TIDMFDEV

RNS Number : 1317Y

Frontier Developments PLC

12 January 2022

Frontier Developments plc

Interim Results

H1 revenue up 33%. Well positioned for an exciting 2022.

Frontier Developments plc (AIM: FDEV, "Frontier", the "Company")

, a leading developer and publisher of video games based in

Cambridge, UK has published its unaudited interim results for the 6

months to 30 November 2021 ('H1 FY22') and provides a trading

update following the important Holiday season.

Financial Highlights

H1 FY22 H1 FY21 FY21

(6 months to (6 months (12 months

30 November 2021) to 30 November to 31 May

2020) 2021)

Revenue GBP49.1m GBP36.9m GBP90.7m

------------------- ----------------- ------------

EBITDA* GBP14.1m GBP15.5m GBP38.1m

------------------- ----------------- ------------

Operating Cash Flow** GBP0.7m GBP3.1m GBP12.2m

------------------- ----------------- ------------

Operating (Loss)/Profit (GBP1.3m) GBP6.9m GBP19.9m

------------------- ----------------- ------------

Operating Margin % (3%) 19% 22%

------------------- ----------------- ------------

EPS (basic) (4.2p) 15.0p 55.4p

------------------- ----------------- ------------

Net Cash Balance at GBP33.6m GBP34.9m GBP42.4m

period end

------------------- ----------------- ------------

*Earnings before interest, tax, depreciation and

amortisation

** EBITDA excluding non-cash items less investments in game

developments and Frontier's game technology

-- Revenue grew 33% over the comparative period to GBP49.1

million (H1 FY21: GBP36.9 million) through the release of Jurassic

World Evolution 2 in November 2021 and the ongoing performance of

our existing game portfolio

-- Gross profit margin of 63% reduced versus the comparative

period (H1 FY21: 71%) through a higher proportion of revenue

attracting IP licence royalties (Jurassic World Evolution 2) and

console physical discs sales of Jurassic World Evolution 2 which

achieve lower profit margins compared with digital sales

-- The combination of a lower gross profit margin percentage and

game release related marketing costs resulted in a slightly lower

EBITDA compared with the comparative period (GBP14.1 million in H1

FY22 versus GBP15.5 million in H1 FY21) with an operating cash

inflow in the period of GBP0.7 million (H1 FY21: GBP3.1

million)

-- Exceptional non-cash foreign exchange and amortisation

charges resulted in a small operating loss of GBP1.3 million in the

period (H1 FY21: profit of GBP6.9 million)

-- Net cash balance of GBP33.6 million at 30 November 2021 (31

May 2021: GBP42.4 million). The net cash outflow of GBP8.8 million

in the period was mainly due to an increase in working capital,

with significant net cash receipts for November sales receivable

from channel partners, including for the launch of Jurassic World

Evolution 2, in December 2021 and January 2022

Operational & Strategic Highlights

-- Our launch and nurture strategy continues to deliver, through

sustaining and growing our portfolio of genre-leading titles:

o Jurassic World Evolution 2 is the latest successful addition

to our portfolio, already selling nearly 1 million base game units

since release in November 2021

o Planet Coaster , Planet Zoo and Jurassic World Evolution all

continue to entertain existing players whilst attracting new ones,

with each title delivering material contributions to sales

throughout calendar 2021

o Elite Dangerous experienced a difficult calendar 2021

following the disappointing launch of the major Odyssey expansion

in May 2021. We continue to support the game and our passionate

players with development updates, and we have seen an upturn in

player sentiment as a result

-- Frontier Foundry, our own games label for third-party

publishing, continues to grow with a number of exciting titles in

discussion as well as those already signed. We have at least four

titles coming in calendar 2022 including FAR: Changing Tides and

Warhammer 40,000: Chaos Gate - Daemonhunters.

-- Our team continues to grow, with over 250 people joining us

during 2021, taking us to a total headcount of 745 as at 31

December 2021. Our amazing people continue to operate positively

through the challenges posed by Coronavirus and, in particular, in

adapting so well to remote and hybrid working during the last 18

months

-- We are very well positioned for the future. This calendar

year will see us enter the incredible world of Formula 1 - a truly

global sport - with the first release for our annual F1 management

game franchise. Furthermore, it will see Foundry continuing to

build momentum to become a material contributor to the business,

and we will see the release of Universal Picture's hugely

anticipated Jurassic World Dominion film, and the expected

corresponding benefit to Jurassic World Evolution 2

Current Trading and Outlook

December is always an important month for sales in the games

industry, and we were pleased to achieve our highest ever December

revenue in 2021, as expected. Jurassic World Evolution 2 delivered

a strong second month of sales following its release in November

2021, and our existing portfolio of established titles all provided

solid contributions.

