TIDMFNX

RNS Number : 8049P

Fonix Mobile PLC

22 February 2021

22 February 2021

Fonix Mobile plc

("Fonix" or the "Company")

Interim results

Strong growth in both revenue and profitability

Fonix, the UK focused mobile payments and messaging company, is

pleased to announce its interim results for the six months to 31

December 2020, which show continued strong revenue and profit

growth across all business segments.

Financial highlights

-- Revenue of GBP24.6m up by 25% (H1 2019: GBP19.7m).

-- Gross profit of GBP5.8m up by 22% (H1 2019: GBP4.8m).

-- Adjusted EBITDA ([1]) of GBP4.6m up by 28% (H1 2019: GBP3.6m).

-- Profit after tax of GBP2.7m (H1 2019: GBP2.8m).

-- Adjusted basic and diluted earnings per share for the period ([2]) of 3.6p (H1 2019: 2.9p).

-- Underlying operating cash inflow ([3]) for the period of GBP3.6m (H1 2019: GBP3.1m).

-- Underlying cash and cash equivalents at the period end of

GBP3.6m (30 June 2020: GBP2.3m) ([4]) .

-- Maiden interim dividend of 1.7p per share, amounting to GBP1.7m, to be paid in March 2021.

All financials are based on unaudited numbers.

Operational highlights

-- Fonix's three business segments of payments, messaging and

managed services have each grown during the period, in line with

expectations.

-- Fonix has continued to attract new customers during the

period across the media, charity, gaming and digital services

sectors and retains a robust pipeline of prospects, with over 20

customers added and no customers lost in the period.

-- A highlight of the period was the successful BBC Children in

Need campaign in November which raised GBP13.9m in donations using

our platform. The event was also the first in the UK where a GBP40

single donation was permitted by the mobile network operators.

Outlook

-- Fonix expects continued growth through 2021 from both

existing clients and a strong pipeline of new business

opportunities.

-- Despite the difficulties of the pandemic the business

continues to operate remotely with no adverse effect on operational

or technical planning.

-- The technical delivery team continues to focus efforts in a

dual stream of platform resilience and performance combined with

innovation and feature development. This ensures the business

maintains the operational requirements to deliver some of the most

high profile interactive campaigns and services in the UK as well

as continuous cycles of feature development to enable revenue

growth.

Rob Weisz, CEO, commented: "This has been an exciting period for

Fonix with the IPO raising our profile, benefiting shareholders,

partners and staff. We remain confident, through both our existing

clients and pipeline of new clients, in the future success and

growth of Fonix."

For further information please contact

Fonix Mobile plc Tel: +44 20 8114 7000

Robert Weisz, CEO

Rupert Horner, CFO

finnCap Ltd (NOMAD and broker) Tel: +44 20 7220 0500

Jonny Franklin-Adams, Giles Rolls (Corporate Finance)

Alice Lane, Sunila de Silva (ECM)

About Fonix Mobile plc

Fonix is a UK focused mobile payments and messaging company,

enabling businesses to charge users' mobile bills and send users

SMSs via their mobile carrier.

Founded in 2006, Fonix allows mobile carriers to provide

additional services in the form of carrier billing, SMS billing,

messaging and voice shortcodes. Fonix has over 120 clients

including ITV, Bauer Media, BT, Global Radio and BBC Children in

Need across a range of multi-billion pound sectors such as media,

gaming, charity, ticketing and digital services. Fonix offers

clients access to the customer base of the mobile carriers.

Fonix is headquartered in London and currently has a UK focused

strategy, differentiating it from its competitors by allowing it to

focus on high quality revenues in mature and highly regulated

market sectors. It is a tier 1 aggregator with direct technical

connections to all of the major UK MNOs, some of whose contracts

have been in place for over 10 years. The long-term nature of these

contracts has resulted in Fonix gaining access to over 95 per cent.

of the UK mobile consumer audience and a strong reputation in the

market.

Chief Executive's review

We are delighted to be reporting our first set of interim

results since our admission to AIM in October 2020.

Operational highlights

Fonix has delivered a strong performance in this period, with

continued growth across all our business segments. This growth has

resulted in significant improvements on all our key financial

metrics on a year on year basis. In particular, it is worth noting

the gross profit growth of 22% to GBP5.8 million (H1 2019: GBP4.8

million) and the adjusted EBITDA growth of 28% to GBP4.6 million

(H1 2019: GBP3.6 million).

Our core businesses

Fonix's main business is its mobile payments service that

enables merchants to charge their customers' mobile phone bills for

products or services. This accounted for 85% of gross profit in the

period. The other two operating segments are mobile messaging,

which allows our customers to communicate, notify and market to

consumers, and managed services which represent fees charged and

non-transactional revenue. These other two operating segments

continue to be an important source of revenue in their own right,

whilst also offering complementary ancillary services to payments

customers. As described further in the financial review below, all

three business segments saw growth in the period, with our core

payments showing the strongest growth with an increased gross

profit contribution of 23% on the corresponding period in the prior

year.

