TIDMIMC

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF

REGULATION (EU) NO. 596/2014 OF THE EUROPEAN PARLIAMENT AND THE COUNCIL OF 16

APRIL 2014 ON MARKET ABUSE AS IT FORMS PART OF RETAINED EU LAW AS DEFINED IN

THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (THE "MARKET ABUSE REGULATION"). UPON

THE PUBLICATION OF THIS ANNOUNCEMENT THE INSIDE INFORMATION IS NOW CONSIDERED

TO BE IN THE PUBLIC DOMAIN. THE INFORMATION CONTAINED IN THIS ANNOUNCEMENT IS

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE

OR IN PART, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, HONG KONG,

SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO SO.

PLEASE SEE THE IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT IS NOT A PROSPECTUS AND THIS ANNOUNCEMENT DOES NOT CONSTITUTE

OR FORM PART OF, AND SHOULD NOT BE CONSTRUED AS, ANY OFFER, INVITATION OR

RECOMMATION TO PURCHASE, SELL OR SUBSCRIBE FOR ANY SECURITIES IN ANY

JURISDICTION AND NEITHER THE ISSUE OF THE INFORMATION NOR ANYTHING CONTAINED

HEREIN SHALL FORM THE BASIS OF OR BE RELIED UPON IN CONNECTION WITH, OR ACT AS

AN INDUCEMENT TO ENTER INTO, ANY INVESTMENT ACTIVITY. A CIRCULAR AND PROSPECTUS

IN RELATION TO THE TRANSACTION DESCRIBED IN THIS ANNOUNCEMENT WILL BE PUBLISHED

IN DUE COURSE.

15 April 2021

IMC EXPLORATION GROUP PLC

("IMC")

Proposed acquisition of Karaberd Mine

IMC is pleased to announce that it has conditionally agreed to purchase the

Karaberd Mine, a gold mine located in Lori Marz, northern Armenia. If the

proposed acquisition proceeds, it will take effect via the acquisition by IMC

of the entire issued share capital of MVI Ireland s.r.o. ("MVI") from Mineral

Ventures Invest spol. s r.o. (the "Seller"), (the "Acquisition"), a transaction

which is classified as a reverse takeover pursuant to the Listing Rules made by

the Financial Conduct Authority of the United Kingdom ("FCA") (the "Listing

Rules"), and the Irish Takeover Panel Act 1997, Takeover Rules 2013 (the "

Takeover Rules"), which means that is it subject to and conditional upon the

granting of a waiver of the requirements of Rule 9 of the Takeover Rules by the

Irish Takeover Panel and the approval of IMC's shareholders.

MVI holds the entire issued share capital in Assat, LLC ("Assat"). Assat holds

the operating licence in respect of the Karaberd Mine, together with an

ore-crushing production facility located near the site of the Karaberd Mine.

Application will be made to the FCA and the London Stock Exchange plc ("LSE"),

respectively, for that number of new ordinary shares in IMC ("New Ordinary

Shares") that will equate to 51% of the issued shares in IMC following the

Acquisition to be allotted and issued by IMC to the Seller as the initial

consideration pursuant to the Acquisition (the "Initial Consideration Shares")

to be admitted to the standard segment of the Official List maintained by the

FCA ("Official List") and to trading on the LSE's Main Market for listed

securities ("Main Market") (together, the "Admission") on completion of the

Acquisition.

Further New Ordinary Shares may be allotted and issued by IMC to the Seller as

deferred consideration for the Acquisition on the achievement of certain

milestones specified in the framework agreement entered into on 14 April 2021

between IMC and the Seller in connection with the Acquisition (the "Framework

Agreement").

The closing date of the Acquisition will be on or as soon as practicable after

the date on which IMC and the Seller notify each other of the satisfaction or

waiver of the Conditions (as set out below), and in any event by the fifth

business day following such notification.

Highlights

The Directors consider that the acquisition of the Karaberd Mine and the

development of the Karaberd ore-crushing facility would serve the existing

strategic direction of IMC while expanding the geographic scope of its

operations.

The Directors believe the Acquisition will deliver the following strategic and

financial benefits to the IMC Group:

· It will be transformational for the Group, taking it from being a purely

junior mining exploration company to being both a mining exploration company

and a mining company.

· It enlarges the geographical base of the Group and will give the Group

access to other potential exploration and mining opportunities, thus

facilitating accelerated growth of the Group.

· It will greatly enhance the expertise within the Group, with the addition of

personnel with vast experience in exploration and mining.

