TIDMEMR

RNS Number : 8253G

Empresaria Group PLC

29 July 2021

29 July 2021

Empresaria Group plc

("Empresaria" or the "Group")

Trading Update and Notice of Results

Strong recovery in profits and investment in future growth

Empresaria (AIM: EMR), the global specialist staffing group,

provides a trading update ahead of announcing its interim results

for the six months ended 30 June 2021 on Thursday 12 August

2021.

Trading update

-- H1 profits expected to be significantly ahead of prior year

-- H1 net fee income up 1% on 2020 (up 4% in constant currency) with Q2 up 30% and Q1 down 19%

-- Net debt increased to GBP16.5m (31 December 2020: GBP13.6m)

reflecting working capital outflows as activity levels increased,

with headroom remaining strong at GBP12.4m

-- Operational investment accelerated with appointment of highly

experienced industry leadership to regional management roles

The ongoing recovery in net fee income resulted in the second

quarter being 30% ahead of 2020 with overall first half net fee

income up 1% on 2020 (up 4% in constant currency) and profits

expected to be significantly ahead of prior year. Net fee income

was down in the first quarter against prior year reflecting the

Group's strong start to 2020 before the impact of COVID-19.

The Group has invested in its senior management structure with

the appointment of Regional CEOs for APAC and for the UK &

Europe and we will be announcing the appointment of a Regional

President for North America in the coming week. The addition of

these proven industry leaders will help the Group accelerate the

implementation of its strategy and growth plans.

Financial position

Adjusted net debt at 30 June 2021 was GBP16.5m, a GBP2.9m

increase since 31 December 2020. The increase is driven by the

higher activity levels as net fee income improved, resulting in

increased working capital requirements. Headroom has reduced

reflecting these working capital changes but remains strong at

GBP12.4m (31 December 2020: GBP17.6m).

Performance by sector

Net fee income by sector for the six months ended 30 June:

% change

(constant

GBPm 2021 2020 % change currency)*

-------------------------------------- ------ ------ --------- ------------

Professional (excluding aviation) 7.7 7.1 +8% +10%

Aviation 0.5 1.7 -71% -72%

-------------------------------------- ------ ------ --------- ------------

Professional (total) 8.2 8.8 -7% -7%

IT 6.5 6.7 -3% +2%

Healthcare 2.2 1.2 +83% +100%

Property, Construction & Engineering 0.4 0.4 -% -%

Commercial 8.4 8.0 +5% +8%

Offshore Recruitment Services 3.2 3.4 -6% +3%

Intragroup (0.5) (0.3)

-------------------------------------- ------ ------ --------- ------------

Total 28.4 28.2 +1% +4%

-------------------------------------- ------ ------ --------- ------------

* The constant currency movement is calculated by translating

the 2020 results at the 2021 exchange rates.

Excluding aviation, the Group's Professional sector had a strong

first half with net fee income up 8% reflecting good performances

across the sector and a 59% increase in net fee income in the

second quarter compared to 2020. Our aviation recruitment business

continues to see very subdued demand with net fee income down more

than 70% against 2020. We continue to be cautious on the speed of

recovery of this business but are confident that it continues to

have good growth potential in the medium and long term.

The Group's IT sector has seen a 3% fall in net fee income

compared to the first half of 2020, although in constant currency

net fee income was up 2%. This, in part, reflects a strong

comparative performance with a delayed impact on net fee income

from COVID-19 in 2020. The second quarter was up 5% on 2020. Our

business in Japan has performed particularly well in 2021

delivering net fee income ahead of the prior year.

The Group's Healthcare sector has performed extremely strongly

in 2021 with net fee income 83% ahead of the first half of 2020.

The COVID-19 vaccination and testing programmes were identified as

a key area of opportunity and our investment in delivering to these

programmes has been the key driver of the sector's performance as

demand has peaked through the first half of 2021. We would expect

this sector to return to more normal levels of activity in the

second half as the COVID-19 related demand in our markets slows

down.

The Group's Property, Construction & Engineering sector is

flat year on year and continues to see low levels of demand,

particularly in our business supplying sales staff to the new home

sector which has continued to operate under COVID-19 restrictions,

limiting the demand for temporary staff. We are looking to

diversify the business as well as positioning ourselves for when

the market recovers.

