TIDMEMH

RNS Number : 5300N

European Metals Holdings Limited

30 September 2021

For immediate release

30 September 2021

EUROPEAN METALS HOLDINGS LIMITED

ANNUAL RESULTS

European Metals Holdings Limited (EMH, Company) (ASX & AIM:

EMH, OTC - Nasdaq Intl ADS: EMHXY) are pleased to announce the

Company's annual results for the year ended 30 June 2021.

The annual report has been released on the Australian Stock

Exchange ("ASX") as required under the listing rules of the

ASX.

Whilst the financial information included in this announcement

has been prepared in accordance with the accounting policies and

basis of preparation set out below, this announcement does not

constitute the Company's statutory financial statements.

A copy of the annual report will be posted to shareholders and

is also available on the Company's website www.europeanmet.com.

CONTACT

For further information on this update or the Company generally,

please visit our website at www.europeanmet.com or see full contact

details at the end of this release.

WEBSITE

A copy of this announcement is available from the Company's

website at www.europeanmet.com.

ENQUIRIES:

European Metals Holdings Limited

Keith Coughlan, Executive Chairman Tel: +61 (0) 419 996 333

Email: keith@europeanmet.com

Kiran Morzaria, Non-Executive Director Tel: +44 (0) 20 7440 0647

Dennis Wilkins, Company Secretary Tel: +61 (0) 417 945 049

Email: dennis@europeanmet.com

WH Ireland Ltd (Nomad & Joint Broker)

James Joyce//Darshan Patel Tel: +44 (0) 20 7220 1666

(Corporate Finance)

Harry Ansell/Jasper Berry (Broking)

Shard Capital (Joint Broker) Tel: +44 (0) 20 7186 9950

Damon Heath

Erik Woolgar

Blytheweigh (Financial PR) Tel: +44 (0) 20 7138 3222

Tim Blythe

Megan Ray

Chapter 1 Advisors (Financial PR

- Aus) Tel: +61 (0) 433 112 936

David Tasker

The information contained within this announcement is considered

to be inside information, for the purposes of Article 7 of EU

Regulation 596/2014, prior to its release. The person who

authorised for the release of this announcement on behalf of the

Company was Keith Coughlan, Executive Chairman.

CORPORATE DIRECTORY

Directors

Mr Keith Coughlan Executive Chairman

Mr Richard Pavlik Executive Director

Mr Kiran Morzaria Non-Executive Director

Ambassador Lincoln Palmer Bloomfield, Non-Executive Director

Jr

Company Secretary

Mr Dennis Wilkins

Registered Office in Australia Geomet s.r.o.

Level 3 Ruská 287, Bystřice

35 Outram Street 417 01 Dubí

West Perth WA 6005 Czech Republic

Telephone 08 6245 2050

Facsimile 08 6245 2055

Email www.europeanmet.com

Registered Address and Place Nominated Nomad & Joint Broker

of Incorporation - BVI WH Ireland Ltd

Woodbourne Hall 24 Martin Lane

PO Box 3162 London EC4R 0DR

Road Town United Kingdom

Tortola VG1 110

British Virgin Islands Joint Broker

Shard Capital Partners LLP

Share Register - Australia 23(rd) Floor, 20 Fenchurch Street

Computershare Investor Services London EC3M 3BY

Limited United Kingdom

Level 11

172 St Georges Terrace UK Depository

Perth WA 6000 Computershare Investor Services

Telephone 1300 850 505 (within plc

Australia) The Pavilions

Telephone +61 3 9415 4000 (outside Bridgewater Road

Australia) Bristol BS99 6ZZ

Facsimile 1800 783 447 (within United Kingdom

Australia)

Facsimile +61 3 9473 2555 (outside

Australia)

Auditor Reporting Accountants (UK)

Stantons International Audit Chapman Davis LLP

and Consulting Pty Ltd 2 Chapel Court

Level 2, 1 Walker Avenue London SE1 1HH

West Perth WA 6005 United Kingdom

Telephone +61 8 9481 3188

Facsimile +61 8 9321 1204

Securities Exchange Listing - Securities Exchange Listing

Australia - United Kingdom

ASX Limited London Stock Exchange plc

Level 40, Central Park 10 Paternoster Square

152-158 St Georges Terrace London EC4M 7LS

Perth WA 6000 United Kingdom

ASX Code: EMH AIM Code: EMH

Securities Exchange Listing - NASDAQ

Nasdaq Inc

151 W. 42(nd) Street

New York City

NY 10036 United States

NASDAQ Code: ERPNF

Chairman's Letter Report 3

Review of Operations 5

Directors' Report 9

Remuneration Report 15

2

Auditor's Independence Declaration 2

Consolidated Statement of Profit or Loss and Other

Comprehensive Income 23

Consolidated Statement of Financial Position 24

Consolidated Statement of Changes in Equity 25

Consolidated Statement of Cash Flows 26

Notes to the Consolidated Financial Statements 27

Directors' Declaration 61

Independent Audit Report to the members of European

Metals Holdings Limited 62

6

Additional Information 7

Tenement Schedule 68

CHAIRMAN'S LETTER

Dear Shareholders

Welcome to the 2021 Annual Report for European Metals Holdings

Limited ("European Metals" or "the Company").

On behalf of the Board of Directors, I am pleased to report to

you on what has been another busy and productive year for your

Company, set against a backdrop of significantly higher prices for

both of our key products, lithium and tin. Our strategy is to

become a Czech based lithium and tin producer. The progress we have

made in the past year, along with the greatly improved macro

conditions, bring us significantly closer towards making that aim a

reality.

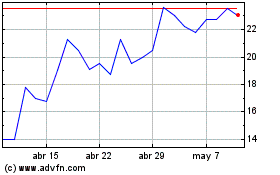

This has been partially reflected in the price of the Company's

securities with the CDI's listed on ASX increasing from AUD 0.29 on

30 June 2020 to AUD 1.535 on 30 June 2021. The price of lithium

performed well for the year also and has made very significant

gains since year end.

As the lithium market moves into deficit, we anticipate the

continuation of strong prices in the foreseeable future.

The Definitive Feasibility Study continues, albeit with some

minor delays related primarily to Covid-19 and the effect that has

had on logistics globally. Whilst we have had no direct Covid-19

related issues at site, moving samples and our people has been

problematic at times. We don't anticipate any escalation in

this.

Apart from these delays, we have made steady progress of the

Cinovec Project with positive developments in the areas of our

locked cycle testwork, permitting advancement and Measured Resource

drilling programme. We have also advanced the Project's ESG

credentials significantly and Cinovec is emerging as a project with

not only very robust economic parameters, but one with a strong ESG

profile relative to its peers. We will continue developing this

aspect of the project over the coming year and expect to be able to

present a positive Life Cycle Assessment (LCA) to the market

shortly. The LCA will demonstrate the Project's anticipated

life-time carbon emissions, which we expect to be comparatively

very attractive.

The Project has been significantly de-risked and at the time of

this report is moving rapidly towards a final investment

decision.

In the previous year, we reported on the completion of an

agreement with CEZ a.s., the Czech national power utility, by which

CEZ became a 51% shareholder of the Project Company, Geomet and

injected approximately EUR 29 million into the Project.

Early in the 2021 Financial Year the Company entered into a

partnership agreement with EIT InnoEnergy, a European Union body

that is the principal facilitator and organiser of the European

Battery Alliance (EBA). The EBA was initiated by the European

Commission to create a competitive and sustainable battery cell

manufacturing value chain in Europe.

The purpose of the partnership agreement with EIT InnoEnergy is

to facilitate the accelerated construction financing and ultimate

commercialisation of Cinovec. This will be achieved through

assistance in the sourcing of construction finance, grant funding

and offtake introductions and negotiations.

Following this, the Company reported on the appointment of SMS

group as the lead engineer for the minerals processing and lithium

battery-grade chemicals production at the Project.

From a corporate perspective, we welcomed Ambassador Lincoln

Bloomfield to the board in early January. Lincoln brings a wealth

of experience to the Company in the fields of governance,

international diplomacy, sustainability, resilience and renewable

energy. Lincoln is based in the United States, home to the largest

capital markets in the world and markets that are becoming

increasingly invested in green energy companies. This, coupled with

our recent US market listing via a NASDAQ ADS programme, provides

the Company with another potential funding option as we head

towards final investment decision next year.

