TIDMIQG

RNS Number : 4790L

IQGeo Group PLC

13 September 2021

IQGeo Group plc

(the "Company" or the "Group")

Interim results for the six months ended 30 June 2021

Continued success in orders and revenue growth

IQGeo Group plc (AIM: IQG), a market leading provider of

geospatial productivity and collaboration software for the telecoms

and utility network industries, is pleased to announce its interim

results for the six months ended 30 June 2021.

Operational highlights:

-- Substantial progress in all regions with new customer wins and extensions

-- Successful integration of the OSPInsight (OSPI) business

which was acquired in December 2020 and which now forms our Small

and Medium Business (SMB) unit

-- Release of mobility solution for OSPI customer base

Group financial highlights:

-- Recurring revenue growth of 58% to GBP2.6 million (H1 2020:

GBP1.6 million) representing 40% of H1 revenue (H1 2020: 34%)

-- Annual recurring revenue (ARR) order intake has increased by

88% to GBP1.5 million (H1 2020: GBP0.8 million)

-- Exit ARR* increased by 131% to GBP6.6 million (H1 2020: GBP2.9 million)

-- Gross margin increased to 63% (H1 2020: 51%) due to positive changes in sales mix

-- Substantially reduced adjusted EBITDA** loss of GBP0.4

million (H1 2020: GBP1.2 million) with a reduced loss for the

period of GBP1.0 million (H1 2020: GBP1.7 million)

-- Net cash balance of GBP12.1 million as at 30 June 2021 (31

December 2020: GBP10.5 million, 30 June 2020: GBP11.2 million)

Outlook:

-- Exit ARR of GBP6.6 million provides good visibility of future revenues and cash flows

-- Expected continued progress in profitability and operating

cash flow as recurring revenues continue to grow

*Exit ARR is defined as the current go forward run rate of

annually renewable subscription and M&S agreements

**Adjusted EBITDA excludes amortisation, depreciation, share

option expense, foreign exchange gains/losses on intercompany

trading balances and non-recurring items and is reported as it

reflects the performance of the Group

Richard Petti, Chief Executive Officer, said:

"I am pleased with IQGeo's performance for the first six months

of the year. Despite continued business disruption caused by the

Covid-19 pandemic, IQGeo performed well against all our key metrics

with strong financial performance, product innovation and

go-to-market strategies.

The IQGeo technology continues to develop its best-in-class

solutions enhanced by significant new software releases and the

integration of our award-winning mobile software for the OSPI

customer base, which we have successfully started to deploy.

Development and demand for our cloud-native capabilities continues

to grow as we continue to accelerate our investments in cloud

technology. We have also made significant progress in the rollout

of our new network "system of record" capabilities, deploying this

technology with customers in both North America and EMEA. These

system of record capabilities take the IQGeo solution into the

heart of the incumbent vendor market, significantly strengthening

our competitive positioning.

Direct sales of our software through our enterprise and SMB

teams remains strong with particularly encouraging growth from our

new SMB unit, delivering an exceptional number of new logos in the

first half. We are making steady progress in geographic market

expansion having established new channel, technology and

integration partners to support our market growth objectives in all

our regional markets.

The IQGeo business is on a firm operational and technology

foundation and combined with the growth in the underlying markets

in which we operate, the directors remain very positive about the

outlook for the Group in the second half of the year and

beyond."

For further information contact:

IQGeo Group plc +44 1223 606655

Richard Petti

Haywood Chapman

FinnCap Ltd +44 20 7220 0500

Henrik Persson, Seamus Fricker (Corporate Finance)

Tim Redfern, Richard Chambers (ECM)

Notes to Editors

About IQGeo

IQGeo(TM) (AIM: IQG), delivers award-winning geospatial software

solutions to telecommunication and utility network operators around

the world ranging from large multinationals to smaller regional

providers. The IQGeo software suite improves productivity and

collaboration across enterprise planning, design, construction,

maintenance, and sales processes reducing costs and operational

risks while enhancing customer satisfaction. Our mobile-first,

cloud-native software helps companies create and maintain an

accurate view of their increasingly complex network assets that is

easily accessible by anyone, wherever and whenever needed. Whether

using our Enterprise IQGeo Platform or targeted OSPInsight fiber

planning and design software, we enable a "System of Action" that

breaks down information silos, improves data quality and

accelerates decision making. Headquartered in Cambridge, with

offices in Denver, Salt Lake City, Frankfurt and Tokyo, we work

with some of the largest network infrastructure operators in the

world. For more information visit: www.iqgeo.com/

Chief Executive Officer's statement

Overview

IQGeo's primary target markets of telecommunications and utility

network operators have remained resilient despite the shift in

business priorities and working patterns caused by the Covid-19

pandemic. These industries are providing critical national

infrastructure which has been highlighted by a greater demand for

nation-wide broadband and utility services as more people work from

home in all our key markets. Combine this trend with the rollout of

fibre and 5G services and grid modernisation for electrical network

operators, we expect to see continued strong demand for IQGeo's

end-to-end geospatial software solutions building on the 39 new

logos signed in the first half of 2021.

The first six months of 2021 have unfortunately also witnessed a

number of catastrophic climate events including wildfires, heat

waves, floods and severe storms which have all had a major impact

on both telecommunication and utility networks. One key theme that

has emerged from our markets in these incidents is the need for

greater network resilience. Creating more resilient networks

against a backdrop of year-on-year staffing declines demands that

operators digitise and automate all aspects of their network

lifecycle. Not only must they respond to natural disasters quickly

but put systems in place to proactively seek out, mitigate network

weaknesses and respond quickly when incidents are reported. These

drivers have resulted in significant wins such as the federal

Western Area Power Administration in North America and a new win at

one of the largest Japanese energy companies in the world, where

the IQGeo solution will be used for disaster prevention and

response. Unlike many of our competitors, IQGeo's software is

optimised for the industries we serve, enabling us to help

operators improve the quality and enterprise-wide accessibility of

network information in order to build and maintain more resilient

networks.

