TIDMINF

RNS Number : 8328G

Informa PLC

29 July 2021

Informa PLC Press Release

29 July 2021

Half-Year Results for Six Months to 30 June 2021

2021-2022: Improving Revenues, Profits and Cashflow

2021-2024: Growth Acceleration Plan II (GAP II)

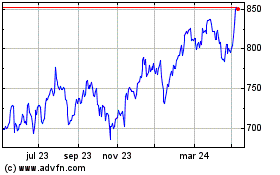

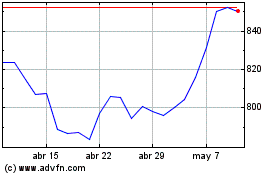

Informa (LSE: INF.L), the Information Services, Advanced

Learning, B2B Exhibitions and Events Group today announced its

financial results for the six months ended 30 June 2021, reporting

further strength in its Subscriptions-led businesses and returning

confidence across its B2B events portfolio.

Stephen A. Carter , Group Chief Executive, Informa PLC, said:

"Informa's Subscriptions-led businesses continue to deliver improving

growth, reflecting our consistent investment in product development

and increasing focus on specialist brands in growth markets."

He added: "Our Physical Events business is increasingly returning

in Mainland China and progressively rebuilding in North America

and the Middle East, with positive forward bookings and growing

commercial confidence. Clearly, however, there is continuing restriction

and uncertainty in other parts of the world and we continue to

monitor the rules and relaxation approaches on a country-by-country

basis."

He concluded: "Looking ahead over the next three years, a Growth

Acceleration Plan will focus on delivering further growth in Subscriptions

and Services, progressive recovery in Physical Events and continued

expansion of our range of Digital Services, to meet growing customer

demand for data-led, digital solutions in all our businesses."

H1 2021 Financial Highlights

-- Revenue and Profit: Statutory revenues of GBP688.9m (H1 2020

GBP814.4m) and Adjusted Operating Profit(1) of GBP69.2m (H1 2020:

GBP118.6m) reflect differing pandemic-impacts on the Physical

Events business in the front half of 2020 and 2021;

-- Improving statutory performance : The reduction in

COVID-related exceptional costs and lower non-cash intangible

amortisation delivers improvement in statutory operating loss to

-GBP58.0m (H1 2020: -GBP739.9m);

-- Strong Free Cash Flow(1) : High cash conversion, supported by

strong subscription renewals, positive forward bookings and low

levels of refunds, delivers Free Cash Flow(1) of GBP134.1m (H1

2020: GBP71.3m)

-- Decreasing Net Debt :(1) Free Cash Flow strength, combined

with currency effect, drives a reduction in net debt to GBP1,890.1m

(FY 2020: GBP2,029.6m); Strong financial position and growing

confidence in the outlook reflected in investment grade status from

Fitch, Moodys and Standard & Poors.

2021-2022: Improving Revenues, Profits and Cashflow

-- Improving performance: Further strength in Subscription-led

businesses is now being supported by growing commercial confidence

in returning Physical Events and deeper digital

diversification;

-- Increased revenue guidance: Revenue guidance for the 2021

Transition Year raised to GBP1,800m+/- (from GBP1,700m+/-), with

adjusted operating profit expected to be GBP375m+/- post currency

effects; Forward momentum into 2022, underpinned by improving

conversion of profits into cash;

-- Confidence in returning Physical Events and Digital Services:

In all three of Informa's major geographic markets (North America,

Mainland China, Middle East), we are seeing a progressive return of

physical event activity alongside increasing demand for Digital

Services, with good customer support and progressive rebooking into

2022;

-- Strength at Taylor & Francis: Strong first half

performance (H1 URG: 3.0%), reflecting flexible, customer-led

approach and consistent investment, including in Open Research.

Robust subscription renewals, strength in eBooks and full pipeline

of Open Research activity expected to deliver 2%+ underlying

revenue growth in the full year;

-- Accelerating growth at Informa Intelligence: Strong demand

for specialist data and content, combined with consistent product

investment continuing to deliver higher levels of growth (H1 URG:

7.9%). Strong forward sales pipeline and further growth in

annualised contract values, most notably in Pharma, sees full year

2021 underlying revenue growth guidance raised to 4.5%+;

-- Informa Intelligence increasing portfolio focus: Continuing

focus in three core markets of Pharma, Maritime and Finance. Market

launch of Curinos, a new brand providing competitive intelligence

to the Retail Banking market, alongside EPFR Global and IGM brands

in Finance, Lloyd's List in Maritime, and Citeline and Trialscope

in Pharma. Confirmation of disposal of Barbour EHS, one of three

non-core brands under review, with ongoing discussions in relation

to Asset Intelligence and Barbour ABI.

2021-2024: Growth Acceleration Plan II (GAP II)

As we approach the end of the Transition Year, using our proven

GAP methodology, Informa will implement GAP II, a programme to

accelerate our strategy of Market Specialisation and increase

Digitisation in all our businesses, thereby expanding our

addressable audiences, improving the mix and quality of our revenue

and bringing us closer to our markets and customers.

-- Market Specialisation: Informa's strategy of building depth

around specific customer markets and subject categories delivered

through the pandemic and is providing momentum on the way out, both

within our Subscriptions-led businesses and across our portfolio of

B2B Physical Events brands and B2B Digital Services;

-- Digital Acceleration: Accelerated customer adoption of

digital technology through the last 18 months is driving change and

creating new opportunities, providing scope to extend brands to

broader audiences, deepen connections to customers and further

expand in specialist Digital Services;

-- Digital Information & Knowledge Services: Following five

years of investment and focus, in Informa Intelligence and Taylor

& Francis we are further advanced on data management and

digital product development, which is delivering increased customer

retention and improving underlying growth.

-- Enhanced B2B Digital Services: Across our three B2B

businesses (Informa Markets, Informa Connect, Informa Tech), we

have accelerated our digital commitment in three areas: Smart

Events, Content Marketing & Audience Access, Data Analytics

& Purchasing Intent. Through IIRIS, our centralised and shared

platform for collecting, collating and curating all our B2B

audience data, we are building the capabilities to further increase

the quality and reach of our digital service offering.

-- FasterForward on ESG: Another key component of GAP II will be further operationalising the sustainability commitments within our FasterForward programme, including on renewable energy, efficient offices, and the increasingly positive role large-scale B2B events can make as effective, carbon-efficient consolidators of business travel.

-- Capital Markets Day: Further details on the approach and

ambitions of the 2021-2024 GAP II will be provided at a Capital

Markets Day on Tuesday 7 December.

(1) In this report we refer to non-statutory measures including

underlying results, as defined in the Financial Review on page 9

and Glossary on page 49.

Enquiries

Stephen A. Carter, Group Chief Executive +44 (0) 20 7017 5771

Gareth Wright, Group Finance Director +44 (0) 20 7017 7096

Richard Menzies-Gow, Director of IR

& Communications +44 (0) 20 3377 3445

+44 (0) 7583 413254 / +44

Tim Burt / Zoë Watt - Teneo (0) 7713 157561

----------------------------------------- -------------------------

H1 2021 Financial Summary

H1 2021 H1 2020 Reported Underlying(1)

GBPm GBPm % %

--------------------------------------------------------- -------------- ----------- ------------- --------------------

Revenue 688.9 814.4 (15.4) (7.5)

Statutory operating loss (58.0) (739.9) n/a

Adjusted operating profit(2) 69.2 118.6 (41.7) (2.5)

Adjusted operating margin (%)(2) 10.0 14.6 (31.2)

Operating cash flow(2) 175.7 183.5 (4.3)

Statutory loss before tax (91.0) (801.2) n/a

Adjusted profit before tax(2) 36.3 71.0 (48.9)

Statutory diluted earnings per share (p) (6.1) (56.9) n/a

Adjusted diluted earnings per share (p)(2) 1.7 5.0 (66.0)

Free cash flow(2) 134.1 71.3 88.1

Net debt (incl. IFRS 16)(2) 1,890.1 1,947.9 (3.0)