· It will give the Group the benefit of access to a polymetal eco-production

facility provider which in turn may be of value when seeking to engage an

eco-production processor for the Groups spoils and tailings polymetal project

in Avoca.

· Following initial and successful production of crushed ore from the Karaberd

mine, the Group would then have a source of cash-flow.

· Having a source of cash-flow should markedly improve the Group's ratings in

the financial markets and accordingly enhance the Groups growth prospects

through greater access to capital.

· An immediate financial benefit to the Groups working capital will be the

provision by the Seller of ?20,000 per month over 24 months totalling ?480,000

over the two-year period.

· The Group will have the further benefit of a Deposit of $650,000 paid to

China National Geological and Mining Corporation ("CGM") by the Seller should

the Group wish either to complete or vary a proposed provision of an

Eco-Production Facility at Karaberd by CGM.

Consideration for the Acquisition

In summary, the Acquisition involves the issue of several tranches of shares to

the Seller, each tranche being conditional on the occurrence of certain

milestones. The issue of the Initial Consideration Shares to the Seller will

result in the Seller holding 51% of the enlarged issued share capital of IMC.

Subject to meeting successive milestones, further tranches may be issued which

could result in the Seller holding up to 59.17% of the issued share capital of

IMC (the Initial Consideration Shares together with any additional shares

issued as consideration following meeting the relevant milestones set out in

the Framework Agreement only as the "Consideration Shares").

The Acquisition

· The Acquisition is classified as a reverse takeover under the Listing

Rules and the Takeover Rules. Accordingly, the Acquisition is conditional upon,

among other matters, the approval of the IMC shareholders at a general meeting

of IMC proposed to be held on [projected date] (the "General Meeting") and the

granting of a waiver of the requirement on the Seller to make a general offer

under to Rule 9 of the Takeover Rules by the Irish Takeover Panel.

· IMC expects to publish a combined circular and prospectus, including the

notice of General Meeting (the "Combined Circular and Prospectus") - such

publication will take place as soon as possible.

· The Board intends unanimously to recommend in the Combined Circular and

Prospectus that IMC shareholders vote in favour of the requisite shareholder

resolutions for the reasons mentioned above (the "Resolutions"). The directors

of IMC intend to vote in favour of the Resolutions in respect of their own

beneficial holdings, which amount to approximately 4.62% of IMC's issued share

capital.

IMC current projects

To date, and based on the knowledge and experience of its existing directors

with strong geological backgrounds, IMC has focused on acquiring what it

considered highly prospective exploration licences in Ireland. This has

resulted in IMC concentrating on two major projects, namely its spoils and

tailings polymetal project in Avoca, Wicklow, and its gold exploration project

in North Wexford. IMC is also collaborating with the Raw Materials Group,

Trinity College, Dublin, in relation to characterising the gold-rich Kilmacoo

zone at IMC's Avoca Mine property in Co. Wicklow.

Commenting on the Acquisition, Eamon O'Brien, IMC Chairman, said:

I am very pleased, following comprehensive negotiations over the past year, to

be in a position to present to IMC's shareholders a proposed Acquisition that I

believe will be transformational for IMC.

On becoming Chairman in May 2018, I saw my first task as that of working to

achieve a full listing for IMC on the Standard segment of the London Stock

Exchange's Main Market. That was achieved on 8 July 2019. This gave IMC a

higher profile and the ability to attract projects that would catalyse its

growth.

The proposed Acquisition will transform IMC by adding a mining project and will

generate cash-flow for IMC from both the monthly contribution to working

capital and future mining operations. Furthermore, the geographical reach of

IMC will be extended outside of Ireland which may lead to further opportunities

for growth of IMC.

A prospectus and circular will be issued in due course to IMC's shareholders

setting out in detail all the aspects associated with this proposed

Acquisition.

This summary should be read in conjunction with the full text of this

announcement.

Enquiries:

Keith, Bayley, Rogers & Co. Graham Atthill-Beck: +44 7506 43 41 07

Limited Graham.Atthill-Beck@kbrl.co.uk

Brinsley Holman: +44 7776 30 22 28

Brinsley.Holman@kbrl.co.uk

IMC Exploration Group plc +353 85 233 6033

1 Introduction

Today, IMC announces that it has conditionally agreed to purchase the Karaberd

Mine, a gold mine located in Lori Marz, northern Armenia. If the Acquisition

proceeds, it will happen by way of acquisition by IMC of the entire issued

share capital of MVI from the Seller. As the Acquisition is a reverse takeover

pursuant to the FCA Listing Rules and the Irish Takeover Rules, it is subject

to and conditional upon approval of the IMC shareholders.