On funding, the Company raised AUD 7.1 million in January and

remains in a very sound financial position relative to the project

timeline. The cornerstone investor for this raising was

Luxembourg-based Thematica Future Mobility.

The very strong commitment within the European Union to build a

sustainable European battery industry and electric vehicle industry

that we reported on last year has gathered greater momentum.

Consequently, the demand for lithium in the region has grown

dramatically and this is likely to continue. This, coupled with a

growing global desire to develop local supply chains, has focused

attention on European based projects involved in the battery metals

supply chain. Cinovec is set to benefit significantly from these

developments.

All things considered, I am very optimistic on the outlook for

the Cinovec Project and for the future of your Company.

Finally, I would like to take this opportunity to thank all

staff, advisors, contractors and our shareholders who have

supported us over the past year. I look forward to updating you

throughout the new financial year as we continue to advance the

Cinovec Project.

Keith Coughlan

EXECUTIVE CHAIRMAN

REVIEW OF OPERATIONS

PROJECT REVIEW

Geomet s.r.o. controls the mineral exploration licenses awarded

by the Czech State over the Cinovec Lithium/Tin Project.

Geomet s.r.o. is owned 49% by European Metals and 51% by CEZ

a.s. through its wholly owned subsidiary, SDAS. CEZ is a

significant energy group listed on various European Exchanges with

the ticker CEZ.

Cinovec hosts a globally significant hard-rock lithium deposit

with a total Indicated Mineral Resource of 372.4Mt at 0.45% Li2O

and 0.04% Sn and an Inferred Mineral Resource of 323.5Mt at 0.39%

Li2O and 0.04% Sn containing a combined 7.22 million tonnes Lithium

Carbonate Equivalent and 263kt of tin, as reported to ASX on 28

November 2017 (Further Increase in Indicated Resource at Cinovec

South). An initial Probable Ore Reserve of 34.5Mt at 0.65% Li2O and

0.09% Sn reported on 4 July 2017 (Cinovec Maiden Ore Reserve -

Further Information) has been declared to cover the first 20 years'

mining at an output of 22,500tpa of battery-grade lithium carbonate

reported on 11 July 2018 (Cinovec Production Modelled to Increase

to 22,500tpa of Lithium Carbonate).

This makes Cinovec the largest hard-rock lithium deposit in

Europe, the fourth largest non-brine deposit in the world and a

globally significant tin resource. The deposit has previously had

over 400,000 tonnes of ore mined as a trial sub-level open-stope

underground mining operation focussed on the recovery of tin only.

In June 2019 EMH completed an updated Preliminary Feasibility

Study, conducted by specialist independent consultants, which

indicated a return post tax NPV of USD1.108B and a post-tax IRR of

28.8%. The study confirmed that the Cinovec Project is a potential

low operating cost producer of battery grade lithium hydroxide or

battery grade lithium carbonate as markets demand. It confirmed the

deposit is amenable to bulk underground mining. Metallurgical

test-work has produced both battery grade lithium hydroxide and

battery grade lithium carbonate in addition to high-grade tin

concentrate.

Cinovec is centrally located for European end-users and is well

serviced by infrastructure, with a sealed road adjacent to the

deposit, rail lines located 5 km north and 8 km south of the

deposit and an active 22 kV transmission line running to the

historic mine. As the deposit lies in an active mining region, it

has strong community support. The economic viability of Cinovec has

been enhanced by the recent strong increase in demand for lithium

globally, and within Europe specifically.

PARTNERSHIP AGREEMENT WITH EUROPEAN UNION BODY

On 28 July 2020, the Company announced that a "Value Added

Services Agreement" with KIC InnoEnergy SE ("EIT InnoEnergy", part

of the European Institute of Innovation and Technology), the

principal facilitator and organiser of the European Battery

Alliance, had been entered into by Geomet in respect of the Cinovec

Lithium Project. The purpose of the financing agreement with EIT

InnoEnergy is to support the construction financing and ultimate

commercialisation of Cinovec by EIT InnoEnergy providing assistance

to support the:

-- Sourcing of construction finance;

-- Securing of grant funding; and

-- Assisting in offtake introductions and negotiations.

APPOINTMENT OF LEADING GLOBAL ENGINEER

SMS group Process Technologies GmbH was appointed as the lead

engineer for the minerals processing and lithium battery-grade

chemicals production at the Cinovec Project in September 2020. SMS

group will provide a complete Front-End Engineering Design ("FEED")

study as the major component of the ongoing Definitive Feasibility

Study ("DFS") work at Cinovec.

APPOINTMENT OF LEADING GLOBAL ENGINEER (CONTINUED)

Headquartered in Dusseldorf, the German family-owned SMS group

is one of the world's leading companies in plant construction and

mechanical engineering for the technology metals and materials

sector. SMS group is also a world leader in electrical and

automation systems including digital solutions for self-learning

processing plants to continuously optimise plant performance,

product quality and energy consumption. Under the Agreement, SMS

will provide the following to the Cinovec Project:

-- Full process integration from the point of delivery of ore to

the underground crusher through to the delivery of finished

battery-grade lithium chemicals for battery and cathode

manufacturers.

-- The FEED will include all of the process steps - comminution,

beneficiation, roasting, leaching and purification.

-- The FEED will encompass both the lithium process flowsheet

and the tin/tungsten recovery circuit delivering metal concentrates

to refineries.

-- The FEED is intended to deliver a binding fixed price lump

sum turnkey EPC contract with associated process guarantee and

product specification guarantees for battery-grade lithium

chemicals. The combination of these will greatly assist to

underwrite project financing from leading European and global

financial institutions lending into this new energy EV-led

industrial revolution.

ESG - ENVIRONMENTAL, SOCIAL AND GOVERNANCE

ESG and impact investing have become key criteria for both

investors and fund managers, leading a new path to how companies

are being assessed. The acceleration has been driven by heightened

social, governmental and consumer attention on the broader impact

of corporations, as well as by the investors and executives who

acknowledge that a strong ESG proposition is a key indicator of a

company's long-term success. ESG reporting offers a tool and

roadmap for investors and society to hold companies to account, to

make sure that the issues such as climate change, social justice,

equality, diversity and environmental protection are reflected and

appropriately addressed by the company in focus.

European Metals has focused very strongly on the Project's ESG

criteria and during the year adopted a set of ESG metrics and

disclosures following the recommendations released by the World

Economic Forum ("WEF") in Geneva, Switzerland which are

acknowledged as the gold standard for ESG reporting. The key points

of this initiative are -

-- Establishment of an ESG Committee at Board level, to be

chaired by Ambassador Lincoln Bloomfield who has considerable

private sector experience centred on sustainability, resilience and

renewable energy.

-- Engagement of Socialsuite ESG technology platform - a global

leader in ESG impact management systems and sustainability

reporting.

-- Initiation of ESG reporting, monitoring and improvement for

European Metals utilising Socialsuite.

-- EMH's ESG transparency commitment will include an independent

lithium production Life Cycle Assessment ("LCA") which will

includes a full carbon footprint assessment.

LITHIUM LIFE CYCLE ASSESSMENT SPECIALIST ENGAGED

In line with the stated ESG adoption, the Project engaged

UK-based and globally recognised sustainability and life cycle

assessment consultancy, Minviro, to provide an ISO compliant life

cycle assessment ("LCA") of the Cinovec project.

This assessment will cover both battery-grade lithium carbonate

and battery grade lithium hydroxide and will be benchmarked against

global lithium peers. Minviro has been actively engaged to identify

decarbonisation optimisation in the developing feasibility study

for Cinovec.

LITHIUM LIFE CYCLE ASSESSMENT SPECIALIST ENGAGED (CONTINUED)

The Company strongly believes that the Cinovec LCAs will

demonstrate strong carbon footprint credentials with lower energy

use, less intensive reagent application and net carbon credits from

mine and process by-products. Minviro has provided the assessment

to Geomet and it is currently undergoing external independent QA/QC

before publication.

