TIDMLBOW

RNS Number : 4579N

ICG-Longbow Snr Sec UK Prop DebtInv

30 September 2021

ICG-Longbow Senior Secured UK Property Debt Investments

Limited

Interim Report And

Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended 31 July 2021

ICG-Longbow Senior Secured UK Property Debt Investments Limited

("the Company") is pleased to announce the released of its Interim

Financial Statements for th e six months ended 31 July 2021 which

will shortly be available on the Company's website at

(ww.lbow.co.uk) where further information on the Company can also

be found.

All capitalised terms are defined in the Glossary of Capitalised

Defined Terms unless separately defined.

Financial Highlights

Key Developments

-- Commencement of capital return to shareholders; capital

distribution of 5.5 pence per ordinary share announced post-period

end.

-- Dividend maintained at 1.5 pence per share per quarter for

the six month period to 31 July 2021.

-- Total loan commitments of GBP110.6 million as at 31 July

2021, as the portfolio continues to reduce in line with the

investment objective, in order to return capital to

shareholders.

-- No losses incurred or impairment provisions required on any portfolio investments.

Performance

-- NAV of GBP119.13 million as at 31 July 2021 (31 January 2021: GBP 119.25 million).

-- Profit after tax of GBP 3.52 million for the six months ended

31 July 2021 (31 July 2020: GBP3.72 million).

-- Earnings per share for the period of 2.90 pence (31 July 2020: 3.07 pence).

Dividend

-- Total dividends paid or declared for the period ended 31 July

2021 of 3 pence per share (31 July 2020: 3 pence per share), made

up as follows:

o Interim dividend of 1.5 pence per share paid in respect of quarter ended 30 April 2021.

o Interim dividend of 1.5 pence per share approved in respect of quarter ended 31 July 2021.

Investment Portfolio

-- As at 31 July 2021, the Group's investment portfolio

comprised eight loans with an aggregate principal balance of

GBP106.47 million, representing 91.1% of the shareholders' equity

(31 January 2021: nine loans with aggregate principal balance of

GBP109.32 million, representing 91.7% of the shareholders'

equity).

-- Total loan commitments as at 31 July 2021 were GBP110.6

million (31 January 2021: GBP117.3 million).

-- As at 29 September 2021, the aggregate drawn balance was GBP

104.8 million, with total commitments of GBP 108.6 million.

-- The portfolio continues to prove resilient in the face of

Covid-linked economic and market disruption.

Chairman's Statement

Introduction

On behalf of the Board, I am pleased to present the Interim

Financial Statements for the Group for the six months ended 31 July

2021.

The reporting period saw the steady emergence of the UK economy

from the winter Covid-19 lockdown. The Government 'roadmap' out of

lockdown published in February 2021 allowed many businesses to plan

for full re-opening and, although the final steps were delayed by a

few weeks, all major domestic restrictions were lifted in England

on 19(th) July, with the devolved administrations following shortly

thereafter.

The recovery shown by the UK economy during the period was

generally stronger than expected, led by the confidence generated

by a rapid and successful vaccine rollout. While the first quarter

lockdown suppressed output, the UK has since seen strong growth

figures. This has been replicated in the labour markets, where the

furlough scheme succeeded in mitigating effects on the unemployment

rate. The number of job vacancies has also reached a record high.

Given the typical relationship between employment figures and

occupier demand for property, this looks to be positive for the

Company's markets.

While the challenges of the winter months now lie ahead, with

the possibility of waning immunity to Covid and emergence of new

variants leading to requirements for booster shots or further

restrictions, it currently appears as though the UK economy may

emerge from the pandemic scarred with materially higher public

borrowing but able to sustain reasonable growth.

Despite this dislocation, the Company has continued to deliver a

robust performance. In addition, the risk profile of several of its

investments has continued to improve as the Investment Manager has

worked with the Group's borrowers to position each investment as

securely as possible. This has led to partial repayments of the

Southport Hotel (via a catch up of capitalised interest) and

Quattro loans. There is no anticipated shortfall in interest or

capital on any of the Group's investments, and no impairment

provisions are required.

In January 2021, shareholders approved an amendment to the

Company's investment objective and policy to allow for the orderly

return of capital as the Company's investments begin to repay. The

first such repayments were received in July and early August 2021,

and, subsequent to the period end, your Board approved a capital

distribution to shareholders of 5.5 pence per ordinary share,

equating to approximately GBP6.7 million.

Although the Company's objective is for an orderly realisation

of its assets, the Board continues to believe that the Company's

shares offer an attractive investment return, with the current

share price secured against a portfolio with a weighted average LTV

of circa 70%. Furthermore, while the share price remains below the

Company's current NAV, the Board believes that the credit

improvements seen across the portfolio (particularly in some of the

investments impacted by Covid), warrants the narrowing or

elimination of this discount.

Portfolio

As a result of the amended investment policy, the Company did

not make any new investments during the period. Under existing

committed facilities, GBP3.9 million in aggregate was advanced to

assist borrowers with delivery of their business plans. As at the

date of this report, undrawn commitments total GBP 3.8 million and

the Company intends to maintain sufficient cash balances to meet

these future obligations.

During the reporting period, the GBP5.7 million Halcyon loan was

repaid in full, with additional exit and prepayment fees of

approximately GBP0.1 million. Shortly after the period end, a

series of partial repayments of the Quattro loan were received,

following a refinancing of one of the portfolio assets, together

with the sale of newly-constructed residential apartments at one of

the remaining properties.

As a result of these repayments and continued advances on

committed facilities, pro forma LTV as at the date of these

accounts is 70.1%, at a weighted average interest coupon of 7.15%,

with returns further enhanced by contractual arrangement and exit

fees.

Revenue and Profitability

Income from the loan portfolio for the period totalled GBP4.67

million (31 July 2020: GBP4.95 million) as the Company had lower

drawn balances, on average, than in the comparable prior year

period. Profits for the period after tax were GBP3.52 million (31

July 2020: GBP3.72 million).

Earnings per share for the period were lower at 2.90 pence (31

July 2020: 3.07 pence), as a result of accruals for the proposed

liquidation of the Group's Luxembourg holding company, which the

Board believes will generate cost savings for shareholders over the

remaining life of the Company. Save for the impact of this accrual,

the dividend was fully covered by earnings.

Dividend Performance

The Company paid a first interim dividend of 1.50 pence per

share in respect of the quarter ended 30 April 2021 on 6 August

2021, and on 29 September 2021 declared a second interim dividend

in respect of the quarter ended 31 July 2021 of 1.5 pence per

share.

As highlighted above, the Group's investments generated

sufficient income to provide for a covered dividend during the

reporting period, albeit that a prudent level of accruals for

future wind up costs modestly reduced headline earnings per

share.

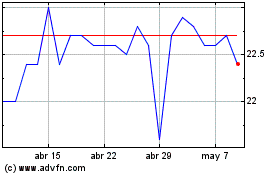

NAV and Share Price Performance

The Group's NAV was largely unchanged at GBP119.13 million as at

31 July 2021 (31 January 2021: GBP119.25 million), consistent with

a substantially stable investment portfolio during a period of

great uncertainty.

The Company's share price was broadly stable in the period,

trading in a range of 85.00 to 92.60 pence per share.

Board and Corporate Structure Changes

During the period the Board announced that Patrick Firth would

not stand for re-election at the Company's forthcoming AGM,

retiring from the Board with effect from 28 June 2021. The Board

would like to thank Patrick for his service and guidance since the

Company's initial public offering.