MVI holds the entire issued share capital of Assat. Assat holds the operating

licence in respect of the Karaberd Mine, together with an ore-crushing

production facility located near the site of the Karaberd Mine.

Application will be made to the FCA and the LSE, respectively, for Admission of

the Initial Consideration Shares on completion of the Acquisition.

Further New Ordinary Shares may be allotted and issued by IMC to the Seller as

deferred consideration for the Acquisition on the achievement of certain

milestones specified in the Framework Agreement.

The closing date of the Acquisition will be on or as soon as practicable after

the date on which IMC and the Seller notify each other of the satisfaction or

waiver of the Conditions (as set out below), and in any event by the fifth

business day following such notification.

The Karaberd Mine is located in the Lori Marz province in the Republic of

Armenia and is wholly owned by Assat.

Assat is a 100% subsidiary of MVI, which is a Czech-based limited liability

company established in 2020 for the purposes of the transaction contemplated by

the Framework Agreement, which does not own any other assets than 100% of the

issued shares in Assat.

MVI is a wholly-owned subsidiary of the Seller, which is a Czech law limited

liability company established in 2018 with gold exploration activities in the

region of eastern Europe and west Asia. The Seller is a member of a Czech

mining group controlled by the Czech joint-stock holding company Zlato a.s.

which is a leader in gold trading in the Czech market.

As the Acquisition is classified as a reverse takeover under the Listing Rules

and the Takeover Rules, the Acquisition is conditional upon, among other

matters, the approval of IMC's shareholders at the General Meeting.

The General Meeting will be convened in due course for IMC shareholders to

consider and, if thought fit, approve the Resolutions. The Resolutions will be

set out in the Combined Circular and Prospectus which will be published as soon

as possible.

2 Background and strategy

The terms of the Acquisition had been under negotiation between the Seller and

IMC since early 2020 and have been carefully considered by the directors of all

parties involved. The commercial rationale for the transactions contemplated by

the Framework Agreement is based on the following:

(i) it represents a joint-venture of two junior mining companies with

activities in different geographical locations, resulting in the creation of a

substantial mining company with a stronger position on the market;

(ii) use of cash-flow provided by the Seller, being the new major

shareholder of IMC following the Acquisition, to expand the activities of IMC;

(iii) the contribution of the Karaberd Mine to IMC, with the potential

significantly to increase the market capitalisation of IMC as enlarged by the

Acquisition;

(iv) new business and exploration opportunities of IMC owing to Seller's

mining projects in eastern Europe and west Asia; and

(v) sharing of know-how, staff and resources in business activities of the

Seller and IMC resulting in cost efficiency improvements.

3 Summary information on IMC

IMC was incorporated on 27 June 2011 in Ireland and operates under the laws of

Ireland. It is a public limited company domiciled in Ireland. The LEI of IMC is

2138006RYVS4BRW33C48.

IMC's principal activity is prospecting for gold, silver, base metals and

barytes in Ireland, in accordance with the terms of the IMC Group's five

exploration licences. The focus and objective of such prospecting is the

discovery of gold, silver and base metals with a view to establishing the

existence or otherwise of economically recoverable quantities of such metals.

4 Summary information on Karaberd Mine

The Karaberd Mine is located in the Lori Marz province of the Republic of

Armenia and is owned by Assat, together with the Karaberd Mine Operating

License that includes a permitted exploitation area, which is valid until 2024.

Within the allotment, an area of 3.96 ha is currently licensed for mineral

extraction. The mineral resources estimate for the Karaberd Mine as at 20 May

2020 at a 0.8 g/t cut-off grade is as follows:

Mineral Tonnes Bulk Gold Silver Gold Silver

Resource (kt[1]) density (t/ grade (g/ grade (g/ content content

classification m3) t) t) (koz[2]) (koz)

category

Inferred 1,271.3 2.5 5.4 10.6 221 434

[1] kilo-tonnes

[2] kilo-ounces

The geology and exploration activities and mineral resources in the Karaberd

Mine are described in detail in Competent Persons´ Report No. R261.2020 dated

25 June 2020 issued by CSA Global.

Assat is the sole owner of the Karaberd mine and the Karaberd Mine Operating

Licence granted by Armenian Ministry of Territorial Management and

Infrastructures, which authorises Assat to conduct exploration and mining

operations in the Mine. Assat has no assets other than those relating to the

Karaberd Mine and has no liabilities.