We start the calendar year with a great portfolio and an

exciting pipeline of new titles, through both our own internal

developments and through Frontier Foundry, working closely with

external partners. We are building valuable long-term relationships

with all of our partners and have some phenomenal projects in

development, which in time will further enrich our portfolio of

great games.

In the remaining five months of the current financial year (to

31 May 2022) we look forward to delivering two new games from

Frontier Foundry, FAR: Changing Tides (now confirmed for release on

1 March 2022) and Warhammer 40,000: Chaos Gate - Daemonhunters,

whilst supporting our existing portfolio with new content. Based on

current estimates for the remaining period, the Board have narrowed

the revenue guidance range for FY22 to GBP100 million to GBP120

million.

Looking a little further ahead, we have exciting plans for FY23

(the 12 months to 31 May 2023):

-- The first of our annual Formula 1(R) management games will

release during the 2022 F1 season (in FY23), as part of our

exclusive licence for Formula 1(R) management games

-- Jurassic World Evolution 2 is expected to benefit from the

release of the Jurassic World Dominion film in June 2022 (in FY23)

and all the promotional awareness that this film release will bring

to the game, with multiple exciting PDLC packs planned through the

year

-- Planet Zoo will also benefit from a continuing roadmap of new PDLC packs

-- Frontier Foundry, our games label for 3(rd) party publishing,

will release multiple new titles as it continues to grow

Our Warhammer Age of Sigmar IP real-time strategy game planned

for release during calendar 2023 will now release later in that

calendar year, falling in FY24. This change will further improve

the quality and longevity of the game, and overall make it more

successful. As a result of this scheduling adjustment, the Board

have revised the revenue guidance range for FY23 to GBP130 million

to GBP160 million, implying 18% to 45% annual growth from the

mid-point of FY22 guidance.

We have excellent prospects for sustainable long-term growth

based on the longevity of our existing portfolio and our future

development and publishing plans, underpinned by our world-class

and growing team.

David Braben, Chief Executive, said:

"We have had an unprecedented couple of years because of

Coronavirus and the resulting changes, both positive and negative.

We have seen increased sales and changes to purchasing patterns,

the acceleration of the transition towards interactive

entertainment and digital purchasing, and changes to production

that embrace home-working. Although Coronavirus challenges remain,

we believe we now have sound production processes that work in the

new hybrid world, as demonstrated by the on-time and high quality

delivery of the excellent Jurassic World Evolution 2, and this sets

us up for future success. Our team has done a fantastic job

adapting to all these challenges and finding new ways of working.

We have the potential for much greater growth in the next few years

as we reap the benefits of all the hard work we have done to adapt

to these changes and capitalise on a great portfolio of existing

games together with the exciting new franchises such as Formula

1(R) management games and our Warhammer Age of Sigmar real-time

strategy game. We are well set up with a great portfolio for an

exciting future."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as amended by The

Market Abuse (Amendment) (EU Exit) Regulations 2019. The person

responsible for making this announcement on behalf of the Company

is Alex Bevis.

Enquiries :

Frontier Developments +44 (0)1223 394 300

David Braben, CEO

Alex Bevis, CFO

Liberum - Nomad and Joint Broker +44 (0)20 3100 2000

Neil Patel / Cameron Duncan

Jefferies - Joint Broker +44 (0)20 7029 8000

Max Jones / William Brown

Tulchan Communications +44 (0)20 7353 4200

Matt Low / Jordan McCulla / Olivia Lucas

About Frontier Developments plc

Frontier is a leading independent developer and publisher of

videogames founded in 1994 by David Braben, co-author of the iconic

Elite game. Based in Cambridge, Frontier uses its proprietary COBRA

game development technology to create innovative genre-leading

games, primarily for personal computers and videogame consoles. As

well as self-publishing internally developed games, Frontier also

publishes games developed by carefully selected partner studios

under its Frontier Foundry games label.

Frontier's LEI number: 213800B9LGPWUAZ9GX18.

www.frontier.co.uk

Interim Results Statement

MAJOR NEW RELEASES

Our biggest new release in the period was our latest

multiplatform game, Jurassic World Evolution 2, which released as

planned on 9 November 2021 on PC via Steam and the Epic Games

Store, PlayStation(R)5, Xbox Series X|S, PlayStation(R)4 and Xbox

One, with both digital and physical formats available to

PlayStation and Xbox players from day one.

