TIDMEWI

RNS Number : 1982V

Edinburgh Worldwide Inv Trust PLC

10 December 2021

RNS Announcement: Results

Edinburgh Worldwide Investment Trust plc

========================================

Legal Entity Identifier: 213800JUA8RKIDDLH380

Regulated Information Classification: Additional regulated

information required to be disclosed under the applicable laws.

The following is the results announcement for the year to 31

October 2021 which was approved by the Board on 9 December

2021.

Results for the year to 31 October 2021

3/4 Over the year to 31 October 2021 the Company's net asset value per share, cum income

with debt at fair value, increased by 18.3% and the share price by 11.1%. The comparative

index, the S&P Global Small Cap Index* total return, increased by 35.9% in sterling terms.

3/4 A number of the Company's holdings contributed to the positive performance, notably:

Tesla, an electric car, autonomous driving and solar energy company, Codexis, an industrial

and pharmaceutical enzyme developer, Upwork, an online freelancing and recruitment services

platform and unlisted PsiQuantum, a developer of commercial quantum computing. In addition,

the formerly private company QuantumScape, a developer of solid state lithium metal batteries

for electric cars, and Oxford Nanopore, a DNA sequencer, both of which listed during the year.

3/4 The Company's portfolio has been managed with a focus on the opportunity set lower down

the market capitalisation spectrum since the end of January 2014. It is pleasing to note the

280.7% growth in the NAV since then is significantly ahead of the 149.9% achieved by the comparative

index.

3/4 No final dividend is being paid. Should the level of underlying income increase in future

years, the Board will seek to distribute the minimum permissible to maintain investment trust

status as the Company's objective remains that of generating capital growth.

3/4 Over the course of the financial year, the Company issued over 50.9 million new shares

at a premium to its NAV, raising net proceeds of GBP182.2 million.

3/4 As at the financial year end, the Company held twelve unlisted investments accounting

for 10.8% of total assets (2020 - 5.8% of total assets in nine holdings). As part of this

year's Annual General Meeting business, shareholder authority is being sought to increase

the permitted investment in unlisted investments from the current 15% to a proposed 25% of

total assets, as measured at the time of initial investment.

(*) Source: Refinitiv and relevant underlying index providers.

See disclaimer at the end of this announcement .

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this announcement.

Edinburgh Worldwide's objective is the achievement of long term

capital growth by investing primarily in listed companies

throughout the world. The Trust has total assets of GBP1,407.5

million (before deduction of loans of GBP66.2 million) as at 31

October 2021.

Edinburgh Worldwide is managed by Baillie Gifford & Co

Limited, the Edinburgh based fund management group with over GBP330

billion under management and advice as at 9 December 2021.

Past performance is not a guide to future performance.

The value of an investment and any income from it is not

guaranteed and may go down as well as up and investors may not get

back the amount invested. This is because the share price is

determined by the changing conditions in the relevant stock markets

in which the Company invests and by the supply and demand for the

Company's shares. Investment in investment trusts should be

regarded as medium to long-term. You can find up to date

performance information about Edinburgh Worldwide on the Edinburgh

Worldwide page of the Managers' website at edinburghworldwide.co.uk

++

++ Neither the contents of the Managers' website nor the

contents of any website accessible from hyperlinks on the Managers'

website (or any other website) is incorporated into, or forms part

of, this announcement.

10 December 2021

For further information please contact:

Anzelm Cydzik, Baillie Gifford & Co Mark Knight, Director, Four Communications

Tel: 0131 275 2000 Tel: 0203 697 4200 or 07803 75

Chairman's Statement

====================

Performance

In the year to 31 October 2021, the Company's net asset

value('NAV') per share, when calculated by deducting borrowings at

fair value, increased by 18.3% and the share price by 11.1%, both

in total return terms. The comparative index, the S&P Global

Small Cap Index * total return, increased by 35.9% in sterling

terms during this period. The Company finished the year with a

market capitalisation of GBP1,294.6 million and total assets of

GBP1,407.5 million. Over the course of the financial year the share

price averaged a 0.7% premium to net assets, with borrowings

deducted at fair value. Portfolio turnover was 9.1% compared to

8.4% for the Company's financial year to 31 October 2020 and the

ongoing charge has reduced to 0.66% from 0.72%. The Company's

portfolio has been managed with a focus on the opportunity set

lower down the market capitalisation spectrum since the end of

January 2014. It is pleasing to note the 280.7% growth in the NAV

since then is significantly ahead of the 149.9% achieved by the

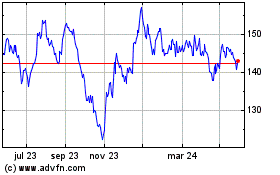

comparative index. The chart below shows the distribution of

returns for all the stocks held within the portfolio since 31

January 2014; each bar representing the return of each stock whilst

held in the portfolio. This cumulative period holding analysis

shows the broad distribution of returns achieved by the holdings

from time of initial purchase to 31 October 2021 or the date in

which the holding was fully sold from the portfolio.

Asymmetry of Returns

Whilst it is understandably disappointing to report relative

underperformance for the year to 31 October 2021, this should be

set in the context of positive absolute returns and this being the

first financial year of relative NAV underperformance since the

financial year to 31 October 2016. Over the year, the top

contributors to relative and absolute performance included Tesla,

an electric car, autonomous driving and solar energy company,

Codexis, an industrial and pharmaceutical enzyme developer, Upwork,

an online freelancing and recruitment services platform and

unlisted PsiQuantum, a developer of commercial quantum computing.

In addition, the formerly private company QuantumScape, a developer

of solid state lithium metal batteries for electric cars, and

Oxford Nanopore, a DNA sequencer, both of which listed during the

year. The top detractors to relative and absolute performance over

the year are names that rank amongst the top contributors to

performance over five years: LendingTree, an online consumer

finance marketplace, MarketAxess, an electronic bond trading

platform, and Ocado, an online grocery retailer and technology

provider.

Share Buybacks, Treasury and Issuance

The Company will once again be seeking to renew its share

buyback, issuance and treasury share authorities. The buyback

facility is sought to allow the Company to buy back its own shares

when the discount is substantial in absolute terms and relative to

its peers. Issuance, either from treasury or of new shares, will

only be undertaken at a premium to the prevailing NAV, with debt

calculated at par, in order to satisfy natural market demand.

Issuance at a premium enhances the NAV per share for existing

shareholders, dilutes ongoing costs and helps with the trading

liquidity of the shares of the Company.

Over the course of the last financial year, the Company issued

50.9 million new shares at a premium to its NAV, raising net

proceeds of GBP182.2 million and increasing the NAV per share by

0.32%. This equates to 14.4% of the issued share capital at the

start of the year. Growth in assets along with the Company's tiered

management fee has contributed to the reduction in the Company's

ongoing charges for the year.

Unlisted Investments

The Managers have shareholder authority to invest up to 15% of

the Company's total assets, at the time of initial investment, in

unlisted investments. As at the Company's year end, the portfolio

weighting in private companies stood at 10.8% of total assets,

invested in twelve companies (2020 - 5.8% of total assets in nine

companies). Six new private company investments were made during

the year: Relativity Space, a 3D printing and aerospace launch

company, QuantumScape which has now listed, Astranis Space

Technologies, a geostationary communications satellite operator and

manufacturer, Shine Technologies (Illuminated Holdings), producer

of medical radioscopes, Snyk, a software security developer, and

Lightning Labs, a money transfer software developer.