As highlighted in our annual report and accounts, due to the

Company's move to a new investment objective, your Board will

continue with four members. Fiona Le Poidevin has been appointed as

the new Chairman of the Audit and Risk Committee and brings a

wealth of experience to the role.

Outlook

We are pleased to have been able to pay a substantially covered

dividend during the period. During the orderly realisation phase,

it is the Board's intention to continue to pay dividends from our

net income.

The Board is aware that shareholders will be eager to understand

the likely timing and quantum of future capital distributions.

While the loan maturity dates set out later in this report give

some guidance as to anticipated repayments, the underlying

borrowers do have the right to repay earlier (subject to meeting

any applicable prepayment fees). Occasionally, loans may extend

beyond their scheduled maturity.

However, certain of the properties securing the Group's loans

are currently either under offer for sale or intended to be

marketed for sale. While there can be no assurance that any such

sales will complete, our current expectation is that a minimum of

GBP 10 million of loans will be repaid, and a similar amount of

capital will be returnable to shareholders, before the calendar

year end.

The Board will communicate with shareholders on a timely basis

with progress on all future capital distributions.

Jack Perry

Chairman

29 September 2021

Investment Manager's Report

The Investment Manager's Report refers to the performance of the

loans and the portfolio for the 6 months to 31 July 2021 and the

general market conditions prevailing at that date. The Investment

Manager continues to work closely with the Board to ascertain any

residual or consequential impacts of the Covid-19 pandemic and

associated policy response. Any forward-looking statements in this

report reflect the latest information available as at 29 September

2021.

Investment Objective

The investment objective of the Group, as approved by the

shareholders of the Company, was revised in January 2021 and is now

to conduct an orderly realisation of the assets of the Group.

Fund facts

-------------------- ---------------- ----------- ------------------------

Closed ended investment

Fund launch: 5 February 2013 Fund type: company

-------------------- ---------------- ----------- ------------------------

Investment Manager: ICG-Longbow Domicile: Guernsey

-------------------- ---------------- ----------- ------------------------

Base currency: GBP Listing: London Stock Exchange

-------------------- ---------------- ----------- ------------------------

Issued shares: 121.3 million ISIN code: GG00B8C23S81

-------------------- ---------------- ----------- ------------------------

Investment Advisory

fee: 1.0% LSE code: LBOW

-------------------- ---------------- ----------- ------------------------

Website: www.lbow.co.uk

----------- ------------------------

Key portfolio statistics at

Share price & NAV at 31 July 2021 31 July 2021

---------------------------------------------------- -----------------------------------------

Share price (pence per

share): 89.60 Number of investments: 8

--------------------------------------- ----------- ------------------------------- --------

Percentage capital invested(2)

NAV (pence per share): 98.21 : 91.1%

--------------------------------------- ----------- ------------------------------- --------

Weighted avg. investment

Premium/(Discount): (8.8%) coupon: 7.17%

--------------------------------------- ----------- ------------------------------- --------

Approved dividend (pence

per share)(1) : 1.5 Weighted avg. LTV: 70.6%

--------------------------------------- ----------- ------------------------------- --------

Dividend payment date(1) 5 November

: 2021

--------------------------------- -----------------

(1) For the Quarter ended 31

July 2021. Ex-Dividend Date is

7 October 2021

(2) Loans advanced at amortised

cost / Total equity attributable

to the owners of the Company.

Summary

At 31 July 2021 the investment portfolio comprised eight

loans.

Given the Company's revised investment objective, no new

investments were made in the period and lending activity in the

period was limited to making further advances totalling GBP3.9

million under the committed facilities on existing portfolio loans.

The Group received repayment in full of the GBP5.7 million Halcyon

loan, with additional exit and prepayment fees of GBP0.1

million.

As at the period end:

-- Reduction in total commitments to GBP110.6 million (31

January 2021: GBP117.3 million) with par value of the loan

portfolio falling to GBP106.5 million (31 January 2021: GBP109.3

million)

-- Weighted average LTV of 70.6% (31 January 2021: 69.3%)

-- Weighted average interest coupon of 7.17% (31 January 2021:

7.19%), before recognition of arrangement and exit fees

-- NAV per share of 98.21 pence (31 January 2021: 98.31 pence)

Following period end, the Group received a series of partial

repayments of the Quattro loan, in line with an exit strategy for

the investment agreed with the Sponsor. These payments totalled GBP

2.0 million in aggregate, from a combination of sales and

refinancing of certain of the assets securing the loan.

Group Performance

During the period the Group received 84% of the interest due

under the loans, with the remainder paid or expected to be received

after period end.

Modest loan advances were made under committed funding

facilities on the Northlands, Affinity, GMG and LBS loans,

totalling GBP3.9 million in aggregate.

The Group received repayment in full of the GBP5.7 million

Halcyon loan, with additional exit fees of GBP0.1 million. A

repayment of GBP1.1 million was received on the Southport hotel

loan representing the catch up of previously capitalised interest.

The total outstanding loan balance fell by GBP2.8 million in the

period. NAV per share for the period was largely stable.

Portfolio LTV stood at 70.6% at period end, slightly ahead of

the year end figure as a result of the new loan advances, the

Halcyon loan repayment and receipt of a number of property

revaluations across the portfolio. In certain cases, for example

the GMG and Affinity loans, the benefit of the capital expenditure

works funded by the new loan advances has not yet been reflected in

the underlying property values.

At period end, the Group had GBP10.5 million of cash, which is

sufficient to cover its committed but undrawn funding obligations

of GBP4.1 million and to allow for a capital distribution to

shareholders, as highlighted in the Chairman's Statement. There

were no drawings on the Company's Revolving Credit Facility during

the period, and the outstanding balance as at 31 July 2021 was

nil.

The weighted average loan coupon was largely unchanged in the

quarter, and the weighted average unexpired loan term reduced to

approximately 1.4 years. As these loans repay the Company intends

to return capital to shareholders in line with its investment

objective.

Portfolio

Portfolio statistics 31 July 2021 31 January 2021

Number of loan investments 8 9

--------------- ----------------

Aggregate principal advanced GBP106,467,217 GBP109,258,944

--------------- ----------------

Undrawn loan commitments GBP4,087,714 GBP8,021,889

--------------- ----------------

Weighted average LTV 69.7% 69.3 %

--------------- ----------------

Weighted average interest coupon p.a. 7.17% 7.19 %

--------------- ----------------

Weighted average unexpired loan term 1.38 years 1.76 years

--------------- ----------------

Weighted average unexpired interest income protection 0.65 years 0.72 years

--------------- ----------------

Cash held GBP10,466,329 GBP8,773,640

--------------- ----------------

Investment Portfolio as at 31 July 2021

Balance

Day undrawn

Unexp. Day 1 1 (GBPm) Current

Balance outstanding LTV

term balance LTV (1, 2) (2)

Project Region Sector Term start (years) (GBPm) (%) (GBPm) (%)

South

Quattro East Mixed use Oct-17 0.00 9.00 83.7 8.86 80.2

South

Affinity West Office Mar-18 0.79 14.20 67.3 17.30 0.40 68.4

North

Southport West Hotel Feb-19 1.71 12.50 59.5 15.00 72.8

Northlands London Mixed use Aug-19 1.21 9.00 55.3 9.96 2.54 55.6

RoyaleLife National Residential Sept-19 2.21 20.27 74.3 25.38 74.6

LBS London Office Oct-19 1.21 4.92 69.3 6.47 58.9

North

Knowsley West Industrial Feb-20 1.71 3.50 60.3 7.75 63.1

GMG London Office July-20 1.21 12.75 70.0 15.74 1.15 76.8

Total / weighted average 1.38 86.14 68.2 106.46 4.09 70.6

--------------------------------------- ------------ --------- --------- ----- -------------------- -------- --------

(1) For the RoyaleLife facility, Balance outstanding includes

capitalised interest

(2) After quarter end, the Quattro loan was repaid by GBP2.0

million with the outstanding balance now GBP6.86 million. LTV is

76.4% as at the date of this Report

Economy and Financial Market Update

The Q1 2021 lockdown restrictions weighed down UK GDP, with a

1.6% quarterly fall, followed by (provisional) 4.8% growth in Q2 as

restrictions eased and the economy steadily re-opened. According to

the ONS, the economy remains 4.4% smaller than pre-pandemic levels,

although Capital Economics is now forecasting a return to the

February 2020 position by October. This outturn would, in our view,

be remarkable in the context of the unprecedented GDP falls of 12

months ago and the bearish economic forecasts earlier this

year.

