TIDMITM

RNS Number : 4872L

ITM Power PLC

13 September 2021

13 September 2021

ITM Power Plc

("ITM Power", the "Company" or the "Group")

Final Results for the Year to 30 April 2021

ITM Power (AIM: ITM), the energy storage and clean fuel group,

announces final results for the year ended 30 April 2021.

HIGHLIGHTS

Developments in the year:

-- First full year of operating the strategic partnership with

Linde Engineering, which together with our investment in ITM Linde

Electrolysis (ILE) GmbH, allows ITM Power to focus on the

manufacture of electrolysis equipment for larger scale systems

-- Sale of world's largest PEM electrolyser to Linde and sale of

first MW-scale electrolyser to Sumitomo for deployment in Japan,

and a 4MW electrolyser for the US market included within the

backlog

-- Commercial partnership agreement with Snam (one of the

world's leading energy infrastructure operators), including a

GBP30m strategic investment and an initial 100MW preferred supplier

commitment to 2024

-- Successful equity fund raise of GBP172m (including the Snam

investment) to accelerate development

-- Completion of the worlds' first electrolyser Gigafactory,

expected to reach annual production capacity of 1,000MW per annum

by end 2023 and official opening by the Business & Energy

Secretary, Kwasi Kwarteng

2021 results:

-- Total Revenue & Project Grant Funding of GBP5.1m (2020: GBP5.4m) down 6%, comprising:

o Sales revenue: GBP4.3m (2020: GBP3.3m) up 30%

o Collaborative grant income recognised: GBP0.8m (2020: GBP2.1m)

down 63%

-- Loss from operations GBP26.7m (2020: GBP29.4m), reduced by 9%

-- Adjusted EBITDA loss GBP21.4m (2020: loss GBP18.1m), increased 18%

-- Available cash balance of GBP176.1m at year-end (2020: GBP39.9m)

Current trading

09/2021 10/2020 % change

Work in Progress* GBP36m GBP16m +125%

Contracts backlog** GBP171m GBP119m +44%

Tender pipeline

*** GBP378m GBP195m +94%

*Work in Contracted backlog

Progress

**Contracts Contracted backlog and contracts in the final stages

backlog of negotiation and preferred supplier backlog

***Tender Quotations submitted in response to commercial

pipeline tenders in the last 12 months and now only reflecting

the value to ITM Power

-- Contracts backlog of GBP171m (2020: GBP119m) constituting 310MW of electrolysers up 44% YoY

-- GBP36m (2020: GBP16m) of contracted backlog (Work in

Progress) up 125% YoY representing 43MW of electrolysers

-- 10MW of the backlog (Work in Progress) is the REFHYNE I project recognised over time

-- The balance of the backlog (Work in Progress) is expected to be delivered in FY22

-- Tender pipeline value to ITM Power of GBP378m (2020: GBP195m), up 94% YoY

-- Tender pipeline constitutes 1,011MW of potential electrolysis demand

-- Installation of the 10MW REFHYNE I project completed, with

expansion by 100MW planned for REFHYNE II, at Shell's Rhineland

Refinery

-- Refuelling assets now grouped together under ITM Motive, with

focus shifting to larger scale refuelling projects for fleets,

buses and trains to increase profitability and provide a more

appropriate structure for sustainable growth of the network.

-- Part of consortium awarded EUR5m for the OYSTER Project to

Study Offshore Green Hydrogen Production

Current Year Guidance

-- Core stack module production to be in excess of 55MW

-- Completed products volume to be between 33-50MW

-- Revenue recognition depends on site access, travel

restrictions, and Micro-chip and steel availability

-- Revenue will be heavily weighted to H2 2022

Graham Cooley, CEO, commented , "2021 has been another

transformational year for ITM Power. We attracted a strategic

investor in Snam S.p.A., and through our fund raise in October 2020

developed a platform to deliver to market our next generation

product, the 5MW Gigastack, two years earlier than previously

planned. We also moved into Bessemer Park, the world's largest PEM

electrolyser factory and commenced manufacturing there in January

2021. We have seen national commitments to net zero accelerate, and

I believe we are very well placed, with our partner Linde, to

address the rapidly growing demand in the market."

For further information please visit www.itm-power.com or

contact:

ITM Power Plc +44 (0)114 551 1205

James Collins, Investor Relations

Investec Bank plc (Nominated Adviser

and Broker) +44 (0)20 7597 5970

Jeremy Ellis / Chris Sim / Ben

Griffiths

Tavistock (Financial PR and IR) +44 (0)20 7920 3150

Simon Hudson / David Cracknell

/ Tim Pearson

About ITM Power Plc

ITM Power Plc manufactures integrated hydrogen energy solutions

for grid balancing, energy storage and the production of renewable

hydrogen for transport, renewable heat and chemicals. ITM Power Plc

was admitted to the AIM market of the London Stock Exchange in

2004. In October 2019, the Company announced the completion of a

GBP58.8 million fundraising, including an investment by Linde of

GBP38 million, together with the formation of a joint venture with

Linde to focus on delivering renewable hydrogen to large-scale

industrial projects worldwide. ITM Power signed a deal to deploy a

10MW electrolyser at Shell's Rhineland refinery. In November 2020,

ITM Power completed a GBP172m fundraising, including a GBP30m

investment by Snam, one of the world's leading energy

infrastructure operators. ITM Power operates from the world's

largest electrolyser factory in Sheffield with a capacity of 1GW

(1,000MW) per annum. ITM Power received an order for the world's

largest PEM electrolyser of 24MW from Linde in January 2021. Other

customers and partners include Sumitomo, Ørsted, Phillips 66,

Scottish Power, Siemens Gamesa, Cadent, Northern Gas Networks,

Gasunie, RWE, Engie, GNVert, National Express, Toyota, Hyundai and

Anglo American among others.

Chairman's Statement

The year to April 2021 was a further year of innovation and

growth for the Group, as the build of Bessemer Park, our new 1GW

factory concluded, and the Group started to win its first contracts

through its joint venture with Linde GmbH, ITM Linde Electrolysis

GmbH. The partnership with Linde has enabled the Group to

concentrate more directly on its key manufacturing capabilities and

to develop a more comprehensive, solutions-led approach to an

increasing number of addressable markets, both in geography and

application.

During the year, the Group announced a GBP172m fund raise to

accelerate the technology offering, both in terms of performance of

existing products but also to accelerate the development of the 5MW

Gigastack, in direct response to market demand for larger systems.

The opportunity pipeline has grown significantly. New and larger

systems, using the Gigastack, remain on track for factory readiness

in late 2022 and are already being bid into a growing range of

projects.

During the past year the Group made changes to the board, with

Katherine Roe joining the board, and leading both the Remuneration

Committee and the ESG Committee. In December 2020, Tom Rae also

joined the board as nominee director of JCB.

