TIDMIBST

RNS Number : 1323R

Ibstock PLC

03 November 2021

3 November 2021

Ibstock plc

Q3 Trading Update - strong trading and further strategic

progress

Launch of Ibstock Futures and GBP50m investment to create new

automated brick slip systems factory

Ibstock plc ('Ibstock' or the 'Group'), a leading UK

manufacturer of clay bricks and concrete products, is today

announcing a trading update for the quarter ended 30 September 2021

and the creation of a new business unit, Ibstock Futures, to

accelerate its growth plans.

Trading update

-- Strong Q3 performance supported by continued robust demand in core markets

-- Supply chain impacts well managed, with both divisions delivering a resilient operational

performance

-- Our expectations for adjusted EBITDA for the 2021 financial year remain unchanged

-- Atlas wire cut factory redevelopment on track with planning now secured

Strategic growth

-- Launch of Ibstock Futures; a new business unit established to capture growth opportunities

in new, fast growth sectors of the UK construction market

-- GBP50m investment to create the UK's first automated brick slip systems factory in West Yorkshire

-- Investment will significantly increase Ibstock's presence in the fast growing market for brick

slip clad walling systems in the offsite and modular construction sectors

-- Net zero carbon brick slips to be in production by early 2024

Joe Hudson, Chief Executive Officer of Ibstock plc

commented:

"Trading in the third quarter remained strong, with robust

demand continuing across both the housebuilding and RMI markets.

While, as expected, supply chain conditions have become more

challenging, we have managed the impacts well and continue to work

closely with our customers on service levels. Despite the more

difficult supply chain backdrop, we remain confident of delivering

an outcome for the year in line with our previous guidance.

"The launch of Ibstock Futures is an important strategic

development for the Group and will directly address a number of

exciting growth markets that complement our existing offer for

conventional building methods as the focus on sustainability and

the industrialisation of construction processes gathers pace. This

investment in brick slips manufacturing capacity at scale will be a

first for the UK and will enable us to take a leadership position

in this fast-growing market. The Nostell plant is the first of a

pipeline of growth initiatives we have in development for Ibstock

Futures and we are excited about the potential this new business

has to accelerate growth in the years ahead."

Trading update

The Group continued to perform well during the third quarter,

against a background of strong demand in both the new build and

repair, maintenance and improvement ("RMI") markets.

Supply chain impacts, particularly relating to the availability

of freight and labour, were well managed, with both divisions

delivering a resilient operational performance during the period.

Product price increases were implemented successfully against a

backdrop of significant input cost inflation, primarily in the

categories of energy, freight, carbon and materials.

As a result, the Group is confident in delivering adjusted

EBITDA for the 2021 financial year in line with its previous

guidance.

Looking to 2022, whilst macro conditions are expected to remain

dynamic, the Group continues to be confident in its ability to make

significant further strategic and financial progress. Ibstock's

hedging policy positions it well against a backdrop of increasing

energy prices: the Group's energy requirements are fully hedged for

the remainder of 2021, with around 80 percent hedged for 2022.

The redevelopment of our Atlas wire cut clay brick facility in

the West Midlands is progressing well with planning approvals

secured, equipment orders placed and construction work underway.

The project is on track to commission, as expected, by the end of

2023.

As part of the commitment to sector leadership in ESG, the Group

is establishing more ambitious targets for carbon reduction and

expects to announce these before the end of the year. The Group

also continues to explore opportunities to use alternative, lower

carbon, fuels in its manufacturing processes.

New business unit established to accelerate growth in UK

construction markets

Alongside its strong trading momentum over the last 12 months,

and in line with its strategic objectives, the Group has made

significant progress in identifying opportunities to accelerate its

growth and diversify its revenue base by targeting fast growing

areas of the UK construction market. In particular, the Group is

targeting technologies, products and solutions aligned to two key

trends that will transform our industry over the long term:

sustainability and the industrialisation of construction

processes.

The potential markets for these technologies and systems are

substantial and growing faster than the wider building products

industry. Furthermore, manufacturing of the target products is

typically less capital intensive, enabling the Group to develop

with greater agility and speed.

To capitalise on this opportunity, Ibstock is today announcing

the launch of a new business unit, Ibstock Futures. Ibstock Futures

will target an immediate opportunity to increase the Group's

presence in façade products and solutions for the fast-growing

off-site and modular construction markets in both the new build and

re-cladding markets, with products suitable for a wide range of

residential, commercial and mixed-use applications. Furthermore,

the new business unit is developing a range of projects across the

construction value chain and will also focus on leveraging the

Group's competitive position to drive value through its

sustainability credentials, including potential alternative uses

for its existing clay reserves.

Ibstock's expectation for the business unit, which will be

headquartered at the Group's London I-studio, is to scale revenues

rapidly over the next five years, delivering growth through a

combination of both organic and inorganic investment.