The critical and audience reception from launch has been very

positive, thanks to the hard work of our talented people across our

development, publishing and support teams. Our player community are

enjoying the enhancements we have made, as well as the new content

that we have introduced, building on the strong foundations of

Jurassic World Evolution. Game reviews are very good - the scores

compiled by Opencritic show 67 reviews providing a Top Critic

Average score of 78.

Base game sales have reached almost 1 million units after 9

weeks from release, with strong sales in both November and

December. Sales rates as we start calendar 2022 are

encouraging.

PDLC is an important element of the post-launch strategy for

Jurassic World Evolution 2 as part of Frontier's proven launch and

nurture approach to game development and publication. Two

well-received PDLC packs have been released to date, with the

Deluxe Upgrade pack available at release and the Early Cretaceous

Pack launching a month later on 9 December 2021. Multiple exciting

PDLC packs are planned for 2022.

Significant sales of both the base game and PDLC are expected

from June 2022 when the Jurassic World Dominion film releases.

REVENUE

Total revenue in H1 FY21 grew to GBP49.1 million, 33% ahead of

the comparative period (H1 FY21: GBP36.9 million). Jurassic World

Evolution 2 was the main catalyst for growth, launching in the

final month of the period. Planet Zoo also delivered growth over

the comparative period, with revenue growing 14% through sales of

new and existing PDLC as well as sales of the base game. Planet

Coaster and Jurassic World Evolution delivered solid sales

performances during H1 FY22 against a tough comparative period

which included major new platform releases for each title: in

November 2020 Planet Coaster expanded onto Xbox Series X|S, Xbox

One, PlayStation 4 and PlayStation 5, and Jurassic World Evolution

released on Nintendo Switch. The overall sales performance of Elite

Dangerous in the period was below expectations following the

disappointing launch of Elite Dangerous: Odyssey in May 2021.

Frontier Foundry, our games label for 3(rd) party publishing,

launched innovative strategic shooter Lemnis Gate during the

period, with more material revenues expected in the second half of

the financial year from FAR: Changing Tides, now confirmed for

release on 1 March 2022, and Warhammer 40,000: Chaos Gate -

Daemonhunters.

PROFITABILITY

Gross profit of GBP30.8 million was recorded in the period (H1

FY21: GBP26.2 million) with gross profit margin at 63% (H1 FY21:

71%). The lower percentage margin resulted from a higher proportion

of revenue attracting IP licence royalties (Jurassic World

Evolution 2) and console physical discs sales of Jurassic World

Evolution 2 which achieve lower profit margins compared with

digital sales.

Gross research and development expenses in the period increased

by 41% to GBP22.2 million (H1 FY21: GBP15.8 million). The growth

resulted from a continued growth in headcount to support Frontier's

development plans, an increase in outsourced activity and

investments in Frontier Foundry partner developments.

Capitalisation of development costs on game developments and

game technology accounted for GBP15.8 million in the six months to

30 November 2021 (H1 FY21: GBP13.1 million). The percentage of

gross research and development costs which were capitalised in the

period was 71%, lower than the 83% recorded for H1 FY21 as more

development staff were working on free updates (as opposed to

chargeable content) during the recent period, notably the ongoing

post-release support for Elite Dangerous: Odyssey. Frontier's

normal expectations for capitalisation is 70-90% of gross

development spending.

R&D amortisation charges related to previously capitalised

development costs grew 73% to GBP12.2 million (H1 FY21: GBP7.0

million). Charges in H1 FY22 included a full six months of

amortisation for major expansion Elite Dangerous: Odyssey and one

month for Jurassic World Evolution 2, as well as an accelerated

amortisation charge for Lemnis Gate following its relatively low

sales performance at release.

Net research and development expenses recorded in the income

statement in the period grew 91% to GBP18.6 million (H1 FY21:

GBP9.7 million), being gross spend of GBP22.2 million, less

capitalised costs of GBP15.8 million, plus amortisation charges of

GBP12.2 million.

Sales and marketing expenses in the period were GBP7.5 million

(H1 FY21: GBP3.4 million) with the largest element of the increase

from the launch of Jurassic World Evolution 2. Administrative

expenses were GBP6.0 million in the period (H1 FY21: GBP6.1

million).

Exceptional non-cash foreign exchange and amortisation charges,

together with a lower gross profit margin percentage, higher net

R&D expenses (including some one-off items) and game release

related marketing costs resulted in a small operating loss of

GBP1.3 million in the period (H1 FY21: profit of GBP6.9

million).