MVI which is the sole shareholder of Assat has been established under Czech law

in 2020 as special purpose vehicle purported to hold 100% shares in Assat. This

means that the transfer of MVI to IMC is governed by Czech law rather than

Armenian law. MVI has no assets other than 100% of the issued shares in Assat

and has no liabilities.

The Seller is the sole shareholder of MVI. The Seller is a Czech mining company

with activities in eastern Europe and west Asia and has, among others, various

interests in several mining projects in Armenia. The activities of the Seller

consist of exploration of prospective gold and silver deposits and extraction

of precious metals. The Seller is a member of a Czech mining group controlled

by the Czech joint-stock holding company Zlato a.s., which is a leader in gold

trading on the Czech market.

5 Summary of the key terms of the Acquisition

5.1 Framework Agreement

On 14 April 2021, IMC and the Seller entered into the Framework Agreement under

which IMC has agreed, on the terms and subject to the conditions of the

Framework Agreement, to acquire the entire issued share capital of MVI for the

consideration set out above.

The closing date of the Acquisition will be on or as soon as practicable after

the date on which IMC and the Seller notify each other of the satisfaction or

waiver of the Conditions (as set out below), and in any event by the fifth

business day following such notification.

5.2 Shareholder approvals

As noted above, since the Acquisition is classified as a reverse takeover under

the Listing Rules and the Takeover Rules, the Acquisition is conditional upon,

among other matters, the approval of IMC's shareholders at the General Meeting.

The directors of IMC intend to vote in favour of the Resolutions in respect of

their own beneficial holdings, which amount to approximately 4.62% of the

issued shares in IMC.

5.3 Conditions

The obligation of the parties to complete the Acquisition as set out in the

Framework Agreement is subject to the satisfaction or the waiver of certain

conditions and their continuing satisfaction as at the closing date (the "

Conditions"), as summarised below:

1. there being no warranty breaches which constitute a Material Adverse

Change (as defined below) with respect to IMC or MVI;

2. IMC having obtained a conditional waiver from the Irish Takeover

Panel from the obligation to make a general offer under Rule 9 of the Irish

Takeover Rules;

3. an announcement of the Acquisition having been made by IMC;

4. the publication of the prospectus, having been filed with, and

approved, to the extent necessary by the Irish Takeover Panel and by the FCA;

5. the directors of IMC (and two persons nominated by the Seller to be

new directors of IMC) having signed and delivered responsibility statements and

having been approved for appointment to the board of directors of IMC by IMC's

financial advisers;

6. IMC having made applications for admission of the Initial

Consideration Shares to the Official List and Main Market;

7. certain fees for such admission having been paid by IMC;

8. IMC having obtained approval from its shareholders for (i) the issue

and allotment of the Consideration Shares to the Seller on a non-preemptive

basis, (ii) the waiver of the requirement for the Seller to make a general

offer pursuant to Rule 9 of the Takeover Rules, and (iii) and the adoption of

new articles of association on the closing date;

9. the board of directors of IMC having resolved to (i) issue and allot

the Consideration Shares to the Seller, (ii) appoint two persons nominated by

the Seller as directors of IMC with effect from the closing date;

10. MVI continuing to be sole shareholder of Assat;

11. Assat continuing to be the sole owner of the Karaberd Mine, free from

encumbrances and to hold the Karaberd operating licence which shall be current

and in full force and effect and not subject to any action by Armenian Ministry

of Territorial Management and Infrastructures seeking revocation or any

qualification;

12. MVI's due diligence having been carried out to the satisfaction of MVI

(i.e. that no adverse finding gives rise to a Material Adverse Change with

respect to IMC);

13. IMC's due diligence having been carried out to the satisfaction of IMC

(i.e. that no adverse finding gives rise to a Material Adverse Change with

respect to MVI or the Karaberd Mine); and

14. no Material Adverse Change having occurred with respect to IMC or MVI.

A "Material Adverse Change" is defined in the Framework Agreement as, inter

alia, an event causing a material and adverse effect to the combined Enlarged

Group which cannot be remedied within a period of 180 days or without the

expenditure of ?1,000,000 or less, excluding certain pandemic-related events.

5.4 Financing the Acquisition

As above, the Acquisition involves the issue of several tranches of shares in

IMC to the Seller, each tranche being conditional on the happening of certain

events. The initial issue of a tranche of shares to the Seller will result in

the Seller holding 51% of the issued share capital of IMC. Subject to meeting

successive milestones, further tranches may be issued which could result in the

Seller holding up to 59.17% of the issued share capital of IMC.

