TIDMITM

RNS Number : 4044S

ITM Power PLC

15 November 2021

15 November 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES OF AMERICA (INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY

STATE OF THE UNITED STATES AND THE DISTRICT OF COLUMBIA) (THE

UNITED STATES), AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH

AFRICA, THE REPUBLIC OF IRELAND OR ANY OTHER JURISDICTION WHERE IT

IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS

ANNOUNCEMENT.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

DOES NOT CONSTITUTE AN OFFER OF SECURITIES IN ANY JURISDICTION.

ITM Power plc

("ITM Power" or the "Company")

Result of General Meeting and Completion of Capital Raise

ITM Power plc (AIM: ITM), the energy storage and clean fuel

company, is pleased to announce that its General Meeting held at 10

a.m. on 15 November 2021 at 2 Bessemer Park, Sheffield, South

Yorkshire S9 1DZ, was successfully concluded.

All the resolutions put to shareholders were duly passed by way

of a poll. The voting results are below and will also be available

on the Company's website ( www.itm-power.com ).

Votes for % Votes % Votes Total votes

against withheld

To authorise

director to

allot ordinary

shares 241,070,799 99.95 131,248 0.05 117,343 241,319,390

------------ ------ ---------- ----- ---------- ------------

To disapply

Section 561

of the Companies

Act 2006 233,849,870 96.94 7,388,942 3.06 80,641 241,319,453

------------ ------ ---------- ----- ---------- ------------

Notes:

(1) Resolution 1 was an ordinary resolution, requiring more than

50% of shareholders' votes to be cast in favour of the resolution.

Resolution 2 was a special resolution, requiring at least 75% of

shareholders' votes to be cast in favour of the resolution.

(2) Votes 'For' include those votes giving the Chairman discretion.

(3) The number of ordinary shares in issue on 15 November 2021

was 550,658,155. Shareholders are entitled to one vote per

share.

(4) A "vote withheld" is not a vote in law and is not counted in

the calculation proportion of the votes "for" or "against" a

resolution.

Accordingly, and as set out in the announcement dated 15 October

2021, the Company now has the requisite authority to complete the

Placing and Subscription raising total gross proceeds of

approximately GBP250 million.

Application has been made to the London Stock Exchange for the

new ordinary shares to be admitted to trading on AIM ("Admission").

It is expected that Admission will take place at 8.00 a.m. on 16

November 2021.

Following Admission, the total number of ordinary shares in

issue in the Company will be 613,158,155. The Company holds no

shares in treasury, and therefore the total number of voting rights

in the Company will be 613,158,155 following Admission, and this

figure may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

Capitalised terms used in this announcement have the meanings

given to them in the proposed accelerated capital raise

announcement published by the Company on 14 October 2021.

For further information please visit www.itm-power.com or

contact:

ITM Power plc

James Collins, Investor Relations +44 (0)114 551 1205

Justin Scarborough, Investor Relations +44 (0)114 551 1080

Investec Bank plc (Nominated Adviser

and Broker) +44 (0)20 7597 5970

Jeremy Ellis / Chris Sim / Ben

Griffiths

Tavistock (Financial PR and IR) +44 (0)20 7920 3150

Simon Hudson / David Cracknell

/ Tim Pearson

About ITM Power plc:

ITM Power manufactures integrated hydrogen energy solutions for

grid balancing, energy storage and the production of renewable

hydrogen for transport, renewable heat and chemicals. ITM Power plc

was admitted to the AIM market of the London Stock Exchange in

2004. In October 2019, the Company announced the completion of a

GBP58.8m fundraising, including an investment by Linde of GBP38m,

together with the formation of a joint venture to deliver renewable

hydrogen to large-scale industrial projects worldwide. In November

2020, ITM Power completed a GBP172m fundraising, including a GBP30m

investment by Snam, one of the world's leading energy

infrastructure operators. In January 2021, the Company received an

order for the world's then largest PEM electrolyser of 24MW from

Linde. In October 2021, the Company, with Linde, announced the

deployment of a 100MW electrolyser at Shell's Rhineland refinery,

following the start-up of an initial 10MW facility at the site.