In May two important reports were published regarding the macro

market dynamics for hydrogen. The IEA (International Energy Agency)

report "Net Zero by 2050; A roadmap for the Global Energy Sector"

stated that to get to net zero by 2050 the world needs 322m Tonnes

of electrolytic hydrogen and a global electrolyser capacity of

3,585GW. The Aurora Energy report "HyMAR" identifies a current

pipeline of electrolysers of over 200GW, with 85% of the 200GW in

Europe.

National electrolyser targets increased from 40GW to 144GW in

the year and the EU announced its new net-zero law. China also

declared net-zero by 2060. The US re-joined the Paris Agreement on

February 19th, 2021 and declared its first Department of Energy

"Earthshot" for Green Hydrogen on 7th June 2021.Global demand for

electrolysers from industry, to decarbonise production processes,

and from utilities and power companies, to store renewable energy,

is accelerating. This potential scale of demand originally

underpinned the Group's decision to invest in a step change in

capacity at the new Bessemer Park facility. In the event, the new

1GW per annum capacity is likely to be fully utilised earlier than

originally envisioned, as evidenced by tendering activity and ITM

Power's backlog of firm orders. As the drive to achieve net zero

targets continues, the market for large scale electrolysis

equipment to produce green hydrogen may well become supply

constrained.

In closing, I would like to thank all shareholders, old and new,

for their support and to recognise the significant achievements of

the staff at ITM Power Plc resulting from their hard work in 2020

and 2021.

Sir Roger Bone

Chairman

10 September 2021

REVIEW

Introduction

ITM Power designs and manufactures integrated hydrogen energy

systems based on Proton Exchange Membrane (PEM) electrolyser

technology and has a product offering that is scalable above 100MW

in size. Of particular importance is the ability of the systems to

respond rapidly and to generate hydrogen at a pressure, flow rate

and purity appropriate to its application.

ITM Power is a globally recognised expert in hydrogen

technologies with the overarching principle of taking renewable

energy from the power network or other directly coupled sources,

converting it into green, zero-carbon-footprint hydrogen and using

it in one of three broad applications, Power-to-Gas, Clean Fuels

and Industrial Hydrogen. There has been significant growth in

demand for these applications in the market place and the directors

continued to believe that all of these markets will grow further

over the coming years based on the commitment by governments

worldwide to mitigate climate change, the growth of renewables in

the energy mix and the need to decarbonise industrial

processes.

The directors believe that ITM Power remains uniquely

well-placed to capture material shares of each market.

Building a Global Presence

ITM Power has worked hard to build relationships globally by

adding anchor points - via our partnership with Linde and through

collaborations - outside of the UK market. This effort will put the

Group in a good position to service markets internationally both

now and in the future.

One such partnership with Optimal will provide long-term

commissioning, operational and maintenance support, enhancing ITM

Power's capabilities to deploy skilled engineering resource and

spare parts for its customers across Australia. To ensure that ITM

Power's customers continue to enjoy the benefits of low cost and

low carbon energy well into the future, Optimal will provide

nationwide service and support through its network of factory

certified ASP's (Authorised Service Personnel).

The provision of a 0.7MW HGas electrolyser system for use in a

hydrogen microgrid project in Tasmania supported by the Federal

Government's Blue Economy CRC programme will be the first

deployment with Optimal and a platform for training through ITM

Power's Hydrogen Academy.

The sale of a 2.0MW electrolyser to Sumitomo Corporation will be

used as an important reference plant for further sales in Japan

through our partnership with Sumitomo. This will be the first MW

scale electrolyser system ITM Power has deployed in Japan. The

HGas3SP product will undergo modification to ensure hydrogen supply

pressure is below 10 bar in order to comply with Japan's High

Pressure Gas Safety Act. ITM Power and Sumitomo are continuing

their collaboration in the areas of business development, local

compliance and after sales support to ensure a comprehensive green

hydrogen offering in Japan.

Covid-19

Covid-19 has continued to have an impact on the normal

operations of the Group. Staff who can work from home have been

doing so throughout the financial year, supported through VPN

access, Microsoft Teams, various Sharepoint spaces dealing with

wellness and mental health related topics and more recently, an

internal network space called Yammer that aims to provide a

community spirit to the workforce.

As reported previously, the factory was temporarily reduced to a

skeleton staff at the start of the 2020-21 financial year, with 29

production staff furloughed under the government job retention

scheme while changes were implemented to ensure the premises were

Covid-secure.

In early June, we began the process of returning people to the

factory. This required risk assessments of areas to make them

suitable for work under new social distancing rules, close liaison

with shop floor personnel over abilities to return to work and

skillset requirements to further the production process at the

correct times, as well as return to work inductions to explain the

new PPE and location requirements for safe, effective working.

With Bessemer Park available for office use from the autumn and

a transfer of the factory after the Christmas break, we have

additional flexibility and space to enable staff to come into work

safely, whilst ensuring numbers remained manageable within social

distancing guidelines. This has allowed us to offer alternatives

for people who have been struggling to work from home.

Management continued to monitor the effect of Covid-19 to deploy

personnel efficiently to project site works in order to minimise

project delays, utilising European and third party engineers in

locations to which UK staff could not travel.

Marketing

ITM Power has been developing a dedicated Training and Marketing

suite facility at the Bessemer Park Gigafactory, which will enable

the business to host our own marketing and training events, as well

as provide a venue for National and International conferences that

align with ITM Power's objectives. The Marketing suite can provide

seating for over 100 attendees and will become an important

marketing resource as the world opens up again post-Covid.

The business has hosted a number of visitors as the Covid

restrictions have begun to lift, including Mr Clive Betts, the

Member of Parliament for Sheffield South East and a delegation from

Chile's Energy and Mining Ministry, led by Minister Juan Carlos

Jobet.

The Group has been active in supporting the 100MW Gigastack

project and developing communications alongside BEIS, Ørsted and

Phillips 66 Limited. The project won the Humber Renewables Award

for Innovation in March 2021, and published a project update in May

this year, with the final report due in September 2021.

This year the Covid restrictions have continued, and exhibitions

including the Hannover Messe, normally a key event in ITM Power's

calendar and the source of much interest for our technology have

been cancelled or limited to online activities.

The Group continues to send out regular communications via a

newsletter and we have a growing number of sign-ups to receive the

news from ITM Power.

Bessemer Park - Global Manufacturing HQ, Sheffield

The fit out of the 1GW (1,000MW) per annum Gigafactory at

Bessemer Park reached 'Practical Completion' - the handover to the

Group by the contractors of the completed building - in January

2021, having suffered only a minor delay from the Covid-19

pandemic. The completed fit out included an expansion of the

existing offices, enlargement of the stack manufacturing and

production areas and a dedicated ATEX rated space for factory

acceptance testing of products, all coupled with the necessary 5MW

power supply on site.