--------------------------------------------------------- -------------- ----------- ------------- --------------------

H1 2021 Divisional Highlights H1 2021 H1 2020 Reported Underlying(1)

GBPm GBPm % %

------------------------------------- -------- -------- --------- --------------

Informa Markets

Revenue 187.6 282.1 (33.5) (29.3)

Statutory operating loss (118.6) (380.0) n/a

Adjusted operating (loss)/profit(2) (43.3) 12.9 n/a (1,459)

Adjusted operating margin(2) (%) n/a 4.6

------------------------------------- -------- -------- --------- --------------

Informa Connect

Revenue 35.8 66.0 (45.8) (6.8)

Statutory operating loss (23.0) (147.3) n/a

Adjusted operating loss(2) (15.1) (19.3) n/a 58.0

Adjusted operating margin(2) (%) n/a n/a

------------------------------------- -------- -------- --------- --------------

Informa Tech

Revenue 58.1 59.8 (2.8) 12.9

Statutory operating loss (14.1) (303.4) n/a

Adjusted operating profit/(loss)(2) (5.6) (19.8) n/a 79.0

Adjusted operating margin(2) (%) n/a n/a

------------------------------------- -------- -------- --------- --------------

Informa Intelligence

Revenue 162.2 150.0 8.1 7.9

Statutory operating profit 38.7 29.0 33.4

Adjusted operating profit(2) 47.2 47.6 (0.8) 4.8

Adjusted operating margin(2) (%) 29.1 31.7

------------------------------------- -------- -------- --------- --------------

Taylor & Francis

Revenue 245.2 256.5 (4.4) 3.0

Statutory operating profit 59.0 61.8 (4.5)

Adjusted operating profit(2) 86.0 97.2 (11.5) 3.6

Adjusted operating margin(2) (%) 35.1 37.9

------------------------------------- -------- -------- --------- --------------

(1) In this document we refer to Statutory and Underlying

results. Underlying figures are adjusted for acquisitions and

disposals, the phasing of events including biennials, the impact of

changes from new accounting standards and accounting policy

changes, and the effects of currency. It includes, on a pro-forma

basis, results from acquisitions from the first day of ownership in

the comparative period and excludes results from sold businesses

from the date of disposal in the comparative period. Statutory

figures exclude such adjustments. Alternative performance measures

are detailed in the Glossary.

(2) In this document we also refer to Statutory and Adjusted

results, as well as other non-statutory financial measures.

Adjusted results are prepared to provide an alternative measure to

explain the Group's performance. Adjusted results exclude adjusting

items as set out in Note 4 to the Financial Statements. Operating

Cash Flow, Free Cash Flow, net debt and other non-statutory

measures are discussed in the Financial Review and the

Glossary.

Trading Outlook

2021-2022: Improving Revenue, Profits and Cashflow

We are seeing further strength in our Subscriptions-led

businesses and continued progress in B2B Digital Services now

supported by the progressive return of Physical Events.

The pace and rate of Physical Events return continues to vary by

region, with Mainland China most advanced, having been running

major physical event brands for over a year post-pandemic. However,

our largest market, North America, is also returning, as is the

Middle East. The return of Physical Events in Europe is scheduled

but later in the year.

We are focused on delivering as full a schedule as possible in

2022, when increasing customer confidence and the return to more

relevant Industry calendar cycles will provide a better product

experience.

In 2021, we are continuing to make scheduling decisions on a

brand-by-brand basis, informed by customer feedback and with the

focus on long-term value. For some markets and brands, like

Construction (World of Concrete) and Healthcare (Arab

Health/Medlab), this has seen us stage more targeted out-of-cycle

events this year, supported by additional marketing support and

continued investment in AllSecure security and hygiene measures.

For others, like Brand Licensing (Licensing Expo) and Environmental

Services (WWETT), we are focusing efforts on 2022. In the next

quarter, we will stage events in CyberSecurity (Black Hat), Fashion

(Magic) and Health & Nutrition (Natural Products Expo East),

amongst others.

Guidance for full year 2021 revenue increased to GBP1,800m

+/-.

Guidance for adjusted operating profit of GBP375m +/-, including

currency effects.

Continuing strength in Subscriptions-led businesses

Our Subscriptions-led businesses performed strongly in the first

six months of the year and momentum remains positive, with customer

retention high and annualised contract values growing

consistently.

In Taylor & Francis, Subscription renewals remain robust, as

does forward growth. In Royalty-Based Publishing (including our

Books business), consistent expansion of our front list and a

strong focus on identifying underserved subject areas continues to

produce results, aided by a full period of access to university

libraries and bookshops through the first half, unlike in H1

2020.

In Open Research, our investment in building a platform of scale

and quality, with a broad base of flexible, customer-led offerings

for authors, funders and institutions, continues to deliver. This

is reflected in the volume of open research articles published in

the first half, which were +20% on the same period in 2020.

Underlying revenue growth guidance for 2021 increased to

2%+.

In Informa Intelligence, consistent levels of product investment

and a clear focus on the quality of service offering continues to

deliver improving underlying growth.

Our strategy to focus our portfolio on specialist markets where

we have real strengths in brand, in data and in specialist

expertise, is also proving effective. The disposal (cGBP35m, c14x

EBITDA) of our Health & Safety information and registration

business (Barbour EHS) will further improve our portfolio

focus.

In each of our three core markets - Pharma (clinical trials

intelligence and MedTech market data), Finance (mortgage pricing

intelligence and international fund flow data) and Maritime

(real-time tracking of global shipping and cargo) - we provide data

and intelligence that delivers tangible value through competitive

intelligence and real-time market analysis, therefore enabling

better decision making.

In the Retail Banking market we have completed the combination

of FBX and Novantas to create Curinos, a new Business and Brand

providing competitive intelligence and decision support tools to

consumer & commercial institutions. This includes product and

pricing analytics and digital optimization tools that enable

customers to make more profitable, data-driven decisions

faster.

In Pharma, we seek to enable drug development companies to plan

and deliver more efficient clinical trials, using proprietary data

and sophisticated analytical tools to provide intelligent insights

into key decisions around timing, location and approach. We have

expanded our range of services in regulatory compliance and patient

recruitment, the latter combining our deep market knowledge and

broad customer reach to help identify the most suitable patients

for trials, something that can save drug companies hundreds of

millions of dollars in lost time and investment.

Underlying revenue growth guidance for 2021 increased to

4.5%+.

Specialist B2B Events and Digital Services

As we move into the second half, we are starting to confirm

schedules and plans for our Brands in Informa Markets, Informa

Connect and Informa Tech for 2022, when many will return to more

relevant industry calendar cycles. In the 2021 Transition Year, we

continue to remain flexible, planning for Physical Events where it

is feasible, makes sense for customers and for the brands, whilst

continuing to expand our B2B Digital Services offering.

Digital Services will be a growing element of the product mix,

providing an opportunity to extend and enhance our specialist B2B

communities through Smart Events, Specialist Content and Specialist

Marketing Services. In the US, in particular, some of our brands

have been generating revenue in these areas for some time,

providing a strong foundation from which to expand this capability

into other verticals.

This activity brings us closer to customers and provides deeper

insight into market trends and individual preferences. It also

generates significant volumes of first party data, from

identification and firmographic data to real-time customer

behavioural data.

Through our proprietary data and analytics platform, IIRIS, we

are building the capabilities to capture, manage and curate

consented customer data in a way that drives value, either in

better informing traditional product development and customer

targeting, or in the creation of a new range of audience solutions

that provide highly qualified and targeted customer access or

insight into purchasing intent.

Demand for face-to-face platforms remains strong and this is

increasingly evident as more markets open up, particularly amongst

commercial SMEs, for whom the trade show remains highly

valuable.

In Mainland China, over the last 12 months since reopening, we

have seen a consistent and progressive recovery in Physical Events

activity, to the extent that some of our major brands in Beauty

& Aesthetics (China Beauty Expo), have more than offset the

absence of international participation through domestic strength.