The recovery has however come with a huge impact on the public

finances. As at July 2021 public sector debt reached GBP2.2

trillion, reflecting 99% of GDP, and on an upward trajectory

despite Government borrowing since April 2021 significantly

undershooting OBR projections. In the coming months there will be

ever louder calls for more spending on public sector pay,

education, and recovery programmes in the lead up to the Autumn

spending review, to supplement the recently announced increases

awarded to the NHS and social care. While this is initially to be

funded through the 1.25% tax rise branded as a 'health and social

care levy', it is hard to see how the Government can materially

restrain wider spending and a return to anything approaching a

balanced budget seems unlikely.

As a result, market observers have paid ever closer attention to

the Bank of England's messaging on its asset buying (QE) programme

and interest rate outlook. Latest guidance suggests any unwinding

of QE will now follow Bank rate reaching 0.5% (previously 1.5%). If

this tapering is used as the principal monetary tightening tool,

interest rates may be held lower for longer, and indeed 15 - 30yr

SONIA swap rates remain in the 0.75% area.

Despite the resurgence of inflationary pressures, CPI data in

the 12 months to July 2021 was in line with the Bank of England's

2% target, and down from the 2.5% seen in the 12 months to June.

The August figures showed a jump to 3.2%, however, and forecasters

estimate that this could rise to 4% - 4.5% by the fourth quarter,

before falling back in 2022 - providing that this does not persist

into ever faster pay growth.

As it stands, the UK labour market has proved resilient to the

worst of the Covid effects, driven by use of the furlough scheme

and, more recently, strong job creation. The UK unemployment rate

was 4.6% in the three months to July 2021, and job vacancies are

now over a million - a record high. The haulage and hospitality

industries are among many struggling to recruit in sufficient

numbers, and this is feeding into real pay growth.

The employment outlook, easing of lockdown restrictions and a

'vaccine bounce' has led to rising consumer confidence, with both

July and August showing an improvement on January 2020

(pre-pandemic) levels. It remains to be seen whether the potential

for a new wave of Covid infections as a result of restrictions

easing and schools returning will affect this in the coming

months.

Occupational Demand/Supply

After a sharp rise in London vacancy rates in 2020 and the first

quarter of 2021, there is evidence to suggest that availability is

stabilising at the half year as work from home restrictions end and

companies rethink their occupational requirements. Recent data from

Savills suggest that active tenant requirements in Central London

total 10 million sq ft, up 41% from the same period last year.

In many regional markets, there is still a significant

supply/demand imbalance notwithstanding the effects of the

pandemic. Vacancy rates in the 'Big Six' markets remain below 8%,

according to Jones Lang LaSalle, in many cases lower for the best

Grade A buildings. As a result of this tight supply there were

record rents set in H1 2021 for prime space in Manchester and

Glasgow, among other markets. Take up remains lower than the long

run average but transactional demand is steadily improving.

The industrial markets continue to show strength. Take up for

the first half of larger (100,000 sq ft+) units was 24.8 million

square feet, in line with prior year figures. Supply remains tight,

with only six months' worth remaining in the market, even allowing

for forecast new scheme completions. As a result rental growth is

still evident, according to MSCI data, and may even be

strengthening, especially for distribution warehouses.

In the retail markets - where for the avoidance of doubt the

Group has negligible exposure - official void rates are 15%, but

this masks differences between sectors, with out of town retail

parks showing only around a 7% void. On high streets and in

shopping centres, many stores are now occupied on flexible

agreements; post- CVA terms; or on a business rates-only basis. In

weaker centres some stores are 'leased' effectively on nil rent

terms. There are now signs that rents in some stronger locations

are stabilising as occupiers take the decision to 'lock in' to the

new terms available, and the retail warehouse sector remains

reasonable buoyant, driven by demand from discounters, food stores

and bulky goods operators.

Property Investment Market

After a 12 month period of suppressed transaction volumes, there

is early evidence indicating a sustained level of investor demand

for real estate, driven by the weight of global capital targeting

the UK (and consistent with global LBO interest in equity markets).

According to Lambert Smith Hampton, GBP13.9bn of deals were

transacted in Q2 2021, some 7% above the five-year quarterly

average, with more than 50% of deal volumes accounted for by

overseas investors. These volumes were accompanied by an increase

in pricing with average yields tightening by 13bp in Q2 2021,

according to Lambert Smith Hampton.

A significant amount of capital remains focused on the office

sector, with investors seeking assets which have, or can be

improved to give, strong sustainability credentials and a flexible

workspace offering. Brookfield has been particularly acquisitive,

with purchases including the Arlington Business Park portfolio for

GBP0.7 billion and 30 Fenchurch Street in London for GBP0.6

billion. In the regions we have seen major deals reported in

Glasgow (GBP200m for a property on Bothwell St) and Bristol

(GBP135m for the Assembly building, leased to BT). The latter was

at a 4.6% yield and the largest deal in the city for 15 years.

Investor demand for industrial assets appears relentless, and as

a result yields have compressed further, with London estates

particularly sought after. Among many notable transactions, Goodman

acquired Howlem Trading Estate in Tottenham for GBP130m, a circa

2.5% yield, and Aberdeen Standard acquired an Amazon-leased

warehouse in Hinckley for a circa 3% yield. The UK industrial

market remains pressured by the inexorable rise of e-commerce and

distribution requirements, compounded by the limited supply of new

available space.

Finance Markets

During the reporting period the Cass Business School UK

Commercial Real Estate Finance Report was published, covering the

2020 calendar year and thus the onset of Covid-19. The research

reported total new lending in 2020 down 23% from a year earlier,

because of the coronavirus pandemic. An improvement in origination

activity was witnessed in the second half of 2020, mirroring the

busy H2 2020 experienced ICG Real Estate's lending programmes.

Coming into 2021 we saw ongoing green shoots emerge in the UK

CMBS market, which has been largely stagnant since the GFC and with

only sporadic issuance over the past few years. Transactions have

been led by Bank of America and Morgan Stanley, with borrowers (so

far) being limited to the largest global players, notably

Blackstone (in respect of loans to its Mileway industrial and

logistics platform) and Brookfield (London office and retail park

loans).

Senior loan pricing reset at higher rebased levels in Q1 2021,

with 'prime' office margins for example reported at an average 229

bps, a c50bps increase from the prior year. Increased competition

saw these spreads tighten significantly towards the end of the

reporting period, particularly for larger ticket deals , driven by

the modest return of CMBS market activity and competition among

European banks and insurers including the likes of ING, Axa and the

German Pfandbrief and Landesbanks. This competition is particularly

acute on low LTV or long income deals, with lending margins now

below 150 basis points.

