TIDMEDL

RNS Number : 1276N

Edenville Energy PLC

28 September 2021

28 September 2021

EDENVILLE ENERGY PLC

("Edenville" or the "Company")

Interim Results for the six months to 30 June 2021

Edenville Energy plc (AIM: EDL), the company developing a coal

project in southwest Tanzania, announces the Company's unaudited

interim results for the six months ended 30 June 2021 (the

"Period").

Highlights

- The Period has seen a significant positive change in prospects

for the Company.

- On 15 January 2021, the Company announced that it had raised

GBP900,000 (before expenses) by way of a placing of 3,600,000

new ordinary shares at a placing price of 25p per ordinary

share with new and existing shareholders.

- On 15 January 2021, the Company announced that it had reached

agreement with Lind Partners LLC ("Lind") regarding its outstanding

funding agreement and, on 22 June 2021, the Company announced

that it had repaid in cash the full outstanding amount owed

to Lind.

- On 5 May 2021, the Company raised GBP2,475,000 (before expenses)

by way of a placing of 9,900,000 new ordinary shares at a

placing price of 25p per ordinary share. Investors also received

one warrant for every placing share. If these warrants are

exercised in full the Company will receive a further GBP2,475,000

for the development of the Company's business.

- As part of the fund raising in May 2021, a new strategic

investor, Anthony (Tony) Buckingham, took an 18.5% stake

in the Company through an investment of GBP1 million, with

the majority of the balance of the funds raised coming from

the Company's substantial shareholders. Mr Buckingham is

well known in the natural resources market, particularly

in Africa, having been CEO and major shareholder of Heritage

Oil Limited from 2006 until its acquisition by a wholly-owned

subsidiary of Qatari investment fund, Al Mirqab Capital SPC,

in 2014 for a consideration of US$1.6 billion. His wealth

of experience and broad network of relationships is expected

to prove highly beneficial as Edenville looks to add additional

assets into the Company.

- The period saw a significant increase in coal prices globally,

with this trend continuing post period also. This has led

to renewed interest in the supply of coal from the Company's

flagship Rukwa project.

- With an improved cash position, the Company is targeting

additional asset acquisitions, leveraging the natural resources

and capital markets expertise of its Board and significant

shareholders.

- Post period end Franco Caselli was appointed as a Non-executive

Director of the Company to assist with its future development.

For further information please contact:

Edenville Energy Plc

Jeff Malaihollo - Chairman

Alistair Muir - CEO +44 (0) 20 3934 6630

Strand Hanson Limited

(Financial and Nominated Adviser)

James Harris

Rory Murphy +44 (0) 02 7409 3494

Brandon Hill Capital Ltd

(Broker)

Oliver Stansfield

Jonathan Evans +44 (0) 20 7936 5200

IFC Advisory Limited

(Financial PR and IR)

Tim Metcalfe

Florence Chandler +44 (0) 20 3934 6630

CEO's report

The reporting period has been characterised by a significant

positive change in prospects for the Company, both with regard to

its existing Rukwa coal project in Tanzania and more widely as with

an improved cash position, the Company targets additional asset

acquisitions, leveraging the natural resources and capital markets

expertise of its Board and significant shareholders.

As the Company has previously reported, following the induction

of the new President in Tanzania there has been considerable

positive sentiment in the country, which appears to be translating

into business confidence and action. In addition, the increase in

the steaming coal price, which has more than doubled over the past

12 months, to its current level of in excess of US$155 per tonne

(September 2021) price for South African Richards Bay FOB), is

bringing Rukwa production into focus, particularly from potential

customers in other East African states.

Rukwa Operations

- The early part of the reporting period was characterised by

ongoing problems related to the Covid-19 pandemic.

- Post period end in August 2021 the Company received an order

of up to a possible 3,500 tonnes per month of washed coal and it is

expected that this will result in an average monthly delivery of at

least 2,000 tonnes per month. It has an additional, ongoing order

of 600 tonnes per month of washed coal to one of its anchor

tenants.