Rebooking trends in the region for 2022 are robust, with the

possibility that total revenue in Mainland China could return close

to 2019 levels, notwithstanding international quarantine measures

remain in place, as does limited cross-border participation.

In North America and the Middle East, the returning schedule is

one year behind China, with shortened sales cycles, and active

decisions to make between an off-cycle return in 2021 or an

on-cycle return in 2022.

Where we have already brought our brands back to market in North

America and the Middle East, participation levels have been broadly

as expected, with the number of exhibitors running around half of

2019 levels and with overall participation running at around

35-40%.

We expect participation levels to build over time and this is

evident in the commitments we have for later in 2021, particularly

where brands are running on a favourable industry calendar cycle.

We are seeing progressive rebooking for 2022, giving us further

confidence in our planned growth and recovery period through

2021-2024.

Board Update

Following the retirement of two Directors from the Board in

June, Stephen Davidson has joined the Audit Committee, effective

from July 2021.

2021-2024 Growth Acceleration Plan II ("GAP II")

Informa will implement a new Growth Acceleration Plan through

2021-2024, applying our growth focused operating methodology to

accelerate our strategy of Market Specialisation and further expand

in Digital Services. This will help us expand addressable

audiences, improve the mix and quality of our revenue and bring us

closer to customers.

Digital acceleration and post-COVID business trends

The COVID-19 pandemic has accelerated the adoption of digital

technology in the workplace, underlining the efficiency of digital

communications but also its shortcomings, with some types of work

tasks and meetings far more suited to digital delivery than

others.

In our events businesses, this delineation is also becoming

clearer, with many of our content-led events, where participants

are absorbing information, listening to speakers, asking questions

etc, migrating online and/or to a hybrid model effectively, often

attracting new audiences that never previously attended Physical

Events.

Our transaction-driven events and exhibitions provide direct

product exposure, direct access to customers, direct competitor

insight and a rounded industry view that translates less naturally

to a digital environment.

However, even here, where a direct digital alternative does not

readily translate, the power of digital technology is increasingly

being applied to deliver value for customers through pre-show

discovery and planning, event registration, hybrid access and

post-show education and connections.

Business travel volumes and indicators: B2B Events as an

effective, carbon efficient consolidator of business travel

The rapid adoption of digital technology has implications for

business travel and this is reflected in forward forecasts on

airline volume and recovery, something we track through our CAPA

aviation data business.

Its latest data, which is free-to-access at

(www.informa.com/capa), shows that in Mainland China, domestic air

travel has already recovered ahead of 2019 levels, whilst in the

US, passenger volumes have been increasing rapidly since May but

remain c20% below 2019 levels. Much of the US recovery to date has

been driven by leisure travel and whilst corporate air ticket sales

have picked up rapidly in recent weeks, our customer research

indicates that US business travel will likely remain muted through

the remainder of 2021 due to ongoing corporate travel restrictions

and locked budgets for the year. As health concerns subside,

airline capacity recovers and travel budgets are reinstated, we

then expect a progressive recovery through 2021-2024, led by the

commercial SME community, for whom the industry trade show is often

a critical platform for launching products and securing business

for the year ahead.

The efficiency of digital communication is expected to have some

long-term impact on business travel. Our research suggests that

internal company meetings and single company closed events will, to

a much greater extent, be delivered through technology. Where

business travel does return, there is an expectation it will be

much more efficient and purposeful, with the average duration

lengthening to incorporate multi-customer meetings and

multi-industry access in a single trip.

All these trends lend themselves to Informa's major brands and

services, which by their very nature deliver highly efficient

platforms for whole industries to meet and do business. In much the

same way that digitisation increased the value of face-to-face

interactions with customers before the pandemic, we believe that

post-pandemic, platforms that act as consolidators of business

travel will become increasingly valuable.

Market Specialisation, Digitisation and GAP II

Informa's long-term focus on building depth in a range of

customer markets and specialist subject categories has served us

well through the pandemic, keeping us close to customers and

ensuring our products and services have remained relevant

throughout.

Market Specialisation will remain a key focus on the other side

of COVID as we look to further deepen our customer relationships

within a targeted range of specialist markets. This will include

further expansion in the range of Digital Services we provide to

these markets to meet the evolving expectations of customers.

We were investing consistently in our digital capabilities

pre-COVID. At Taylor & Francis and Informa Intelligence, this

started with the 2014-2017 Growth Acceleration Plan, when we set

about upgrading our core product platforms and accelerating digital

product development. Over time, this commitment, combined with an

increasing focus on certain customer markets, has led to a

progressive improvement in the scale and quality of growth of these

businesses, as evidenced by current performance.

Across our three B2B businesses (Informa Markets, Informa

Connect, Informa Tech), pre-COVID we were investing in building a

range of B2B Digital Services around our core events brands,

including specialist content and media products, marketing services

and digital directories.

Through 2021-2024 GAP II, we will seek to further expand and

enhance this service offering, combining digital and face-to-face

platforms to deliver an improved product and customer

experience.

This expansion will focus on three core categories of B2B

digital services:

1. Smart Events (Digital-only events, hybrid events, online training etc)

2. Content Marketing & Audience Access (Specialist Media

& Specialist Marketing Services, Specialist Content, B2B

Marketplaces, B2B Communities etc)

3. Data Analytics & Purchasing Intent (Audience Solutions,

including audience extension, audience development and purchasing

intent etc)

FasterForward on ESG

Another key component of GAP II will be further operationalising

the sustainability commitments within FasterForward, our five-year

programme to become a sustainable, positive impact company. These

commitments include moving Faster to Zero, with the ambition to

become a zero waste and net zero carbon company by 2030 or earlier,

embedding Sustainability Inside all of our brands by 2025, and

becoming a positive Impact Multiplier by enabling more than one

million disconnected people to access networks and knowledge by

2025.

Our commitment to use our specialist brands and platforms to

support sustainable development in our customers markets will also

see us leverage the increasingly positive role large-scale B2B

events can make as effective, carbon-efficient consolidators of

business travel.

IIRIS...harnessing the power of B2B customer data

One of the foundations for effectively expanding our B2B digital

service offering will be the collection and management of our first

party data, helping us understand our customers and audiences

better and deliver better experiences and more tailored

services.

We are already capturing significant volumes of first party

profile and behavioural data through the Physical Events and

Digital Services we deliver. For example, in our market facing

Informa Tech business, we have already identified more than 3.5

million unique customer profiles. However, the quality of our data

is mixed in terms of the detail we have built, its accuracy and

quality, and the proportion of customers we are actively engaged

with where we have consent.

Through IIRIS, we are building a unified, centralised and shared

platform to standardise our methodology and improve these outputs,

providing a consistent approach to collation, curation and the

management of all our B2B customer/audience profile and behavioural

data. This will inform and support both our Physical Events and our

B2B Digital Services, whilst also opening up the potential to

deliver a range of data-led audience solutions, within the third

category outlined above.

Financial Review

The statutory financial results for the first six months of the

year reflect the differing impact of the COVID-19 pandemic on

Informa's Physical Events business in the first half of 2020 and

2021. Our subscriptions businesses continue to deliver improving

levels of growth, reflecting consistent investment and focus on our

specialist brands within attractive growth markets. This strength

is being supported by continued demand for B2B Digital Services and

returning confidence in physical events in all three of our major

geographic markets.

Furthermore, our balance sheet remains secure, with liquidity

increasing to GBP1.5bn, no financial covenants on any of our Group

level borrowings and no debt due to mature until 2023.

Income Statement

The results for the six months to 30 June 2021 reflect a strong

trading performance in our Informa Intelligence and Taylor and

Francis businesses, offset by the continuing pandemic related

disruption to our physical events business. The continuing benefits

of our COVID-19 Action Plan helped to limit the overall impact on

the Group's financial performance. H1 2021 reported revenues and

profits were lower than H1 2020 due to the prior year period

including over two months of physical events revenues before

COVID-19 control measures were introduced in North America, the

Middle East and Europe.