At the Company's Annual General meeting ('AGM') held on 23

January 2019, shareholders approved an increase in the permissible

limit of investment in unlisted investments from 5% to 15% of total

assets at the time of initial investment. As part of the 2 February

2022 AGM business, the Board is seeking shareholder approval to

increase this authority to 25% as the Board and Managers are of the

view that private companies are becoming an increasingly relevant

part of the Company's objective; to invest in a global portfolio of

initially immature entrepreneurial companies, typically with a

market capitalisation of less than US$5 billion at the time of

initial investment, which are believed to offer long-term growth

potential.

Accelerating improvements in technology are reducing the capital

and time needed for young businesses to both experiment with and

scale their product offerings. For many new entrepreneurs this is

delaying the need for a public fundraising or resulting in some

really exceptional companies entering the stock market when they

are larger and more mature, and the rising availability of private

capital is serving to compound this shift. In 2006, 18 private

companies globally had valuations of over US$500 million with an

aggregate value of US$18 billion. As of the end of 2020 there were

923 companies with valuations of over US$500 million, and an

aggregate value of US$2.2 trillion. This makes this market

approximately the same size as the S&P MidCap 400 index. As at

31 October 2021, Baillie Gifford had GBP4 billion invested in 73

private companies across 14 countries.

Given the potential for this to be an increasingly valuable

source of investment ideas for Edinburgh Worldwide and Baillie

Gifford's growing capability to deploy capital here, the Board

would like the Managers to have flexibility to invest a greater

portion of the Company's assets in private companies as suitable

opportunities arise. This would allow better scope for long term

asymmetry to play out within existing private holdings without

limiting the Managers' ability to invest opportunistically in new

ideas in the future. The number of private holdings is expected to

continue increasing gradually whilst several more businesses will

also undertake public listings in the fullness of time, as has been

the case to date with, for example, Oxford Nanopore, QuantumScape

and Spire Global this year.

Over the last seven years, Edinburgh Worldwide has invested in

eighteen private companies and the weighting has risen from 0% to a

little under 11% of the Company's assets as at 31 October 2021.

Depending on the outcome of the shareholder vote, and in due course

reflecting on future investor sentiment at the time towards private

companies and the investable opportunity set, and the performance

being generated from such holdings, the Board will keep the matter

of the weighting to unlisted investments under review.

Borrowings

The extent and range of equity gearing is discussed by the Board

and Managers at each Board meeting. Both parties agree that the

Company should typically be geared to equities to maximise

potential returns, with the current aspirational parameters set at

+5% to +15% of shareholders' funds. Over the year, the invested

equity gearing ranged between -2.7% and +2.6%, and stood at +2.5%

of shareholders' funds at the financial year end (2020 -

+0.9%).

During the period, the Company entered into a new five year

GBP100 million multi-currency revolving credit facility, with The

Royal Bank of Scotland International Limited, with an expiry date

of 9 June 2026. This facility is in addition to the existing five

year GBP25 million multi-currency revolving credit facility, with

National Australia Bank Limited, with an expiry date of 29 June

2023 and the five year GBP36 million multi-currency revolving

credit facility, with National Australia Bank Limited, with an

expiry date of 30 September 2024. As at 31 October 2021, the

Company had drawings of EUR7,200,000, US$53,150,000 and

GBP21,300,000.

Earnings and Dividend

The Company's objective is that of generating capital growth and

investors should not expect any income from this investment. This

year the net revenue return per share was a negative 0.62p (2020 -

negative 0.46p per share). As the revenue account is running at a

deficit, no final dividend is being recommended by the Board.

Should the level of underlying income increase in future years, the

Board will seek to distribute to shareholders the minimum

permissible to maintain investment trust status by way of a final

dividend.

Board Composition and Ceiling on Aggregate Remuneration

During the course of the year, Mr William Ducas retired from the

Board. I would like to place on record my and the Board's thanks

for his contribution to Company discussions and his pragmatic

advice and guidance. There are no changes expected in Board

composition over the coming year although Mr Donald Cameron has

highlighted to colleagues that he is unlikely to stand for

re-election at the Company's 2023 AGM .

The current aggregate remuneration ceiling for Directors' fees

is set at GBP200,000 per annum. Based on the level of aggregate

remuneration expected to be paid for the financial year ending 31

October 2022 (GBP182,500 - being GBP40,500 for the Chairman,

GBP27,000 for each Director, an additional GBP6,000 for the

Chairman of the Audit and Management Engagement Committee and an

additional GBP1,000 for the Senior Independent Director), should

the Board wish to appoint a new Director the aggregate fees would

likely exceed the current authorised limit. Accordingly, it is

proposed that, pursuant to Resolution 14, as set out in the Notice

of Annual General Meeting, the maximum permissible aggregate amount

of fees payable to the Directors be increased to GBP250,000 per

annum in aggregate.

Investment Outlook

Markets continued to rise notably until the tail end of the

first quarter of 2021 and subsequently declined due in part to

concerns regarding future inflation and dislocated supply, largely

as a result of Covid-19 and the measures put in place to curb its

impact on businesses. More recently, market sentiment has been

pushed and pulled by attempts at 'normality' against a backdrop of

new virus variants and a Chinese regulatory clampdown. However,

there are now signs that markets are becoming more fundamentals-led

rather than momentum driven.

As mentioned in the past, your portfolio managers continue to

direct their efforts to picking the best entrepreneurial, immature

growth companies that create and exploit investment opportunities,

and which exhibit excellent long-term growth prospects and the

potential for positive long term returns wherever they are listed

and whatever the macro backdrop. Whilst markets exhibit volatility,

the investment trust structure permits the portfolio managers and

discerning long-term investors to take positions in exciting,

dynamic and innovative companies for the long term.

An overview of the portfolio is provided on pages 13 and 15 of

the Annual Report and .Financial Statements.

Annual General Meeting

As part of the Company's AGM business, the Company is seeking to

update its Articles of Association, details of which can be found

on page 71 of the Annual Report and Financial Statements. The

principal proposed change regards the ability to hold hybrid AGMs,

permitting, in extremis circumstances such as those resulting from

Covid-19, shareholders to attend by electronic means as well as in

person. It is however intended that future meetings be physical

unless restrictions prohibiting this are in force at the time.

It is anticipated that the Company's next AGM will be held in

person and be held at Baillie Gifford's offices in Edinburgh at 12

noon on Wednesday 2 February 2022. The Managers will be presenting

and I and the Board look to see as many of you there as

possible.

Should the situation change, further information will be made

available through the Company's website at edinburghworldwide.co.uk

and the London Stock Exchange regulatory news service. Further

information, including the proposed resolutions and information on

the deadlines for submitting votes by proxy should you not be able

to attend, can be found on pages 68 to 70 of the Annual Report and

Financial Statements. Shareholders who hold shares

in their own name on the main register will be provided with a

Form of Proxy and there are also special arrangements for holders

of shares through the abrdn Investment Trusts Share Plan,

Individual Savings Account and Investment Plan for Children who are

provided with a Form of Direction. If you hold shares through a

share platform or other nominee, the Board would encourage you to

contact these organisations directly as soon as possible to arrange

for you to submit votes in advance of the AGM.

Henry CT Strutt

Chairman

9 December 2021

(*) Source: Refinitiv and relevant underlying index providers.

See disclaimer at the end of this announcement .

calculated by dividing the value of sales by the average of the

opening and closing value of the investment portfolio.

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this announcement.

Past performance is not a guide to future performance.

Managers' Review

================

What We Seek to Offer

Edinburgh Worldwide Investment Trust's philosophy is one where

we seek ambitious, problem-solving companies with what we believe

to be excellent long-term growth potential. By identifying

attractive growth companies earlier, we seek to benefit during the

most dynamic phase of a company's lifecycle and retain ownership of

successful companies as they grow and thrive. It's an approach that

requires patience, a long-term mindset and recognition that

progress in young companies rarely happens in a straight line. The

solutions that our holdings are working towards are not designed to

be transient or modestly incremental. Should they succeed the

likelihood is that they will embed themselves as key drivers of

their respective industries in the years that follow.