We have yet to see any spread compression reach the mid-market,

where there remains a funding gap driven by the retrenchment of UK

clearing banks, which is only partially offset by growth of

alternative lenders. In the banking market, l everage on new

transactions remains conservative at between 50% - 55% LTV on

average, and indeed ICG Real Estate's analysis of the FY 2020

accounts of the major clearing banks shows average LTVs across

their lending books reported as ranging from 38% LTV (Barclays) to

50% (Lloyds).

In the market more widely, our long-held thesis of bank

retrenchment driving a reduction in lending appetite continues to

be borne out, with a GBP1.1 billion contraction in net lending to

property during Q2 2021, according to the Bank of England. With UK

banks having provided approximately GBP80 billion of Covid-recovery

loans since the onset of the pandemic, according to Government

data, we believe that these banks' lending appetite and internal

credit committee time for real estate debt will remain limited in

the near- to medium-term.

Portfolio Profile and Activity

The Group's investment portfolio was largely stable during the

reporting period, with no new investments and the sole repayment

being the exit of the GBP5.7 million Halcyon loan. We also saw

partial repayments of the Southport loan (being the catch up of

previously capitalised interest) and shortly after period end a

GBP1.7 million repayment of the Quattro loan, following the

refinancing of one of the portfolio properties.

The Group continues to make advances under committed funding

facilities in support of its borrowers' business plans. In

particular, the major development and refurbishment works on the

Knowsley and GMG loans, respectively, were largely completed during

the period and this results in a significant improvement in the

risk profile for those loans, which in the case of the GMG facility

has yet to be fully reflected in the value.

As a result of the portfolio changes, the Company's weighted

average LTV is now 70.6%, with a weighted average unexpired loan

term of 1.38 years. With no new investment occurring, these loan

terms will continue to reduce allowing for the prospect of capital

distributions to shareholders upon final repayment.

The weighted average interest coupon is 7.17%, and as

highlighted in prior reports this is supplemented by contractual

arrangement fees paid at closing and exit fees upon repayment.

Several of the remaining loans continue to feature coupon

protection or other minimum earnings clauses, which give the

prospect (but not the certainty) of additional fees should

facilities repay early.

Business plan highlights across the portfolio during the quarter

included:

-- Completion of the pre-let development of an industrial unit

on vacant land at the Knowsley property;

-- Record summer trading at the Southport hotel, driven by a rise in 'staycations';

-- Substantial completion of refurbishment works at the property

securing the GMG loan, with two new lettings in solicitors'

hands;

-- Further letting activity at the Spectrum office property, securing the Affinity loan

We have seen improvements in the credit profile of some of the

Group's more challenging investments, with partial repayments of

both the Southport and Quattro loans, and a welcome increase in

sales velocity in the RoyaleLife portfolio, where challenges remain

with tight working capital, but the outlook is positive. Here, the

Investment Manager agreed to staged payments of interest from the

sponsor in exchange for an increase to the minimum earnings on the

loan, which will benefit shareholders in the event of early

repayment.

Portfolio Outlook

The Group's loan commitments totalled approximately GBP110

million at period end, of which circa GBP106 million was drawn. It

has ample available liquidity to meet remaining loan commitments

whilst commencing the process of returning capital to

shareholders.

The Company recently announced a first capital distribution of

5.5 pence per ordinary share (equating to approximately GBP6.7

million), to be paid on or around 30 September 2021. This allows

the Company to retain cash balances sufficient to meet working

capital requirements and future funding obligations, which totalled

approximately GBP4.1 million at period end.

Further capital distributions are expected to follow repayments

received from the Group's loan portfolio. The Investment Manager is

aware that certain of the properties securing the Group's loans are

either under offer for sale or intended to be marketed for sale in

the coming months. While there can be no assurance that any such

sales will complete, our current guidance is that we expect a

minimum of GBP 10 million of loans will be repaid, and a similar

amount of shareholder capital returned, by the calendar year

end.

We will provide shareholders with regular updates on the outlook

for capital distributions when appropriate, but continue to be

satisfied with the Group's loan portfolio which retains a first

mortgage position with an average LTV of approximately 70%.

Loan Portfolio

As set out above, as at 31 July 2021, the Group's portfolio

comprised of eight loans with an aggregate balance outstanding of

GBP106.47 million.

A summary of each of the individual loans as at 31 July 2021 is

set out below :

Quattro

In October 2017, the Group advanced a new GBP9.00 million loan to a private property company,

secured by three mixed use assets in and around the London Borough of Kingston. The Group

initially financed a GBP6.00 million participation in the loan subsequently acquiring the

minority GBP3.00 million position from ICG following an equity issuance under the 2017 Placing

Programme. The initial LTV ratio was 83.3%.

The loan has passed its maturity date during the period and all rights have been reserved

in respect of this default. The sponsor is pursuing an exit from the loan via a combination

of sales and refinancing, and after quarter end the first property was sold under this agreed

process, with the Group receiving repayment of GBP1.7 million. Subsequently, the Company received

a further GBP0.3 million from a residential apartment sale.

The LTV as at the date of these accounts is 76.4%. We remain comfortable with the Company's

security position.

Property profile Debt profile

Number of properties 3 Day one debt GBP9,000,000

-------------- -------------------------- -------------

Property value GBP11,050,000 Debt outstanding GBP8,858,259

-------------- -------------------------- -------------

Property value per sq. ft. GBP290 Original term 3.2 years

-------------- -------------------------- -------------

Property area (sq. ft.) 38,038 Maturity January 2021

-------------- -------------------------- -------------

Number of tenants 7 LTV as at 31 July 80.2%

-------------- -------------------------- -------------

Weighted lease length 6.5 years Loan exposure per sq. ft. GBP233

-------------- -------------------------- -------------

Affinity

On 28 February 2018, a new GBP16.20 million commitment was made, of which GBP14.20 million

was advanced, to refinance a multi-let office property in Bristol, and to provide a GBP2.00

million capital expenditure facility to fund a refurbishment programme. Subsequently, the

loan was increased to GBP16.70 million in support of the borrower's business plan and thereafter

a further GBP1.00 million loan commitment was made to allow for further upgrade works to the

property.

The property is currently 93% occupied with a contracted rent of GBP1.9 million per annum.

The sponsor has continued to invest in the property, most recently introducing a flexible

workspace offering into the building.

Property profile Debt profile

Number of properties 1 Day one debt GBP14,200,000

-------------- -------------------------- --------------

Property value GBP25,300,000 Debt outstanding GBP17,299,963

-------------- -------------------------- --------------

Property value per sq. ft. GBP221 Original term 4.2 years

-------------- -------------------------- --------------

Property area (sq. ft.) 114,364 Maturity May 2022

-------------- -------------------------- --------------

Number of tenants 15 LTV as at 31 July 68.4%

-------------- -------------------------- --------------

Weighted lease length 2.5 years Loan exposure per sq. ft. GBP151

-------------- -------------------------- --------------

Southport

Initially a GBP15.0 million loan commitment, secured by a hotel and leisure complex in Southport,

Merseyside. The initial loan to value ratio was 59.5%. The business plan focused on investing

in improving the asset, renovating the bedrooms and thereafter driving room rates. Substantially

all business plan works across the hotel were completed prior to the onset of Covid-19.

In 2020 the Government's Covid restrictions meant the hotel was largely closed for trade,

and the Investment Manager agreed to an element of interest capitalisation during this period

to support the loan sponsor through the disruption. Subsequently, the sponsor reached agreement

with one of the property's commercial tenants for a lease surrender. The premium paid by the

tenant was sufficient to repay the previously capitalised interest, with the loan balance

of GBP15.0 million consistent with the original commitment.