Adjusted Adjusting Statutory Adjusted Adjusting Statutory

results items results results items results

H1 2021 H1 2021 H1 2021 H1 2 020 H1 2 020 H1 2 020

GBPm GBPm GBPm GBPm GBPm GBPm

----------------- --------------- --------------- -------------- --------------- --------------- ---------------

Revenue 688.9 - 688.9 814.4 - 814.4

----------------- --------------- --------------- -------------- --------------- --------------- ---------------

Operating

profit/(loss) 69.2 (127.2) (58. 0) 118.6 (858.5) (739.9)

Loss on disposal - (0.1) (0.1) - (4.0) (4.0)

Net finance

costs (32.9) - (32. 9) (47.6) (9.7) (57.3)

----------------- --------------- --------------- -------------- --------------- --------------- ---------------

Profit/(loss)

before tax 36.3 (127.3) (91.0) 71.0 (872.2) (801.2)

Tax

(charge)/credit (6.2) 10.3 4.1 (9.2) 43.9 34.7

----------------- --------------- --------------- -------------- --------------- --------------- ---------------

Profit/(loss)

for the period 30.1 (117.0) (86.9) 61.8 (828.3) (766.5)

----------------- --------------- --------------- -------------- --------------- --------------- ---------------

Adjusted

operating

margin 10.0% 14.6%

Adjusted diluted

and statutory

diluted EPS 1.7p ( 6.1)p 5.0p (56.9)p

----------------- --------------- --------------- -------------- --------------- --------------- ---------------

Statutory income statement results

The continuing disruption to our physical events portfolio led

to a 15.4% decrease in statutory revenue to GBP688.9m, with the

comparator period for the six months to 30 June 2020 including over

two months where trading was unaffected by COVID-19.

The Group reported a lower statutory operating loss of GBP58.0m

this year, compared with an operating loss of GBP739.9m for the six

months to 30 June 2020. Both periods reflect the impact of the

COVID-19 disruption on our events businesses, with the losses in

the prior half year period significantly higher due to the non-cash

goodwill impairment of GBP592.9m.

Statutory net finance costs reduced by GBP24.4m to GBP32.9m. The

main driver of this decrease was the reduction in average net debt

due to improving free cash flow in the first half of 2021, and the

benefits of the COVID-19 Financing Action Plan implemented in 2020,

which included debt rescheduling (replacing Private Placement debt

with lower cost EMTN financing) and an equity issue. The reduction

also reflects one-off costs associated with this plan within the

prior half year period.

The combination of all these factors led to a statutory loss

before tax of GBP91.0m, compared with a loss before tax of

GBP801.2m in the six months ended 30 June 2020.

This lower statutory loss led to a tax credit for the period of

GBP4.1m, compared with a GBP34.7m tax credit in the six months

ended 30 June 2020.

This outcome translated into a statutory loss per share of 6.1p,

compared with a loss per share of 56.9p for the six months ended 30

June 2020. The difference primarily reflects the net impact of

further strength in our subscriptions businesses, the continuing

impact of the COVID-19 pandemic on our events portfolio and the

related non-cash impairment charge recorded last year, partially

offset by a lower tax charge in that period. In addition, there is

a 12.2% year-on-year increase in the weighted average number of

shares in the first half of 2021, reflecting the full period impact

of the equity issue of 250.3m shares in H1 2020.

Measurement and Adjustments

In addition to statutory results, adjusted results are prepared

for the Income Statement. These include adjusted operating profit,

adjusted diluted earnings per share and other underlying measures.

A full definition of these metrics can be found in the glossary of

terms on page 58. The Divisional table on page 11 provides a

reconciliation between statutory operating profit and adjusted

operating profit by Division.

Underlying revenue and adjusted operating profit growth on an

underlying basis are reconciled to statutory growth in the table

below.

Underlying Phasing Acquisitions Currency Statutory

growth/ and other and disposals change growth/

(decline) items (decline)

H1 2021

Revenue (7.5%) (3.6%) 1.3% (5.6%) (15.4%)

Adjusted operating

profit (2.5%) (28.5%) 2.1% (12.8%) (41.7%)

--------------------- ----------- ----------- --------------- --------- -----------

H1 2020

Revenue (26.2%) (15.0%) (1.4%) 0.5% (42.1%)

Adjusted operating

profit (54.0%) (19.1%) (1.0%) 1.3% (72.8%)

--------------------- ----------- ----------- --------------- --------- -----------

Adjusting Items

The items below have been excluded from adjusted results. The

total adjusting items included in the operating loss in the period

were GBP127.2m (H1 2020: GBP858.5m), with the decrease largely due

to the non-recurrence of the non-cash impairment of goodwill of

GBP592.9m incurred in H1 2020. The most significant items in H1

2021 were intangible asset amortisation of GBP134.8m and a credit

of GBP18.7m for one-off insurance receipts associated with

COVID-19-related event cancellations.

H1 2021 H1 2020 FY 2020

GBPm GBPm GBPm

-------------------------------------------------------------- -------- -------- --------

Intangible amortisation and impairment

Intangible asset amortisation(1) 134.8 148.2 291.8

Impairment - goodwill - 592.9 592.9

Impairment - acquisition-related intangible assets - 1.0 38.5

Impairment - right of use assets 2.1 17.4 36.1

Impairment - property and equipment 0.7 - 8.8

Impairment - investments - 3.9 3.9

Acquisition costs 0.3 0.8 2.8

Integration costs 2.9 33.1 46.3

Restructuring and reorganisation costs

Reorganisation and redundancy costs 2.6 2.3 47.6

Vacant property and finance lease modification costs (1.1) 13.9 30.0

One-off insurance credits associated with COVID-19 (18.7) - -

Onerous contracts and one-off costs associated with COVID-19 4.4 43.4 52.6

Subsequent re-measurement of contingent consideration (0.8) 1.0 (3.1)

VAT charges - 0.6 -

Adjusting items in operating loss 127.2 858.5 1,148.2

Loss on disposal businesses 0.1 4.0 8.4

Finance income - - (8.3)

Finance costs - 9.7 161.8

-------------------------------------------------------------- -------- -------- --------

Adjusting items in loss before tax 127.3 872.2 1,310.1

Tax related to adjusting items (10.3) (43.9) (127.7)

Adjusting items in loss for the period 117.0 828.3 1,182.4

-------------------------------------------------------------- -------- -------- --------

(1) Excludes acquired intangible product development and

software amortisation

Intangible amortisation of GBP134.8m relates to the historical

additions of book lists and journal titles, acquired databases,

customer and attendee relationships and brands related to

exhibitions, events and conferences. As it relates to acquisitions,

it is not treated as an ordinary cost. By contrast, intangible

asset amortisation arising from software assets and product

development is treated as an ordinary cost in the calculation of

operating profit, so is not treated as an adjusting item.

The non-cash impairment of goodwill in H1 2020 of GBP592.9m

arose from the impact of the COVID-19 pandemic on the carrying

value of our physical events portfolio, with no impairment in H1

2021.

The effective implementation of a Balanced Working Programme

across the Group has improved real estate utilisation and

efficiency, leading Informa to vacate a number of offices

permanently. This led to the one-off impairment of right of use

assets of GBP2.1m, together with vacant property and finance lease

modification costs of GBP0.7m.

Integration costs of GBP2.9m include GBP2.3m relating to the

acquisition of UBM, consisting mainly of process, property and

colleague-related reorganisation costs.

Reorganisation and redundancy costs include one-off costs

relating to initiatives within the Group's COVID-19 Action Plan

undertaken in the first half of 2021.

One-off costs relating to onerous contracts associated with the

pandemic were reduced significantly through the period, from

GBP43.4m in the first half of 2020 to GBP4.4m this year. This

reflects costs for events which were cancelled or postponed due to

COVID-19, where the costs could not be recovered, typically related

to venues and event set-up. One-off insurance credits associated

with COVID-19 relate to insurance receipts from cancelled

events.

