TIDMIXI

RNS Number : 6508Z

IXICO plc

25 May 2021

IXICO plc

("IXICO", the "Company" or the "Group")

Half yearly report to 31 March 2021

8% revenue growth, 18% EBITDA margin

GBP7.0m cash

GBP19.0m order book(1) at 31 March 2021 reflecting contract wins

across the period

IXICO plc (AIM: IXI), the AI data analytics company delivering

insights in neuroscience, announces its unaudited interim results

for the six months ended 31 March 2021.

IXICO's proprietary AI technology increases the utility and

value of brain imaging and digital biomarker data and supports

pharmaceutical and biotech clients to obtain more information from

their neurological disease clinical development programmes.

Financial highlights

-- Reported revenues of GBP4.9 million for the six months to 31

March 2021 (H1 2020: GBP4.6m) representing 8% growth;

-- Continued strong gross margin at 67.6% (H1 2020: 66.5%);

-- Growth in earnings before interest, taxation, depreciation

and amortisation ('EBITDA') to GBP0.9 million (H1 2020:

GBP0.7m);

-- EBITDA margin at 18.0% (H1 2020: 14.8%);

-- Cash position of GBP7.0 million as of 31 March 2021 (H1 2020: GBP6.7m); and

-- Profit per share of 1.78p (H1 2020: 1.01p)

Commercial and operational highlights

-- Order book(1) of GBP19.0 million at 31 March 2021 (H1 2020:

GBP15.3m) despite reduction relating to Phase III and OLE HD trail

failures as announced 23 March 2021;

-- GBP9.4 million of new contracts signed during the period

across a range of clients and neurological therapeutic

indications;

-- Significant capital investment in next generation image

capture and analysis platform and associated partnership with

Microsoft; and

-- Research and Development investments in expanded range of

analytical tools to support advanced quantitative image

analysis.

Corporate development highlights

-- Increased focus on corporate development and strategic

partnership opportunities within Central Nervous System ('CNS')

indications across medical imaging and emerging digital health

technologies.

(1) Order book is contracted but unrecognised revenue adjusted

down to provide the Company's best expectations of delivery.

Giulio Cerroni, CEO of IXICO, commented: "Despite the ongoing

COVID-19 pandemic, this is another strong set of financial results

and I am particular pleased with the continued top line revenue

growth and acquisition of new clients reported through the period.

The CNS clinical trials market is showing the green shoots of

recovery and IXICO's technology-driven business model is well

suited to support our pharma and biotech clients as they

increasingly look to accelerate their adoption of remote data

collection technologies. I am pleased, not only in the progress of

our client traction across the last six months, but also in the

operational progress we have made through investments to ensure we

can scale to meet the demands of our growing marketplace.

"Whilst we expect to see the impact of clinical trial delays and

of the recent loss of revenues from our order book following the

client trial failure announced in March, we remain confident of our

ability to grow across the medium to long term. This conviction is

underpinned by increasing numbers of discussions with a wider range

of clients for our specialist neuroimaging services, across a

broader range of CNS therapeutic indications and potential

strategic partnerships in emerging digital health

technologies."

A recording of the results presentation will be made available

on the Group's website here:

https://ixico.com/investors/company-information/investor-videos/

For further information please contact:

IXICO plc +44 (0)20 3763 7498

Giulio Cerroni, Chief Executive Officer

Grant Nash, Chief Financial Officer

Cenkos Securities PLC (Nominated adviser

and sole broker) +44 (0)20 7397 8900

Giles Balleny / Max Gould (Corporate

Finance)

Michael F Johnson / Russell Kerr

(Sales)

Walbrook PR Ltd Tel: 020 7933 8780 or IXICO@walbrookpr.com

Paul McManus / Lianne Cawthorne / Mob: 07980 541 893 / 07584 391 303

Alice Woodings / 07407 804 654

About IXICO

IXICO is dedicated to delivering insights in neuroscience. Our

mission is to transform the progression of our biopharmaceutical

clients' neurological therapeutic pipelines through the application

of novel imaging and digital biomarkers.