DRILLING

Throughout the year the Company reported a number of times on

the ongoing drilling programme at the Project. The programme began

in the third quarter of 2020 and continued on and off for the

duration of the year. There were some delays in the programme

brought about by unfavourable weather and also impacts of Covid -19

as mentioned earlier.

The aims of the drilling programme are to convert a sufficient

portion of the existing Indicated Mineral Resource to the Measured

Resource category and subsequently to a Mineral Reserve, to cover

the first two years of the scheduled mining plan and obtaining a

sufficient amount of ore samples for the next phase of

metallurgical testing. The majority of the material will be

utilised in the pilot scale testing for the FEED Study. The

drilling programme was planned to define blocks of resource for the

first 5 years of mining within the Cinovec-South area. The holes

have been terminated in ore consistent with the aim of targeting

the first 5 years of resource blocks for the mine.

The Company reported interim drilling results either in line

with, or better than expectations.

Given the relative ease of beneficiation of the Cinovec deposit

through wet magnetic separation, the Company decided that it was

important to report the drill results and the "in lab"

beneficiation results, with historic results of wet magnetic

separation achieving a >80% pure lithium mica concentrate

grading 2.85% Li2O with a lithium recovery of 92%.

CORPORATE

The Company completed a significant capital raising of AUD 7.1

million in February 2021, the proceeds of which will be used to

advance the Company's strategy including progressing the

development of the Project, progressing discussions with CEZ and

discussions with potential off take and strategic partners. The

capital raising was cornerstoned by the Luxembourg based green

energy fund, Thematica Future Mobility.

NOMAD CHANGE

In January of this year, the Company advised it had appointed WH

Ireland plc as its Nominated Adviser on AIM. WH Ireland will

continue to act as joint broker to the Company, along with Shard

Capital.

BOARD CHANGE

Also in January, Ambassador Lincoln Bloomfield joined the board

of the Company as a Non-executive Director. Ambassador Bloomfield

who is based in Washington, DC, brings governance and regulatory

experience, years of international diplomacy and security expertise

to the Board, along with a North American presence while his

private sector experience is centered on sustainability, resilience

and renewable energy.

Ambassador Bloomfield's prior work in developing the US

Government's first international policy on Cyber Security, and his

related work on Critical Infrastructure Protection will help EMH

and downstream partners operate securely for many years. His deep

experience in managing bilateral relationships with both the State

Department and the Department of Defense will help EMH sustain

effective relationships, both governmental and non-governmental. He

will support EMH in its key relationships with the European

Community, European Battery Alliance, European Raw Metals Alliance,

and others seeking to create a highly secure, uniform and resilient

framework for batteries and critical raw materials supply.

Ambassador Bloomfield is a valuable addition as EMH is focused

on ESG-related aspects of the critical raw materials and battery

supply chain, as part of its commitment to support the European

Commission's new Batteries Regulation, a significant, far-reaching

legislative development. Ambassador Bloomfield's appointment

confirms EMH's commitment to meet the new Batteries Regulation's

three main objectives: strengthening the functioning of the EU

internal market by ensuring a level playing field through a common

set of rules; promoting a circular economy; and reducing

environmental and social impact throughout all stages of the

battery life cycle. Given the complexity of the new Batteries

Regulation, EMH is reassured to know that he will be contributing

to its efforts to achieve compliance throughout the organization.

Ambassador Bloomfield holds several roles in the private sector

promoting sustainability. Having served for eight years until 2017

as Chairman of the non-partisan Stimson Center, he is now Stimson

Chairman Emeritus. He is a Director and National Executive

Committee Member of the U.S. Water Partnership, a public-private

non-profit entity co-chaired by Madeleine Albright and Colin

Powell. He is a Director of the Detroit-based non-profit energy NGO

The Last Kilometer, and Vice Chairman of Mana Pacific, a

Honolulu-based enterprise seeking to provide locally-managed and

affordable renewable energy microgrids throughout the Pacific

islands. He provides expert policy and consulting services to three

Washington DC entities including the law firm Akin Gump. As

President of Palmer Coates LLC, Lincoln maintains commercial

relationships with startup entities developing innovative energy

and transportation technologies, including as Advisor and investor

in Seatrec, Inc. and President of an early-stage technology

startup, called D3E, offering next-generation "optimal" flight

control technology to enable robustness and autonomy in future

drone aircraft.

COVID-19 UPDATE

On 24 April 2020, the Company provided the market with an update

regarding the operations and Covid-19. It was reported that all

management and staff of both EMH and Geomet were unaffected by

COVID-19 and the restrictions on travel at the time and meetings

were not expected to have any impact for the foreseeable future;

all staff were able and continued to work remotely. To-date, the

Cinovec Project has drilled in excess of 13,800m of diamond

drilling under the management of EMH. Extensive sample quantities

are available from the resulting drill core as well as material

recovered from historic adit drives into the ore body. Significant

quantities of ore sample are held at our laboratory partners in

Germany and at the project office in the Czech Republic. European

Metals and Geomet have confirmed with our laboratory and

engineering partners in Germany and Australia that staff and

laboratories involved in the DFS and FEED programmes over the next

3 months are ready and open for work on an immediate basis.

Your Directors present their report, together with the financial

statements of the Group, being European Metals Holdings Limited

("EMH" or the "Company") and its controlled entities ("Group"), for

the year ended 30 June 2021.

DIRECTORS' REPORT

Directors

The following persons were Directors of the Company and were in

office for the entire year, and up to the date of this report,

unless otherwise stated:

Mr Keith Coughlan Executive Chairman Appointed 30 June 2020

Previously Managing Appointed 6 September 2013

Director

Mr Richard Pavlik Executive Director Appointed 27 June 2017

Mr Kiran Morzaria Non-Executive Director Appointed 10 December 2015

Ambassador Lincoln Non-Executive Director Appointed 3 January 2021

Palmer Bloomfield,

Jr

Principal Activities

The Group is primarily involved in the development of the

Cinovec lithium and tin project in the Czech Republic.

Review of Operations

The 2021 Financial Year has been one of significant growth and

development for the Group. For further information refer to the

Project Review section of this report.

Results of Operations

The consolidated loss after tax for year ended 30 June 2021 was

$3,962,450 (2020 profit after tax: $2,813,807).

(The 2020 profit was due to the gain on the deconsolidation of

Geomet.)

Financial Position

The net assets of the Group have increased by $7,208,412 to

$25,277,915 at 30 June 2021 (2020: $18,069,503).

Significant Changes in the State of Affairs

There have not been any significant changes in the state of

affairs of the Group during the financial year other than as

disclosed in the Review of Operations section of this report.

Dividends Paid or Recommended

No dividends were declared or paid during the year and the

Directors do not recommend the payment of a dividend for the

period.

Information on

Directors

Keith Coughlan Executive Chairman - Appointed 30 June 2020

Previously Managing Director (CEO) - Appointed

6 September 2013 to 30 June 2020

Qualifications BA

Experience Mr Coughlan has had almost 30 years' experience

in stockbroking and funds management. He has

been largely involved in the funding and promoting

of resource companies listed on ASX, AIM and

TSX. He has advised various companies on the

identification and acquisition of resource

projects and was previously employed by one

of Australia's then largest funds management

organizations.

Interest in CDIs Mr Coughlan has 850,000 CDIs direct interest

and Options and 8,500,000 CDIs indirect interest held by

Inswinger Holdings Pty Ltd, an entity of which

Mr Coughlan is a director and a shareholder.

Performance Rights On 17 December 2020, the shareholders approved

the grant of 2,400,000 Performance Rights to

Mr Coughlan (or his nominee). These Performance

Rights have yet to be issued at the date of

this Report.

Special Responsibilities Member of Nomination Committee

Member of Environment, Social and Governance

Committee

Directorships held Non-Executive Chairman of Doriemus plc

in other listed Non-Executive Director of Calidus Resources

entities Limited

Non-Executive Director of Southern Hemisphere

Mining Limited (resigned on 8 February 2021)

Richard Pavlik Executive Director - Appointed 27 June 2017

Qualifications Masters Degree in Mining Engineer

Experience Mr Pavlik is the Chief Advisor to the CEO of

Geomet s.r.o, and is a highly experienced Czech

mining executive. Mr Pavlik holds a Masters

Degree in Mining Engineer from the Technical

University of Ostrava in Czech Republic. He

is the former Chief Project Manager and Advisor

to the Chief Executive Officer at OKD. OKD

has been a major coal producer in the Czech

Republic. He has almost 30 years of relevant

industry experience in the Czech Republic.