We provide our services to a wide range of industry sectors with

specific focus on media, gaming, charity and digital merchants. Our

largest sector is media businesses in the UK, where we saw

particularly strong growth during the period, partly as a result of

the services provided being unaffected by COVID-19. We are also

pleased with our continued success in running charity campaigns,

where some of the initiatives that we have enabled contributed to

increased donations.

Our clients

We have secured a further 21 new clients in the period and now

have over 120 active clients, including ITV, Bauer and Global in

our media division, Children in Need and Cancer Research in our

charity division and Intouch Games in our gaming division. It is a

key part of our business philosophy to work closely with our

clients to continue to improve the range and quality of services

that we provide. It is pleasing to note that this has contributed

to no contracts being lost in the period. The majority of the

growth experienced during the period came from existing customers.

We saw longer sales cycles resulting from our sales team being

unable to attend the usual face-to-face sales, conferencing and

networking event, so whilst we have secured new contracts in the

period, the monetary contribution from them in the current period

has been modest and they should begin to make a more meaningful

contribution towards the end of the current financial year.

Strategy for growth and market opportunity

We have continued to refine our growth strategy. Fonix's success

is built on focus - a deep product knowledge of both the mobile

operator payments and messaging landscape, coupled with thorough

insight into our key client sectors. This focus ensures alignment

across all partners in the value chain, with high throughput

transactional performance and optimising payment conversion

ingrained in our technology, operational and commercial

culture.

Each of our target sectors are multi-billion pound markets in

their own right. For example, the UK broadcast market delivered

$6.3bn ([5]) in pay TV revenues in 2020 and the UK charity sector

received over GBP5.4bn ([6]) in donations in the first half of

2020, with a noticeable move to alternative payment strategies due

to COVID-19 preventing traditional fundraising.

It therefore makes sense for us to continue to focus on these

sectors, particularly given our expertise within them:

-- Media. This is Fonix's largest market consisting primarily of

TV, radio, print and digital publishers. The growth strategy is to

improve upon Fonix's position in the SMS billing market, increase

market share by focusing on carrier billing into TV, print and

radio paywalls and support clients moving into international

markets. We have continued to see strong growth from our existing

clients and we would expect this to continue, whilst we also

continue to work to win significant new clients.

-- Charity. We have won new charity clients in the period and

our focus will be to continue to drive Fonix's market leading 'text

to donate' and 'click to donate' products in the UK.

-- Gaming. This is a large market which is underserved by

carrier billing and where we see the opportunity to win new clients

as well as work on an international roll out of existing

clients.

-- Digital services. This covers growing markets including

dating, memberships, fitness/diets, content and ticketing. This is

currently a relatively small part of the Fonix business but has the

potential to grow significantly, as carrier billing is an obvious

and convenient payment method, particularly when combined with the

ability to use the mobile channel to communicate with customers. We

won a number of new business contracts in this sector during the

period.

-- Technical service providers (TSPs). Fonix remains positioned

to be the 'go to' direct carrier billing and SMS billing partner

for the reseller market in the UK, demonstrated through the success

of the contracts it has with a number of TSPs. Fonix continues to

identify global TSPs looking for UK connectivity and support their

growth.

-- Telecoms. Fonix continues to deliver its telecoms services

through channel sales partners, direct sales through mobile network

operator (MNO) relationships and extending to other telecoms

partners and opportunities.

International

Whilst Fonix is currently predominantly UK focused, we have

started our planned expansion into new jurisdictions and regions

and expect to be operating in at least one mainland European market

in 2021. We are adopting a targeted client led approach to

expansion, with a focus on mature Carrier Billing markets with

robust regulatory frameworks.

Acquisitions

Whilst no acquisition targets have been identified to date, we

will continue to keep acquisition opportunities under review and

remain receptive to the right value accretive or strategic

opportunities should they arise.

Technology and platform

Fonix's platform is a critical part of the business. It is a

scalable and agile proprietary platform that has been built

in-house by industry experts with Fonix retaining full ownership of

all intellectual property. We have a team of 14 developers who work

full time on improving and servicing the platform to ensure it is

best in class. The platform is able to achieve high transaction

processing speeds in excess of 2,000 transactions per second,

providing significant capacity headroom above the current

requirements. We continue to invest in our development roadmap and

technology team, with particular focus on platform resilience and

feature improvements to drive improved performance and optimisation

for our clients. This continued development is important in our

ability to retain existing clients and win new business.

Market dynamics

The global mobile payments market continues to evolve and grow

with direct carrier billing demonstrating, for many brands, that it

can form a key part of their payments strategy. Adoption from some

of the largest brands in the world, including Apple, Google,

Netflix and Spotify to name but a few, only adds support to the

prospect that delivering convenience, reduced friction and

ultimately choice to consumers can be a hugely powerful piece of

the payments landscape. As carrier billing becomes more accepted as

a payment mechanism, this will help Fonix grow in its target

sectors.