IXICO's data analytics services are used by the global

biopharmaceutical industry to interpret data from brain scans and

digital biosensors to enable better trial design, site

qualification, patient selection and clinical outcomes. We provide

technology-enabled services across all phases of clinical

evaluation. Our integrated digital platform provides a scalable and

secure infrastructure for the capture and analysis of regulatory

compliant clinical data to enable clients to make rapid, better

informed decisions. IXICO is also collaborating with partners to

develop new analytical techniques and digital health products

targeted at improving patient outcomes.

More information is available on www.IXICO.com

CHIEF EXECUTIVE OFFICER'S STATEMENT

Statement from Giulio Cerroni

Across the past six months, we have reported revenues of GBP4.9

million, representing 8% growth compared to the same period of the

prior year. As at 31 March 2021, our contracted order book totalled

GBP19.0 million (H1 2020: GBP15.3 million), which I am particularly

pleased with, considering the reduction of revenues reflected in

the order book relating to our largest client's Huntington disease

('HD') trial following its failure, as announced on 23 March

2021.

This revenue growth has supported the delivery of EBITDA of

GBP0.9 million for the half-year period, reflecting further

accretion in our EBITDA margin to 18% (H1 2020: GBP0.7 million and

14.8%). This strong performance has been driven by continued

commercial momentum of the Group's technology services, which

enable the pharmaceutical industry to derive valuable insights from

their neuroscience clinical development programmes. This is

particularly pleasing when considered alongside the diversification

of our order book and broader reach across neuroscience therapeutic

indications.

The Group has encountered headwinds in its progression during

the period because of the descope of our largest client's Phase 3

and open label HD trials. These, along with the ongoing impact of

COVID-19, mean we anticipate a levelling off of growth across the

next eighteen months. Whilst we continue to hold a strong order

book, it does reflect a reduction in near term revenues expected

compared to the prior year. Positively, this also reflects the

gradual transition within our order book to a broader

diversification of clients. We anticipate this rebalancing, which

has increased the relative proportion of early-stage trials in our

order book, to underpin our ability to achieve medium- and

longer-term growth with a reduced risk profile associated with the

early termination of a trial. As the market responds to an easing

of COVID restrictions and continues to benefit from underlying

growth drivers, we anticipate a continued uptick in the rate of

signing new trials as has been achieved across the last six

months.

In the period we have further accelerated our programs of

investment, specifically in our Microsoft Azure cloud-based image

capture and analysis platform, which we expect to launch during

2022. In addition to this, we have broadened our analytical

offerings across neurological indications and invested in our

operational structures and processes. These investments are all

focussed on scaling the business to ensure the Group maximises the

growth opportunity available to us.

We have continued to invest in our digital biomarkers offering

and pursue a strategy of both organic, and where the appropriate

opportunity arises, inorganic growth in this developing field. We

believe that the COVID-19 pandemic will prove to be a propulsive

force for digital adoption in clinical trials and we see digital

health technologies (wearables in particular) as highly

complementary to our imaging offering to CNS clinical trials. We

consider recent consolidation in the market as a reflection of the

increasing imperative to install these important technologies which

support a more decentralised and remote based trial model.

Looking forward to the second half of the year, we retain our

focus on the business fundamentals of winning new contracts, across

a diverse client base and an increasing breadth of neuroscience

indications. We are, by strategic intent, a neuroscience specialist

and our investments are accordingly entirely focussed on ensuring

we offer the best possible services to our clients in this

field.

The Group is well-capitalised, debt-free and profitable with a

cash balance of GBP7.0 million as at 31 March 2021. As a result, we

can look forward with confidence, knowing that we have built a

resilient business model well placed for growth. Our priority

remains ensuring delivery of the best possible services to our

clients as the industry adjusts to new ways of working and, in so

doing, maximise value for all our stakeholders.

