK is 51%.

Business Performance

The geographical analysis of the Group's revenue in the six

months ended 30th September 2020 compared to the prior period in

2019 and the full year ended 31st March 2020 was as follows:

6 months ended 30th

Revenue Summary September Year ended

31(st)

March

2020 2019 2020 % change

(GBP'm) (GBP'm) (GBP'm) 2019 to 2020

Restated Restated

China and Japan 20.8 7.0 23.1 197%

North America (USA and Canada) 6.4 3.6 11.6 78%

South and South East Asia 4.0 7.1 14.2 (44%)

Latin America 6.4 5.1 12.6 25%

Europe 4.1 4.7 7.6 (13%)

Rest of World and UK 0.8 0.8 3.0 0%

42.5 28.3 72.1 50%

-------------------------------- ---------- ---------- ----------- -------------

Group revenue improved by 50% to GBP42.5 million compared to the

prior period in 2019 - a period which continued to be dominated by

the unprecedented impact of Covid-19.

The recovery from ASF in China has been widely reported. The

rate of restocking of the pig herd has been ahead of most

predictions; the strong pork commodity price driving a number of

mechanisms to increase the number of breeding sows and resulting in

extraordinary farm profitability. This is turn has resulted in the

greater use of premium medications such as Aivlosin(R). It is

believed that the efficacy benefits that new users have experienced

will result in a number of new, long term, customers.

Revenue in North America, USA in particular, has been strong

with a return to pre-2019 levels of business and margins. This has

been a result of a normalisation in pork prices in that market as

well as export markets (China) becoming available.

India had a steady six months; the poultry market has been badly

affected during the Covid-19 pandemic but commentators are

expecting a recovery during 2022.

Brazil continues to record strong revenue resulting from a

buoyant domestic and export swine market as well as an effective

in-country distributor.

Research and Development

In our core product area, a marketing authorisation was obtained

from the European Medicines Agency for the use of Aivlosin(R) Water

Soluble Granules in the treatment of pigs for Mycoplasma

hyopneumoniae. This, together with the equivalent authorisation in

the USA and Canada received in January 2021 further demonstrates

the strength and depth of our cornerstone product family and the

"evergreening" of the Group's core offering.

The Group will continue to invest in building a product pipeline

targeting both viral and bacterial diseases of economic importance

in pigs and poultry, with the intention of developing a range of

vaccines and new products to complement our existing antimicrobial

business. The product pipeline contains a mix of well-established

concepts as well as novel, potentially disruptive technologies and

approaches. These are in various stages of development thereby

ensuring that the Group has several mid and late stage projects

able to deliver revenues from 2022/23. We were very pleased to

announce the approval of the first of these vaccine projects - this

was received in January 2021 in Brazil and is for the combined

vaccination of pigs against Porcine Circovirus Type2 and Mycoplasma

hyopneumoniae.

Brexit

The Group has successfully transferred all EU marketing

authorisations to a new European subsidiary, ECO Animal Health

Europe Limited with a registered address in Dublin, Republic of

Ireland. All contingency planning is in place and the financial and

operational impact of Brexit is expected to be minimal.

Prior to 31(st) December 2020, the vast majority of orders for

delivery in the first quarter of the calendar year 2021 were

delivered to insulate the Group from any possible effects of

logistical issues, port delays and transport interruptions.

Dividend

The directors recognise the importance of the dividend to

shareholders. However, having due regard to the Group's significant

investment in new product development, operating cash flow, and

cash balances, the directors consider it prudent to defer the

declaration of a dividend at this time.

Outlook

Performance so far in the current financial year ending 31st

March 2021 has been strong with the strength seen in both our

Chinese and US markets continuing into the second half of our

current financial year. In October 2020, we announced that n

otwithstanding the historical second half weighting to the Group's

revenue, if the first half revenue trends continued through the

second half of the financial year the Board expected that the

Group's full year revenue for the year ending 31st March 2021 would

exceed market expectations. This resulted in an upgraded market

expectation both for revenue and profitability.

