TIDMIDOX

RNS Number : 9513A

IDOX PLC

07 June 2021

07 June 2021

Idox plc

('Idox' or the 'Group' or the 'Company')

Acquisition

Idox acquires Aligned Assets , a UK based public sector software

business

ldox plc (AIM: IDOX), a leading supplier of specialist

information management software and solutions to the public and

asset-intensive sectors, is pleased to announce the acquisition of

Aligned Assets Holdco Limited ("Aligned Assets"), a UK based public

sector software business.

Highlights

-- Acquisition enhances Idox's leading offering to local authorities

-- Builds on public sector software focused growth strategy,

following disposal of Content division

-- Initial cash consideration of GBP7.5m paid from Idox's existing resources

-- Expected to be immediately earnings enhancing

Financials

Initial cash consideration is GBP7.5m, increasing to a total

maximum of GBP10.5m, comprising earn-out amounts of up to GBP1.5m

payable in cash and GBP1.5m payable in equity over two years. The

size of earn-out is dependent on progress against targets

associated with retention of existing recurring revenues, winning

new revenues, and delivery of technical advancements and

integrations with the existing Idox Group product set. The

consideration will be funded from Idox's existing financial

resources, which were bolstered by the disposal of its Content

division in March 2021.

About Aligned Assets

A well-established software business with high levels of

recurring revenue, Aligned Assets has provided software solutions

to local authorities and a range of other public and private

sectors for Address Management Solutions for over 20 years.

As market leaders in the address management field, Aligned

Assets provide cutting edge solutions ranging from high-speed

matching and cleansing, to sub-second predictive searching, as well

as solutions for managing, sharing and viewing address data

including in augmented reality. For local authorities, the business

provides specialist cloud-based solutions for creating and managing

Local Land and Property Gazetteers (LLPG) and Local Streets

Gazetteers (LSG), as well as street naming and numbering.

Aligned Assets is based in Woking and has 24 employees. As part

of the acquisition, both Aligned Assets Directors will continue in

their current roles as part of the Idox Group.

Significant benefits to Idox

The acquisition of Aligned Assets will enhance Idox's market

leading offering to local authorities in relation to the built

environment and is in line with Idox's acquisition criteria of

purchasing UK based, public sector focused businesses with strong

internal IP. The product set of Aligned Assets is complimentary to

Idox Cloud and will support future organic growth in this area.

It is expected to be immediately earnings enhancing and the

Board believes there is scope to deliver attractive profit growth

over the medium term through a range of commercial synergies.

David Meaden, CEO of Idox commented:

"This is a valuable acquisition for Idox that builds on our

public sector software focused growth strategy. Having recommended

Aligned Assets to existing customers to use alongside our own built

environment software, the acquisition will enhance and optimise our

current offering and is a natural fit.

"We look forward to welcoming the Aligned Assets team to Idox

and are confident that the combination will drive value for the

customers of both organisations and for shareholders."

Notes:

For the year ended 31 March 2020, Aligned Assets reported

revenues of GBP2.2m and PBT of GBP0.8m. Net assets at 31 March 2020

were GBP2.3m. For the year ended 31 March 2021, Aligned Assets

expects to report revenues of GBP2.7m, of which 75% are recurring

and GBP1.4m of EBITDA, under Idox's accounting policies, with gross

assets of GBP0.4m. Aligned Assets is majority owned and controlled

by its four directors Andy Hird, Dinesh Thanigasalam, Carl Nunn and

Phillip Gee who control 94% of the shares, with certain individuals

making up the other 6%.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

The person responsible for making this notification is Ruth

Paterson, Company Secretary.

-Ends-

Enquiries :

Idox plc +44 (0) 870 333 7101

Chris Stone, Non-Executive Chairman

David Meaden, Chief Executive

Rob Grubb, Chief Financial Officer

Peel Hunt LLP (NOMAD and Broker) +44 (0) 20 7418 8900

Edward Knight

Paul Gillam

Nick Prowting

MHP Communications +44 (0) 203 128 8170

Reg Hoare / James Bavister / Amy O'Sullivan idox@mhpc.com

About Idox plc

For more information see www.idoxplc.com @Idoxgroup

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFFMLTMTJMMAB

(END) Dow Jones Newswires

June 07, 2021 02:00 ET (06:00 GMT)

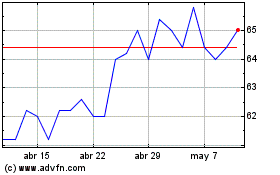

Idox (LSE:IDOX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

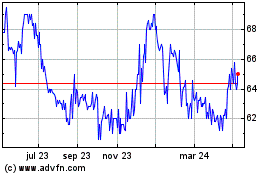

Idox (LSE:IDOX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024