Our style of investing is one in which many of our ideas will

ultimately fail to live up to our lofty aspirations for them.

Rather than fret about this we view it as an inevitable outcome of

our bias towards immature companies with long-term potential.

Occasionally, that failure can be abrupt, with clear implications

for the viability of the business and the capital invested. For

others, it will be much less spectacular: a solid business emerges

with acceptable returns for investors but with nagging frustration

that the outcomes could have been much better. But some companies

(and it's the minority) will both surprise and delight: their

initial traction in opening new avenues for growth will likely make

our original hypothesis look rather feeble. This wide range of

outcomes is evident in the asymmetry of returns chart shown in the

Chairman's statement.

It's from this extreme dispersion of outcomes that we actively

desire long-term returns to be moulded. Sorting the deep winners

from the losers and the also-rans takes both time and patience. The

differentiating factors that drive that outcome will most likely be

formed within the individual companies themselves, refined further

by their operating environment and lastly polished through the

actions of their shareholders. Attempting to take the readout on

that experiment at anything less than five years will probably not

tell you very much. It's for this reason that we view the NAV

performance in the year ended 31 October 2021 as more an

observation. It's effectively a snapshot that probably conveys more

about the prevailing narrative within stock markets than a useful

barometer on how our approach is faring. With Edinburgh Worldwide's

NAV having risen by 203% over the five years to the end of October

2021 (versus the 69% rise in the comparative index * ) we think the

evidence leans towards our philosophy having long-term merit.

Implicit in the dispersion of winners versus losers discussed

above is the direct link between a company's progress and the

magnitude of the investment returns that it can generate. A

company's operational success will translate ultimately into

cashflow, the present value of which investors can use to judge a

company's intrinsic value. But the notion of a company's cashflow

(or its more relatable cousin, profits) is not an abstract one that

resides in a CFO's or investment analyst's spreadsheet. It's the

output of a myriad of interactions and decisions involving the

company and its surroundings. How those cashflows are produced and

how they impact a wider group of stakeholders, society and the

environment, will also be crucial determinants of not only their

size, but their long-term durability and permissibility.

Consequently, the notion of sustainability, in all its guises, is

something we believe to be deeply ingrained in bona fide long-term

growth investing.

In Edinburgh Worldwide, we think our remit and philosophy enable

us to go a step further. We have long found that the most

interesting companies are invariably those that position themselves

on the frontiers of socio-economic change, rather than shy away

from it. They are the ones that address the most pressing

questions, seek to tackle the largest problems and build solutions

that seek to drive the world forward. For such companies,

sustainability is not just the how they go about operating, it's

also the why: why they exist, why society should care and why,

ultimately, they might be an outstanding investment

opportunity.

We think our focus on companies pursuing durable long-term

progress, improving outcomes and reducing both costs and frictions

across a range of diverse areas, means that the portfolio is

well-positioned to participate in the change that will follow.

Moreover, through provision of primary capital to private companies

we think that role can become more active.

Observations and Portfolio Update

The past year has seen stock markets wrestle with a world trying

to get back to normal and the oscillations from optimism to fear

seem even more pronounced than usual. Second and third order

effects related to the pandemic will likely persist but predicting

these with conviction is difficult and can arguably be a

distraction from our core task (although we are mindful of the

opportunities they may create in markets prone to overreaction). In

the near-term, we expect that supply-demand imbalances will

persist, behaviours of consumers and businesses will be hard to

predict and the overall level of uncertainty will remain elevated.

Against such a backdrop we expect the narrative and typical time

horizon in equity markets to remain skewed to a 'here and now'

mindset.

The second and third quarter reporting periods have been

atypical in that companies were annualising the immediate impact of

the pandemic. For some companies this presents as a recovery-type

boost but for several of our companies, especially those that were

natural beneficiaries of the pandemic (e.g. Telemedicine providers

or ecommerce businesses) this period has been one where the

comparator has been tough. As previously discussed, we are more

intrigued by how the fortunes of such businesses have been

transformed on a multi-year, perhaps even a multi-decade basis.

Annualising an extreme base effect often excites stock markets but

it tends to tell you very little of relevance to the real long-term

progress of a business.

For companies such as Teladoc, the stock market's questioning

relates to a modest near-term membership growth opportunity. Yet we

think the evidence of the company going much deeper with existing

members is much more reflective of the value being built. Likewise,

with Ocado the shrinking basket size and limited near-term growth

could be expected from a business that was running at well above

optimal capacity a year ago. Much more relevant in our minds is the

increasingly delighted noises emerging from its grocery partners as

they go live with their Ocado-enabled facilities.

A notable area of weakness in the portfolio has been our Chinese

stocks. Referring to our holdings by geographic location always

feels rather odd to us but is probably justified in this context,

given the challenges that have emerged. We prefer to simplify the

debate on China investing to two key axes. The first axis is a

geopolitical one. The roots here extend well beyond the recent

months but the 'who lists where and why' and 'where do companies

keep sensitive customer data' arguments don't feel like they will

be resolved imminently. The second axis is arguably a bit easier

for investors to have a considered view on, namely domestic Chinese

companies where the accrued power and influence have begun to sit

at odds with the more holistic, openly socialist approach of the

governing party. Certain sectors have been singled out for

intervention, most obviously those involved in aspects of lending,

education and gaming. For some of our holdings such as Huya and

Agora this has created headwinds, even if the impact on these

businesses is much more indirect than direct.

In actively looking for companies that are innovating and trying

to move the world forward we believe we are concentrating on an

opportunity set whose own actions will be the greatest determinant

of their own success or failure. As observers along frontiers of

innovation in a wide range of industries and applications, we

continue to be excited by the opportunities that abound.

Consequently, we feel that the current portfolio and investment

approach is as relevant as it's ever been. We think this is well

illustrated by the eleven new purchases we reported on in the

Interim Report to the end of April 2021 and is reinforced by the

further five names (two listed businesses and three private) we

purchased over the subsequent six months. We introduce these

below:

- ITM Power is a UK company which designs and manufactures PEM

electrolysers (proton exchange membrane). Electrolysers are devices

that produce hydrogen gas using electricity and water as inputs

(with oxygen gas as a side-product). The hydrogen gas can then be

used as chemical feedstock or it can be consumed in a fuel cell to

yield back energy and water. With the declining cost of renewable

energy and mounting imperative across society and industry of net

zero targets, we see the prospect of the much-heralded hydrogen

economy being transformed over the coming decades. Green

electrolyser-derived hydrogen is likely to be the most viable route

for many heavy emitting industries to decarbonise. While batteries

are a practical energy store in many applications, when the energy

storage requirement is long term and the utilisation conditions are

more demanding, the benefits of hydrogen come to the fore. ITM is

among the major electrolyser producers that cater to this

opportunity. It focuses uniquely on the more differentiated PEM

type electrolysers and has the largest PEM manufacturing

capacity.

3/4 Shine Technologies (Illuminated Holdings) is a private

nuclear technology company, with an initial focus on the production

of medical radioisotopes for diagnostic and therapeutic procedures.

The company's approach offers

several advantages here, being cleaner, safer and more

affordable to operate than legacy infrastructure. It also addresses

a growing gap between the supply and demand for these important

products within healthcare systems around the world. Longer term,

Shine has a path to leverage this technology and operating

experience into larger and more transformational opportunities

around nuclear waste recycling and the production of clean fusion

energy.