The table below shows the results and adjusting items by

Division, highlighting further strength in our Subscription-led

businesses, Informa Intelligence and Taylor & Francis, offset

by the impact of COVID-19 on physical events activity within

Informa Markets, Informa Connect and Informa Tech.

Informa Markets Informa Informa Tech Informa Connect Taylor & Group

Intelligence Francis

GBPm GBPm GBPm GBPm GBPm GBPm

------------------ ---------------- ---------------- ------------- ---------------- ---------------- -----------

Revenue 187.6 162.2 58.1 35.8 245.2 688.9

Underlying

revenue

(decline)/growth (29.3)% 7.9% 12.9% (6.8)% 3.0% (7.5)%

Statutory

operating

(loss)/profit (118.6) 38.7 (14.1) (23.0) 59.0 (58.0)

Add back:

Intangible asset

amortisation(1) 86.7 7.3 9.0 6.7 25.1 134.8

Impairment -

right of use

assets 0.5 0.3 - 0.1 1.2 2.1

Impairment -

property and

equipment 0.3 0.1 0.1 0.1 0.1 0.7

Acquisition and

integration

costs 1.9 1.0 (0.2) 0.3 0.2 3.2

Reorganisation

and redundancy 0.8 0.3 (0.5) 0.5 0.4 1.5

One-off insurance

credits related

to COVID-19 (18.7) - - - - (18.7)

Onerous contracts

and one-off

costs associated

with COVID-19 4.1 - 0.1 0.2 - 4.4

Remeasurement of

contingent

consideration (0.3) (0.5) - - - (0.8)

Adjusted

operating

(loss)/profit (43.3) 47.2 (5.6) (15.1) 86.0 69.2

Underlying

adjusted

operating profit

(decline)/growth (1,460%) 4.8% 79.0% 58.0% 3.6% (2.5%)

------------------ ---------------- ---------------- ------------- ---------------- ---------------- -----------

1 Intangible asset amortisation is in respect of acquired

intangibles, and excludes amortisation of software and product

development

Adjusted Net Finance Costs

Adjusted net finance costs, consisting of the interest costs on

our corporate bonds and bank borrowings, decreased by GBP14.7m to

GBP32.9m. The decrease primarily relates to lower debt levels

reflecting improving free cash flow through the first half, as well

as the benefits of the COVID-19 Financing Action Plan implemented

in 2020. This included debt rescheduling (replacing Private

Placement debt with lower cost EMTN financing) and an equity

issue.

There were no adjusting items in finance costs or finance

income. The amounts in the prior half year period include costs and

income associated with the restructuring and rescheduling of debt,

which included make-whole interest payments to debt holders.

The reconciliation of adjusted net finance costs to the

statutory finance costs and finance income is as follows:

H1 2021 H1 2020 FY 2020

GBPm GBPm GBPm

------------------------------------------------------ -------- -------- --------

Finance income (2.0) (4.8) (15.3)

Finance costs 34.9 62.1 266.2

Add back: Adjusting items relating to finance income - - 8.3

Add back: Adjusting items relating to finance costs - (9.7) (161.8)

------------------------------------------------------- -------- -------- --------

Adjusted net finance costs 32.9 47.6 97.4

------------------------------------------------------- -------- -------- --------

Taxation

The Group continues to recognise that taxes paid are part of the

economic benefit created for the societies in which we operate, and

that a fair and effective tax system is in the interests of

tax-payers and society at large. We aim to comply with tax laws and

regulations everywhere the Group does business and Informa has open

and constructive working relationships with tax authorities

worldwide. Our approach balances the interests of stakeholders

including shareholders, governments, colleagues and the communities

in which we operate.

The Group's Effective Tax Rate (as defined in the glossary)

reflects the blend of tax rates and profits in the jurisdictions in

which we operate. In H1 2021, the Effective Tax Rate was 17.0% (H1

2020: 13.0%).

Earnings Per Share

Adjusted diluted earnings per share (EPS) was lower at 1.7p (H1

2020: 5.0p), reflecting lower adjusted earnings of GBP25.7m (H1

2020: GBP66.9m), combined with a 12.5% increase in the weighted

average number of shares.

An analysis of adjusted diluted EPS and statutory diluted EPS is

as follows:

H1 2021 H1 2020 FY 2020

GBPm GBPm GBPm

-------------------------------------------------------------------- -------- -------- ----------

Statutory loss for the period (86.9) (766.5) (1,037.6)

Add back: Adjusting items in loss for the period 117.0 828.3 1,182.4

-------------------------------------------------------------------- -------- -------- ----------

Adjusted profit for the period 30.1 61.8 144.8

Non-controlling interests (4.4) 5.1 (3.9)

-------------------------------------------------------------------- -------- -------- ----------

Adjusted earnings 25.7 66.9 140.9

Weighted average number of shares used in adjusted diluted EPS (m) 1,510.3 1,342.8 1,426.5

-------------------------------------------------------------------- -------- -------- ----------

Adjusted diluted EPS (p) 1.7p 5.0p 9.9p

-------------------------------------------------------------------- -------- -------- ----------

Statutory loss for the period (86.9) (766.5) (1,037.6)

Non-controlling interests (4.4) 5.1 (3.9)

-------------------------------------------------------------------- -------- -------- ----------

Statutory Earnings (91.3) (761.4) (1,041.5)

Weighted average number of shares used in diluted EPS (m) 1,501.0 1,337.8 1,419.7

-------------------------------------------------------------------- -------- -------- ----------

Statutory diluted EPS (p) (6.1p) (56.9p) (73.4)p

-------------------------------------------------------------------- -------- -------- ----------

Currency Movements

One of the Group's strengths is its international reach and

balance, with colleagues and businesses located in most major

economies of the world. This means the Group generates revenues and

costs in a mixture of currencies, with particular exposure to the

US dollar, as well as some exposure to the Euro and the Chinese

Renminbi.

In H1 2021, approximately 57% (H1 2020: 73%) of Group revenue

was received in USD or currencies pegged to USD, with 5% (H1 2020:

4%) received in Euro and around 12% (H1 2020: 1%) in Chinese

renminbi.

Similarly, we incurred approximately 46% (H1 2020: 56%) of our

costs in USD or currencies pegged to USD, with 2% (H1 2020: 2%) in

Euro and around 10% (H1 2020: 3%) in Chinese renminbi.

Each one cent ($0.01) movement in the USD to GBP exchange rate

has a circa GBP7.7m (H1 2020: circa GBP11.2m) impact on annual

revenue, and a circa GBP2.7m (H1 2020: circa GBP6m) impact on

annual adjusted operating profit.

The following rates versus GBP were applied during the

period:

H1 2021 H1 2020 FY 2020

------------ ------------------ ------------------ ------------------

Closing Average Closing Average Closing Average

rate rate rate rate Rate rate

----------- -------- -------- -------- -------- -------- --------

US Dollar 1.39 1.39 1.23 1.26 1.37 1.29

Euro 1.16 1.15 1.10 1.15 1.11 1.13

Renminbi 8.95 8.97 8.68 8.90 8.94 8.88

------------ -------- -------- -------- -------- -------- --------

Free Cash Flow

Cash generation remains a key priority and focus for the Group,

providing the funds and flexibility for paying down debt, future

organic and inorganic investment, and consistent Shareholder

returns. Our businesses typically convert adjusted operating profit

into cash at an attractive rate, reflecting the relatively low

capital intensity of the Group. In H1 2021, absolute levels of cash

flow improved significantly year-on-year but remains lower than

historical levels due to the current impact of COVID-19 on our

event-led businesses.

The following table reconciles the statutory operating loss to

Operating Cash Flow (OCF) and Free Cash Flow (FCF), both of which

are defined in the glossary.

