TIDMFUM

RNS Number : 6135A

Futura Medical PLC

02 June 2021

NEITHER THIS ANNOUNCEMENT, NOR ANY COPY OF IT, MAY BE TAKEN OR

TRANSMITTED, PUBLISHED OR DISTRIBUTED, DIRECTLY OR INDIRECTLY, IN

WHOLE OR IN PART, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA,

JAPAN, NEW ZEALAND OR THE REPUBLIC OF SOUTH AFRICA OR TO ANY

PERSONS IN ANY OF THOSE JURISDICTIONS OR ANY OTHER JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT

SECURITIES LAWS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN ANY JURISDICTION. NEITHER THIS

ANNOUNCEMENT NOR THE FACT OF ITS DISTRIBUTION SHALL FORM THE BASIS

OF, OR BE RELIED ON IN CONNECTION WITH, ANY INVESTMENT DECISION IN

RESPECT OF FUTURA MEDICAL PLC. PLEASE SEE THE IMPORTANT NOTICES AT

THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF MARKET ABUSE REGULATION (REGULATION 596/2014) (AS

IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018, AS AMED) ("UK MAR").

Unless otherwise indicated defined terms used in this

announcement have the same meaning as those terms defined and used

in the circular published in connection with the Fundraising, dated

17 May 2021.

2 June 2021

Futura Medical plc

("Futura" or "the Company")

Result of General Meeting & Total Voting Rights

On 17 May 2021 Futura (AIM: FUM), a pharmaceutical company

developing a portfolio of innovative products based on its

proprietary, transdermal Dermasys(R) drug delivery technology and

currently focused on sexual health and pain, announced that it had

conditionally raised GBP12 million in aggregate before fees and

expenses through an oversubscribed Placing and Retail Offer with

certain existing and new institutional and other investors at the

Issue Price of 40 pence per share.

The Company is pleased to announce that at the General Meeting

held today, all Resolutions proposed were duly passed. The

Fundraising remains conditional on, inter alia, Admission.

The total number of votes received on each resolution were as

follows:

Resolution Votes % of Votes Against % of Withheld

For votes votes

1. To authorise the Directors

to allot equity securities 89,486,568 99.80 182,315 0.20 2,352,044

----------- ------- -------------- ------- ----------

2. To disapply pre-emption

rights 89,516,459 99.83 152,424 0.17 2,352,044

----------- ------- -------------- ------- ----------

Note: Any proxy appointments which gave discretion to the

Chairman have been included in the "for" total.

James Barder, Chief Executive Officer of Futura, said: "I would

like to thank our current and new shareholders for their commitment

and strong vote of confidence in Futura. The Company has had a

transformative few months, securing European approval for MED3000,

signing an out-licensing deal for Asia and agreeing a final

structure for the confirmatory US study, and this fundraising opens

up an exciting future for Futura."

"We believe Futura is now fully funded to proceed with its plans

to achieve MED3000 approval in the US and launch the product in the

coming months and years with commercial partners across the EU and

multiple other regions, including many parts of Asia, where the CE

Mark is recognised."

Application has been made to the London Stock Exchange for the

30,000,000 Fundraising Shares to be admitted to trading on AIM. It

is expected that Admission will become effective, and that dealings

in the Fundraising Shares will commence, at 8.00 a.m. on 3 June

2021.

For the purposes of the FCA's Disclosure Guidance and

Transparency Rules (DTRs), the Company's total voting rights as

from the date of Admission will be 287,070,971 Ordinary Shares.

Since the Company currently holds no shares in treasury, the

total number of voting rights in the Company is 287,070,971 and

this figure may therefore be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interest in, the share capital of the Company under the FCA's

DTRs.

This announcement should be read in conjunction with the full

text of the Circular dated 17 May 2021 , published in connection

with the Fundraising.