The hotel remained closed for trading for much of the reporting period. However since reopening

trading has been strong, with all key operating metrics exceeding pre-pandemic levels and

a robust pipeline of forward bookings. The property was revalued during the period at GBP20.6

million, providing a LTV at period end of 72.8%.

Property profile Debt profile

Number of properties 1 Day one debt GBP12,500,000

-------------- -------------------------- --------------

Property value (GBP) GBP20,600,000 Debt outstanding GBP15,000,000

-------------- -------------------------- --------------

Property value (GBP/bedroom) GBP154,887 Original term 4 years

-------------- -------------------------- --------------

Property value (GBP/sq. ft.) GBP453 Maturity April 2023

-------------- -------------------------- --------------

Bedrooms 133 LTV as at 31 July 72.8%

-------------- -------------------------- --------------

Property area (sq. ft.) 45,430 Loan exposure per bedroom GBP112,782

-------------- -------------------------- --------------

Northlands

In October 2019 the Group provided a GBP12.50 million commitment to the sponsor, secured by

a highly diversified portfolio of high street retail, office and tenanted residential units

located predominantly in London and the South East. The initial loan amount was GBP9.00 million

with a LTV ratio of 55.3%.

The sponsor's business plan includes implementation of a planning consent to develop residential

apartments on one of the sites in the portfolio, and in support of this the Group provided

a GBP3.50 million capital expenditure commitment. This commitment has been steadily drawn

during the period, with the outstanding balance now GBP9.96 million.

Progress against business plan has been steady, and during the period a revaluation of the

portfolio showed an improvement of approximately 10% since loan closing, reflecting the ongoing

investment in the assets.

Property profile Debt profile

Number of properties 14 Day one debt GBP9,000,000

-------------- --------------------------

Property value GBP17,906,500 Debt outstanding GBP9,963,590

-------------- -------------------------- -------------

Property value per sq. ft. GBP147 Original term 3.0 years

-------------- -------------------------- -------------

Property area (sq. ft.) 121,285 Maturity October 2022

-------------- -------------------------- -------------

Number of tenants 113 LTV as at 31 July 55.6%

-------------- -------------------------- -------------

Weighted lease length 3.2 years Loan exposure per sq. ft. GBP85

-------------- -------------------------- -------------

RoyaleLife

In September 2019 the Group provided a GBP24.6 million commitment to an affiliate of RoyaleLife,

the UK's leading provider of bungalow homes, secured by a portfolio of ten assets in the residential

bungalow homes sector. The facility forms part of a larger four-year, GBP142.7 million loan

originated by the Investment Manager, with the Group participating alongside two other funds

managed by the Investment Manager.

The initial loan drawn down was GBP20.3 million, with the balance comprising a capital expenditure

commitment in support of the borrower's business plan.

The Sponsor's home sales were adversely affected by Covid-19 and the subsequent lockdown restrictions,

and as a result the Investment Manager agreed to capitalise some of the interest due on the

loan, with the sponsor also committing new equity capital into the business. The total outstanding

loan balance is now GBP25.38 million, above the day 1 commitment owing to the capitalised

interest.

Following the easing of lockdown restrictions and to aid working capital recovery, the Investment

Manager agreed to staged payments of interest from the sponsor, in exchange for an increase

to the minimum earnings due from the loan. This will be beneficial for shareholders in the

event of any early repayment.

Property profile Debt profile

Number of properties 10 Day one debt GBP20,267,119

------------------- -------------------

Property value (GBP) * GBP34,026,976 Debt outstanding GBP25,382,017

------------------- ------------------- --------------

Number of tenants n/a Original term 4.1 years

------------------- ------------------- --------------

Weighted lease length n/a Maturity October 2023

------------------- ------------------- --------------

LTV as at 31 July 74.6%

------------------------------------------------------------------------ --------------

*pro rata based on Company's share of total loan

------------------- --------------

LBS

In September 2019, the Group entered into a GBP6.5 million loan commitment with a fund advised

by LBS Properties, secured by a multi-let office property in Farringdon, London.

The loan carried an initial LTV ratio of 69.0%, and included a capital expenditure commitment

in support of the borrower's business plan for a full refurbishment of the property. The refurbishment

works were completed ahead of schedule, a new tenant was secured for the majority of the space

and an improvement in the valuation was recorded, with the LTV now 58.9 % . Loan performance

was stable during the period but remains ahead of business plan overall.

Property profile Debt profile

Number of properties 1 Day one debt GBP4,922,000

-------------- -------------------------- -------------

Property value GBP11,000,000 Debt outstanding GBP6,474,586

-------------- -------------------------- -------------

Property value per sq. ft. GBP1,042 Original term 3.1 years

-------------- -------------------------- -------------

Property area (sq. ft.) 10,557 Maturity October 2022

-------------- -------------------------- -------------

Number of tenants 1 LTV as at 31 July 58.9%

-------------- -------------------------- -------------

Weighted lease length 9.0 years Loan exposure per sq. ft. GBP613

-------------- -------------------------- -------------

Knowsley

The Group entered into a new GBP7.75 million loan commitment in March 2020 to an affiliate

of Seybourne Estates, secured by a multi-let industrial property in Knowsley, Merseyside.

The property is spread over 37 acres and originally comprised an income-producing industrial

estate which provides cashflow to service the loan, alongside a development site which was

pre-let to a new tenant. The Sponsor completed the build out of this property during the period,

and the lease has now commenced with the loan fully drawn.

Following completion of the Sponsor's business plan, the property was independently revalued

at GBP12.29 million, reflecting a LTV as at the date of these accounts of 63.1%. We are aware

that the Sponsor is in discussions for a possible sale of all or part of the security property

which, if concluded, would see the Group's loan repaid.

Property profile Debt profile

Number of properties 1 Day one debt GBP3,500,000

-------------- -------------------------- -------------

Property value GBP12,290,000 Debt outstanding GBP7,750,000

-------------- -------------------------- -------------

Property value per sq. ft. GBP77 Original term 3.1 years

-------------- -------------------------- -------------

Property area (sq. ft.) 160,149 Maturity April 2023

-------------- -------------------------- -------------

Number of tenants 5 LTV as at 31 July 63.1%

-------------- -------------------------- -------------

Weighted lease length 6.8 years Loan exposure per sq. ft. GBP48

-------------- -------------------------- -------------

GMG

In July 2020 the Group entered into a GBP16.9 million commitment with an affiliate of GMG

Real Estate, secured by an office property in St James's, London. The Group is participating

in a larger three-year, GBP22.3 million loan alongside another client of the Investment Manager.

The property was originally leased to a UK Government Agency, with a short unexpired lease

term. The tenant vacated the property allowing the sponsor to complete a renovation of the

space, in line with the business plan and using funds from the committed facility. The refurbishment

works completed after period end and the sponsor has had some early letting success, with

two floors in solicitors' hands at levels ahead of business plan.

With the works now finalised the LTV is stated based on the independent valuer's assumed valuation

upon completion, with the LTV on this basis being 76.8%. We expect this to steadily fall as

new leases are agreed.

Property profile Debt profile

Number of properties 1 Day one debt GBP12,753,393

------------------ ---------------------------

Property value GBP20,495,700 Debt outstanding GBP15,738,802

------------------ --------------------------- --------------

Property value per sq. ft. GBP1,239 Original term 2.2 years

------------------ --------------------------- --------------

Property area (sq. ft.) 21,786 Maturity October 2022

------------------ --------------------------- --------------

Number of tenants - LTV as at 31 July 76.8%

------------------- -------------------------- --------------

Weighted lease length - Loan exposure per sq. ft. GBP941

------------------- -------------------------- --------------

* pro rata based on Company's share of total loan

Subsequent Events

Significant subsequent events have been disclosed in Note 11 to

the Financial Statements .