H1 2021 H1 2020 FY 2020

GBPm GBPm GBPm

----------------------------------------------------------------------- -------- --------- ---------

Statutory operating loss (58.0) (739.9) (880.4)

Add back: Adjusting items 127.2 858.5 1,148.2

----------------------------------------------------------------------- -------- --------- ---------

Adjusted operating profit 69.2 118.6 267.8

Depreciation of property and equipment 6.5 8.5 16.8

Depreciation of right of use assets 11.5 16.9 30.3

Software and product development amortisation 22.6 19.8 41.1

Share-based payments 7.5 3.6 11.2

Loss on disposal of other assets 0.1 0.4 0.9

Adjusted share of joint venture and associate results (1.3) 0.3 (0.8)

---------

Adjusted EBITDA (1) 116.1 168.1 367.3

Net capital expenditure (18.9) (25.5) (48.4)

Working capital movement (2) 81.0 44.2 (81.9)

Pension deficit contributions (2.5) (3.3) (6.2)

----------------------------------------------------------------------- -------- --------- ---------

Operating Cash Flow 175.7 183.5 230.8

Restructuring and reorganisation (19.3) (6.0) (35.6)

Onerous contracts and one-off costs / income associated with COVID-19 17.7 (35.4) (44.6)

Net interest (24.3) (49.1) (271.6)

Taxation (15.7) (21.7) (32.9)

----------------------------------------------------------------------- -------- --------- ---------

Free Cash Flow 134.1 71.3 (153.9)

----------------------------------------------------------------------- -------- --------- ---------

(1) Adjusted EBITDA represents adjusted operating profit before

interest, tax, and non-cash items including depreciation and

amortisation

(2) Working capital movement excludes movements on

restructuring, reorganisation, COVID-19 costs and acquisition and

integration accruals or provisions as the cash flow relating to

these amounts is included other lines in the Free Cash Flow and

reconciliation from Free Cash Flow to net funds flow. The variance

between the working capital in the Free Cash Flow and the

Consolidated Cash Flow Statement is driven by the non-cash movement

on these items.

Free Cash Flow was substantially higher than H1 2020 due to the

effective management of working capital, as well as a reduction in

one-off related COVID-19 costs and lower net interest and tax. The

calculation of Operating Cash Flow conversion and Free Cash Flow

conversion is as follows :

Operating Cash Flow Free Cash Flow

---------------------------------------------- ----------------------------------

H1 H1 FY H1 H1 FY

2021 2020 2020 2021 2020 2020

GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------- ------- ------- ------- ------- ------ --------

OCF / FCF 175.7 183.5 230.8 134.1 71.3 (153.9)

Adjusted operating profit 69.2 118.6 267.8 69.2 118.6 267.8

OCF / FCF conversion 253.9% 154.7% 86.2% 193.8% 60.1% (57.5%)

----------------------------- ------- ------- ------- ------- ------ --------

Net capital expenditure was GBP18.9m (H1 2020: GBP25.5m),

equivalent to 2.7% of H1 2021 revenue (H1 2020: 3.1%). We expect

full year 2021 capital expenditure to be at a similar level

relative to revenue.

The working capital inflow of GBP81.0m was GBP36.8m higher than

the inflow in H1 2020, reflecting strong cash controls and cash

management. This includes the effective management of refund rates

on events within our Postponement Programme, with only GBP12.6m of

refunds requested during the period, and improving levels of cash

collections on future events, with GBP383.9m of cash relating to

future events held as at 30 June 2021.

Net cash interest payments of GBP24.3m were GBP24.8m lower than

the prior half year, largely reflecting the timing of payments

together with lower levels of debt in the period, the latter

reflecting the improving free cash flow, the mix benefit of

replacing Private Placement debt with lower cost EMTN financing and

one-off finance fees of GBP12.5m in H1 2020.

The following table reconciles net cash inflow from operating

activities, as shown in the consolidated cash flow statement to

Free Cash Flow:

H1 2021 H1 2020 FY 2020

GBPm GBPm GBPm

------------------------------------------------------------------------------ -------- -------- --------

Net cash inflow/ (outflow) from operating activities per statutory cash flow 146.1 76.1 (139.5)

Interest received 2.0 3.6 5.7

Borrowing fees paid - (10.1) (17.6)

Purchase of property and equipment (2.4) (3.6) (10.7)

Purchase of intangible software assets (8.3) (19.0) (23.8)

Product development cost additions (8.2) (2.9) (13.9)

Add back: Acquisition and integration costs paid 4.9 27.2 45.9

--------

Free Cash Flow 134.1 71.3 (153.9)

------------------------------------------------------------------------------ -------- -------- --------

Net cash from operating activities increased by GBP70.0m to

record an inflow of GBP146.1m, principally driven by reduced

COVID-19 costs, the event cancellation insurance receipts, reduced

integration spend and lower interest payments.

The following table reconciles cash generated by operations, as

shown in the Consolidated Cash Flow Statement, to Operating Cash

Flow shown in the Free Cash Flow table above:

H1 2021 H1 2020 FY 2020

GBPm GBPm GBPm

------------------------------------------------------------------------------------ -------- -------- --------

Cash generated by operations per statutory cash flow 188.1 140.4 153.1

Capex paid (18.9) (25.5) (48.4)

Add back: Acquisition and integration costs paid 4.9 27.2 45.9

Add back: Restructuring and reorganisation costs paid 19.3 6.0 35.6

Onerous contracts and one-off credits received/costs paid associated with COVID-19 (17.7) 35.4 44.6

--------

Operating Cash Flow 175.7 183.5 230.8

------------------------------------------------------------------------------------ -------- -------- --------

The following table reconciles Free Cash Flow to net funds flow

and net debt, with net debt reducing by GBP139.5m to GBP1,890.1m

during the 6 months to 30 June 2021, primarily due the positive

free cash of GBP134.1m, and a GBP76.1m favourable movement in

exchange rates, mainly driven by the movement in the EUR to GBP

exchange rates.

H12021 H1 FY

GBPm 2020 2020

GBPm GBPm

--------------------------------------------- ---------- ---------- ----------

Free Cash Flow 134.1 71.3 (153.9)

Acquisitions (3.1) (81.3) (176.3)

Disposals 3.7 11.8 10.4

Dividends paid to Shareholders - - (0.2)

Dividends paid to non-controlling interests (4.8) (10.1) (13.6)

Issuance of shares - 975.2 973.7

Purchase of shares (1.6) - (1.3)

--------------------------------------------- ---------- ---------- ----------

Net funds flow 128.3 966.9 638.8

Non-cash movements (21.5) (67.1) 61.3

Foreign exchange 76.1 (178.7) (59.9)

Net finance lease additions in the period (9.7) (11.4) (12.2)

Net debt at 1 January (2,029.6) (2,657.6) (2,657.6)

Acquired debt (33.7) - -

---------- ----------

Net debt (1,890.1) (1,947.9) (2,029.6)

--------------------------------------------- ---------- ---------- ----------

Financing and Leverage

The strong free cash flow performance, combined with positive

currency effects through the period, helped to reduce net debt to

GBP1.9bn at 30 June 2021 (H1 2020: GBP1.9bn; 31 December 2020:

GBP2.0bn).

The Group retains significant available liquidity, with

unutilised committed financing facilities available to the Group of

GBP1,050.0m (30 June 2020: GBP1,650m which included SCCF facilities

of GBP750m; 31 December 2020: GBP1,050.0m). Combined with GBP412.4m

of cash, this resulted in available group level liquidity at 30

June 2021 of GBP1,462.4m. Details of acquired debt are provided in

Note 14.

Following the proactive management of our financing structure,

the average debt maturity on our drawn borrowings is currently 4.4

years (30 June 2020: 5.3 years; 31 December 2020: 4.8 years), with

no significant maturities until July 2023.