On 24th November 2020 we confirmed that strong trading had

continued during November and, being mindful of the continuing

global uncertainties and four months remaining until the end of the

financial year, we were confident of meeting the upgraded market

expectations.

On 21st January 2021 we issued a positive trading update,

confirming Group revenues and EBITDA were expected to be

significantly ahead of market expectations for the year ending 31st

March 2021. We noted that the strength in the Chinese market,

supported by the rebuilding of pig herds and the high price for

pork, continued through the third quarter and the outlook for the

final quarter sales continued these strong trading trends.

We look forward to the rest of this financial year and our

reporting prospects for 2021 with continuing optimism.

Dr Andrew Jones

Non-Executive Chairman

3 February 2021

CONSOLIDATED INCOME STATEMENT

FOR THE SIX MONTHS TO 30th SEPTEMBER 2020

Six months Six months Year ended

to 30.09.20 to 30.09.19 31.03.20

Notes (unaudited) (unaudited) (audited)

GBP000's GBP000's GBP000's

Restated*

Revenue 4 42,530 28,316 72,106

Cost of sales (22,098) (16,197) (38,742)

----------------------- --------------------- ---------------------

Gross Profit 20,432 12,119 33,364

Other income 397 8 105

Administrative expenses (10,524) (7,154) (16,991)

R&D expense (4,093) (3,563) (8,775)

Currency profits/(losses) (843) 714 (539)

Amortisation of intangible assets (789) (821) (1,685)

Share based payments (85) (208) (284)

----------------------- --------------------- ---------------------

Profit from operating activities: 4,495 1,095 5,195

Net finance cost (39) (4) (30)

Share of profit of associate - 42 42

----------------------- --------------------- ---------------------

Profit before income tax 4,456 1,133 5,207

Income tax benefit/(charge) (598) 130 (1,032)

----------------------- --------------------- ---------------------

Profit for the period 3,858 1,263 4,175

----------------------- --------------------- ---------------------

Attributable to:

Owner of parent company 2,113 1,133 2,582

Non-controlling interest 1,745 130 1,593

----------------------- --------------------- ---------------------

3,858 1,263 4,175

======================= ===================== =====================

Earnings per share (pence 2019 -

restated) 6 3.13 1.68 3.82

Diluted earnings per share (pence

- restated) 6 3.01 1.67 3.67

Earnings before interest, taxation,

depreciation,

amortisation and share based payments

(EBITDA) 5,838 2,408 7,823

Exclude foreign exchange differences 843 (714) 539

Adjusted EBITDA excluding foreign

exchange differences 6,681 1,694 8,362

======================= ===================== =====================

*Details of the restatement, which is unaudited,

is presented in Note 3.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months Six months Year ended

to 30.09.20 to 30.09.19 31.03.20

(unaudited) (unaudited) (audited)

GBP000's GBP000's GBP000's

Restated*

Profit for the period 3,858 1,263 4,175

Other Comprehensive income/(losses) (net

of related tax effects):

Items that will or may be reclassified

to profit/(loss) in future periods:

Revaluation of freehold property - - (92)

Adjustment for intangible assets - note

3 - 835 -

Adjustment to tax rates on previously

reported adjustments - note 3 - (617) -

Foreign currency translation differences 507 47 98

Items that will not be reclassified:

Defined benefit plan - actuarial losses - - 12

Other comprehensive income/(losses) for

the period 507 265 18

---------------------- ---------------------- ---------------------

Total comprehensive income for the period 4,365 1,528 4,193

Attributable to:

Owners of the parent Company 2,651 1,424 2,561

Non-controlling interest 1,714 104 1,632

4,365 1,528 4,193

====================== ====================== =====================

*Details of the restatement, which is unaudited,

is presented in Note 3.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Foreign Minority

Share Share Revaluation Other Exchange Retained Total Total

Capital Premium Reserves Reserves Reserve Earnings Interest Equity

Account Account

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

FOR THE YEARED

31 MARCH 2020

Balance as

at 31 March

2019 3,372 62,650 664 106 467 17,214 84,473 5,102 89,575

Profit for

the year - - - - - 2,582 2,582 1,593 4,175

Other

comprehensive

income:

Foreign currency

differences - - - - 59 - 59 39 98

Revaluation

of freehold - - (92) - - - (92) - (92)

Actuarial

(losses)

on pension

scheme assets - - - - - 12 12 - 12

Total

comprehensive

income for

the year - - (92) - 59 2,594 2,561 1,632 4,193

------------- --------------- ------------------ --------------- --------------- -------------- ------------- ------------- ------------

Transactions

with owners

recorded directly

in equity:

Issue of shares

in the year 5 232 - - - - 237 - 237

Share-based

payments - - - - - 284 284 - 284

Deferred tax

on share-based

payments - - - - - (373) (373) - (373)

Dividends - - - - - (7,453) (7,453) (968) (8,421)

Transactions

with owners 5 232 - - - (7,542) (7,305) (968) (8,273)

------------- --------------- ------------------ --------------- --------------- -------------- ------------- ------------- ------------

Balance as

at 31 March

2020 3,377 62,882 572 106 526 12,266 79,729 5,766 85,495

============= =============== ================== =============== =============== ============== ============= ============= ============

FOR THE SIX MONTHSED 30 SEPTEMBER

2020

Profit for

the period - - - - - 2,113 2,113 1,745 3,858

Other

comprehensive

income:

Foreign currency

differences - - - - 538 - 538 (31) 507

Total

comprehensive

income for

the period - - - - 538 2,113 2,651 1,714 4,365

------------- --------------- ------------------ --------------- --------------- -------------- ------------- ------------- ------------

Transactions

with owners

recorded directly

in equity:

Issue of shares

in the period - 6 - - - - 6 - 6

Share-based

payments - - - - - 85 85 - 85

Total

transactions

with owners - 6 - - - 85 91 - 91

------------- --------------- ------------------ --------------- --------------- -------------- ------------- ------------- ------------

Balance as

at 30 September

2020 3,377 62,888 572 106 1,064 14,464 82,471 7,480 89,951

============= =============== ================== =============== =============== ============== ============= ============= ============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Foreign Minority

Share Share Revaluation Other Exchange Retained Total Total

Capital Premium Reserves Reserves Reserve Earnings Interest Equity

Account Account

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

FOR THE SIX MONTHSED 30 SEPTEMBER

2019

Balance as at

31 March 2019 3,372 62,650 664 106 467 17,214 84,473 5,102 89,575

Profit for the

period - as

reported - - - - - 1,018 1,018 130 1,148

Prior period

adjustments:

Adjustment for

intangible

assets

- note 3 - - - - - 115 115 - 115

------------- --------------- --------------- --------------- ----------------- -------------- ------------- ------------- -------------

Profit for the

period -

restated - - - - - 1,133 1,133 130 1,263

Other

comprehensive

income:

Adjustment for

intangible

assets

- note 3 - - - - - 835 835 - 835

Adjustment to

tax rates on

previously

reported

adjustments -

note 3 - - - - - (617) (617) - (617)

Foreign currency

differences - - - - 73 - 73 (26) 47

Total

comprehensive

income for the

period - - - - -73 1,351 1,424 104 1,528

------------- --------------- --------------- --------------- ----------------- -------------- ------------- ------------- -------------

Transactions

with owners

recorded

directly in

equity:

Issue of shares

in the period 5 232 - - - - 237 - 237

Share-based

payments - - - - - 208 208 - 208

Dividends - - - - - (7,453) (7,453) - (7,453)

Total

transactions

with owners 5 232 - - - (7,245) (7,008) - (7,008)

------------- --------------- --------------- --------------- ----------------- -------------- ------------- ------------- -------------

Balance as at

30 September

2019 3,377 62,882 664 106 540 11,320 78,889 5,206 84,095

============= =============== =============== =============== ================= ============== ============= ============= =============

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at As at As at

30.09.20 30.09.19 31.03.20

(unaudited) (unaudited) (audited)