Financial Review

KPI H1-21 H1-20 Movement FY20 FY19

--------------------- ------------- ------------- --------------------- ------------ ------------

Revenue GBP4.9m GBP4.6m 7.9% á GBP9.5m GBP7.6m

Gross profit GBP3.3m GBP3.0m 9.7% á GBP6.3m GBP4.9m

Gross margin 67.6% 66.5% 1.2% á 66.6% 65.4%

EBITDA profit GBP0.9m GBP0.7m GBP0.2m á GBP1.3m GBP0.5m

EBITDA margin 18.0% 14.8% 3.2% á 13.6% 6.3%

Operating profit GBP0.6m GBP0.5m GBP0.1m á GBP0.9m GBP0.4m

/ (loss)

Profit / (loss) per

share 1.78p 1.01p 0.77p á 2.02p 0.92p

Orderbook (1) GBP19.0m GBP15.3m GBP3.7m á GBP21.7m GBP15.9m

Cash GBP7.0m GBP6.7m GBP0.3m á GBP7.9m GBP7.3m

Revenue per FTE (2) GBP103k GBP123k GBP20k â GBP122k GBP124k

--------------------- ------------- ------------- ---------- --------- ------------ ------------

Orderbook is contracted but not yet recognised revenue adjusted down

(1 to reflect the Company's best estimate of delivery.

2) Revenue per FTE for the interim periods are annualised

Revenue

-- Revenue of GBP4.9 million (H1 2020: GBP4.6m) representing a 7.9% increase on prior period.

-- Robust order book of GBP19.0 million (H1 2020: GBP15.3m)

despite reduction of GBP7.1m revenues from trial cessations in the

period.

Gross profit and margin

-- Gross profit growth of GBP0.3 million to GBP3.3 million (H1

2020: GBP3.0m) with a marginal increase in gross margin to 67.6%

from 66.5%

Operating expenses

-- Operating expenditure remained consistent at GBP2.9 million

(H1 2020: GBP2.9m), representing management's ability to maintain a

consistent cost base whilst growing the revenues of the

Company.

-- Capitalised R&D expenditure increased in the period to

GBP0.5 million (H1 2020: GBP0.1m), demonstrating the Company's

commitment to continued investment in building scale and

capabilities to drive growth.

EBITDA and operating profit

-- Growth in EBITDA to GBP0.9 million (H1 2020: GBP0.7m),

reflecting the increase in revenue and gross margin and accessing

additional operational leverage via growth.

-- Growth in operating profit to GBP0.6 million (H1 2020:

GBP0.5m), reflecting EBITDA growth partially offset by increased

depreciation and amortisation arising from increased capital

investment as the Group positions itself for future growth

opportunities.

Cash

-- Increase in closing position of GBP7.0 million (H1 2020:

GBP6.7m) reflecting a careful balance between profitability and

investment activities, supported by share issues relating to the

exercise of share options.

-- Operating cash outflow maintained at GBP0.3 million (H1 2020:

GBP0.3m). The operating cash outflow reflects timings of cash in

and out flows resulting from an increased trade receivables

position and reduced trade payables position, which together offset

the positive cash flows derived from a growing EBITDA

performance.

Revenue per FTE

-- Annualised revenue per FTE of GBP103,000 for the period (H1

2020: GBP123,000) reflects continued investment in employees to

further strengthen the operational and scientific capabilities of

the organisation, as well as augmenting the technology team to

develop our next generation image capture and analysis platform.

This reflects the Group's conviction in the opportunity for growth

over the medium- and long-term.