A net zero corporation tax charge was recorded in the income

statement for the period (H1 FY21: GBP0.6 million), since for the

full financial year enhanced deductions from the Video Game Tax

Relief scheme are expected to offset tax charges on profits. The

Group expects to provide additional corporation tax disclosures in

the FY22 financial statements.

A loss after tax of GBP1.7 million was recorded in the period

(H1 FY21: profit of GBP5.8 million). Basic earnings per share was a

loss of 4.2 pence (H1 FY21: profit of 15.0 pence).

BALANCE SHEET AND CASH FLOW

The Company continues to benefit from a strong balance sheet,

with cash balances of GBP33.6 million at 30 November 2021 (31 May

2021: GBP42.4 million; 30 November 2020: GBP34.9 million). The

majority of the GBP8.8 million reduction in cash during the period

was due to an increase in net working capital at the end of the

period related to the release of Jurassic World Evolution 2. Trade

and other receivables grew by GBP14.1 to GBP27.8 million at 30

November 2021 (31 May 2021: GBP13.7 million), with trade and other

payables increasing by GBP5.4 million to GBP20.2 million (31 May

2021: GBP14.8 million). This working capital increase is expected

to unwind during the second half of the financial year.

Although cash balances reduced in the period, Frontier recorded

an overall operating cash inflow of GBP0.7 million in the period

(H1 FY21: GBP3.1 million), defined as EBITDA excluding non-cash

items less investments in game developments and Frontier's game

technology.

CONSOLIDATED INCOME STATEMENT

6 months to 6 months to 12 months

30 November 30 November to 31 May

2021 2020 2020

Notes GBP'000 GBP'000 GBP'000

------------------------------------------- ------ ------------- ------------- -----------

Revenue 6 49,116 36,907 90,688

Cost of sales (18,326) (10,747) (27,538)

------------------------------------------- ------ ------------- ------------- -----------

Gross profit 30,790 26,160 63,150

------------------------------------------- ------ ------------- ------------- -----------

Research and development expenses (18,593) (9,717) (22,025)

Sales and marketing expenses (7,503) (3,432) (7,269)

Administrative expenses (6,037) (6,133) (13,940)

------------------------------------------- ------ ------------- ------------- -----------

Operating (loss)/profit (1,343) 6,878 19,916

------------------------------------------- ------ ------------- ------------- -----------

Finance costs (310) (423) (731)

------------------------------------------- ------ ------------- ------------- -----------

(Loss)/Profit before tax (1,653) 6,455 19,185

------------------------------------------- ------ ------------- ------------- -----------

Income tax - (646) 2,373

------------------------------------------- ------ ------------- ------------- -----------

(Loss)/Profit for the period attributable

to shareholders (1,653) 5,809 21,558

------------------------------------------- ------ ------------- ------------- -----------

Earnings per share

Basic earnings per share 7 (4.2p) 15.0 55.4

Diluted earnings per share 7 (4.2p) 14.4 53.3

All the activities of the Group are classified as continuing

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months to 6 months to 12 months

to

30 November 30 November 31 May 2021

2021 2020

GBP'000 GBP'000 GBP'000

---------------------------------------- ------------ ------------ ------------

(Loss)/Profit for the period (1,653) 5,809 21,558

Other comprehensive income:

Exchange differences on translation of

foreign operations (12) 13 23

---------------------------------------- ------------ ------------ ------------

Total comprehensive (loss)/income for

the period attributable to the equity

holders of the parent (1,665) 5,822 21,581

---------------------------------------- ------------ ------------ ------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 NOVEMBER 2021

(REGISTERED COMPANY NO: 02892559)

30 November

30 November 2021 2020 31 May 2021

Notes GBP'000 GBP'000 GBP'000

------------------------------- ------ ----------------- ------------- ------------

Non-current assets

Intangible assets 8 73,508 58,940 71,318

Property, plant and equipment 9 6,967 5,854 6,078

Right-of-use asset 20,296 21,920 21,108

Deferred tax asset 384 6,175 384

101,155 92,889 98,888

------------------------------- ------ ----------------- ------------- ------------

Current assets

Trade and other receivables 27,845 14,979 13,741

Current tax asset 2,511 2,377 6,468

Cash and cash equivalents 33,561 34,892 42,423

63,917 52,248 62,632

------------------------------- ------ ----------------- ------------- ------------

Total assets 165,072 145,137 161,520

------------------------------- ------ ----------------- ------------- ------------

Current liabilities

Trade and other payables (20,167) (11,940) (14,768)

Lease liability (1,440) (1,337) (1,419)

Deferred income (1,327) (1,972) (2,180)

Current tax liabilities - (684) -

(22,934) (15,933) (18,367)