Financial review

We are pleased to report strong growth in all key financial

metrics:

-- Total payments volume. TPV represents the cash payments

processed by Fonix on behalf of clients. TPV grew 18% to GBP123m

(H1 2019: GBP104 million). There is an element of seasonality to

the business and Fonix saw the normal uplift in the Christmas

period, with a record total payment volume (TPV) month in

December.

-- Revenue. Revenue increased in the period to GBP24.6m (H1

2019: GBP19.7m), representing the total amount charged to consumers

on behalf of merchants, including mobile network operators'

charges.

-- Gross profit. As a business, the most important number is

gross profit as this represents the amount we charge for processing

the services we provide. Gross profit grew 22% in the period to

GBP5.8m (H1 2019: GBP4.8m), with mobile payment payments growing

23%, mobile messaging 13% and managed services 16%. Gross profit

margins have remained largely unchanged with small variations being

attributable to changes in product and client mix. The gross profit

to TPV margin has improved to 4.7% during the period (H1 2019:

4.6%), whilst the gross profit to revenue margin has reduced to 23%

(H1 2019: 24.3%).

-- Costs. Operating costs have been kept firmly under control.

Removing AIM admission costs of GBP844k and share based payment

expenses of GBP22k, our administrative costs were GBP1.49 (H1 2019:

GBP1.44m), representing a 3% increase. Our largest expense is

payroll which accounted for 75% of our total costs. This includes

the technology department which has 14 employees. We capitalised

GBP255k of development costs in the period (H1 2019: GBP193k) and

had an amortisation charge of GBP178k (H1 2019: GBP153k). We do not

anticipate any significant increases in costs in the near term but

will continue to ensure we commit resources to development and

sales.

-- Adjusted EBITDA. Our ability to increase the volume of

transactions and clients without having to increase our overhead

costs significantly is an important characteristic of our business,

providing significant operational gearing. We have therefore been

able to increase our adjusted EBITDA by 27% to GBP4.6 million (H1

2019: GBP3.6 million), excluding the costs of our AIM admission and

share based expenses.

-- Earnings per share. Adjusted EPS for the period increased to

3.6p per share (H1 2019: 2.9p per share).

-- Cash generation. Fonix receives cash collected from the

mobile operators (who have in turn collected the cash from the end

users on the mobile phone bill), before paying it on to our

clients. The cash balance therefore fluctuates depending on the

timing of "pass through" cash received and paid. We monitor the

underlying cash which effectively unwinds these timing differences

and shows the underlying cash from trading activities. The

underlying cash is derived from total cash by adjusting for trade

and other receivables, less trade and other payables excluding

corporation tax liabilities. On this basis, we have continued to be

strongly cash generative with free underlying cash generated from

operations of GBP3.6m for the period (H1 2019: GBP3.1m).

-- Balance sheet. We continue to have a strong balance sheet

with no debt. This is important as we are a payment business and

our clients need to maintain confidence in our ability to handle

the cash payments on their behalf.

COVID-19

Whilst we continue to monitor the evolving situation with

COVID-19 closely, we have now demonstrated a clear ability for the

business to run remotely from a technical, operational and

administrative standpoint. As noted above, we have seen some

slowdown in our ability to bring new clients on board but

fortunately this has not had a material impact on our financial

performance.

Dividend

We are pleased to declare our maiden interim dividend of 1.7p

per share, which is in line with our stated policy of paying out

75% of adjusted EPS, with one third paid as an interim dividend and

two thirds paid as a final dividend. The interim dividend will be

paid on 19 March 2021 to shareholders on the register on 5 March

2021, with an ex-dividend date of 4 March 2021.

Outlook

This has been an exciting period for Fonix with the IPO raising

our profile, benefiting shareholders, partners and staff. We remain

confident, through both our existing clients and pipeline of new

clients, in the future success and growth of Fonix.

Robert Weisz

Chief Executive Officer

22 February 2021

Statement of comprehensive income

For the half-year ended 31 December 2020

Half year Half year Year to

to 31 December to 31 December 30 June

2020 2019 2020 (Restated)

Note GBP'000 GBP'000 GBP'000

Revenue 3 24,608 19,733 40,061

Cost of sales (18,776) (14,934) (30,073)

------------------------------- ---- --------------- --------------- ----------------

Gross profit 2 5,832 4,800 9,988

Administrative costs (2,353) (1,438) (2,810)

Other operating income 0 16 31

------------------------------- ---- --------------- --------------- ----------------

Operating profit 3,479 3,378 7,209

Financial expense (2) (2) (4)

Financial income 13 21 49

------------------------------- ---- --------------- --------------- ----------------

Profit before tax expense 3,490 3,397 7,254

Income tax expense (760) (596) (1,235)

------------------------------- ---- --------------- --------------- ----------------

Profit and total comprehensive

income 2,730 2,801 6,019

------------------------------- ---- --------------- --------------- ----------------