Notes GBP000's GBP000's GBP000's

Restated*

Non-current assets

Intangible assets 7 40,667 41,470 41,439

Property, plant and

equipment 2,323 2,044 2,426

Investment property 305 200 305

Right of use assets 1,525 2,043 1,658

Investments 150 166 166

--------------------------- --------------------------- ---------------------------

44,970 45,923 45,994

Current assets

Inventories 20,282 20,647 17,264

Trade and other

receivables 28,083 19,896 28,353

Income tax recoverable 1,964 1,416 1,265

Other taxes and social

security 359 420 652

Cash and cash

equivalents 17,058 13,411 11,877

--------------------------- --------------------------- ---------------------------

67,746 55,790 59,411

Total assets 112,716 101,713 105,405

--------------------------- --------------------------- ---------------------------

Current liabilities

Trade and other

payables (16,304) (9,653) (14,486)

Borrowings (4,117) - (2,032)

Income tax (25) (55) (940)

Other taxes and social

security - (690) -

Amounts due under

leases (375) (431) (342)

Dividends (50) (4,803) (50)

--------------------------- --------------------------- ---------------------------

(20,871) (15,632) (17,850)

Total assets less

current

liabilities 91,845 86,081 87,555

Non-current

liabilities

Deferred tax (686) (309) (636)

Amounts due under

leases (1,208) (1,677) (1,424)

--------------------------- --------------------------- ---------------------------

Total assets less

total

liabilities 89,951 84,095 85,495

=========================== =========================== ===========================

Equity

Capital and reserves

Issued share capital 3,377 3,377 3,377

Share premium account 62,888 62,882 62,882

Revaluation reserve 572 664 572

Other reserves 106 106 106

Foreign exchange

reserve 1,064 540 526

Retained earnings 14,464 11,320 12,266

--------------------------- --------------------------- ---------------------------

Shareholders' funds 82,471 78,889 79,729

Non-controlling

interests 7,480 5,206 5,766

Total equity 89,951 84,095 85,495

=========================== =========================== ===========================

*Details of the restatement, which is unaudited, is presented in

Note 3.

CONSOLIDATED STATEMENT OF CASH FLOWS

Six months Six months

to to Year ended

30.09.20 30.09.19 31.03.20

(unaudited) (unaudited) (audited)

GBP000's GBP000's GBP000's

Restated*

Cashflows from operating

activities

Profit before income tax 4,456 1,133 5,207

Adjustment for:

Net finance cost 39 4 30

Foreign exchange gain/(loss) (688) (212) 62

Depreciation 155 271 334

Revaluation of investment

property - - (64)

Amortisation of right-of-use

assets 187 184 389

Amortisation of intangible

assets 789 821 1,685

Pension payments - (29) (59)

Share of associate's results - (42) (42)

Share-based payments 85 208 284

--------------------------- ------------------------------ ------------------------

Operating cash flow before

movement

in working capital 5,023 2,338 7,826

Change in inventories (3,018) (1,002) 2,212

Change in receivables 563 3,278 (5,209)

Change in payables 952 (3,313) 662

--------------------------- ------------------------------ ------------------------

Cash generated from operations 3,520 1,301 5,491

Finance costs (40) 41 (17)

Income tax (116) (770) (1,076)

--------------------------- ------------------------------ ------------------------

Net cash from operating

activities 3,364 572 4,398

=========================== ============================== ========================

Cash flows from investing

activities

Acquisition of property, plant

and

equipment (231) (85) (767)

Disposal of property, plant

and

equipment - - -

Purchase of intangibles (17) (1,282) (2,115)

Finance income 64 51 112

Net cash (used in) investing

activities (184) (1,316) (2,770)

--------------------------- ------------------------------ ------------------------

Cash flows from financing

activities

Change in borrowings 2,085 - 2,032

Proceeds from issue of share

capital 6 237 237

Interest paid on lease

liabilities (63) (70) (125)

Principal paid on lease

liabilities (182) - (364)

Finance lease repayments - (273) -

Dividends paid - (2,699) (8,421)

--------------------------- ------------------------------ ------------------------

Net cash (used in) financing

activities 1,846 (2,805) (6,641)

--------------------------- ------------------------------ ------------------------

Net (decrease)/increase in

cash

and cash equivalents 5,026 (3,549) (5,013)

Foreign exchange movements 155 97 27

Balance at the beginning of

the

period 11,877 16,863 16,863

Balance at the end of the

period 17,058 13,411 11,877

=========================== ============================== ========================

Free cash flow 3,180 (744) 1,628

--------------------------- ------------------------------ ------------------------

*Details of the restatements, which are unaudited,

are presented in Note 3.