Consolidated Statement of Comprehensive Income

For the six months ended 31 March 2021 - unaudited

31 Mar 21 31 Mar 20 30 Sep 20

6 months 6 months 12 months

Unaudited Unaudited Audited

Notes GBP000 GBP000 GBP000

---------------------------------------------- ------ ---------- ---------- -----------

Revenue 4,913 4,555 9,532

Cost of sales (1,593) (1,528) (3,186)

---------------------------------------------- ------ ---------- ---------- -----------

Gross profit 3,320 3,027 6,346

Other income 224 378 606

Operating expenses

Research and development expenses (650) (631) (1,309)

Sales and marketing expenses (651) (906) (1,579)

General and administrative expenses (1,604) (1,382) (3,208)

Total operating expenses (2,905) (2,919) (6,096)

---------------------------------------------- ------ ---------- ---------- -----------

Operating profit 639 486 856

Finance income 1 17 20

Finance expense (5) (10) (18)

Profit on ordinary activities before

taxation 635 493 858

Taxation 208 (18) 94

---------------------------------------------- ------ ---------- ---------- -----------

Profit attributable to equity holders

for the period 842 475 952

---------------------------------------------- ------ ---------- ---------- -----------

Other comprehensive expense:

Items that will be reclassified subsequently

to profit or loss

Foreign exchange translation differences 9 (13) (1)

---------------------------------------------- ------ ---------- ---------- -----------

Total other comprehensive expense 9 (13) (1)

Total comprehensive income attributable

to equity holders for the period 851 462 951

---------------------------------------------- ------ ---------- ---------- -----------

Profit per share (pence)

---------------------------------------------- ------ ---------- ---------- -----------

Basic profit per share 3 1.78 1.01 2.02

Diluted profit per share 3 1.68 1.00 2.00

---------------------------------------------- ------ ---------- ---------- -----------

Consolidated Statement of Financial Position

As at 31 March 2021 - unaudited

31 Mar 21 31 Mar 20 30 Sep 20

6 months 6 months 12 months

Unaudited Unaudited Audited

Notes GBP000 GBP000 GBP000

------------------------------- ---- ------ ---------- ---------- -----------

Assets

Non-current assets

Property, plant and equipment 1,183 652 1,014

Intangible assets 1,711 395 796

Total non-current assets 2,894 1,047 1,810

Current assets

Trade and other receivables 2,887 2,598 2,082

Current tax receivables 558 273 259

Cash and cash equivalents 7,011 6,664 7,945

------------------------------------- ------ ---------- ---------- -----------

Total current assets 10,456 9,535 10,286

Total assets 13,350 10,582 12,096

------------------------------------- ------ ---------- ---------- -----------

Liabilities and equity

Non-current liabilities

Trade and other payables 159 - 167

Provisions - - 90

Lease liabilities 548 130 45

------------------------------------- ------ ---------- ---------- -----------

Total non-current liabilities 707 130 302

Current liabilities

Trade and other payables 2,050 1,741 2,407

Provisions 175 - 100

Lease liabilities 29 164 168

Total current liabilities 2,254 1,905 2,675

Equity

Ordinary shares 4 480 471 471

Share premium 4 84,802 84,499 84,499

Merger relief reserve 1,480 1,480 1,480

Reverse acquisition reserve (75,308) (75,308) (75,308)

Foreign exchange translation

reserve (88) (94) (97)

Capital redemption reserve 7,456 7,456 7,456

Accumulated losses (8,433) (9,957) (9,382)

------------------------------------- ------ ---------- ---------- -----------

Total equity 10,389 8,547 9,119

Total liabilities and equity 13,350 10,582 12,096

------------------------------------- ------ ---------- ---------- -----------

Consolidated Statement of Changes in Equity

For the six months ended 31 March 2021 - unaudited

Foreign

Merger Reverse exchange Capital

Ordinary Share relief acquisition translation redemption Accumulated

shares premium reserve reserve reserve reserve Losses Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------- --------- --------- --------- ------------ ------------ ----------- ------------ ---------

Balance at 30

September 2019 469 84,436 1,480 (75,308) (81) 7,456 (10,533) 7,919

------------------- --------- --------- --------- ------------ ------------ ----------- ------------ ---------

Total

comprehensive

income/(expense)

Profit for the

period - - - - - - 952 952

Other

comprehensive

expense:

Realised losses on

foreign

exchange - - - - (15) - 15 -

Foreign exchange

translation - - - - (1) - - (1)

------------------- --------- --------- --------- ------------ ------------ ----------- ------------ ---------