The Covid-19 pandemic has also accelerated an ongoing shift in

buying patterns for enterprise software from direct sales

engagement to online research and evaluation. We see potential

customers spending much more time researching and evaluating

software solutions on their own before engaging with salespeople,

with some studies pointing to a 100% increase in digital research

by clients(1) . This shifting pattern plays to the strengths of

IQGeo as an agile, digital organisation. We are constantly

measuring and evaluating our own online footprint and working to

develop digital sales content and marketing strategies that support

online prospects. As a result of this improvement in our online

presence, IQGeo have attracted a greater variety of network

operators including cities, airports, universities, departments of

transport, oil and mining companies aside from the traditional

commercial telecommunications and utilities operators.

This trend toward a greater online presence also speaks to

IQGeo's Cloud-first product architecture that is helping customers

move their software deployments from on-premise to a cloud hosted

environment, a trend we have seen increase significantly with our

customer deployments compared to that of a year ago. While cautious

telecommunications and utility network operators have been slower

to move to cloud-based deployments than other industries, we

believe that the move to cloud will accelerate in the coming years.

There are compelling technical and financial advantages to SaaS

based cloud deployments and IQGeo will continue to invest in this

area to provide an industry leading solution.

(1)

https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/the-b2b-digital-inflection-point-how-sales-have-changed-during-covid-19

Strategic Priorities

The strategic priorities of the Group remain consistent with

those identified within our 2020 Annual report which was published

in April 2021. Since then, the Group has achieved continued

progress against our strategic objectives in the first half and

this positive performance is reflected in our first half

results.

-- Regional Growth: The Group has added 39 new customer logos

during the first six months of the year, with market share being

expanded in North America, Europe and Japan. This included new

business with notable brands such as Shaw Communications and

Western Area Power Administration in North America, Deutsche

GigaNetz and Swish fiber in Europe and two tier one utilities

companies in Japan.

-- Building Recurring Revenues: The combination of new customers

and expansion orders from existing customers has added GBP1.5

million of Annual Recurring Revenues ('ARR') through subscription

and M&S arrangements to our exit ARR, which now stands at

GBP6.6 million.

-- Product Innovation: IQGeo has continued to grow investment in

the IQGeo product stack adding functionality with an increased

focus on cloud capabilities for both enterprise and small/medium

business clients.

Board changes

In May 2021 IQGeo announced the appointment of Carolyn Rand as a

new Non-executive Director to the IQGeo Board. Carolyn is a great

addition to the existing Board members and her extensive expertise

with enterprise mobile software is a particularly good fit given

IQGeo's focus on mobile-first, cloud-native software architecture

and business operations. With a strong background in finance and

audit Carolyn has taken the role of Chair of the Audit

Committee.

Current trading and outlook

Our financial performance remains in-line with Board

expectations, and we remain positive about the outlook for our

target markets in the telecommunication and utility industries.

With major private and public initiatives for electrical grid

modernisation and the roll out of fibre and 5G networks, we

continue to see significant opportunity in our two industry

verticals in all our geographic markets. In addition, the OSPI

acquisition at the end of 2020 has expanded our addressable market

as we successfully target the high-growth area of regional,

private, and governmental fibre network operators.

Richard Petti

Chief Executive Officer

Financial Review

On 21 December 2020 the Group acquired OSPInsight International

Inc. ("OSPI") for a total consideration of up to $8.75 million.

During the six months to 30(th) June 2021, the OSPI business has

been successfully integrated into IQGeo's operations and the

positive results of the acquisition along with the organic growth

achieved by IQGeo's pre-existing operations are reflected in the

Group KPIs below:

KPIs H1 2021 H1 2020

GBP'000 GBP'000

--------------------------------- -------- --------

Total revenue 6,378 4,722

Recurring revenue 2,574 1,625

Recurring revenue % 40% 34%

Exit recurring revenue run rate 6,581 2,850

IQGeo own product orders 6,900 5,500

Gross margin % 63% 51%

Adjusted EBITDA loss (357) (1,209)

Loss for the period (1,041) (1,732)

Recurring revenue net retention 109% 133%

Cash, net of debt 12,115 11,209

--------------------------------- -------- --------

The Group continues to focus on increasing Annual Recurring

Revenue ("ARR") through subscription-based software sales and

maintaining long-term relationships with customers, creating

recurring revenue growth and achieving sustained profitability and

cash flows. ARR also includes maintenance and support arrangements

from perpetual licence sales.

During the first half of 2021, ARR order intake has increased by

88% to GBP1.5 million (H1 2020: GBP0.8 million), the highest ever

recurring revenue order intake for a 6 month period for IQGeo. This

has been achieved through winning 39 new customer logos combined

with expansion sales to existing customers. The Exit ARR of the

Group as of 30 June 2021 has increased by 131% to GBP6.6 million

(H1 2020: GBP2.9 million). Although lower than H1 2020, the

recurring revenue net retention rate of 109% was still pleasing.

The driver behind the 2020 figure was the large order received from

Tokyo Electric and Power Company, an existing customer, in March

2020. In H1 2021, ARR order intake was across 39 new logos as well

as current customers.

Orders

Bookings of orders related to IQGeo own products increased by

over 25% to GBP6.9 million during H1 2021 (H1 2020: GBP5.5 million)

with new customers being added in all three of our key markets

(North America, Europe and Japan). Bookings of orders related to

third-party Geospatial Services were GBP0.2 million (H1 2020:

GBP0.5 million).

IQGeo product order backlog (orders won, revenue not recognised)

as at 30 June 2021 was GBP9.2 million (H1 2020: GBP5.8 million)

with the growth being due to increased order intake. Third-party

Geospatial Services order backlog was GBP0.6 million (H1 2020:

GBP1.0 million).