ICG Real Estate

29 September 2021

Directors' Responsibilities Statement

The Directors are responsible for preparing this Interim

Financial Report in accordance with applicable law and regulations.

The Directors confirm that to the best of their knowledge:

-- The Unaudited Condensed Consolidated Interim Financial

Statements have been prepared in accordance with IAS 34 Interim

Financial Reporting as adopted by the EU; and

-- The Chairman's Statement and Investment Manager's Report

include a fair review of the information required by:

(i) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the Unaudited Condensed Consolidated Interim Financial

Statements; and a description of the principal risks and

uncertainties for the remaining six months of the year; and

(ii) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the financial year and that have materially

affected the financial position and performance of the entity

during that period; and any changes in the related party

transactions described in the last Annual Report and Financial

Statements that could do so.

On behalf of the Board

Jack Perry

Chairman

29 September 2021

Principal Risks and Uncertainties

The Company, through its subsidiary, invests primarily in UK

commercial real estate loans of a fixed rate nature; as such, it is

exposed to the performance of the borrower, and underlying property

on which its loans are secured. The Company's key risks are

discussed below. In this statement, references to the Company also

apply to the Group as a whole.

The Directors have identified the following as the key risks

faced by the Company:

-- timing of capital repayments and dividend maintenance;

-- inability to secure sales or refinancing of underlying properties;

-- non-payment of interest;

-- fall in collateral values and accuracy of valuations;

-- economic risk; and

-- portfolio diversification.

The principal risks and uncertainties of the Company were

identified in further detail in the Annual Report and Financial

Statements for the year ended 31 January 2021. The Covid-19

pandemic has had a profound impact on economic and certain market

conditions in the six months ended 31 July 2021. The effect of the

pandemic on the Company's portfolio of loans and its assessment of

new investment opportunities has been assessed by the Investment

Manager and is discussed in detail elsewhere in this report. The

Company's principal risk factors are fully discussed in the

Company's Prospectus, available on the Company's website

(www.lbow.co.uk) and should be reviewed by shareholders.

Condensed Consolidated Statement of Comprehensive Income

FOR THE SIX MONTH PERIOD TO 31 JULY 2021

1 February 2021 to 1 February 2020 to 1 February 2020 to

31 July 2021 31 July 2020 31 January 2021

GBP GBP GBP

Notes (Unaudited) (Unaudited) (Audited)

---------------------------------------- ---------------------------------------- ---------------------------------------

Income

Income from loans 4,640,240 4,649,438 9,655,862

Other fee income

from loans 34,000 296,547 297,979

Income from cash and

cash equivalents - 47 49

Total income 4,674,240 4,946,032 9,953,890

---------------------------------------- ---------------------------------------- ---------------------------------------

Expenses

Investment

management/advisory

fees 9 595,958 595,971 1,195,588

Other expenses 10 262,617 447,180 740,022

Reorganisation costs 156,800 - 208,397

Directors'

remuneration 91,375 98,750 199,953

Finance costs 47,382 84,655 194,664

Total expenses 1,154,132 1,226,556 2,538,624

---------------------------------------- ---------------------------------------- ---------------------------------------

Profit for the

period/year before

tax 3,520,108 3,719,476 7,415,266

---------------------------------------- ---------------------------------------- ---------------------------------------

Taxation charge 2,079 - 4,461

Profit for the

period/year after

tax 3,518,029 3,719,476 7,410,805

---------------------------------------- ---------------------------------------- ---------------------------------------

Total comprehensive

income for the

period/year 3,518,029 3,719,476 7,410,805

---------------------------------------- ---------------------------------------- ---------------------------------------

Basic and diluted

Earnings per Share

(pence) 5 2.90 3.07 6.11

---------------------------------------- ---------------------------------------- ---------------------------------------

All items within the above statement have been derived from

discontinuing activities on the basis of the orderly realisation of

the company's assets.

The Group has no recognised gains or losses for either period

other than those included in the results above, therefore, no

separate statement of other comprehensive income has been

prepared.

The accompanying notes form an integral part of these Interim

Financial Statements.

Condensed Consolidated Statement of Financial Position

As at 31 July 2021

31 July 2021 31 January 2021 31 July 2020

GBP GBP GBP

Notes (Unaudited) (Audited) (Unaudited)

------------- ----------------------------- -----------------------------

Assets

Cash and cash equivalents 10,466,329 8,773,640 2,183,556

Trade and other receivables 1,620,797 1,233,834 1,976,770

Loans advanced at amortised cost 4 108,468,063 110,712,112 120,674,195

------------- ----------------------------- -----------------------------

Total assets 120,555,189 120,719,586 124,834,521

------------- ----------------------------- -----------------------------

Liabilities

Loan Payable - - 4,400,000

Other payables and accrued

expenses 1,427,105 1,470,447 1,237,626

------------- ----------------------------- -----------------------------

Total liabilities 1,427,105 1,470,447 5,637,626

------------- ----------------------------- -----------------------------

Net assets 119,128,084 119,249,139 119,196,895

------------- ----------------------------- -----------------------------

Equity

Share capital 119,115,310 119,115,310 119,115,310

Retained earnings 12,774 133,829 81,585

------------- ----------------------------- -----------------------------

Total equity attributable to the

owners of the Company 119,128,084 119,249,139 119,196,895

------------- ----------------------------- -----------------------------

Number of ordinary shares in

issue at period/year end 6 121,302,779 121,302,779 121,302,779

------------- ----------------------------- -----------------------------

Net Asset Value per ordinary

share (pence) 5 98.21 98.31 98.26

------------- ----------------------------- -----------------------------

The Interim Financial Statements were approved by the Board of

Directors on 29 September 2021 and signed on their behalf by:

Jack Perry Fiona Le Poidevin

Chairman Director

29 September 2021 29 September 2021

The accompanying notes form an integral part of these Interim

Financial Statements.

Condensed Consolidated Statement of Changes in Equity

For the six month period to 31 July 2021

Number Share Retained

of shares capital earnings Total

GBP GBP GBP

Notes (Unaudited) (Unaudited) (Unaudited)

As at 1 February 2021 121,302,779 119,115,310 133,829 119,249,139

Profit for the period - - 3,518,029 3,518,029

Dividends paid 7 - - (3,639,084) (3,639,084)

As at 31 July 2021 121,302,779 119,115,310 12,774 119,128,084

------------ ------------ ------------ ------------

For the six month period to 31 July 2020

Number Share Retained

Notes of shares capital earnings Total

GBP GBP GBP

(Unaudited) (Unaudited) (Unaudited)

As at 1 February 2020 121,302,779 119,115,310 1,192 119,116,502

Profit for the period - - 3,719,476 3,719,476

Dividends paid 7 - - (3,639,083) (3,639,083)

As at 31 July 2020 121,302,779 119,115,310 81,585 119,196,895

------------ ------------ ------------ ------------

The accompanying notes form an integral part of these Interim

Financial Statements.

