TIDMIHC

RNS Number : 9820N

Inspiration Healthcare Group PLC

05 October 2021

"This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR") and is disclosed in accordance with

the Company's obligations under Article 17 of MAR. Upon the

publication of this announcement via the Regulatory Information

Service, this inside information is now considered to be in the

public domain."

Inspiration Healthcare Group plc

("Inspiration Healthcare", the "Company" or the "Group")

5 October 2021

Interim Results

Inspiration Healthcare Group plc (AIM: IHC), the global medical

technology company, today announces its unaudited interim results

for the six months ended 31 July 2021 ("H1 2021/22").

Financial highlights

-- Total Group Revenue up by 47% to GBP20.9m

-- Gross Margin up from 51.4% to 52.5%

-- Branded products represent 55% of total Group Revenue

-- EBITDA(1) up 42% to GBP3.6m

-- Operating Profit up 140% to GBP2.6m

-- Net cash position of GBP8.6m

(1) Earnings before interest, tax, depreciation, share based

payments and non-trading items

Operational highlights

-- Successful integration of SLE Ltd continues in line with operational plans

-- Synergies and cross selling opportunities being realised

-- New regulatory approvals secured for key products (SLE6000) in China and Japan

-- AlphaCore, patient warming portfolio has seen increased

demand within UK market with units placed up by 104% compared to

the equivalent period of last financial year

-- Increased investment in R&D to fast-track product development

-- The Queens Award for Enterprise for Innovation was awarded to

SLE Ltd for the Oxygenie(R) product

-- Project WAVE recruited first patient in University Hospitals

Sussex (formerly Brighton and Sussex University NHS Trust)

-- Micrel SA - UK and Ireland distribution agreement renewed

Neil Campbell, Chief Executive Officer, said today:

"Our revenues are in line with management expectations with

costs being carefully controlled, margins improving and as a

result, operating profit is above our expectations. The integration

of SLE Ltd into the Group has been successful and our teams have

collaborated closely through the use of technology during

unprecedented times to come together in the enlarged Group. We have

prioritised enhancing our operational infrastructure, developing

our commercial, strategic, R&D and regulatory teams to

facilitate our growth ambitions. With a strong order book we are

now well positioned to move into the next phase of the financial

year focusing on the additional benefits we can leverage and

driving sales through our enhanced global distribution

network."

Enquiries:

Inspiration Healthcare Group plc Tel: 01455 840555

Neil Campbell, Chief Executive Officer

Jon Ballard, Chief Financial Officer

Nominated Adviser & Broker Tel: 0207 397 8900

Cenkos Securities plc

Mark Connelly

Stephen Keys

-------------------

Cadogan PR Tel: 07771 713608

Alex Walters

alex.walters@cadoganpr.com

-------------------

About Inspiration Healthcare

Inspiration Healthcare (AIM: IHC) is a global provider of

medical technology for use in neonatal intensive care &

operating theatres. The Company provides high quality innovative

products to patients around the world which help to improve patient

outcomes and it actively invests in innovative product

opportunities and disruptive technologies.

The Company has key own brand products that can be used within

the first days of life to help premature and sick babies; helping

resuscitation and stabilisation in the first moments of life

through to preventing brain damage and both invasive and

non-invasive respiratory support in terms of capital equipment and

disposable medical devices. Additionally, the Company has its own

range of products for maintaining normothermia pre, during and

post-surgery.

Since September 2019, the Company has acquired Vio Holdings a

designer, manufacturer and supplier of single use respiratory

products and sterile medical consumables and S.L.E., a leading

designer, manufacturer and global provider of neonatal ventilation

products. The Group generates approximately 58% of its revenues

from export markets and more than half of its revenues come from

its own-branded products.

With product availability actively promoted to over 80 countries

through a distribution network, Inspiration Healthcare's success

has been built on continuous innovation, excellent customer service

and an inherent commitment to improving patient outcomes, working

in close collaboration with key opinion leaders across the

globe.

In the UK and Ireland, the Group has direct sales teams selling

Group Branded and complementary products from third parties, with

an additional range of home healthcare products. This is supported

by Technical Support for planned preventative maintenance and

emergency assistance.

