TIDMEDV

EAVOUR REPORTS STRONG Q3-2021 RESULTS

WELL POSITIONED TO BEAT FULL YEAR PRODUCTION GUIDANCE

OPERATIONAL AND FINANCIAL HIGHLIGHTS

-- Q3-2021 production of 382koz at an AISC of $904/oz;

YTD production of 1,138koz at an AISC of $875/oz

-- Group is well positioned to beat FY-2021 production

guidance of 1,365-1,495koz at AISC within $850-900/oz

guidance

-- Adjusted Net Earnings of $153m or $0.61/share in

Q3-2021; $429m or $1.81/share year to date

-- Operating Cash Flow before working capital of $326m

or $1.30/share in Q3-2021; $875m or $3.69/share year

to date

-- Healthy balance sheet at quarter-end with Net Debt of

$70m, despite having returned $105m to shareholders,

and Net Debt to adjusted EBITDA leverage ratio of

0.05x

SHAREHOLDER RETURNS PROGRAMME

-- Payment of H1-2021 interim dividend of $70m on 28

September 2021; well positioned to deliver more than

the minimum committed dividend of $125m for the full

year

-- Share buybacks continue to supplement shareholder

returns with a total of $94m of shares repurchased

since April 2021, $35m of which were repurchased in

Q3-2021

ORGANIC GROWTH

-- Construction of Sabodala-Massawa Phase 1 expansion on

schedule for completion by year-end; DFS underway for

Sabodala-Massawa Phase 2 expansion, Fetekro and

Kalana projects

-- Group on track to discover over 2.5Moz of Indicated

resources in 2021 with resource updates expected to

be published in in Q4-2021; Group is targeting to

discover 15-20Moz of Indicated resources over next 5

years

London, 11 November 2021 -- Endeavour Mining plc (LSE:EDV,

TSX:EDV, OTCQX:EDVMF) ('Endeavour' or the 'Group' or the 'Company')

is pleased to announce its operating and financial results for

Q3-2021, with highlights provided in Table 1 below. Management will

host a conference call and webcast on Thursday 11 November, at 8:30

am ET / 1:30 pm GMT. For instructions on how to participate, please

refer to the conference call and webcast section at the end of the

news release.

Table 1: Consolidated Highlights(1)

All amounts in US$

million, unless

otherwise stated THREE MONTHSED NINE MONTHSED

<DELTA>

30 30 30 30 30 YTD-2021

September June September September September vs.

2021 2021 2020 2021 2020 YTD-2020

OPERATING DATA

Gold Production,

koz 382 409 244 1,138 565 +101%

All-in Sustaining

Cost(2) , $/oz 904 853 906 875 911 (4)%

Realised Gold

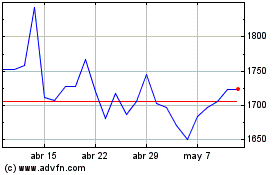

Price, $/oz 1,763 1,791 1,841 1,769 1,714 +3%

--------- ----- --------- --------- --------- --------

CASH FLOW FROM

CONTINUING

OPERATIONS(3)

Operating Cash Flow

before Changes in

WC 326 286 195 875 366 +139%

Operating Cash Flow

before Changes in

WC(2) , $/sh 1.30 1.13 1.20 3.69 2.85 +29%

Operating Cash Flow 312 300 182 819 335 +144%

Operating Cash

Flow(2) , $/sh 1.25 1.19 1.12 3.46 2.61 +33%

PROFITABILITY FROM

CONTINUING

OPERATIONS(3)

Net Earnings

Attributable to

Shareholders(2) 114 127 52 327 30 +990%

Net Earnings per

Share, $/sh 0.45 0.50 0.32 1.38 0.24 +475%

Adjusted Net

Earnings

Attributable to

Shareholders(2) 153 183 81 429 154 +179%

Adjusted Net

Earnings per

Share(2) , $/sh 0.61 0.73 0.49 1.81 1.20 +51%

EBITDA(2) 344 363 203 1,041 327 +218%

Adjusted EBITDA(2) 370 400 225 1,076 432 +149%

--------- ----- --------- --------- --------- --------

SHAREHOLDER RETURNS

Shareholder

dividends paid 70 -- -- 130 -- n.a.

Share buyback

(commenced in

Q2-2021) 35 59 -- 94 -- n.a.

--------- ----- --------- --------- --------- --------

FINANCIAL POSITION

HIGHLIGHTS

Net Debt/(Net

Cash)(2) 70 77 175 70 175 (60)%

Net (Cash)/Debt /

Adjusted EBITDA

(LTM) ratio(2,4) 0.05 0.07 0.29 0.05 0.29 (83)%

--------- ----- --------- --------- --------- --------

(1) All amounts include Teranga assets from 10 February

2021 and SEMAFO assets from 1 July 2020. (2) This

is a non-GAAP measure. Refer to the non-GAAP measure

section of the Management Report. (3) From Continuing

Operations excludes the Agbaou mine which was divested

on 1 March 2021. (4) LTM means last twelve months.

Sebastien de Montessus, President and CEO, commented: "Following

a strong third quarter performance, we are on track to achieve a

record year. We are now well positioned to beat the top end of our

1.5Moz full year production guidance at an AISC within the guided

range.

Given this strong performance we expect to generate well in

excess of $1 billion in operating cash flow for the full year,

which has already significantly improved our balance sheet strength

and bolstered our ability to reward shareholders.

Having already returned $224 million in dividends and share

buybacks this year, and considering our near zero Net Debt to

adjusted EBITDA leverage ratio, we expect to continue to supplement

our shareholder return programme with further share buybacks and

deliver more than the guided minimum dividend of $125 million for

the full year.

Our growth pipeline continues to develop with the

Sabodala-Massawa phase 1 expansion on track for completion in

Q4-2021. Additionally, our Definitive Feasibility Studies are

progressing well for the Sabodala-Massawa Phase 2 expansion, the

Fetekro and Kalana projects.

We continue to demonstrate exploration success, with the Group

on track to delineate over 2.5 million ounces of Indicated

resources in 2021, significantly more than the expected annual

depletion. Looking forward, we expect to unlock significant

additional value by delivering on our recently published 5-year

exploration strategy targeting the discovery of 15 to 20 million

ounces of Indicated resources.

Following our successful listing on the premium-segment of the

London Stock Exchange in June, we were pleased to enter the FTSE

indexes in September which positions us well to attract a wider

investor pool.

There is strong momentum across our business and we look forward

to continuing to drive our strategy forward."

ON TRACK TO BEAT FY-2021 PRODUCTION GUIDANCE

-- Strong year to date production of 1,138koz at an AISC of $875/oz

positions the Group well to beat the top end of its FY-2021 production

guidance of 1,365-1,495koz at an AISC within its guidance of $850-900/oz.

-- Group outperformance is led by the Houndé, Ity, Sabodala-Massawa and

Mana mines where full year production is expected to be near or above the

top end of their respective guidances, while the other mines are tracking

within guidance. In addition, the Company is benefiting from the

successful rapid integration of the Teranga Gold assets and associated

synergies.

Table 2: YTD-2021 Performance vs. FY-2021 Guidance

YTD-2021 2021 FULL YEAR GUIDANCE

--------

Production, koz 1,138 1,365 -- 1,495

AISC, $/oz 875 850 -- 900

-------- ---------- ---- ---------

UPCOMING CATALYSTS

The key upcoming expected catalysts are summarised in the table

below.

Table 3: Key Upcoming Catalysts

TIMING CATALYST

Q4-2021 Exploration Resource updates at Sabodala-Massawa, Houndé,

Ity and Fetekro

Q4-2021 Sabodala-Massawa Completion of Phase 1 plant upgrades

Q1-2022 Sabodala-Massawa Completion of Definitive Feasibility Study for Phase

2

Q1-2022 Fetekro Completion of Definitive Feasibility Study

Q1-2022 Shareholder H2-2021 dividend

Returns

Q1-2022 Kalana Completion of Definitive Feasibility Study

--------- ------------------

SHAREHOLDER RETURNS PROGRAMME

-- As disclosed on 7 June 2021, Endeavour has implemented a shareholder

returns programme that is composed of a minimum progressive dividend that

may be supplemented with additional dividends and buybacks, provided the

prevailing gold price remains above $1,500/oz and that Endeavour's

leverage remains below 0.5x Net Debt / adjusted EBITDA.

-- Endeavour paid its previously announced H1-2021 interim dividend of $70

million on 28 September 2021, highlighting its strong commitment to

paying supplemental shareholder returns.

-- Shareholder returns have also been supplemented through the Company's

share buyback programme. A total of $94 million or 4.15 million of shares

have been repurchased since the start of the buyback programme on 9 April

2021, of which $35 million or 1.48 million shares were repurchased in

Q3-2021.