Revenue

In addition to recurring revenue described above, revenue is

derived from consultancy services on own IP products and also

consultancy services connected to third party products. The Group

continues to focus its strategy on its core IP products rather than

lower margin non-core 3rd party products, this revenue stream will

continue to diminish, replaced by higher margin IQGeo products.

Revenue composition by revenue stream is summarised in the table

below

Revenue by stream H1 2021 % of total H1 2020 % of total Year on

GBP'000 revenue GBP'000 revenue year growth

--------- ----------- --------- -----------

Recurring IQGeo product revenue 2,574 40% 1,625 34% 58%

--------------------------------- --------- ----------- --------- ----------- -------------

Perpetual Software 761 12% 122 3% 524%

Services 2,599 41% 1,847 39% 41%

--------------------------------- --------- ----------- --------- ----------- -------------

Non-recurring IQGeo product

revenue 3,360 53% 1,969 42% 71%

Total IQGeo product revenue 5,934 93% 3,594 76% 65%

--------- ----------- --------- -----------

Geospatial services from

third party products 444 7% 1,128 24% (61)%

--------------------------------- --------- ----------- --------- ----------- -------------

Total revenue 6,378 100% 4,722 100% 35%

--------------------------------- --------- ----------- --------- ----------- -------------

Recurring revenues have increased by 58% to GBP2.6m (H1 2020:

GBP1.6m) as a result of the ARR won during 2020 and the acquired

OSPI customer base. ARR won during H1 2021 has had limited impact

on revenues for the six months ended 30 June 2021, with the

increase in recurring revenues to be realised in future periods.

Sales of perpetual software licences will continue to fluctuate in

reporting periods as the Group continues to focus on subscription

sales and the increase during H1 was due to a single new customer.

The increase in deployments and expansion orders has led to a 41%

increase in associated service revenues which reflects the growing

customer base using IQGeo software. The Group continues to have

visibility of services revenues of around six months forward due to

the strong backlog of orders won

Gross profit

Gross profit H1 2021 Gross H1 2020 Gross Gross margin

GBP'000 margin GBP'000 margin mvt

% %

--------- -------- --------- --------

Gross profit/gross margin 4,037 63% 2,422 51% 12%

--------------------------- --------- -------- --------- -------- -------------

Gross margin percentage increased by 12% compared with the prior

period. High margin recurring product revenues are 40% of total

revenues for the six months ended 30 June 2021 (H1 2020: 34%). This

shift in product mix has driven the increase in gross margin

percentage along with improved services margins.

Operating expenses and adjusted EBITDA

Operating expenses were GBP5.5 million (H1 2020: GBP4.1 million)

and are summarised as follows:

H1 2021 H1 2020

GBP'000 GBP'000

--------------------------------------------- -------- --------

Other operating expenses 4,394 3,631

Depreciation 156 223

Amortisation and impairment 780 472

Share option expense 119 20

Unrealised foreign exchange on intercompany

trading balances 55 (282)

Non-recurring items 8 -

Total operating expense 5,512 4,064

--------

Other operating expenses of the Group include sales, product

development, marketing, and administration costs.

Other operating costs during the period have increased with the

addition of the OSPI acquired business adding GBP0.8 million of

operating costs to the Group. The Covid-19 pandemic has continued

to restrict travel and face-to-face sales activities which has

resulted in reduced costs. Operating costs are anticipated to

increase in the future to drive further revenue growth.

Adjusted EBITDA excludes amortisation and impairment,

depreciation, share option expense, foreign exchange gains/losses

on intercompany trading balances and non-recurring items and is

reported as it reflects the performance of the Group. Adjusted

EBITDA for the period was a GBP0.4 million loss (H1 2020: GBP1.2

million loss).

The operating loss for the period was GBP0.9 million (H1 2020:

GBP1.6 million loss).

EPS and dividends

Adjusted diluted loss per share was 2.2 pence (H1 2020: 4.0

pence). Reported basic and diluted loss per share was 1.8 pence (H1

2020: 3.5 pence).

Consolidated statement of financial position and cash flow.

Cash as at 30 June 2021 was GBP12.1 million (31 December 2020:

GBP11.1 million, 30 June 2020: GBP11.9 million).

Cash net of debt as at 30 June 2021 was GBP12.1 million (31

December 2020: GBP10.5m, 30 June 2020: GBP11.2m). In April 2020,

IQGeo America Inc, a subsidiary of IQGeo Group plc applied for and

received a loan of $819,000 under the USA CARES Act's "Paycheck

Protection Program" in order to support the USA operations during

the uncertainty caused by the impact of the global COVID-19

pandemic. This loan was forgiven by the US Small Business

Administration along with interest accrued in June 2021.

Net cash outflows from operating activities materially reduced

to GBP0.4 million (H1 2020: GBP1.1 million) partly due to R&D

tax credit cash received during the period.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of

the business. The key risks that could affect the Group's

performance, and the factors which mitigate these risks, have not

significantly changed from those set out on pages 32 to 35 of the

Group's Annual Report for 2020 (a copy of which is available from

our website www.iqgeo.com).