The Group's Commercial sector has had a mixed first half with

net fee income up 5% on 2020, with the second quarter up by 17%. We

have seen good recovery in our operations in Chile and in our

temporary staffing businesses in Germany and Austria. However, our

logistics business in Germany, which had a very strong 2020, has

seen a fall in net fee income. While demand remains strong it has

become increasingly difficult to fill these lower paid roles as the

wider economy recovers and there have been increased challenges in

attracting candidates into Germany from Eastern Europe.

In Offshore Recruitment Services net fee income has reduced by

6%, primarily driven by foreign currency fluctuations and the exit

from our loss-making operation in Dubai with effect from 1 January

which contributed GBP0.4m of net fee income in 2020. Excluding

these factors, net fee income increased and our operation in India,

which recovered strongly in the second half of 2020, has continued

to grow with high demand from clients in both the UK and the US.

Our headcount in this business is now at a record high with more

than 1,500 employees at 30 June.

Rhona Driggs, CEO of Empresaria, commented:

"We have had a positive start to 2021 with a strong recovery in

profits after an extremely challenging 2020. This is testament to

the resilience of our people and businesses and a result of the

operational initiatives and investments we have made over the last

two years.

We have made key senior appointments in the last few months

bringing in individuals with proven track records and significant

industry experience. Our ability to attract top talent illustrates

our potential and ambition and these appointments to our senior

management team will be key in helping us deliver on our growth

strategies.

Despite the positive demand, there remain ongoing challenges in

some of our key markets and sectors. Given the broad global

footprint of the Group and the varying impact in each market we

expect COVID-19 to remain a challenge in the short term. In

addition, industry data tells us that while global hiring optimism

is returning to pre-pandemic levels the talent shortages are at

their highest for 15 years. Our investments in technology are going

to be critical in enabling us to deliver in this environment.

This year marks our 25th anniversary but, in many ways, we have

only just begun our journey. The acceleration of operational

improvements and key leadership appointments means we are better

placed than ever to realise the exceptional potential of the

Group."

Investor presentation

In line with Empresaria's commitment to ensuring appropriate

communication structures are in place for all sections of its

shareholder base, management will deliver an online results

presentation open to all existing and potential investors via the

Investor Meet Company platform on Thursday 12 August 2021 at 4:30pm

UK time.

Questions can be submitted pre-event through the platform or at

any time during the live presentation. Management may not be in a

position to answer every question it receives but will address

those it can while remaining within the confines of information

already disclosed to the market.

Q&A responses will be published at the earliest opportunity

on the Investor Meet Company platform.

Investors can sign up for free via:

https://www.investormeetcompany.com/empresaria-group-plc/register-investor.

Those who have already registered and requested to meet the Company

will be automatically invited.

- Ends -

Enquiries:

Empresaria Group plc via Alma PR

Rhona Driggs, Chief Executive Officer

Tim Anderson, Chief Financial Officer

Singer Capital Markets (Nominated

Adviser and Broker)

Shaun Dobson / James Moat 020 7496 3000

Alma PR (Financial PR) 020 3405 0205

Sam Modlin empresaria@almapr.com

David Ison

Hilary Buchanan

Notes for editors:

-- Empresaria Group plc is a global specialist staffing group

offering temporary and contract recruitment, permanent recruitment

and offshore recruitment services across 6 sectors: Professional,

IT, Healthcare, Property, Construction and Engineering, Commercial

and Offshore Recruitment Services.

-- Empresaria operates from locations across the world including

the 4 largest staffing markets of the US, Japan, UK and Germany

along with a strong presence elsewhere in Asia Pacific and Latin

America.

-- Empresaria is listed on AIM under ticker EMR. For more

information visit www.empresaria.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRGDRGUDDGBI

(END) Dow Jones Newswires

July 29, 2021 02:00 ET (06:00 GMT)

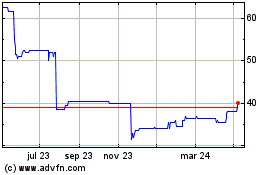

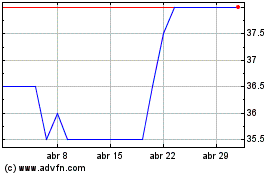

Empresaria (LSE:EMR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Empresaria (LSE:EMR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024