FTSE RUSSELL INDEXATION

-- Following the completion of Endeavour's premium listing on the London

Stock Exchange ("LSE") on 14 June 2021, positioning the Company as the

largest pure-play gold producer listed on the premium segment of the LSE,

Endeavour was assigned UK nationality status on 9 August 2021 by the FTSE

Russell group for indexation purposes.

-- Subsequent to the successful nationality and liquidity review period,

Endeavour was included in the FTSE All Share, FTSE 250, FTSE 350 and FTSE

350 Lower Yield indexes as part of the FTSE Q3-2021 rebalancing, which

became effective on 20 September 2021.

CASH FLOW AND LIQUIDITY SUMMARY

The table below presents the cash flow and Net Debt position for

Endeavour for the three and nine month period ending 30 September

2021, with accompanying notes below.

Table 4: Cash Flow and Net Debt Position

THREE MONTHSED NINE MONTHSED

30 30 30 30

September 30 June, September September September

In US$ million unless otherwise specified 2021 2021 2020 2021 2020

----------- ---------- ----------- ----------- -----------

Net cash from (used in), as per cash flow statement:

Operating cash flows before changes in working capital

from continuing operations 326 286 195 875 366

Changes in working capital (14) 15 (13) (56) (30)

Cash generated from/(used by) discontinued operations -- -- 19 (9) 49

------ ------ ------ ------ ------

Cash generated from operating activities [1] 312 300 201 810 385

Cash (used in)/generated from investing activities [2] (137) (137) 42 (379) (64)

Cash (used in)/generated from financing activities [3] (233) (192) (74) (360) 10

Effect of exchange rate changes on cash (15) (7) 3 (25) 3

------ ------ ------ ------ ------

(DECREASE)/INCREASE IN CASH (73) (35) 172 46 333

------ ------ ------ ------ ------

Cash position at beginning of period 833 868 352 715 190

------ ------ ------ ------ ------

CASH POSITION AT OF PERIOD [4] 760 833 523 760 523

---- ------ ------ ------ ------ ------

Equipment financing -- -- (58) -- (58)

Convertible senior bond (330) (330) (330) (330) (330)

Drawn portion of corporate loan facility [5] (500) (580) (310) (500) (310)

---- ------ ------ ------ ------ ------

NET DEBT POSITION [6] 70 77 175 70 175

---- ------ ------ ------ ------ ------

Net Debt / Adjusted EBITDA (LTM) ratio(1) [7] 0.05 x 0.07 x 0.29 x 0.05 x 0.29 x

---- ------ --- ------ ------ --- ------ --- ------ ---

(1) Net Debt and Adjusted EBITDA are Non-GAAP measures. Refer to

the non-GAAP measure section of the Management Report.

NOTES:

1) Operating cash flows increased by $11.4 million from $300.5

million (or $1.19 per share) in Q2-2021 to $311.9 million (or $1.25

per share) in Q3-2021 mainly due to less income taxes paid and less

foreign exchange losses incurred, which was offset slightly by

lower gold sales at a lower realised gold price and a decrease in

working capital. Operating cash flow before working capital

increased by $40.2 million from $285.7 million (or $1.13 per share)

in Q2-2021 to $325.9 million (or $1.30 per share) in Q3-2021.

Notable variances are summarised below:

-- Income taxes paid decreased by $51.0 million over Q2-2021 to $55.5

million in Q3-2021, as higher income taxes paid in Q2-2021 were

reflective of the timing of provisional payments for 2021 based on full

year 2020 earnings and the tax payments upon filing of the 2020 tax

returns.

-- Gold sales decreased by 28koz over Q2-2021 to 392koz in Q3-2021 due to

lower ounces produced and sold at the Ity, Wahgnion and Karma mines. The

realised gold price for Q3-2021 was $1,763/oz compared to $1,791/oz for

Q2-2021. Total cash cost per ounce increased from $729/oz in Q2-2021 to

$743/oz in Q3-2021 due to higher costs at the Ity, Mana, Wahgnion and

Karma mines.

-- Working capital decreased by $14.0 million in Q3-2021 mainly due to a

decrease in accounts payable at Boungou, Ity and Mana, which was

partially offset by a decrease in inventories resulting from the

unwinding of the fair value adjustment to stockpiles at the

Sabodala-Massawa and Wahgnion mines recognised upon acquisition. There

was also a decrease in inventory stockpiles and finished good balances at

Houndé, Ity, Sabodala-Massawa and Wahgnion.

-- Acquisition and restructuring costs decreased by $12.7 million to $1.8

million in Q3-2021 from $14.5 million in Q2-2021, related to the Teranga

acquisition and integration as well as restructuring costs

2) Cash flows used by investing activities of $136.8 million in

Q3-2021 remained consistent with the prior quarter. Sustaining and

growth capital expenditures increased while non-sustaining capital

expenditure decreased slightly, as described below:

-- Sustaining capital from continuing operations increased by $13.0 million

from $41.5 million in Q2-2021 to $54.5 million in Q3-2021 due to higher

sustaining capital at Houndé, Sabodala-Massawa and Wahgnion

primarily due to planned waste capitalisation.

-- Non-sustaining capital from continuing operations decreased from $58.3

million in Q2-2021 to $41.5 million in Q3-2021, due to decreases at

Houndé, Ity, Karma, Mana and Wahgnion mainly due to a reduction in

TSF raise construction and reduced pre-stripping activities, which were

partially offset by increases at Boungou due to pre-stripping and at

Sabodala-Massawa due to relocation activities and infrastructure

developments.

-- Growth capital spend decreased by $1.7 million from Q2-2021 to $10.9

million in Q3-2021 and primarily relates to the Sabodala-Massawa Phase 1

expansion with the remainder for ongoing Definitive Feasibility Studies

("DFS") studies

3) Cash flows used by financing activities increased by $41.1 million from $191.8 million in Q2-2021 to $232.9 million in Q3-2021, mainly due to minority and shareholder dividends paid of $99.8 million, and higher interest payments of $12.6 million, offset by a lower net repayment of long-term debt of $80.0 million than the previous quarter and a lower amount paid towards the buyback of the Company's own shares of $34.6 million for the quarter.

4) At quarter-end, Endeavour's liquidity remained strong with $760.4 million of cash on hand and $300.0 million undrawn of the revolving credit facility.

5) Endeavour's corporate loan facilities were increased from $430.0 million to $800.0 million in Q1-2021 to retire Teranga's various higher cost debt facilities. In Q3-2021, $80.0 million was repaid on the facility with $500.0 million drawn on the facility at quarter-end. Following the quarter-end, Endeavour restructured its debt, as described in the below "Debt Refinancing Activity" section.

6) Net Debt amounted to $69.6 million at quarter-end, a decrease of $7.5 million during the quarter despite shareholder dividend payments of $70.0 million and $34.6 million of shares repurchased. Net Debt increased by $144.3 million compared to the beginning of the year as approximately $332.0 million of Net Debt was absorbed from Teranga in Q1-2021.

7) The Net Debt / Adjusted EBITDA (LTM) leverage ratio ended the quarter at a healthy 0.05x, down from 0.07x in Q2-2021, and well below the Company's long-term target of less than 0.50x, which provides flexibility to continue to supplement its shareholder return programme while maintaining headroom to fund its organic growth. The ratio has improved by 83% from the corresponding period last year when the ratio stood at 0.29x.

DEBT REFINANCING ACTIVITY

-- On 14 October 2021, the Company completed an offering of $500.0 million

fixed rate senior notes (the "Notes") due in 2026 with a 5.00% annual

coupon paid semi-annually. The Company also entered into a new $500.0

million unsecured RCF agreement due in 2025 with an interest rate between

2.40 - 3.40% plus LIBOR depending on leverage (the "New RCF") with a

syndicate of international banks. The proceeds of the Notes, together

with the Group's available cash, were used to repay all amounts

outstanding under the Company's existing loan facilities and to pay fees

and expenses in connection with the offering of the Notes. The New RCF

will replace the bridge facility and existing RCF, which was cancelled

upon completion of the Notes offering.

-- The New RCF and Notes will extend the maturities of the Company's

existing debt structure, while providing enhanced financial flexibility

and ample liquidity headroom.

-- As part of the bond issuance process, Endeavour received issuer and bond

ratings from S&P and Fitch of BB- stable and BB stable, respectively.

EARNINGS FROM CONTINUING OPERATIONS

The table below presents the earnings and adjusted earnings for

Endeavour for the three and nine month period ending 30 September

2021, with accompanying notes below.