- Whilst efforts have been focused on short term contract

opportunities, there is strong interest in coal purchases coming

from other parts of East Africa and the Congo and the Company is

working to secure a number of significant long term contracts that

have an immediate demand for coal supply. In addition, discussions

are being held with the Tanzanian Government on power station

supply options.

Funding

- On 15 January 2021, the Company announced that it had raised

GBP900,000 (before expenses) by way of a placing of 3,600,000 new

ordinary shares at a placing price of 25p per ordinary share with

new and existing shareholders

- On 5 May 2021, the Company raised GBP2,475,000 (before

expenses) by way of a placing of 9,900,000 new ordinary shares at a

placing price of 25p per ordinary share. Investors also received

one warrant for every placing share. If these warrants are

exercised in full the Company will receive a further GBP2,475,000

for the development of the Company's business.

- As part of the fund raising in May 2021, a new strategic

investor, Anthony (Tony) Buckingham, took an 18.5% stake in the

Company through an investment of GBP1 million, with the majority of

the balance of the funds raised coming from the Company's

substantial shareholders. Mr Buckingham is well known in the

natural resources market, particularly in Africa, having been CEO

and major shareholder of Heritage Oil Limited from 2006 until its

acquisition by a wholly-owned subsidiary of Qatari investment fund,

Al Mirqab Capital SPC, in 2014 for a consideration of US$1.6

billion. His wealth of experience and broad network of

relationships is expected to prove highly beneficial as Edenville

looks to add additional assets into the Company.

Lind Partners

- On 15 January 2021, the Company announced that it had reached

agreement with Lind Partners LLC ("Lind") regarding its outstanding

funding agreement and o n 22 June 2021, the Company announced that

it had repaid in cash the full outstanding amount owed to Lind.

To the Future

- With an improved cash position, the Company is targeting

additional asset acquisitions, leveraging the natural resources and

capital markets expertise of its Board, and significant

shareholders.

Board Changes

- Post period end Franco Caselli was appointed as a

Non-executive Director of the Company to assist with its future

development.

- In June 2021 Alistair Muir returned to the position of CEO and

Jeff Malaihollo soley to the position of Non-executive

Chairman.

Financial Results

For the six month period ended 30 June 2021 the Company had

revenue of GBP27,752 (H1 2020: GBP16,003).

The Group made a loss after taxation of GBP587,354 (H1 2020 loss

of GBP638,198). The net assets at 30 June 2021

amounted to GBP7,842,563 (30 June 2020 GBP6,549,050).

The total comprehensive loss for the period was GBP513,497 (H1

2020 loss of GBP172,744) which included a gain of GBP73,857 arising

from the translation of the Tanzanian subsidiary accounts from US

Dollars to Sterling.

Alistair Muir

Chief Executive Officer

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months Six months Year

ended ended ended

30 June 30 June 31 Dec

21 20 20

Unaudited Unaudited Audited

As restated

Note GBP GBP GBP

Revenue 27,752 16,003 33,852

Cost of sales (280,320) (250,856) (583,876)

Gross loss (252,568) (234,853) (550,024)

Administrative expenses (332,209) (284,330) (529,632)

Share based payments - (50,398) (50,398)

Group operating loss (584,777) (569,581) (1,130,054)

Finance income 12 52 112

Finance costs (2,589) (68,669) (111,503)

Loss on operations before taxation (587,354) (638,198) (1,241,445)

Taxation - - -

Loss for the period after taxation (587,354) (638,198) (1,241,445)

Other comprehensive income/(loss):

Gain/(loss) on translation of

overseas subsidiary 73,857 465,454 (203,935)

Total comprehensive loss for

the period (513,497) (172,744) (1,445,380)

Attributable to:

Equity holders of the Company (512,683) (171,948) (1,443,488)

Non-controlling interest (814) (797) (1,892)

(513,497) (172,744) (1,445,380)

Loss per share

- basic and diluted (pence) 2 (4.43) (9.43) (16.66)