Adjusted EBITDA

Operating profit - as above 3,479 3,378 7,209

Add back:

Amortisation 178 153 311

Right of use amortisation 60 61 122

Depreciation 8 5 13

------------------------------- ---- --------------- --------------- ----------------

EBITDA 3,725 3,597 7,655

Share-based payments expense 4 22 0 0

AIM admission costs 844 0 0

------------------------------- ---- --------------- --------------- ----------------

Adjusted EBITDA 4,591 3,597 7,655

Earnings per share Half year Half-year Year to

to 31 December to 31 December 30 June

2020 2019 2020

(Restated)

Weighted average number of

shares in issue 5 100,000,000 97,417,025 98,712,690

Basic and diluted earnings

per share 5 2.7p 2.9p 6.1p

Adjusted basic and diluted

earnings per share 5 3.6p 2.9p 6.1p

------------------------------- ---- --------------- --------------- ----------------

The profit for the year has been generated from continuing

operations.

The weighted average number of shares in issue has been

recalculated to take into account the share reorganisation that was

implemented in September and October 2020, whereby the ordinary

shares in issue was increased from 4,476,466 ordinary shares of

GBP0.00001 each to 100,000,000 ordinary shares of GBP0.001

each.

Statement of financial position

At 31 December 2020

Half year to Half year to Year to 30

31 December 31 December June 2020 (Restated)

2020 2019

Note GBP'000 GBP'000 GBP'000

Non-current assets

Intangible asset 761 581 684

Right of use asset 324 102 41

Tangible assets 28 38 33

---------------------------- ---- ------------ ------------ ---------------------

Total non-current

assets 1,113 721 758

---------------------------- ---- ------------ ------------ ---------------------

Current assets

Trade and other receivables 30,729 35,719 21,148

Cash and cash equivalent 28,570 15,107 28,618

---------------------------- ---- ------------ ------------ ---------------------

Total current assets 59,299 50,826 49,766

---------------------------- ---- ------------ ------------ ---------------------

Total assets 60,412 51,547 50,524

---------------------------- ---- ------------ ------------ ---------------------

Equity and liabilities

Equity

Share capital 7 100 0 0

Share premium account 679 779 779

Share option reserves 22 0 0

Retained earnings 2,740 1,971 1,654

---------------------------- ---- ------------ ------------ ---------------------

Total equity 3,541 2,750 2,433

---------------------------- ---- ------------ ------------ ---------------------

Liabilities

Non-current liabilities

Deferred tax liabilities 88 72 92

Lease liabilities 216 0 0

---------------------------- ---- ------------ ------------ ---------------------

Total non-current

liabilities 304 72 92

---------------------------- ---- ------------ ------------ ---------------------

Current liabilities

Trade and other payables 56,445 48,623 47,958

Lease liabilities 122 102 41

---------------------------- ---- ------------ ------------ ---------------------

Total current liabilities 56,567 48,725 47,999

---------------------------- ---- ------------ ------------ ---------------------

Total liabilities 56,871 48,797 48,091

---------------------------- ---- ------------ ------------ ---------------------

Total equity and

liabilities 60,412 51,547 50,524

---------------------------- ---- ------------ ------------ ---------------------

Statement of changes in equity

For the half-year ended 31 December 2020

Share capital Share premium Share option Distributable Total equity

reserves reserves

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 July 2020 0 779 1,654 2,433

Total comprehensive

income 2,730 2,730

Transactions with

shareholders:

Dividend 6 (1,643) (1,643)

Share-based payments 22 22

Capital issued 7 100 (100) 0

--------------------- ---- ------------- ------------- ------------ ------------- ------------

As at 31 December

2020 100 679 22 2,741 3,542

As at 1 July 2019 0 505 1,687 2,192

Total comprehensive

income 2,801 2,801

Transactions with

shareholders:

Dividend 6 (2,517) (2,517)

Capital issued 7 274 274

--------------------- ---- ------------- ------------- ------------ ------------- ------------

As at 31 December

2019 0 779 0 1,971 2,750

As at 1 July 2019 0 505 1,687 2,192

Total comprehensive

income 0 0 6,019 6,019

Transactions with

shareholders:

Dividend 6 0 0 (6,052) (6,052)

Capital issued 7 0 274 0 274

--------------------- ---- ------------- ------------- ------------ ------------- ------------

As at 30 June 2020 0 779 0 1,654 2,433

Statement of cash flows

For the half-year ended 31 December 2020

Half year Half year Year to

to 31 December to 31 December 30 June

2020 2019 2020

(Restated)

Note GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit after tax 2,730 2,801 6,019

Taxation charge 760 596 1,235

Amortisation 178 153 311

Depreciation 8 5 13

Right of use amortisation 60 61 122

Share based payment expense 22 0 0

Profit on disposal of tangible

assets 0 (16) (16)

Interest receivable (13) (21) (49)

Interest payable 2 2 4

(Increase) / decrease in trade

and other receivables (9,876) (11,795) 2,775

Increase in trade and other payables 8,141 15,917 15,359

--------------------------------------- ---- --------------- --------------- -----------