The Group operates from various sites in the UK for R&D,

Marketing and operations with manufacturing based in Croydon (south

London) and Hailsham (East Sussex). The Group's Head Office is

located in Crawley, a short distance from London's Gatwick

Airport.

Further information on Inspiration Healthcare can be found at

www.inspirationhealthcaregroup.plc.uk

Chairman's Statement

The Company's dedication to the goal of becoming a world leader

in neonatal medical technology has fuelled our success and revenue

growth during the continued COVID-19 pandemic. The early successes

reported in this interim report highlight a step towards realising

the full advantages of the combined Group and the innovative,

diverse portfolio we can offer.

Recognition of our innovative portfolio of products was proudly

received in the form of The Queens Award for Enterprise in the

Innovation category which was awarded to SLE Ltd (acquired by

Inspiration Healthcare in July 2020) in recognition of their work

in developing an infant ventilator with a closed-loop Oxygen

delivery software algorithm called Oxygenie(R). The algorithm

enables safe and responsive management of stable saturation,

reducing the risks around oxygenation of the patient, hopefully

allowing them to leave the Neonatal Intensive Care Unit (NICU)

earlier with a better outcome.

In the first half of this financial year, we have enjoyed

benefits from the enlarged Group's global distribution network

which has created cross selling opportunities. One example of this

was an order for GBP350k for our own brand Viomedex circuits from

an SLE Ltd distributor in the middle east. This not only opened a

new market for our Viomedex circuits, which complement our SLE

ventilator portfolio but clearly shows the synergies which now

exist within the Group. Both sales in our distributed and own brand

devices continue to perform well with attractive margins throughout

the Group and continuing this growth in new markets remains a

focus. We were pleased to announce the securing of regulatory

approvals in both China and Japan for our SLE6000 and Oxygenie(R)

which not only resulted in a significant number of new orders but

also demonstrated the attractiveness of our entire innovative

neonatal ventilator portfolio at an international level.

In my statement in the annual report I detailed our ambition to

start putting something back into the neonatal community we serve.

I am therefore delighted to announce the set up of our Charitable

project is now complete and we are working with The Charity Aid

Foundation to process charitable donations selected by our

Charitable Giving Committee. The Committee is entirely made up of

our staff, allowing them to recommend which charities they feel are

important to support and which focus on improving the lives and

outcomes of patients globally.

Financial Review

Revenue for the six months to 31 July 2021 totalled GBP20.9

million (H1 2020/21: GBP14.2 million), an increase of 47% over the

equivalent period for the previous financial year with the

inclusion of a full 6 month contribution from SLE Ltd. EBITDA(1)

improved by 42% to GBP3.6 million as a result of additional

revenues, improved gross margins and the continuing impact of

Covid-19 on the timing of some cash based overheads now expected to

be incurred during the second half of the financial year.

Revenue from branded products increased 293% over the equivalent

period for the previous financial year to GBP11.5 million and

accounted for 55% of revenue. This is primarily attributable to a

full 6 month contribution from SLE Ltd. Revenue from distributed

products decreased by 4% to GBP7.1 million, excluding GBP2.9

million of Covid-19 revenue received during the first half of

2020/21. This is reflective of the anticipated loss of a

distributor contract with Acutronic, as a result of the acquisition

of SLE Ltd, which was offset by strong performances across our

other distributor product range. Technology Support increased 131%

year on year to GBP2.3 million again reflective of a full 6 month

contribution from SLE Ltd.

Gross margin improved to 52.5% from 51.4% in the equivalent

period due to product mix driven by increased revenue from branded

products (now representing 55% of total revenue).

Unaudited Unaudited Audited

6 months ended 6 months Year ended

31 July 2021 ended 31 January

GBP'000 31 July 2020 2021

GBP'000 GBP'000

-------------------------------- ---------------- -------------- ------------

Adjusted EBITDA 3,618 2,547 5,611

---------------- --------------

Depreciation (492) (178) (606)

Amortisation of intangible

assets (391) (153) (622)

Impairment of intangible

assets - - (47)

Share based payment (137) (94) (78)

---------------- -------------- ------------

Adjusted operating profit 2,598 2,122 4,258

---------------- -------------- ------------

Non-trading items:

- Acquisition related expenses - (605) (579)

- Final Settlement of deferred

consideration - (435) (435)

---------------- -------------- ------------

Operating profit 2,598 1,082 3,244

---------------- --------------

The Group reported adjusted operating profit of GBP2.6 million,

an increase of 22% over the equivalent period of the previous

financial year.