Condensed consolidated income statement

for the six months ended 30 June 2021

6 months 12 months

6 months to to

to 30 June 31 December

30 June 2021 2020 2020

unaudited unaudited audited

Notes GBP'000 GBP'000 GBP'000

------------------------------------------- ----- ------------- ----------- ------------

Revenue 4 6,378 4,722 9,155

Cost of revenues (2,341) (2,300) (4,409)

------------------------------------------- ----- ------------- ----------- ------------

Gross profit 4,037 2,422 4,746

Other operating income 5 592 - -

Operating expenses (5,512) (4,064) (9,074)

------------------------------------------- ----- ------------- ----------- ------------

Operating loss (883) (1,642) (4,328)

------------------------------------------- ----- ------------- ----------- ------------

Analysed as:

Gross profit 4,037 2,422 4,746

Other operating expenses (4,394) (3,631) (7,241)

------------------------------------------- ----- ------------- ----------- ------------

Adjusted EBITDA (357) (1,209) (2,495)

Depreciation (156) (223) (369)

Amortisation and impairment of intangible

assets (780) (472) (1,002)

Share option expense (119) (20) (130)

Unrealised foreign exchange gains/(losses)

on intercompany trading balances (55) 282 (43)

Non-recurring items 5 584 - (289)

------------------------------------------- ----- ------------- ----------- ------------

Operating loss (883) (1,642) (4,328)

------------------------------------------- ----- ------------- ----------- ------------

Net finance income/(costs) (76) (42) (98)

Loss before tax (959) (1,684) (4,426)

Income tax (82) (48) 315

------------------------------------------- ----- ------------- ----------- ------------

Loss for the period (1,041) (1,732) (4,111)

Loss per share

Basic and diluted 6 (1.8p) (3.5p) (8.2p)

------------------------------------------- ----- ------------- ----------- ------------

Condensed consolidated statement of comprehensive income

for the six months ended 30 June 2021

12 months

6 months 6 months to

to to 31 December

30 June 2021 30 June 2020 2020

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

------------------------------------------------ ------------- -------------- ------------

Loss for the period (1,041) (1,732) (4,111)

Other comprehensive income:

Items that may be reclassified subsequently

to profit and loss

Exchange difference on retranslation

of net assets and results of overseas

subsidiaries 16 (109) 80

Items that will not be reclassified to

profit and loss

Changes in the fair value of equity investments

at fair value through other comprehensive

income - (1,800) 500

Total comprehensive loss for the period (1,025) (3,641) (3,531)

------------------------------------------------ ------------- -------------- ------------

Condensed consolidated statement of changes in equity

for the six months ended 30 June 2021

Attributable to equity shareholders

of the parent company

-----------------------------------------------------

Share Capital Merger

based redemption relief

Share Share payment reserve reserve Translation Retained

capital premium reserve GBP'000 GBP'000 reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Balance at 1 January

2020 990 17,454 632 476 - (1,866) (2,114) 15,572

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Loss for the period - - - - - - (1,732) (1,732)

Exchange difference on

retranslation of net

assets

and results of

overseas

subsidiaries - - - - - (109) - (109)

Other comprehensive

losses - - - - - - (1,800) (1,800)

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Total comprehensive

loss

for the period - - - - - (109) (3,532) (3,641)

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Reserve debit for

equity-settled

share-based payment - - 20 - - - - 20

Exercise of share

options 2 10 (3) - - - 3 12

Lapse of share options - - (567) - - - 567 -

Transactions with

owners 2 10 (550) - - - 570 32

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Balance at 30 June 2020

(unaudited) 992 17,464 82 476 - (1,975) (5,076) 11,963

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Loss for the period - - - - - - (2,379) (2,379)

Exchange difference on

retranslation of net

assets

and results of

overseas

subsidiaries - - - - - 189 - 189

Other comprehensive

income - - - - - - 2,300 2,300

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Total comprehensive

loss

for the period - - - - - 189 (79) 110

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Issue of shares -

fundraise,

net of costs 136 5,030 - - - - - 5,166

Issue of shares -

acquisition 18 - - - 739 - - 757

Lapse of share options - - (2) - - - 2 -

Reserve debit for

equity-settled

share-based payment - - 110 - - - - 110

Transactions with

owners 154 5,030 108 - 739 - 2 6,033

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Balance at 31 December

2020 1,146 22,494 190 476 739 (1,786) (5,153) 18,106

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Loss for the period - - - - - - (1,041) (1,041)

Exchange difference on

retranslation of net

assets

and results of

overseas

subsidiaries - - - - - 16 - 16

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Total comprehensive

loss

for the period - - - - - 16 (1,041) (1,025)

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Lapse of share options - - (9) - - - 9 -

Reserve debit for

equity-settled

share-based payment - - 119 - - - - 119

Transactions with

owners - - 110 - - - 9 119

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Balance at 30 June 2021

(unaudited) 1,146 22,494 300 476 739 (1,770) (6,185) 17,200

----------------------- ------- --------- --------- ---------- ------- ----------- -------- ----------

Condensed consolidated statement of financial position

for the six months ended 30 June 2021

At At At

30 June 30 June 31 December

2021 2020 2020

unaudited unaudited audited

Notes GBP'000 GBP'000 GBP'000

------------------------------------ ----- ---------- ----------- ------------

Assets

Intangible assets 8 8,969 1,772 8,902

Property, plant, and equipment 167 197 167

Right of use assets 1,425 1,771 1,567

Investments 9 - 200 -

Total non-current assets 10,561 3,940 10,636

------------------------------------ ----- ---------- ----------- ------------

Current assets

Trade and other receivables 3,343 2,431 2,850

Corporation tax receivable - 14 413

Asset held for sale 9 - - 2,500

Cash and cash equivalents 12,115 11,874 11,078

------------------------------------ ----- ---------- ----------- ------------

Total current assets 15,458 14,319 16,841

------------------------------------ ----- ---------- ----------- ------------

Total assets 26,019 18,259 27,477

------------------------------------ ----- ---------- ----------- ------------

Liabilities

Current liabilities

Trade and other payables 10 (6,639) (3,392) (5,828)

Lease obligation (235) (103) (208)

Bank loans - (332) (167)

------------------------------------ ----- ---------- ----------- ------------

Total current liabilities (6,874) (3,827) (6,203)

------------------------------------ ----- ---------- ----------- ------------

Non-current liabilities

Deferred income tax liabilities (424) (322) (351)

Trade and other payables 10 - - (746)