For further information please contact:

Futura Medical plc

James Barder, Chief Executive

Angela Hildreth, Finance Director and COO

Email: investor.relations@futuramedical.com

Tel: +44 (0) 1483 685 670

www.futuramedical.com

Nominated Adviser and Sole Broker:

Liberum

Richard Lindley/ Euan Brown/ Kane Collings

Tel: +44 (0) 20 3100 2000

For media enquiries please contact:

Optimum Strategic Communications

Mary Clark/ Eva Haas/ Hollie Vile

Email: futuramedical@optimumcomms.com

Tel: +44 (0) 20 3922 0900

About Futura Medical plc

Futura Medical plc (AIM: FUM), is a pharmaceutical company

developing a portfolio of innovative products based on its

proprietary, transdermal DermaSys(R) technology. Each DermaSys(R)

formulation is separately patented and specifically tailored for

the selected indication and application, as well as being optimised

for clinical efficacy, safety, administration and patient

convenience. The products are developed for the prescription and

consumer healthcare markets as appropriate. Current therapeutic

areas are sexual health, including erectile dysfunction, and pain

relief. Development and commercialisation strategies are designed

to maximise product differentiation and value creation whilst

minimising risk.

MED3000 is Futura's topical gel formulation that is a

breakthrough treatment for erectile dysfunction (ED) through a

unique evaporative mode of action. Futura has conducted a Phase 3

study using MED3000 in ED, referred to as "FM57". This was a 1,000

patient, dose-ranging, multi-centre, randomised, double blind,

placebo-controlled, home use, parallel group study delivering

highly statistically significant results compared to pre-treatment

baseline, consistently meeting all co-primary endpoints of IIEF,

SEP2 and SEP3 (internationally accepted clinical trial endpoints in

ED) with over 60% of patients experiencing a clinically meaningful

improvement in their ED. MED3000 also begins to work immediately in

some patients, with 60% of patients seeing onset of their erection

within 10 minutes of application. MED3000 is CE marked in Europe

and the UK as a clinically proven topical treatment for adult men

with erectile dysfunction.

Futura is based in Guildford, Surrey, and its shares trade on

the AIM market of the London Stock Exchange.

www.futuramedical.com

Important Notices

No action has been taken by the Liberum Capital Limited

("Liberum") or any of its affiliates, or any person acting on its

or their behalf that would permit an offer of the Placing Shares or

possession or distribution of this announcement or any other

offering or publicity material relating to the Placing Shares in

any jurisdiction where action for that purpose is required. Persons

into whose possession this announcement comes are required by the

Company and Liberum to inform themselves about, and to observe,

such restrictions.

No prospectus, offering memorandum, offering document or

admission document has been or will be made available in connection

with the matters contained in this announcement and no such

prospectus is required (in accordance with the UK Prospectus

Regulation) to be published. Persons needing advice should consult

a qualified independent legal adviser, business adviser, financial

adviser or tax adviser for legal, financial, business or tax

advice.

THIS ANNOUNCEMENT, INCLUDING THE INFORMATION CONTAINED IN IT, IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE, FORWARDING OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR

INTO THE UNITED STATES OF AMERICA, ITS TERRITORIES AND POSSESSIONS,

ANY STATE OF THE UNITED STATES OR THE DISTRICT OF COLUMBIA

(COLLECTIVELY, THE "UNITED STATES"), AUSTRALIA, CANADA, JAPAN, NEW

ZEALAND, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN

WHICH SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS

NOT AN OFFER OF SECURITIES IN ANY JURISDICTION. THIS ANNOUNCEMENT

HAS NOT BEEN APPROVED BY THE LONDON STOCK EXCHANGE, NOR IS IT INTED

THAT IT WILL BE SO APPROVED.

This announcement or any part of it does not constitute or form

part of any offer to issue or sell, or the solicitation of an offer

to acquire, purchase or subscribe for, any securities in the United

States, Australia, Canada, Japan, New Zealand, the Republic of

South Africa or any other jurisdiction in which the same would be

unlawful. No public offering of the Placing Shares is being made in

any such jurisdiction.