- Snyk is a private IT security company focused on the growing

opportunity in application development. It offers a toolkit for

software developers that allows them to detect vulnerabilities and

fix bugs themselves, embedding security functions at an early stage

and significantly improving the pace at which the software can be

signed off and released for use. We think such tools will become

increasingly standard in the software application development cycle

as Snyk has the synergistic advantage of appealing to both the

developer community and those tasked to maintain the robustness of

a company's overall IT operations. As more code is tested against,

and modified by, Snyk's toolkit we think the company will be well

positioned to create a valuable data advantage that will become

increasingly hard for others to replicate.

- Angelalign is China's leading domestic provider of invisible

orthodontic products. The clear aligners market in China is

relatively small but growing rapidly, underpinned by secular

drivers like greater awareness of dental care and aesthetics

associated with increasing disposable incomes. Angelalign

effectively democratises access to such orthodontic treatments by

empowering all dental professionals, not just the limited number of

orthodontic specialists. We are encouraged by its success so far

and with the founding management team still in place, we believe it

can become the dominant player in this rapidly expanding

market.

- Lightning Labs is a private San Francisco-based company which

was founded to drive the adoption of, and to commercialise, the

Bitcoin Lightning Network, an open source project which operates as

a second layer built on top of Bitcoin. The Lightning Network

substantially improves Bitcoin's utility by enabling scalable,

instantaneous and nearly free payments. The software designed and

maintained by Lightning Labs is quickly gaining traction among

developers seeking to build Lightning applications. It has the

potential to establish itself as the go-to codebase not only for

payment applications but for incipient higher-level protocols for

programmatically routing any data/value over the Lightning Network.

It does this instantly, privately and at exceptionally low cost.

While early, we are intrigued by the potential for Lightning Labs

to become a key infrastructure provider in the emerging Bitcoin

ecosystem.

We sold the position in Cloudera following a takeover offer from

private equity. We also exited the holding in Yext. Our original

investment hypothesis was that Yext was well-placed to carve out a

highly differentiated position in the increasingly important area

of corporate knowledge management. The product roadmap since has

diverged from what we perceive to be Yext's core skillset and

competitive strength.

* S&P Global Small Cap Index total return (in sterling

terms). Source: Refinitiv and relevant underlying index providers.

See disclaimer at the end of this announcement.

Investment Philosophy

=====================

Most small businesses are destined to stay small given their

limited scope for both structural growth and meaningful

differentiation. Such businesses constitute the bulk of the smaller

companies' universe yet are of no appeal to us. However, what is

intriguing about the smaller companies' universe is that it

contains a subset of immature but potentially high growth

companies. By identifying attractive growth companies earlier we

seek to benefit from growth at an earlier stage in a company's

lifecycle and retain ownership of successful companies as they grow

and thrive; we see our role as investing in what are potentially

the larger companies of the future as opposed to the smaller

companies of today.

We are looking to concentrate on the part of the market where we

believe our analytical effort and the pursuit of genuinely

transformational growth can be better exploited. The focus at time

of initial investment is on younger, more immature companies that

are global and exhibiting strong growth.

It is important to remember that big successful ideas typically

start out as small, tentative and unproven. Early iterations are

easy to dismiss as unworkable but experimentation with, and

evolution of, an initially raw concept can, over time, yield huge

commercial relevance. Our philosophy involves weighing up what is

proven and tangible alongside what has promise and long term

potential. Integral to this approach is recognising the role of

innovation in business development; it provides the fuel for

business creation, growth and long term competitive

differentiation. Consequently, identifying companies that value

innovation, having both a cultural acceptance of it and a means to

develop commercial opportunities around it, is fundamental to our

investment approach.

Growth companies, especially those which are young and hard to

model, are difficult businesses to value. The wide range of

potential outcomes and profitability that is heavily skewed to

future years is a combination of uncertainties that many investors

struggle with. We do not have all the answers but by approaching

the challenge with a genuine long term perspective, accepting a

degree of uncertainty, backing robust innovation and

entrepreneurial management, we believe we are well positioned to

identify the smaller businesses most likely to shape the world in

which we live. As technological advancements encroach into an

increasing pool of opportunity, the rate and extent of growth that

a small business can achieve, in a relatively short period of time,

is almost unrecognisable to that of a few years ago. Innovative

smaller businesses that are unburdened by the legacy of historic

business practices, or those willing to adapt to change, are best

positioned to harness this opportunity.

Baillie Gifford Statement on Stewardship

Reclaiming Activism for Long-Term Investors

Reclaiming Activism for Long-Term Investors

Baillie Gifford's over-arching ethos is that we are 'actual'

investors. We have a responsibility to behave as supportive and

constructively engaged long-term investors. We invest in companies

at different stages in their evolution, across vastly different

industries and geographies and we celebrate their uniqueness.

Consequently, we are wary of prescriptive policies and rules,

believing that these often run counter to thoughtful and beneficial

corporate stewardship. Our approach favours a small number of

simple principles which help shape our interactions with

companies.

Our Stewardship Principles

Prioritisation of long-term value creation

We encourage company management and their boards to be ambitious

and focus their investments on long-term value creation. We

understand that it is easy for businesses to be influenced by

short-sighted demands for profit maximisation but believe these

often lead to sub-optimal long-term outcomes. We regard it as our

responsibility to steer businesses away from destructive financial

engineering towards activities that create genuine economic

value

over the long run. We are happy that our value will often be in

supporting management when others do not.

A constructive and purposeful board

We believe that boards play a key role in supporting corporate

success and representing the interests of minority shareholders.

There is no fixed formula, but it is our expectation that boards

have the resources, cognitive diversity and information they need

to fulfil these responsibilities. We believe that a board works

best when there is strong independent representation able to

assist, advise and constructively test the thinking of

management.

Long-term focused remuneration with stretching targets

We look for remuneration policies that are simple, transparent

and reward superior strategic and operational endeavour. We believe

incentive schemes can be important in driving behaviour, and we

encourage policies which create alignment with genuine long-term

shareholders. We are accepting of significant pay-outs to

executives if these are commensurate with outstanding long-run

value creation, but plans should not reward mediocre outcomes. We

think that performance hurdles should be skewed towards long-term

results and that remuneration plans should be subject to

shareholder approval.

Fair treatment of stakeholders

We believe it is in the long-term interests of companies to

maintain strong relationships with all stakeholders, treating

employees, customers, suppliers, governments and regulators in a

fair and transparent manner. We do not believe in one-size-fits-all

governance and we recognise that different shareholder structures

are appropriate for different businesses. However, regardless of

structure, companies must always respect the rights of all equity

owners.

Sustainable business practices

We look for companies to act as responsible corporate citizens,

working within the spirit and not just the letter of the laws and

regulations that govern them. We believe that corporate success

will only be sustained if a business's long-run impact on society

and the environment is taken into account. Management and boards

should therefore understand and regularly review this aspect of

their activities, disclosing such information publicly alongside

plans for ongoing improvement.

Income statement

================

For the year ended For the year ended

31 October 2021 31 October 2020

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============================================== ======== ======== ======== ======== ======== ========

Gains on investments - 178,323 178,323 - 329,236 329,236

Currency losses - (1,631) (1,631) - (1,360) (1,360)

Income (note 2) 827 - 827 773 - 773

Investment management fee (1,952) (5,857) (7,809) (1,145) (3,434) (4,579)

Other administrative expenses (907) - (907) (715) - (715)

============================================== ======== ======== ======== ======== ======== ========

Net return before finance costs and taxation (2,032) 170,835 168,803 (1,087) 324,442 323,355

============================================== ======== ======== ======== ======== ======== ========

Finance costs of borrowings (340) (1,019) (1,359) (331) (991) (1,322)

============================================== ======== ======== ======== ======== ======== ========

Net return before taxation (2,372) 169,816 167,444 (1,418) 323,451 322,033

============================================== ======== ======== ======== ======== ======== ========

Tax (50) - (50) (61) - (61)

============================================== ======== ======== ======== ======== ======== ========

Net return after taxation (2,422) 169,816 167,394 (1,479) 323,451 321,972

============================================== ======== ======== ======== ======== ======== ========

Net return per ordinary share (note 4) (0.62p) 43.37p 42.75p (0.46p) 100.89p 100.43p

============================================== ======== ======== ======== ======== ======== ========

The total column of this Statement represents the profit and

loss account of the Company. The supplementary revenue and capital

columns are prepared under guidance published by the Association of

Investment Companies.