Lease obligation (1,521) (1,814) (1,638)

Bank loans - (333) (433)

Total non-current liabilities (1,945) (2,469) (3,168)

------------------------------------ ----- ---------- ----------- ------------

Total liabilities (8,819) (6,296) (9,371)

------------------------------------ ----- ---------- ----------- ------------

Net assets 17,200 11,963 18,106

------------------------------------ ----- ---------- ----------- ------------

Equity attributable to owners of

the parent company

Ordinary share capital 11 1,146 992 1,146

Share premium 11 22,494 17,464 22,494

Share based payment reserve 300 82 190

Capital redemption reserve 476 476 476

Merger relief reserve 739 - 739

Translation reserve (1,770) (1,975) (1,786)

Retained earnings (6,185) (5,076) (5,153)

------------------------------------ ----- ---------- ----------- ------------

Equity attributable to shareholders

of the Company 17,200 11,963 18,106

------------------------------------ ----- ---------- ----------- ------------

Condensed consolidated statement of cash flows

for the six months ended 30 June 2021

6 months 12 months

to 6 months to

30 June to 31 December

2021 30 June 2020 2020

unaudited unaudited audited

Notes GBP'000 GBP'000 GBP'000

------------------------------------------ ----- ---------- -------------- ------------

Loss before tax from operating activities (959) (1,684) (4,426)

Adjustments for:

Depreciation 156 223 369

Amortisation and impairment 780 472 1,002

Revaluation of intercompany balances 55 (282) 43

Forgiveness of bank loan 5 (592) - -

Share-based payment charge 119 20 130

Finance income (7) (7) (7)

Finance costs 83 49 105

------------------------------------------ ----- ---------- -------------- ------------

Operating cash flows before working

capital movement (365) (1,209) (2,784)

Change in receivables (493) (78) 190

Change in payables 87 204 295

------------------------------------------ ----- ---------- -------------- ------------

Cash generated from operations before

tax (771) (1,083) (2,299)

------------------------------------------ ----- ---------- -------------- ------------

Net income taxes received/(paid) 404 (11) (17)

------------------------------------------ ----- ---------- -------------- ------------

Net cash flows from operating activities (367) (1,094) (2,316)

------------------------------------------ ----- ---------- -------------- ------------

Cash flows from investing activities

Purchases of property, plant, and

equipment (37) (143) (165)

Expenditure on intangible assets (951) (647) (1,307)

Cash received on sale of the RTLS

SmartSpace business unit 2,500 - -

Acquisition of subsidiaries, net of

cash acquired 14 - (3,990)

Interest received 7 7 7

Net cash flows from investing activities 1,533 (783) (5,455)

------------------------------------------ ----- ---------- -------------- ------------

Cash flows from financing activities

Borrowings - 662 662

Interest paid - (1) -

Payment of lease liability (110) (78) (78)

Proceeds from the issue of ordinary

share capital - 13 5,178

------------------------------------------ ----- ---------- -------------- ------------

Net cash flows from financing activities (110) 596 5,762

------------------------------------------ ----- ---------- -------------- ------------

Net increase/(decrease) in cash and

cash equivalents 1,056 (1,281) (2,009)

Cash and cash equivalents at start

of period 11,078 13,053 13,053

Exchange differences on cash and cash

equivalents (19) 102 34

------------------------------------------ ----- ---------- -------------- ------------

Cash and cash equivalents at end of

period 12,115 11,874 11,078

------------------------------------------ ----- ---------- -------------- ------------

Notes to the interim consolidated financial statements

1 General information

IQGeo Group plc ("the Company") and its subsidiaries (together,

"the Group") deliver end-to-end geospatial software which improves

productivity and collaboration across enterprise planning, design,

construction, maintenance and sales processes for telecoms and

utility network operators. Our mobile-first enterprise solutions

create and maintain, an accurate view of complex network assets

that is easily accessible by anyone, wherever and whenever

needed.

Specialised applications combined with our open IQGeo Platform

help network operators create a single source of network truth to

meet their digital transformation ambitions and operational KPIs.

Our award-winning, cloud-enabled solutions save time and money, and

improve safety and productivity, while enhancing customer

satisfaction.

The Company is a public limited company which is listed on the

Alternative Investment Market (AIM) of the London Stock Exchange

(IQG) and is incorporated and domiciled in the United Kingdom. The

address of its registered office is Nine Hills Road, Cambridge CB2

1GE.

The Group has its operations in the UK, USA, Canada, Germany and

Japan, and sells its products and services in North America, Japan,

the UK and Europe.

The condensed consolidated interim financial statements were

approved by the Board of Directors for issue on 10 September

2021.

The condensed consolidated interim financial statements do not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. Statutory accounts for the year ended 31

December 2020 were approved by the Board of Directors on 22 March

2021 and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified, did not contain a

material uncertainty related to going concern paragraph and did not

contain any statement under section 498 of the Companies Act

2006.

The condensed consolidated interim financial statements have

been reviewed, not audited.

2 Basis of preparation

The condensed consolidated interim financial statements should

be read in conjunction with the annual financial statements of the

Group and are prepared in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006 ('IFRS').

Going concern basis

The Directors have adopted the going concern basis in preparing

the financial statements. In assessing whether the going concern

assumption is appropriate, the Directors have taken into account

all relevant information about the current status of the business

operations. The Directors have a reasonable expectation that the

Group has adequate resources to continue operations for the

foreseeable future and for at least 12 months following the

approval of these accounts. This expectation is arrived at

following a review of cash resources, cashflow projections,

customer order book, and pipeline of future projects.

For the purposes of the preparation of the consolidated

financial statements, the Group has applied all standards and

interpretations as adopted in the European Union that are effective

and applicable for accounting periods beginning on or before 1

January 2021. There are no standards in issue and not yet adopted

that will have a material impact on the financial statements.