The securities referred to herein have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "Securities Act"), or with any securities regulatory

authority of any State or other jurisdiction of the United States,

and may not be offered, sold or transferred directly or indirectly

in or into the United States except pursuant to an exemption from,

or in a transaction not subject to, the registration requirements

of the Securities Act and in compliance with the securities laws of

any State or any other jurisdiction of the United States.

Accordingly, the Placing Shares are being offered and sold by the

Company only outside the United States in "offshore transactions"

(as such terms are defined in Regulation S under the Securities Act

("Regulation S")) pursuant to Regulation S under the Securities Act

and otherwise in accordance with applicable laws. No public

offering of securities is being made in the United States.

Certain statements contained in this announcement constitute

"forward-looking statements" with respect to the financial

condition, results of operations and businesses and plans of the

Company and its subsidiaries (the "Group"). Words such as

"believes", "anticipates", "estimates", "expects", "intends",

"plans", "aims", "potential", "will", "would", "could",

"considered", "likely", "estimate" and variations of these words

and similar future or conditional expressions, are intended to

identify forward-looking statements but are not the exclusive means

of identifying such statements. These statements and forecasts

involve risk and uncertainty because they relate to events and

depend upon future circumstances that have not occurred. There are

a number of factors that could cause actual results or developments

to differ materially from those expressed or implied by these

forward-looking statements and forecasts. As a result, the Group's

actual financial condition, results of operations and business and

plans may differ materially from the plans, goals and expectations

expressed or implied by these forward-looking statements. No

representation or warranty is made as to the achievement or

reasonableness of, and no reliance should be placed on, such

forward-looking statements. No statement in this announcement is

intended to be, nor may it be construed as, a profit forecast or be

relied upon as a guide to future performance. The forward-looking

statements contained in this announcement speak only as of the date

of this announcement. The Company, its directors, Liberum, their

respective affiliates and any person acting on its or their behalf

each expressly disclaim any obligation or undertaking to update or

revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise, unless required to

do so by applicable law or regulation, the AIM Rules or the rules

of the London Stock Exchange.

Liberum, which is authorised and regulated in the United Kingdom

by the FCA and is a member of the London Stock Exchange, is acting

exclusively for the Company in connection with the Placing. Liberum

is not acting for the Company in relation to the Retail Offer nor

is it acting for any other person in connection with the matters

referred to in this announcement and will not be responsible to

anyone other than the Company for providing the protections

afforded to clients of Liberum or for giving advice in relation to

the matters referred to in this announcement.

This announcement has been issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by

Liberum or by any of its affiliates or any person acting on its or

their behalf as to, or in relation to, the accuracy or completeness

of this announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers, and any liability therefore is expressly disclaimed.

Any indication in this announcement of the price at which

Ordinary Shares have been bought or sold in the past cannot be

relied upon as a guide to future performance. The price of shares

and any income expected from them may go down as well as up and

investors may not get back the full amount invested upon disposal

of the shares. Past performance is no guide to future performance.

The contents of this announcement are not to be construed as legal,

business, financial or tax advice. Each investor or prospective

investor should consult his, her or its own legal adviser, business

adviser, financial adviser or tax adviser for legal, financial,

business or tax advice.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this announcement should seek appropriate advice before taking

any action.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into or forms part of this announcement.

This announcement has been prepared for the purposes of

complying with applicable law and regulation in the United Kingdom

and the information disclosed may not be the same as that which

would have been disclosed if this announcement had been prepared in

accordance with the laws and regulations of any jurisdiction

outside the United Kingdom.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROMFLLFBFQLZBBQ

(END) Dow Jones Newswires

June 02, 2021 07:50 ET (11:50 GMT)

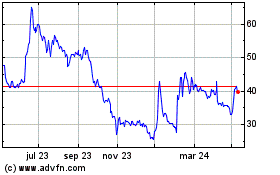

Futura Medical (LSE:FUM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

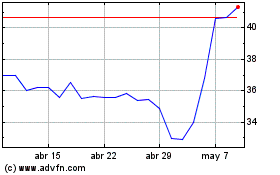

Futura Medical (LSE:FUM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024