Mr Pavlik also has experience as a Project

Analyst at Normandy Capital in Sydney as part

of a postgraduate program from Swinburne University.

Mr Pavlik has held previous senior positions

within OKD and New World Resources as Chief

Engineer, and as Head of Surveying and Geology.

He has also served as the Head of the Supervisory

Board of NWR Karbonia, a Polish subsidiary

of New World Resources (UK) Limited. He has

an intimate knowledge of mining in the Czech

Republic.

Interest in CDIs Mr Pavlik has 300,000 CDIs direct interest

and Options

Performance Rights On 17 December 2020, the shareholders approved

the grant of 1,200,000 Performance Rights to

Mr Pavlik (or his nominee). These Performance

Rights have yet to be issued at the date of

this Report.

Special Responsibilities Member of Environment, Social and Governance

Committee

Member of Nomination Committee

Directorships held Nil

in other listed

entities

Information on Directors (continued)

Kiran Morzaria Non-Executive Director - Appointed 10 December

2015

Qualifications Bachelor of Engineering (Industrial Geology)

from the Camborne School of Mines and an MBA

(Finance) from CASS Business School

Experience Mr Morzaria has extensive experience in the

mineral resource industry working in both

operational and management roles. He spent

the first four years of his career in exploration,

mining and civil engineering before obtaining

his MBA. Mr Morzaria has served as a director

of a number of public companies in both an

executive and non-executive capacity.

Interest in CDIs Mr Morzaria has 200,000 CDIs direct interest.

and Options Mr Morzaria is a director and chief executive

of Cadence Minerals Plc which owns 17,663,864

CDIs. Mr Morzaria has no control on the acquisition

or sale of the shares held by Cadence Minerals

plc.

Special Responsibilities Chair of Remuneration Committee

Chair of Nomination Committee

Member of Audit and Risk Committee

Member of Environment, Social and Governance

Committee

Directorships held Chief Executive Officer and Director of Cadence

in other listed Minerals plc and Director of UK Oil & Gas

entities plc. Mr Morzaria was previously a Director

of Bacanora Minerals plc.

Lincoln Palmer Non-Executive Director - Appointed 3 January

Bloomfield Jr. 2021

Qualifications Harvard College (cum laude, Government, 1974),

Fletcher School of Law and Diplomacy (M.A.L.D.,

1980)

Experience Ambassador Bloomfield is based in Washington,

DC, and brings governance and regulatory experience,

years of international diplomacy and security

expertise to the EMH Board, along with a North

American presence while his private sector

experience is centered on sustainability,

resilience and renewable energy.

Interest in CDIs Ambassador Bloomfield has 122,500 direct interest

and Options in CDIs.

Special Responsibilities Chair of Environment, Social and Governance

Committee

Chair of Audit and Risk Committee

Member of Remuneration Committee

Member of Nomination Committee

Directorships held Nil

in other listed

entities

Company Secretary

Mr Dennis Wilkins (appointed 2 November 2020)

Mr Wilkins is the founder and principal of DWCorporate Pty Ltd,

a corporate advisory firm servicing the natural resources industry.

Since 1994 he has been a director of, and involved in the executive

management of, several publicly listed resource companies with

operations in Australia, PNG, Scandinavia and Africa. He was the

Finance Director of Lynas Corporation Ltd during the period when

the Mt Weld Rare Earths project was acquired by the group. He was

also founding director and advisor to Atlas Iron Limited at the

time of Atlas' initial public offering. Since July 2001 Mr Wilkins

has been running DWCorporate Pty Ltd, where he provides advice on

the formation of, and capital raising for, emerging companies in

the Australian resources sector. He is currently a Non-executive

Director of Key Petroleum Limited.

Ms Julia Beckett (resigned on 2 November 2020).

Director Meetings

The number of Directors' meetings and meetings of Committees of

Directors held during the year and the number of meetings attended

by each of the Directors of the Company during the year is:

Directors' Meetings

Name Number attended Number eligible

to attend

Keith Coughlan 3 3

Richard Pavlik 3 3

Kiran Morzaria 3 3

Lincoln Palmer Bloomfield,

Jr 3 3

Indemnifying officers or auditor

During or since the end of the financial year the Company has

given an indemnity or entered into an agreement to indemnify, or

paid or agreed to pay insurance premiums as follows:

i. The Company has entered into agreements to indemnify all

Directors and provide access to documents, against any liability

arising from a claim brought by a third party against the Company.

The agreement provides for the Company to pay all damages and costs

which may be awarded against the Directors.

ii. The Company has paid premiums of $73,500 (2020: $30,000) to

insure each of the Directors against liabilities for costs and

expenses incurred by them in defending any legal proceedings

arising out of their conduct while acting in the capacity of

Director of the Company, other than conduct involving a willful

breach of duty in relation to the Company. Under the terms and

conditions of the insurance contract, the nature of the liabilities

insured against and the premium paid cannot be disclosed.

iii. No indemnity or insurance of auditors has been paid.

CDIs under option

During the year, the following unquoted options and warrants

were issued to consultants:

Grant date/Issue date Expiry date Exercise Number under

Price option

----------------------------- ------------------ --------- -------------

15 June 2020/17 July

2020 15 June 2022 25 cents 250,000(1)

25 September 2020 / 23 23 October

October 2020 2023 42 cents 2,500,000(2)

8 October 2020 / 23 October 23 October

2020 2023 45 cents 1,000,000

5 February 2021/5 March 31 January

2021 2023 $1.10 1,200,000

The above options vest immediately.

(1) On 17 September 2020, 50,000 of these options were exercised

and the remaining 200,000 were exercised on 21 December 2020. The

options conversions raised $62,500.

(2) On 10 May 2021, 238,000 of these options were exercised. The

option conversions raised $99,960.

CDIs under option (continued)

Unissued CDIs of European Metals Holdings Limited under option

and warrant at the date of this report is as follows:

Expiry date Exercise Price Number under option

------------------ --------------- --------------------

22 November

2021 20 pence 27,500

31 December

2022 25 cents 10,000,000

23 October

2023 42 cents 2,024,000

23 October

2023 45 cents 1,000,000

31 January

2023 $1.10 1,200,000

During the year ended 30 June 2021, the following ordinary

shares were issued on the exercise of options granted:

Grant date/Issue Exercise Price Number of Shares

date Issued

------------------ ------------------ ---------------- -----------------

Issued to:

- Key management

personnel 17 August 2015 16.6 cents 3,750,000

15 June 20/17

- Consultant July 20 25 cents 250,000

* Brokers 22 November 2018 20 pence 89,375

- Consultant 12 July 2019 35 cents 200,000

- Consultant 12 July 2019 40.18 cents 100,000

- Consultants 6 December 2019 31.11 cents 100,000

- Consultant 23 October 2020 42 cents 238,000

Since the end of the reporting year, the following options were

exercised:

On 16 July 2021, the Company issued 238,000 CDIs upon the

exercise of unquoted options at 42 cents. The options conversions

raised a total of $99,960.

No person entitled to exercise the option or warrant has or has

any right by virtue of the option or warrant to participate in any

share issue of any other body corporate.

Performance Shares

Performance shares on issue at the date of this report is as

follows:

Issue date Expiry date Number on

issue

--------- ------------- ------------- ----------

A Class 18 Dec 2018 18 Dec 2021 3,000,000

Performance Rights

On 17 December 2020, the shareholders approved the grant of

2,400,000 Performance Rights to Mr Keith Coughlan and 1,200,000

Performance Rights to Mr Richard Pavlick. These Performance Rights

have yet to be issued at the date of this Report.

Environmental, Social and Governance

During the year the Company has adopted a set of Environmental,

Social and Governance ("ESG") metrics and disclosures following the

recommendations released by the World Economic Forum ("WEF") in

Geneva, Switzerland which are acknowledged as the gold standard for

ESG reporting.

