Headlam Group PLC Disposal of Swiss Business (1359X)

30 Abril 2021 - 1:00AM

UK Regulatory

TIDMHEAD

RNS Number : 1359X

Headlam Group PLC

30 April 2021

30 April 2021

Headlam Group plc

('Headlam' or the 'Company')

Disposal of Swiss business

Headlam (LSE: HEAD), Europe's leading floorcoverings distributor

, announces that it has entered into an agreement to dispose of its

wholly-owned Swiss business, Belcolor AG ('Belcolor'), to the

management team(1) of Belcolor ('management buyout'). As a result

of the disposal, Headlam will realise approximately GBP12.0

million(2) in cash.

Belcolor is a floorcoverings distribution business based in St.

Gallen, Switzerland, and represents the entirety of Headlam's Swiss

operations. Headlam's Continental European operations accounted for

17.2% of total revenue in 2020, with Switzerland being the smallest

reflecting the small landmass and population of the country. For

the year ended 31 December 2020, Belcolor reported revenue of

GBP31.1 million and profit before tax of GBP1.1 million, with

fairly uninterrupted operations during 2020 in contrast to the

Company's UK and French operations which were subject to stringent

COVID-19 related lockdown measures.

While Belcolor is highly established and industry-leading in its

country, there are limited avenues for meaningful organic or

acquisitive growth. Additionally, the Swiss market varies

significantly from the Company's other geographic markets in terms

of supplier base and product mix, and therefore there is limited

ability to leverage group synergies. The disposal will allow the

Company to more effectively focus its activities and investments on

its operations which offer greater opportunity. In-line with the

Company's Capital Allocation Priorities published in January 2021,

the proceeds of the disposal will be directed towards investment in

the Company's operations to optimise performance and growth as well

as expediate the attainment of the targeted net debt and dividend

distribution parameters.

The management team will acquire 100% of Belcolor through a new

entity, CH Floorcovering Group AG, while continuing to operate the

business under the Belcolor name. Following formal completion of

the disposal, anticipated on or around 17 May 2021, Headlam will

have no further assets or operations in Switzerland, with its

operations subsequently focused in the UK, France, and the

Netherlands.

Headlam will realise approximately GBP12.0 million(2) in cash as

a result of the disposal, comprising a pre-completion cash dividend

of GBP11.1 million(2), and the balance payable in cash on or around

formal completion. The gross assets subject to the disposal were

approximately GBP18.0 million(2) as at 31 March 2021.

(1) The management team of Belcolor who will transfer with

Belcolor on formal completion of the disposal and are involved in

the management buyout are: Patrick Meier, Peter Jud, Robert Engel

and Joel Schneider.

(2) Approximate as subject to exchange rate movements.

Enquiries:

Headlam Group plc Tel: 01675 433 000

Steve Wilson, Chief Executive Email: headlamgroup@headlam.com

Chris Payne, Chief Financial

Officer

Catherine Miles, Director of

Communications

Investec Bank plc (Corporate Tel: 020 7597 5970

Broker)

David Flin / Alex Wright

Panmure Gordon (UK) Limited Tel: 020 7886 2500

(Corporate Broker)

Erik Anderson / Dominic Morley

/ Ailsa MacMaster

Alma PR (Financial PR) Tel: 020 3405 0205

Susie Hudson / Harriet Jackson headlam@almapr.co.uk

/ Faye Calow

Notes for Editors:

Headlam is Europe's leading floorcoverings distributor,

providing the channel between suppliers and trade customers of

floorcoverings.

Headlam works with suppliers across the globe manufacturing a

diverse range of floorcovering products, and provides them with a

cost efficient and effective route to market for their products

into the highly fragmented customer base. Alongside

long-established processing and distribution expertise, suppliers

benefit from Headlam's marketing and customer servicing into the

most extensive customer base.

To maximise customer reach, Headlam currently operates 67

businesses across the UK and Continental Europe (France, the

Netherlands and Switzerland). Each business operates under its own

trade brand and utilises individual sales teams while being

supported by the Company's network and centralised resources.

The Company's customer base covers both the residential and

commercial sectors, with the principal customer groups being

independent retailers and smaller flooring contractors alongside

other groups such as larger retailers, housebuilders, specifiers,

and local authorities.

Headlam is focused on providing customers with a market-leading

service through:

-- the broadest product offering;

-- unrivalled product knowledge and tailored solutions;

-- sales team and marketing support;

-- e-commerce support;

-- 'just-in-time' nationwide delivery and collection service; and

-- other support including the provision of credit.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISSEUFMUEFSEEL

(END) Dow Jones Newswires

April 30, 2021 02:00 ET (06:00 GMT)

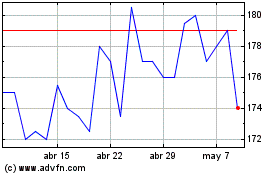

Headlam (LSE:HEAD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Headlam (LSE:HEAD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024