Ecofin US Renewables Infrastr.Trust Wind Acquisition Commitment (9305P)

22 Octubre 2021 - 1:00AM

UK Regulatory

TIDMRNEW

RNS Number : 9305P

Ecofin US Renewables Infrastr.Trust

22 October 2021

21 October 2021

ECOFIN U.S. RENEWABLES INFRASTRUCTURE TRUST PLC

Wind Acquisition Commitment

The Board of Ecofin U.S. Renewables Infrastructure Trust PLC

("RNEW" or the "Company") is pleased to announce the contractual

commitment of the following $49.0 million acquisition, which will

be funded by a combination of the remaining net proceeds from the

IPO and from the newly established Revolving Credit Facility. The

closing of this transaction will fully deploy the Company's IPO

proceeds and satisfy RNEW's diversification objective for wind

energy.

$49.0 million commitment to the acquisition of a 60 MW operating

wind asset ("Whirlwind")

Whirlwind is a proven operating wind asset, placed in service in

December 2007, using 26 Siemens 2.3 MW wind turbine generators with

operations and maintenance performed by Siemens Gamesa under a

long-term service and maintenance agreement. It benefits from a

fixed-price power purchase agreement with an investment grade

electric utility with over 6 years remaining on the initial

contract term, providing predictable cash flow. Whirlwind is

located in Texas, which is experiencing sustained growth in

electricity demand due to population growth and corporations

migrating to this business friendly state. With electricity prices

linked to natural gas prices, which have been rising, these factors

provide a good backdrop for recontracting in the future and

potential for inflation protection.

With the inclusion of Whirlwind, RNEW's portfolio will have a

weighted average remaining revenue contract term of approximately

17 years. It will provide additional diversification to RNEW's

existing solar portfolio in terms of technology, its proven wind

resource, and location in the central U.S. Moreover, Whirlwind is

expected to add incremental distributable cash flow to RNEW

immediately. The acquisition of Whirlwind is expected to close

before the end of October once its existing project lender has

released its liens concurrent with the debt being fully repaid as

part of the acquisition.

For further information, please contact:

Ecofin Advisors, LLC (Investment Manager)

Jerry Polacek

Matthew Ordway

Prashanth Prakash +1 913 981 1020

Stifel (Corporate Broker)

Mark Bloomfield

Nick Donovan +44 207 710 7600

FTI Consulting (Financial PR)

Matthew O'Keeffe

Mitch Barltrop

Vee Montebello +44 797 607 5797

Further information on the Company can be found on its website

at

https://uk.ecofininvest.com/funds/us-renewables-infrastructure-trust-plc/

.

The Company's LEI is 2138004JUQUL9VKQWD21.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQDZMZGKZFGMZG

(END) Dow Jones Newswires

October 22, 2021 02:00 ET (06:00 GMT)

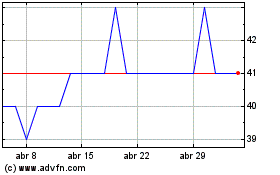

Ecofin U.s. Renewables I... (LSE:RNEP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

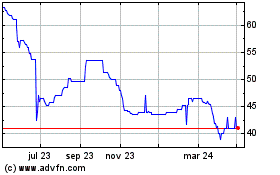

Ecofin U.s. Renewables I... (LSE:RNEP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024