Table 5: Earnings from Continuing Operations

THREE MONTHSED NINE MONTHSED

30 September 30 June 30 September 30 September 30 September

2021 2021 2020 2021 2020

------------ ------- ------------ ------------ --------------

Revenue [8] 692 753 435 2,081 871

Operating expenses [9] (257) (278) (166) (789) (346)

Depreciation and depletion [9] (157) (158) (115) (447) (194)

Royalties [10] (43) (44) (30) (131) (60)

----- ------------ ------- ------------ ------------ ------------

Earnings from mine operations 235 273 123 715 271

------------ ------- ------------ ------------ ------------

Corporate costs [11] (12) (16) (5) (42) (15)

Acquisition and restructuring costs [12] (2) (15) (19) (29) (26)

Share-based compensation (7) (10) (7) (25) (14)

Exploration costs (3) (6) (1) (19) (4)

------------ ------- ------------ ------------ ------------

Earnings from operations 211 227 91 600 212

------------ ------- ------------ ------------ ------------

(Loss)/gain on financial instruments [13] (20) (15) (26) 7 (101)

Finance costs (15) (14) (12) (41) (36)

Other (expense)/income (3) (7) 23 (14) 23

------------ ------- ------------ ------------ ------------

Earnings before taxes 173 191 75 553 98

------------ ------- ------------ ------------ ------------

Current income tax expense [14] (40) (44) (53) (157) (72)

Deferred income tax (expense)/recovery -- 2 41 (4) 34

Net comprehensive earnings/(loss) from continuing

operations [15] 133 149 64 392 61

-------------------------------------------------------------- ----- ------------ ------- ------------ ------------ ------------

Add-back adjustments [16] 41 59 24 112 120

----- ------------ ------- ------------ ------------ ------------

Adjusted net earnings from continuing operations [17] 174 208 87 505 181

----- ------------ ------- ------------ ------------ ------------

Portion attributable to non-controlling interests 21 25 7 75 27

------------ ------- ------------ ------------ ------------

Adjusted net earnings from continuing operations attributable

to shareholders of the Company [17] 153 183 81 429 154

----- ------------ ------- ------------ ------------ ------------

Earnings/(loss) per share from continuing operations 0.45 0.50 0.32 1.38 0.24

Adjusted net earnings per share from continuing operations 0.61 0.73 0.49 1.81 1.20

------------ ------- ------------ ------------ ------------

NOTES:

8) Revenue decreased by $61.7 million in Q3-2021 over Q2-2021

mainly due to lower gold sales at Ity, Karma and Wahgnion, together

with a lower realised gold price for Q3-2021 of $1,763/oz compared

to $1,791/oz for Q2-2021.

9) Operating expenses and depreciation and depletion decreased

for Q3-2021 compared to Q2-2021 due to decreased levels of

production at the Houndé, Ity, Karma and Wahgnion mines as well as

due to a decrease in the value of the depreciation of inventory

associated with the fair value adjustment on purchase price

allocation of Teranga and Semafo.

10) Royalties remained flat in Q3-2021 at $42.5 million.

11) Corporate costs were $12.0 million for Q3-2021 compared to

$15.9 million for Q2-2021. The decrease in corporate costs are

primarily due to decreased costs associated with listing on the LSE

incurred during Q2-2021.

12) Acquisition and restructuring costs were $1.8 million in

Q3-2021 compared to $14.5 million in Q2-2021. Costs decreased in

Q3-2021 compared to the prior period due to the completion of

several integration projects in Q2-2021, after the acquisition of

Teranga on 10 February 2021.

13) The loss on financial instruments was $20.0 million in

Q3-2021 compared to a loss of $14.8 million in Q2-2021. The loss in

Q3-2021 is mainly due to foreign exchange losses of $23.3 million

that were offset slightly by a realized gain on forward contracts

of $5.0 million and a gain on other financial instruments of $2.7

million. The loss in Q2-2021 was mainly due to the net impact of a

loss on change in fair value of the warrant liabilities and call

rights of $5.3 million and $7.0 million respectively, and foreign

exchange losses of $7.2 million.

14) Current income tax expense was $40.4 million in Q3-2021

compared to $44.5 million in Q2-2021. Current income tax expense

for Q3-2021 decreased slightly compared to Q2-2021 due to lower

earnings before taxes as a result of lower ounces sold in Q3-2021

compared to Q2-2021.

15) Net comprehensive earnings were $132.5 million for Q3-2021

compared to $148.9 million in Q2-2021. The decrease in earnings was

related to lower earnings from mine operations due lower gold sales

at Ity, Karma and Wahgnion, together with a lower realised gold

price for Q3-2021 of $1,763/oz compared to $1,791/oz for

Q2-2021.

16) For Q3-2021, adjustments mainly included a loss on financial

instruments of $20.0 million, share based compensation of $7.3

million, non-cash expense of inventory associated with the fair

value adjustment on purchase price allocation of Teranga of $8.6

million, acquisition and restructuring costs of $1.8 million,

deferred income tax expense of $0.2 million and other non-recurring

expenses of $3.4 million. In Q2-2021, adjustments were primarily

made up of a loss on financial instruments of $14.8 million, share

based compensation of $9.8 million, non-cash expense of inventory

associated with the fair value adjustment on purchase price

allocation of SEMAFO and Teranga of $15.3 million, acquisition and

restructuring costs of $14.5 million, deferred income tax

recoveries of $2.2 million and other non-recurring expenses of $7.1

million.

17) Adjusted net earnings attributable to shareholders for

continuing operations were $153.0 million (or $0.61 per share) in

Q3-2021 compared to $183.1 million (or $0.73 per share) in

Q2-2021.

OPERATIONS REVIEW SUMMARY

-- Continued strong safety record for the Group, with a Lost Time Injury

Frequency Rate ("LTIFR") of 0.21 for the trailing twelve months ending 30

September 2021.

-- The acquisition of Teranga Gold was completed on 10 February 2021 and the

Sabodala-Massawa and Wahgnion assets have been consolidated into the

financial statements from this date. The sale of Endeavour's non-core

Agbaou mine closed on 1 March 2021, and has been classified as a

discontinued operation.

-- A better than expected performance was achieved in Q3-2021 due to

outperformance notably at the Houndé and Sabodala-Massawa mines.

Production decreased by 7% in Q3-2021 over Q2-2021 to 382koz mainly due

to the rainy season, while AISC increased by $50/oz to $904/oz due to the

rainy season and scheduled higher sustaining capital spend.

-- Production increased by 57% in Q3-2021 over Q3-2020, due to the full

benefit of consolidated production from Sabodala-Massawa and Wahgnion and

the strong operational performance notably at Ity, Houndé and

Boungou, while Group AISC remained fairly flat.

Table 6: Consolidated Group Production

THREE MONTHSED NINE MONTHSED

(All amounts in koz, 30 September 30 June 30 September 30 September 30 September

on a 100% basis) 2021 2021 2020 2021 2020

------------ ------- ------------ ------------ --------------

Boungou(1) 41 39 30 139 30

Houndé 70 80 62 216 175

Ity 61 79 44 212 152

Karma 21 25 22 67 70

Mana(1) 49 49 60 151 60

Sabodala-Massawa(2) 106 96 -- 241 --

Wahgnion(2) 34 41 -- 100 --

------------ ------- ------------ ------------ ------------

PRODUCTION FROM

CONTINUING

OPERATIONS 382 409 219 1,126 488

------------ ------- ------------ ------------ ------------

Agbaou(2) -- -- 25 13 77

------------ ------- ------------ ------------ ------------

GROUP PRODUCTION 382 409 244 1,138 565

------------ ------- ------------ ------------ ------------

(1) Included for the post acquisition period commencing 1 July

2020.(2) Included for the post acquisition period commencing 10

February 2021. (3) Divested on 1 March 2021.

Table 7: Consolidated All-In Sustaining Costs(1)

THREE MONTHSED NINE MONTHSED

(All amounts in 30 September 30 June 30 September 30 September 30 September

US$/oz) 2021 2021 2020 2021 2020

------------ ------- ------------ ------------ --------------

Boungou(1) 800 950 752 795 752

Houndé 921 741 865 833 966

Ity 915 806 775 830 728

Karma 1,259 1,070 1,073 1,162 949

Mana(1) 1,029 1,016 896 996 896

Sabodala-Massawa(2) 655 637 -- 667 --

Wahgnion(2) 1,097 980 -- 964 --

Corporate G&A 23 25 22 26 30

AISC FROM CONTINUING

OPERATIONS 904 858 881 872 896

-------------------- ------------ ------- ------------ ------------ ------------

Agbaou(2) -- -- 1,139 1,131 1,013

------------ ------- ------------ ------------ ------------

GROUP AISC 904 853 906 875 911

------------ ------- ------------ ------------ ------------

(1) Included for the post acquisition period commencing 1 July

2020.(2) Included for the post acquisition period commencing 10

February 2021. (3) Divested on 1 March 2021.