The establishment of an ESG Committee at Board level is chaired

by Ambassador Lincoln Bloomfield who has considerable private

sector experience centred on sustainability, resilience and

renewable energy. Ambassador Bloomfield has stated, "European

Metals is making every effort to ensure that any finished product

containing our lithium will satisfy the public's need for assurance

that high ESG standards have been upheld at every stage of our

production process. We are committed to the well-being of our

workforce, minimizing environmental impact throughout our process,

and being a good neighbour within the local community".

The Company engaged Socialsuite ESG technology platform - a

global leader in ESG impact management systems and sustainability

reporting.

The Company has deployed Socialsuite's ESG technology platform

to set its initial ESG baseline in its first quarterly ESG

dashboard. With a tailored action plan, the Company will focus on

delivering and reporting ongoing progress toward disclosing and

improving ESG metrics and indicators. Socialsuite's ESG reporting

technology provides an easy way for investors and other

stakeholders to assess the commitment and progress of the Company

on its journey to create "best in class" ESG credentials and

outcomes.

The Company's ESG transparency commitment is a precursor to an

independent lithium production Life Cycle Assessment2 ("LCA") which

includes a full Carbon Footprint assessment.

Proceedings on Behalf of the Company

No person has applied for leave of Court to bring proceedings on

behalf of the Company or intervene in any proceedings to which the

Company is a party for the purpose of taking responsibility on

behalf of the Company for all or any part of those proceedings.

The Company was not a party to any such proceedings during the

year.

Non-audit Services

Stantons International has not provided any non-audit services

during the year.

Significant events after the reporting date

On 16 July 2021, the Company issued 238,000 CDIs upon the

exercise of unquoted options at 42 cents. The options conversions

raised a total of $99,960.

Except for the matters noted above there have been no other

significant events arising after the reporting date.

Auditor's Independence Declaration

The auditor's independence declaration for the year ended 30

June 2021 has been received and can be found on page 2 2 of the

financial report.

REMUNERATION REPORT (AUDITED)

This report details the nature and amount of remuneration for

each Director of the Company, and key management personnel ("KMP").

The Directors are pleased to present the remuneration report which

sets out the remuneration information for European Metals Holdings

Limited's Non-Executive Directors, Executive Directors and other

key management personnel.

A. Principles used to determine the nature and amount of

remuneration

The remuneration policy of the Group has been designed to align

Director and management objectives with shareholder and business

objectives by providing a fixed remuneration component, and

offering specific long-term incentives based on key performance

areas affecting the Group financial results. The Board of the

Company believes the remuneration policy to be appropriate and

effective in its ability to attract and retain the best management

and Directors to run and manage the Group, as well as create goal

congruence between Directors, Executives and shareholders.

The Board's policy for determining the nature and amount of

remuneration for Board members and Senior Executives of the Group

is as follows:

The remuneration policy, setting the terms and conditions for

the Executive Directors and other Senior Executives, was developed

by the Board. All Executives receive a base salary (which is based

on factors such as length of service and experience),

superannuation, options and performance incentives. The Board

reviews Executive packages annually by reference to the Group's

performance, executive performance, and comparable information from

industry sectors and other listed companies in similar

industries.

Executives are also entitled to participate in the employee

share and option arrangements.

All remuneration paid to Directors and Executives is valued at

the cost to the Group and expensed.

The Board policy is to remunerate Non-executive Directors at

commercial market rates for comparable companies for time,

commitment, and responsibilities. The Board determines payments to

the Non-executive Directors and reviews their remuneration annually

based on market practice, duties, and accountability. Independent

external advice is sought when required. The maximum aggregate

amount of fees that can be paid to Non-executive Directors is

subject to approval by shareholders at the Annual General Meeting.

Fees for Non-Executive Directors are not linked to the performance

of the Group. However, to align Directors' interests with

shareholder interests, the Directors are encouraged to hold CDIs in

the Company.

The remuneration policy has been tailored to increase the direct

positive relationship between shareholders' investment objectives

and Directors' and Executives' performance. Currently, this is

facilitated through the issue of options to the majority of

Directors and Executives to encourage the alignment of personal and

shareholder interests. The Company believes this policy will be

effective in increasing shareholder wealth. For details of

Directors' and Executives' interests in CDIs, options and

performance shares at year end, refer to the remuneration

report.

B. Details of Remuneration

Details of the nature and amount of each element of the

emoluments of each of the KMP of the Company (the Directors) for

the year ended 30 June 2021 are set out in the following

tables:

The maximum amount of remuneration for Non-Executive Directors

is $300,000 as approved by shareholders.

During the financial period, the Company did not engage any

remuneration consultants.

REMUNERATION REPORT (AUDITED)

2021

Group Key Short-term benefits Post- Long-term Equity-settled Total % of

Management employment benefits share-based remuneration

Personnel benefits payments as share

based

payments

Salary, Profit Non-monetary Other Super- Long Equity Options

fees share annuation Service

and and Leave

leave bonuses

Directors $ $ $ $ $ $ $ $ $

Keith

Coughlan(i) 279,000 99,490 - 27,407 27,345 17,825 - - 451,067 -

Kiran

Morzaria 33,567 - - - - - - - 33,567 -

Richard

Pavlik - 50,469 - - - - - - 50,469 -

Lincoln

Palmer

Bloomfield,

Jr (ii) 27,468 19,714 - - - - - - 47,182 -

340,035 169,673 - 27,407 27,345 17,825 - - 582,285 -

-------- -------- ------------ ------ ---------- --------- ------- ------- ------- ------------

Notes:

(i) During the financial year, a total of $137,280 of Mr

Coughlan's remuneration was reimbursed by Geomet s.r.o.

(ii) Includes $4,689 accrual of June 2021 fee.

2020

Group Key Short-term benefits Post- Long-term Equity-settled Total % of

Management employment benefits share-based remuneration

Personnel benefits payments as share

based

payments

Salary, Profit Non-monetary Other Super- Long Equity Options

fees share annuation Service (iv)

and and Leave

leave bonuses

Directors $ $ $ $ $ $ $ $ $

David

Reeves(i) 36,000 - - - - - - - 36,000 -

Keith

Coughlan(ii) 240,000 - - 4,822 22,800 26,663 - - 294,285 -

Kiran

Morzaria 24,000 - - - - - - - 24,000 -

Richard

Pavlik(iii) 140,691 - - - - - - 29,802 170,493 17.4%

440,691 - - 4,822 22,800 26,663 - 29,802 524,778 -

-------- -------- ------------ ----- ---------- --------- ------- ------- ------- ------------

Notes:

(i) Resigned 30 June 2020.

(ii) Effective 28 April 2020, a portion of Mr Coughlan's

remuneration has been reimbursed by Geomet s.r.o. The Company was

appointed to provide services of managing the Cinovec project

development subsequent to finalization of final agreement with CEZ

Group. During the financial year, a total of $22,880 was reimbursed

by Geomet s.r.o.

(iii) Represents remuneration from 1 July 2020 to 27 April 2020.

Effective 28 April 2020, Mr Pavlik's remuneration has been paid by

Geomet s.r.o directly.

(iv) The value of the options granted to key management

personnel as part of their remuneration is calculated as at the

grant date using the Black and Scholes. The amount disclosed as

part of remuneration for the financial year is the amount expensed

over the vesting period.

REMUNERATION REPORT (AUDITED)

C. Service Agreements

It was formally agreed at a meeting of the directors that the

following remuneration be established; there are no formal notice

periods, leave accruals or termination benefits payable on

termination.

Mr Keith Coughlan, Executive Chairman, received a salary of

$240,000 plus statutory superannuation contribution from 1 July

2020 to 31 December 2020. His salary was increased to $318,000 per

annum plus statutory superannuation contribution from 1 January

2021.

D. Share-based compensation

During the financial year, nil CDIs were issued to KMP under the

Employee Securities Incentive Plan (ESIP) (2020: nil).

