European Assets Trust PLC Dividend Declaration (5539X)

06 Enero 2022 - 1:00AM

UK Regulatory

TIDMEAT

RNS Number : 5539X

European Assets Trust PLC

06 January 2022

To: RNS

From: European Assets Trust PLC ("the Company")

LEI: 213800N61H8P3Z4I8726

Date: 6 January 2022

Dividend announcement

Highlights

-- Total dividends declared for 2022 will be 8.80 pence per

share. This represents an increase of 10.0 per cent from the 2021

dividend of 8.00 pence.

-- Continued policy of six per cent dividend on year-end net

asset value per share for annual distribution to shareholders.

-- Dividend to be paid in four equal instalments of 2.20 pence

per share in January, April, July and October 2022.

-- Share price total return (23.2 per cent in Sterling) and net

asset value total return (16.3 per cent in Sterling) (unaudited)

exceeding the benchmark, the EMIX Smaller European Companies (ex

UK) Index (14.9 per cent) over the year.

Dividend for 2022

The Board is pleased to confirm that the Company's stated

distribution policy of declaring, barring unforeseen circumstances,

an annual dividend equivalent to six per cent of the net asset

value per share at the end of the preceding year will be continued

in 2022.

The net asset value per share increased over the year which will

result in an increase in total dividends payable by the Company for

2022 to 8.80 pence per share. This represents an increase of 10.0

per cent from the 2021 dividend of 8.00 pence per share.

The 2022 dividend will be paid in four equal instalments of 2.20

pence per share on 31 January, 29 April, 29 July and 31 October

2022.

The January dividend payment of 2.20 pence per share will be

paid to shareholders on 31 January 2022, having an ex-dividend date

of 13 January 2022 and a record date of 14 January 2022.

Investment Performance and Review

The Company's net asset value total return (capital performance

with dividends reinvested) per share was 16.3 per cent in Sterling

( 24.0 per cent in Euros) (unaudited) for the year ended 31

December 2021. Sterling share price total return for the year was

23.2 per cent (31.3 per cent in Euros). This compares with the

benchmark, the EMIX Smaller European Companies (ex UK) Index, which

produced a total return of 14.9 per cent in Sterling (22.5 per cent

in Euros).

We are pleased to announce an increase in dividend and a strong

NAV total return ahead of the Company's benchmark in what was

another year of extreme volatility. 2021 was supposed to be a year

of economic driven recovery as the world discarded the restrictions

implemented to deal with COVID-19. Unfortunately, while the markets

have made good progress, economic activity is still heavily

influenced by COVID-19 with the Omicron variant driving a return of

social restrictions at the time of writing.

The year had started with optimism and the first half registered

most of the year's gains. The rest of the year has, however, been

characterised by volatility and uncertainty over both the progress

of the fight against COVID-19 and the policy response to rising

inflation. The debate on the permanency of the latter and its

impact on monetary policy drove wild swings in market leadership.

In addition to an uncertain economic outlook and policy framework,

companies have had to contend with severely challenged supply

chains and rising costs which has held back earnings progress.

Last year's dividend announcement discussed the high levels of

portfolio activity in 2020 which was driven by decisions taken in

response to rare opportunities offered at the height of the

COVID-19 crisis. We are pleased to report that portfolio trading

activity has returned to normal levels. This, we believe, reflects

the confidence we have in our holdings. The portfolio is a

relatively concentrated collection of quality, growth biased

businesses that we believe will prosper over the long term,

irrespective of the uncertainty that we are currently seeing in the

markets.

For further information contact:

Sam Cosh (Investment Manager) Tel +44 (0)207 628 8000

Scott McEllen (Company Secretary) Tel +44 (0)207 628 8000

BMO Investment Business Limited

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVEASFSEDFAEFA

(END) Dow Jones Newswires

January 06, 2022 02:00 ET (07:00 GMT)

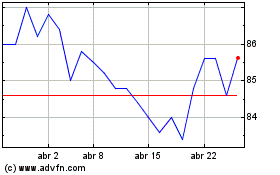

European Assets (LSE:EAT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

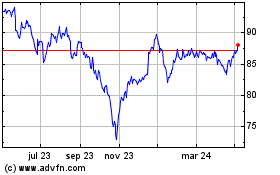

European Assets (LSE:EAT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024