OPERATING ACTIVITIES BY MINE

Boungou Gold Mine, Burkina Faso

Table 8: Boungou Performance Indicators (for the post

acquisition period)

For The Period

Ended Q3-2021 Q2-2021 Q3-2020 YTD-2021 YTD-2020

------- ------- ------- -------- ----------

Tonnes ore mined,

kt 539 350 124 1,136 124

Total tonnes mined,

kt 7,126 8,346 294 22,144 294

Strip ratio (incl.

waste cap) 12.22 22.82 1.38 18.50 1.38

Tonnes milled, kt 349 336 308 1,000 308

Grade, g/t 3.76 3.84 3.15 4.34 3.15

Recovery rate, % 95 93 94 95 94

PRODUCTION, KOZ 41 39 30 139 30

------- ------- ------- -------- --------

Total cash cost/oz 717 714 737 675 737

AISC/OZ 800 950 752 795 752

------- ------- ------- -------- --------

Q3-2021 vs Q2-2021 Insights

-- Production remained consistent with Q2-2021 as the greater throughput and

recovery rate were offset by lower grades.

-- Total tonnes mined decreased in Q3-2021 following the accelerated

mining activity in the first half of the year, due to the

scheduled reduction in mining during the wet season and a lower

strip ratio, as the focus was on ore mining in Phase 2 of the West

Pit and waste stripping in the Phase 3 of the West and East pits.

Ore mining was constrained to lower grade areas as the larger

mining fleet was focused on waste extraction at the East pit.

Mining activities continued to focus on the West pit Phase 2 and 3

with total tonnes of ore mined increasing as a result of the lower

strip ratio and the benefit of mining on the top benches.

Pre-stripping activities at the East pit continued during Q3-2021.

-- Tonnes milled increased in Q3-2021 relative to Q2-2021 as higher

mill utilisation resulted from improved mining fragmentation of

the ore, as well as the benefit of improvements made to the SAG

mill, pebble crusher and vertical tower mill.

-- Average processed grades decreased in Q3-2021 as the mill feed

continued to be sourced from the lower grade areas of the West Pit

Phase 2, as the higher grade areas were targeted during the

restart of mining activities in Q4-2020 and Q1-2021.

-- AISC per ounce decreased in Q3-2021 compared to Q2-2021 due to the

decrease in sustaining capital resulting from less stripping at the West

pit and a decrease in unit mining and processing costs due to improved

mining fragmentation and shorter hauls associated with the near surface

Phase 3 expansion.

-- Sustaining capital of $3.4 million mainly related to waste capitalisation

at the West Pit and the third TSF wall raise.

-- Non-sustaining capital of $5.4 million related to pre-stripping at the

East pit.

2021 Outlook

-- Boungou is expected to achieve the bottom half of the FY-2021 production

guidance of 180 - 200koz, while AISC are expected to continue to trend

above the guided $690 - 740 per ounce range as a result of higher fuel

prices and increased security costs.

-- Plant feed is expected to continue to be sourced from the West Pit with

waste stripping activities continuing at the East Pit through to the end

of the year. Mill throughput and average processed grades are expected to

remain broadly consistent with year to date performance in Q4-2021.

-- The sustaining capital spend outlook for FY-2021 remains unchanged

compared to the initial guidance of $19.0 million, of which $16.5 million

has been incurred year to date. The non-sustaining capital spend outlook

for FY-2021 also remains unchanged compared to the initial guidance of

$22.0 million, of which $13.9 million has been incurred year to date.

Houndé Gold Mine, Burkina Faso

Table 9: Houndé Performance Indicators

For The Period

Ended Q3-2021 Q2-2021 Q3-2020 YTD-2021 YTD-2020

------- ------- ------- -------- ----------

Tonnes ore mined,

kt 596 1,399 1,231 3,620 3,204

Total tonnes mined,

kt 11,966 11,718 9,933 37,620 32,754

Strip ratio (incl.

waste cap) 19.07 7.38 7.07 9.39 9.22

Tonnes milled, kt 1,142 1,108 1,010 3,396 3,111

Grade, g/t 2.11 2.47 2.06 2.15 1.91

Recovery rate, % 92 92 92 92 92

PRODUCTION, KOZ 70 80 62 216 175

------- ------- ------- -------- --------

Total cash cost/oz 631 629 753 672 796

AISC/OZ 921 741 865 833 966

------- ------- ------- -------- --------

Q3-2021 vs Q2-2021 Insights

-- As guided, production decreased in Q3-2021 due to lower average processed

grades as mining activities focused on waste stripping.

-- Tonnes of ore mined significantly decreased as a result of the

scheduled increased focus on waste stripping at the Vindaloo Main

and Kari Pump Phase 2 pits and pre-stripping at the Kari West pit.

Ore tonnes mined were primarily sourced from the Kari Pump pit

with supplemental ore being sourced from Vindaloo Centre and

Bouéré as well as Kari West, where mining started during

the quarter.

-- Tonnes milled slightly increased due to the higher throughput rate

that resulted from a higher proportion of oxide ore being

processed.

-- Average gold grade milled decreased, as guided, due to the

increased focus on lower grade ore during the wet season, this was

partially offset by higher grade ore sourced from the Kari Pump

and Vindaloo Main pits.

-- AISC increased due to higher sustaining capital as well as higher unit

processing cost due to an increased use of on-site generated power and

drawdown of stockpiles. Higher costs were partially offset by lower unit

mining costs as a result of mining more oxide material with lower

associated drill and blast costs.

-- Sustaining capital of $21.9 million related to waste capitalisation at

the Vindaloo Main and Kari Pump pits and component replacements within

the mining fleet.

-- Non-sustaining capital of $0.6 million related to the costs associated

with the development of the Kari West pit.

2021 Outlook

-- FY-2021 production at Houndé is expected to be near the top end of

its guidance of 240 - 260koz as year to date performance was stronger

than scheduled due to the better-than-expected mining productivity

achieved during the pre-stripping of Kari Pump which enabled access to

greater volumes of high grade oxide ore. AISC is expected to be near the

bottom end of its guided range of $855 - 905 per ounce.

-- In Q4-2021, mining activities will continue to focus on Kari Pump,

supplemented by contributions from Vindaloo Main and Kari West. Mining is

expected to increase at Vindaloo Main and Kari West after completion of

the pre-strip. Throughput is expected to decline slightly, compared to

year to date throughput, and processed grade is expected to be lower as

the contribution from the high grade Kari Pump deposit will be reduced as

Vindaloo Main and Kari West provide an increased proportion of the feed.

-- Due to a stronger than guided production outlook, the sustaining capital

spend for FY-2021 is expected to be above initial guidance of $39.0

million, of which $35.2 million has been incurred year to date.

-- Non-sustaining capital spend outlook for FY-2021 remains unchanged

compared to the initial guidance of $13.0 million, of which $10.3 million

has been incurred year to date.

Ity Gold Mine, Côte d'Ivoire

Table 10: Ity Performance Indicators

For The Period

Ended Q3-2021 Q2-2021 Q3-2020 YTD-2021 YTD-2020

------- ------- ------- -------- ----------

Tonnes ore mined,

kt 1,690 1,877 2,352 5,672 5,911

Total tonnes mined,

kt 5,576 5,934 6,322 18,326 16,923

Strip ratio (incl.

waste cap) 2.30 2.16 1.69 2.23 1.86

Tonnes milled, kt 1,530 1,544 1,307 4,624 3,897

Grade, g/t 1.50 1.96 1.34 1.74 1.52

Recovery rate, % 83 81 81 81 81

PRODUCTION, KOZ 61 79 44 212 152

------- ------- ------- -------- --------

Total cash cost/oz 828 720 728 749 692

AISC/OZ 915 806 775 830 728

------- ------- ------- -------- --------

Q3-2021 vs Q2-2021 Insights

-- Production decreased, as guided, due to the lower average processed grade

as a result of the greater emphasis on stripping activities at Bakatouo,

which reduced the grade of ore mined.

-- Tonnes of ore mined decreased due to a greater focus on waste

stripping at the Ity, Bakatouo, Walter and Colline Sud pits. Ore

was mainly sourced from the Bakatouo and Daapleu pits as well as

the heap stockpile, supplemented by ore from the Ity, Colline Sud,

Walter, Flotouo and Le Plaque pits.

-- Tonnes milled decreased slightly due to a higher proportion of

transitional and fresh ore being processed, however throughput

continued to perform above nameplate capacity due to the

improvements in plant maintenance strategies and continued use of

the surge bin feeder that provides supplemental oxide ore.

-- Average gold grade milled decreased in Q3-2021 due to an increase

in the proportion of feed from lower grade stockpiles.

-- Despite the higher proportion of transitional and fresh ore

processed in Q3-2021, recovery rates increased, as a higher

proportion of Bakatouo fresh ore, with associated higher

recoveries, displaced some fresh and transitional ore from

Daapleu.

-- AISC per ounce increased due to higher unit mining costs as a result of

longer hauling distance for ore mined from the Flotouo and Walter pits.