The Gigafactory also houses the 24-hour remote and technical

monitoring centre that will support ITM Power's after-sales service

proposition, the Marketing centre, Technology centre and component

stores. The site, just off J34 of the M1 in Sheffield will welcome

visitors in the near future, with the creation of the conferencing

facility, as well as a Hydrogen Academy to support the training of

apprentices, local engineers and customers, together with

facilities for site visits by customers, shareholders and other

stakeholders.

The ITM Power Gigafactory delivers a blueprint for a high

capacity, semi-automated PEM electrolyser manufacturing facility,

which can be readily replicated elsewhere, enabling a local

facility to be planned and rapidly deployed in response to large

order volumes.

The factory was officially opened by the Rt Hon Kwasi Kwarteng,

Secretary of State for Business, Energy and the Environment on 17

August 2021 as he launched the UK Government's Hydrogen

Strategy.

Products and technology

ITM Power continues to place strategic focus on the development

of its technology. The opening of Bessemer Park earlier this year

saw the Product Development and Technology teams relocate into the

new Technology Centre. The additional space provides an excellent

location to build on the Group's 20 years of experience and

accelerate key development activities.

The ITM Power technology roadmap is focused on reducing cost,

increasing efficiency and expanding production capacity of our

electrolyser stacks and products. Particular emphasis has been

placed on verification of improvements at the stack level. These

have included improved membrane materials, ultra-low catalyst

loadings and in-house component preparation. The now co-located

technology and production teams work closely together as new

manufacturing machines are adopted by the business to underpin

production capacity ramp up and prepare for the larger 5MW

Gigastack platform.

Product cost reduction is an important focus area for ITM Power.

Last year the Group presented a full system price reduction plan

including a target to halve the average product price within five

years. The strategy to achieve these improvements is centred on

standardisation and modularisation of the product offering

alongside fully leveraging global buying power of partners and an

integrated technology roadmap. The single biggest gains are

available from the PEM stack and the power conversion systems. ITM

Power has brought key stack preparation processes in-house with the

move to Bessemer Park. Together with semi-automation and in-line

quality assurance, this has achieved both cost reduction and

capacity expansion for the stack platform.

Another focus area has been continued reduction of precious

metal loading. Over the last 10 years, the use of precious metals

within ITM Power stacks has reduced by over 80%. This core

competency and vertical integration enabled ITM Power to achieve

the 2030 EU target of 0.4mg/W for precious metal loading for

electrolysers in 2019 and significant further progress has been

made since then. As a manufacturer of its own catalyst inks, ITM

Power has been working on the reduction, recycling and reuse of

precious metal catalyst loading for 20 years. As part of the

Group's existing cost reduction plan, these developments will be

rolled out in phases, subject to ITM Power's well-established

verification process. This long running activity makes an important

contribution to cost reduction and provides some insulation against

the risk of supply constraints in the precious metal supply

chain.

Working with Linde GmbH

Following on from Linde GmbH's strategic investment in ITM Power

and the establishment of ITM Linde Electrolysis GmbH, in which ITM

Power holds a 50% stake, work has continued to develop and embed

the strategic partnership with Linde. This partnership allows each

company to focus on its core competencies, with ITM Power to focus

solely on its prime source of competitive advantage - the efficient

manufacture and supply of best in class PEM electrolysers, while

Linde will provide its world leading EPC services to offer

best-available hydrogen solutions to customers.

This partnership is now starting to bear fruits, with the

signing in January 2021, of the first contact under the

partnership, to build, own and operate the world's largest PEM

electrolyser plant at the Leuna Chemical Complex in Germany. This

new 24-megawatt electrolyser, supplied by ITM Power will produce

green hydrogen for industrial customers through Linde's existing

pipeline network. In addition, Linde will distribute liquefied

green hydrogen to refuelling stations and other industrial

customers in the region. The total green hydrogen to be produced

from the electrolyser system could fuel approximately 600 fuel cell

buses driving 40 million kilometres and save up to 40,000 tons of

carbon dioxide exhaust emissions per year.

The pipeline of potential projects coming through the joint

venture continues to grow and the relationship with Linde continues

to strengthen at all levels.

Working with Snam S.p.A.

As part of the strategic fund raise in October 2020, Snam

invested GBP30 million in ITM Power, and entered into a Commercial

Partnership Agreement between the businesses, which included

preferred supplier status for the first 100MW of Snam's PEM

electrolyser orders for delivery by 2024/2025.

The Commercial Partnership Agreement also includes the potential

for collaboration on a global pipeline of further projects. Since

the partnership was agreed in October 2020, initial discussions

have taken place between ITM Power and Snam to establish best

practices for working and partnering on projects. SNAM have also

taken positions on the Technology Management Committee and

Strategic Advisory Committee within the ITM Power business.

Business environment

In July 2020, the European Commission announced its EU Hydrogen

Strategy and its Energy Systems Integration Strategy. The

announcement prioritised the development of renewable hydrogen,

produced using mainly wind and solar energy and went on to

state:

-- From 2020 to 2024, we will support the installation of at

least 6GW of renewable hydrogen electrolysers in the EU, and the

production of up to one million tonnes of renewable hydrogen.

-- From 2025 to 2030, hydrogen needs to become an intrinsic part

of our integrated energy system, with at least 40GW of renewable

hydrogen electrolysers and the production of up to ten million

tonnes of renewable hydrogen in the EU.

-- From 2030 to 2050, renewable hydrogen technologies should

reach maturity and be deployed at large scale across all

hard-to-decarbonise sectors.

To help deliver on this Strategy, the Commission has launched

the European Clean Hydrogen Alliance, which aims to build up an

investment pipeline for scaled-up production and support demand for

clean hydrogen in the EU.

In August 2021, the UK government set out its own Hydrogen

Strategy to drive forward a green industrial revolution and meet

their ambition for 5 GW of low-carbon hydrogen production capacity

by 2030. The Strategy sets out a policy landscape to identify

priorities and support mechanisms for rolling out green hydrogen

production in the UK. It includes a Hydrogen Business Model

designed to overcome the cost gap between low-carbon hydrogen and

fossil fuels and a Net Zero Hydrogen Fund for the commercial

deployment of new low-carbon hydrogen production plants across the

UK.

Power-to-Gas

As governments and supra-national bodies continue to legislate

for the reduction of emissions following the COP21 Paris Agreement

on climate change, planting up with renewable generation has

increased the need for energy storage to address the challenge of

intermittency. Battery technology cannot achieve this at the scale

required. Thus, the offshore wind and gas sectors have started to

advocate green hydrogen as the means for sustaining their long-term

business models.

