TIDMENW

RNS Number : 2807Y

Enwell Energy PLC

13 January 2022

13 January 2022

Enwell Energy plc

("Enwell" or the "Company")

Ukraine Update

Enwell Energy plc (AIM: ENW), the AIM-quoted oil and gas

exploration and production group, provides an update on its

operational activities in Ukraine, where it operates the

Mekhediviska-Golotvshinska (MEX-GOL), Svyrydivske (SV) and

Vasyschevskoye (VAS) gas and condensate fields, as well as the

Svystunivsko-Chervonolutskyi (SC) exploration licence .

Production - Q4 2021

The average daily production of gas, condensate and LPG from the

MEX-GOL, SV and VAS fields for the period from 1 October 2021 to 31

December 2021 was as follows:-

Field Gas Condensate LPG Aggregate

(MMcf/d) (bbl/d) (bbl/d) boepd

Q4 2021 Q4 2020 Q4 2021 Q4 2020 Q4 2021 Q4 2020 Q4 2021 Q4 2020

-------- -------- -------- -------- -------- -------- -------- --------

MEX-GOL

& SV 15.3 17.4 588 614 295 309 3,501 3,908

-------- -------- -------- -------- -------- -------- -------- --------

VAS 2.4 2.7 24 29 - - 463 536

-------- -------- -------- -------- -------- -------- -------- --------

Total 17.7 20.1 612 643 295 309 3,964 4,444

-------- -------- -------- -------- -------- -------- -------- --------

Overall production volumes in Q4 2021 were lower, both compared

with Q4 2020 and the previous quarter, predominantly as a result of

the shut-in of the SV-2 and MEX-109 wells during the quarter, after

these wells suffered water ingress (see announcement dated 29

November 2021). While the shut-in of these wells has had a material

impact on overall production rates in the quarter, remedial work on

these wells is ongoing, as outlined below, in order to seek to

restore production from these wells.

The significant increase in European gas prices in the quarter

has fed through to Ukrainian gas prices, which has benefited the

sales prices being achieved by the Company for its gas, as well as

condensate and LPG. These continued high hydrocarbons sales prices

have helped to offset the impact on revenues during the quarter due

to the lower production volumes.

Production - Full Year 2021

The average daily production of gas, condensate and LPG from the

MEX-GOL, SV and VAS fields for the year ended 31 December 2021 was

as follows:-

Field Gas Condensate LPG Aggregate

(MMcf/d) (bbl/d) (bbl/d) boepd

2021 2020 2021 2020 2021 2020 2021 2020

----- ----- ------ ----- ----- ----- ------ ------

MEX-GOL

& SV 18.9 17.6 681 641 308 295 4,237 3,960

----- ----- ------ ----- ----- ----- ------ ------

VAS 2.6 2.9 26 32 - - 493 581

----- ----- ------ ----- ----- ----- ------ ------

Total 21.5 20.5 707 673 308 295 4,730 4,541

----- ----- ------ ----- ----- ----- ------ ------

Overall production volumes for the full year 2021 increased by

approximately 4.2% compared with the 2020 year.

Operations

At the SV field, testing operations on the SV-29 development

well were delayed for a period due to local shortages of materials

required in the operations, but supplies have now improved and work

on initial testing of the well has resumed. The well was spudded in

February 2021 and drilled to a final depth of 5,450 metres. The

primary target of the well was the V-22 reservoir within the Visean

formation, and to date, one interval within this reservoir, at a

drilled depth of 5,246 - 5,249 metres, has been perforated. Testing

of this interval was undertaken using a variety of choke sizes, and

initial results showed gas flows and an unexpectedly high, but

somewhat variable, proportion of condensate. The higher than

anticipated condensate rates from this interval required that a

longer period of initial testing be conducted. However, a

mechanical issue connected to the perforating of the well caused a

further delay, but this issue has now been rectified. It is now

intended to perforate and test a further interval, at a drilled

depth of 5,228 - 5,232 metres, in the V-22 reservoir. Thereafter,

the well output will be run through the gas processing facilities

to allow longer-term production testing to be conducted in order to

optimise the operating parameters of the well.

Drilling of the SV-31 well is ongoing, with the well having

reached a depth of approximately 5,100 metres. This well was

spudded in September 2021, and has a target depth of 5,250 metres.

The well is a development well, targeting production from the V-21

and V-22 reservoirs in the Visean formation, which have

demonstrated good productivity in an existing nearby well. Drilling

operations are scheduled to be completed by the end of the first

quarter of 2022, and, subject to successful testing, production

hook-up is scheduled during the second quarter of 2022.

The workover operations on the SV-2 well are progressing

satisfactorily, with the removal of the existing production string

nearly completed. It is then planned to install a new production

string, and to lift the well using coiled tubing. This well is

operated under a joint venture agreement with PJSC Ukrnafta, the

majority State-owned oil and gas producer, pursuant to which the

gas and condensate produced is sold under an equal net profit

sharing arrangement between the Company and PJSC Ukrnafta.

