TIDMFRP

RNS Number : 6051Y

FRP Advisory Group PLC

14 May 2021

FRP Advisory Group plc

("FRP" or the "Group")

Full Year Trading Update

Strong performance, with continued growth and strategic

delivery

FRP Advisory Group plc, a leading UK professional services firm

specialising in advisory services, today announces a trading update

for the full year ended 30 April 2021.

Trading performance

In its first, full financial year as a plc, the Group delivered

a strong performance, continuing to grow revenues, profits and the

team. Organic growth was driven by some large high-profile

appointments early in the financial year and further gains in

market share which were supported by demand-led hiring. In line

with the Group's stated strategy, four complementary acquisitions

were completed within the year, also contributing towards our

growth.

As a result, the Group expects to report revenues for the full

year to 30 April 2021 of GBP79 million, up 25% on the prior year

(FY 2020: GBP63.2 million), and underlying adjusted EBITDA* of

GBP23 million, up 22% on the prior year (FY 2020: GBP18.8 million).

These results exceed the guidance provided in the 12 February 2021

trading update.

The FRP Corporate Finance team had a very busy year in a

challenging, but ultimately active, UK M&A market. Notable

transactions include advising The Goat Agency on its minority

investment from Inflexion, Encore Group on its MBO backed by

Queen's Park Equity, Vehicle Replacement Group on its sale to

Davies, Everest Dairies on its sale to Vibrant Foods and Prezzo on

its sale to Cain International. The previously announced highly

complementary acquisitions of Spectrum Corporate Finance Limited

(who also have a Debt Advisory team) and JDC in East Anglia (who

also have a Forensics team) during the year have given FRP a key

position in the UK mid-cap transactional advisory market.

The FRP Restructuring team continue to serve the full range of

clients, including Personal clients, SME's, the core mid-market and

high-profile appointments. The Restructuring team grew market share

in an overall subdued market, due to the various support measures

made available by the UK Government in response to the Covid-19

pandemic. As a result of the support measures, the number of formal

Company insolvency appointments over the past 12 months was 26%

down, compared to the prior period.

* Our underlying adjusted EBITDA compares the current model of

partner compensation on a like-for-like basis to the prior

corresponding period, as the business was previously a full

distribution partnership. It also excludes exceptional costs and a

share based payment expense that arises from a) the Employee

Incentive Plan (EIP) funded on IPO and b) Deemed remuneration

amortisation linked to acquisitions.

Balance sheet

The Group's balance sheet remains strong with an unaudited net

cash balance as at 30 April 2021 of GBP16.4 million (Cash of

GBP24.4 million less recent structured debt of GBP8 million). The

group also has an undrawn revolving credit facility (RCF) available

of GBP10 million with Barclays Bank.

FRP acquired Spectrum Corporate Finance Ltd on 26 February 2021

which required a temporary draw on the RCF. Post completion, on 25

March 2021, FRP entered into a structured acquisition finance term

loan facility with Barclays Bank. GBP8 million was drawn down from

this facility, the temporary RCF draw was repaid and this term loan

will be repaid over five years in 20 quarterly instalments.

The Group did not apply for any Covid-19 support, for example

government backed lending schemes or delayed tax settlements.

During the Covid-19 pandemic period FRP have been dedicating

significant effort and resources to help businesses navigate the

crisis. In addition to our appointments, we have offered pro bono

advice and shared extensive business support resources through our

website.

Given the trading performance and strong balance sheet, the

Group intends to propose a final dividend, in line with its stated

dividend policy.

People and operations

The Board remains focused on the health, safety and wellbeing of

all colleagues. Throughout the Covid-19 pandemic period, we have

operated without interruption and none of our people were placed on

furlough. Colleagues adapted well to remote working during lockdown

periods and previous investments in our IT infrastructure have

proven to be invaluable. Ongoing investments within our IT

infrastructure, Information Security and Risk management are

expected.

The overall FRP team grew 30% year on year to 457 colleagues

excluding consultants (30 April 2020: 351) through both

acquisitions and demand-led hires. At 30 April 2021 we had 73

partners (2020: 51), 288 other fee earners (2020: 230) and 96

support staff (2020: 70).

FRP's offices across 22 locations in the UK continue to work

well together, drawing on specialists from different service lines

as necessary, in order to give each assignment the right team in

order to deliver the best possible service and outcome. The Group

has recently hired a team of six in Scotland, including Partners

Michelle Elliot and Stuart Robb to establish a new FRP office in

Glasgow. In April 2021, Marco Piacquadio was hired as a Partner,

who will be based in a new FRP office in Milton Keynes.

Notice of results

The Group expects to report its audited results for the full

year on 27 July 2021 .

Geoff Rowley, Chief Executive Officer of FRP Advisory Group plc,

said:

"We are pleased with the progress that has been made during our

first year as a plc. I am particularly pleased with how our

colleagues have navigated the uncertainties during the pandemic and

adapted to serve clients without interruption.

We have continued to execute our growth strategy, with strong

contributions from all five business divisions. After acquiring and

then integrating two boutiques we have significantly bolstered our

Corporate Finance offering. FRP now has a key position in the UK

mid-cap transactional advisory market and is able to support a

broader range of clients through a strengthened referral

network.

There is continued uncertainty around the shape and scale of the

nationwide recovery following the economic impacts of the Covid-19

pandemic. FRP's resilient business model is well positioned to help

clients throughout their lifecycle, in addressing both their

strategic ambitions, as pent-up liquidity is deployed and being

available to help as challenges arise.

The medium-term outlook for our market remains positive and we

have sufficient resource flexibility to service an increase in

demand. The board remains confident of making further progress in

the upcoming financial year."

The information contained within this announcement is deemed by

the Group to constitute inside information under the Market Abuse

Regulations No. 596/2014.

Enquiries:

FRP Advisory Group plc

Geoff Rowley, CEO

Jeremy French, COO

Gavin Jones, CFO

Enquiries via MHP

Cenkos Securities plc (Nominated Adviser and Sole Broker)

Max Hartley/Max Gould (Corporate Finance)

Alex Pollen (Sales)

Tel: +44 (0) 207 397 8900

MHP Communications (Financial Public Relations)

Oliver Hughes

Charlie Barker

Pete Lambie

Tel: +44 (0) 3128 8540 / +44 (0) 20 3128 8570

FRP@mhpc.com

Notes to Editors

FRP is a professional services firm established in 2010 which

offers a range of advisory services to companies, lenders,

investors and other stakeholders, as well as individuals. These

services include:

-- Corporate finance: mergers & acquisitions (M&A),

strategic advisory and valuations, financial due diligence, capital

raising, special situations M&A and partial exits.

-- Restructuring advisory: corporate financial advisory, formal

insolvency appointments, informal restructuring advisory, personal

insolvency and general advice to all stakeholders.

-- Debt advisory: raising and refinancing debt, debt amendments

and extensions, restructuring debt, asset based lending and

corporate and leveraged debt advisory.

-- Forensic services: forensic investigations, compliance and

risk advisory, dispute services and forensic technology.

-- Pensions advisory: pension scheme transaction advisory,

pension scheme restructuring advisory, covenant advisory and

corporate governance

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDXLFFFELEBBB

(END) Dow Jones Newswires

May 14, 2021 02:00 ET (06:00 GMT)

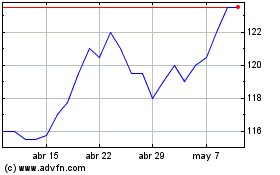

Frp Advisory (LSE:FRP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Frp Advisory (LSE:FRP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024