Power-to-Gas can meet the demand for long-term, large-scale

energy storage, converting surplus renewable energy into hydrogen

gas by rapid response electrolysis and subsequently injecting it

into the gas distribution network. These grid balancing services

can be an important source of revenue for operators and ITM Power's

rapid response Proton Exchange Membrane (PEM) technology allows

units to be turned on and off in under one second making them

eligible for the UK National Grid's Enhanced Frequency Response

Payments.

ITM Power enjoys a unique position having supplied the world's

first PEM Power-to-Gas electrolyser in 2014, and continues to

engage in a number of industry-leading strategic projects.

The OYSTER Project to Study Offshore Green Hydrogen

Production

The Fuel Cells and Hydrogen 2 Joint Undertaking (FCH2-JU), a

public private partnership of the European Commission, has made an

award of EUR5m to investigate the feasibility and potential of

combining an offshore wind turbine directly with an electrolyser

and transporting renewable hydrogen to shore.

To realise the potential of offshore hydrogen production, there

is a need for compact electrolysis systems that can withstand harsh

offshore environments and have minimal maintenance requirements

while still meeting cost and performance targets that will allow

production of low-cost hydrogen. The project will provide a major

advance towards this aim. The electrolyser system will be designed

to be integrated with a single offshore wind turbine, and to follow

the turbine's production profile. Furthermore, the electrolyser

system will integrate desalination and water treatment processes,

making it possible to use seawater as a feedstock for the

electrolysis process.

The OYSTER project partners share a vision of hydrogen being

produced from offshore wind at a cost that is competitive with

natural gas (with a realistic carbon tax), thus unlocking bulk

markets for green hydrogen making a meaningful impact on CO(2)

emissions, and facilitating the transition to a fully renewable

energy system in Europe. This project is a key first step on the

path to developing a commercial offshore hydrogen production

industry and will demonstrate innovative solutions with significant

potential in Europe and beyond.

The project is planned to start in 2021 and run to the end of

2024, over which time the consortium will develop and test a

megawatt-scale fully marinised electrolyser in a shoreside pilot

trial. ITM Power is responsible for the development of the

electrolyser system and the electrolyser trials, while Ørsted will

lead the offshore deployment analysis, the feasibility study of

future physical offshore electrolyser deployments, and support ITM

Power in the design of the electrolyser system for marinisation and

testing. Siemens Gamesa Renewable Energy and Element Energy are

providing technical and project expertise.

Clean Fuel

The transport sector is one of the largest users of fuel in the

world, and currently it is dependent on fossil fuels, which are

highly polluting and are becoming ever scarcer and more expensive.

Hydrogen fuel is generated on site by ITM Power's rapid response

electrolyser system, using renewable electricity and water with a

full tank of fuel dispensed within a matter of minutes at the

station where it is generated. This means a zero-carbon footprint

and no use of further transport infrastructure.

Hydrogen is light and can be stored under pressure, making it

suitable for many vehicle types as it does not add further weight,

or use further energy when on board. An additional benefit of

hydrogen is its role in supporting the drive for cleaner air,

especially important in densely populated cities. When hydrogen

fuel cell electric vehicles are driven, the only emission is water

vapour and each three-minute car refuel provides a range of up to

400 miles.

ITM Motive: Owner-operator of refuelling stations

ITM Power continue to roll out a network of hydrogen refuelling

stations in the UK and was proud to play a part in the support of

key workers during the Covid-19 lockdowns. In the year, the Group

dispensed 14 tonnes of hydrogen from its refuelling stations (2020:

31 tonnes).

The Group recently completed work on its ninth UK public access

hydrogen refuelling station (HRS) at Tyseley Energy Park in

Birmingham. This is due to be joined by a bus refueller in the

coming months.

Post year-end plans were announced to group ITM Power's

refuelling station portfolio into a separate but still wholly owned

subsidiary, ITM Motive. The strategy will be to focus on larger

scale refuelling for fleets of vehicles while the public stations

build their revenue. Motive continues to work closely with its

partners across the entire supply chain and is particularly excited

to see OEMs bringing new vehicles to the market including the MK2

Mirai this year, several bus options, and coming early next year

trucks from Hyzon and panel vans from a range of manufacturers

including Vauxhall in the UK. The availability of a wide range of

vehicle options should lead to a significant growth in the

market.

Larger vehicle refuelling

Within the transport sector, a renewed focus has been placed on

the development of zero-emission heavy vehicles, where fleets need

to be refuelled with large amounts of hydrogen on a regular basis.

ITM Power has won contracts to supply on-site hydrogen generation

equipment for refuelling in the UK, France, the US and

Australia.

'Green Hydrogen for Scotland' to help reach net zero targets

A pioneering strategic partnership has been established to

create new green hydrogen production facilities with clusters of

refuelling stations across Scotland. These clusters will allow

Scotland's abundant renewable power generation capacity to be

converted to hydrogen for use by vehicles, supporting efforts to

achieve net zero by 2045 . 'Green Hydrogen for Scotland' will offer

an end-to-end market solution for reducing vehicle emissions

through the provision of green hydrogen.

The partnership's first project, 'Green Hydrogen for Glasgow',

is designed to provide carbon-free transport and clean air for

communities across the city, which wants to become the first

net-zero city in the UK. A planning application has now been made

for a proposed green hydrogen production facility located on the

outskirts of the city at ScottishPower Renewables' Whitelee Wind

Farm, the UK's largest onshore wind farm . This will be operated by

BOC, using wind and solar energy to power a 20MW electrolyser,

delivered by ITM Power . This represents a doubling in the

electrolyser scale capacity originally envisaged and is in response

to market demand . The project aims to supply hydrogen to the

commercial market within the next two years.

This project also supports the Scottish Government's

decarbonisation targets and Glasgow City Council's commitment to

creating a zero emissions vehicle fleet, using only electric and

hydrogen-powered vehicles by the end of 2029.

H2OzBus Project - Deploying Hydrogen Fuel Cell Bus Fleets for

Public Transport across Australia

In May 2020, ITM Power announced the formation of the H2OzBus

Project and the signing of a memorandum of understanding with

strategic partners. The project will focus on infrastructure

requirements and detailed plans for an initial deployment of 100

hydrogen fuel cell electric buses in up to 10 central hub locations

across Australia where interest and demand for fuel cell buses has

already been identified. This aligns well with ARENA's (Australian

Renewable Energy Agency) key investment priorities in Accelerating

Hydrogen and Decarbonising Industry.

The key expertise of each partner and their proposed roles in

the project are: ITM Power and BOC will provide the hydrogen

production and refuelling infrastructure; Ballard Power Systems

will supply the fuel cell system to be integrated into the electric

buses supplied by supporting bus manufacturers; Transit Systems,

will maintain and operate the vehicles as part of their daily urban

transit operations (or within a strategically located project

managed by Transit Systems), and: Palisade Investment Partners will

assist in providing funding and strategic financial oversight, for

the project.