At the MEX field, the workover operations on the MEX-109 well

are also continuing, and after logging identified the source of the

water ingress, r emedial work was undertaken to seal the water

ingress. The well is currently under observation and further

operations to attempt to remove the remaining water in the well are

planned.

Construction work on the upgrades to the gas processing

facilities at the MEX-GOL and SV fields is progressing well and

remains on schedule. In total, the upgrade works are scheduled to

take approximately three and a half months to complete. T hese

works involve an upgrade of the LPG extraction circuit, an increase

to the flow capacity of the facilities, and a significant increase

to the liquids tank storage capacity, which are designed to improve

overall plant efficiencies , improve the quality of liquids

produced and boost recoveries of LPG, while reducing environmental

emissions.

At the SC licence, drilling of the SC-4 well is continuing, with

the well having reached a depth of approximately 5,260 metres. This

well was spudded in August 2021, and has a target depth of 5,565

metres. The well is primarily an appraisal well, targeting

production from the V-22 horizon, as well as exploring the V-16 and

V-21 horizons, in the Visean formation. Drilling operations are

scheduled to be completed in Q2 2022.

Also at the SC licence, the acquisition of 1 50 km(2) of 3D

seismic is progressing well and is expected to be completed by the

end of January 2022. Processing and interpretation of the acquired

seismic data will then be undertaken.

VAS Licence Order for Suspension

The Company does not have any further information to report in

relation to the Order for suspension relating to the production

licence for the VAS field since the announcements made on 12 March

2019 and 19 March 2019 respectively, other than to report that the

legal proceedings issued in the Ukrainian Courts to challenge the

validity of the Order are ongoing, and the Com pany remains

confident that it will ultimately be successful in such legal

proceedings.

Cash Holdings

At 31 December 2021, the Company's cash resources were

approximately $92.5 million, comprised of $29.0 million equivalent

in Ukrainian Hryvnia and the balance of $63.5 million equivalent in

a combination of US Dollars, Pounds Sterling and Euros. The cash

resources have been significantly boosted by the high hydrocarbon

prices achieved during the quarter, despite the lower production

volumes.

COVID-19 Pandemic

The Group continues to monitor the situation relating to the

COVID-19 pandemic, and to take any steps necessary to protect its

staff and operations. However, as of the date hereof, there has

been no operational disruption linked to the COVID-19 pandemic, and

no material impact is currently envisaged on the Group's prospects.

Nevertheless, the Group remains acutely aware of the risks, and is

taking action to mitigate them where possible, with the safety of

individuals and communities continuing to be the priority.

Sergii Glazunov, Chief Executive Officer, said : "Although we

have continued to generate strong revenues and benefit from the

high prevailing gas prices, the water ingress issues with the SV-2

and MEX-109 wells have been frustrating, as have the supply

constraints experienced in Ukraine. However, we are now making

progress with the remedial work being undertaken on these wells, as

well as with the testing of the SV-29 well, and look forward to

making further progress in the near future. We are also pleased

with the good progress we are making in the drilling of the SV-31

and SC-4 wells, the acquisition of 3D seismic at the SC licence and

the construction works at the MEX-GOL and SV gas processing

facilities."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, which forms part of United

Kingdom domestic law by virtue of the European Union (Withdrawal)

Act 2018, as amended.

For further information, please contact:

Enwell Energy plc Tel: 020 3427 3550

Chris Hopkinson, Chairman

Sergii Glazunov, Chief Executive Officer

Bruce Burrows, Finance Director

Strand Hanson Limited Tel: 020 7409 3494

Rory Murphy / Matthew Chandler

Arden Partners plc Tel: 020 7614 5900

Ruari McGirr / Elliot Mustoe (Corporate

Finance)

Simon Johnson (Corporate Broking)

Citigate Dewe Rogerson Tel: 020 7638 9571

Ellen Wilton

Dmitry Sazonenko, MSc Geology, MSc Petroleum Engineering, Member

of AAPG, SPE and EAGE, Director of the Company, has reviewed and

approved the technical information contained within this press

release in his capacity as a qualified person, as required under

the AIM Rules.

Definitions

bbl/d barrels per day

boepd barrels of oil equivalent per day

cf cubic feet measured at 20 degrees Celsius and

one atmosphere

km(2) square kilometre

LPG liquefied petroleum gas

MMcf/d million cubic feet per day

% per cent

$ US Dollars

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBKBBBKBKBODD

(END) Dow Jones Newswires

January 13, 2022 02:00 ET (07:00 GMT)

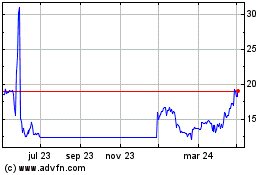

Enwell Energy (LSE:ENW)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

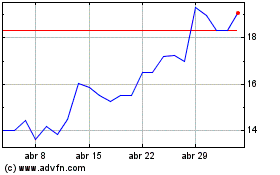

Enwell Energy (LSE:ENW)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024