All revenue and capital items in this statement derive from

continuing operations.

A Statement of Comprehensive Income is not required as the

Company does not have any other comprehensive income and the net

return after taxation is both the profit and comprehensive income

for the year.

Balance sheet

=============

At 31 October 2021 At 31 October 2020

GBP'000 GBP'000

=============================================================== ================== ==================

Fixed assets

Investments held at fair value through profit or loss (note 6) 1,376,365 1,002,194

=============================================================== ================== ==================

Current assets

Debtors 322 160

Cash and cash equivalents 33,127 40,894

=============================================================== ================== ==================

33,449 41,054

=============================================================== ================== ==================

Creditors

Amounts falling due within one year (note 8) (68,459) (51,514)

=============================================================== ================== ==================

Net current liabilities (35,010) (10,460)

=============================================================== ================== ==================

Net assets 1,341,355 991,734

=============================================================== ================== ==================

Capital and reserves

Share capital 4,052 3,543

Share premium account 497,999 316,281

Special reserve 35,220 35,220

Capital reserve 808,197 638,381

Revenue reserve (4,113) (1,691)

Shareholders' funds 1,341,355 991,734

=============================================================== ================== ==================

Net asset value per ordinary share 331.03p 279.90p

=============================================================== ================== ==================

Ordinary shares in issue (note 9) 405,203,695 354,318,695

=============================================================== ================== ==================

Statement of changes in equity

==============================

For the year ended 31 October 2021

Share premium

Share account Special reserve Capital reserve* Revenue Shareholders'

capital GBP'000 GBP'000 GBP'000 reserve funds

GBP'000 GBP'000 GBP'000

=================== ========= =================== ================= ================== ========= ===============

Shareholders' funds

at 1 November 2020 3,543 316,281 35,220 638,381 (1,691) 991,734

Ordinary shares

issued (note 9) 509 181,718 - - - 182,227

Net return after

taxation - - - 169,816 (2,422) 167,394

Shareholders' funds

at 31 October 2021 4,052 497,999 35,220 808,197 (4,113) 1,341,355

=================== ========= =================== ================= ================== ========= ===============

For the year ended 31 October 2020

Share premium

Share account Special reserve Capital reserve* Revenue Shareholders'

capital GBP'000 GBP'000 GBP'000 reserve funds

GBP'000 GBP'000 GBP'000

=================== ========= =================== ================= ================== ========= ===============

Shareholders' funds

at 1 November 2019 3,026 183,754 35,220 314,930 (212) 536,718

Ordinary shares

issued (note 9) 517 132,527 - - - 133,044

Net return after

taxation - - - 323,451 (1,479) 321,972

Shareholders' funds

at 31 October 2020 3,543 316,281 35,220 638,381 (1,691) 991,734

=================== ========= =================== ================= ================== ========= ===============

* The capital reserve balance as at 31 October 2021 includes

investment holdings gains on fixed asset investments of

GBP591,196,000 (2020 - gains of GBP476,217,000).

Cash flow statement

===================

For the year ended For the year ended

31 October 2021 31 October 2020

GBP'000 GBP'000 GBP'000 GBP'000

================================================= ========= ========= ========= =========

Cash flows from operating activities

Net return before taxation 167,444 322,033

Net gains on investments (178,323) (329,236)

Currency losses 1,631 1,360

Finance costs of borrowings 1,359 1,322

Overseas withholding tax incurred (50) (62)

Changes in debtors and creditors 416 623

------------------------------------------------- --------- --------- --------- ---------

Cash from operations* (7,523) (3,960)

Interest paid (1,244) (1,378)

Net cash outflow from operating activities (8,767) (5,338)

------------------------------------------------- --------- --------- --------- ---------

Cash flows from investing activities

Acquisitions of investments (305,256) (164,843)

Disposals of investments 108,235 65,917

Net cash outflow from investing activities (197,021) (98,926)

------------------------------------------------- --------- --------- --------- ---------

Cash flows from financing activities

Ordinary shares issued (note 9) 182,227 133,044

Bank loans drawn down 318,406 198,933

Bank loans repaid (299,373) (198,933)

Net cash inflow from financing activities 201,260 133,044

------------------------------------------------- --------- --------- --------- ---------

(Decrease)/increase in cash and cash equivalents (4,528) 28,780

Exchange movements (3,239) (1,228)

Cash and cash equivalents at 1 November 40,894 13,342

================================================= ========= ========= ========= =========

Cash and cash equivalents at 31 October 33,127 40,894

================================================= ========= ========= ========= =========

* Cash from operations includes dividends received of GBP781,000

(2020 - GBP727,000) and no deposit interest received

(2020 - GBP60,000)

Twenty largest holdings and Twelve Month Performance at

31 October 2021

=============

Fair % of Absolute Relative

Value total performance performance

Name Business Country 2021 assets(*) % %

GBP'000

=================== ==================== =========== ============ ================ ============= =============

Electric vehicles,

autonomous

driving

Tesla and solar energy USA 85,450 6.1 171.4 99.6

US online real

Zillow (#) estate portal USA 51,095 3.6 10.5 (18.7)

Drug developer

focussed

on

harnessing gene

Alnylam silencing

Pharmaceuticals technology USA 46,706 3.3 22.6 (9.8)

Online grocery

retailer

and technology

Ocado provider UK 45,747 3.3 (20.8) (41.7)

Online freelancing

and

recruitment

Upwork services platform USA 41,225 2.9 141.3 77.5

Ophthalmic implants

for

vision

STAAR Surgical correction USA 39,236 2.8 54.0 13.3

Designs,

manufactures and

Space Exploration launches

Technologies advanced rockets

(#U) and spacecraft USA 38,016 2.6 73.4 (++) 27.6 (++)

Industrial and

pharmaceutical

enzyme

Codexis developer USA 33,953 2.4 145.7 80.8

Developer of

commercial

PsiQuantum quantum 266.1

(#U) computing USA 33,757 2.4 (++) 169.3

Electronic bond

trading

MarketAxess platform USA 33,339 2.4 (28.1) (47.1)

Telemedicine

Teladoc services provider USA 32,447 2.3 (28.2) (47.2)

Manufacturer of

medical

devices for

Novocure cancer treatment USA 27,476 2.0 (20.8) (41.7)

Online educational

Chegg company USA 26,259 1.9 (23.7) (43.8)

Enterprise

financial software

BlackLine provider USA 25,922 1.8 22.6 (9.8)

Oxford Nanopore Novel DNA

Technologies sequencing

(#P) technology UK 25,910 1.8 113.5 57.1

Enterprise

Kingdee management

International software

Software provider China 24,591 1.7 19.0 (12.4)

Chinese

bio-pharmaceutical

development and

distribution

Zai Lab ADR company China 23,525 1.7 19.8 (11.9)

Ceres Power Developer of fuel

Holding cells UK 23,497 1.7 79.5 32.0

Cloud based

accounting

software for

small and

medium-sized New

Xero enterprises Zealand 21,537 1.5 36.9 0.7

Enterprise software

Appian developer USA 20,944 1.5 48.1 9.0

=================== ==================== =========== ============ ================ ============= =============

700,632 49.7

==================================================== ============ ================ ============= =============

* Total assets comprises all assets held less all liabilities

other than liabilities in the form of borrowings.