Total

comprehensive

income/(expense) - - - - (1) - 967 951

Transactions with

owners

Charge in respect

of share

options - - - - - - 184 184

Exercise of share

options 2 63 - - - - - 65

Total transactions

with owners 2 63 - - - - 184 249

Balance at 30

September 2020 471 84,499 1,480 (75,308) (97) 7,456 (9,382) 9,119

------------------- --------- --------- --------- ------------ ------------ ----------- ------------ ---------

Total

comprehensive

income

Profit for the

period - - - - - - 842 842

Other

comprehensive

expense:

Foreign exchange

translation - - - - 9 - - 9

------------------- --------- --------- --------- ------------ ------------ ----------- ------------ ---------

Total

comprehensive

income - - - - 9 - 842 851

Transactions with

owners

Charge in respect

of share

options - - - - - - 107 107

Exercise of share

options 9 303 - - - - - 312

Total transactions

with owners 9 303 - - - - 107 419

Balance at 31

March 2021 480 84,802 1,480 (75,308) (88) 7,456 (8,433) 10,389

------------------- --------- --------- --------- ------------ ------------ ----------- ------------ ---------

Consolidated Statement of Cashflows

For the six months ended 31 March 2021 - unaudited

31 Mar 21 31 Mar 20 30 Sep 20

6 months 6 months 12 months

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

------------------------------------------ ---- ---------- ---------- -----------

Cash flows from operating activities

Profit for the period 842 475 952

Finance income (1) (17) (20)

Finance expense 5 10 18

Taxation (208) 18 (94)

Depreciation of fixed assets 247 152 356

Amortisation of intangibles 50 36 82

Disposal of fixed assets - - 1

Dilapidation provision release (53) - -

Impairment of intangible assets - - 2

Research and development expenditure

credit (92) (91) (162)

Share option charge 107 101 184

897 684 1,319

Changes in working capital

(Increase)/decrease in trade and

other receivables (755) (214) 297

(Decrease)/increase in trade and

other payables (436) (982) (128)

------------------------------------------------ ---------- ---------- -----------

Cash (used in)/generated from operations (294) (512) 1,488

Taxation received - 251 447

------------------------------------------------ ---------- ---------- -----------

Net cash (used in)/generated from

operating activities (294) (261) 1,935

Cash flows from investing activities

Purchase of property, plant and

equipment (36) (203) (686)

Purchase of intangible assets including

staff costs capitalised (877) (101) (456)

Finance income 1 12 20

Net cash used in investing activities (912) (292) (1,122)

Cash flows from financing activities

Issue of shares 312 65 65

Repayment of lease liabilities (44) (89) (177)

Interest paid (5) (10) (18)

Net cash generated from financing

activities 263 (34) (130)

Movements in cash and cash equivalents

in the period (943) (587) 683

------------------------------------------------ ---------- ---------- -----------

Cash and cash equivalents at start

of period 7,945 7,264 7,264

Effect of exchange rate fluctuations

on cash held 9 (13) (2)

------------------------------------------------ ---------- ---------- -----------

Cash and cash equivalents at end

of period 7,011 6,664 7,945

------------------------------------------------ ---------- ---------- -----------

Notes to the financial statements

1. Presentation of the financial statements

a. General information

IXICO plc (the 'Company') is a public limited company

incorporated in England and Wales and is admitted to trading on the

AIM market of the London Stock Exchange under the symbol IXI. The

address of its registered office is 4th Floor, Griffin Court, 15

Long Lane, London EC1A 9PN.

The Company is a parent of a number of subsidiaries, together

referred to throughout as 'the Group'. The Group is an established

provider of technology-enabled services to the global

biopharmaceutical industry. The Group's services are used to select

patients for clinical trials and assess the safety and efficacy of

new drugs in development within the field of neurological

disease.

b. Basis of preparation

The condensed consolidated interim financial statements were

approved by the Board of Directors for issue on 24 May 2021. The

condensed consolidated interim financial statements do not comprise

statutory accounts within the meaning of section 434 of the

Companies Act 2006. The condensed consolidated interim financial

statements together with the comparative information for the six

months ended 31 March 2021 are unaudited.