Cash generated from / (used in)

operations 2,012 7,703 25,773

Corporation tax paid (446) (475) (1,200)

--------------------------------------- ---- --------------- --------------- -----------

Net cash generated from/(used

in) operating activities 1,566 7,228 24,573

--------------------------------------- ---- --------------- --------------- -----------

Cash flows from investing activities

Interest received 13 21 49

Purchase of intangible assets (255) (193) (454)

Proceeds from sale of tangible

assets 0 23 23

Purchase of tangible assets (3) (36) (39)

--------------------------------------- ---- --------------- --------------- -----------

Net cash used in investing activities (245) (185) (421)

--------------------------------------- ---- --------------- --------------- -----------

Cash flows from financing activities

Payment of principal lease liabilities 0 (61) (122)

Interest paid on lease liabilities 0 (2) (4)

Issue of shares 7 274 0 0

Dividends 6 (1,643) (2,517) (6,052)

--------------------------------------- ---- --------------- --------------- -----------

Net cash used in financing activities (1,369) (2,580) (6,178)

--------------------------------------- ---- --------------- --------------- -----------

Net (decrease) / increase in

cash and cash equivalents (48) 4,463 17,974

Cash at bank at beginning of

period 28,618 10,644 10,644

--------------------------------------- ---- --------------- --------------- -----------

Cash at bank at end of year 28,570 15,107 28,618

--------------------------------------- ---- --------------- --------------- -----------

Cash and cash equivalents at the end of each period comprises

balances held at the bank.

Statement of cash flows - continued

For the half-year ended 31 December 2020

The Company's mobile payments segment involves collecting cash

on behalf of clients which is then paid to clients net of the

Company's share of revenues or fees associated with collecting the

cash. The Company's cash balance therefore fluctuates depending on

the timing of "pass through" cash received and paid. The underlying

cash in the analysis below has effectively unwound these timing

differences and shows the underlying cash from the Company's

trading activities. The underlying cash is derived from total cash

by adjusting for trade and other receivables less trade and other

payables excluding corporation tax liabilities.

Reconciliation of free underlying

cash flows

Half year Half year Year to

to 31 December to 31 December 30 June

2020 2019 2020

(Restated)

GBP000s GBP000s GBP000s

Net cash generated from operating

activities 1,566 7,228 24,573

Interest receivable 13 21 49

AIM admission costs 844 0 0

Purchase of fixed assets (258) (229) (493)

Sale of fixed assets 0 23 23

Lease liability payments 0 (65) (126)

Working capital adjustment 1,412 (3,848) (17,860)

--------------------------------------- --------------- --------------- -----------

Free underlying cash generated

from operations 3,577 3,130 6,166

AIM admission costs paid (844) 0 0

Issue of shares 274 0 0

Dividends (1,643) (2,515) (6,052)

--------------------------------------- --------------- --------------- -----------

Underlying cash movement 1,364 615 114

--------------------------------------- --------------- --------------- -----------

Statement of cash flows - continued

For the half-year ended 31 December 2020

Analysis of underlying cash balances

Half year Half year Year to

to 31 December to 31 December 30 June

2020 2019 2020

(Restated)

GBP000s GBP000s GBP000s

Cash at bank at end of period 28,570 15,107 28,618

------------------------------------------ --------------- --------------- -----------

Consisting of:

Underlying cash 3,618 2,755 2,254

Other cash 24,952 12,352 26,364

------------------------------------------ --------------- --------------- -----------

Total 28,570 15,107 28,618

------------------------------------------ --------------- --------------- -----------

Underlying cash at beginning of

period 2,254 2,140 2,140

Underlying cash movement (as above) 1,364 615 114

------------------------------------------ --------------- --------------- -----------

Underlying cash at end of period 3,618 2,755 2,254

------------------------------------------ --------------- --------------- -----------

Cash and cash equivalents at the end of each period comprises

balances held at the bank.

Underlying cash is derived from total cash by adjusting for

trade and other receivables less trade and other payables

(excluding corporation tax liabilities).

Notes to the financial information

For the half-year ended 31 December 2020

1. Basis of preparation and change in accounting policies

The financial information relating to the half year ended 31

December 2020 is unaudited and does not constitute statutory

financial statements as defined in section 434 of the Companies Act

2006.

The comparative figures for the year ended 30 June 2020 have

been extracted from the financial statements prepared for the

Company's admission onto the Alternative Investment Market of the

London Stock Exchange ("AIM") and were included in the Company's

admission document.

The annual report and accounts for the year ended 30 June 2020,

which received an unqualified audit opinion and did not include a

statement under section 498 (2) or (3) of the Companies Act 2006,

have been filed with the Registrar of Companies. The statutory

financial statements for the year ended 30 June 2020 were prepared

in accordance with FRS 102, the Financial Reporting Standard

applicable in the UK and the Republic of Ireland (United Kingdom

Generally Accepted Accounting Practice - "UK GAAP").