Condensed Consolidated Statement of Cash Flows

For the six month period to 31 July 2021

1 February 2021 to 1 February 2020 to 1 February 2020 to

31 July 2021 31 July 2020 31 January 2021

GBP GBP GBP

Notes (Unaudited) (Unaudited) (Audited)

------------------- ------------------- -------------------

Cash flows generated from operating activities

Profit for the period/year 3,518,029 3,719,476 7,410,805

Adjustments for non-cash items and working

capital movements:

Movement in other receivables (386,963) (691,304) 51,632

Movement in other payables and accrued

expenses (45,402) (764,525) (522,614)

Movement in tax payable 2,061 - (9,090)

Loan amortisation (608,726) 197,071 (512,292)

2,478,999 2,460,718 6,418,441

Loans advanced (3,938,975) (20,721,920) (27,442,180)

Arrangement fees paid - - 297,980

Loans repaid 4 6,791,749 21,500,000 38,593,726

Net loans (advanced)/repaid less arrangement

fees 2,852,774 778,080 11,449,526

------------------- ------------------- -------------------

Net cash generated from operating activities 5,331,773 3,238,798 17,867,967

------------------- ------------------- -------------------

Cash flows used in financing activities

Net amounts repaid on loan facility - (800,000) (5,200,000)

Dividends paid 7 (3,639,084) (3,639,083) (7,278,168)

------------------- ------------------- -------------------

Net cash used in financing activities (3,639,084) (4,439,083) (12,478,168)

------------------- ------------------- -------------------

Net movement in cash and cash equivalents 1,692,689 (1,200,285) 5,389,799

Cash and cash equivalents at the start of the

period/year 8,773,640 3,383,841 3,383,841

Cash and cash equivalents at the end of the

period/year 10,466,329 2,183,556 8,773,640

------------------- ------------------- -------------------

The accompanying notes form an integral part of these Interim

Financial Statements.

Notes to the Unaudited Condensed Consolidated Interim Financial

Statements

For the six month period to 31 July 2021

1. General information

ICG-Longbow Senior Secured UK Property Debt Investments Limited

is a non-cellular company limited by shares and was incorporated in

Guernsey under the Companies Law on 29 November 2012 with

registered number 55917 as a closed-ended investment company. The

registered office address is Floor 2, PO Box 286, Trafalgar Court,

Les Banques, St Peter Port, Guernsey, GY1 4LY.

The Company's shares were admitted to the Premium Segment of the

Official Lists and to trading on the Main Market of the London

Stock Exchange on 5 February 2013.

The unaudited condensed consolidated financial statements

comprise the financial statements of the Group as at 31 July

2021.

In line with the revised Investment Objective and Policy

approved by shareholders in the Extraordinary General Meeting in

January 2021, the Company is now undertaking an orderly realisation

of its investments. As sufficient funds become available the Board

intends to return capital to shareholders, taking account of the

Company's working capital requirements and funding commitments.

ICG Alternative Investment Limited is the external discretionary

investment manager. The Board resolved to simplify its corporate

structure by collapsing the Luxembourg subsidiary company which has

historically acted as the lender for the Group's investments.

Following year ended 31 January 2021, the process of winding up the

Luxembourg company has now commenced.

2. Accounting policies

a) Basis of preparation

The Interim Financial Statements included in this Interim

Report, have been prepared in accordance with IAS 34 'Interim

Financial Reporting', as adopted by the EU, and the Disclosure and

Transparency Rules of the FCA.

The Interim Financial Statements have not been audited or

reviewed by the Company's Auditor.

The Interim Financial Statements do not include all the

information and disclosures required in the Annual Report and

Financial Statements and should be read in conjunction with the

Company's Annual Report and Financial Statements for the year ended

31 January 2021, which are available on the Company's website

(www.lbow.co.uk). The Annual Report and Financial Statements have

been prepared in accordance with IFRS as adopted by the EU.

The same accounting policies and methods of computation have

been followed in the preparation of these Interim Financial

Statements as in the Annual Report and Financial Statements for the

year ended 31 January 2021.

The Company applied, for the first time, certain standards and

amendments, which are effective for annual periods beginning on or

after 1 January 2021. The new standards or amendments to existing

standards and interpretations, effective from 1 January 2021, did

not have a material impact on the Company's interim condensed

financial statements. It is not anticipated that any standard which

is not yet effective, will have a material impact on the Company's

financial position or on the performance of the Company's

statements.

b) Going concern

The Directors, at the time of approving the Interim Financial

Statements, are required to satisfy themselves that they have a

reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future and do

not consider there to be any threat to the going concern status of

the Group. At the EGM of the Company on 14 January 2021, following

a recommendation from the Board published in a circular on 16

December 2020, shareholders voted by the requisite majority in

favour of a change to the Company's Objectives and Investment

Policy which would lead to an orderly realisation of the Company's

assets and a return of capital to shareholders.

It is intended that the investments will be realised as and when

the loans fall due, and the Directors expect that the investments

will be held to maturity with the last loan repaying by the end of

2023. Whilst the Directors are satisfied that the Company has

adequate resources to continue in operation throughout the

realisation period and to meet all liabilities as they fall due,

given the Company is now in a managed wind down, the Directors

consider it appropriate to adopt a basis other than a going concern

in preparing the consolidated financial statements. The basis of

valuation for investments is fair value, recognising the realisable

value of each investment in the orderly wind down of the Company.

There has been no material change in the carrying value of the

investments. No material adjustments have arisen as a result of

ceasing to apply the going concern basis.

c) Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board of Directors, as a

whole. The key measure of performance used by the Board to assess

the Group's performance and to allocate resources is the total

return on the Group's Net Asset Value, as calculated under IFRS,

and therefore no reconciliation is required between the measure of

profit or loss used by the Board and that contained in the Interim

Financial Statements.

For management purposes, the Group is organised into one main

operating segment, being the provision of a diversified portfolio

of UK commercial property backed senior debt investments.

The majority of the Group's income is derived from loans secured

on commercial and residential property in the United Kingdom.

Due to the Group's nature, it has no employees.

The Group's results do not vary significantly during reporting

periods as a result of seasonal activity.

3. Critical accounting judgements in applying the Group's accounting policies

The preparation of the Interim Financial Statements under IFRS

requires management to make judgements, estimates and assumptions

that affect the application of policies and reported amounts of

assets and liabilities, income and expenses. The estimates and

associated assumptions are based on historical experience and other

factors that are believed to be reasonable under the circumstances,

the results of which form the basis of making judgements about

carrying values of assets and liabilities that are not readily

apparent from other sources. Actual results may differ from these

estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision affects

only that period or in the period of the revision and future period

if the revision affects both current and future periods.

Critical judgements

In assessing ECL, the Board has made critical judgements in

relation to the staging of the loans and assessments which impact

the loss given default. In assessing whether the loans have

incurred a significant increase in credit risk the Investment

Manager, on behalf of the Board, assesses the credit risk attaching

to each of the loans. The Group has adopted the Investment

Manager's internal credit rating methodology and has used its loss

experience to benchmark investment performance and potential

impairment for both Stage 1 and Stage 2 loans under IFRS 9

considering both probability of default and loss given default. The

judgement applied in allocating each investment to Stage 1, 2 or 3

is key in deciding whether losses are considered for the next 12

months or over the life of the loan. The Board has estimated that

two loans have shown evidence of heightened credit risk. In

assessing the ultimate ECL in relation to these loans, the Board

has made assumptions regarding the collateral value and headroom

over the principal loan amounts as well as the residual term of the

loans.