The statutory accounts of the Company for the year ended 30

September 2020 were approved by the Board of Directors on 1

December 2020 and delivered to the Registrar of Companies. The

report of the auditors on those accounts was unqualified, did not

contain an emphasis of matter paragraph and did not contain any

statement under section 498 of the Companies Act 2006.

The condensed consolidated interim financial statements have

been prepared on a going concern basis and in accordance with IFRS

as adopted by the EU, IFRIC interpretations and the Companies Act

2006 applicable to companies operating under IFRS. They comprise a

Statement of Comprehensive Income, a Statement of Financial

Position, a Statement of Changes in Equity, a Statement of Cash

Flows, and accompanying notes. These financial statements have been

prepared under the historical cost convention modified by the

revaluation of certain financial instruments.

The condensed consolidated interim financial statements are

presented in Great British Pounds ('GBP' or 'GBP') and are rounded

to the nearest thousand unless otherwise stated. This is the

predominant functional currency of the Group, and is the currency

of the primary economic environment in which it operates. Foreign

currency transactions are accounted for in accordance with the

policies set out below.

c. Basis of consolidation

The condensed consolidated interim financial statements

incorporate the accounts of the Company and its subsidiary

companies adjusted to eliminate intra-Group balances and any

unrealised gains and losses or income and expenses arising from

intra-Group transactions. When necessary, adjustments are made to

the financial statements of subsidiaries to bring their accounting

policies into line with the Group's accounting policies.

The Group controls a subsidiary when the Group is exposed to, or

has rights to, variable returns from its involvement with a

subsidiary and has the ability to affect those returns through its

power over a subsidiary. In assessing control, potential voting

rights that are currently exercisable or convertible are taken into

account.

The results of subsidiary companies are included in the

condensed consolidated financial statements from the date that

control commences until the date that control ceases. The assets

and liabilities of foreign operations are translated into GBP at

exchange rates prevailing at the end of the reporting period.

Income statements and cash flows of foreign operations are

translated into GBP at average monthly exchange rates which

approximate foreign exchange rates at the date of the transaction.

Foreign exchange differences arising on retranslation are

recognised directly in a separate translation reserve.

d. Going concern

At the time of approving the condensed consolidated financial

statements, the Directors have considered the expected future

performance together with the Group's estimated future cash inflows

from existing long-term contracts and sales pipeline.

The ongoing COVID-19 pandemic continues to cause uncertainty

across global markets for the short and medium term. During 2020,

the Group reacted quickly to this by preparing a series of

financial scenario forecasts based on discussions with clients over

the likely impact of the pandemic on their clinical trials. In

parallel the Group moved rapidly to a fully remote model, which

included providing additional equipment to employees enabling all

to work from home effectively and allowing the Group to trade

uninterrupted throughout the year.

In assessing going concern, management prepare forecasts which

are updated monthly that consider different scenarios throughout

the course of the financial year, as well as ad-hoc forecasts that

extend into future years. These include the risk to current

projects and expected future sales pipelines, the ability for

patients to attend imaging centres (due to global COVID-19 lockdown

restrictions) and potential delays in new trial start-up timelines.

The Directors have considered these forecasts, alongside the

Group's strong balance sheet and cash balance as well as the

ability for the Group to mitigate costs if necessary.

After due consideration of these forecasts, the Directors

concluded with confidence that the Group has adequate financial

resources to continue in operation for the foreseeable future.

2. Significant accounting policies, judgements, and estimation uncertainty

The unaudited condensed consolidated interim financial

statements have been prepared using the accounting policies as

described in the 30 September 2020 audited year end Annual Report

and have been consistently applied.

When preparing the condensed consolidated interim financial

statements, the Directors make a number of judgements, estimates

and assumptions about the recognition and measurement of assets,

liabilities, income and expenses.