3 Accounting policies

The accounting policies adopted in the preparation of the

condensed consolidated interim financial statements are unchanged

from those set out in the Group's consolidated financial statements

for the year ended 31 December 2020. However, new contractual

arrangements entered into in the first half of the year have

necessitated we update and expand on our revenue policy going

forward. This change does not impact on revenue recognition for

past periods. Our updated policy is as follows:

Revenue recognition

Revenue represents the fair value of consideration received or

receivable for the sales of goods and services net of discounts and

sales taxes. Revenue is recognised based on the distinct

performance obligations under the relevant customer contract as set

out below. Where goods and/or services are sold in a bundled

transaction or on a subscription basis, the Group allocates the

total consideration under the contract to the different individual

elements based on actual amounts charged by the Group on a

standalone basis.

Software licence

Software is sold under perpetual licence agreements or that of a

term licence for a defined period of time. Under these arrangements

revenue is recognised when the software is made available to the

customer for use, provided that all obligations associated with the

sale of the licence have been made fulfilled.

If contracts include performance obligations which result in

software being customised or altered, the software cannot be

considered distinct from the labour service. Revenue recognition is

dependent on the contract terms and assessment of whether the

performance obligation is satisfied over time. If the conditions of

IFRS15 to recognise revenue over time are not satisfied, revenue is

deferred until the software is available for customer use.

Maintenance and support

Maintenance and support is recognised on a straight-line basis

over the term of the contract, which is typically one year. Revenue

not recognised in the consolidated income statement is classified

as deferred revenue on the consolidated statement of financial

position.

Subscription services

Subscription services, which may include hosting services, are

considered to be a single distinct performance obligation due to

the promises stated within the contract. Revenue is recognised

evenly over the subscription period as the customer receives the

benefits of the subscription services.

Services

Services revenue includes consultancy and training. Services

revenue from time and materials contracts is recognised in the

period that the services are provided on the basis of time worked

at agreed contractual rates and as direct expenses are

incurred.

Revenue from fixed price, long-term customer specific contracts

is recognised over time following assessment of the stage of

completion of each assignment at the period end date compared to

the total estimated service to be provided over the entire contract

where the outcome can be estimated reliably. If a contract outcome

cannot be estimated reliably, revenues are recognised equal to

costs incurred, to the extent that costs are expected to be

recovered. An expected loss on a contract is recognised immediately

in the consolidated income statement.

Timing of payment

Maintenance and support income and subscription income is

invoiced annually in advance at the commencement of the contract

period. Other revenue is invoiced based on the contract terms in

accordance with performance obligations. Amounts recoverable in

contracts (contract assets) relate to our conditional right to

consideration for completed performance obligations under the

contract prior to invoicing. Deferred income (contract liabilities)

relates to amounts invoiced in advance of services performed under

the contract.

4 Segmental information

4.1 Operating segments

Management provides information reported to the Chief Operating

Decision Maker (CODM) for the purpose of assessing performance and

allocating resources. The CODM is the Chief Executive Officer.

The Geospatial operations are reported to the CODM as a single

business unit.

4.2 Revenue by type

The following table presents the different revenue streams of

the Geospatial business unit:

6 months 12 months

to 6 months to

30 June to 31 December

2021 30 June 2020 2020

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

-------------------------------------------- ---------- -------------- ------------

Subscription 1,672 976 1,860

Maintenance and support 902 649 1,335

--------------------------------------------- ---------- -------------- ------------

Recurring IQGeo product revenue 2,574 1,625 3,195

--------------------------------------------- ---------- -------------- ------------

Software 761 122 299

Services 2,599 1,847 3,846

--------------------------------------------- ---------- -------------- ------------

Non-recurring IQGeo product revenue 3,360 1,969 4,145

--------------------------------------------- ---------- -------------- ------------

Total revenue generated from IQGeo products 5,934 3,594 7,340

--------------------------------------------- ---------- -------------- ------------

Geospatial services from third party

products 444 1,128 1,815

--------------------------------------------- ---------- -------------- ------------

Total revenue 6,378 4,722 9,155

--------------------------------------------- ---------- -------------- ------------

4.3 Geographical areas

The Board and Management Team also review the revenues on a

geographical basis, based around the regions where the Group has

its significant subsidiaries or markets.

The Group's revenue from external customers in the Group's

domicile, the UK, and its major worldwide markets have been

identified on the basis of the customers' geographical location and

is presented below:

6 months 12 months

to 6 months to

30 June to 31 December

2021 30 June 2020 2020

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

-------------- ---------- -------------- ------------

UK 119 179 316

Europe 83 102 146

USA 3,727 2,999 5,990

Canada 1,658 559 1,233

Japan 642 872 1,437

Rest of World 149 11 33

--------------- ---------- -------------- ------------

Total revenue 6,378 4,722 9,155

--------------- ---------- -------------- ------------

5 Non-recurring items

6 months 12 months

to 6 months to

30 June to 31 December

2021 30 June 2020 2020

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

-------------------------- ---------- -------------- ------------

Waiver of loan 592 - -

Acquisition costs (8) - (289)

Total non-recurring items 584 - (289)

--------------------------- ---------- -------------- ------------

In April 2020, IQGeo America Inc, a subsidiary of IQGeo Group

plc applied for and received a loan of $819,000 under the USA CARES

Act's "Paycheck Protection Program" in order to support the USA

operations during the uncertainty caused by the impact of the

global COVID-19 pandemic. The loan was provided by HSBC Bank USA

and accrued interest at a rate of 1.0% p.a. In June 2021, the loan

was forgiven by the US Small Business Administration along with

interest accrued.

On 21 December 2020 the Group acquired OSPInsight International

Inc. Costs have been expensed as they were incurred.