On admission to AIM, the Company adopted International Financial

Reporting Standards and interpretations (collectively "IFRS")

issued by the International Accounting Standards Board ("IASB") as

adopted by the European Union. The financial information in these

interim accounts have been prepared and presented on that

basis.

The comparative figures for the year ended 30 June 2020 included

in these interim accounts are therefore not consistent with the

annual report and accounts as filed at Companies House. A

reconciliation of the differences between the figures used in these

interim accounts and those that are filed at Companies House are

shown in note 8 below.

The financial information for the half year ended 31 December

2020 has been prepared in accordance with the accounting policies

the Company applied in the preparation of the audited accounts for

the year ended 30 June 2020 which were audited and included in the

Company's admission document and are expected to be applied in the

annual financial statements for the year ending 30 June 2021. These

accounting policies are based on the EU-adopted International

Financial Reporting Standards ("IFRS").

Whilst the financial information included in these interim

accounts has been prepared in accordance with IFRS, they do not

contain sufficient information to comply with IFRS. In addition,

this report is not prepared in accordance with IAS 34.

The Company's financial risk management objectives and policies

are consistent with those disclosed in the admission document.

This interim report was approved by the board of directors on 21

February 2021 and is available on the Company's website, fonix.com

.

Going concern

At the time of approving these interim accounts, the directors

have a reasonable expectation that the Company has adequate

resources to continue in operational existence for the foreseeable

future.

The Company is not externally funded and accordingly is not

affected by borrowing covenants. In addition, the cost of capital

represents the dividend distributions - which are

discretionary.

At 31 December 2020 the Company had cash and cash equivalents of

GBP28.6m and net current assets of GBP2.7m. The business model of

the Company is cash generative with increased sales impacting

positively on the working capital cycle and profits from trading

activities being rapidly reflected in cash at bank.

The directors maintain a commensurate level of net assets in the

Company by moderating or increasing dividend distributions as

necessary.

The directors have prepared detailed cash flow forecasts for the

next 18 months that indicate the existing activities of the Company

do not require additional funding during that period. The forecasts

are challenged by various downside scenarios to stress test the

estimated future cash and net current asset position. The directors

are pleased to note that the stress tests did not have a

significant impact on the funding requirement. In addition, current

trading is ahead of the forecasts.

There has been negligible impact of COVID-19 on the trading

position of the Company and this is expected to continue in the

future. Employees are seamlessly working from home where required

and no staff have been furloughed.

Accordingly, the directors continue to adopt the going concern

basis of accounting in preparing the interim accounts.

2. Segmental reporting

Management currently identifies one operating segment in the

Company under IFRS 8, being the facilitating of mobile payments and

messaging. However the Directors monitor results and performance

based upon the gross profit generated from the service lines as

follows:

Half year to Half year to Year to 30 June

31 December 31 December 2020

2020 2019

(Restated)

GBP'000 GBP'000 GBP'000

Mobile payments 4,944 4,023 8,297

Mobile messaging 508 449 1,027

Managed services 380 328 664

----------------- ------------ ------------ ---------------

Gross profit 5,832 4,800 9,988

----------------- ------------ ------------ ---------------

3. Revenue

The Company disaggregates revenue between the different streams

as this is intended to show its nature and amount.

The total revenue of the Company has been derived from its

principal activity wholly undertaken in the United Kingdom. Revenue

is recognised at the point in time of each transaction when the

economic benefit is received.

The total revenue of the Company by service line is as

follows:

Half year to Half-year to Year to 30 June

31 December 31 December 2020

2020 2019

(Restated)

GBP'000 GBP'000 GBP'000

Mobile payments 19,651 14,834 29,747

Mobile messaging 4,171 4,168 8,867

Managed services 786 731 1,447

----------------- ------------ ------------ ---------------

Total income 24,608 19,733 40,061

----------------- ------------ ------------ ---------------

In each of three periods, the number of customers that

represented more than 10% of revenue were as follows: Half year to

31 December 2020: 2, half year to 31 December 2019: 3 and year to

30 June 2020: 3.

4. Share options and share-based payment charge

The Company granted share options to Ed Spurrier and certain

employees on admission to AIM. In total, options have been granted

over 1,310,000 ordinary shares in the Company, representing 1.3% of

the existing share capital of the Company, with a strike price of

GBP0.90 per share, which corresponds to the price at which shares

were sold at the placing which coincided with the admission.

The share based payment charge has been calculated using the

Black-Scholes model and represents the charge for the period from

admission to 31st December 2020.

5. Earnings per share

The basic earnings per share calculation is the same as for the

fully diluted earnings per share position, as there are no

potentially dilutive instruments.