NOTES TO THE PRELIMINARY RESULTS FOR THE SIX MONTHS TO 30

SEPTEMBER 2020

1. Basis of preparation

The financial information for the period to 30 September 2020

does not constitute statutory accounts as defined by Section 435 of

the Companies Act 2006. It has been prepared in accordance with the

accounting policies set out in, and is consistent with, the audited

financial statements for year ended 31 March 2020.

The Group applies revised IAS 1 "Presentation of Financial

Statements (2007)". As a result, the Group presents all non-owner

changes in equity in consolidated statements of comprehensive

income and all owner changes in equity in consolidated statements

of changes in equity.

These Interim Statements have not been audited or reviewed by

the Group's auditors.

2. Statement of compliance

This interim financial statement is prepared in accordance with

IAS 34 "Interim Financial Reporting". Accordingly, whilst the

interim statements have been prepared in accordance with IFRS, and

the primary statements follow the format of the annual financial

statements, only selected notes are included - those that provide

an explanation of events and transactions that are significant to

an understanding of the changes in financial position and

performance of the Group since the last annual reporting date. IAS

34 states a presumption that anyone who reads the Group's interim

report will also have access to its most recent annual report.

Accordingly, annual disclosures are not repeated in these interim

condensed reports.

3. Changes to significant accounting policies and other restatements

The principal accounting policies which are adopted by the Group

in the preparation of its financial statements are set out in in

the consolidated financial statements of the Group for the year

ended 31 March 2020. These policies have been consistently applied

to all prior years. Where necessary, and as detailed in the

consolidated financial statements of the Group for the year ended

31 March 2020, any corrections to the application of the Group's

accounting policies to comply with International Financial

Reporting Standards have been made as restatements of prior period

financial statements for the correction of errors in accordance

with IAS8 . The correct application of the Group's accounting

policies in accordance with IFRS continued into the six months

ended 30 September 2020.

Since the September 2019 interim accounts the group has

completed its review of the capitalization of historic development

expenditure, and reviewed the amortization policy applied to such

assets. This has had the effect of increasing the net book value of

intangible assets held at September 2019. Full details are given in

the Annual Report and Accounts for the year ended 31 March 2020,

but the financial effect is summarized below.

Development costs adjustment: Impact on the Balance Sheet and

Income Statement

Adjustment Adjustment

to retained through Income

As reported earnings Statement Restated

Sept 2019 Sept 2019

GBP000's GBP000's GBP000's GBP000's

Balance sheet

Cost 44,922 (3,900) (270) 40,752

Accumulated amortisation (23,004) 4,735 385 (17,884)

Net Book Value 21,918 835 115 22,868

============== ============= ================ =============

Income Statement

As reported Adjustment Adjustment Restated for

for 6 months to retained through Income 6 months to

to Sept 2019 earnings Statement Sept 2019

GBP000's GBP000's GBP000's GBP000's

R&D Expense 3,293 - 270 3,563

Amortisation

charge 1,206 - (385) 821

-------------- ------------- ---------------- -------------

(115)

================

NOTES TO THE PRELIMINARY RESULTS FOR THE SIX MONTHS TO 30

SEPTEMBER 2020 (Continued)

3. Changes to significant accounting policies and other restatements (continued)

In addition, during the completion of the audit of the Group's

financial statements for the year ended 31 March 2020 the Group

identified some amendments that needed to be made to previously

reported prior year adjustments. These amendments arose in respect

of changes to the tax rates applied to the previously reported

adjustments. The effect of these changes is reported in the

Consolidated Statement of Changes in Equity that forms part of

these results, and full details are contained in the Group's Annual

Report and Accounts for the year ended 31 March 2020.

