TIDMEUZ

RNS Number : 9220L

Europa Metals Ltd

18 January 2021

18 January 2021

Europa Metals Ltd

("Europa Metals", the "Company" or the "Group") (AIM, AltX:

EUZ)

PFS Update : Commencement of Drilling Campaign at the Toral Pb,

Zn & Ag Project, Spain

Europa Metals , the European focused lead-zinc and silver

developer, is pleased to announce that, further to the mobilisation

of a diamond drill rig to site by Sondeos y Perforaciones

Industriales de Bierzo SA ("SPI"), drilling has now commenced at

the Company's wholly owned, Toral lead, zinc and silver project

("Toral" or the "Toral Project") situated in the region of Castilla

y Leo n, north-west Spain.

Objectives of the drilling campaign

This latest drilling campaign forms part of the Group's

Pre-Feasibility Study ("PFS") workstreams initiated at the Toral

Project. The first phase of the drill programme will target areas

above the 600m level, concentrating on increasing Europa Metals'

understanding of the initial four years of potential future

production at Toral and thereby building on the results of the

independent preliminary economic study announced in November 2020.

Core to be recovered and analysed from the drill campaign is

expected to contribute to the following specific workstreams:

- Increasing resource delineation to JORC standards - looking to

'fill-in' gaps from historical drills holes within the upper

siliceous zone.

- Performing further metallurgical testwork including additional

ore sorting analysis within the upper siliceous zone that has

demonstrated potential, before utilisation in the mining

schedule.

- Advancing geotechnical studies around areas of potential future mine development.

In addition, further to the Company's announcement of 19 October

2020, the current drill programme forms part of the Innovation

Partnership with the University of Salamanca and SPI (the

"Partnership"), which helped secure the grant award of

EUR466,801.50 to the Company from the Centre for the Development of

Industrial Technology (CDTI).

Data from the drilling campaign will be recovered and processed

by the Partnership in order to progress the development of a

software package that can correct or reduce deviation within

diamond drilling operations. Europa Metals looks forward to

updating the market on the results from such work to be conducted

by the Partnership as algorithm development progresses.

Drilling operations have commenced to schedule but, in light of

the worldwide Coronavirus health emergency and the need to

prioritise the health and safety of the Group's employees and

consultants, no specific commitments will be made at this time

regarding the duration of ongoing and planned additional fieldwork.

Europa Metals will announce material work/progress on the

achievement of milestones and findings on a timely basis, as

appropriate, and looks forward to updating shareholders on other

workstreams during the course of 2021.

Commenting today, Laurence Read, CEO of Europa Metals, said

:

"Today's drilling campaign will build on the operational work

completed over the last two years that has seen significant

advances in the potential production rate and overall estimated

economics for Toral. This initial phase will concentrate on the

upper zone of Toral in order to focus on refining the planned

design and economics for the early years of the project, which have

become an attractive feature of the recent preliminary economic

study as a result of a comparatively low level of capex, early

mining and breakeven within four years."

For further information on the Company, please visit

www.europametals.com or contact:

Europa Metals Ltd

Dan Smith, Non-Executive Director and Company Secretary

(Australia)

T: +61 417 978 955

Laurence Read, CEO (UK)

T: +44 (0)20 3289 9923

Linkedin: Europa Metals ltd

Twitter: @ltdeuropa

Toral flythrough: https://youtu.be/qLbiyfItXbY

Presentation with commentary:

http://www.europametals.com/site/content/

Strand Hanson Limited (Nominated Adviser)

Rory Murphy/Matthew Chandler

T: +44 (0)20 7409 3494

Tavistock (PR and IR)

Emily Moss /Oliver Lamb

T: +44 (0)20 7920 3150 / EuropaMetals@Tavistock.co.uk

Turner Pope Investments (TPI) Limited (Broker)

Andy Thacker

T: +44 (0)20 3657 0050

Sasfin Capital Proprietary Limited (a member of the Sasfin

group)

Sharon Owens

T (direct): +27 11 809 7762

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014.

Notes to Editors :

Toral flythrough: https://youtu.be/qLbiyfItXbY

Toral Pb, Zn & Ag Project, Spain : Comparison of 2020 and

2018 Scoping Study Key Parameters

2020 2018

============ ========================= ======================= =======================

Resource Indicated Tonnes 3.8m -

========================= ======================= =======================

Inferred Tonnes 13m 16m

====================================== ======================= =======================

Total Tonnes 17m 16m

====================================== ======================= =======================

Av. ZnEq.% 7.3 7.5

====================================== ======================= =======================

Av. Zn% 4.2 3.9

====================================== ======================= =======================

Av. Pb% 3 3.1

====================================== ======================= =======================

Av. Ag g/t 24 24

====================================== ======================= =======================

Mining Rate tpa 700,000 450,000

========================= ======================= =======================

Grade ZnEq% 7.6% 7.5%

====================================== ======================= =======================

Method SLOS Cut&Fill

========================= ======================= =======================

Approach Contractor Owner

========================= ======================= =======================

Cost US$36/t US$36/t

========================= ======================= =======================

LOM 12 years 15 years

========================= ======================= =======================

Metallurgy Process Sorting+Flotation Flotation

========================= ======================= =======================

Recovery (Average) 85% Zn, 87% Pb, 86% Ag 93% Zn, 89% Pb, 80% Ag

========================= ======================= =======================

Cost US$22/t US$25/t

========================= ======================= =======================

Capex Mine US$86m US$46m

========================= ======================= =======================

Plant US$30m US$33m

========================= ======================= =======================

Infrastructure US$4m US$5m

========================= ======================= =======================

Other US$11m -

========================= ======================= =======================

LOM Capex US$131m (Y1-12) US$159m (Y1-15)

========================= ======================= =======================

Upfront (to production) US$79m US$94m

========================= ======================= =======================

Financials NPV US$156m US$110m

========================= ======================= =======================

IRR 31.3% 24.4%

====================================== ======================= =======================

Payback Year 4 6

====================================== ======================= =======================

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLDKPBQABKDBDD

(END) Dow Jones Newswires

January 18, 2021 02:00 ET (07:00 GMT)

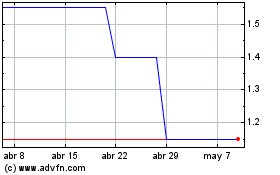

Europa Metals (LSE:EUZ)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Europa Metals (LSE:EUZ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024