5.5 Management and employees

The Board of IMC will be increased by the addition of two directors appointed

by the Seller. From an operational point of view in Armenia, a country

manager, and a senior geologist, will become employees of Assat. A mining

company has been sub-contracted to carry out the mining operations of the

Karaberd mine.

5.6 Dividends

IMC has no intention to pay dividends.

5.7 Expected timetable of events

The Combined Circular and Prospectus containing further details on the

Acquisition, the Board's recommendation, and the notice of the General Meeting

and the Resolutions will be sent to IMC shareholders (other than IMC

shareholders with a registered address in certain excluded jurisdictions) as

soon as possible.

6 DEFINITIONS

"Board" The board of directors of IMC.

"Completion" Completion of the Acquisition.

"Enlarged Group" The IMC Group as enlarged by the Acquisition upon

Completion.

"IMC Group" IMC together with its subsidiaries and

subsidiary undertakings.

"LSE" London Stock Exchange plc.

7 IMPORTANT NOTICE

The contents of this announcement have been prepared by and are the sole

responsibility of IMC.

This announcement is not a prospectus. Investors are urged to read the Combined

Circular and Prospectus if, as and when it is published and, where possible, to

base any investment decisions on the information contained in that document.

The purpose of this announcement is to disclose the Framework Agreement entered

into today between IMC and the Seller and to summarise it in sufficient detail

to give readers a clear picture of the Framework Agreement's terms and its

significance in relation to the Acquisition. The other information contained in

this announcement is for background and contextual purposes only and does not,

for reasons which are explained in the announcement, purport to be full or

complete. No reliance may be placed by any person for any purpose on the

information contained in this announcement or its accuracy, fairness or

completeness. The delivery of this announcement shall not create any

implication that there has been no change in the affairs of IMC or MVI since

the date of this announcement or that the information in this announcement is

correct as at any time subsequent to its date. IMC may issue further

announcement(s) between the date of this announcement and the publication of

the Combined Circular and Prospectus to the extent that it becomes aware of any

matters affecting it or MVI which are liable to be disclosed in accordance with

the Market Abuse Regulation, the FCA's Disclosure Guidance and Transparency

Rules and/or the Listing Rules.

In consultation with their advisers and having regard to the content of this

announcement, the Listing Rules and the disclosure requirements under the

Market Abuse Regulation and the FCA's Disclosure Guidance and Transparency

Rules, the Directors of IMC have formed the view that it should not request the

FCA temporarily to suspend the listing of IMC's shares, thereby causing the

cessation for the duration of such a suspension of trading in its shares on the

Main Market of the LSE.A copy of the Combined Circular and Prospectus when

published will be available from the registered office of IMC and on IMC's

website at https://www.imcexploration.com/ provided that the Combined Circular

and Prospectus will not, subject to certain exceptions, be available to

shareholders in certain excluded jurisdictions.

Neither the content of IMC's website nor MVI's website, nor any website

accessible by hyperlinks on IMC's website or MVI's website, is incorporated in,

or forms part of, this announcement.

This announcement is not to be published, distributed, forwarded or

transmitted, directly or indirectly, in or into the United States. The

distribution of this announcement may be restricted by law in certain

jurisdictions and persons into whose possession any document or other

information referred to herein comes should inform themselves about and observe

any such restriction and consult their professional advisers as appropriate.

Any failure to comply with these restrictions may constitute a violation of the

securities laws of any such jurisdiction.

No Offer of Securities

This announcement does not contain or constitute an offer to sell or issue, or

the solicitation of an offer to buy, securities, including to any person in the

United States, Australia, Canada, South Africa, Japan, Hong Kong or in any

jurisdiction to whom or in which such offer or solicitation is unlawful. The

securities referred to herein may not be offered, sold, pledged, taken up,

exercised, resold, renounced, transferred or delivered, directly or indirectly,

into or within the United States absent registration under the US Securities

Act of 1933, as amended (the "Securities Act") or an applicable exemption from,

or in a transaction not subject to, the registration requirements of the

Securities Act and in compliance with any applicable securities laws of any

state or other jurisdiction of the United States. The securities referred to

herein have not been approved, disapproved or recommended by the US Securities

and Exchange Commission, any state securities commission in the United States

or any other US regulatory authority, nor have any of the foregoing authorities

passed upon or endorsed the merits of the offering of the securities referred

to herein. Subject to certain exceptions, the securities referred to herein may

not be offered or sold in the United States, Australia, Canada, South Africa,

Japan or Hong Kong or to, or for the account or benefit of, any national,

resident or citizen of the United States, Australia, Canada, South Africa,

Japan or Hong Kong. There will be no public offer of securities made in

conjunction with the Acquisition discussed in this announcement and to be more

particularly described in the Combined Circular and Prospectus.