4. Revenue is derived from the Group's animal pharmaceutical businesses.

5. Principal risks and uncertainties

These were set out on pages 20-22 of the Group's Annual Report

and Accounts for the year ended 31 March 2020. The key exposures

are to foreign currency exchange rates, potential delays in

obtaining marketing authorisations, single sources of supply for

some raw materials and trade debtor recovery and have remained

unchanged since the year end. In addition, the Annual Report and

Accounts highlighted disease impact to growth in emerging markets

as a key risk and this, in the form of ASF, is a principal

uncertainty.

6. Earnings per share

Six months Six months Year ended

to 30.09.20 to 30.09.19 31.03.20

(unaudited) (unaudited) (audited)

Restated

Weighted average number of shares in issue

(000's) 67,530 67,493 67,530

Fully diluted weighted average number of

shares in issue (000's) 70,313 68,092 70,313

Profit attributable to equity holders of

the company (GBP000's) 2,113 1,133 2,582

Basic earnings per share (pence) 3.13 1.68 3.82

Fully diluted earnings per share (pence) 3.01 1.67 3.67

NOTES TO THE PRELIMINARY RESULTS FOR THE SIX MONTHS TO 30

SEPTEMBER 2020 (Continued)

7. Intangible non-current assets

Distribution Development

Goodwill rights Costs Total

GBP000's GBP000's GBP000's GBP000's

Cost

At 1 April 2019 - restated 17,930 1,442 39,470 58,842

Additions - restated - - 1,282 1,282

------------------ ------------------ --------------- ---------------

At 30 September 2019

- restated 17,930 1,442 40,752 60,124

Additions - - 833 833

------------------ ------------------ --------------- ---------------

At 31 March 2020 17,930 1,442 41,585 60,957

Additions - - 17 17

------------------ ------------------ --------------- ---------------

At 30 September 2020 17,930 1,442 41,602 60,974

================== ================== =============== ===============

Amortisation

At 1 April 2019 - restated 735 17,098 17,833

Charge for the period

- restated 35 786 821

------------------ ------------------ --------------- ---------------

At 30 September 2019

- restated - 770 17,884 18,654

Charge for the period - 35 829 864

------------------ ------------------ --------------- ---------------

At 31 March 2020 - 805 18,713 19,518

Charge for the period - 35 754 789

------------------ ------------------ --------------- ---------------

At 30 September 2020 - 840 19,467 20,307

================== ================== =============== ===============

Net Book Value

At 30 September 2020 17,930 602 22,135 40,667

================== ================== =============== ===============

At 31 March 2020 17,930 637 22,872 41,439

================== ================== =============== ===============

At 30 September 2019

- restated 17,930 672 22,868 41,470

================== ================== =============== ===============

At 1 April 2019 - restated 17,930 707 22,372 41,009

================== ================== =============== ===============

This financial information was approved by the board on 3

February 2021.

Copies of this interim report are being sent to all the

Company's shareholders.

DIRECTORS AND OFFICERS Andrew Jones (Non-Executive Chairman)

Marc Loomes (Chief Executive)

Chris Wilks (Chief Financial Officer)

Anthony Rawlinson (Non-Executive Director)

Frank Armstrong (Non-Executive Director)

REGISTERED OFFICE 78 Coombe Road, New Malden, Surrey. KT3 4QS

Tel: 020 8447 8899

COMPANY NUMBER 01818170

INFORMATION AT www.ecoanimalhealthgroupplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR ZZGGZVDRGMZG

(END) Dow Jones Newswires

February 04, 2021 02:02 ET (07:02 GMT)

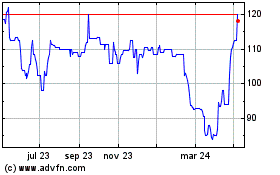

Eco Animal Health (LSE:EAH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

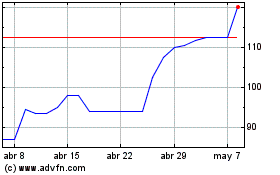

Eco Animal Health (LSE:EAH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024