------------------------------- ------ ----------------- ------------- ------------

Net current assets 40,983 36,315 44,265

------------------------------- ------ ----------------- ------------- ------------

Non-current liabilities

Provisions (49) (34) (41)

Lease liability (20,008) (21,530) (20,739)

Deferred income - (230) -

Other payables (8,825) (7,184) (9,219)

Deferred tax liabilities - (4,038) -

(28,882) (33,016) (29,999)

------------------------------- ------ ----------------- ------------- ------------

Total liabilities (51,816) (48,949) (48,366)

------------------------------- ------ ----------------- ------------- ------------

Net assets 113,256 96,188 113,154

------------------------------- ------ ----------------- ------------- ------------

Equity

Share capital 10 197 196 197

Share premium account 36,368 35,772 36,079

Equity reserve (8,635) (9,529) (9,351)

Foreign exchange reserve (11) (9) 1

Retained earnings 85,337 69,758 86,228

Total equity 113,256 96,188 113,154

------------------------------- ------ ----------------- ------------- ------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Foreign

Share premium Equity exchange Retained Total

Capital account reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 May 2020 195 34,589 (925) (22) 62,897 96,734

------------------------------------- --------- --------- --------- ---------- ---------- ---------

Profit for the period - - - - 5,809 5,809

Other comprehensive income:

Exchange differences on translation

of foreign operations - - - 13 - 13

------------------------------------- --------- --------- --------- ---------- ---------- ---------

Total comprehensive income

for the period - - - 13 5,809 5,822

------------------------------------- --------- --------- --------- ---------- ---------- ---------

Issue of share capital net

of expenses 1 1,183 - - - 1,184

Share-based payment charges - - 1,045 - - 1,045

Share-based payment transfer

relating to option exercises

and lapses - - (1,052) - 1,052 -

EBT cash outflows from share

purchases - - (10,000) - - (10,000)

EBT net cash inflows from

option exercises - - 1,403 - - 1,403

------------------------------------- --------- --------- --------- ---------- ---------- ---------

At 30 November 2020 196 35,772 (9,529) (9) 69,758 96,188

------------------------------------- --------- --------- --------- ---------- ---------- ---------

Profit for the period - - - - 15,749 15,749

Other comprehensive income:

Exchange differences on translation

of foreign operations - - - 10 - 10

------------------------------------- --------- --------- --------- ---------- ---------- ---------

Total comprehensive income

for the period - - - 10 15,749 15,759

------------------------------------- --------- --------- --------- ---------- ---------- ---------

Issue of share capital net

of expenses 1 307 - - - 308

Share-based payment charges - - 1,110 - - 1,110

Share-based payment transfer

relating to option exercises

and lapses - - (718) - 718 -

EBT cash outflows from share

purchases - - - - - -

EBT net cash inflows from

option exercises - - (214) - - (214)

Deferred tax movements posted

directly to reserves - - - - 3 3

------------------------------------- --------- --------- --------- ---------- ---------- ---------

At 31 May 2021 197 36,079 (9,351) 1 86,228 113,154

------------------------------------- --------- --------- --------- ---------- ---------- ---------

(Loss)/Profit for the period - - - - (1,653) (1,653)

Other comprehensive income:

Exchange differences on translation

of foreign operations - - - (12) - (12)

------------------------------------- --------- --------- --------- ---------- ---------- ---------

Total comprehensive loss for

the period - - - (12) (1,653) (1,665)

------------------------------------- --------- --------- --------- ---------- ---------- ---------

Issue of share capital net

of expenses - 289 - - - 289

Share-based payment charges - - 1,175 - - 1,175

Share-based payment transfer

relating to option exercises

and lapses - - (762) - 762 -

EBT cash outflows from share

purchases - - - - - -

EBT net cash inflows from

option exercises - - 303 - - 303

------------------------------------- --------- --------- --------- ---------- ---------- ---------

At 30 November 2021 197 36,368 (8,635) (11) 85,337 113,256

------------------------------------- --------- --------- --------- ---------- ---------- ---------

CONSOLIDATED STATEMENT OF CASHFLOWS

6 months to 6 months to 12 months

30 November 30 November to 31 May

2021 2020 2021

GBP'000 GBP'000 GBP'000

----------------------------------------- ------------- ------------- -----------

Cash generated from operations 5,368 11,597 38,916

Taxes received 3,957 38 38

Cashflow from operating activities 9,325 11,635 38,954

----------------------------------------- ------------- ------------- -----------

Investing activities

Purchase of property, plant and

equipment (1,779) (488) (1,375)