In addition, unit processing costs increased due to the increase in the

proportion of transitional and fresh material and the resultant higher

reagent consumption.

-- Sustaining capital of $5.5 million related primarily to waste stripping

at the Ity, Bakatouo, Walter and Colline Sud pit as well as mining

geotechnical monitoring equipment, additional dewatering boreholes and

strategic heavy vehicle spare parts.

-- Non-sustaining capital of $3.9 million mainly related to the construction

of the pre-leach and tank spargers as well as Le Plaque waste dump

sterilisation drilling.

2021 Outlook

-- FY-2021 production at Ity is on track to be near the top end of its

guidance of 230 - 250koz with AISC expected to be near the top end of its

$800 - 850 per ounce guided range. Year to date performance was stronger

than anticipated due to the benefit of a combination of higher throughput,

grade, and higher recoveries

-- Mining activity is expected to increase at the higher grade Le Plaque pit

in Q4-2021. Stripping activity, which was partially deferred due to low

equipment availability earlier in the year, is expected to continue in

Q4-2021 at the Ity pit. Throughput is expected to be slightly lower in

Q4-2021 compared to previous quarters due to an increased proportion of

fresh ore sourced from Daapleau.

-- The sustaining capital spend outlook for FY-2021 remains unchanged

compared to the initial guidance of $28.0 million, of which $17.9 million

has been incurred year to date. As previously reported, non-sustaining

capital spend for FY-2021 is expected to amount to approximately $40.0

million, of which $24.4 million has been incurred year to date.

Karma Gold Mine, Burkina Faso

Table 11: Karma Performance Indicators

For The Period

Ended Q3-2021 Q2-2021 Q3-2020 YTD-2021 YTD-2020

------- ------- ------- -------- ----------

Tonnes ore mined,

kt 1,393 1,253 1,011 3,889 3,528

Total tonnes mined,

kt 4,972 6,212 4,392 16,330 14,146

Strip ratio (incl.

waste cap) 2.57 3.96 3.35 3.20 3.01

Tonnes stacked, kt 1,264 1,267 1,192 3,911 3,544

Grade, g/t 0.70 0.91 0.76 0.77 0.86

Recovery rate, % 64 68 72 66 79

PRODUCTION, KOZ 21 25 22 67 70

------- ------- ------- -------- --------

Total cash cost/oz 1,258 1,059 1,007 1,155 890

AISC/OZ 1,259 1,070 1,073 1,162 949

------- ------- ------- -------- --------

Q3-2021 vs Q2-2021 Insights

-- Production decreased due to the lower average grade as well as the

expected lower recovery rates which resulted from a higher proportion of

transitional ore stacked from the GG1 pits.

-- Total tonnes mined decreased due to the lower strip ratio at the

GG1 pits during the quarter.

-- Tonnes of ore mined increased slightly due to the improved strip

ratio as some of the smaller higher strip ratio GG1 pits were

depleted.

-- The stacked ore grade decreased as expected due to the lower grade

ore sourced from the GG1 pits.

-- The recovery rate decreased as expected due to the increased

proportion of transitional ore from the GG1 pit, which has a lower

associated recovery rate owing to the copper and carbon content

found locally in the ore.

-- AISC per ounce increased due to the lower recovery rate and slightly

higher unit mining and processing costs associated with the transitional

ore from the GG1 pits.

-- Sustaining capital was negligible during Q3-2021.

-- Non-sustaining capital was $0.2 million, which was related to

construction of new heap leach cells.

2021 Outlook

-- Karma is well positioned to meet its FY-2021 production guidance of 80 -

90koz and achieve AISC near the bottom end of the guided $1,220 - $1,300

per ounce range.

-- In Q4-2021, mining activity is expected to focus on the GG1 pits,

supplemented by ore from the Rambo Pit. As a result of the increase in

transitional material mined from the GG1 pits, processed grades and

recoveries are expected to be lower, while mill throughput is expected to

slightly increase compared to Q3-2021

-- The sustaining capital outlook at Karma is expected to be significantly

lower than the $11.0 million guided as a result of the waste development

being included as an operating cost for 2021 due to the short mine life

remaining at Karma.

-- The non-sustaining capital spend outlook for FY-2021 remains unchanged

compared to the initial guidance of $5.0 million, of which $3.1 million

has been incurred year to date.

Mana Gold Mine, Burkina Faso

Table 12: Mana Performance Indicators (for the post acquisition

period)

For The Period

Ended Q3-2021 Q2-2021 Q3-2020 YTD-2021 YTD-2020

------- ------- ------- -------- ----------

OP tonnes ore

mined, kt 592 549 465 1,496 465

OP total tonnes

mined, kt 5,114 7,187 6,416 20,834 6,416

OP strip ratio

(incl. waste cap) 7.64 12.09 12.80 12.93 12.80

UG tonnes ore

mined, kt 199 214 197 658 197

Tonnes milled, kt 667 670 593 1,942 593

Grade, g/t 2.50 2.49 3.43 2.62 3.43

Recovery rate, % 91 92 95 91 95

PRODUCTION, KOZ 49 49 60 151 60

------- ------- ------- -------- --------

Total cash cost/oz 986 911 826 932 826

AISC/OZ 1,029 1,016 896 996 896

------- ------- ------- -------- --------

Q3-2021 vs Q2-2021 Insights

-- Production remained flat over Q2-2021 as plant throughput, average grade

milled and recoveries remained fairly stable.

-- Total open pit tonnes of ore mined was higher as a result of the

lower strip ratio at the Wona South stage 2 and 3 pits, as they

merged into a single pit at depth.

-- Total underground tonnes of ore mined decreased as a result of the

wet season due to additional dewatering activities required at

Siou as well as lower contributions from development mining, as

the development is now largely completed..

-- Tonnes milled in Q3-2021 was consistent with Q2-2021, benefiting

from increased mill availability and utilisation due to better

mining fragmentation, leading to higher plant throughput. The ore

processed was mainly fresh material, sourced from both the Wona

open pit and the Siou underground.

-- The average processed grade adn recovery was consistent with

Q2-2021 due to the feed remaining similar.

-- AISC slightly increased due to higher processing and related maintenance

costs as well as higher open pit unit mining costs due to an increase in

blasting and drilling activities during the period. This was offset by

lower loading and hauling costs due to a decrease in total tonnes mined.

-- Sustaining capital of $2.1 million is related to underground development

to create new stopping levels.

-- Non-sustaining capital of $11.2 million was mainly related to waste

capitalisation, activities related to the preparation of the Wona

underground portals and the TSF raise.

2021 Outlook

-- FY-2021 production at Mana is well positioned to be near the top end of

its guidance of 170 - 190koz and near the top end of its AISC guidance of

$975 - 1,050 per ounce, due to its strong performance driven by improved

mill availability, and increased underground tonnes mined.

-- Ore in Q4-2021 is expected to continue to be sourced from the Siou

underground mine while open pit mining activities at Wona Stage 2 and 3

pits are expected to wind down in H1-2022. Following optimisation studies

completed in Q2-2021, Wona is being pursued as an underground operation

with underground development being expedited as the portal development

has commenced. Grades are expected to be slightly lower, compared to

Q3-2021, while recovery rates and throughput are expected to remain

similar.

-- The total sustaining and non-sustaining capital spend outlook for FY-2021

remains unchanged. As previously reported, in light of the reduction in

required stripping activities at Wona, following the decision to shift to

underground mining, the FY-2021 sustaining capital outlook is expected to

be significantly lower than the $27.0 million guided, of which $10.2

million has been incurred. Due to the reallocation of capital to the Wona

underground development, the non-sustaining capital outlook for FY-2021

is expected to amount to slightly more than the $62.0 million guided, of

which $56.4 million has been incurred.

Sabodala-Massawa Gold Mine, Senegal

Table 13: Sabodala-Massawa Performance Indicators (for the post

acquisition period)

For The Period Ended Q3-2021 Q2-2021 Q3-2020 YTD-2021 YTD-2020

------- ------- ------- -------- --------

Tonnes ore mined, kt 1,717 2,111 n/a 4,884 n/a

Total tonnes mined, kt 11,515 10,798 n/a 28,144 n/a

Strip ratio (incl.

waste cap) 5.71 4.11 n/a 4.76 n/a

Tonnes milled, kt 1,079 1,067 n/a 2,696 n/a

Grade, g/t 3.32 3.20 n/a 3.11 n/a

Recovery rate, % 90 89 n/a 90 n/a

PRODUCTION, KOZ 106 96 n/a 241 n/a

------- ------- ------- -------- --------

Total cash cost/oz 492 548 n/a 528 n/a

AISC/OZ 655 637 n/a 667 n/a

------- ------- ------- -------- --------

Q3-2021 vs Q2-2021 Insights

-- Production increased in Q3-2021 compared to Q2-2021 mainly due to higher

average processed grades and slightly higher tonnes milled and recovery

rate.