Operating profit for the period under review was GBP2.6 million,

an increase of 140% over the equivalent period of the previous

financial year.

Administrative expenses increased by 34% to GBP8.4 million,

slightly lower than expected mainly due to travel restrictions and

associated marketing costs. The increases included 6 months of

overheads associated with SLE Ltd along with our planned continued

investment in personnel to maintain growth. Investment in R&D

amounted to approximately 9% of revenue in the first half as we

accelerate our new product development programme.

Profit before tax of GBP2.5 million was up 133% on last

year.

Profit after tax of GBP2.2 million was up 180% on last year.

EBITDA(1) amounted to GBP3.6 million, an increase of 42% over

the equivalent adjusted amount from the previous period of the

previous financial year.

Adjusting for non-trading items and amortisation of intangible

assets acquired through business combinations, underlying diluted

earnings per share was 3.7p (H1 2020/21: 4.3p). This is reflective

of an increase in the weighted average number of shares in issue as

at 31 July 2021 compared to the previous financial year, primarily

as a result of the acquisition of SLE Ltd and the inclusion of

profit in relation to "one-off" Covid-19 related sales in the

previous financial year. Please see note 6 to the unaudited interim

financial statements for more information.

Cash at 31 July 2021 was GBP8.6 million. The GBP5 million RCF

facility that was put in place during the acquisition of SLE Ltd

remains undrawn and in place and is available for further

utilisation should the Group require.

Operational Review

During the period, the enlarged Group has been strengthened

through development of all of our operational teams and

specifically by investing in roles which focus on increasing

revenue; R&D, Quality and Regulatory, Product Management and

Marketing.

The key business systems (our ERP and document control systems)

are being integrated across the entire Group in line with our plan

and the synergies of the Group products and services are resulting

in new sales opportunities and orders. The focus on optimising our

operational infrastructure continues, with the planned move to new

state of the art facilities likely to take place in Spring 2022,

enabling us to minimise the impact to our business in the run up to

our year end caused by the delays currently being experienced in

construction industry supply chains .

Our own brand AlphaCore portfolio has seen a significant level

of growth in the UK with an 104% increase in units placed compared

to the equivalent period in the last financial year. With a focus

on promoting our rental and service programme stimulating interest,

operating theatres have adopted the technology having seen the

benefits of the environmentally friendly and affordable technology.

This growth has been achieved through a combination of sales and

for the first time, a series of rental agreements. We are now

actively investigating opportunities to repeat this success

internationally with our distributors.

We were delighted to announce the extension of our agreement

with Micrel SA in March 2021. Micrel is a leading manufacturer for

infusion therapies which are distributed by Inspiration Healthcare

in the UK and Ireland and which are used in a wide range of

applications, including parenteral feeding, post operative pain

management, regional analgesia, chemotherapy and a range of other

applications. Offering a robust and diverse product range is a

major strength of our portfolio, reducing the risks associated with

a singular product line. Following the integration of SLE Ltd into

the Group and the increased capabilities and product range, we

continue to explore the most effective solutions to give our to

clients a much wider and more effective range of technology through

further acquisitions, licencing and developing our intellectual

property or other commercial partnerships.

Like most companies involved in manufacturing we have been

mindful of supply issues concerning electronic components such as

semi-conductors ('silicon chips') and whilst we are not immune to

these challenges, we are managing them within our business. We have

experienced some cost increases which we expect to be largely short

term and are currently looking at removing the most costly

components and replacing them with longer term solutions that are

less problematic in terms of supply. We were pleased to announce in

June that Project WAVE study had recruited its first patient in the

Trevor Mann Baby Unit part of the University Hospitals Sussex

(formerly Brighton and Sussex University NHS Trust). The

respiratory device, whose patent have been exclusively licenced by

Inspiration Healthcare for the paediatric patients has been

designed by Inspiration Healthcare. Currently the WAVE trial is

requesting to expand the patient selection criteria due to slower

than expected recruitment to allow earlier preterm babies to be

recruited. The aim is to offer the technology to the patient

population who are affected by apnoea of prematurity and associated

respiratory complications.

