TIDMIMPP

THIS ANNOUNCEMENT IS NOT FOR RELEASE, DISTRIBUTION, PUBLICATION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO OR FROM THE UNITED STATES, CANADA,

AUSTRALIA, NEW ZEALAND, THE REPUBLIC OF SOUTH AFRICA OR JAPAN OR ANY OTHER

JURISDICTION WHERE TO DO SO MIGHT CONSTITUTE A VIOLATION OF THE RELEVANT LAWS

OR REGULATIONS OF SUCH JURISDICTION.

03 June 2021

Imperial X Plc

("Imperial X" or the "Company")

ADMISSION TO TRADING ON THE MAIN MARKET, CLOSING OF THE £2 MILLION FUNDRAISING

& FIRST DAY OF DEALINGS

Imperial X Plc (LSE: CDL), a natural resource project generator, is pleased to

announce that its entire issued ordinary share capital consisting of

389,565,060 ordinary shares of £0.001 will today be admitted to the Official

List (by way of Standard Listing under Chapter 14 of the Listing Rules) and to

trading on the London Stock Exchange's Main Market for listed securities

(together, the "Admission"). Dealing will commence at 8:00 a.m. today, Thursday

3rd June 2021, under the ticker "CDL" (ISIN: GB00B44LQR57). The Company has

filed an application to change its name to Cloudbreak Discoveries Plc, however,

due to Covid-19 related delays, this is not expected to become effective for

approximately two weeks and a further announcement will be made to confirm the

change.

Highlights

* Successful £2 million fundraising at 3p per share which was oversubscribed

* With effect from Admission, Imperial X will hold equity positions and

royalties in a variety of projects in the natural resources sectors across

multiple jurisdictions, primarily in North America and Africa

* Imperial X provides European investors with a business model and range of

assets which to date has been a largely untapped opportunity in Europe

* The Directors believe the model is capable of bringing investors a high

level of scalability and excellent returns while not compromising the level

of risk being undertaken

* Imperial X has the ability to pivot between commodities for the best

prospects and opportunities but has a core focus on bulk, industrial and

base materials and metals with an early focus on critical metals for the

ongoing electrification revolution

* The proceeds of the Fundraising will be used to pursue the Group's

immediate objective of developing its existing portfolio of assets and

interests and acquiring suitable additions and provide working capital to

cover ongoing annual operating costs

* Imperial X's business model is not constrained by geographic location or

commodity, allowing it to diversify its range of assets and partners

Kyler Hardy, CEO of Imperial X Plc, commented, "Listing on the Standard Segment

of the Official List represents a significant milestone for the Company. This

listing offers investors first mover advantage to be a part of a project

generator and royalty business model which is well established in North

American capital markets but remains largely untapped across Europe.

"The Company will deploy our business model to acquire undervalued assets in

the global natural resources sectors and partner them with exceptional

partners. Utilising the Board and management's technical and transactional

experience across deal structures, commodities, and jurisdictions, we have the

flexibility to pivot our investments to the best prospects and opportunities.

Our exposure to a diverse range of commodities, across multiple jurisdictions

significantly de-risks our portfolio and creates true shareholder value.

"As we now join the Main Market, I look forward to scaling up the business

through a pipeline of acquisitions. I am proud of what we have achieved in

getting to this point and am excited about expanding our portfolio and

providing strong returns for new and existing investors."

- Ends -

For additional information please contact:

Imperial X PLC Tel: +1 604 428 9480

Kyler Hardy, CEO khardy@cloudbreakdiscovery.com

Kyle Hookey, Director khookey@cloudbreakdiscovery.com

Novum Securities Tel: +44 7399 9400

Financial Adviser and

Broker

David Coffman / Lucy

Bowden

Colin Rowbury

Blytheweigh Tel: +44 207 138 3204 Cloudbreak@blytheweigh.com

(Financial PR/IR-London)

Tim Blythe

Megan Ray

ABOUT IMPERIAL X PLC

Imperial X Plc is looking to become a leading natural resource prospect

generator, working across a wide array of projects that are being developed and

managed by an experienced team with a proven track record. Value accretion

within the projects being developed by the new Cloudbreak generator model

enables a multi asset approach to investing. Diversification within the mining

sector and amongst resource classes is key to withstanding the cycles of

resource investing.

IMPORTANT INFORMATION

This announcement does not constitute, or form part of, any offer or invitation

to sell, allot or issue, or any solicitation of any offer to purchase or

subscribe for, any securities in the Company in any jurisdiction nor shall it,

or any part of it, or the fact of its distribution, form the basis of, or be

relied on in connection with or act as an inducement to enter into, any

contract or commitment therefor.

No reliance may be placed, for any purpose whatsoever, on the information or

opinions contained in this announcement or on its completeness. To the fullest

extent permitted by applicable law or regulation, no undertaking,

representation or warranty, express or implied, is given by or on behalf of the

Company, Novum Securities Limited ("Novum") or its parent or subsidiary

undertakings or the subsidiary undertakings of any such parent undertakings or

any of their respective directors, officers, partners, employees, agents,

affiliates, representatives or advisers or any other person as to the accuracy,

sufficiency, completeness or fairness of the information, opinions or beliefs

contained in this announcement and, save in the case of fraud, no

responsibility or liability is accepted by any of them for any errors,

omissions or inaccuracies in such information or opinions or for any loss, cost

or damage suffered or incurred, howsoever arising, from any use, as a result of

the reliance on, or otherwise in connection with this announcement.