Net Debt

30 June 30 June 31 December

2021 2020 2020

GBPm GBPm GBPm

--------------------------------------------------------------- --------- -------- ------------

Cash and cash equivalents (412.4) (915.2) (299.4)

Private Placement loan notes - 1,141.0 -

Private Placement fees - (2.5) -

Bond borrowings 2,037.3 1,349.8 2,111.1

Bond borrowing fees (13.7) (10.2) (15.3)

Bank borrowings 36.1 - -

Bank borrowing fees (4.0) (10.4) (2.6)

Derivative assets associated with borrowings (24.5) (4.8) (44.6)

Derivative liabilities associated with borrowings 7.1 95.0 7.5

--------------------------------------------------------------- --------- -------- ------------

Net debt before leases 1625.9 1,642.7 1,756.7

Finance lease liabilities 271.8 314.5 280.8

Finance lease receivables (7.6) (9.3) (7.9)

--------

Net debt 1,890.1 1,947.9 2,029.6

--------------------------------------------------------------- --------- -------- ------------

Borrowings (excluding derivatives, leases, fees & overdrafts) 2 ,073.4 2,490.8 2,111.1

Unutilised committed facilities (undrawn RCF) 1 ,050.0 900.0 1,050.0

Unutilised committed facilities (undrawn SCCF) - 750.0 -

Unutilised committed facilities (undrawn Novantas facilities) 4 3.3 - -

--------------------------------------------------------------- --------- -------- ------------

Total committed facilities 3,16 6.7 4,140.8 3,161.1

--------------------------------------------------------------- --------- -------- ------------

Following the repayment of the Private Placement loan notes in

2020, there are no financial covenants on our group level debt

facilities in issue at 30 June 202 1. There are financial covenants

over $50.0m of drawn borrowings in the Novantas business

combination. Our leverage ratio at 30 June 2021 was 6.2 times (31

December 2020: 5.6 times), and the interest cover ratio was 3.6

times (31 December 2020: 3.6 times). Both are calculated

consistently with our historical financial covenants which no

longer applied at 30 June 2021. See the glossary of terms for the

definition of leverage ratio and interest cover .

The calculation of the leverage ratio is as follows:

H1 2021 H1 2020 FY 2020

GBPm GBPm GBPm

----------------------------------------- -------- -------- --------

Net debt as reported 1,890.1 1,947.9 2,029.6

Adjusted EBITDA (12 months to reporting

date) 315.3 715.8 367.3

Leverage 6.0x 2.7x 5.5x

Adjustment to EBITDA for covenant

calculation 1 1.0x 0.2x 0.8x

Adjustment to net debt for covenant

calculation 1 (0.8)x (0.6)x (0.7)x

------------------------------------------- -------- -------- --------

Leverage ratio per p revious debt

covenants 6.2x 2.3x 5.6x

------------------------------------------- -------- -------- --------

1 Refer to Glossary for details of the nature of debt covenant

adjustments to EBITDA and Net Debt for leverage ratio

The calculation of interest cover is as follows:

H1 2021 H1 2020 FY 2020

GBPm GBPm GBPm

---------------------------------------------------------- -------- -------- --------

Adjusted EBITDA (12 months to reporting date) 315.3 715.8 367.3

Adjusted net finance costs (12 months to reporting date) 82.7 101.4 97.4

------------------------------------------------------------ -------- -------- --------

Interest cover reported value 3.8x 7.1x 3.8x

Interest cover covenant EBITDA adjustment to ratio 1 (0.2)x 0.2x (0.2)x

------------------------------------------------------------ -------- -------- --------

Interest cover per previous debt covenants 3.6x 7.3x 3.6x

------------------------------------------------------------ -------- -------- --------

1 Refer to Glossary for details of the nature of debt covenant

adjustments to EBITDA for interest cover

Corporate development

Informa has a proven track record in creating value through

identifying, executing and integrating complementary businesses

effectively into the Group. In H1 2021, cash invested in

acquisitions was GBP3.1m (H1 2020: GBP81.3m), with GBP5.2m net

receipts relating to acquisitions net of cash acquired. Of this,

GBP1.9m related to cash paid for business assets (H1 2020:

GBP26.0m), GBP4.9m (H1 2020: GBP27.2m) to acquisition and

integration spend and GBP1.5m (H1 2020: GBP28.1m) to the cash

settlement on the exercise of an option relating to minority

interests in certain Fashion shows in the US. Net proceeds from

disposals amounted to GBP3.7m (H1 2020: GBP11.8m).

Acquisitions

On 28 May 2021, the Group combined its existing FBX business

with Novantas. The Novantas business provides quantitative and

qualitative competitive intelligence solutions for US retail banks

and forms part of the Informa Intelligence division. This

combination seeks to create a leading competitive intelligence and

specialist data business serving the retail banking markets. The

agreement is structured as an acquisition of Novantas on a cash and

debt free basis by Informa and private equity firm, Inflexion, with

Informa contributing its FBX business as non-cash consideration.

None of the Group's existing liquidity was used to finance the

acquisition.

Informa owns 57% of the equity voting shares of the combined

business and have control to direct the relevant activities of the

combined business and have therefore fully consolidated the results

of Novantas.

The non-controlling interest at the acquisition date represents

the total of the non-controlling share of the fair value of the

Novantas net assets acquired together with the non-controlling

interest share of the carrying value of FBX that has been

contributed and the non-controlling interest share of value of

preference shares that have been issued by Inflexion and Novantas

management to the combined business. See note 14 for further

details.

Pensions

The Group continues to meet all commitments to its pension

schemes, which include six defined benefit schemes, all of which

are closed to future accrual.

At 30 June 2021, the Group had a net pension liability of

GBP11.0m (31 December 2020: GBP71.4m, 30 June 2020 GBP77.2m),

comprising pension assets of GBP6.2m and pension deficits of

GBP17.2m. Gross liabilities were GBP730.2m at 30 June 2021 (31

December 2020: GBP786.8m, 30 June 2020 GBP767.2m). The decrease in

liabilities since the year end is predominantly driven by the

increase to the discount rates used for calculating the present

value of the pension liability with rates for UK schemes increasing

0.55% to 1.85%.

The net deficit remains relatively small compared with the size

of the Group's balance sheet.

The triennial funding valuations for the UBM Pension Scheme and

the Informa Final Salary Scheme (the two largest UK schemes

representing 88% of the gross pension liabilities) have been

completed with a valuation date of 31 March 2020.

Financial market conditions have significantly improved since

the valuation date, meaning the aggregate funding positions of

these schemes has improved, and in line with Regulator guidance to

use post valuation experience, we have agreed with the respective

Trustee Boards to allow most of the improvement in funding

positions since the 31 March 2020 valuation date when calculating

the required deficit repair contributions from the Group.

This has avoided an increase in Group cash contributions to

these schemes from the amounts paid in recent years, with

contributions remaining unchanged at GBP4.5m p.a. until such time

as the Group resumes the payment of shareholder dividends when the

contribution will rise to GBP5.75m p.a.

Principal Risks and Uncertainties

As with any company, at Informa, risk arises both as a natural

consequence of doing business and in the pursuit of our strategy

and business goals, and as a result Informa aim to manage rather

than avoid risk. Informa's approach to risk management is

focused:

-- To identify and understand business risks, to ensure we are

being curious, conscious and open about the risks we choose to take

according to our risk appetite;

-- To develop and deploy appropriate and effective risk

strategies to address these risks and take advantage of

opportunities, where these are present and appropriate; and

-- To clearly report on risk assessments through the company's

governance and management channels and bodies.

The Company's risk framework is designed to provide the Board,

Audit Committee and executive management with oversight of the most

significant risks faced by the Group. Regular analysis and scanning

for emerging risks are embedded in our risk management process and

overseen by the Risk Committee. The Risk Committee reports through

the Audit Committee which in turn reports through to the Board.

In the first half of 2021, COVID-19 has continued to restrict

the operation of physical events and is recognised as a Principal

Risk to the Group. Our response continues to be provided through

our COVID-19 Action Plan and business planning process. We continue

to monitor actions to ensure we are responding in the most

appropriate ways for our colleagues, customers, communities and

business operations.

Risk Profile at Half Year 2021

The risk of economic instability continues to be assessed as

high due to the current control measures in place in many

countries, designed to limit the spread of the pandemic. Such

measures create an uncertain global trading environment and, more

specifically, often include restrictions on face-to-face

gatherings.

We continue to manage our response to the pandemic through our

COVID-19 Action Plan, a programme of initiatives to build stability

and security across the Group, which have included the

implementation of an extended Postponement Programme across our

physical events portfolio, the conservation of cash and the

strengthening of our balance sheet to build financial resilience

across the period of reduced trading.