The income for the period arises from the Group's continuing

operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 30 June 2021

As at As at As at

30 June 30 June 31 Dec

21 20 20

Unaudited Unaudited Audited

As restated

Note GBP GBP GBP

Non-current assets

Property, plant and equipment 4 5,466,165 6,429,954 5,644,577

Intangible assets 5 307,080 343,496 311,032

5,773,245 6,773,450 5,955,609

Current assets

Inventories 248,864 264,583 251,736

Trade and other receivables 429,672 428,893 301,251

Cash and cash equivalents 1,873,072 301,535 25,690

2,551,608 995,011 578,677

Current liabilities

Trade and other payables (419,825) (699,826) (685,809)

Borrowings (16,094) (461,051) (440,831)

(435,919) (1,160,877) (1,126,640)

Current assets less current

liabilities 2,115,689 (165,866) (547,963)

Total assets less current liabilities 7,888,934 6,607,584 5,407,646

Non - current liabilities

Borrowings (23,517) (35,534) (39,873)

Environmental rehabilitation

liability (22,854) (23,000) (21,912)

7,842,563 6,549,050 5,345,861

Capital and reserves

Called-up share capital 6 4,176,601 4,024,935 4,041,601

Share premium account 22,373,442 19,357,514 19,390,849

Share based payment reserve 341,522 355,277 301,174

Foreign currency translation

reserve 420,273 1,163,549 494,130

Retained earnings (19,453,531) (18,336,955) (18,866,991)

Issued capital and reserves

attributable to owners of the

parent company 7,858,307 6,564,320 5,360,763

Non-controlling interest (15,744) (15,270) (14,902)

Total equity 7,842,563 6,549,050 5,345,861

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

----------------------------------Equity

Interests--------------------------------

Foreign

Share currency Non-

Share Share Retained option translation Controlling

capital premium Earnings reserve reserve Total interest Total

GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January

2021 4,041,601 19,390,849 (18,866,991) 301,174 494,130 5,360,763 (14,902) 5,345,861

Issue of share

capital 135,000 3,240,000 - - - 3,375,000 - 3,375,000

Share issue costs - (217,059) - - - (217,059) - (217,059)

Foreign currency

translation - - - - (73,857) (73,857) (28) (73,885)

Share based

payment

charge - (40,348) - 40,348 - - - -

Loss for the

period - - (586,540) - - (586,540) (814) (587,354)

Balance at 30 June

2021 4,176,601 22,373,442 (19,453,531) 341,522 420,273 7,858,307 (15,744) 7,842,563

z

Foreign

Share currency Non-

Share Share Retained option translation Controlling

capital premium Earnings reserve reserve Total interest Total

GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January

2020 3,414,935 18,811,157 (17,736,330) 281,502 698,095 5,469,359 (13,517) 5,455,842

Issue of share

capital 610,000 615,000 - - - 1,225,000 - 1,225,000

Share issue costs - (68,643) - 8,643 (60,000) - (60,000)

Share based

payment

charge - - - 101,938 - 101,938 - 101,938

Lapse/cancelation

of share options - - 36,806 (36,806) - - - -

Foreign currency

translation - - - - 446,504 446,504 (986) 445,518

Loss for the

period - - (625,631) - - (625,631) (767) (626,398)

Balance at 30 June

2020 (as

previously

stated) 4,024,935 19,357,514 (18,325,155) 355,277 1,144,599 6,557,170 (15,270) 6,541,900

Restatement - - (11,800) - 18,950 7,150 - 7,150

Balance at 30 June

2020 (as

restated) 4,024,935 19,357,514 (18,336,955) 355,277 1,163,549 6,564,320 (15,270) 6,549,050

=========== =========== ============= =========== ============== ============ ============= ============

Foreign

Share currency Non-

Share Share Retained option translation Controlling

capital premium Earnings reserve reserve Total interest Total

GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January

2020 3,414,935 18,811,157 (17,718,347) 281,502 698,065 5,487,312 (13,517) 5,473,795

Issue of share

capital 626,666 648,334 - - - 1,275,000 - 1,275,000

Share issue costs - (68,642) - - - (68,642) - (68,642)

Share

options/warrants

charge - - - 110,581 - 110,581 - 110,581

Cancellation of

share

options - - 90,909 (90,909) - - - -

Foreign currency

translation - - - - (203,935) (203,935) - (203,935)

Loss for the year - - (1,239,553) - - (1,239,553) (1,892) (1,241,445)