The measurement of both the initial and ongoing ECL allowance

for loan receivables measured at amortised cost is an area that

requires the use of significant assumptions about credit behaviour

such as likelihood of borrowers defaulting and the resulting

losses. In assessing the probability of default, the Board has

taken note of the experience and loss history of the Investment

Manager which may not be indicative of future losses. The default

probabilities are based on a number of factors including interest

cover and LTV headroom which the Investment Manager believes to be

a good predictor of the probability of default, in accordance with

recent market studies of European commercial real estate loans. The

effects of Covid-19 on certain real estate markets has impacted

valuations and resulting LTVs, with any future impact of the

pandemic across the wider markets remaining uncertain. However, the

Directors consider the loss given default to be close to zero as

the loans are the subject of very detailed due diligence procedures

on inception and close monitoring through their life to provide

early warning of a deteriorating credit position. In line with the

Company's investment strategy when the investments were made, most

loans benefit from significant LTV headroom, and business plans

designed to deliver further value increases overtime. Following the

change in Investment Strategy to one of orderly wind down the

Investment Manager, and the Board, have placed greater emphasis on

the source and delivery of repayment

over the residual term of each loan when assessing the risk of capital loss. As a result of these considerations, no loss allowance has been recognised based on 12-month ECLs for those in stage 1 nor for lifetime losses for those in stage 2, as any such impairment would be wholly insignificant to the Group.

Revenue recognition is considered a significant accounting

judgement and estimate that the Directors make in the process of

applying the Group's accounting policies.

The Directors also make estimates in determining the fair value

of prepayment options embedded within the contracts for loans

advanced. The key factors considered in the valuation of prepayment

options include the exercise price, the interest rate of the host

loan contract, differential to current market interest rates, the

risk free rate of interest, contractual terms of the prepayment

option, and the expected term of the option. Given the low

probability of exercise and undeterminable exercise date, the value

attributed to these embedded derivatives is considered to be GBPnil

(31 January 2021: GBPnil).

4. Loans advanced

(i) Loans advanced

31 July 2021 31 July 2021 31 January 2021 31 January 2021

Principal advanced Fair value (at amortised cost) Principal advanced Fair value (at amortised cost)

GBP GBP GBP GBP

Northlands 9,963,590 10,000,160 9,578,514 9,542,788

Halycon - - 5,732,465 5,864,704

Quattro 8,858,259 8,979,848 8,853,459 8,974,982

Affinity 17,299,963 17,657,901 16,700,000 17,010,855

Southport 15,000,000 15,132,877 16,059,285 16,157,217

RoyaleLife 25,382,017 26,549,925 25,382,017 26,174,473

LBS 6,474,586 6,501,067 6,283,119 6,271,791

Knowsley 7,750,000 7,785,753 7,750,000 7,747,844

GMG 15,738,802 15,860,532 12,981,133 12,967,458

106,467,217 108,468,063 109,319,992 110,712,112

------------------------------------ -------------------------------------- ------------------------------- -------------------------------

(ii) Valuation considerations

As noted above the Company is now in the process of an orderly

wind down. It remains the intention of the Manager and Directors to

hold loans through to their repayment date. The Directors consider

that the carrying value amounts of the loans, recorded at amortised

cost in the Interim Financial Statements, are approximately equal

to their fair value. For further information regarding the status

of each loan and the associated risks see the Investment Manager's

Report.

Amortised cost is calculated using the effective interest rate

method which takes into account all contractual terms (including

arrangement and exit fees) that are an integral part of the loan

agreement. As these fees are taken into account when determining

initial net carrying value, their recognition in profit or loss is

effectively spread over the life of the loan.

The Group's investments are in the form of bilateral loans, and

as such are illiquid investments with no readily available

secondary market. Whilst the terms of each loan includes repayment

and prepayment fees, in the absence of a liquid secondary market,

the Directors do not believe a willing buyer would pay a premium to

the par value of the loans to recognise such terms and as such the

amortised cost is considered representative of the fair value of

the loans.

Each property on which investments are secured was subject to an

independent, third party valuation at the time the investment was

entered into. All investments are made on a hold to maturity basis.

Each investment is monitored on a quarterly basis, in line with the

underlying property rental cycle, including a review of the

performance of the underlying property security. No market or other

events have been identified through this review process which would

result in a fair value of the investments significantly different

to the carrying value.

Whilst the forced closure of much of the UK economy due to

Covid-19 lockdown during the period has impacted rent collection

and business plan progress on a number of investments, resulting in

interest deferral, capitalisation and in some cases term

extensions, the balance outstanding in each case is at a

substantial discount to the value of the underlying real estate on

which they are secured, the Directors do not consider any loan to

be subject to specific impairment, or for there to be a risk of not

achieving full recovery, including arears of interest over the

residual term of each loan.

(iii) IFRS 9 - Impairment of Financial Assets

The internal credit rating of each loan as at 31 July 2021 has

been reviewed. Of the three loans identified as Stage Two assets at

31 January 2021, two have shown positive credit migration following

the delivery of the underlying business plans and one remains at

Stage Two. One additional loan showed deterioration in its internal

credit rating since 31 January 2021 and has been considered as a

stage 2 asset; all other loans showed no deterioration and were

considered as Stage 1 assets with no ECL over a twelve month

period.

As at 31 July 2021

Stage 1 Stage 2 Stage 3 Total

Principal advanced 80,308,995 26,158,222 - 106,467,217

----------- ----------- -------- ------------

Gross carrying value 81,830,314 26,637,749 108,468,063

Less ECL allowance - - - -

----------- ----------- -------- ------------

81,830,314 26,637,749 - 108,468,063

----------- ----------- -------- ------------

As at 31 January 2021

Stage 1 Stage 2 Stage 3 Total

Principal advanced 84,407,248 24,912,744 - 109,319,922

----------- ----------- -------- ------------

Gross carrying value 85,579,913 25,132,199 - 110,712,112

Less ECL allowance - - - -

----------- ----------- -------- ------------

85,579,913 25,132,199 - 110,712,112

----------- ----------- -------- ------------

The stage 2 loans at 31 July 2021 were Quattro and Affinity.

The Stage 2 loan, Quattro, was first identified as a Stage 2

asset at 31 January 2019 following a deterioration in credit rating

as a result of a reduction in interest cover as the interest

reserve was utilised. The borrower has made significant progress in

new lettings and adding value through the development of

residential apartments above one of the properties and, following

the period end made a first partial repayment of the loan following

an asset sale. The new apartments have been completed following the

period end and are now under offer for sale which will lead to a

further pay down of the loan and a consequential improvement in

risk profile. Whilst the loan has passed its formal maturity date,

given the positive progress in the period and favourable valuation

outlook, the Investment Manager has agreed a short-term extension

of the facility to allow for an orderly repayment. The loan remains

at Stage 2 and no provision for impairment is deemed necessary

given the level of valuation equity in the residual portfolio and

repayment plans in place.

In the case of the Affinity loan, in line with business plan,

the Sponsor has drawn down on capital expenditure facilities to

complete the refurbishment of the building, resulting in a higher

loan to value exposure. Whilst new lettings are in place leading to

increase contractual rents, these are currently in rent free

periods meaning interest cover has also reduced. Looking through to

the contractual income we expect the loan to exhibit material

credit improvement in the near term and as such no provision for

impairment is deemed necessary.

Two loans previously considered at Stage 2 (Southport and

RoyaleLife) due to the impact of Covid lockdowns on their

respective business plans have exhibited material credit

improvement, in terms of either asset valuation or operating

income, as the UK economy has reopened.

All other loans showed no deterioration and were considered as

Stage 1 assets with no ECL over a twelve month period.

Following the change in Investment Policy and expectation that

the Company will be wound up through an orderly repayment of loans

by the borrowers, and given the significant equity valuation buffer

present in all loans relative to the residual term, then,

notwithstanding the IFRS9 sensitivity analysis discussed below, the

loans are not considered to be permanently impaired and no