Expenditure on intangible assets (15,969) (13,515) (31,502)

Interest received 14 27 48

Cashflow from investing activities (17,734) (13,976) (32,829)

----------------------------------------- ------------- ------------- -----------

Financing activities

Proceeds from issue of share capital 289 1,184 1,492

Employee Benefit Trust cash outflows

from share purchases - (10,000) (10,000)

Employee Benefit Trust cash inflows

from option exercises 303 1,403 1,189

Payment of principal element of

lease liabilities (709) (669) (1,377)

Payment of interest element of

lease liabilities (325) (365) (691)

Interest paid - (88) (88)

Cashflow from financing activities (442) (8,535) (9,475)

----------------------------------------- ------------- ------------- -----------

Net change in cash and cash equivalents

from continuing operations (8,851) (10,876) (3,350)

Cash and cash equivalents at beginning

of period 42,423 45,751 45,751

Exchange differences on cash and

cash equivalents (11) 17 22

Cash and cash equivalents at end

of period 33,561 34,892 42,423

----------------------------------------- ------------- ------------- -----------

The accompanying notes form part of this financial information.

Reconciliation of operating profit to cash

generated from operations

6 months to 6 months to 12 months

30 November 30 November to 31 May

2021 2020 2021

GBP'000 GBP'000 GBP'000

----------------------------------------- ------------- ------------- -----------

Operating (loss)/profit (1,343) 6,878 19,916

Depreciation and amortisation 15,481 8,616 18,167

----------------------------------------- ------------- ------------- -----------

EBITDA 14,138 15,494 38,083

----------------------------------------- ------------- ------------- -----------

Movement in unrealised exchange

(gains)/losses on forward contracts 1,224 (298) (223)

Share-based payment expenses 1,175 1,045 2,155

----------------------------------------- ------------- ------------- -----------

Operating cashflow before movements

in working capital 16,537 16,241 40,015

----------------------------------------- ------------- ------------- -----------

Net changes in working capital:

Change in trade and other receivables (14,105) (2,397) (1,233)

Change in trade and other payables 2,929 (2,254) 119

Change in provisions 7 7 15

----------------------------------------- ------------- ------------- -----------

Cash generated from operations 5,368 11,597 38,916

----------------------------------------- ------------- ------------- -----------

NOTES TO THE FINANCIAL INFORMATION

1. CORPORATE INFORMATION

Frontier Developments plc (the 'Company') along with its

subsidiaries (together the 'Group') develops and publishes video

games for the interactive entertainment sector.

The Company is a public limited company and is incorporated and

domiciled in the United Kingdom, registered number 02892559. The

address of its registered office is 26 Science Park, Milton Road,

Cambridge CB4 0FP. The Group's operations are based in the UK and

the US.

2. BASIS OF PREPARATION AND STATEMENT OF COMPLIANCE

Basis of preparation

The consolidated interim financial statements have been prepared

in accordance with International Accounting Standard 34 'Interim

Financial Reporting' (IAS 34), as issued by the International

Accounting Standards Board (IASB) and as adopted by the UK, and the

disclosure requirements of the Listing Rules.

The consolidated interim financial statements do not comprise

statutory accounts within the meaning of section 434 of the

Companies Act 2006, and have not been audited or reviewed by the

Company's auditors.

The consolidated interim financial statements should be read in

conjunction with the financial statements for the year ended 31 May

2021.

Statutory accounts for the year ended 31 May 2021 were approved

by the Board of Directors on 8 September 2021 and delivered to the

Registrar of Companies. The Auditors Report was unqualified, did

not contain an emphasis of matter paragraph and did not contain any

statement under section 498 of the Companies Act 2006.

The financial information has been prepared under the historical

cost convention except for financial instruments held at fair

value. The financial information is presented in Sterling, the

presentation and functional currency for the Group and Company. All

values are rounded to the nearest thousand pounds (GBP'000) except

when otherwise indicated.

Going concern basis

The Group's forecasts and projections, taking account of current

cash resources and reasonably possible changes in trading

performance, support the conclusion that there is a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future, a period of not

less than 12 months from the date of approval of these financial

statements. The Group therefore continues to adopt the going

concern basis in preparing its financial statements.

Impact of COVID-19 on going concern

The Board continuously monitor the performance of the Groups

operational activities and the expected future prospects. As well

as reviewing the current market trends and a number of downside

scenarios, including any mitigations, the Board have assessed the

ability to continue as a going concern during the pandemic. The

results of this assessment is that the Group would be able to

withstand significant changes in trading behaviour and still be

able to continue operationally.