Dividend Declaration

In line with our progressive dividend policy we can confirm our

interim dividend payment will increase from 0.2p per share to

0.205p per share (an increase of 2.5% over the prior financial

year). This will be payable to shareholders on the register on

26(th) November 2021 and paid on 29(th) December 2021.

Outlook

The integration of SLE Ltd into the Group is now almost complete

and, as expected, has delivered significant opportunities for

revenue growth globally. Expanding our global opportunities further

remains a key focus and we will continue to invest in resources to

support these projects. Recent operational challenges have been

unavoidable due to the current pandemic climate we have experienced

and I'm pleased to report that we continue to adapt and innovate to

overcomes these issues. Against this background we continue to have

strong order book and seeing increasing demand across the entire

Group. Our portfolio is diverse and robust, offering us the ability

to maintain a flexible strategy aligning with the developing market

needs.

Our expectations of revenue remains unchanged for the year,

albeit with a different product mix in the second half. However,

given the strong margin performance with lower than anticipated

cash based costs in the first half, our expectations for full year

profit have increased.

Mark Abrahams

Chairman

5 October 2021

(1) Earnings before interest, tax, depreciation, share based

payments and non-trading items

Unaudited Consolidated Income Statement

For the six months ended 31 July 2021

Unaudited Unaudited Audited

6 months 6 months Year

ended ended Ended

31 July 31 July 31 January

2021 2020 2021

Notes GBP'000 GBP'000 GBP'000

------------------------------------ ------ ---------- ---------- -------------------

Revenue 20,893 14,218 36,980

Cost of sales (9,932) (6,916) (18,958)

Gross profit 10,961 7,302 18,022

Administrative expenses (8,363) (6,220) (14,778)

Operating profit 2,598 1,082 3,244

Finance income - 2 3

Finance cost (98) (10) (114)

Profit before tax 2,500 1,074 3,133

Income tax 4 (289) (287) (318)

Profit attributable to the owners

of the parent company 2,211 787 2,815

Earnings per share, attributable

to owners of the parent company

Basic expressed in pence per share 6 3.25p 1.84p 5.10p

Diluted expressed in pence per

share 6 3.22p 1.82p 5.07p

------------------------------------ ------ ---------- ---------- -------------------

Unaudited Consolidated Statement of Comprehensive Income

For the six months ended 31 July 2021

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 July 31 July 31 January

2021 2020 2021

Notes GBP'000 GBP'000 GBP'000

---------------------------------- ------- ---------- ---------- -----------

Profit for the period/year 2,211 787 2,815

Other comprehensive income

Items that may be reclassified

to profit or loss

Cash flow hedges 9 65 31

Total other comprehensive income

for the period/year 9 65 31

------------------------------------------- ---------- ---------- -----------

Total comprehensive income for

the period/year 2,220 852 2,846

------------------------------------------- ---------- ---------- -----------

Unaudited Consolidated Statement of Financial Position

As at 31 July 2021

(Registered Number: 03587944)

Unaudited Unaudited Audited

As at As at As at

31 July 31 July 31 January

2021 2020 2021

GBP'000 GBP'000 GBP'000

------------------------------- ----------- ---------- -----------

ASSETS

Non-current assets

Intangible assets 16,364 15,818 15,206

Property, plant and equipment 1,174 811 919

Right of use asset 3,031 482 3,102

----------- ----------

20,569 17,111 19,227

------------------------------- ----------- ---------- -----------

Current assets

Inventories 6,792 9,118 8,190

Trade and other receivables 7,575 9,547 5,163

Cash and cash equivalents 8,608 7,663 10,653

------------------------------- ----------- ---------- -----------

22,975 26,328 24,006

Total assets 43,544 43,439 43,233

------------------------------- ----------- ---------- -----------

Liabilities

Current liabilities

Trade and other payables (5,206) (8,627) (6,809)

Lease liabilities (429) (97) (369)

Financial derivative - - (9)