Absolute and relative performance has been calculated on a total

return basis over the period 1 November 2020 to 31 October 2021.

Absolute performance is in sterling terms; relative performance is

against S&P Global Small Cap Index (in sterling terms).

(#) More than one line of stock held. Holding information

represents the aggregates of both lines of stock.

(++) Figures relate to part-period returns where security has

been purchased or added to during the period.

(U) Denotes unlisted security.

(P) Denotes listed security previously held in the portfolio as

an unlisted security .

Source: Baillie Gifford/StatPro and relevant underlying index

providers. See disclaimer at the end of this announcement.

Past performance is not a guide to future performance.

List of investments as at 31 October 2021

=========

Fair Fair

Value % of Value

2021 total 2020

Name Business Country GBP'000 assets GBP'000

======================= ==================================== =========== ========= ========= =========

Electric vehicles, autonomous

driving and solar

Tesla energy USA 85,450 6.1 51,332

Zillow Class C US online real estate portal USA 44,097 3.1 33,235

Zillow Class A US online real estate portal USA 6,998 0.5 6,272

========= ========= =========

51,095 3.6 39,507

========= ========= =========

Drug developer focussed on

Alnylam harnessing gene

Pharmaceuticals silencing technology USA 46,706 3.3 32,238

Online grocery retailer and

Ocado technology provider UK 45,747 3.3 49,460

Online freelancing and recruitment

services

Upwork platform USA 41,225 2.9 12,250

Ophthalmic implants for vision

STAAR Surgical correction USA 39,236 2.8 21,787

Space Exploration

Technologies Designs, manufactures and

Series N launches advanced

Preferred (U) rockets and spacecraft USA 21,788 1.5 12,374

Space Exploration

Technologies Designs, manufactures and

Series J launches advanced

Preferred (U) rockets and spacecraft USA 9,884 0.7 5,613

Space Exploration

Technologies Designs, manufactures and

Series K launches advanced

Preferred (U) rockets and spacecraft USA 4,506 0.3 2,559

Space Exploration

Technologies Designs, manufactures and

Class A launches advanced

Common (U) rockets and spacecraft USA 1,405 0.1 -

Space Exploration

Technologies Designs, manufactures and

Class C launches advanced

Common (U) rockets and spacecraft USA 433 0.0 -

========= ========= =========

38,016 2.6 20,546

========= ========= =========

Industrial and pharmaceutical

enzyme

Codexis developer USA 33,953 2.4 11,961

PsiQuantum Series

C Developer of commercial quantum

Preferred (U) computing USA 20,626 1.5 3,867

PsiQuantum Series

D Developer of commercial quantum

Preferred (U) computing USA 13,131 0.9 -

--------- --------- ---------

33,757 2.4 3,867

--------- --------- ---------

MarketAxess Electronic bond trading platform USA 33,339 2.4 46,703

Teladoc Telemedicine services provider USA 32,447 2.3 26,308

Manufacturer of medical devices

for cancer

Novocure treatment USA 27,476 2.0 28,789

Chegg Online educational company USA 26,259 1.9 32,964

Enterprise financial software

BlackLine provider USA 25,922 1.8 19,058

Oxford Nanopore

Technologies Novel DNA sequencing technology UK 1,132 0.1 11,276

Oxford Nanopore

Technologies

(P) Novel DNA sequencing technology UK 24,778 1.7 -

========= ========= =========

25,910 1.8 11,276

========= ========= =========

Kingdee International Enterprise management software

Software provider China 24,591 1.7 17,622

Chinese bio-pharmaceutical

development and

Zai Lab ADR distribution company China 23,525 1.7 16,207

Ceres Power Holding Developer of fuel cells UK 23,497 1.7 11,924

Cloud based accounting software

for small and New

Xero medium-sized enterprises Zealand 21,537 1.5 15,729

Appian Enterprise software developer USA 20,944 1.5 14,160

List of investments as at 31 October 2021 (ctd)

Fair Fair

Value % of Value

2021 total 2020

Name Business Country GBP'000 assets GBP'000

========================= ======================================= ============= ========= ========= =========

Solid-state batteries for

QuantumScape (P) electric vehicles USA 19,255 1.4 -

Cloud based software for social

media

Sprout Social management USA 18,599 1.3 -

Genmab Antibody based drug development Denmark 18,001 1.3 12,691

Non-invasive molecular tests

for early cancer

Exact Sciences detection USA 17,900 1.3 14,746

IP commercialisation focused

PureTech Health on healthcare UK 17,701 1.2 12,951

Law enforcement equipment

and software

Axon Enterprise provider USA 17,351 1.2 7,810

Critical event management

Everbridge software provider USA 17,253 1.2 12,019

Online furniture and homeware

Wayfair retailer USA 15,783 1.1 16,691

CyberArk Software Cyber security solutions provider Israel 15,115 1.1 8,827

Manufacturer of insulin pumps

Tandem Diabetes for diabetic

Care patients USA 14,746 1.0 12,508

Small unmanned aircraft and

tactical missile

AeroVironment systems USA 14,318 1.0 13,022

Hydrogen energy solutions

ITM Power manufacturer UK 13,811 1.0 -

Trupanion Pet health insurance provider USA 13,790 1.0 10,236

LendingTree Online consumer finance marketplace USA 13,786 1.0 25,321

ShockWave Medical Medical devices manufacturer USA 13,366 1.0 4,538

Video compression and image

processing

Ambarella semiconductors USA 13,232 0.9 4,129

Livestock breeding and technology

Genus services UK 12,842 0.9 9,517

Enterprise sales management

Zuora software USA 12,451 0.9 1,823

Akili Interactive

Labs

Series C Preferred

(U) Digital medicine company USA 3,614 0.3 4,600

Akili Interactive

Labs

Series D Preferred

(U) Digital medicine company USA 8,754 0.6 -

--------- --------- ---------

12,368 0.9 4,600

--------- --------- ---------

Pacira BioSciences Opioid free analgesics developer USA 12,235 0.9 10,510

Adaptimmune

Therapeutics Cell therapies for cancer

ADR treatment UK 12,135 0.9 8,494

M3 Online medical database Japan 12,017 0.9 14,556

Cardlytics Digital advertising platform USA 11,770 0.8 -

LiveRamp Marketing technology company USA 11,523 0.8 13,392

MonotaRO Online business supplies Japan 11,489 0.8 14,932

Relativity Space

Series D 3D printing and aerospace

Preferred (U) launch company USA 7,812 0.5 -

Relativity Space

Series E 3D printing and aerospace

Preferred (U) launch company USA 3,648 0.3 -

========= ========= =========

11,460 0.8 -

========= ========= =========

Biotechnology company focused

on next

Sutro Biopharma generation protein therapeutics USA 11,041 0.8 6,462

Online platform for restaurant

InfoMart supplies Japan 11,039 0.8 9,936

IPG Photonics High-power fibre lasers USA 10,473 0.8 10,613

Designs and manufactures power

systems and

American Superconductor superconducting wire USA 10,292 0.7 6,071

Temenos Group Banking software provider Switzerland 10,210 0.7 7,594

Software development tools

JFrog and management Israel 9,860 0.7 -

Astranis Space

Technologies Communication satellite manufacturing

Series C and

Preferred (U) operation USA 9,329 0.7 -

Messaging tools for business

and customer

LivePerson interactions USA 9,315 0.7 10,247

Splunk Data diagnostics USA 8,884 0.6 11,316

List of investments as at 31 October 2021 (ctd)