The Group benefits from a strong cash position, continued demand

for products and no negative impacts on debtor recoverability.

Therefore the Board are satisfied that the financial statements are

prepared under the going concern basis.

3. ACCOUNTING POLICIES

Except for the application for UK-adopted international

accounting standards, for which there are no material differences

from International Financial Reporting Standards as issued by the

IASB and adopted by the EU when applied to the Group, the

consolidated interim financial statements have been prepared in

accordance with the accounting policies adopted in the Group's most

recent annual financial statements for the year ended 31 May

2021.

4. ACCOUNTING ESTIMATES AND KEY JUDGEMENTS

When preparing the interim financial statements, management

undertakes a number of judgements, estimates and assumptions about

recognition and measurements of assets, liabilities, income and

expenses. The actual results may differ from these estimates.

The judgements, estimates and assumptions applied in the interim

financial statements, including the key sources of estimation

uncertainty, were the same as those applied in the Group's last

annual financial statements for the year ended 31 May 2021.

5. SIGNIFICANT EVENTS AND TRANSACTIONS

There were no significant events or transactions in the interim

period (1 June 2021 to 30 November 2021) which were not included

within the interim financial statements. There have been no

significant events or transactions during the period from the end

of the interim period to the day preceding the date of this report

(1 December 2021 to 11 January 2022).

6. SEGMENT INFORMATION

The Group identifies operating segments based on internal

management reporting that is regularly reviewed by the chief

operating decision maker and reported to the Board. The chief

operating decision maker is the Chief Executive Officer.

Management information is reported as one operating segment,

being revenue from self-published and publishing franchises and

other revenue streams such as royalties and licensing.

The Group does not provide any information on the geographical

location of sales as the majority of revenue is through third-party

distribution platforms which are responsible for the sales data of

consumers. The cost to develop this information internally would be

excessive.

All of the Group's non-current assets are held within the

UK.

All material revenue is categorised as either publishing revenue

or other revenue. Other revenue mainly related to royalty

income.

The Group typically satisfies its performance obligations at the

point that the product becomes available to the customer and

payment has been received up front.

6 months to

6 months to 30 November 12 months to

30 November 2021 2020 31 May 2021

GBP'000 GBP'000 GBP'000

-------------------- ------------------ ------------- -------------

Publishing revenue 49,016 36,818 90,471

Other revenue 100 89 217

-------------------- ------------------ ------------- -------------

49,116 36,907 90,688

-------------------- ------------------ ------------- -------------

7. EARNINGS PER SHARE

The calculation of the basic earnings per share is based on the

profits attributable to the shareholders of Frontier Developments

plc divided by the weighted average number of shares in issue

during the period.

6 months to 6 months to 12 months

to

30 November 30 November 31 May 2021

2021 2020

Profit attributable to shareholders

(GBP'000) (1,653) 5,809 21,558

Weighted average number of shares 39,162,921 38,779,241 38,909,932

Basic earnings per share (pence) (4.2) 15.0 55.4

------------------------------------- ------------ ------------ -------------

The calculation of the diluted earnings per share is based on

the profits attributable to the shareholders of Frontier

Developments plc divided by the weighted average number of shares

in issue during the period as adjusted for the dilutive effect of

share options.

6 months to 6 months to 12 months

to

30 November 30 November 31 May 2021

2021 2020

Profit attributable to shareholders

(GBP'000) (1,653) 5,809 21,558

Diluted weighted average number

of shares 39,162,921 40,469,204 40,471,633

Diluted earnings per share (pence) (4.2) 14.4 53.3

------------------------------------- ------------ ------------ -------------

The reconciliation of average number of Ordinary Shares used for

basic and diluted earnings per share is as follows:

6 months to 6 months to 12 months to

30 November 30 November 31 May 2021

2021 2020

Weighted average number of shares 39,162,921 38,779,241 38,909,932

Dilutive effect of share options - 1,689,963 1,561,701

Diluted average number of shares 39,162,921 40,469,204 40,471,633

----------------------------------- ------------ ------------ -------------

The dilutive effect of share options is nil for the 6 months to

30 November 2021 because a loss was recorded for that period.

8. INTANGIBLE ASSETS

Game technology Game developments Third-party IP licences Total

software

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ---------------- ------------------ ------------ ------------ --------

Cost

At 31 May 2020 9,158 72,328 1,093 10,824 93,403

Additions 1,529 11,602 384 - 13,515

Transfers - (347) 347 - -

------------------------------------ ---------------- ------------------ ------------ ------------ --------