ITM Power operates from the world's largest electrolyser factory

in Sheffield with a capacity of 1GW (1,000MW) per annum, with the

announced intention to build a second UK Gigafactory in Sheffield

with a capacity of 1.5GW expected to be fully operational by the

end of 2023. The Group's first international facility, expected to

have a capacity of 2.5GW per annum, is intended to be operational

by the end of 2024, bringing total Group capacity to 5GW per annum.

Customers and partners include Sumitomo, Ørsted, Phillips 66,

Scottish Power, Siemens Gamesa, Cadent, Northern Gas Networks,

Gasunie, RWE, Engie, GNVert, National Express, Toyota, Hyundai and

Anglo American among others.

IMPORTANT NOTICES

Investec Bank is authorised by the Prudential Regulation

Authority (the "PRA") and regulated in the United Kingdom by the

Financial Conduct Authority (the "FCA") and the PRA. Investec

Europe Limited (trading as Investec Europe) ("Investec Europe"),

acting as agent on behalf of Investec Bank in certain jurisdictions

in the EEA is regulated in Ireland by the Central Bank of Ireland.

Investec is acting solely for the Company and no-one else in

connection with the Placing and the transactions and arrangements

described in this Announcement and will not regard any other person

(whether or not a recipient of this Announcement) as a client in

relation to the Placing or the transactions and arrangements

described in this Announcement. Investec is not responsible to

anyone other than the Company for providing the protections

afforded to clients of Investec nor for providing advice in

connection with the contents of this Announcement, the Placing or

the transactions and arrangements described herein.

BofA Securities is authorised by the PRA and regulated in the

United Kingdom by the FCA and the PRA. BofA Securities is acting

solely for the Company and no-one else in connection with the

Placing and the transactions and arrangements described in this

Announcement and will not regard any other person (whether or not a

recipient of this Announcement) as a client in relation to the

Placing or the transactions and arrangements described in this

Announcement. BofA Securities is not responsible to anyone other

than the Company for providing the protections afforded to clients

of BofA Securities nor for providing advice in connection with the

contents of this Announcement, the Placing or the transactions and

arrangements described herein.

This announcement has been issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by either

of the Banks or by any of their respective affiliates, directors,

employees, advisers or agents as to, or in relation to, the

accuracy or completeness of this announcement or any other written

or oral information made available to any interested party or its

advisers, and any liability therefore is expressly disclaimed.

Neither this Announcement nor any copy of it, nor the

information contained in it, is for publication, release,

transmission distribution or forwarding, in whole or in part,

directly or indirectly, in or into the United States, Australia,

Japan or the Republic of South Africa or any other jurisdiction in

which publication, release or distribution would be unlawful (or to

any persons in any of those jurisdictions), subject to certain

limited exceptions. Any failure to comply with these restrictions

may constitute a violation of the securities laws of such

jurisdictions.

Certain statements contained in this announcement are, or may be

deemed to be, "forward-looking statements". Without limitation, any

statements preceded or followed by or that include the words

"targets", "plans", "believes", "expects", "aims", "intends",

"anticipates", "estimates", "projects", "will", "may", "would",

"could" or "should", or words or terms of similar substance or the

negative thereof, are forward-looking statements. Forward-looking

statements are prospective in nature and are not based on

historical facts, but rather on current expectations and

projections of the management of the Company about future events,

and are therefore subject to risks and uncertainties that could

significantly affect expected results and are based on certain key

assumptions. Many factors could cause actual results, performance

or achievements to differ materially from those projected or

implied in any forward-looking statements. Due to such

uncertainties and risks, readers are cautioned not to place undue

reliance on such forward-looking statements, which speak only as of

the date hereof.

The new ordinary shares to be issued or sold pursuant to the

Placing and Subscription will not be admitted to trading on any

stock exchange other than AIM.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROMDKPBNDBDDODD

(END) Dow Jones Newswires

November 15, 2021 07:19 ET (12:19 GMT)

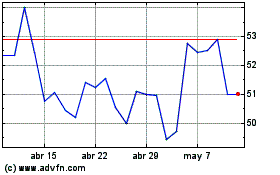

Itm Power (LSE:ITM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Itm Power (LSE:ITM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024