Green Hydrogen Project in Herten, Germany with Linde

Engineering

Linde Engineering announced its successful bid for the design

and construction of an integrated hydrogen refuelling station and

electrolysis plant for AGR in Herten, confirming that ITM Power is

the preferred supplier of the electrolysis equipment envisioned by

the project.

The project is receiving funding from the German Federal

Ministry of Transport and Digital Infrastructure.

The electrolysers will have an annual capacity of around 440,000

kg of hydrogen with electricity coming from AGR's waste-to-energy

thermal power plant, where municipal and commercial waste with a

biogenic content of around 50 percent serves as the primary fuel

source. The planned refuelling station will be able to fill

vehicles at 350 bar and 700 bar and therefore will be suitable for

both cars and trucks, including AGR's own fleet of waste

trucks.

Through the thermal recycling of local waste and its conversion

into hydrogen, the undertaking is a successful example of the

circular economy in action, providing an important reference site

for the municipality market.

Industrial

Many industries use hydrogen as part of their production

processes. Today, almost all of this hydrogen is made by steam

reformation of methane (natural gas), a highly carbon intensive

method. Three industries dominate carbon emissions from the use of

hydrogen: ammonia production, steel making and the Group's prime

target, refineries. Refineries currently use hydrogen to improve

the quality of fractional distillation products and most of this

hydrogen is produced from steam-reformation but in order to comply

with stringent legislation and avoid fines, refineries need a

cost-effective green hydrogen solution that reduces carbon

emissions while allowing them to maintain output.

In addition, natural gas reformers have long start-up times.

With their rapid start up times, ITM Power's PEM electrolysers

could provide an immediate backup solution to prevent production

downtime and preserve security of hydrogen supply.

In steel making, iron ore requires chemical reduction before

being used to produce steel; this is currently achieved through the

use of carbon, in the form of coal or coke. When oxidised, this

leads to emissions of about 2.2 tonnes of CO(2) for each tonne of

liquid steel produced. The substitution of hydrogen for carbon has

the potential to significantly reduce CO(2) emissions, because

hydrogen is an excellent reducing agent and produces only water as

a by-product.

Sale to Linde of World's Largest PEM Electrolyser

In January 2021, Linde announced that it will build, own and

operate the world's largest PEM electrolyser plant at the Leuna

Chemical Complex in Germany. This new 24-megawatt electrolyser will

be supplied by ITM Power to produce green hydrogen for industrial

customers through Linde's existing pipeline network. In addition,

Linde will distribute liquefied green hydrogen to refuelling

stations and other industrial customers in the region. The total

green hydrogen to be produced could fuel approximately 600 fuel

cell buses driving 40 million kilometres and save up to 40,000 tons

of carbon dioxide exhaust emissions per year.

Planned 100MW expansion of the Shell refinery project

In February, Shell announced plans to increase the capacity of

the ITM Power PEM electrolysis plant by 100MW at its Rhineland

Refinery in Germany. Shell's partners for the REFHYNE II

electrolysis project are ITM Power, ITM Linde Electrolysis and

Linde. Subject to finalising contracts and securing some matching

funding, the partners will work with the Shell to effect this

upgrade.

Shell intends to manufacture sustainable aviation fuels in the

Wesseling section of the Rhineland Refinery. To this end, the

company wants to set up a first commercial Bio Power-to-Liquid

plant. The synthetically produced kerosene is intended to help

reduce airlines' CO2 footprint. Construction of this facility could

start in 2022, pending final investment decisions. Both the

electrolyser upgrade and the synthetic kerosene projects are

integral parts of the planned transformation of the site into the

"Shell Energy and Chemicals Park Rhineland.

Electrolyser Sale to Linde for H2Pioneer in Austria

One of the main goals of the H2Pioneer project is demonstrating

the production of green hydrogen on-site to be used in

semiconductor production, mostly replacing the supply of liquified

hydrogen delivered in trailers. An HGas3SP (2MW) electrolyser

system will produce green hydrogen, which after further

purification by Linde will be ultra-pure and suitable for

semiconductor manufacture. The use of electrolysis simplifies

downstream hydrogen purification and minimises delivery logistics

while helping to reduce carbon dioxide emissions from the hydrogen

supply chain. This is an industry that Linde understands very well

and in which it has numerous existing customers worldwide but will

be a new industry for ITM Power technology.

FINANCIAL REVIEW

Revenue Streams for the Group

As well as having potential revenue streams from three large

application markets, there are a variety of ways in which the Group

can generate revenue globally:

Product Sales

ITM Power positions itself as a provider of PEM electrolyser

systems, selling to a range of customers and target markets

globally. The Group offers standard containerised and modular

large-scale solutions based around core technology.

Consulting Contracts

Many system contracts that are bespoke are preceded by a design

study or a Front-End Engineering Design (FEED) contract that

defines solutions to customer specifications.

Maintenance Contracts

ITM Power offers warranties on systems alongside remote support

and maintenance contracts. The Group expects to generate a growing

long-term income stream from these activities as system deployments

continue.

Fuel Sales (Own and Operate model)

The Group has been the beneficiary of funding from UK and EU

bodies, which has helped accelerate infrastructure development for

the provision of hydrogen to fleets and individual users.

Grant Funding for Innovation and scale up

The Group utilises funding from grant bodies to contribute

towards research and the technical advancement of its electrolyser

products through generating greater efficiencies and cost

reductions for ITM Power systems.

Financial performance

Sales revenues in the year were largely generated from product

sales and consultancy. This was predominantly from two major

projects, the REFHYNE I electrolyser build and the design and proof

of concept project commissioned by BEIS.

Whilst the investment partnership with Linde has started to

generate new contracts, the revenues and cost of sales from these

have not yet materialised, owing to the accounting treatment under

accounting standard IFRS 15 Revenue from Contracts with Customers,

which will keep our standard product sales in WIP until handover to

the customer. Thus, the gross margin is still heavily influenced by

legacy projects and the challenging EPC scope of the works

contracted, particularly when hampered further by Covid-19

restrictions.

Fuel sales also suffered through Covid-19 lockdowns, generating

only GBP0.2m (2020: GBP0.4m), despite continuing to provide

hydrogen road fuel to emergency service workers.

New collaborative project funding recognised in the year was

GBP0.8m. This has funded research and data collection projects.

The pre-tax loss for the year under review decreased to GBP27.6m

(2020: GBP29.5m). The prior year contained the significant

impairment of our refuelling assets but despite the continuing

growth of the workforce, costs have also been kept in check this

year through a combination of reduced expenditure during Covid-19

lockdowns and through closure of our previous properties, leading

to a consolidation of related service expenditure that will

continue into the new financial year.