No statement in this announcement is intended as a forecast of future financial

results and no statement in this announcement should be interpreted to mean

that the future financial performance, including earnings (losses) per share,

profits (losses), operating margins (losses), or cash flows of the Enlarged

Group will necessarily match or exceed the published historical earnings

(losses) per share, profits (losses), operating margins (losses) or cash flows

of IMC.

Keith, Bayley, Rogers & Co. Limited, which is authorised and regulated by the

Financial Conduct Authority in the United Kingdom, is acting for IMC and for no

one else in connection with the matters described in this document, including

the Rule 9 Waiver, and accordingly will not be responsible to any person other

than IMC for providing the protections afforded to customers of Keith, Bayley,

Rogers & Co. Limited, or for providing advice to any other person in relation

to the arrangements described in this document, including the Rule 9 Waiver.

Forward-looking Statements

This announcement may include statements that are, or may be deemed to be,

"forward-looking statements". These forward-looking statements may be

identified by the use of forward-looking terminology, including the terms

"believes", "estimates", "plans", "projects", "anticipates", "expects",

"intends", "may", "will" or "should" or, in each case, their negative or other

variations or comparable terminology, or by discussions of strategy, plans,

objectives, goals, future events or intentions. Forward-looking statements may

and often do differ materially from actual results. Any forward-looking

statements reflect IMC's current view with respect to future events and are

subject to risks relating to future events and other risks, uncertainties and

assumptions relating to IMC's business, results of operations, financial

position, liquidity, prospects, growth, strategies, integration of the business

organisations and achievement of anticipated combination benefits in a timely

manner. Forward-looking statements speak only as of the date they are made.

Such forward-looking statements are based on beliefs, expectations and

assumptions of IMC board and other members of senior management regarding IMC's

present and future business strategies, the timetable for integration of MVI,

the benefits to be derived from the Acquisition and the environment in which

IMC, MVI and/or, following Completion, the Enlarged Group will operate in the

future. Although the directors of IMC believe that these beliefs and

assumptions are reasonable, by their nature, forward-looking statements involve

risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future or are beyond IMC's

control. IMC, MVI and/or, following Completion, the Enlarged Group's actual

operating results, financial condition, dividend policy and the development of

the industry in which they operate, as well as the benefits and combination

benefits actually received, may differ materially from the impression created

by the forward-looking statements contained in this announcement. In addition,

even if the operating results, financial condition and dividend policy of IMC,

MVI and/or, following Completion, the Enlarged Group, and the development of

the industry in which they operate, are consistent with the forward-looking

statements contained in this announcement, those results or developments may

not be indicative of results or developments in subsequent periods. Important

factors that could cause these differences include, but are not limited to,

general economic and business conditions, industry trends, competition, changes

in government and other regulation, including in relation to the environment,

health and safety and taxation, labour relations and work stoppages, changes in

political and economic stability and changes in business strategy or

development plans, difficulties encountered in integrating the two

organisations and/or achieving the anticipated combination benefits in a timely

manner and other risks.

You are advised to read this announcement and the Combined Circular and

Prospectus (if, as and when published) in their entirety for a further

discussion of the factors that could affect IMC's and/or the Enlarged Group's

future performance. In light of these risks, uncertainties and assumptions, the

events described in the forward-looking statements in this announcement may not

occur.

Except to the extent required by applicable laws and regulations, including the

Listing Rules of the FCA, each of IMC and Keith, Bayley, Rogers & Co. Limited

and their respective affiliates expressly disclaim any obligation or

undertaking to update, review or revise any forward-looking statement contained

in this announcement whether as a result of new information, future

developments or otherwise.

The persons responsible for this announcement are the Directors of IMC.

END

END

(END) Dow Jones Newswires

April 15, 2021 02:00 ET (06:00 GMT)

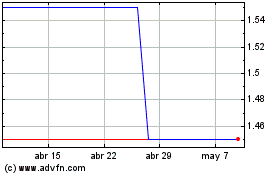

Imc Exploration (LSE:IMC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Imc Exploration (LSE:IMC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024