Loan CDIs on issue to KMP under the ESIP are as follows:

30 June Balance at

2021 Loan CDIs Grant Details Exercised Lapsed/Cancelled End of Year

Grant Date No. Value No. Value No. Value No. Value

$ $ $ Vested $

Group KMP

Keith Coughlan 30 Nov 2017 850,000 592,245 - - - - 850,000 592,245

Richard

Pavlik 30 Nov 2017 300,000 209,028 - - - - 300,000 209,028

Kiran Morzaria 30 Nov 2017 200,000 139,352 - - - - 200,000 139,352

1,350,000 940,625 - - - - 1,350,000 940,625

--------- ------- ---- ----- ------- ----------- ------------ ---------

30 June Balance at

2020 Loan CDIs Grant Details Exercised Lapsed/Cancelled End of Year

Grant Date No. Value No. Value No. Value No. Value

$ $ $ Vested $

Group KMP

David Reeves* 30 Nov 2017 300,000 209,028 - - - - 300,000 209,028

Keith Coughlan 30 Nov 2017 850,000 592,245 - - - - 850,000 592,245

Richard

Pavlik 30 Nov 2017 300,000 209,028 - - - - 300,000 209,028

Kiran Morzaria 30 Nov 2017 200,000 139,352 - - - - 200,000 139,352

1,650,000 1,149,653 - - - - 1,650,000 1,149,653

--------- --------- ---- ----- ------- ----------- --------- ---------

* Resigned on 30 June 2020

The terms of the loan CDIs are disclosed in Note 16.

REMUNERATION REPORT (AUDITED)

E. Options issued for the year ended 30 June 2021

No options were issued as part of the remuneration for the year

ended 30 June 2021 (2020: nil).

F. Performance Rights granted for the year ended 30 June

2021

30 June Performance Rights Balance at

2021 Details Exercised Lapsed End of Year Vested Unvested

Grant

Date No. Value(1) No. Value No. Value No. Value(1) No. No.

$ $ $ $

Group KMP

Keith 17 Dec

Coughlan 20 2,400,000 2,088,000 - - - - 2,400,000 2,088,000 - 2,400,000

Richard 17 Dec

Pavlik 20 1,200,000 1,044,000 - - - - 1,200,000 1,044,000 - 1,200,000

-------- ---------

3,600,000 3,132,000 - - - - 3,600,000 3,132,000 - 3,600,000

--------- --------- ---- ----- --- ----- --------- --------- -------- ---------

Notes:

1. The value of performance rights granted to key management

personnel is calculated as at the grant date based on the share

price at grant date. As at 30 June 2021, management has yet to

indicate the number of these performance rights expected to vest,

hence has not expensed any of the value of these performance

rights. Management shall revise this estimate when subsequent

information indicates that the number of performance rights

expected to vest differs from previous estimate.

G. Equity instruments issued on exercise of remuneration

options

There were no equity instruments issued during the year to

Directors or other KMP as a result of options exercised that had

previously been granted as compensation.

H. Loans to Directors and Key Management Personnel

There were no loans issued to Key Management Personnel during

the financial year.

I. Company performance, shareholder wealth and Directors' and

Executives' remuneration

The remuneration policy has been tailored to increase the direct

positive relationship between shareholders' investment objectives

and Directors' and Executives' performance. This will be

facilitated through the issue of options to the majority of

Directors and Executives to encourage the alignment of personal and

shareholder interests. The Company believes this policy will be

effective in increasing shareholder wealth. At commencement of mine

production, performance-based bonuses based on key performance

indicators are expected to be introduced.

REMUNERATION REPORT (AUDITED)

J. Other information

Options held by Key Management Personnel

The number of options to acquire CDIs in the Company held during

the 2021 and 2020 reporting period by each of the Key Management

Personnel of the Group including their related parties are set out

below.

Balance Balance Unvested

at the Granted Exercised Other changes at the end

start of during during during of Vested

30 June 2021 the year the year the year the year the year and exercisable

Keith Coughlan 2,000,000 - - (2,000,000)* - - -

Richard Pavlik - - - - - - -

Kiran Morzaria - - - - - - -

Lincoln Palmer - - - - - - -

Bloomfield,

Jr

--------- --------- --------- ------------- ----------- ---------------- --------

Total 2,000,000 - - (2,000,000) - - -

--------- --------- --------- ------------- ----------- ---------------- --------

*Off market transfer

Balance Balance Unvested

at the Granted Exercised Other changes at the end

start of during during during of Vested

30 June 2020 the year the year the year the year the year and exercisable

David Reeves* 1,000,000 - - - 1,000,000 1,000,000 -

Keith Coughlan 2,000,000 - - - 2,000,000 2,000,000 -

Kiran Morzaria - - - - - - -

Richard Pavlik 400,000 - - (400,000) - -

Total 3,400,000 - - (400,000) 3,000,000 3,000,000 -

--------- --------- --------- ------------- ----------- ---------------- --------

*Resigned on 30 June 2020.

Chess Depositary Interests ('CDIs') held by Key Management

Personnel

The number of ordinary CDIs held in the Company during the 2021

and 2020 reporting period held by each of the Key Management

Personnel of the Group; including their related parties are set out

below. The CDIs held directly have been obtained through the

Employee Securities Incentive Plan.

Balance Granted Issued Other Changes Balance

at Start as remuneration on exercise during at end

2021 of year during the of options the year of year

Name year

Keith Coughlan 850,000 - - - 850,000

Indirect(1) 8,500,000 - - - 8,500,000

Richard Pavlik 300,000 - - - 300,000

Kiran Morzaria 200,000 - - - 200,000

Indirect(2) 23,259,751 - - (5,595,887) 17,663,864

Lincoln Palmer Bloomfield,

Jr 122,500(3) - - - 122,500

Total 33,232,251 - - (5,595,887) 27,636,364

=========== ================= ============= ============== ===========

Notes:

1. Mr Coughlan has 850,000 CDIs direct interest and 8,500,000

CDIs indirect interest held by Inswinger Holdings Pty Ltd, an

entity of which Mr Coughlan is a director and a shareholder.

2. Mr Morzaria is a director and chief executive of Cadence

Minerals plc, an entity which owns 17,663,864 CDIs in European

Metals Holdings Limited. Mr Morzaria does not have direct control

over the disposal of the shares either by means of his directorship

of Cadence Minerals plc or his shareholding in Cadence Minerals

plc.

3. Represent balance held on appointment.

REMUNERATION REPORT (AUDITED)

Balance Granted Issued Other Changes Balance

at Start as remuneration on exercise during at end

2020 of year during the of options the year of year

Name year

David Reeves(i) 300,000 - - - 300,000

Indirect(1) 3,720,244 - - 325,596(4) 4,045,840

Keith Coughlan 850,000 - - - 850,000

Indirect(2) 8,500,000 - - - 8,500,000

Kiran Morzaria 200,000 - - - 200,000

Indirect(3) 27,896,470 - - (4,636,719) 23,259,751

Richard Pavlik 300,000 - - - 300,000

Total 41,766,714 - - (4,311,123) 37,455,591

=========== ================= ============= ============== ===========

Notes:

1. Mr Reeves has 300,000 CDIs direct interest and 4,045,840 CDIs

indirect interest held by Eleanor Jean Reeves <Elanwi A/C>,

Mr Reeves' spouse.

2. Mr Coughlan has 850,000 CDIs direct interest and 8,500,000

CDIs indirect interest held by Inswinger Holdings Pty Ltd, an

entity of which Mr Coughlan is a director and a shareholder.

3. Mr Morzaria has 23,259,751 indirect interest held by Cadence

Minerals Plc, an entity of which Mr Morzaria is a director and

chief executive.

4. Issued on conversion of A Class Performance Shares and B

Class Performance Shares.

(i) Resigned 30 June 2020. The balance at end of year represents

balance at date of resignation.

Performance Shares held by Key Management Personnel

There were no Performance shares held by Key Management

Personnel of the Group during the 2021 financial year.