Half year Half year Year to 30

to 31 December to 31 December June 2020

2020 2019

(Restated)

GBP'000 GBP'000 GBP'000

Basic calculation

Earnings used in calculation of

earnings per share 2,730 2,801 6,019

------------------------------------ --------------- --------------- -----------

Number Number Number

Weighted average number of shares

in issue 100,000,000 97,417,025 98,712,690

------------------------------------ --------------- --------------- -----------

Basic and diluted earnings per

share 2.7p 2.9p 6.1p

------------------------------------ --------------- --------------- -----------

Adjusted basic and diluted earnings

per share 3.6p 2.9p 6.1p

------------------------------------ --------------- --------------- -----------

The adjusted basic and diluted earnings per share have been

calculated on the basis of excluding the costs involved in the AIM

admission and the share based payments expense.

6. Dividends

Half year Half year Year to 30

to 31 December to 31 December June 2020

2020 2019

(Restated)

GBP'000 GBP'000 GBP'000

Interim paid 1,643 2,517 6,052

------------------- --------------- --------------- -----------

Dividend per share 1.6p 2.6p 6.1p

------------------- --------------- --------------- -----------

The interim dividend of GBP1,642,867 paid in the period ended 31

December 2020 was paid to shareholders on the register in August

2020 before the Company was admitted to AIM. A further interim

dividend for the current year, being the maiden dividend since

admission, of GBP1,700,000 (representing a payment of 1.7 pence per

share).

7. Share capital

31 December 31 December 30 June 2020

2020 2019

Number Number Number

Ordinary shares of GBP0.001

each 100,000,000

A Ordinary shares at 0.00001p

each 4,028,133 4,028,133

B Ordinary shares at 0.00001p

each 448,333 448,333

------------------------------ ----------- ----------- ------------

4,476,466 4,476,466

------------------------------ ----------- ----------- ------------

31 December 31 December 30 June 2020

2020 2019

GBP GBP GBP

Allotted, called up and

fully paid

Ordinary shares of GBP0.001

each 100,000

A Ordinary shares at 0.00001p

each 40 40

B Ordinary shares at 0.00001p

each 5 5

------------------------------ ----------- ----------- ------------

100,000 45 45

------------------------------ ----------- ----------- ------------

During the year ended 30 June 2020 301,300 B shares were issued

for a total consideration of GBP273,831.

As at the year ended 30 June 2020 GBP273,826 was unpaid in

respect of this share issue - which is included in trade and other

receivables. These monies were received in October 2020.

Share rights

The A Ordinary shares have attached to them full voting,

dividend and capital distribution rights - including on a winding

up. They do not confer any right of redemption.

The B Ordinary shares have attached to them full dividend and

capital distribution rights - including on a winding up. They do

not confer any voting rights or rights of redemption.

Share premium

The share premium reserve reflects the excess over nominal value

arising on the issue of B Ordinary shares.

Retained earnings reserve

The retained earnings reserve represents the accumulated profits

of the Company that are available for distribution to members.

IPO reorganisation

As at 30 June 2020 the issued share capital of the Company

comprised 4,028,133 A ordinary shares of GBP0.00001 each ("A

Shares") and 448,333 B ordinary shares of GBP0.0001 each ("B

Shares").

In connection with admission, the Company undertook a number of

steps to reorganise its share capital as follows:

1. On 23 September 2020, GBP99,955.24 of the available

GBP505,329.00 of the Company's share premium account was

capitalised through the issue of bonus A Shares and B Shares,

issued to existing shareholders pro rata to their holdings of A

Shares and/or B Shares. The capitalisation resulted in an issued

share capital of 8,998,466,648 A Shares and 1,001,533,352 B

Shares.

2. On 23 September 2020, the 8,998,466,648 A Shares and

1,001,533,352 B Shares in issue were consolidated into 89,984,666 A

ordinary shares of GBP0.001 each and 10,015,334 B ordinary shares

of GBP0.001 each in the capital of the Company.

3. Immediately prior to admission taking place, the A Shares and

B Shares were re-designated as Ordinary Shares on the basis of one

Ordinary Share per A Share or B Share then in issue.

4. Following the pre-IPO reorganisation, the issued share

capital of the Company as at 12th October 2020 comprised

100,000,000 ordinary shares of GBP0.001 each.

8. Adoption of and conversion to IFRS

Impact on statement of comprehensive income

The impact of the adjustments on the statement of comprehensive

income is as follows:

FRS 102 year Revenue IFRS year

to 30 June recognition to 30 June

2020 adjustment 2020

GBP'000 GBP'000 GBP'000

Revenue 113,341 (73,280) 40,061

Cost of sales (103,353) 73,280 (30,073)

-------------------------------------- ------------ ------------ -----------

Gross profit 9,988 9,988

Administrative costs (2,783) (27) (2,810)

Other operating income 0 31 31

-------------------------------------- ------------ ------------ -----------

Operating profit 7,205 4 7,209

Financial expense 0 (4) (4)

Financial income 49 49

-------------------------------------- ------------ ------------ -----------

Profit before tax expense 7,254 7,254

Income tax expense (1,235) (1,235)