The Group will give a more detailed update on Ibstock Futures

with the full year results in March 2022.

GBP50m investment to create the UK's first automated brick slips

factory

As Ibstock Futures' launch project, the Group is today

announcing plans to build the UK's first automated brick slip

systems factory in Nostell, West Yorkshire. Brick slips provide a

durable, safe and energy efficient alternative to other cladding

solutions. The UK market for brick slips is significant, with

annual volumes of circa 120 million slips, and is growing fast. The

addition of a significant brick slip capability will be highly

complementary to the Group's existing clay brick business and the

investment will enable Ibstock to take a leadership position in the

market, significantly increasing its presence in the fast growing

mid and high-rise construction sectors.

The planned GBP50 million capital investment will provide

capacity for up to 60 million brick slips per annum. An initial

investment of around GBP38 million, providing capacity to produce

30 million brick slips, will be spread evenly across 2022 and 2023,

with the factory commissioning in late 2023. The second phase of

investment is expected to be made shortly thereafter as additional

capacity is required. EBITDA from the initial investment is

expected to be at least GBP10 million per annum once the plant is

operating at expected capacity levels from 2025. The investment is

expected to deliver a return on capital employed (ROCE) at least in

line with the Group average.

The factory will be constructed within the existing footprint of

the Group's Nostell facility, which operated as a brick factory

until its closure in 2020. The facility benefits from significant

adjacent clay reserves and established infrastructure, and is well

situated within the heartland of its anticipated key markets. The

planning application process has commenced, and construction on

site is expected to start during Q1 2022.

The new factory will manufacture a wide range of different brick

slip types and associated systems, and will incorporate the latest

manufacturing technology to deliver a very significant reduction in

carbon compared to both imported and domestically cut slips. In

combination with high-quality offset projects, this will result in

Nostell producing the UK's first net-zero carbon brick slip.

Analyst Call

Ibstock is hosting an audio webcast for investors and analysts

at 0900 UK time today.

To register for the webcast, please click here

The presentation can also be heard via a conference call, where

there will be the opportunity to ask questions.

Conference Call Dial-In Details: +44 (0)330 336 9127

Confirmation code: 6708115

An archived version of today's call will be available on

www.Ibstockplc.co.uk later today.

Ibstock plc 01530 261 999

Joe Hudson, CEO

Chris McLeish,

CFO

Citigate Dewe Rogerson 020 7638 9571

Kevin Smith

Holly Gillis

About Ibstock plc

Ibstock plc is a leading UK manufacturer of clay bricks and a

diversified range of clay and concrete products. Its principal

products are clay bricks, brick components, concrete roof tiles,

concrete substitutes for stone masonry, concrete fencing and

pre--stressed concrete products.

The Group's two divisions are:

Ibstock Clay: The leading manufacturer by volume of clay bricks

sold in the United Kingdom. With 16 manufacturing sites Ibstock

Brick has the largest brick production capacity in the United

Kingdom. It operates a network of 18 active quarries located close

to its manufacturing plants. Ibstock Kevington provides masonry and

pre-fabricated component building solutions, operating from 6 sites

across the United Kingdom.

Ibstock Concrete: A leading manufacturer of concrete roofing,

walling, flooring and fencing products, along with lintels and

general concrete building products, with 14 manufacturing plants in

the United Kingdom.

About Brick Slips

Brick slips are clay bricks with an adapted thickness for use

with a variety of cladding systems across both off-site and on-site

construction. Slips deliver the same appearance as clay brickwork

and are suitable for external or internal applications. Brick slips

offer an attractive, durable and safe alternative for cladding

large residential and commercial buildings, a market that is seeing

significant growth.

At present, automated plants in continental Europe supply around

two-thirds of the brick slips used in the UK, with the remainder

cut manually from facing bricks in the UK.

The visual aesthetic and flexibility of clay brick slips and

their contribution to improved construction speed are making the

product increasingly popular with architectural specifiers. The

clay brick slip market is expanding rapidly and brick slip volumes

are expected to grow significantly over the next 5 years, with

slips increasingly used in multi-storey urban buildings as the

façade of choice, using a variety of panel-based cladding

systems.

Clay brick slips are also a preferred façade for the growing

market for manufactured panel cladding systems for use in offsite

manufactured residential housing units and offer a safe,

non-combustible solution for recladding applications.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEANFAEDNFFFA

(END) Dow Jones Newswires

November 03, 2021 03:00 ET (07:00 GMT)

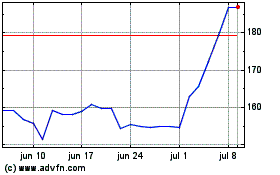

Ibstock (LSE:IBST)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ibstock (LSE:IBST)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024