Contract liabilities (445) (2,624) (533)

------------------------------- ----------- ---------- -----------

(6,080) (11,348) (7,720)

------------------------------- ----------- ---------- -----------

Non-current liabilities

Trade and other payables - (248) -

Lease liabilities (2,705) (376) (2,796)

Contract liabilities (7) - -

Borrowings - (1,500) -

Deferred tax liability (1,091) (227) (1,141)

------------------------------- ----------- ---------- -----------

(3,803) (2,351) (3,937)

------------------------------- ----------- ---------- -----------

Total liabilities (9,883) (13,699) (11,657)

------------------------------- ----------- ---------- -----------

Net assets 33,661 29,740 31,576

------------------------------- ----------- ---------- -----------

Shareholders' equity

Called up share capital 6,812 6,797 6,812

Share premium account 18,838 18,761 18,838

Reverse acquisition reserve (16,164) (16,164) (16,164)

Share based payment reserve 276 247 139

Other reserves - 31 (9)

Retained earnings 23,899 20,068 21,960

------------------------------- ----------- ---------- -----------

Total equity attributable to

owners of the parent company 33,661 29,740 31,576

------------------------------- ----------- ---------- -----------

Unaudited Consolidated Statement of Changes in Shareholders'

Equity

For the six months ended 31 July 2021

Share

Called Reverse based

up Share Share acquisition payment Other Retained Total

Notes Capital Premium reserve reserve reserves earnings equity

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

At 31 January 2020 3,838 3,475 (16,164) 153 (34) 19,281 10,549

Profit for the period

1 February 2020 to

31 July 2020 - - - - - 787 787

Other comprehensive

income - - - - 65 - 65

Total comprehensive

income for the period - - - - 65 787 852

----------------------------- --------- --------- ------------ --------- ------------ ------------ -----------

Transactions with

owners in their

capacity

of owners

Employee share scheme

expense - - - 94 - - 94

Issue of ordinary

shares, net of transaction

cost and tax 2,959 15,286 - - - - 18,245

Total transactions

with owners 2,959 15,286 - 94 - - 18,339

----------------------------- --------- --------- ------------ --------- ------------ ------------ -----------

At 31 July 2020 6,797 18,761 (16,164) 247 31 20,068 29,740

Profit for the period

1 August 2020 to

31 January 2021 - - - - - 2,028 2,028

Other comprehensive

expense - - - - (34) - (34)

----------------------------- --------- --------- ------------ --------- ------------ ------------ -----------

Total comprehensive

income/(expense)

for the period - - - - (34) 2,028 1,994

----------------------------- --------- --------- ------------ --------- ------------ ------------ -----------

Transactions with

owners in their

capacity

of owners

Dividends - - - - - (136) (136)

Employee share scheme

expense - - - (16) - - (16)

Issue of ordinary

shares, net of transaction

costs 15 77 - (92) - - -

Deferred tax - - - - (6) - (6)

Total transactions

with owners 15 77 - (108) (6) (136) (158)

----------------------------- --------- --------- ------------ --------- ------------ ------------ -----------

At 31 January 2021 6,812 18,838 (16,164) 139 (9) 21,960 31,576

Profit for the period

1 February 2021 to

31 July 2021 - - - - - 2,211 2,211

Other comprehensive

income - - - - 9 - 9

----------------------------- --------- --------- ------------ --------- ------------ ------------ -----------

Total comprehensive

income for the period - - - - 9 2,211 2,220

----------------------------- --------- --------- ------------ --------- ------------ ------------ ---------

Transactions with

owners in their

capacity

of owners

Dividends - - - - - (272) (272)

Employee share scheme

expense - - - 137 - - 137

Total transactions

with owners - - - 137 - (272) (135)

----------------------------- --------- --------- ------------ --------- ------------ ------------ ---------

At 31 July 2021 6,812 18,838 (16,164) 276 - 23,899 33,661

----------------------------- --------- --------- ------------ --------- ------------ ------------ ---------

Unaudited Consolidated Statements of Cash flows

For the six months ended 31 July 2021

Unaudited Unaudited Audited

6 months 6 months Year

ended Ended ended

31 July 31 July 31 January

2021 2020 2021

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit for the year 2,211 787 2,815

