TIDMIGE

RNS Number : 8697W

Image Scan Holdings PLC

28 April 2021

The following amendment(s) has (have) been made to the 'Interim

Results' announcement released on 28/04/2021 at 7.00 a.m. under RNS

No 7769W.

The financial statements have been included in this

announcement.

All other details remain unchanged.

The full amended text is shown below.

Image Scan Holdings plc

Interim Report 2021

28/04/2021

IMAGE SCAN HOLDINGS PLC

("Image Scan" or the "Company")

(AIM: IGE)

INTERIM RESULTS

Image Scan, (AIM: IGE) specialists in the field of X-ray imaging

for the security and industrial inspection markets, today announces

its interim results for the six months ended 31 March 2021. During

the first six months the performance of the Company has continued

to be impacted by COVID-19, but there is a sufficiently strong

orderbook and pipeline of new business for us to expect a stronger

second half.

Financial summary:

-- Revenue GBP868k (2020: GBP2.3m)

-- Gross profit margin improved to 55% (2020: 45%)

-- Loss before taxation of GBP201k (2020: profit of GBP180k)

-- Period end bank balance of GBP1m (2020: GBP1.1m)

-- Order intake GBP938k (2020: GBP1.5m)

-- Period end order book of GBP702k (2020: GBP933k)

-- Order book increased to GBP1.5m at 27 April 2021 including

large Asian portable X-ray contract win

Operational highlights:

-- First order for new conveyor X-ray system received from USA

-- New portable X-ray customer in Canada

-- Contract to supply portable X-ray systems to RAF

-- New orders for industrial screening systems

-- Research and Development effort supported by customer funding

-- Large portable X-ray order received from Asian customer after period end

The Board considers that the Company has a sufficiently strong

pipeline of new orders to continue to trade in line with market

expectations for the year ending 30 September 2021 which are for

sales of GBP3m and a loss of GBP200k.

Bill Mawer, Chairman and Chief Executive Officer of Image Scan

commented: "We expected that the COVID-19 pandemic would continue

to impact the flow of new orders into the business in the first

half of this financial year, and that impact is reflected in these

results. However, we are delighted that our new products are

finding their first customers and that we have been able to open up

new markets in North America and the UK. The new portable X-ray

order and our strong new business pipeline point to a stronger

performance in the second half, though we continue to monitor

closely the potential impact of COVID-19 outbreaks in important

markets such as India and Brazil. Nonetheless, we will continue our

ambitious new product development programme as this is putting us

in a strong position for when the effects of the pandemic

diminish."

For further information on the Company, please visit:

www.ish.co.uk and for further information on its

products, please visit: www.3dx-ray.com

Enquiries:

Image Scan Holdings plc Tel: +44 (0) 1509 817

William Mawer, Chairman and Chief Executive Officer 400

Sarah Atwell King, Finance Director and Company ir@ish.co.uk

Secretary

----------------------

W H Ireland - Nominated Adviser and Broker Tel: +44 (0) 117 945

Mike Coe/Chris Savidge (Corporate Finance) 3470

Jasper Berry (Broking)

----------------------

Chairman's statement

Introduction

Image Scan Holdings plc is a specialist in innovative X-ray

technology, operating globally in the security and industrial

inspection sectors. The Company's principal activity is the design,

manufacture, and supply of both portable and fixed X-ray security

screening systems to governments, security organisations and law

enforcement agencies. The Company also supplies high-quality image

acquisition systems for non-destructive testing to commercial

organisations worldwide.

Financial results

Revenues for the six months ended 31 March 2021 declined to

GBP868k (2020: GBP2.3m) reflecting the low opening order book of

GBP633k and the fact that much of the order intake of GBP938k

(2020: GBP1.5m) arrived towards the end of the period. We saw

delays in a number of important projects as Governments worldwide

continued to focus on battling the pandemic. However, a key new

portable X-ray project, one of those directly delayed by COVID-19,

was won after the period end.