Net cash burn increased to GBP32.7m before fund raise (2020:

GBP23.3m). Cash burn is a non-statutory measure the directors use

to monitor the Group, and is calculated by deducting from annual

cash flow (GBP136.2m) the effects of any equity fund raise

(GBP168.9m). A key factor in this movement is that we have

continued to invest in our future, as illustrated by the increase

in the investment activities section of the cashflow statement from

GBP11.1m in 2020 to GBP12.4m in the current financial year. Within

this cash burn figure, there was the completion of our new building

and the fit-out of the factory, from which we have been operating

since January.

Financial position

In the year, the Group capitalised development costs of GBP1.5m

(2020: GBP1.6m). This was for design of standard products that will

facilitate our offering to the markets and developments to adapt

our core technologies for new potential uses. The directors see

continued product development as key to building commercial

traction.

There was an increase in fixed assets (excluding right of use

assets) to GBP13.5m from GBP6.5m in the prior year. The uplift

relates to the leasehold improvements at our new premises and the

kitting out of all the new areas, including labs, factory, test

bays and offices.

At year end, ITM Power Plc had current assets totalling

GBP205.5m (2020: GBP67.5m). Funds in the bank totalled GBP177.1m

(2020: GBP41.0m), of which there were amounts on guarantee of

GBP1.0m (2020: GBP1.1m). The Group has previously been required to

place amounts on guarantee as cash cover, which limits working

capital available to the Group mid-contract. ITM Power Plc

continues to structure quotes to obtain sufficient monies up front

to limit the adverse impact of increased activity on working

capital.

Total receivables excluding restricted cash amounts have reduced

from GBP22.1m (2020) to GBP21.9m. However, this balance is no

longer dominated by pro forma and early stage payments made to

suppliers for stock items required in the next wave of units

through production. Instead the balance is split fairly evenly

between trade debtors, prepayments and accrued project income. The

effort to reduce the number of prepaid suppliers will continue into

the new financial year but has been aided by an improved credit

rating and a review of our approved supplier base. Prepayments

totalled GBP6.5m (2020: GBP13.3m), down 51%.

Trade debtors in the prior year predominantly related to grant

income debtors, whereas in the current year it is purely made up of

commercial customers (2021: GBP5.5m and 2020: GBP4.3m). At year

end, the Group had trade creditors of GBP1.2m against a prior year

balance of GBP2.5m.

Overall, creditors have decreased from GBP14.0m (2020) to

GBP12.9m. The figure continues to be dominated by deferred income

(GBP9.0m in the current year and GBP9.2m in 2020), which for the

most part this year reflects money received up front on contracts.

This is partly due to the timing of contracts as we embarked on the

next wave of commercial contracts but also point in time revenue

recognition now that we have moved on to standard product

sales.

Key financials

A summary of the financial KPIs is set out in the table

below:

2021 2020 2019

GBPm GBPm GBPm

------- ------- ------

Total Projects income, being sales

and grants receivable

(as split below) 5.04 5.35 17.56

------- ------- ------

Of which: Sales Revenue 4.28 3.29 4.59

------- ------- ------

Of which: Grant recognised in the income

statement 2.12 2.47 7.23

------- ------- ------

Of which: Grant recognised on the balance

sheet * (1.35) (0.42) 5.74

------- ------- ------

Pre-tax loss 27.65 29.52 9.32

------- ------- ------

Adjusted EBITDA (21.4) (18.1) (7.3)

------- ------- ------

Property, plant and equipment plus

intangible assets 16.78 8.66 6.41

------- ------- ------

Net Assets 197.44 55.75 26.21

------- ------- ------

*Grant income recognised on the balance sheet includes grant

income recognised against the cost of assets acquired and the

movement on grant income receivable for assets paid on pro-forma

terms but not yet delivered.

Non-financial key performance indicators

FY 2021 FY 2020 FY 2019 FY 2018 FY 2017

Fuel Dispensed

(kg) 14,452 30,707 31,984 13,036 1,043

-------- -------- -------- -------- --------

Fuel Contracts

signed 40 36 33 20 14

-------- -------- -------- -------- --------

No expectations have been set with regards to KPI but prior

years provide a baseline. Fuel dispensed has been affected by the

Covid-19 lockdowns in the year with people working from home and

not travelling to events or meetings.

The number of new fuel contracts will become a less important

measure of the growth of the market for ITM Power. This is due to

an increase in the number of vehicles on the road but under the

umbrella of existing customer contracts and the uptake of private

users rather than businesses. New contracts in the current year

were mainly foreign one-off users.

Events after the Balance Sheet Date

Post balance sheet, a new subsidiary was created to house the

refuelling assets that were previously within ITM Power (Trading)

Limited. ITM Motive Limited will own and operate the UK refuelling

stations in order to drive their profitability. It is a 100% owned

subsidiary so there will be no material impact on the consolidated

accounts.

OUTLOOK

Against a rapidly growing market backdrop ITM Power has made

strong progress in the period, laying the foundations to deliver

turnkey solutions that include the Group's manufactured products to

markets as a result of partnering with world-class EPC provider

Linde. The near-term outlook is positive as the record backlog

reflects the demand for larger systems, as well as the strength of

partnerships with major blue-chip companies.

Post year end, the creation of ITM Motive Ltd -still a

100%-owned subsidiary- allows the Group to focus on both its core

manufacturing model and the own/operate model for refuelling

assets. ITM Support is also developing into a revenue-generating

business unit that will add a further offer to customers.

The Board looks forward to reporting progress as contracts are

awarded, and to providing an update at the AGM in September.

CONSOLIDATED INCOME STATEMENT AND OTHER COMPREHENSIVE INCOME

Note 2021 2020

restated

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 3 4,275 3,291

Direct costs (12,145) (10,839)

Grant income against direct

costs 3 1,356 1,719

--------- -------- ---------

(10,789) (9,120)

Gross loss (6,514) (5,829)

Operating costs

Research and development (3,489) (2,298)

Production and engineering (8,839) (13,919)

Sales and marketing (1,436) (1,386)

Administration expenses (7,404) (7,028)

Expected credit loss (165) 15

Other income - government

grants 3 1,190 1,049

Loss from operations (26,657) (29,396)

Share of loss of associate

company (595) (3)

Investment income 83 90

Finance costs (479) (214)

Loss before tax (27,648) (29,523)

Tax (49) (38)

Loss for the year (27,697) (29,561)

-------- ---------

OTHER TOTAL COMPREHENSIVE INCOME:

Items that may be reclassified subsequently to profit or loss

Foreign currency translation

differences on foreign operations (78) 50

-------- ---------

Net other total comprehensive

income (78) 50

-------- ---------

Total comprehensive loss for

the year (27,775) (29,511)

======== =========

Basic and diluted loss per

share 5 (5.5p) (7.4p)

======== =========

Research and development, Production and engineering, Sales and

marketing were included as "Distribution costs" in the previous

year. These have been presented as individual functions in the

current year and therefore restated in the comparative.