This risk is also mitigated through the breadth and diversity of

Informa's portfolio of businesses, with our Subscription-led

businesses relatively unaffected by the pandemic and continuing to

deliver strong underlying growth. In addition, with our Events-led

businesses, we have a growing portfolio of B2B Digital Services,

including Specialist Content, Media and Specialist Marketing

Services activities.

The strength of Informa's specialist brands and customer

relationships has also enabled the Company to build a portfolio of

digital and smart events over the last 18 months, whilst scope for

staging physical events around the world has been limited.

This increased focus on Digital Services has the potential to

expand our addressable markets, albeit carries a degree of

execution risk. The Company has therefore maintained the Market

Risk assessment to be high.

The Company has a reliance on key counterparties in certain

activities and areas of business operations. Global economic

uncertainty, reduced revenue and capacity constraints may lead to

individual key counterparties becoming less reliable, and therefore

this risk continues to be monitored closely.

Data privacy related risks remain relevant for Informa and

increases as the Group expands its Digital Services offering, and

uses data in new ways to reach target audiences and improve the

digital customer experience. The Company maintains and continues to

target compliance with the relevant data privacy requirements, with

ongoing focus on evolving privacy regulations around the world.

The Principal Risk around the inability to attract and retain

key talent continues to evolve with the pandemic. As restrictions

ease, at a group level we are starting to see voluntary colleague

attrition increase gradually from 2020 levels, which were

relatively low due to the pandemic. Results from our latest

Colleague Pulse survey shows Colleague engagement remains strong at

80% and a high proportion of Colleagues (92%) believe management's

response to the pandemic has been sensible and effective, with

management leading by example and providing clear direction and

information (91%). Colleagues also believe we have been strong at

staying connected as teams (87%) and supporting flexible working

(84%). Attracting, developing and retaining talent remains a risk,

however, and as we put more emphasis on Digital Services, this risk

may increase as we compete for highly sought after digital

talent.

With Government restrictions still in place in some countries,

business travel relatively subdued and physical events returning

progressively, the likelihood and impact of a health and safety

incident remains relatively low. As control measures are relaxed,

more physical events return and customers and colleagues start to

attend physical events and return to offices in larger numbers,

this risk is expected to increase back towards pre-pandemic

levels.

As at 30 June 2021, the Group recognises 13 principal risks

which have the potential to cause the most significant impact to

the delivery of its strategic objectives, performance, future

prospects and reputation. These are the same 13 Principal Risks and

Uncertainties identified at the 2020 year-end and outlined on pages

71 to 77 of the 2020 Annual Report and Accounts (available on the

Company's website at www.informa.com).

These risks are summarised below (not in order of

magnitude):

-- Acquisition and integration risk

-- Data loss and cyber breach

-- Economic instability

-- Health and safety incident

-- Inability to attract and retain key talent

-- Inadequate regulatory compliance

-- Ineffective change management

-- Inadequate response to major incidents

-- Market risk

-- Pandemic risk

-- Privacy regulation risk

-- Reliance on key counterparties

-- Technology failure

Going Concern

Overview

In adopting the going concern basis for preparing the financial

statements, the Directors have considered the future trading

prospects of the Group's businesses, the Group's cash generation in

H1 2021, available liquidity, debt maturities and the Group's

Principal Risks as set out on the previous two pages. There are no

financial covenants on any of the Group level borrowings. A summary

of the impact of COVID-19 on the Group's trading is detailed on

pages 4-5.

Liquidity and Financing

The Group has a strong liquidity position. At 30 June 2021 the

Group has GBP0.4bn of cash and undrawn committed credit facilities

of GBP1.1bn. In addition, the cost base has been matched to current

activity levels through the cost savings actioned in H2 2020,

meaning the Group generated cash in the first half of 2021 and

therefore the Group liquidity has increased since 31 December

2020.

The Group is a well-established borrower with an investment

grade credit rating from Fitch, Moody's and S&P, which provides

the Directors with confidence that the Group could further increase

liquidity by raising additional debt finance. Following the

repayment of the Private Placement (PP) notes in 2020, the group

has no financial covenants on any of its Group level

borrowings.

There are no borrowing maturities until July 2023. The first

tranche of the Revolving Credit Facility ("RCF") mainly matures in

February 2024, with the second tranche mainly maturing in February

2026.

Financial modelling

The business and operational impact of COVID-19 is discussed on

pages 4 to 5. The Government control restrictions adopted worldwide

to limit the spread of COVID-19 have created a degree of

uncertainty around the forecasting of when physical events will be

allowed to reopen and the pace and rate of revenue return. In

response, in the going concern assessment period up to the end of

2022, the Directors have modelled two main scenarios: the base case

and a reverse stress test. Key assumptions made in these scenarios

include the timing of when control restrictions are relaxed,

allowing physical events to resume, and also the participation

levels at these events as confidence returns.

Financial Reporting

In modelling the base case the Directors have assumed the

following:

--A robust performance by the subscriptions-led businesses in H2

2021 and 2022.

--A progressive return and reopening of physical events across

2021.

--All physical events in the going concern period deliver lower

levels of revenue compared to 2019, as confidence and participation

is not assumed to fully return in this period, international travel

is assumed to recover gradually, events will often be taking place

outside of the annual industry cycle and individual events may

suffer from date bunching as they reopen.

In this base case scenario, the Group maintains liquidity

headroom of more than GBP1.3bn.

The Directors have also modelled a reverse stress test, which

assesses the liquidity position if the Group had no gross profit

from 1 August 2021 to the end of 2022 and all event-related cash

collected as at 30 June 2021 is refunded to customers. In this test

the Group maintains positive liquidity headroom for at least 12

months following the start of the assessment period on 1 August

2021. The Directors feel that the assumptions applied in this

reverse stress test are extremely remote, given that the Group's

subscription-led businesses continue to trade strongly and physical

events in our key markets outside Mainland China are starting to

reopen.

Going concern basis

Based on the scenarios modelled the Directors believe that the

Group is well placed to manage its financing and other business

risks satisfactorily and have been able to form a reasonable

expectation that the Group has adequate resources to continue in

operation for at least twelve months from the signing date of these

consolidated interim financial statements. The Directors therefore

consider it appropriate to adopt the going concern basis of

accounting in preparing the financial statements. The long-term

impact of COVID-19 is uncertain and should the impact of the

pandemic on trading conditions be more prolonged or severe than

currently forecast by the Directors, the Group may need to

implement additional operational or financial measures including

further cost savings.

Cautionary statements

This interim management report contains certain forward-looking

statements. These statements are subject to a number of risks and

uncertainties and actual results and events could differ materially

from those currently being anticipated. The terms 'expect', 'should

be', 'will be' and similar expressions (or their negative) identify

forward-looking statements. Factors which may cause future outcomes

to differ from those foreseen in forward-looking statements

include, but are not limited to: general economic conditions and

business conditions in Informa's markets; exchange rate

fluctuations, customers' acceptance of its products and services;

the actions of competitors; legislative, fiscal and regulatory

developments; changes in law and legal interpretation affecting

Informa's intellectual property rights and internet communications;

and the impact of technological change.

Past performance should not be taken as an indication or

guarantee of future results, and no representation or warranty,

express or implied, is made regarding future performance. These

forward-looking statements speak only as of the date of this

interim management report and are based on numerous assumptions

regarding Informa's present and future business strategies and the

environment in which Informa will operate in the future. Except as

required by any applicable law or regulation, the Group expressly

disclaims any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements contained in

this document to reflect any change in the Group's expectations or

any change in events, conditions or circumstances on which any such

statement is based after the date of this announcement or to update

or keep current any other information contained in this interim

management report.

Nothing in this interim management report should be construed as

a profit forecast. All persons, wherever located, should consult

any additional disclosures that Informa may make in any regulatory

announcements or documents which it publishes. This announcement

does not constitute an invitation to underwrite, subscribe for or