A favourable mix of sales lead to an improvement in gross margin

to 55% (2020: 45%). Costs were carefully managed, and we received

GBP32k from the Government furlough scheme to support salaries in

quiet periods, allowing us to reduce overheads by 20% to GBP682k

(2020: GBP840k). The loss for the period was GBP201k (2020: profit

of GBP180k).

The Company finished the period with an orderbook of GBP702k

(2020: GBP933k) and positive cash balance of GBP1m (2020: GBP1.1m).

Trading in the first part of April, brought the orderbook to

GBP1.5m at April 27(th) .

Overview

While overall order intake for security systems was at a

disappointing level in the period, the orders received did include

some notable wins. Examples include: a follow-on order for portable

X-ray systems from a major global NGO, who uses our scanners to

support its worldwide operations; a first order for a conveyor

X-ray system for a customer in the USA, as well as previously

announced orders in the UK and Canada. Since the period end, we

have received a large contract for portable X-ray systems and the

first order for the new Axis-CXi cabinet X-ray screening system,

both from customers in Asia

While we have been concerned about the impact of the pandemic on

our automotive customers, it is reassuring to have received orders

for two new industrial screening systems and to be working on the

implementation of new X-ray measurement techniques under a customer

funded software development contract.

Our access to global security markets is a key strength of the

Company and it has been pleasing to see our investment in

appointing a sales consultant in North America bear fruit with new

customers in both Canada and the USA. We have also won orders from

new customers in Eastern Europe and Asia.

Servicing our large installed base of industrial screening

systems has presented a challenge through the pandemic, but we have

adapted to this situation through customer training, increased

remote machine access and recruitment of overseas service

partners.

We continue to invest in our product range and the launch of the

Axis-CXi cabinet X-ray scanner in October 2020 was a significant

milestone. This system brings new levels of performance to the

cabinet X-ray market and we are pleased by the level of customer

interest. We expect to have a number of variants of our conveyor

X-ray system fully on the market in the next few months. We are

exploring new X-ray detection and image processing techniques to

further strengthen the differentiation of our products in the

security X-ray marketplace.

Outlook - COVID-19 and beyond

The path of the Covid-19 pandemic continues to be unpredictable.

Two places where the disease is currently most prevalent are India

and Brazil, one a longstanding market for the Company, the other a

more recent addition for which we have high hopes for the future.

In other parts of the world, the disease has subsided, and more

normal levels of activity are starting to return. The new portable

X-ray order described above will be delivered in the second half

and so we remain cautiously optimistic for an improved performance

in the second half and that we can trade in line with market

expectations for the year as a whole.

Our strategy continues to be focussed on expansion of the

product range so that, as market activity returns to more normal

levels, we are well placed to capitalise, offering the broader

product range through our excellent network of local partners. Our

product development strategy meets several goals: the maintenance

and upgrade of existing products, for which recently launched Wi-Fi

range extenders for portable X-ray systems would be an example; the

broadening of current product ranges to include multiple formats

for different users, and, lastly the development of new product

ranges such as the recent addition of new conveyor X-ray systems.

The partner network continues to expand, and this has led to the

recent acquisition of promising new customers in several

regions.

To better support the sales activity in an environment where

travel is difficult or impossible, we are currently building a

demonstration room at our facility that will be fully equipped to

support on-site visits, attendance at on-line trade exhibitions and

person to person remote presentations and demonstrations. We

continue to expand our on-line and social media presence and our

participation in counter terrorism forums.

The Company retains a positive outlook and our small but

industrious team work hard to build a platform for sustainable

growth into the future. On behalf of my fellow Board members, I

would like to formally thank all our personnel for their

outstanding response to the continuing challenging

circumstances.