-- Total tonnes mined increased, reflecting the combination of

favourable mining conditions, a high proportion of oxide material

mined in Sofia North and good productivity of shovels and

excavators. More waste extraction than scheduled was conducted at

the Sofia North pit which provided access to better grades and

offers increased mining optionality. Ore tonnes mined comprised of

mainly fresh ore from the Sofia Main pit, supplemented by oxide

material from Sofia North pit, the Sabodala pit and high-grade

stockpiles.

-- Tonnes milled were slightly higher due to continued high mill

availability and improvements in our mill feed blending strategy

which reduced mill chute blockages.

-- Average processed grades were higher due to processing high grade

fresh ore sourced from the Sofia Main pit, which were supplemented

with oxide ore from the Sofia North pit.

-- AISC per ounce slightly increased in Q3-2021 compared to Q2-2021 due to

an increase in the strip ratio associated with waste stripping at Sofia

North and a higher sustaining capital spend, which was slightly offset by

lower mining and processing unit costs due to improved mining conditions.

-- Sustaining capital of $17.5 million was related to purchases of

additional dump trucks, bulldozers, water tankers, slope radar system and

planned waste capitalisation.

-- Non-sustaining capital of $10.1 million mostly was related to the

relocation activities of the Sabodala village, the Massawa haul road and

other infrastructure developments at Massawa.

Plant Expansion

-- The Massawa deposit is being integrated into the Sabodala mine through a

two-phased approach, as outlined in the 2020 pre-feasibility study

("PFS").

-- Phase 1 of the plant expansion, which is on schedule for completion in

Q4-2021, will facilitate processing of an increased proportion of high

grade, free-milling Massawa ore through the Sabodala processing plant.

-- Installation of Packages 1 to 5, which include the electrowinning cell,

carbon regeneration kiln, acid wash and elution circuit, and new leach

tank are all now largely complete. Commissioning of these packages is

underway with completion expected ahead of schedule in early Q4-2021.

Installation of Package 6, the Gravity Circuit, is well underway with

civil and structural works completed and expected commissioning during

Q4-2021.

-- A total of $11.6 million was incurred year to date for the Phase 1 plant

expansion and classified as growth capital, of which $0.3 million was

incurred prior to its acquisition on 10 February 2021.

-- Phase 2 of the expansion will add an additional processing circuit to

process the high grade refractory ore from the Massawa deposit. The

definitive feasibility study ("DFS") for Phase 2 is underway. Following

successful exploration drilling, resource updates are expected to be

published in Q4-2021 and will be incorporated into the DFS which is now

scheduled to be published in early 2022.

2021 Outlook

-- Given its strong performance year to date, FY-2021 production at

Sabodala-Massawa is well positioned to be near the top end of its

guidance of 310 - 330koz with an AISC near the bottom end of the $690 -

740 per ounce guidance, for the post acquisition period commencing on 10

February 2021.

-- The Sofia Main and Sofia North pits will continue to contribute the

majority of the ore mined for Q4-2021, while waste extraction at Sofia

North and Sabodala pits is expected to continue. Mill throughput and

processed grades are expected to remain similar to year to date average

grades.

-- As previously reported, the sustaining capital spend for FY-2021 is

expected to be above the initially guided $35.0 million, with $36.0

million already incurred, due to investments in additional mining fleet

and equipment.

-- As also previously reported, non-sustaining capital spend for FY-2021 is

expected to be below the initial guided $47.0 million, with $19.9 million

already incurred, due to the deferral of spend on the Sabodala relocation

construction costs as a greater focus was placed on mining the Sofia

pits.

Wahgnion Gold Mine, Burkina Faso

Table 14: Wahgnion Performance Indicators (for the post

acquisition period)

For The Period Ended Q3-2021 Q2-2021 Q3-2020 YTD-2021 YTD-2020

------- ------- ------- -------- --------

Tonnes ore mined, kt 917 1,187 n/a 2,753 n/a

Total tonnes mined, kt 6,154 7,615 n/a 18,220 n/a

Strip ratio (incl.

waste cap) 5.71 5.42 n/a 5.62 n/a

Tonnes milled, kt 809 1,016 n/a 2,363 n/a

Grade, g/t 1.40 1.31 n/a 1.35 n/a

Recovery rate, % 93 95 n/a 94 n/a

PRODUCTION, KOZ 34 41 n/a 100 n/a

------- ------- ------- -------- --------

Total cash cost/oz 983 928 n/a 897 n/a

AISC/OZ 1,097 980 n/a 964 n/a

------- ------- ------- -------- --------

Q3-2021 vs Q2-2021 Insights

-- Production decreased in Q3-2021 due to lower mill throughput and lower

recovery rates, reflecting the high proportion of fresh material

processed.

-- Both the total tonnes mined and tonnes of ore mined decreased in

Q3-2021 due to the impact of the wet season and the increased

focus on waste stripping. Ore mined was sourced mainly from the

Nogbele North, Nogbele South and Fourkoura pits.

-- Tonnes milled decreased as a result of the higher proportion of

fresh ore being processed.

-- Average grade milled increased slightly as the proportion of

higher grade ore sourced from the Nogbele South deposit increased

during the quarter.

-- AISC per ounce increased in Q3-2021 compared to Q2-2021 due to increased

sustaining capital per ounce sold and higher unit mining and processing

costs. Both mining and processing unit costs were higher as a result of

increased fuel costs, with increased drilling and blasting and haulage

costs also contributing to the higher unit mining cost.

-- Sustaining capital expenditure of $4.1 million was related to waste

capitalisation.

-- Non-sustaining capital expenditure of $7.5 million related to the TSF

stage 2 raise, construction of the airstrip and Foukoura resettlement

costs.

2021 Outlook

-- Wahgnion is positioned to achieve the bottom half its FY-2021 production

guidance of 140 - 155koz at an AISC of $940 - 990 per ounce, for the post

acquisition period commencing on 10 February 2021.

-- In Q4-2021, mining is expected to continue at Nogbele North, Nogbele

South, and Fourkoura pits with significant waste capitalisation

continuing. Plant throughput is expected to decrease compared to year to

date due to a higher proportion of fresh ore being processed, while

process grades are expected to increase.

-- The sustaining capital spend outlook for FY-2021 remains unchanged

compared to the initial guidance of $14.0 million, of which $7.5 million

has been incurred, with the remaining spend mainly related to waste

extraction at Fourkoura and Nogbele North pits.

-- The non-sustaining capital spend outlook for FY-2021 also remains

unchanged compared to the initial guidance of $26.0 million, of which

$20.3 million has been incurred. The Q4-2021 non-sustaining spend mainly

relates to construction of a second TSF cell.

EXPLORATION AND DEVELOPMENT ACTIVITIES

-- On 30 September 2021, Endeavour published a new exploration strategy with

a discovery target of 15-20Moz of Indicated resources over the next five

years at an average discovery cost of less than $25/oz. Near-mine

exploration aims to continue to extend the mine lives of core assets to

beyond the 10 years while greenfield exploration targets the discovery of

at least one new standalone project over the next five years.

-- Exploration efforts remain on track to discover more than 2.5 million

ounces of Indicated resources in 2021, with updated resource estimates

expected to be published in Q4-2021, most notably for Ity, Houndé,

Sabodala-Massawa and Fetekro.

-- More than 421,000 meters have been drilled across the Group year to date,

of which 109,000 meters were drilled in Q3-2021. Total exploration spend

of $82 million has been incurred year to date, of which $28 million was

spent during Q3-2021.

Table 15: Consolidated Exploration Expenditures(1)

(All amounts in US$m) YTD-2021 2021 GUIDANCE

-------- -------------

Sabodala-Massawa 9 13

Wahgnion 8 12

Ity 10 9

Mana 9 8

Houndé 14 7

Boungou 5 7

Karma 0 0

-------- -------------

MINE SUBTOTAL 55 56

Greenfield and development projects 27 14 - 34

-------- -------------

TOTAL 82 $70 - 90

-------- -------------

(1) Consolidated exploration expenditures include expensed,

sustaining, and non-sustaining exploration expenditures. Amounts

may differ from Management Report due to rounding.

Boungou mine

-- An exploration programme of up to $7 million was planned for 2021, of

which $5 million has been spent year to date consisting of 25,700 meters

of drilling across 280 drillholes. During Q3-2021, $1 million was spent

on exploration, consisting of 1,300 meters of drilling. The exploration

efforts were focused on delineating near mine targets including Natougou

Northeast, Boungou Northwest and Boungou North.

-- At Natougou Northwest, drilling continues to delineate the zone of

higher-grade mineralisation trending North-Northwest that remains open to

the north. Throughout Q4-2021 and into 2022, drilling will focus on both

delineating this trend, and at Natougou Southeast and Natougou Southwest

targeting the extension of existing mineralised trends and on the

evaluation of inferred resources.