6 Earnings per share (EPS)

6 months 6 months to 12 months

to 30 June 2020 to

30 June unaudited 31 December

2021 GBP'000 2020

unaudited audited

GBP'000 GBP'000

----------------------------------------------- ---------- ------------- ------------

Earnings attributable to Ordinary Shareholders

Loss from operations (1,041) (1,732) (4,111)

----------------------------------------------- ---------- ------------- ------------

Number of shares

Weighted average number of ordinary shares

for the purposes of basic EPS ('000) 57,312 49,577 50,195

Effect of dilutive potential ordinary

shares:

- Share options ('000) 2,162 540 1,002

----------------------------------------------- ---------- ------------- ------------

Weighted average number of ordinary shares

for the purposes of diluted EPS ('000) 59,474 50,117 51,197

----------------------------------------------- ---------- ------------- ------------

EPS

Basic and diluted EPS (pence) (1.8) (3.5) (8.2)

----------------------------------------------- ---------- ------------- ------------

Basic earnings per share is calculated by dividing profit/(loss)

for the period attributable to ordinary shareholders of the Company

by the weighted average number of ordinary shares outstanding

during the period. For diluted earnings per share, the weighted

average number of shares is adjusted to allow for the effects of

all dilutive share options and warrants outstanding at the end of

the year. Options have no dilutive effect in loss-making years and

are therefore not classified as dilutive for EPS since their

conversion to ordinary shares does not decrease earnings per share

or increase loss per share.

The Group also presents an adjusted diluted earnings per share

figure which excludes amortisation and impairment of acquired

intangible assets, share-based payments charge, unrealised foreign

exchange gains/(losses) on intercompany trading balances and

non-recurring items from the measurement of profit for the

period.

6 months 12 months

6 months to to

to 30 June 2020 31 December

30 June 2021 unaudited 2020

unaudited GBP'000 audited

GBP'000 GBP'000

-------------------------------------------- ---------------- ------------- ------------

Earnings for the purposes of diluted EPS

being net loss attributable to equity holders

of the parent company (GBP'000) (1,041) (1,732) (4,111)

Adjustments:

Amortisation and impairment of acquired

intangible assets (GBP'000) 193 - -

Reversal of share-based payments charge

(GBP'000) 119 20 130

Unrealised foreign exchange gains/(losses)

on intercompany trading balances 55 (282) 43

Reversal of non-recurring items (GBP'000) (584) - 289

--------------------------------------------------- --------- ------------- ------------

Net adjustments (GBP'000) (217) (262) 462

--------------------------------------------------- --------- ------------- ------------

Adjusted earnings (GBP'000) (1,258) (1,994) (3,649)

--------------------------------------------------- --------- ------------- ------------

Adjusted diluted EPS (pence) (2.2) (4.0) (7.3)

--------------------------------------------------- --------- ------------- ------------

The adjusted EPS information is considered to provide a fairer

representation of the Group's trading performance. Options have no

dilutive effect in loss-making years.

7 Revenue and profit contribution of OSPI acquisition

OSPInsight acquired on 21 December 2020, contributed revenues of

GBP1.4 million and a net profit of GBP0.1 million to the Group

results of the six months ended 30 June 2021.

8 Intangible assets

At 30 June At 30 June At 31 December

2021 2020 2020

unaudited unaudited audited

Net book amount GBP'000 GBP'000 GBP'000

-------------------------------- ---------- ---------- --------------

Goodwill 4,334 - 4,403

Acquired customer relationships 1,942 - 2,072

Acquired software products 386 - 470

Acquired brands 42 - 56

Capitalised product development 2,228 1,695 1,843

Software 37 77 58

Total intangible assets 8,969 1,772 8,902

-------------------------------- ---------- ---------- --------------

9 Investments

On 31 December 2018 the Group disposed of its RTLS SmartSpace

business unit for a consideration of up to GBP35.0 million with

GBP30.0 million paid in cash on completion (subject to adjustments

for net debt and net working capital) in addition to a GBP2.0

million roll over investment in Abyssinian Topco Limited.

Abyssinian Topco Limited is a UK registered company (company number

11649721) and is the ultimate UK parent company of Ubisense Limited

which along with its subsidiary companies, comprise the former RTLS

SmartSpace business unit.

On 29 December 2020, the Group entered into an agreement to sell

its shares in Abyssinian Topco Limited with the sale completing

during January 2021 for a consideration of GBP2.5 million.

10 Trade and other payables

At 30 June At 30 June At 31 December

2021 2020 2020

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

------------------------------------- ---------- ---------- --------------

Trade and other payables due within

1 year:

Deferred income 2,946 1,260 2,833

Trade payables 220 370 74

Trade accruals 1,664 1,364 1,741

Other taxation and social security 281 383 430

Deferred acquisition consideration 755 - 746

Contingent acquisition consideration 755 - -

Other payables 18 15 4

Trade and other payables due within

1 year 6,639 3,392 5,828

------------------------------------- ---------- ---------- --------------

Trade and other payables due after

1 year:

Contingent acquisition consideration - - 746

------------------------------------- ---------- ---------- --------------

Trade and other payables due after

1 year - - 746

------------------------------------- ---------- ---------- --------------

Total trade and other payables 6,639 3,392 6,574

------------------------------------- ---------- ---------- --------------

On 21 December 2020 the Group acquired 100% of the equity

instruments of OSPInsight International Inc. ("OSPI"), a business

based in Utah, USA, thereby obtaining control. The deferred

acquisition consideration associated with the acquisition will be

satisfied by cash payment of $538,000 with the balance settled

through issue of shares in IQGeo Group plc with the deferred

consideration fully settled on 21 December 2021.

The purchase agreement included an additional consideration of

up to $1.1 million subject to achievement of defined levels of

recurring revenue during the year ended 31 December 2021.

Management anticipate this earn out will be settled in full with

amounts payable in January 2022.