-------------------------------------- ------------ ------------ -----------

Profit and total comprehensive income 6,019 6,019

-------------------------------------- ------------ ------------ -----------

Impact on statement of financial position

The impact of adopting IFRS 16 on the statement of financial

position was to reflect the right of use asset and corresponding

liability as follows:

FRS 102 30 IFRS 16 IFRS at

June 2020 revision 30 June

2020

Statement of net assets GBP'000 GBP'000 GBP'000

Non-current assets

Intangible asset 684 684

Right to use asset 0 41 41

Tangible assets 33 33

------------------------------ ---------- --------- --------

Total non-current assets 717 41 758

------------------------------ ---------- --------- --------

Current assets

Trade and other receivables 21,148 21,148

Cash and cash equivalent 28,618 28,618

------------------------------ ---------- --------- --------

Total current assets 49,766 49,766

------------------------------ ---------- --------- --------

Total assets 50,483 41 50,524

------------------------------ ---------- --------- --------

Equity and liabilities

Equity

Share capital 0 0

Share premium account 779 779

Retained earnings 1,654 1,654

------------------------------ ---------- --------- --------

Total equity 2,433 2,433

------------------------------ ---------- --------- --------

Liabilities

Non-current liabilities

Deferred tax liabilities 92 92

Lease liabilities 0 0

------------------------------ ---------- --------- --------

Total non-current liabilities 92 92

------------------------------ ---------- --------- --------

Current liabilities

Trade and other payables 47,958 47,958

Lease liabilities 0 41 41

------------------------------ ---------- --------- --------

Total current liabilities 47,958 41 47,999

------------------------------ ---------- --------- --------

Total liabilities 48,050 41 48,091

------------------------------ ---------- --------- --------

Total equity and liabilities 50,483 41 50,524

------------------------------ ---------- --------- --------

Impact on statement of cash flows

The IFRS 16 impact on the statement of cash flows is the

reallocation and re-categorisation of expenditure that does not

impact on cash generated for any period. There is no impact on the

statement of cash flows for any period resulting from the revenue

recognition adjustment.

The impact on the statement of cash flows is as follows:

FRS 102 year IFRS 16 IFRS year

to 30 June revision to 30 June

2020 2020

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit after tax 6,019 6,019

Taxation charge 1,235 1,235

Amortisation 311 311

Depreciation 13 13

Right of use amortisation 0 122 122

Profit on disposal of tangible assets (16) (16)

Interest receivable (49) (49)

Interest payable 0 4 4

(Increase) / decrease in trade and

other receivables 2,775 2,775

Increase in trade and other payables 15,359 15,359

------------------------------------------- ------------ --------- -----------

Cash generated from / (used in) operations 25,647 126 25,773

Corporation tax paid (1,200) (1,200)

------------------------------------------- ------------ --------- -----------

Net cash generated from/(used in)

operating activities 24,447 126 24,573

------------------------------------------- ------------ --------- -----------

Cash flows from investing activities

Interest received 49 49

Purchase of intangible assets (454) (454)

Proceeds from sale of tangible assets 23 23

Purchase of tangible assets (39) (39)

------------------------------------------- ------------ --------- -----------

Net cash used in investing activities (421) (421)

------------------------------------------- ------------ --------- -----------

Cash flows from financing activities

Payment of principal lease liabilities 0 (122) (122)

Interest paid on lease liabilities 0 (4) (4)

Issue of shares 0 0

Dividends (6,052) (6,052)

------------------------------------------- ------------ --------- -----------

Net cash used in financing activities (6,052) (126) (6,178)

------------------------------------------- ------------ --------- -----------

Net (decrease) / increase in cash

and cash equivalents 17,974 17,974

Cash at bank at beginning of year 10,644 10,644

------------------------------------------- ------------ --------- -----------

Cash at bank at end of year 28,618 28,618

------------------------------------------- ------------ --------- -----------

([1]) Adjusted EBITDA excludes share based payment charges along

with depreciation, amortisation, depreciation, AIM admission costs

and tax.

([2]) Adjusted profit per share excludes share based payment

charges and AIM admission costs.

([3]) Underlying operating cash inflow excludes the fluctuations

arising from the timing of receipts and payments of pass through

cash collected on behalf of and paid onto clients.

([4]) Net cash and cash equivalents at the period end of

GBP28.6m (30 June 2020: GBP28.6m).

([5])

https://www.digitaltveurope.com/2020/10/09/pay-tv-revenues-to-decline-in-spite-of-increasing-subscriber-numbers/

([6])

https://www.cafonline.org/docs/default-source/about-us-publications/caf-uk-giving-2020-covid-19.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UKUWRARUUAAR

(END) Dow Jones Newswires

February 22, 2021 02:00 ET (07:00 GMT)

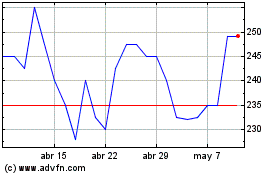

Fonix Mobile (LSE:FNX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Fonix Mobile (LSE:FNX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024