At 30 November 2020 10,687 83,583 1,824 10,824 106,918

Additions 6,322 13,536 236 361 20,455

------------------------------------ ---------------- ------------------ ------------ ------------ --------

At 31 May 2021 17,009 97,119 2,060 11,185 127,373

Additions 1,254 14,557 158 - 15,969

At 30 November 2021 18,263 111,676 2,218 11,185 143,342

------------------------------------ ---------------- ------------------ ------------ ------------ --------

Amortisation

At 31 May 2020 5,589 33,007 803 1,336 40,735

Amortisation charges 699 6,350 194 - 7,243

------------------------------------ ---------------- ------------------ ------------ ------------ --------

At 30 November 2020 6,288 39,357 997 1,336 47,978

Amortisation charges 770 7,077 230 - 8,077

------------------------------------ ---------------- ------------------ ------------ ------------ --------

At 31 May 2021 7,058 46,434 1,227 1,336 56,055

Amortisation charges 1,058 11,115 229 1,377 13,779

------------------------------------ ---------------- ------------------ ------------ ------------ --------

At 30 November 2021 8,116 57,549 1,456 2,713 69,834

------------------------------------ ---------------- ------------------ ------------ ------------ --------

Net Book Value

Net book value at 30 November 2021 10,147 54,127 762 8,472 73,508

Net book value at 31 May 2021 9,951 50,685 833 9,849 71,318

------------------------------------ ---------------- ------------------ ------------ ------------ --------

Net book value at 30 November 2020 4,399 44,226 827 9,488 58,940

------------------------------------ ---------------- ------------------ ------------ ------------ --------

Net book value at 31 May 2020 3,569 39,321 290 9,488 52,668

------------------------------------ ---------------- ------------------ ------------ ------------ --------

9. TANGIBLE ASSETS

Fixtures Computer Leasehold Total

and Fittings Equipment Improvements

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- -------------- ----------- -------------- --------

Cost

At 31 May 2020 863 2,781 5,358 9,002

Additions - 488 - 488

------------------------------- -------------- ----------- -------------- --------

At 30 November 2020 863 3,269 5,358 9,490

Additions - 887 - 887

------------------------------- -------------- ----------- -------------- --------

At 31 May 2021 863 4,156 5,358 10,377

Additions - 1,779 - 1,779

------------------------------- -------------- ----------- -------------- --------

At 30 November 2021 863 5,935 5,358 12,156

------------------------------- -------------- ----------- -------------- --------

Depreciation

At 31 May 2020 396 1,999 681 3,076

Charge for the period 75 318 167 560

------------------------------- -------------- ----------- -------------- --------

At 30 November 2020 471 2,317 848 3,636

Charge for the period 75 420 168 663

------------------------------- -------------- ----------- -------------- --------

At 31 May 2021 546 2,737 1,016 4,299

Charge for the period 75 648 167 890

------------------------------- -------------- ----------- -------------- --------

At 30 November 2021 621 3,385 1,183 5,189

------------------------------- -------------- ----------- -------------- --------

Net Book Value

Net book value at 30 November

2021 242 2,550 4,175 6,967

-------------------------------

Net book value at 31 May 2021 317 1,419 4,342 6,078

------------------------------- -------------- ----------- -------------- --------

Net book value at 30 November

2020 392 952 4,510 5,854

------------------------------- -------------- ----------- -------------- --------

Net book value at 31 May 2020 467 782 4,677 5,926

------------------------------- -------------- ----------- -------------- --------

10. SHARE CAPITAL

Nominal Value

Number GBP

------------------------------------------------ ----------- --------------

At 1 June 2020 38,911,810 194,559

------------------------------------------------ ----------- --------------

Shares issued on option exercises and warrants 377,047 1,885

------------------------------------------------ ----------- --------------

At 30 November 2020 39,288,857 196,444

------------------------------------------------ ----------- --------------

Shares issued on option exercises and warrants 54,747 274

------------------------------------------------ ----------- --------------

At 31 May 2021 39,343,604 196,718

------------------------------------------------ ----------- --------------

Shares issued on option exercises and warrants 49,651 248

------------------------------------------------ ----------- --------------

At 30 November 2021 39,393,255 196,966

------------------------------------------------ ----------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VFLFFLFLXBBF

(END) Dow Jones Newswires

January 12, 2022 02:00 ET (07:00 GMT)

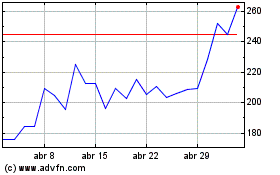

Frontier Developments (LSE:FDEV)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Frontier Developments (LSE:FDEV)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024