Adjustments for:

Depreciation and amortisation 883 331 1,228

Impairment of intangible assets - - 47

Employee share scheme expense 137 94 78

Contingent consideration share issue - 435 435

Loss on disposal of tangible asset 10 - 14

Loss on disposal of intangible asset 67 - 65

Finance income - (2) (3)

Finance expense 98 10 114

Income tax expense 289 287 318

--------------------------------------------- ------------------- ----------------- --------------------

3,695 1,942 5,111

Decrease/(increase) in inventories 1,398 (1,653) (573)

(Increase)/ decrease in trade and

other receivables (2,412) 995 4,009

(Decrease)/increase in trade and

other payables (1,543) 1,101 (3,597)

Decrease in contract liabilities (81) (143) (6)

--------------------------------------------- ------------------- ----------------- --------------------

Cash flows generated from operations 1,057 2,242 4,944

Taxation paid (398) (114) (209)

--------------------------------------------- ------------------- ----------------- --------------------

Net cash generated from operating

activities 659 2,128 4,735

--------------------------------------------- ------------------- ----------------- --------------------

Cash flow from investing activities

Payment for acquisition of subsidiary - (16,200) (19,457)

Cash acquired through business combinations - - 6,314

Interest received - 2 3

Purchase of property, plant and

equipment (496) (59) (257)

Purchase of intangible assets (238) (16) (49)

Capitalised development costs (1,379) (87) (614)

--------------------------------------------- ------------------- ----------------- --------------------

Net cash used in investing activities (2,113) (16,360) (14,060)

--------------------------------------------- ------------------- ----------------- --------------------

Cash flow from financing activities

Proceeds from issue of shares - 16,967 16,967

Share issue costs - (957) (957)

Principal elements of lease payments (221) (85) (262)

Interest paid on lease liabilities (66) - (87)

Interest paid on loans and borrowings (32) (10) (27)

Dividends paid to the holders of

the parent (272) - (136)

Proceeds from borrowings - 1,500 1,500

Repayments from loans and borrowings - - (1,500)

Net cash generated from financing

activities (591) 17,415 15,498

--------------------------------------------- ------------------- ----------------- --------------------

Net (decrease)/increase in cash

and cash equivalents (2,045) 3,183 6,173

Cash and cash equivalents at the

beginning of the period 10,653 4,480 4,480

Cash and cash equivalents at the

end of the period/year 8,608 7,663 10,653

--------------------------------------------- ------------------- ----------------- --------------------

Notes to the Unaudited Interim Financial Statements

For the six months ended 31 July 2021

1. Basis of Preparation

This condensed consolidated interim financial information for

the six months ended 31 July 2021 have been prepared in accordance

with AIM rule 18 in relation to half year reports. This information

should be read in conjunction with the annual financial statements

for the year ended 31 January 2021, which have been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union.

2. Going concern basis

The Group meets its day-to-day working capital requirements

through its cash resources. After making enquiries, the directors

have a reasonable expectation that the Group has adequate resources

to continue in operational existence for the foreseeable future.

The Group therefore continues to adopt the going concern basis in

preparing its consolidated interim financial statements.

3. Interim financial information

The interim financial information for the period ended 31 July

2021 is unaudited and does not constitute statutory accounts within

the meaning of Section 434 of the Companies Act 2006. The interim

financial information for the period ended 31 July 2020 is also

unaudited. The audited accounts for the year ended 31 January 2021

for Inspiration Healthcare Group plc were approved by its Board of

Directors on 14 May 2021 and have been delivered to the Registrar

of Companies with an unqualified audit report.

The Company's annual report and financial statements for the

year ended 31 January 2021 were prepared under International

Financial Reporting Standards (IFRS) as adopted by the European

Union, International Financial Reporting Interpretations Committee

(IFRIC) interpretations and with those parts of the Companies Act

2006 applicable to companies reporting under IFRS. The standards

used are those published by the International Accounting Standards

Board (IASB) and endorsed by the EU at the time of preparing those

statements.

4. Taxation

A provision has been made for corporation tax at the rate of 19%

on the estimated taxable profits for the period with an effective

tax rate of 13.5% reflecting primarily the Groups benefit from

R&D tax credits.