Balance at

30 June 2020 Grant Details Exercised Lapsed/cancelled End of Year

Class Grant No. Value

Date No. Value No. Value No. Value

$ $ $ Unvested $

Group KMP

18 Dec

David Reeves(i) A Class 18 542,651 86,824 (217,064) 34,730 - - 325,587 52,094

24 Nov

David Reeves(i) B Class 16 542,651 289,932 (108,532) 57,987 (434,119) 231,945 - -

Keith Coughlan - - - - - - - - -

Richard Pavlik - - - - - - - - -

Kiran Morzaria - - - - - - - - -

1,085,302 376,756 (325,596) 92,717 (434,119) 231,945 325,587 52,094

--------- ------- --------- ------ --------- ------- -------- ------

(i) Resigned 30 June 2020. The balance at end of the year

represents balance at the date of resignation.

REMUNERATION REPORT (AUDITED)

Other transactions with Key Management Personnel

Purchases from related parties are made on terms equivalent to

those that prevail in arm's length transactions. From January 2021,

the Company received accounting and bookkeeping services of $56,256

plus GST from Everest Corporate, a company controlled by the spouse

of Executive Chairman, Keith Coughlan. Amount payable to Everest

Corporate as at 30 June 2021 was $12,528.

From 1 May 2021, the Company received rental income of $24,515

plus GST for the period 1 May 2021 to 31 December 2021 from Everest

Corporate for subletting the office in West Perth.

During the 2021 financial year, the Company paid $4,900 plus GST

for office rental to Wild West Enterprises Pty Ltd, an entity

controlled by former director, David Reeves (2020: $15,600).

There were no other transactions with Key Management Personnel

during the financial year.

End of Remuneration Report

Signed in accordance with a resolution of the Board of

Directors.

Keith Coughlan

EXECUTIVE CHAIRMAN

Dated at 30 September 2021

[to be inserted]

AUDITOR'S INDEPENCE DECLARATION

30 September 2021

Board of Directors

European Metals Holdings Limited Level 3, 35 Outram Street

WEST PERTH WA 6005

Dear Directors

RE: EUROPEAN METALS HOLDINGS LIMITED

In accordance with section 307C of the Corporations Act 2001, I

am pleased to provide the following declaration of independence to

the directors of European Metals Holdings Limited.

As Audit Director for the audit of the financial statements of

European Metals Holdings Limited for the year ended 30 June 2021, I

declare that to the best of my knowledge and belief, there have

been no contraventions of:

(i) the auditor independence requirements of the Corporations

Act 2001 in relation to the audit; and

(ii) any applicable code of professional conduct in relation to the audit.

Yours faithfully

STANTONS INTERNATIONAL AUDIT & CONSULTING PTY LTD

(An Authorised Audit Company)

Samir R Tirodkar Director

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE YEARED 30 JUNE 2021

Note 30 June 30 June

2021 2020

$ $

Revenue 6 1,102,953 183,824

Other income 66,199 47,255

R&D rebate 289,335 -

Professional fees (1,565,631) (2,043,727)

Audit fees 7 (43,526) (54,450)

Directors' fees (80,748) (60,000)

Share based payments 16,17 (987,490) (2,439,192)

Advertising and promotion (405,276) (175,052)

Employees' benefits (559,026) (294,342)

Travel and accommodation (7,248) (98,576)

Insurance expense (64,619) (25,552)

Share registry and listing expense (239,475) (139,514)

Depreciation and amortisation expense (8,876) (1,344)

Equity accounting on investment in Geomet

s.r.o 12 (1,263,167) 490,051

Facility, advance fee and finance costs (61,155) -

Foreign exchange gain/(loss) (7,460) 45,018

Other expenses (127,240) (43,128)

-------------- ------------

Loss before income tax (3,962,450) (4,608,729)

Income tax expense 3 - -

-------------- ------------

Loss from continuing operations (3,962,450) (4,608,729)

Gain from discontinued operations - De-consolidation

of Geomet s.r.o 20 - 7,422,536

-------------- ------------

(Loss)/Income for the year attributable to

the members of the Company (3,962,450) 2,813,807

-------------- ------------

Other comprehensive income/(loss)

Items that may be reclassified subsequently

to profit or loss

- Exchange differences on translating foreign

operations 9,644 (1,522,451)

* Equity accounting on investment in Geomet s.r.o (242,337) -

Other comprehensive loss for the year, net

of tax (232,693) (1,522,451)

Total comprehensive (loss)/income for the

year attributable to members of the Company (4,195,143) 1,291,356

============== ============

Loss per share for loss from continuing operations

Basic loss per CDI (cents) 8 (2.39) (3.05)

Diluted loss per CDI (cents) 8 (2.39) (3.05)

Earnings per share for income from discontinued

operations

Basic earnings per CDI (cents) 8 - 4.92

Diluted earnings per CDI (cents) 8 - 4.92

The above statement should be read in conjunction with the

accompanying notes.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AR 30 JUNE

2021

2021 2020

Note $ $

CURRENT ASSETS

Cash and cash equivalents 9 7,880,673 58,951

GST and other receivables 53,046 17,252

Other assets 10 337,196 5,110

TOTAL CURRENT ASSETS 8,270,915 81,313

------------ ------------

NON-CURRENT ASSETS

Other assets 10 47,392 -

Property, plant and equipment - 869

Right-of-use asset 11 136,122 -

Investments accounted for using equity

method 12 17,461,027 18,966,531

TOTAL NON-CURRENT ASSETS 17,644,541 18,967,400

------------ ------------

TOTAL ASSETS 25,915,456 19,048,713

------------ ------------

CURRENT LIABILITIES

Trade and other payables 13 439,798 924,592

Provisions - employee entitlements 14 99,850 54,618

Lease liability 11 6,038 -

------------ ------------

TOTAL CURRENT LIABILITIES 545,686 979,210

------------ ------------

NON-CURRENT LIABILITIES

Lease liability 11 91,855 -

TOTAL NON-CURRENT LIABILITIES 91,855 979,210

------------ ------------

TOTAL LIABILITIES 637,541 979,210

------------ ------------

NET ASSETS 25,277,915 18,069,503

============ ============

EQUITY

Issued capital 15 34,087,930 23,954,204

Reserves 16 8,752,723 7,715,587

Accumulated losses (17,562,738) (13,600,288)

------------ ------------

TOTAL EQUITY 25,277,915 18,069,503

========== ============

The above statement should be read in conjunction with the

accompanying notes.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30

JUNE 2021

Issued Capital Share Based Foreign Currency Accumulated

Payment Reserve Translation Losses Total

Reserve

$ $ $ $ $

Balance at 1 July 2019 22,074,314 5,511,581 1,287,265 (16,414,095) 12,459,065

Income attributable to

members of the Company - - - 2,813,807 2,813,807

Other comprehensive loss - - (1,522,451) - (1,522,451)

---------- --------- ----------- ------------ -----------

Total comprehensive income

for the year - - (1,522,451) 2,813,807 1,291,356

---------- --------- ----------- ------------ -----------

Transactions with owners,

recognized directly in

equity

CDIs issued during the

year, net of costs 1,879,890 - - - 1,879,890

Equity based payments - 2,439,192 - - 2,439,192

---------- --------- ----------- ------------ -----------

Balance at 30 June 2020 23,954,204 7,950,773 (235,186) (13,600,288) 18,069,503

========== ========= =========== ============ ===========

Balance at 1 July 2020 23,954,204 7,950,773 (235,186) (13,600,288) 18,069,503

Loss attributable to

members of the Company - - - (3,962,450) (3,962,450)

Other comprehensive loss - - (232,693) - (232,693)

---------- --------- ----------- ------------ -----------

Total comprehensive loss

for the year - - (232,693) (3,962,450) (4,195,143)

---------- --------- ----------- ------------ -----------

Transactions with owners,

recognized directly in

equity

CDIs issued during the

year 9,100,000 - - - 9,100,000

Capital raising costs (526,387) 355,000 - - (171,387)

Exercise of options and

warrants 958,733 - - - 958,733

Repayment of Loan CDIs 271,380 - - - 271,380

Share based payments 330,000 914,829 - - 1,244,829

Balance at 30 June 2021 34,087,930 9,220,602 (467,879) (17,562,738) 25,277,915

========== ========= =========== ============ ===========

The above statement should be read in conjunction with the

accompanying notes.