Bill Mawer

Chairman and Chief Executive Officer

28/04/2021

Consolidated income statement

For the six months ended 31 March 2021

Six months Six months Year ended

ended ended 30 September

31 March 31 March

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

Note GBP'000 GBP'000 GBP'000

------------

Revenue 868 2,287 3,484

------------ ------------ -------------

Cost of sales (387) (1,268) (1,760)

------------ ------------ -------------

Gross profit 481 1,019 1,724

------------ ------------ -------------

Operating expenses (682) (840) (1,612)

------------ ------------ -------------

Operating (loss)/profit (201) 179 112

------------ ------------ -------------

Finance income - 1 1

------------ ------------ -------------

Loss/(profit) before taxation (201) 180 113

------------ ------------ -------------

Taxation - - 25

------------ ------------ -------------

Loss/(profit) for the period (201) 180 138

------------ ------------ -------------

Pence Pence Pence

Earnings per share

---- ------ ----- -----

Basic profit per share [3] (0.15) 0.13 0.10

---- ------ ----- -----

Diluted profit per share (0.15) 0.13 0.10

------ ----- -----

Consolidated statement of changes in equity

For the six months ended 31 March 2020

Six months Six months Year ended

ended ended 30 September

31 March 31 March

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

Note GBP'000 GBP'000 GBP'000

------------

Opening equity shareholders' funds 1,409 1,268 1,268

------------ ------------ -------------

Share-based payments [4] - 4 3

----- ------------ ------------ -------------

(Loss)/profit attributable to equity

shareholders (201) 180 138

------------ ------------ -------------

Closing equity shareholders' funds 1,208 1,452 1,409

------------ ------------ -------------

Consolidated statement of financial position

As at 31 March 2020

As at As at As at

31 March 31 March

2021 2020 30 September

(Unaudited) (Unaudited) 2020

GBP'000 GBP'000 (Audited)

GBP'000

Non-current assets

------------ ------------ -------------

Intangible and tangible assets 61 40 64

------------ ------------ -------------

61 40 64

------------ ------------ -------------

Current assets

------------ ------------ -------------

Inventories 366 439 450

------------ ------------ -------------

Trade and other receivables 404 697 315

------------ ------------ -------------

Cash and cash equivalents 1,048 1,140 1,410

------------ ------------ -------------

1,818 2,276 2,175

------------ ------------ -------------

Total assets 1,879 2,316 2,239

------------ ------------ -------------

Current liabilities

------------ ------------ -------------

Trade and other payables 671 864 783

------------ ------------ -------------

Non-current liabilities

------------ ------------ -------------

Bank Loan 47

------------ ------------ -------------

Total liabilities 671 864 830

------------ ------------ -------------

Net assets 1,208 1,452 1,409

------------ ------------ -------------

Equity

------------ ------------ -------------

Share capital 1,363 1,363 1,363

------------ ------------ -------------

Share premium account 8,328 8,328 8,328

------------ ------------ -------------

Retained earnings (8,483) (8,239) (8,282)

------------ ------------ -------------

Equity shareholders' funds 1,208 1,452 1,409

------------ ------------ -------------

Consolidated cash flow statement

For the six months ended 31 March 2021

Six months Year ended

ended 30 September

31 March

2021 2020

(Unaudited) (Audited)

GBP'000 Six months

ended 31

March 2020

(Unaudited)

GBP'000 GBP'000

Cash flows from operating activities

------------ ------------ -------------

Operating (loss)/profit (201) 179 112

------------ ------------ -------------

Adjustments for:

------------ ------------ -------------

Depreciation 10 11 21

------------ ------------ -------------

Impairment of inventories 9 14 26

------------ ------------ -------------

Amortisation of Lease 21 - 39

------------ ------------ -------------

(Decrease)/increase in provision for

warranty (9) 16 18

------------ ------------ -------------

Decrease in inventories 75 330 306

------------ ------------ -------------

(Increase)/decrease in trade and other

receivables (90) (143) 350

------------ ------------ -------------

(Decrease)/increase in trade and other

payables (98) 29 (140)

------------ ------------ -------------

Share-based payment charge - 4 4

------------ ------------ -------------

Net cash used in operating activities (283) 440 736

------------ ------------ -------------

Corporation tax recovered (1) 64 32

------------ ------------ -------------

Net cash outflow from operating activities (284) 504 768

------------ ------------ -------------

Cash flows from investing activities

------------ ------------ -------------

Interest received - 1 1

------------ ------------ -------------

Purchase of intangible and tangible

assets (7) (6) (10)