-- At Boungou Northwest, year to date drilling demonstrated promising

initial results, identifying the continuation of the Boungou shear down

plunge. Follow-up drilling in Q4-2021 and 2022 will continue to evaluate

this shear zone.

-- During Q4-2021 and in 2022 further drilling will focus on expanding the

footprints and defining resources at Natougou Northwest, Boungou North

and Boungou Northwest.

-- Reconnaissance drilling to the north of Boungou following up on

geochemical anomalies, at the Osaanpalo and Tawori targets, identified

shallow oxide mineralization. Follow up drilling in 2022 will focus on

delineating these early-stage targets, as well as the Dangou target.

Houndé mine

-- An exploration programme of up to $7 million was initially planned for

2021, however given our exploration success here early in the year, $14

million has now been spent year to date, consisting of 74,800 meters of

drilling across 667 drillholes. During Q3-2021, $7 million was spent on

exploration consisting of 6,000 meters of drilling. The exploration

efforts were focused on Mambo, Vindaloo South and the intersection

between Kari Gap and Kari Center.

-- Drilling at the Mambo target, a recent discovery located 12km from the

Houndé plant, has continued to extend mineralisation to over 1,000

meters in length and it remains open to the Southwest, Northeast, and at

depth. A maiden resource at Mambo is expected to be published in Q4-2021.

-- During Q3-2021, at Vindaloo South and the intersection between Kari Gap

and Kari Center drilling continued to target extensions to the currently

defined mineralisations.

-- During Q4-2021 and into 2022, exploration will continue to focus on

expanding Mambo, Vindaloo South and the intersection between Kari Gap and

Kari Center. In addition, Endeavour will advance higher grade targets

such as Sia Sianikoui and Dohoum through additional drilling.

Ity mine

-- An exploration programme of $9 million was initially planned for 2021,

however given the success, $10 million has already been spent year to

date consisting of 69,500 meters of drilling across 538 drillholes.

During Q3-2021, $4 million was spent on exploration consisting of more

than 24,400 meters of drilling. The exploration efforts were focused on

Le Plaque South (Delta Extension), West Flotouo (Verse Ouest), Daapleu

Deep, Yopleu-Legaleu and the junction between Bakatouo and Walter.

-- During Q3-2021, drilling on the West Flotouo target led to the discovery

of further high grade mineralised lenses immediately below the former

Flotouo dump, located in proximity to the plant. West Flotouo is open to

the north, south and at depth. As such, during Q4-2021 further

delineation of this discovery is expected and a maiden resource is

expected to be published in late 2021.

-- Drilling in the Le Plaque area focused on extending mineralisation at Le

Plaque South, Delta Extension and Yopleu-Legaleu. An updated Le Plaque

resource is expected to be published in Q4-2021.

-- Drilling conducted at Daapleu Deep continued to extend mineralisation to

over 300 meters downdip of the current pit design. Daapleau Deep will be

delineated further in Q4-2021 and in 2022.

-- Drilling at the junction between the Bakatouo and Walter deposits

confirmed that the skarn style mineralisation is continuous between the

two deposits and that it remains open at depth. Exploration will continue

to delineate this target in Q4-2021 and in 2022.

Karma mine

-- During Q3-2021, limited exploration work continued as part of the

advanced grade control drilling programme, targeting near mine extensions

to be added into the current mine plan. The focus was on Kao Main, Kao

North, Kao North Southeast, Rambo, GG1, GG2, Anomaly B and Kanongo, which

will be pursued in Q4-2021 and in 2022.

Mana mine

-- An exploration programme of $8 million was planned for 2021 of which $9

million has already been spent year to date consisting of 59,600 meters

of drilling across 459 drillholes. During Q3-2021, $2 million was spent

on exploration focussed on the Maoula open pit oxide target, and on

evaluating underground targets at Siou, Wona and Nyafe.

-- At Maoula, exploration work focused on defining Indicated resources in

the western and eastern lenses of the deposit and to the southwest, where

the deposit remains open.

-- At Siou South and Nyafe, exploration work focused on interpreting

drilling completed earlier this year to plan further delineation drilling

in Q4-2021 and in 2022.

Sabodala-Massawa mine

-- An exploration programme of up to $13 million was planned for 2021, of

which $9 million has already been spent year to date consisting of 72,300

meters of drilling across 680 drillholes. During Q3-2021 alone, $5

million was spent on exploration consisting of more than 25,900 meters of

drilling. The exploration efforts were focused on Samina, Tina, Sofia

North Extension and Bambaraya. Following the exploration success year to

date, an updated resource is expected to be published in Q4-2021.

-- During Q3-2021, drilling conducted at Samina, Tina and Sofia North

Extension deposit was focused on extending mineralization along strike

and downdip.

-- Drilling at Bambaraya has been prioritised as Bambaraya is a prime target

located just 13 kilometres away from the Sabodala mill. During Q3-2021

mineralisation was extended to 800 meters in strike length in the

north-south direction. In addition, higher grade zones have been

identified and will be followed up in Q4-2021 and in 2022.

-- During Q4-2021, exploration work will be focused on defining resources at

Samina, Tina and the Sofia North Extension with a resource update

expected in Q4-2021.

Wahgnion mine

-- An exploration programme of up to $12 million was planned for 2021, of

which $8 million was spent year to date consisting of 41,100 meters of

drilling across 330 drillholes. During Q3-2021, $5 million was spent on

exploration consisting of 31,500 meters of drilling. The exploration

efforts continued to focus on Nogbele North and Nogbele South deposits,

targeting the continuation of mineralised structures beneath and between

the Nogbele pits.

-- Exploration efforts ramped up in Q3-2021, with continued focus on the

extension and expansion of the Nogbele mineralization and this will

continue in Q4-2021 and in 2022.

-- Delineation drilling at Fourkoura and Hillside targets, as well as

reconnaissance drilling at Ouahiri South, Kassira and Bozogo will

continue in Q4-2021 and in 2022.

Fetekro project

-- Fetekro has been the largest greenfield exploration focus year to date

with $9 million incurred on exploration work. During Q3-2021, $3 million

was spent on exploration consisting of more than 14,800 meters of

drilling. In total, 58,100 meters of drilling were completed year to date

and 69,100 meters have been completed since the last resource update,

published in August 2020.

-- At Lafigué North, a portion of the remaining Inferred resources has

been converted into Indicated resources, which will be included in the

upcoming resource update. At the area between Lafigué Center and

Lafigué North, infill drilling focused on delineating shallow,

subparallel, stacked mineralised lenses located outside of the current

resource. These stacked lenses will also be included in the upcoming

resource update.

-- An updated resource estimate is expected to be published in Q4-2021

following the successful drilling programme which extended the existing

resource. In order to include these new resources within the DFS, the

study is now expected to be published in early Q1-2022.

-- The mining permit for the Lafigué deposit was granted to Endeavour

on 22 September 2021.

Kalana project

-- During Q3-2021, metallurgical testwork continued with samples from Kalana

and Kalanako submitted for metallurgical testing and the permit for the

village resettlement received.

-- In Q4-2021, the DFS flow sheets will be finalized incorporating the

results of the recent metallurgical testwork. The DFS is expected to be

published in Q1-2022.

Greenfield exploration projects

-- At the Woulo Woulo target on the Afema property, Endeavour completed the

initial exploration programme started by Teranga, drilling 8,347 meters

since the acquisition of Teranga was completed in February 2021. Further

work in Q4-2021 and in 2022 will be focused on expanding the mineralised

trend at Woulo Woulo Main.

-- At Bantou, year to date exploration work on the Karankasso JV permits

focused on completing soil geochemical surveys and ground geophysical

surveys to help advance high priority targets. The Dynikongolo permit

hosts both the Bantou and Bantou North deposits. Activities have focused

on mapping and relogging of existing core and drill chips to refine the

geologic model. Resource conversion drilling is expected to commence in

late Q4-2021 and continue into H1-2022.

-- At Siguiri, a program of 4,500 meters of drilling will commence in

Q4-2021, focusing on two promising targets which were selected based on

the analysis conducted in H1-2021.

CONFERENCE CALL AND LIVE WEBCAST

Management will host a conference call and webcast on Thursday

11 November, at 8:30 am ET / 1:30 pm GMT to discuss the Company's

financial results.

The conference call and webcast are scheduled at:

5:30am in Vancouver

8:30am in Toronto and New York

1:30pm in London

9:30pm in Hong Kong and Perth

The webcast can be accessed through the following link:

https://edge.media-server.com/mmc/p/wc2s3hwk

Analysts and investors are also invited to participate and ask

questions using the dial-in numbers below:

International: +44 (0) 207 192 8338

North American toll-free: +1 877 870 9135

UK toll-free: +44 (0) 800 279 6619

Confirmation Code: 3980665

The conference call and webcast will be available for playback

on Endeavour's website.