Non-controlling

interest

share of goodwill - - - - - - 507 507

Balance at 31

December

2020 4,041,601 19,390,849 (18,866,991) 301,174 494,130 5,360,763 (14,902) 5,345,861

consolidated CASH FLOW STATEMENT

Six months Six months Year

ended ended ended

30 June 30 June 31 Dec

21 20 20

Unaudited Unaudited Audited

As restated

GBP GBP GBP

Cash flows from operating activities

Operating loss (584,777) (569,581) (1,130,054)

Depreciation 113,420 92,129 277,921

Interest paid - (57) (351)

Share based payments - 50,398 50,398

Increase in inventories - (17,045) (4,198)

(Decrease)/increase in trade and

other receivables (169,082) (41,534) 54,984

Increase in trade and other payables (222,450) (149,557) (116,836)

Foreign exchange (loss)/gain (4,597) 51,080 (34,521)

Net cash used in operating activities (867,486) (584,167) (902,657)

Cash flows from investing activities

Finance income 12 52 112

Net cash used in investing activities 12 52 112

Cash flows from financing activities

Borrowings - 180,000 180,000

Repayment of convertible loan

notes (432,226) (122,809) (160,421)

Repayment of lease liabilities (8,267) (11,650) (17,404)

Lease interest (2,589) (41,207) (5,059)

Proceeds on issue of ordinary

shares 3,375,000 900,000 950,000

Share issue costs (217,059) (60,000) (60,000)

Net cash generated from financing

activities 2,714,859 844,334 887,116

Net decrease in cash and cash

equivalents 1,847,385 260,219 (15,429)

Cash and cash equivalents at beginning

of year 25,690 41,110 41,110

Exchange losses on cash and cash

equivalents (3) 206 9

Cash and cash equivalents at end

of year 1,873,072 301,535 25,690

NOTES TO THE INTERIM REPORT

1. Financial information and basis of preparation

The interim financial statements of Edenville Energy Plc are

unaudited consolidated financial statements for the six months

ended 30 June 2021 which have been prepared in accordance with UK

adopted international accounting standards. They include unaudited

comparatives for the six months ended 30 June 2020 together with

audited comparatives for the year ended 31 December 2020.

The interim financial statements do not constitute statutory

accounts within the meaning of section 434 of the Companies Act

2006. The statutory accounts for the year ended 31 December 2020

have been reported on by the company's auditors and have been filed

with the Registrar of Companies. The report of the auditors

contained an Emphasis of mater paragraph on the recoverability of

VAT in Tanzania and on the recoverability of inventory. Aside from

the Emphasis of matter paragraphs above, the auditor's report did

not contain any statement under section 498 of the Companies Act

2006.

The interim consolidated financial statements for the six months

ended 30 June 2021 have been prepared on the basis of accounting

policies expected to be adopted for the year ended 31 December

2021. These are anticipated to be consistent with those set out in

the Group's latest financial statements for the year ended 31

December 2020. These accounting policies are drawn up in accordance

with adopted International Accounting Standards ("IAS") and

International Financial Reporting Standards ("IFRS") as issued by

the International Accounting Standards Board.

2. Loss per share

The calculation of the basic and diluted loss per share is based

on the following data:

30 June 21 30 June 20 31 December

20

GBP GBP GBP

As restated As restated

Loss after taxation (587,354) (638,198) (1,241,445)

Weighted average number

of shares in the period 13,270,575 6,768,595 7,452,470

Basic and diluted loss

per share (pence) (4.43) (9.43) (16.66)

The loss attributable to equity shareholders and weighted

average number of ordinary shares for the purposes of calculating

diluted earnings per ordinary share are identical to those used for

basic earnings per ordinary share. This is because the exercise of

share options and warrants would have the effect of reducing the

loss per ordinary share and is therefore anti-dilutive.

The earnings per share as at 30 June 2020 and 31 December 2020

have been restated to reflect the consolidation of shares that took

place in January 2021.

3. Dividends

No dividends are proposed for the six months ended 30 June 2021

(six months ended 30 June 2020: GBPnil, year ended 31 December

2020: GBPnil).