All results presented above are derived from continuing

operations and are attributable to owners of the Company.

CONSOLIDATED BALANCE SHEET

Note 2021 2020

GBP'000 GBP'000

NON-CURRENT ASSETS

Investment in associate 259 346

Intangible assets 3,269 2,154

Right of use assets 6,399 6,520

Property, plant and equipment 13,514 6,501

Financial Asset at amortised cost 148 137

--------- ---------

TOTAL NON-CURRENT ASSETS 23,589 15,658

--------- ---------

CURRENT ASSETS

Inventories 6,418 4,432

Trade and other receivables 22,981 23,166

Cash and cash equivalents 176,078 39,919

--------- ---------

TOTAL CURRENT ASSETS 205,477 67,517

--------- ---------

CURRENT LIABILITIES

Trade and other payables (12,857) (14,013)

Provisions (12,276) (6,890)

Lease liability (204) (211)

--------- ---------

TOTAL CURRENT LIABILITIES (25,337) (21,114)

--------- ---------

NET CURRENT ASSETS 180,140 46,403

--------- ---------

NON-CURRENT LIABILITIES

Lease liability (6,282) (6,315)

NET ASSETS 197,447 55,746

========= =========

EQUITY

Called up share capital 6 27,533 23,664

Share premium account 6 302,248 137,236

Merger reserve 6 (1,973) (1,973)

Foreign exchange reserve 6 83 161

Retained loss 6 (130,444) (103,342)

--------- ---------

TOTAL EQUITY 197,447 55,746

========= =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Note Called Share Merger Foreign Retained Total

up share premium reserve exchange loss equity

capital account GBP'000 reserve GBP'000 GBP'000

GBP'000 GBP'000 GBP'000

At 1 May 2019 6 16,200 86,631 (1,973) 111 (74,760) 26,209

Transactions with Owners

Issue of shares 6 7,464 50,605 - - - 58,069

Credit to equity for

share based payment - - - - 979 979

--------- -------- --------- --------- --------- ---------

Total Transactions

with Owners 7,464 50,605 - - 979 59,048

Loss for the year - - - - (29,561) (29,561)

Other comprehensive

income 6 - - - 50 - 50

--------- -------- --------- --------- --------- ---------

Total comprehensive

income - - - 50 (29,561) (29,511)

At 1 May 2020 6 23,664 137,236 (1,973) 161 (103,342) 55,746

========= ======== ========= ========= ========= =========

Transactions with Owners

Issue of shares 6 3,869 165,012 - - - 168,881

Credit to equity for

share based payment - - - - 595 595

--------- -------- --------- --------- --------- ---------

Total Transactions

with Owners 3,869 165,012 - - 595 169,476

Loss for the year - - - - (27,697) (27,697)

Other comprehensive

income 6 - - - (78) - (78)

--------- -------- --------- --------- --------- ---------

Total comprehensive

income - - - (78) (27,697) (27,775)

At 30 April 2021 6 27,533 302,248 (1,973) 83 (130,444) 197,447

========= ======== ========= ========= ========= =========

CONSOLIDATED CASH FLOW STATEMENT

Note 2021 2020

GBP'000 GBP'000

Net cash used in operating activities 7 (20,141) (12,040)

-------- --------

Investing activities

Investment in associate (535) (349)

Purchases of property, plant and equipment (14,422) (8,986)

Finance asset (security deposit) - (137)

Capital Grants received against purchases

of non-current assets 3,992 89

Proceeds on disposal of Property, Plant

& Equipment 3 1

Payments for intangible assets (1,524) (1,771)

Interest received 83 90

--------

Net cash used in investing activities (12,403) (11,063)

-------- --------

Financing activities

Issue of ordinary share capital 173,835 59,299

Costs associated with fund raise (4,954) (1,230)

Payment of lease liabilities (156) (236)

--------

Net cash from financing activities 168,725 57,833

-------- --------

Increase in cash and cash equivalents 136,181 34,730

Cash and cash equivalents at the beginning

of year 39,919 5,173

Effect of foreign exchange rate changes (22) 16

-------- --------

Cash and cash equivalents at the end

of year 176,078 39,919

======== ========

NOTES

1. GENERAL INFORMATION

ITM Power Plc is a public company incorporated in England and

Wales under the Companies Act 2006. The registered office is at 2

Bessemer Park, Shepcote Lane, Sheffield, South Yorkshire S9

1DZ.

The summary accounts set out above do not constitute statutory

accounts as defined by Section 434 of the UK Companies Act 2006.

The summarised consolidated balance sheet at 30 April 2021, the

summarised consolidated income statement and other comprehensive

income, the summarised consolidated statement of changes in equity

and the summarised consolidated cash flow statement for the year

then ended have been extracted from the Group's 2021 statutory

financial statements upon which the auditor's opinion is

unqualified and did not contain a statement under either sections

498(2) or 498(3) of the Companies Act 2006. The audit report for

the year ended 30 April 2020 did not contain statements under

sections 498(2) or 498(3) of the Companies Act 2006. The statutory

financial statements for the year ended 30 April 2020 have been

delivered to the Registrar of Companies. The 30 April 2021 accounts

were approved by the directors on 10 September 2021, but have not

yet been delivered to the Registrar of Companies.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of accounting

The summary accounts are based on the consolidated financial

statements that have been prepared in accordance with international

accounting standards, in conformity with the requirements of the

Companies Act 2006.

They have been prepared under the assumption that the Group

operates on a going concern basis and on the historical cost basis.

Historical cost is generally based on the fair value of the

consideration given in exchange for goods and services.

Going Concern

The directors have prepared a cash flow forecast for the period

ending 30 September 2022. This forecast indicates that the Group

and parent company would expect to remain cash positive without the

requirement for further fund raising based on delivering the

existing pipeline, for a period of at least 12 months from the date

of approval of these financial statements.

By the end of the period analysed, the Group will still hold a

large proportion of the monies from the fund raise in the year.

This should give the business sufficient funds to trade for the

next three years if the business continued to operate in a similar

way beyond the forecast period.

With the uncertainty created for the economy by Covid-19, this

cash flow forecast has also been stress tested. As a worst-case

scenario, if all payments had to continue as forecast while

receipts were not received at all, the business would remain cash

positive for the full twelve months from the date of approval of

these financial statements.

The accounts have therefore been prepared on a going concern

basis.