Significant management judgements

The following are significant management judgements in applying

the accounting policies of the Group that have the most significant

effect on the condensed consolidated interim financial

statements.

Revenue recognition

The Group recognises revenue in accordance with amounts charged

to clients under service contracts. All contracts include an

agreed, detailed work order which defines the deliverables. The

service contracts are typically multi-year and may be amended

through a change order process, which may include changes to data

volumes (increased or decreased), different methods of data

analysis or changes to the timing of providing the

deliverables.

Revenue is recognised upon achievement of deliverables set out

in the service contract. The recognition is expected to approximate

to the timing of the physical performance of the contracts. The

Group records the performance of the contractual obligations to

determine that the deliverables and actual work performed is in

accordance with the contract and agreed change orders. The scope of

the project and contract terms are reviewed to determine whether

the Group is acting as principal or agent in respect of the

project, which depends on facts and circumstances and requires

judgement.

Client contracts include an agreed work order so the transaction

price for a contract is allocated against distinct performance

obligations based on their relative stand-alone selling prices.

Management determines the fair value of individual components based

on actual amounts charged by the Group on a stand-alone basis. The

transaction price for a contract excludes any amounts collected on

behalf of third parties.

Capitalisation of internally developed software

Distinguishing the research and development phases of a new

software product and determining whether the requirements for the

capitalisation of development costs are met requires judgement.

Management will assess whether a project meets the recognition

criteria as set out in IAS 38 based on an individual project basis.

Where the criteria are not met, the research and development

expenditure will be expensed in the Consolidated Statement of

Comprehensive Income. Where the recognition criteria are met, the

items will be capitalised as an intangible asset.

During the period ended 31 March 2021, total research and

development expenses totalled GBP1,136,000 (2020: GBP711,000). Of

this amount, GBP486,000 (2020: GBP80,000) was capitalised as an

intangible asset. The balance of expenditure being GBP650,000

(2020: GBP631,000) is recognised in the Consolidated Statement of

Comprehensive Income as an expense.

Recovery of deferred tax assets

Deferred tax assets have not been recognised for deductible

temporary differences and tax losses. The Directors consider that

there is not sufficient certainty that future taxable profits will

be available to utilise those temporary differences and tax

losses.

Estimation uncertainty

Information about estimates and assumptions that have the most

significant effect on recognition and measurement of assets,

liabilities, income and expenses is provided below. Changes to

these estimations may result in substantially different results for

the year.

Share-based payments

The Group measures the cost of equity-settled transactions with

employees by reference to the fair value of the equity instruments

at the date at which they are granted. The fair value of the

options granted is measured using an option valuation model, taking

into account the terms and conditions upon which the options were

granted.

Useful lives of depreciable assets

The useful lives of depreciable assets are determined by

management at the date of purchase based on the expected useful

lives of the assets. These are subsequently monitored and reviewed

annually and where there is objective evidence of changes in the

useful economic lives, these estimates are adjusted. Any changes to

these estimates may result in significantly different results for

the period.

Provisions

The amounts included in both long- and short-term provisions are

based on estimates provided by professionals relevant to the

field

the provision relates. These were reviewed by management and are

considered to be a reasonable estimate of the expected cost of

fulfilling these provisions.

3. Earnings per share

The calculation of basic and diluted earnings per share ('EPS')

of the Group is based on the following data:

31 Mar 21 31 Mar 20 30 Sep 20

6 months 6 months 12 months

Unaudited Unaudited Audited

Earnings

Earnings for the purposes of basic and

diluted EPS, being net profit attributable

to the owners of the Company (GBP000) 842 475 952

Number of shares

Weighted average number of shares for the

purposes of basic EPS 47,259,617 46,981,814 47,036,398

Effect of potentially dilutive ordinary

shares:

* Weighted average number of share options 2,950,951 701,770 513,521

Weighted average number of shares for the

purposes of diluted EPS 50,210,568 47,683,584 47,549,919

Basic earnings per share is calculated by dividing earnings

attributable to the owners of the Company by the weighted average

number of shares in issue during the year. The diluted EPS is

calculated by dividing earnings attributable to the owners of the

Company by the weighted average number of shares in issue taking

into account the share options outstanding during the year.