4. Property, plant and equipment

Coal Production Plant & Fixtures Motor vehicles

assets machinery & fittings Total

GBP GBP GBP GBP GBP

Cost or valuation

As at 1 January

2021 5,164,384 1,186,781 7,153 191,390 6,549,708

Foreign exchange

adjustment (58,917) (16,770) 318 (1,993) (77,362)

At 30 June 2021 5,105,467 1,170,011 7,471 189,397 6,472,346

Accumulated depreciation

As at 1 January

2021 106,209 678,472 6,958 113,494 905,133

Depletion/Charge

for the year - 103,800 44 9,576 113,420

Foreign exchange

adjustment (1,212) (10,260) 162 (1,062) (12,372)

At 30 June 2021 104,997 772,012 7,164 122,008 1,006,181

Net book value

As at 30 June 2021 5,000,470 397,999 307 67,389 5,466,165

Coal Production Plant & Fixtures Motor vehicles

assets machinery & fittings Total

GBP GBP GBP GBP GBP

Cost or valuation

As at 1 January

2020 5,317,637 1,225,972 7,253 197,196 6,748,058

Additions 19,640 - - - 19,640

Foreign exchange

adjustment 366,154 83,902 213 12,428 462,697

At 30 June 2020 5,703,431 1,309,874 7,466 209,624 7,230,395

Accumulated depreciation

As at 1 January

2020 83,342 482,401 6,990 89,922 662,655

Depletion/Charge

for the year - 78,000 43 14,086 92,129

Foreign exchange

adjustment 5,738 34,313 213 5,391 45,655

At 30 June 2020 89,080 594,714 7,246 109,399 800,439

Net book value

As at 30 June 2020 5,614,351 715,160 220 100,225 6,429,956

4. Property, plant and equipment (continued)

Coal Production Plant & Fixtures Motor vehicles

assets machinery & fittings Total

GBP GBP GBP GBP GBP

Cost or valuation

As at 1 January

2020 5,317,637 1,225,972 7,253 197,196 6,748,058

Additions 17,788 - - - 17,788

Foreign exchange

adjustment (171,033) (39,191) (100) (5,806) (216,130)

At 31 December 2020 5,164,392 1,186,781 7,153 191,390 6,549,716

Accumulated depreciation

As at 1 January

2020 83,342 482,401 6,990 89,925 662,658

Depletion/Charge

for the year 25,547 224,719 65 27,590 277,921

Foreign exchange

adjustment (2,674) (28,648) (97) (4,021) (35,440)

At 31 December 2020 106,215 678,472 6,958 113,494 905,139

Net book value

As at 31 December

2020 5,058,177 508,309 195 77,896 5,644,577

5. Intangible assets

Mining Licences Total

GBP GBP

Cost or valuation

As at 1 January 2021 1,470,833 1,470,833

Foreign exchange

adjustment (17,185) (17,185)

At 30 June 2021 1,453,648 1,453,648

Accumulated amortisation

and impairment

As at 1 January 2021 1,159,801 1,159,801

Foreign exchange

adjustment ( 13,233) (13,233)

At 30 June 2021 1,146,568 1,146,568

Net book value

As at 30 June 2021 307,080 307,080

5. Intangible assets (continued)

Mining Licences Total

GBP GBP

Cost or valuation

As at 1 January 2020 1,519,712 1,519,712

Foreign exchange adjustment 104,642 104,642

At 30 June 2020 1,624,354 1,624,354

Accumulated amortisation

and impairment

As at 1 January 2020 1,198,344 1,198,344

Foreign exchange adjustment 82,514 82,514

At 30 June 2020 1,280,858 1,280,858

Net book value

As at 30 June 2020 343,496 343,496

Mining Licences Total

GBP GBP

Cost or valuation

As at 1 January 2020 1,519,712 1,519,712

Foreign exchange adjustment (48,879) (48,879)

At 31 December 2020 1,470,833 1,470,833

Accumulated amortisation

and impairment

As at 1 January 2020 1,198,344 1,198,344

Foreign exchange adjustment (38,543) (38,543)