Fair Fair

Value % of Value

2020 total 2019

Name Business Country GBP'000 assets GBP'000

======================== ========================================= ============= ========= ========= =========

Shine Technologies

(Illuminated

Holdings)

Serices C-5 Preferred

(U) Medical radioisotope production USA 8,754 0.6 -

Consumer robotics and connected

iRobot devices USA 7,809 0.6 7,896

Quanterix Ultra-sensitive protein analysers USA 7,742 0.6 -

Snyk Ordinary

Shares (U) Security software UK 2,736 0.2 -

Snyk Series F

Preferred (U) Security software UK 4,560 0.4 -

========= ========= =========

7,296 0.6 -

========= ========= =========

Lightning Labs Lightning software that enables

Series B users to send

Preferred (U) and receive money USA 7,295 0.5 -

Measurement and calibration

Renishaw equipment UK 7,055 0.5 7,863

Cloud based virtual banking

Q2 Holdings solutions provider USA 6,997 0.5 8,625

Specialised processor chips

Graphcore Series for machine

D2 Preferred (U) learning applications UK 5,244 0.4 4,247

Specialised processor chips

Graphcore Series for machine

E Preferred (U) learning applications UK 1,672 0.1 -

========= ========= =========

6,916 0.5 4,247

========= ========= =========

Cloud based accounting software

for small and

freee K.K. medium-sized enterprises Japan 6,833 0.5 -

Affinity based diagnostic

reagents and

Avacta Group therapeutics UK 6,642 0.5 9,218

IP Group Intellectual property commercialisation UK 6,601 0.4 4,324

Manufacturer of gas and flow

Sensirion Holding sensors Switzerland 5,939 0.4 2,400

SEEK Online recruitment portal Australia 5,846 0.4 3,812

Reaction Engines

(U) Advanced heat exchange company UK 5,750 0.4 5,750

Digital watermarking technology

Digimarc provider USA 5,693 0.4 3,791

Discovery and development

of novel materials

Ilika for mass market applications UK 5,379 0.4 3,348

Clinical stage biotechnology

company focussing

on autoimmune and fibrosis

Galapagos diseases Belgium 5,187 0.4 8,806

Advanced instrumentation and

equipment

Oxford Instruments provider UK 5,144 0.4 3,526

Rightmove UK online property portal UK 4,771 0.3 4,263

Cloud-based healthcare software

Tabula Rasa HealthCare developer USA 4,711 0.3 3,686

Biotechnology tools focused

on cell

Berkeley Lights characterisation USA 4,186 0.3 7,274

Nanomedicine company focused

on cancer

Nanobiotix ADR radiotherapy France 4,066 0.3 -

Voice and video platform technology

Agora ADR provider China 4,056 0.3 4,987

Commerce platform for small

and medium-sized

BASE enterprises Japan 3,951 0.3 -

Huya ADR A live game streaming platform China 3,725 0.3 5,036

Chinese e-commerce solution

Baozun SPN ADR provider China 3,712 0.3 8,314

Satellite powered data collection

and analysis

Spire Global (P) company USA 3,570 0.3 -

Antibody based drug discovery

Morphosys platform Germany 3,451 0.2 5,866

Peptide based drug discovery

PeptiDream platform Japan 3,377 0.2 6,843

Stratasys 3D printer manufacturer USA 3,327 0.2 1,429

Victrex High-performance thermo-plastics UK 2,909 0.2 2,345

KSQ Therapeutics

Series Biotechnology target identification

C Preferred (U) company USA 2,744 0.2 1,925

Licenses IP to the semiconductor

CEVA industry USA 2,743 0.2 2,573

ASOS Online fashion retailer UK 2,532 0.2 4,494

Online marketplace for buying

EverQuote insurance USA 2,329 0.2 4,853

List of investments as at 31 October 2021 (ctd)

Fair Fair

Value % of Value

2021 total 2020

Name Business Country GBP'000 assets GBP'000

======================= =================================== ============= =========== ============== ============

C4X Discovery Rational drug design and

Holdings optimisation UK 2,178 0.2 510

C4X Discovery

Warrants Software to aid drug design UK 37 0.0 -

=========== ============== ============

2,215 0.2 510

=========== ============== ============

Next generation chemotherapy

NuCana SPN ADR developer UK 2,178 0.1 4,523

Genetic engineering for cell

Cellectis based therapies France 1,915 0.1 2,966

Regenerative medicine and

nerve repair

AxoGen company USA 1,880 0.1 1,645

New Horizon Health Cancer screening company China 1,870 0.1 -

Therapies for gastrointestinal

Cosmo Pharmaceuticals diseases Italy 1,846 0.1 2,084

Employee benefits software

Benefitfocus provider USA 1,810 0.1 1,807

Analytics and data collection

Catapult Group technology for

International sports teams and athletes Australia 1,752 0.1 1,638

Developer of novel therapies

using engineered

Rubius Therapeutics red blood cells USA 1,596 0.1 505

4D Pharma Microbiome biology therapeutics UK 1,105 0.1 1,971

4D Pharma Warrants Microbiome biology therapeutics UK 0 0.0 35

=========== ============== ============

1,105 0.1 2,006

=========== ============== ============

Online Chinese used car

Uxin ADR marketplace China 984 0.1 420

Chinook Therapeutics

(formerly Aduro

Biotechnology) Immunotherapy drug development USA 917 0.1 1,117

Chinook Therapeutics

(formerly Aduro

Biotechnology)

CVR Line Immunotherapy drug development USA 0 0.0 -

=========== ============== ============

917 0.1 1,117

=========== ============== ============

Kaleido Biosciences Microbiome chemistry therapeutics USA 898 0.1 913

Summit Therapeutics Developer of novel antibiotics USA 835 0.1 479

Biotechnology company seeking

Unity Biotechnology to develop

(P) anti-ageing therapies USA 595 0.0 1,018

Ricardo Engineering services provider UK 577 0.0 483

Biotechnology company focussed

Adicet Bio (formerly on age

resTORbio) related disorders USA 553 0.0 728

Adicet Bio (formerly Biotechnology company focussed

res on age

TORbio) CVR Line related disorders USA 0 0.0 -

=========== ============== ============

553 0.0 728

=========== ============== ============

Angelalign Technology Medical devices manufacturer China 261 0.0 -

Regenerative medicine technology

Tissue Regenix provider UK 104 0.0 66

Polymer technology company

Xeros Technology with laundry and

Group textile applications UK 76 0.0 93

VYNE Therapeutics Biopharmaceutical company

(formerly Menlo focused in the

Therapeutics) dermatology space USA 49 0.0 248

Velocys Gas to liquid technology UK 27 0.0 19

Ensogo (D) South East Asian e-commerce Australia 0 0.0 0

Mines, processes and manufactures

China Lumena New natural

Materials (S) thenardite products China 0 0.0 0

Total equities 1,376,365 97.8

=========================================================================== =========== ============== ============

Net liquid assets 31,143 2.2

=========================================================================== =========== ============== ============

Total assets at

fair value* 1,407,508 100.0

=========================================================================== =========== ============== ============

* Total assets comprises all assets held less all liabilities

other than liabilities in the form of borrowings.

(U) Denotes unlisted security.

(P) Denotes listed security previously held in the portfolio and an unlisted security.

(D) Denotes delisting security.

(S) Denotes suspended unlisted security.

Listed Unlisted Net liquid Total

equities securities assets assets

% % % %

================= ========== ============ =========== ========

31 October 2021 87.0 10.8 2.2 100.0

================= ========== ============ =========== ========

31 October 2020 90.5 5.8 3.7 100.0

================= ========== ============ =========== ========

Figures represent percentage of total assets.

Includes holdings in preference shares, ordinary shares and

convertible promissory notes.