3. Revenue, OPERATING SEGMENTS & INCOME FROM GOVERNMENT GRANTS

All revenues are derived from continuing operations. An analysis

of the Group's revenue is as follows:

2021 2020

GBP'000 GBP'000

Revenue from product sales recognised

over time 1,697 2,256

Consulting contracts recognised over

time 2,108 470

Maintenance contracts recognised at

a point in time 112 48

Fuel Sales 153 367

Other (e.g. scrap sales) 205 150

-------- --------

Revenue in the Consolidated Income Statement 4,275 3,291

Grant income shown against cost of sales 1,356 1,719

Grant income (claims made for projects) 761 753

Other government grants (R&D claims) 404 252

Other government grants (Covid-19 furlough

scheme) 25 44

--- -------- --------

1,190 1,049

6,821 6,059

======== ========

At 30 April 2021, the aggregate amount of the transaction price

allocated to remaining performance obligations of continuing build

contracts was GBP16.7m (2020: GBP3.8m). The Group expects to

recognise the remaining performance obligations within one

year.

Segment Information

ITM Power Plc is organised internally to report to the Group's

Chief Operating Decision Maker, the Chief Executive Officer, on the

financial and operational performance of the Group as a whole. The

Group's Chief Operating Decision Maker is ultimately responsible

for entity-wide resource allocation decisions, evaluating

performance on a group-wide basis and any elements within it on a

combination of information from the executives in charge of the

Group and Group financial information.

Management has previously identified three target markets for

our products (Power-to-Gas, Refuelling, and Industrial). Revenue

reporting has begun to look at these three sectors to assess the

commerciality of those sales. However, decisions for resourcing

etc. cannot be made by reference to these segments. The Group

operates a single factory that builds units for use across all

sectors. It would be hard to assign overhead costs to particular

product segments as builds all occur in that one facility and can

run concurrently. Similarly, fixed assets and suppliers' balances

cannot be assigned to the production of one specific segment. For

overhead costs and net asset resources, therefore, decisions are

taken on a group basis.

An analysis of the Group's revenue, by major product (or

customer group), is as follows:

2021 2020

GBP'000 GBP'000

Power-to-Gas

(of which product sales recognised over time GBP42,000) 210 332

Refuelling

(of which product sales recognised over time -GBP215,000) (38) 1,247

Industrial

(of which product sales recognised over time GBP1,870,000) 1,870 1,147

Other 2,233 565

-------- --------

Revenue in the Consolidated Income Statement 4,275 3,291

======== ========

The negative sales revenue on refuelling was caused by the

effects of foreign exchange as well as actual and forecast overruns

(affecting stage of completion) on the product sale therein.

Geographical Analysis

The United Kingdom is the Group's country of domicile but the

Group also has subsidiary trading companies in the United States,

Germany and Australia. All non-current assets were domiciled in the

United Kingdom, with the exception of one hydrogen refuelling

station in California (net book value GBPNil, 2020: GBPNil) and

assets relating to our German office (net book value GBP60,000,

2020: GBP31,000). Revenues have been generated as follows:

2021 2020

GBP'000 GBP'000

United Kingdom 2,505 828

Germany

(of which product sales recognised over time GBP1,893,000) 1,966 1,167

Rest of Europe

(of which product sales recognised over time -GBP196,000) (196) 1,118

United States - 178

4,275 3,291

================ ================

Included in revenue are the following amounts, which each

accounted for more than 10% of total revenue:

2021

GBP'000 2020

GBP'000

Customer A Industrial 1,870 1,140

Customer B Other 2,027 410

Customer C Refuelling <10% 854

4. CALCULATION OF ADJUSTED EBITDA

In reporting EBITDA, management use the metric of adjusted

EBITDA, to better reflect underlying performance and remove the

effect of the following items;

2021 2020

GBP'000 GBP'000

Loss before interest and tax (26,657) (29,396)

Add back:

Depreciation 2,321 2,440

Impairment 1,713 5,588

Amortisation 274 197

Loss on disposal 173 473

Share based payment charge 799 2,625

---------- ----------

(21,377) (18,073)

========== ==========

5. LOSS PER SHARE

The calculation of the basic and diluted earnings per share is

based on the following data:

2021 2020

GBP'000 GBP'000

Loss for the purposes of basic and diluted

loss per share being net loss attributable

to owners of the Company (27,697) (29,561)

Number of shares

Weighted average number of ordinary shares

for the purposes of basic and diluted earnings

per share 507,262,743 398,184,707

Loss per share 5.5p 7.4p

=============== ===============

The loss per ordinary share and diluted loss per share are equal

because share options are only included in the calculation of

diluted earnings per share if their issue would decrease the net

profit per share. The number of potentially dilutive shares not

included in the calculation above due to being anti-dilutive in the

years presented were 50,893,546 (2020: 85,329,719).

6. CALLED UP SHARE CAPITAL AND RESERVES

2021 2020

GBP'000 GBP'000

Called up, allotted and fully paid:

550,658,155 (2020: 473,277,926) ordinary shares

of 5p each 27,533 23,664

======== ========

Authorised Share capital:

======== ========

550,658,155 (2020: 473,277,926) ordinary shares

of 5p each 27,533 23,664

======== ========

Holders of ordinary shares have voting rights at Annual General

Meetings and Extraordinary General Meetings in proportion with

their shareholding.

The share premium account can move when shares are sold and

represents the amount paid in excess of the nominal value when

shares are issued.

The merger reserve arose on the acquisition of ITM Power

(Research) Limited in 2004.

The foreign exchange reserve arises upon consolidation of the

foreign subsidiaries in the Group, and accounts for the difference

created by translation of the income statement at average rate

compared with the year-end rate used on the balance sheet as well

as the effect of the change in exchange rates on opening and

closing balances.

The Group's other reserve is retained earnings which represents

cumulative profits or losses, net of any dividends paid and other

adjustments.

7. notes to the cash flow statement

2021 2020

GBP'000 GBP'000

Loss from operations (26,657) (29,396)

Adjustments:

Depreciation 2,321 2,440

Share based payment 595 978

Loss on disposal 173 473

Impairment 1,712 5,588

Amortisation 274 197

Operating cash flows before movements in

working capital (21,582) (19,720)

(Increase) in inventories (1,987) (2,525)

Decrease in receivables 185 7,964

Decrease in payables (1,156) (2,882)

Increase in provisions 4,857 5,285

Cash used in operations (19,683) (11,878)

Interest paid (479) (214)

Income taxes received 21 52

-------- --------

Net cash used in operating activities (20,141) (12,040)

======== ========

The movement on provisions has been adjusted by GBP530,000 as

the Bessemer Park dilapidations provision has been posted against

Right of Use Assets and therefore no adjustment to the income

statement for this non-cash item is required.

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DBGDCUSBDGBD

(END) Dow Jones Newswires

September 13, 2021 02:00 ET (06:00 GMT)

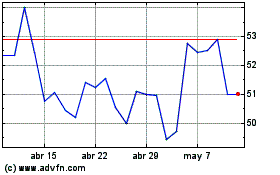

Itm Power (LSE:ITM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Itm Power (LSE:ITM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024