QUALIFIED PERSONS

Clinton Bennett, Endeavour's VP Metallurgy and Process

Improvement - a Fellow of the Australasian Institute of Mining and

Metallurgy, is a "Qualified Person" as defined by National

Instrument 43-101 - Standards of Disclosure for Mineral Projects

("NI 43-101") and has reviewed and approved the technical

information in this news release.

CONTACT INFORMATION

Martino De Ciccio Brunswick Group LLP in London

VP -- Strategy & Investor Relations Carole Cable, Partner

+44 203 640 8665 +44 7974 982 458

mdeciccio@endeavourmining.com ccable@brunswickgroup.com

Vincic Advisors in Toronto

John Vincic, Principal

+1 (647) 402 6375

john@vincicadvisors.com

ABOUTEAVOUR MINING CORPORATION

Endeavour Mining is one of the world's senior gold producers and

the largest in West Africa, with operating assets across Senegal,

Cote d'Ivoire and Burkina Faso and a strong portfolio of advanced

development projects and exploration assets in the highly

prospective Birimian Greenstone Belt across West Africa.

A member of the World Gold Council, Endeavour is committed to

the principles of responsible mining and delivering sustainable

value to its employees, stakeholders and the communities where it

operates. Endeavour is admitted to listing and to trading on the

London Stock Exchange and the Toronto Stock Exchange, under the

symbol EDV.

For more information, please visit www.endeavourmining.com.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This document contains "forward-looking statements" within the

meaning of applicable securities laws. All statements, other than

statements of historical fact, are "forward-looking statements",

including but not limited to, statements with respect to

Endeavour's plans and operating performance, the estimation of

mineral reserves and resources, the timing and amount of estimated

future production, costs of future production, future capital

expenditures, the success of exploration activities, the

anticipated timing for the payment of a shareholder dividend and

statements with respect to future dividends payable to the

Company's shareholders, the completion of studies, mine life and

any potential extensions, the future price of gold and the share

buyback programme. Generally, these forward-looking statements can

be identified by the use of forward-looking terminology such as

"expects", "expected", "budgeted", "forecasts", "anticipates",

believes", "plan", "target", "opportunities", "objective",

"assume", "intention", "goal", "continue", "estimate", "potential",

"strategy", "future", "aim", "may", "will", "can", "could", "would"

and similar expressions .

Forward-looking statements, while based on management's

reasonable estimates, projections and assumptions at the date the

statements are made, are subject to risks and uncertainties that

may cause actual results to be materially different from those

expressed or implied by such forward-looking statements, including

but not limited to: risks related to the successful integration of

acquisitions or completion of divestitures; risks related to

international operations; risks related to general economic

conditions and the impact of credit availability on the timing of

cash flows and the values of assets and liabilities based on

projected future cash flows; Endeavour's financial results, cash

flows and future prospects being consistent with Endeavour

expectations in amounts sufficient to permit sustained dividend

payments; the completion of studies on the timelines currently

expected, and the results of those studies being consistent with

Endeavour's current expectations; actual results of current

exploration activities; production and cost of sales forecasts for

Endeavour meeting expectations; unanticipated reclamation expenses;

changes in project parameters as plans continue to be refined;

fluctuations in prices of metals including gold; fluctuations in

foreign currency exchange rates; increases in market prices of

mining consumables; possible variations in ore reserves, grade or

recovery rates; failure of plant, equipment or processes to operate

as anticipated; extreme weather events, natural disasters, supply

disruptions, power disruptions, accidents, pit wall slides, labour

disputes, title disputes, claims and limitations on insurance

coverage and other risks of the mining industry; delays in the

completion of development or construction activities; changes in

national and local government legislation, regulation of mining

operations, tax rules and regulations and changes in the

administration of laws, policies and practices in the jurisdictions

in which Endeavour operates; disputes, litigation, regulatory

proceedings and audits; adverse political and economic developments

in countries in which Endeavour operates, including but not limited

to acts of war, terrorism, sabotage, civil disturbances,

non-renewal of key licenses by government authorities, or the

expropriation or nationalization of any of Endeavour's property;

risks associated with illegal and artisanal mining; environmental

hazards; and risks associated with new diseases, epidemics and

pandemics, including the effects and potential effects of the

global Covid-19 pandemic.

Although Endeavour has attempted to identify important factors

that could cause actual results to differ materially from those

contained in forward-looking statements, there may be other factors

that cause results not to be as anticipated, estimated or intended.

There can be no assurance that such statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements. Please refer to Endeavour's most recent Annual

Information Form filed under its profile at www.sedar.com for

further information respecting the risks affecting Endeavour and

its business.

The declaration and payment of future dividends and the amount

of any such dividends will be subject to the determination of the

Board of Directors, in its sole and absolute discretion, taking

into account, among other things, economic conditions, business

performance, financial condition, growth plans, expected capital

requirements, compliance with the Company's constating documents,

all applicable laws, including the rules and policies of any

applicable stock exchange, as well as any contractual restrictions

on such dividends, including any agreements entered into with

lenders to the Company, and any other factors that the Board of

Directors deems appropriate at the relevant time. There can be no

assurance that any dividends will be paid at the intended rate or

at all in the future.

NON-GAAP MEASURES

Some of the indicators used by Endeavour in this press release

represent non-IFRS financial measures, including "all-in margin",

"all-in sustaining cost", "net debt", "EBITDA", "adjusted EBITDA",

"net debt to adjusted EBITDA ratio", "cash flow from continuing

operations", "total cash cost per ounce", "sustaining and

non-sustaining capital", "net earnings", "adjusted net earnings",

"operating cash flow per share", and "return on capital employed".

These measures are presented as they can provide useful information

to assist investors with their evaluation of the pro forma

performance. Since the non-IFRS performance measures listed herein

do not have any standardized definition prescribed by IFRS, they

may not be comparable to similar measures presented by other

companies. Accordingly, they are intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS. Please refer to the non-GAAP measures section of the

Company's most recently filed Management Report for a

reconciliation of the non-IFRS financial measures used in this

press release.

Corporate Office: 5 Young St, Kensington, London W8 5EH, UK

Table of Contents

MANAGEMENT REPORT

1. BUSINESS OVERVIEW 3

1.1. OPERATIONS DESCRIPTION 3

2. HIGHLIGHTS FOR THE THREE AND NINE MONTHSED

30 SEPTEMBER 2021 4

3. ENVIRONMENTAL, SOCIAL AND GOVERNANCE 5

3.1. HEALTH AND SAFETY 5

3.2. COVID-19 RESPONSE 6

4. OPERATIONS REVIEW 8

4.1. OPERATIONAL REVIEW SUMMARY 8

4.2. BOUNGOU GOLD MINE 9

4.3. HOUNDE GOLD MINE 11

4.4. ITY GOLD MINE 13

4.5. KARMA GOLD MINE 15

4.6. MANA GOLD MINE 17

4.7. SABODALA-MASSAWA GOLD MINE 19

4.8. WAHGNION GOLD MINE 21

4.9. DISCONTINUED OPERATIONS 23

5. FINANCIAL REVIEW 24

5.1. STATEMENT OF COMPREHENSIVE EARNINGS 24

5.2. SUMMARISED CASH FLOWS 26

5.3. SUMMARISED BALANCE SHEET 28

5.4. LIQUIDITY AND FINANCIAL CONDITION 29

5.5. RELATED PARTY TRANSACTIONS 30

5.6. ACCOUNTING POLICIES AND CRITICAL JUDGEMENTS 30

6. USE OF PROCEEDS 30

7. NON-GAAP MEASURES 31

7.1. ALL-IN MARGIN 31

7.2. ADJUSTED EBITDA 32

7.3. CASH AND ALL-IN SUSTAINING COST PER OUNCE OF

GOLD SOLD 32

7.4. ADJUSTED NET EARNINGS AND ADJUSTED NET EARNINGS

PER SHARE 35

7.5. OPERATING CASH FLOW PER SHARE 35

7.6. NET DEBT, NET CASH/ADJUSTED EBITDA RATIO 35

7.7. RETURN ON CAPITAL EMPLOYED 36

8. QUARTERLY AND ANNUAL FINANCIAL AND OPERATING RESULTS 37

9. PRINCIPAL RISKS AND UNCERTAINTIES 39

10. CONTROLS AND PROCEDURES 42

10.1. DISCLOSURE CONTROLS AND PROCEDURES 42

10.2. INTERNAL CONTROLS OVER FINANCIAL REPORTING 42

10.3. LIMITATIONS OF CONTROLS AND PROCEDURES 42

11. RESPONSIBILITY STATEMENTS 43

UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

INDEPENT REVIEW REPORT TOEAVOUR MINING PLC 44