------------ ------------ -------------

Net cash used in investing activities (7) (5) (9)

------------ ------------ -------------

Cash flows from financing activities

------------ ------------ -------------

(Repayment)/proceeds from bank loan (50) - 50

------------ ------------ -------------

Lease payments (21) - (40)

------------ ------------ -------------

Net cash from financing activities (71) - 10

------------ ------------ -------------

Net (decrease)/increase in cash and

cash equivalents (362) 499 769

------------ ------------ -------------

Cash and cash equivalents at beginning

of period 1,410 641 641

------------ ------------ -------------

Cash and cash equivalents at end of

period 1,048 1,140 1,410

------------ ------------ -------------

Notes to the unaudited interim financial statements

For the six months ended 31 March 2021

1 Basis of preparation

The interim financial statements, which are unaudited, have been

prepared on the basis of the accounting policies expected to apply

for the financial year to 30 September 2021 and in accordance with

recognition and measurement principles of International Financial

Reporting Standards ('IFRSs') as endorsed by the European Union.

The accounting policies applied in the preparation of these interim

financial statements are consistent with those used in the

financial statements for the year ended 30 September 2020.

The interim financial statements do not include all of the

information required for full annual financial statements and do

not comply with all the disclosures in IAS 34 'Interim financial

reporting'. Accordingly, whilst the interim statements have been

prepared in accordance with IFRSs, they cannot be construed as

being in full compliance with IFRSs.

The financial information for the year ended 30 September 2020

does not constitute the full statutory accounts for that period.

The annual report and financial statements for the year ended 30

September 2020 have been filed with the Registrar of Companies. The

Independent auditor's report on the report and financial statements

for the year ended 30 September 2020 was unqualified, did not draw

attention to any matters by way of emphasis, and did not contain a

statement under Section 498(2) or 498(3) of the Companies Act

2006.

2 Going concern

The interim financial information has been prepared on a going

concern basis, which assumes that the Company will have adequate

resources to continue in operational existence for the foreseeable

future.

3 Earnings per share ('EPS')

Basic earnings per ordinary share is based on the loss on

ordinary activities before taxation of GBP201,198 and on

136,354,577 ordinary shares in issue throughout the period.

Diluted profit per share is calculated by adjusting the weighted

average number of ordinary shares in issue on the assumption of

conversion of dilutive potential ordinary shares, based on the

share price at the end of the period. The Company's dilutive

potential ordinary shares are shares issued under the Company's

Enterprise Management Incentive ('EMI') scheme and options issued

under the Company's Unapproved scheme.

4 IFRS 2 'Share-based payments'

Operating expenses includes a charge of GBPnil (2020: GBP3,877)

after valuation of the Company's employee share option schemes in

accordance with IFRS 2. Under this standard, the fair value of the

options at the grant date is spread over the vesting period. These

charges have been credited to equity in accordance with IFRS2 as

presented in the consolidated statement of changes in equity.

5 Additional copies

Further copies of the 2021 interim report are available on the

Company's website, www.ish.co.uk, and from the Company's registered

office, 16-18 Hayhill Industrial Estate, Sileby Road,

Barrow-upon-Soar, Leicestershire LE12 8LD.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KZGZDRRLGMZG

(END) Dow Jones Newswires

April 28, 2021 05:03 ET (09:03 GMT)

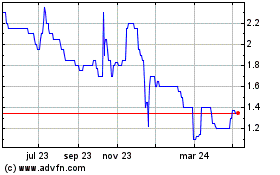

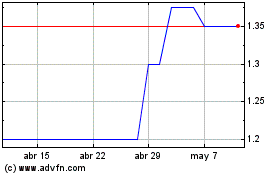

Image Scan (LSE:IGE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Image Scan (LSE:IGE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024