Novum, which is authorised and regulated by the Financial Conduct Authority,

acted only for the Company in connection with the Fundraising, Acquisitions and

Admission and did not acting for nor advise any other person, or treat any

other person as their respective client, in relation thereto and is not

responsible for providing the regulatory protection afforded to clients of

Novum, or advice to any other person in relation to the matters contained

herein. Such persons should seek their own independent legal, investment and

tax advice as they see fit. This announcement does not constitute any form of

financial opinion or recommendation on the part of Novum or any of its

affiliates and is not intended to be an offer, or the solicitation of any

offer, to buy or sell any securities. Novum is not responsible for the contents

of this announcement. This does not exclude any responsibilities which Novum

may have under the Financial Services and Market Act 2000 or the regulatory

regime established thereafter. Novum has not authorised or approved the

contents of, or any part of, this announcement and no representation or

warranty, express or implied, is made by Novum or their affiliates as to any of

its contents.

This announcement and its contents are for information purposes only and are

directed at and is only being communicated to (a) in the European Economic Area

("EEA"), persons who are "qualified investors" within the meaning of Article 2

(e) of the Prospectus Regulation (EU) 2017/1129 (the "Prospectus Regulation")

or persons to whom it may otherwise lawfully be communicated to ("Qualified

Investors"); (b) in the United Kingdom, persons who are "qualified investors"

within the meaning of Article 2(e) of the Prospectus Regulation as it forms

part of English law by virtue of the European Union (Withdrawal) Act 2018 (as

amended) and regulations made under that Act: (i) who have professional

experience in matters relating to investments falling within Article 19(5) of

the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005,

as amended (the "Order") and Qualified Investors falling within Article 49(2)

(a) to (d) of the Order; and/or (ii) to whom it may otherwise lawfully be

communicated (all such persons together being referred to as "relevant

persons"). This announcement must not be acted on or relied on: (i) in the

United Kingdom, by persons who are not relevant persons; and (ii) in any Member

State of the EEA, by persons who are not Qualified Investors. It is not

intended that this announcement be distributed or passed on, directly or

indirectly, to any other class of person and in any event, and under no

circumstances should persons of any other description rely on or act upon the

contents of this announcement.

Neither this announcement nor any copy of it may be (i) taken or transmitted

into or distributed, directly or indirectly, in the United States (within the

meaning of regulations made under the US Securities Act of 1933, as amended),

(ii) taken or transmitted into, distributed, published, reproduced or otherwise

made available or disclosed in Canada, Australia, New Zealand or the Republic

of South Africa or to any resident thereof, except in compliance with

applicable securities laws, or (iii) taken or transmitted into or distributed

in Japan or to any resident thereof for the purpose of solicitation or

subscription or offer for sale of any securities or in the context where the

distribution thereof may be construed as such a solicitation or offer. Any

failure to comply with these restrictions may constitute a violation of the

securities laws or the laws of any such jurisdiction. The distribution of this

announcement in other jurisdictions may be restricted by law and the persons

into whose possession this announcement comes should inform themselves about,

and observe, any such restrictions.

The Company has not been and will not be registered under the United States

Investment Company Act of 1940, as amended (the "Investment Company Act"), and

as such investors will not be entitled to the benefits of the Investment

Company Act. The Company's ordinary shares have not been and will not be

registered under the United States Securities Act of 1933, as amended (the

"Securities Act"), or with any securities regulatory authority of any state or

other jurisdiction of the United States, and may not be offered, sold, resold,

pledged, transferred or delivered, directly or indirectly, into or within the

United States or to, or for the account or benefit of, any "U.S. persons" as

defined in Regulation S under the Securities Act ("US Persons"), except

pursuant to an exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and in compliance with any

applicable securities laws of any state or other jurisdiction of the United

States and in a manner which would not require the Company to register under

the Investment Company Act. There will be no public offer of the Shares in the

United States.

Acquiring investments in the Company may expose an investor to a significant

risk of losing all of the amount invested. The value of shares can decrease as

well as increase. This announcement does not constitute a recommendation

concerning investments in the Company. Persons considering an investment in

such investments should consult an authorised person specialising in advising

on such investments.

This announcement contains certain statements that are, or may be, forward

looking statements with respect to the financial condition, results of

operations, business achievements and/or investment strategy of the Company.

Such forward looking statements are based on the Company's board of directors'

(the "Board") expectations of external conditions and events, current business

strategy, plans and the other objectives of management for future operations,

and estimates and projections of the Company's financial performance. Though

the Board believes these expectations to be reasonable at the date of this

document they may prove to be erroneous. Forward looking statements involve

known and unknown risks, uncertainties and other factors which may cause the

actual results, achievements or performance of the group, or the industry in

which the group operates, to be materially different from any future results,

achievements or performance expressed or implied by such forward looking

statements.

Certain figures in this announcement, including financial information, have

been subject to rounding adjustments. Accordingly, in certain instances, the

sum or percentage change of the numbers contained in this announcement may not

conform exactly to the total figure given.

END

(END) Dow Jones Newswires

June 03, 2021 02:00 ET (06:00 GMT)

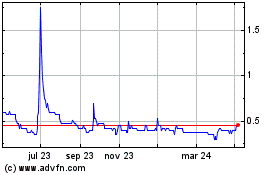

Cloudbreak Discovery (LSE:CDL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

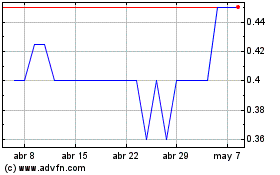

Cloudbreak Discovery (LSE:CDL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024