5. Dividends Paid

The final dividend for the year ended 31 January 2021 of 0.4p

per share (2020: nil per share) was paid on 30 July 2021.

The Board has declared an interim dividend of 0.205 p per share

(H1 2020/2021: 0.2p per share) to be paid on 29(th) December

2021.

6. Earnings per ordinary share

Basic earnings per share for the period is calculated by

dividing the profit attributable to ordinary shareholders for the

year after tax by the weighted average number of shares in

issue.

Basic diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares in issue to assume

conversion of all potential dilutive ordinary shares.

Unaudited Unaudited Audited

6 months 6 months Year

Ended Ended Ended

31 July 31 July 31 January

2021 2020 2021

GBP'000 GBP'000 GBP'000

------------------------------------------------ ---------- ---------- -----------

Profit

Profit attributable to equity holders

of the Company 2,211 787 2,815

Add back non-trading items - 1,040 1,014

Add back amortisation of intangible

assets acquired through business combinations 302 31 -

Numerator for underlying earnings per

share calculation 2,513 1,858 3,829

------------------------------------------------ ---------- ---------- -----------

The weighted average number of shares in issue and the diluted

weighted average number of shares in issue were as follows:

Unaudited Unaudited Audited

6 months 6 months Year

Ended Ended Ended

31 July 31 July 31 January

2021 2020 2021

-------------------------------------------- ----------- ----------- -----------

Shares

Weighted average number of ordinary

shares in issue for the purpose of

basic earnings per share 68,121,447 38,380,850 38,380,850

Weighted average number of shares issued

during the period/year - 4,485,115 16,855,015

-------------------------------------------- ----------- ----------- -----------

Weighted average number of ordinary

shares in issue during the period/year

for the purposes of basic earnings

per share 68,171,447 42,865,965 55,235,865

Dilutive effect of potential Ordinary

shares:

Share options 616,616 474,675 309,342

-------------------------------------------- ----------- ----------- -----------

Diluted weighted number of shares in

issue for the purpose of diluted earnings

per share 68,788,063 43,340,640 55,545,207

-------------------------------------------- ----------- ----------- -----------

The basic and diluted earnings per share are as follows:

Unaudited Unaudited Audited

6 months 6 months Year

Ended Ended Ended

31 July 31 July 31 January

2021 2020 2021

Pence Pence pence

-------------------------------------------- ---------- ---------- -----------

Basic earnings per share 3.25 1.84 5.10

Adjust for:

Non-trading items - 2.43 1.83

Amortisation of intangible assets acquired

though business combinations 0.44 0.07 -

Underlying basic earnings per share 3.69 4.34 6.93

-------------------------------------------- ---------- ---------- -----------

Diluted earnings per share 3.22 1.82 5.07

-------------------------------------------- ---------- ---------- -----------

Adjusted for:

Non-trading items - 2.40 1.82

Amortisation of intangible assets acquired

through business combinations 0.44 0.07 -

Underlying diluted earnings per share 3.66 4.29 6.89

-------------------------------------------- ---------- ---------- -----------

6. Related party transactions

-- Lease of Leicestershire facility

The Leicestershire facility at Earl Shilton is rented on an arms

length basis from a self-invested pension plan controlled by Neil

Campbell, Toby Foster and others. The lease was renewed on an arms

length basis in April 2018.

-- Key management

Key management control 7% of the voting shares of the Company as

at 31 July 2021.

Key management comprise the Group's Executive and Non-executive

Directors

Registere d Office:

2 Satellite Business Village

Fleming Way

Crawley RH10 9NE

T elephone : +4 4 (0) 1455 840555

Fax : +4 4 (0) 1455 841464

Website www.inspirationhealthcaregroup.plc.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FSSESLEFSEIS

(END) Dow Jones Newswires

October 05, 2021 02:00 ET (06:00 GMT)

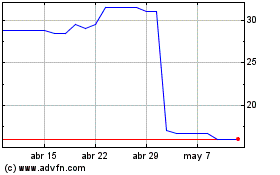

Inspiration Healthcare (LSE:IHC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Inspiration Healthcare (LSE:IHC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024