11 Share capital and premium

Number Merger

of relief

ordinary reserve

shares Share Share GBP'000

of GBP0.02 capital premium Total

each GBP'000 GBP'000 GBP'000

----------------------------------- ----------- -------- -------- -------- --------

Balance at 1 January 2020 49,503,429 990 17,454 - 18,444

----------------------------------- ----------- -------- -------- -------- --------

Issued under share-based payment

plans 90,657 2 10 - 12

----------------------------------- ----------- -------- -------- -------- --------

Balance at 30 June 2020 49,594,086 992 17,464 - 18,456

----------------------------------- ----------- -------- -------- -------- --------

Issued on placing to institutional

investors 6,794,872 136 5,030 - 5,166

Issued as part consideration for

acquisition 923,294 18 - 739 757

Balance at 31 December 2020 and

30 June 2021 57,312,252 1,146 22,494 739 24,379

----------------------------------- ----------- -------- -------- -------- --------

The Company has one class of ordinary shares which carry no

right to fixed income.

12 Share options

At 30 June 2021, the Group had the following share-based payment

arrangements.

Awards Awards Awards

outstanding Granted Exercised Forfeited outstanding exercisable

at during during during at at

Award Exercise Currency 1 Jan the the the 30 June 30 June

date Vests Expires price 2021 year year year 2021 2021

Arrangement Year Years Year GBP Number Number Number Number Number Number

------------ ------ ------- ----------- ---------- --------- --------------- ------- --------- --------- ----------- -----------

2012 -

Options 2011 14 2021 1.050 GBP 24,200 - - 11,200 13,000 13,000

2013 -

2012 15 2022 2.125 GBP 24,000 - - 7,000 17,000 17,000

2014 -

2013 16 2023 2.055 GBP 32,750 - - 5,500 27,250 27,250

2015 -

2014 17 2024 2.250 GBP 10,000 - - 5,000 5,000 5,000

2019 -

2018 21 2028 0.555 GBP 350,000 - - - 350,000 350,000

2020 -

2020 23 2030 0.460 GBP 1,971,000 - - 5,000 1,966,000 655,333

2020 -

2020 23 2030 0.625 GBP 110,000 - - - 110,000 36,666

2020 -

2020 23 2030 0.783 USD 1,390,000 - - 120,000 1,270,000 423,333

2020 -

2020 23 2030 0.675 GBP 500,000 - - - 500,000 166,666

------ ------- ----------- ---------- --------- --------------- ------- --------- --------- ----------- -----------

Total 4,411,950 - - 153,700 4,258,250 1,694,248

------------------------------------------ ------------------------- ----------- ------- --------- --------- ----------- -----------

Weighted average

exercise price (GBP) 0.562 - - 0.789 0.554 0.587

------------------------------------ ---------- ----------------------- ------- ------- --------- --------- ----------- -----------

2020 granted share options

During 2020, IQGeo Group plc implemented a new long-term

incentive share option plan with options granted to Executive

Directors and employees of the Group. IQGeo Group plc granted a

total of 3,971,000 options of two pence each in the Company with

varying exercise prices as set out above. The options vest in

portions of one third on the first, second and third anniversaries

of grant and have no further performance conditions other than

ongoing employment on the date of vesting and of exercise. Awards

will be subject to a two-year holding period from vesting point,

with participants only permitted to sell shares sufficient to cover

the exercise cost and any tax liability within this holding

period

Independent review report to IQGeo Group plc

Introduction

We have reviewed the consolidated condensed set of financial

statements in the half-yearly financial report of IQGeo Group plc

(the 'company') for the six months ended 30 June 2021 which

comprise the condensed consolidated income statement, the condensed

consolidated statement of comprehensive income, the condensed

consolidated statement of changes in equity, the condensed

consolidated statement of financial position, the condensed

consolidated statement of cash flows and related notes. We have

read the other information contained in the half-yearly financial

report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial information.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors.

As disclosed in the notes, the annual financial statements of

the company are prepared in accordance with International Financial

Reporting Standards in conformity with the requirements of the

Companies Act 2006. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34, 'Interim

Financial Reporting'.

Our responsibility

Our responsibility is to express a conclusion to the company on

the consolidated condensed set of financial statements in the

half-yearly financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity'. A review of interim financial information consists

of making enquiries, primarily of persons responsible for financial

and accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK) and consequently does not enable us to obtain assurance that

we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

The impact of uncertainties arising from the UK exiting the

European Union on our review

Our review of the condensed set of financial statements in the

half-yearly financial report requires us to obtain an understanding

of all relevant uncertainties, including those arising as a

consequence of the effects of Brexit. Such reviews assess and

challenge the reasonableness of estimates made by the directors and

the related disclosures and the appropriateness of the going

concern basis of preparation of the financial statements. All of

these depend on assessments of the future economic environment and

the company's future prospects and performance.

Brexit is one of the most significant economic events for the

UK, and at the date of this report its effects are subject to

unprecedented levels of uncertainty, with the full range of

possible outcomes and their impacts unknown. We applied a

standardised firm-wide approach in response to these uncertainties

when assessing the company's future prospects and performance.

However, no review of interim financial information should be

expected to predict the unknowable factors or all possible future

implications for a company associated with a course of action such

as Brexit.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2021 is not prepared, in all material respects, in accordance

with International Accounting Standard 34, 'Interim Financial

Reporting'.

Grant Thornton UK LLP

Statutory Auditor, Chartered Accountants

London

10 September 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR URARRAVUKAUR

(END) Dow Jones Newswires

September 13, 2021 02:00 ET (06:00 GMT)

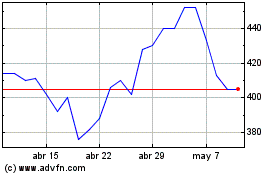

Iqgeo (LSE:IQG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Iqgeo (LSE:IQG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024