The basic and diluted earnings per share for the Group and

Company is:

31 Mar 31 Mar 30 Sep

21 20 20

6 months 6 months 12 months

Unaudited Unaudited Audited

---------------------------- ---------- ---------- -----------

Basic earnings per share 1.78 1.01p 2.02p

Diluted earnings per share 1.68 1.00p 2.00p

4. Issued capital and reserves

Ordinary shares and share premium

The Company has one class of ordinary shares. The share capital

issued has a nominal value of GBP0.01 and all carry the right to

one vote at shareholders' meetings and are eligible to receive

dividends. Share premium is recognised when the amount paid for a

share is in excess of the nominal value.

The Group and Company's opening and closing share capital and

share premium reserves are:

Group and Company

Ordinary Share Share

shares capital premium

Number GBP000 GBP000

----------------------------------- ----------- -------- --------

Authorised, issued and fully paid

At 30 September 2020 47,091,292 471 84,499

Share options exercised 878,229 9 303

At 31 March 2021 47,969,521 480 84,802

----------------------------------- ----------- -------- --------

Exercise of share options

During the period, the following share options were

exercised:

Key management Other Exercise

personnel Employees Total price Value

Date of exercise Shares Shares Shares Pence GBP000

------------------ --------------- ----------- -------- --------- -------

7 January 2021 - 10,039 10,039 49.0 5

7 January 2021 - 25,098 25,098 30.5 8

7 January 2021 - 10,039 10,039 36.5 4

5 February 2021 112,942 - 112,942 30.5 34

5 February 2021 43,529 - 43,529 34.0 15

4 March 2021 676,582 - 676,582 36.5 246

Total 833,053 45,176 878,229 - 312

------------------ --------------- ----------- -------- --------- -------

This resulted in an increase in share capital of GBP8,782 and an

increase in share premium of GBP303,656.

5. Share-based payments

Certain Directors and employees of the Group hold options to

subscribe for shares in the Company under share option schemes.

There are 2 distinct structures to the share options in operation

in the Group (2020: 2). Both structures relate to a single scheme

outlined in the EMI Share Option Plan 2014.

The scheme is open, by invitation, to both Executive Directors

and employees. Participants are granted share options in the

Company which contain vesting conditions. These are subject to the

achievement of individual employee and Group performance criteria

as determined by the Board. The vesting period varies by award and

the conditions approved by the Board. Options are usually forfeited

if the employee leaves the Group before the options vest.

Total share options outstanding have a range of exercise prices

from GBP0.01 to GBP0.70 per option and the weighted average

contractual life is 3.1 years (2020: 4.1 years). The total charge

for each period relating to employee share-based payment plans for

continuing operations is GBP107,000 (2020: GBP101,000).

Details of the share options under the scheme outstanding during

the period are as follows:

As at 31 March 2021 As at 30 September 2020

--------------------------- ----------------------------- -------------------------------

Number Weighted average Number Weighted average

exercise price exercise price

Outstanding at start of

the period 4,438,511 GBP0.17 3,690,572 GBP0.18

Granted - - 1,990,000 GBP0.17

Exercised (878,229) GBP0.36 (188,998) GBP0.34

Lapsed - - (1,053,063) GBP0.17

--------------------------- ----------

Outstanding at end of the

period 3,560,282 GBP0.13 4,438,511 GBP0.17

Exercisable at end of the

period 277,852 GBP0.36 1,118,581 GBP0.36

--------------------------- ---------- ----------------- ------------ -----------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZLFLFELZBBF

(END) Dow Jones Newswires

May 25, 2021 02:00 ET (06:00 GMT)

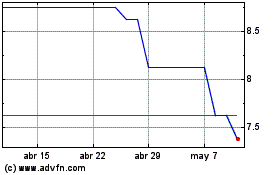

Ixico (LSE:IXI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ixico (LSE:IXI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024