At 31 December 2020 1,159,801 1,159,801

Net book value

As at 31 December 2020 311,032 311,032

6. Share capital

No No GBP No GBP GBP

Ordinary Ordinary Ordinary Deferred Deferred Total share

shares shares of shares shares of shares capital

of 1p 0.02p each of 0.02p/1p 0.001p each of 0.001p

each each each

Issued and

fully paid

At 1 January

2021 - 8,145,575,094 1,629,116 241,248,512,346 2,412,485 4,041,601

On 5 January

the company

consolidated

and then subdivided

the brought

forward shares* 8,145,575 (8,145,575,094) (1,547,659) 154,765,925,000 1,547,659 -

On 21 January

the company

issued 3,600,000

1p shares at

0.25p 3,600,000 - 36,000 - - 36,000

On 26 May the

company issued

9,900,000 1p

shares at 0.25p 9,900,000 - 99,000 - - 99,000

As at 30 June

2021 21,645,575 - 216,457 396,014,437,346 3,960,144 4,176,601

============ ================ ============= ================ =========== ============

*On 5 January 2021 the Company reduced the number of issued

ordinary shares of GBP0.0002 each in the Company by a multiple of

1,000 (the "Consolidation"), Following the Consolidation the

Company sub-divided each consolidated ordinary share of GBP0.20

each in the capital of the Company, into 1 ordinary share of

GBP0.01 each in the capital of the Company and 19,000 new deferred

shares of GBP0.00001 each in the capital of the Company.

No GBP No GBP GBP

Ordinary shares Ordinary Deferred Deferred Total

of 0.02p each shares shares of shares share

of 0.02p 0.001p each of 0.001p capital

each each

Issued and fully

paid

At 1 January 2020 5,012,241,761 1,002,450 241,248,512,346 2,412,485 3,414,935

On 9 January the

company issued 50,000,000

shares at 0.05p 50,000,000 10,000 - - 10,000

On 21 January 2020

the company issued

1,750,000,000 shares

at 0.04p 1,750,000,000 350,000 - - 350,000

On 8 June 2020 the

company issued 1,250,000,000

shares at 0.4p 1,250,000,000 250,000 - - 250,000

As at 30 June 2020 8,062,241,761 1,612,450 241,248,512,346 2,412,485 4,024,935

================ ========== ================ =========== ==========

6. Share capital (continued)

No GBP No GBP GBP

Ordinary shares Ordinary Deferred Deferred Total

of 0.02p each shares shares of shares share

of 0.02p 0.001p each of 0.001p capital

each each

Issued and fully

paid

At 1 January 2020 5,012,241,761 1,002,450 241,248,512,346 2,412,485 3,414,935

On 9 January the

company issued 50,000,000

shares at 0.05p 50,000,000 10,000 - - 10,000

On 21 January 2020

the company issued

1,750,000,000 shares

at 0.04p 1,750,000,000 350,000 - - 350,000

On 8 June 2020 the

company issued 1,250,000,000

shares at 0.4p 1,250,000,000 250,000 - - 250,000

On 14 August 2020

the company issued

83,333,333 shares

at 0.06p 83,333,333 16,666 - - 16,666

As at 31 December

2020 8,145,575,094 1,629,116 241,248,512,346 2,412,485 4,041,601

================ ========== ================ =========== ==========

7. Prior year adjustment

Edenville Energy Plc have identified an error relating to mining

licences capitalised under IFRS 16 in the prior year, which fall

outside the scope of the standard. As a result of the error, the

financial statements for the period ended 30 June 2020 had to be

restated. Items previously incorrectly capitalised as Right of use

assets and lease liabilities have all been reversed.

8. Distribution of interim report to shareholders

The interim report will be available for inspection by the

public at the registered office of the company during normal

business hours on any weekday and from the Company's website

http://www.edenville-energy.com/ . Further copies are available on

request.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDCDXDDGBR

(END) Dow Jones Newswires

September 28, 2021 01:59 ET (05:59 GMT)

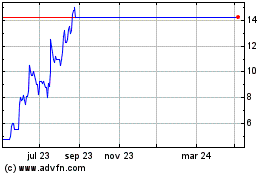

Edenville Energy (LSE:EDL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Edenville Energy (LSE:EDL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024