INTEGRATED VENTURES REPORTS 2021 REVENUES OF $1,851,390 AND SHAREHOLDER'S EQUITY OF $13,363,965.

24 Septiembre 2021 - 8:15AM

ADVFN Crypto NewsWire

INTEGRATED

VENTURES REPORTS 2021 REVENUES OF $1,851,390 AND SHAREHOLDER'S

EQUITY OF $13,363,965.

Philadelphia, PA – September 24, 2021 --

InvestorsHub NewsWire -- Integrated Ventures, Inc, (OTCQB:

INTV), (“Company”) is pleased to confirm the filing of Annual

Report (Form 10K), after the market close, on 09/24/2021, for

financial period, ending on July 30, 2021.

YEAR TO YEAR

REVENUES INCREASED BY 308% AND SHAREHOLDER'S EQUITY GREW BY

2,344%.

Additional financial highlights, for the period ending

06/30/2021 vs 06/30/2020, are as follow:

-

Cryptocurrency mining revenues, mostly during Q3 and Q4,

increased to $1,851,390.00 from $454,170.00.

-

Gross Profit: excluding operational expenses, related to the

non-cash (stock based) management's employment and consultant's

compensation, the Company reported a gross profit from mining

operations, in the amount of $931,014.00 vs loss of

($542,239.00).

-

Total Cash: the Company had reported increase in the total cash

on Balance Sheet, to $2,097,537.00 from $6,675.00.

-

Total Shareholder's Equity or Assets: the Company reported

increase in the total assets on Balance Sheet, to $13,363,965.00

from $546,822.00.

-

Total Liabilities: the Company reported reduction in total

liabilities to $274,083.00 from $656,425.00.

-

Shareholder's Equity: the Company reported increase in the total

Shareholder's Equity, to $5,145,938.00 from $546,822.00.

-

Digital Currencies Holdings were at $245,320 vs $82,855.00. As

of 09/01/2021, INTV had over $2.0 million of digital currencies on

its Balance Sheet.

Steve Rubakh, CEO of Integrated Ventures,Inc, adds the following

commentary:

“INTV has delivered a best year to date results, in terms of (1)

mining revenues, (2) mining equipment purchases of miners made by

Bitmain, Canaan and WhatsMiner, (3) shareholder's equity and asset

growth and (4) equity based capital raised. In addition, our

revenues for Q1/2022 are tracking over $1.8 million.

Must be noted again that mining revenues for 2021 have increased

by 308%, while operational costs and total liabilities were

significantly reduced. The Company ‘s shareholder’s equity, key

component to the Nasdaq uplisting process, has reached $13.36

million. Based on our Bitmain contract and current cryptocurrency

market pricing trend, INTV projects that total revenues for 2022,

shall exceed $35m, with 60%+ operational margins and solid cash

flow.

Future is bright and very defined - INTV is well capitalized and

positioned to move forward, while aggressively expanding its

operations and targeting $70m, in total revenues, by the year

2022.”

About: Integrated Ventures, Inc is Technology

Portfolio Holdings Company with focus on Blockchain Technology and

Cryptocurrency Mining. For more details, please visit the Company's

website: www.integratedventuresinc.com.

Statement: The information posted in this

release may contain forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of1995. You can

identify these statements by use of the words "may," "will,"

"should," "plans," "explores," "expects," "anticipates,"

"continue," "estimate," "project," "intend," and similar

expressions. Forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially

from those projected or anticipated. These risks and uncertainties

include, but are not limited to, general economic and business

conditions, effects of continued geopolitical unrest and regional

conflicts, competition, changes in technology and methods of

marketing, and various other factors beyond the company's

control.

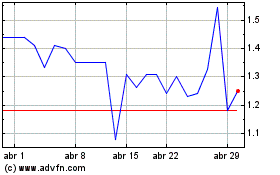

Integrated Ventures (QB) (USOTC:INTV)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Integrated Ventures (QB) (USOTC:INTV)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024