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEARED 30 JUNE

2021

30 June 30 June 2020

2021

Note $ $

CASH FLOWS FROM OPERATING ACTIVITIES

Revenue received 1,011,041 275,736

Government grant 55,118 39,370

Payments to suppliers and employees (2,640,953) (2,177,875)

Interest received 1,340 11

R&D Rebate 289,335 -

Payments for Cinovec associated costs (1,007,678) -

Net cash (used in) operating activities 18 (2,291,797) (1,862,758)

----------- ------------

CASH FLOWS FROM INVESTING ACTIVITIES

Payments for exploration and evaluation

expenditure - (331,372)

Net cash (used in) investing activities - (331,372)

----------- ------------

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from issue of CDIs 9,100,000 2,024,905

Capital raising costs paid (171,387) (145,015)

Proceeds from exercise of options and

warrants 958,733 -

Proceeds from repayment of loan CDIs 271,380 -

Payment for lease liability (47,391) -

----------- ------------

Net cash from financing activities 10,111,335 1,879,890

----------- ------------

Net increase/(decrease) in cash and cash

equivalents 7,819,538 (314,240)

Cash and cash equivalents at the beginning

of the financial year 58,951 426,178

Exchange differences in foreign currency

held 2,184 (52,987)

----------- ------------

Cash and cash equivalents at the end

of financial year 9 7,880,673 58,951

=========== ============

The above statement should be read in conjunction with the

accompanying notes.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARED 30

JUNE 2021

NOTE 1: STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of preparation

These consolidated financial statements and notes represent those

of European Metals Holdings Limited ("EMHL" or "the Company")

and its Controlled Entities (the "Consolidated Group" or "Group").

The financial statements are general purpose financial statements,

which have been prepared in accordance with Australian Accounting

Standards, Australian Accounting Interpretations, other authoritative

pronouncements of the Australian Accounting Standards Boards

(AASB) and the Corporations Act 2001. The Group is a for-profit

entity for financial reporting purposes under Australian Accounting

Standards.

The accounting policies detailed below have been adopted in the

preparation of the financial report. Except for cash flow information,

the financial statements have been prepared on an accrual basis

and are based on historical cost, modified, where applicable,

by the measurement at fair values of selected non-current assets,

financial assets and financial liabilities.

The Company is a listed public company, incorporated in the British

Virgin Islands and registered in Australia.

(i) Accounting policies

The Group has considered the implications of new and amended

Accounting Standards which have become applicable for the current

financial reporting year.

New and Revised Accounting Standards Adopted by the Group

Initial adoption of AASB 2020-04: COVID-19-Related Rent

Concessions

AASB 2020-4: Amendments to Australian Accounting Standards -

COVID-19 Related Rent Concessions amends AASB 16 by providing a

practical expedient that permits lessees to assess whether rent

concessions that occur as a direct consequence of the COVID-19

pandemic and, if certain conditions are met, account for those rent

concessions as if they were not lease modifications.

Initial adoption of AASB 2018-6: Amendments to Australian

Accounting Standards - Definition of a Business

AASB 2018-6 amends and narrows the definition of a business

specified in AASB 3: Business Combinations, simplifying the

determination of whether a transaction should be accounted for as a

business combination or an asset acquisition. Entities may also

perform a calculation and elect to treat certain acquisitions as

acquisitions of assets.

Initial adoption of AASB 2018-7: Amendments to Australian

Accounting Standards - Definition of Material

This amendment principally amends AASB 101 and AASB 108 by

refining the definition of material by improving the wording and

aligning the definition across the standards issued by the

AASB.

Initial adoption of AASB 2019-3: Amendments to Australian

Accounting Standards - Interest Rate Benchmark

This amendment amends specific hedge accounting requirements to

provide relief from the potential effects of the uncertainty caused

by interest rate benchmark reform.

Initial adoption of AASB 2019-1: Amendments to Australian

Accounting Standards - References to the Conceptual Framework

This amendment amends Australian Accounting Standards,

Interpretations and other pronouncements to reflect the issuance of

Conceptual Framework for Financial Reporting by the AASB.

The standards listed above did not have any impact on the

amounts recognised in prior periods and are not expected to

significantly affect the current or future periods.

NOTE 1: STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES

(CONTINUED)

(a) Basis of preparation (continued)

(i) Accounting policies (continued)

New and revised Accounting Standards for Application in

Future

Periods

Any new, revised or amending Accounting Standards or

Interpretations

that are not yet mandatory have not been early adopted. The

adoption

of these Accounting Standards and Interpretations did not

have

any significant impact on the financial performance or

position

of the Group.

There are no other standards that are not yet effective and

that

would be expected to have a material impact on the entity

in

the current or future reporting period and on foreseeable

future

transactions.

(ii) Statement of Compliance

The financial report was authorised for issue on 30

September

2021.

Australian Accounting Standards set out accounting policies

that

the AASB has concluded would result in the financial

statements

containing relevant and reliable information about

transactions,

events and conditions. Compliance with Australian

Accounting

Standards ensures that the financial statements and notes

also

comply with International Financial Reporting Standards as

issued

by the IASB.

(iii) Financial Position

The Directors have prepared the financial statements on

going

concern basis, which contemplates continuity of normal

business

activities and the realisation of assets and extinguishment

of

liabilities in the ordinary course of business.

At 30 June 2021, the Group comprising the Company and its

subsidiaries

has incurred a loss for the year amounting to $3,962,450

(2020:

income of $2,813,807). The Group has a net working capital

surplus

of $7,725,229 (2020: deficit of $897,897) and cash and cash

equivalents

of $7,880,673 (2020: $58,951).

The Directors have prepared a cash flow forecast, which

indicates

that the Company will have sufficient cash flows to meet

all

commitments and working capital requirements for the

12-month

period from the date of signing this financial report.

Based on the cash flow forecasts, the Directors are

satisfied

that the going concern basis of preparation is appropriate.

In

determining the appropriateness of the basis of

preparation,

the Directors have considered the impact of the COVID-19

pandemic

on the position of the Company at 30 June 2021 and its

operations

in future periods.

(iv) Critical accounting estimates and judgements

The application of accounting policies requires the use of

judgements,

estimates and assumptions about carrying values of assets

and

liabilities that are not readily apparent from other

sources.

The estimates and associated assumptions are based on

historical

experience and other factors that are considered to be

relevant.

Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing

basis. Revisions are recognised in the period in which the

estimate

is revised if it affects only that period or in the period

of

the revision and future periods if the revision affects

both

current and future periods.

Share-based payment transactions

The Group measures the cost of equity-settled transactions

with

employees and consultants by reference to the estimated

fair

value of the equity instruments at the date at which they

are

granted. These are expensed over the estimated vesting

periods.

Judgement has been exercised on the probability and timing

of

achieving milestones related to performance rights granted

to

Directors.

NOTE 1: STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

(a) Basis of preparation (continued)

(iv) Critical accounting estimates and judgements (continued)

Estimation of the Group's borrowing rate

The lease payments used to determine the lease liability and

rignt-of-use of asset at 1 July 2020 under AASB 16 Leases are

discounted using the Group's incremental borrowing rate of

5%.

Recognition of deferred tax assets

Deferred tax assets relating to temporary differences and unused

tax losses have not been recognised as the Directors are of

the opinion that it is not probable that future taxable profit

will be available against which the benefits of the deferred

tax assets can be utilised.

(b) Income Tax

Current income tax expense charged to the profit or loss is

the tax payable on taxable income calculated using applicable

income tax rates enacted, or substantially enacted, as at reporting

date. Current tax liabilities (assets) are therefore measured

at the amounts expected to be paid to (recovered from) the

relevant taxation authority.

Deferred income tax expense reflects movements in deferred

tax asset and deferred tax liability balances during the year

as well unused tax losses. Current and deferred income tax

expense (income) is charged or credited directly to equity

instead of the profit or loss when the tax relates to items

that are credited or charged directly to equity.

Deferred tax assets and liabilities are ascertained based on

temporary differences arising between the tax bases of assets

and liabilities and their carrying amounts in the financial

statements. Deferred tax assets also result where amounts have

been fully expensed but future tax deductions are available.

No deferred income tax will be recognised from the initial