Distribution of total assets(*) by industry

Industry Analysis Portfolio Weightings

31 October 2021 (relative to comparative index )

% of total assets* at 31 October 2021

================================================= ==================== =================================

Software 17.5 12.1

Biotechnology 15.2 10.8

Healthcare Equipment and Supplies 7.3 5.3

Automobiles 6.1 5.8

Aerospace and Defence 6.0 5.1

Healthcare Technology 4.6 4.0

Electrical Equipment 4.1 2.3

Real Estate Management and Development 3.6 1.5

Professional Services 3.3 1.7

Life Sciences Tools and Services 3.3 2.0

Food and Staples Retailing 3.3 2.4

Technology Hardware, Storage and Peripherals 3.1 2.5

Capital Markets 2.8 (0.1)

Electronic Equipment, Instruments and Components 2.1 (0.3)

IT Services 1.9 (0.4)

Diversified Consumer Services 1.9 1.1

Pharmaceuticals 1.8 0.1

Internet and Direct Marketing Retail 1.5 1.0

Auto Components 1.4 (0.2)

Semiconductors and Semiconductor Equipment 1.1 (1.9)

Insurance 1.0 (1.6)

Consumer Finance 1.0 0.2

Interactive Media and Services 0.9 0.2

Media 0.8 (0.7)

Trading Companies and Distributors 0.8 (0.6)

Household Durables 0.6 (1.1)

Entertainment 0.3 (0.8)

Chemicals 0.2 (2.9)

Internet and Catalogue Retail 0.2 0.2

Healthcare Providers and Services 0.1 (1.9)

Machinery <0.1 (4.2)

Energy Equipment and Services <0.1 (0.6)

Net Liquid Assets 2.2

================================================== ==================== =================================

Total assets* 100.0

================================================== ==================== =================================

* Total assets comprises all assets held less all liabilities other than liabilities in the

form of borrowings.

S&P Global Small Cap Index (in sterling terms). Weightings

exclude industries where the Company has no exposure.

See disclaimer at the end of this announcement.

Distribution of total assets

============================

Geographical Analysis

31 October 2021 31 October 2020

% %

================================= ================ ==================

North America 66.9 63.5

USA 66.9 63.5

Europe 20.9 20.7

United Kingdom 15.6 15.5

Eurozone 1.1 2.2

Developed

Europe (non

euro) 4.2 3.0

Asia 8.0 10.1

Japan 3.5 5.0

China 4.5 5.1

Australasia 2.0 2.0

Australia 0.5 0.5

New Zealand 1.5 1.5

================================ ================ ================

Total equities 97.8 96.3

================================= ================ ================

Net liquid assets 2.2 3.7

================================= ================ ================

Total assets* 100.0 100.0

================================= ================ ================

Sectoral Analysis

31 October 2021 31 October 2020

% %

========================= ================ === ================

Communication Services 5.6 5.6

Consumer Discretionary 15.0 16.5

Financials 4.9 8.3

Healthcare 32.3 32.5

Industrials 14.2 9.2

Information Technology 25.6 24.0

Materials 0.2 0.2

Net Liquid Assets 2.2 3.7

========================= ================ === ================

Total assets* 100.0 100.0

========================= ================ === ================

* Total assets comprises all assets held less all liabilities

other than liabilities in the form of borrowings.

Notes to the condensed financial statements (unaudited)

=======================================================

1. Basis of Accounting

The Financial Statements for the year to 31 October 2021 have been prepared in accordance

with FRS 102 'The Financial Reporting Standard applicable in the UK and Republic of Ireland'

and on the basis of the accounting policies which are unchanged from the prior year and have

been applied consistently.

=====================================================================================================

2. Income 2021 2020

GBP'000 GBP'000

================================================================================= ======== ========

Income from investments

UK dividends 411 154

Overseas dividends 402 538

Overseas interest 14 21

===================================================================================== ======== ========

827 713

===================================================================================== ======== ========

Other income

Deposit interest - 60

===================================================================================== ======== ========

Total income 827 773

===================================================================================== ======== ========

Total income comprises:

Dividends from financial assets designated at fair value through profit or loss 813 692

Interest from financial assets designated at fair value through profit or loss 14 21

Interest from financial assets not at fair value through profit or loss - 60

===================================================================================== ======== ========

827 773

===================================================================================== ======== ========

3. Investment Manager

The Company has appointed Baillie Gifford & Co Limited, a wholly owned subsidiary of Baillie

Gifford & Co, as its Alternative Investment Fund Manager and Company Secretaries. Baillie

Gifford & Co Limited has delegated portfolio management services to Baillie Gifford & Co.

Dealing activity and transaction reporting have been further sub-delegated to Baillie Gifford

Overseas Limited and Baillie Gifford Asia (Hong Kong) Limited. The Management Agreement can

be terminated on three months' notice.

The annual management fee is 0.75% on the first GBP50m of net assets, 0.65% on the next GBP200m

of net assets and 0.55% on the remaining net assets. Management fees are calculated and payable

quarterly.

4. 2021 2020

Net return per ordinary Revenue Capital Total Revenue Capital Total

share

========================== ======== ======== ====== ======== ======== =======

Net return after taxation (0.62p) 43.37p 42.75p (0.46p) 100.89p 100.43p

Revenue return per ordinary share is based on the net revenue loss after taxation of GBP2,422,000

(2020 - net revenue loss of GBP1,479,000) and on 391,579,802 (2020 - 320,606,304) ordinary

shares, being the weighted average number of ordinary shares during the year.

Capital return per ordinary share is based on the net capital gain for the financial year

of GBP169,816,000 (2020 - net capital gain of GBP323,451,000) and on 391,579,802 (2020 - 320,606,304)

ordinary shares, being the weighted average number of ordinary shares in issue during the

year.

There are no dilutive or potentially dilutive shares in issue.

5. Dividends

There are no dividends paid and proposed in respect of the financial year. There is no revenue

available for distribution by way of dividend for the year to 31 October 2021. Revenue loss

of GBP2,442,000 (2020 - revenue loss of GBP1,479,000) which is the basis on which the requirements

of section 1158 of the Corporation Tax Act are considered.

6. Fair Value

Hierarchy

=================== ================== =============== =========== =============================================

As at 31 October Level 1 Level 2 Level 3 Total

2021 GBP'000 GBP'000 GBP'000 GBP'000

=================== ================== =============== =========== =============================================

Listed equities 1,224,768 - - 1,224,768

Unlisted ordinary shares - - 18,235 18,235

Unlisted preference

shares* - - 133,362 133,362

Unlisted

convertible

promissory note - - - -

=================== ================== =============== =========== =============================================

Total financial asset

investments 1,224,768 - 151,597 1,376,365

-------------------------- ------------------ --------------- ----------- ---------------------------------------------

As at 31 October Level 1 Level 2 Level 3 Total

2020 GBP'000 GBP'000 GBP'000 GBP'000

=================== ================== =============== =========== =============================================

Listed equities 941,393 - - 941,393

Unlisted ordinary shares - - 23,213 23,213

unlisted preference

shares* - - 37,319 37,319

Unlisted convertible

promissory note - - 269 269

-------------------------- ------------------ --------------- ----------- ---------------------------------------------

Total financial asset

investments 941,393 - 60,801 1,002,194

-------------------------- ------------------ --------------- ----------- ---------------------------------------------

* The investments in preference shares are not classified as equity holdings as they include

liquidation preference rights that determine the repayment (or multiple thereof) of the original

investment in the event of a liquidation event such as a take-over.

Investments in securities are financial assets designated at fair value through profit or

loss. In accordance with Financial Reporting Standard 102, the tables above provide an analysis

of these investments based on the fair value hierarchy described below, which reflects the