TIDMINSE

RNS Number : 4633K

Inspired PLC

02 September 2021

2 September 2021

Inspired PLC

("Inspired" or the "Group")

Results for the six months ended 30 June 2021

Inspired (AIM: INSE), a leading technology enabled service

provider supporting businesses in their drive to net zero,

controlling energy costs and managing their response to climate

change, announces its consolidated, unaudited half year results for

the six-month period ended 30 June 2021.

Financial Results

H1 2021 H1 2020 % change

*Restated

------------------------------ --------- --------- --------

Revenue GBP32.62m GBP24.94m 31%

Gross profit GBP24.09m GBP20.27m 19%

Adjusted EBITDA** GBP8.82m GBP7.64m 15%

Adjusted profit before tax*** GBP6.00m GBP5.08m 18%

Profit before tax GBP0.94m GBP0.95m -1%

Adjusted Diluted EPS**** 0.53p 0.66p -20%

Diluted Basic EPS 0.07p 0.14p -50%

Net Debt GBP30.17m GBP33.68m -10%

Order book GBP69.0m GBP61.5m 12%

Interim dividend per share 0.12p 0.10p 20%

------------------------------ --------- --------- --------

-- Half year revenue of GBP32.6 million, up 31% against 2020 (H1

2020: GBP24.9 million), achieving organic growth of 19% (H1 2020:

-5%) as the Group's customers, markets and economic activity

continues to recover.

-- Industrial and commercial energy consumption levels in H1

were in line with expectations, being 13% below 2019 levels in Q1

and 9% below in Q2, with H2 consumption to date reflecting the

continuing economic recovery from the pandemic.

-- Despite continued lockdown disruption, Optimisation Services

has shown a strong rebound in performance with revenue growth of

59% in H1 2021.

-- Group adjusted EBITDA increased 15%, to GBP8.8 million (H1 2020: GBP7.6 million).

-- The order book as at 30 June 2021 increased 12% to GBP69.0

million (H1 2020: GBP61.5 million).

-- Net debt of GBP30.2 million (2020: GBP33.7 million), a reduction of 10%.

-- Underlying cash generated from continuing operations

(excluding the impact of deal fees, restructuring costs and

repayment of Q2 2020 VAT deferrals) of GBP1.08 million (H1 2020:

GBP7.21 million) includes:

- GBP5.3 million increase in trade receivables in the period,

the majority of which relates to delayed payments from a small

number of significant optimisation customers, predominantly in the

public sector. Management fully expect to recover the balance

during H2 2021.

- Increase in accrued income on optimisation projects of GBP0.8

million due to timing, with projects restarting and progressed

during Q2 2021, with the relevant project invoices raised

subsequent to the half-year period end.

- Management expect cash conversion ratios in FY2021 onwards to

remain consistent with the levels seen in FY2020.

-- Interim dividend of 0.12 pence per share (H1 2020: 0.10

pence) in line with the Group's dividend policy.

Operational and acquisition highlights

-- Name change to Inspired PLC, reflecting the transition of the

business to a technology enabled, ESG service provider, supporting

clients to manage their response to climate change and deliver net

zero carbon.

-- Structured across three divisions and four reporting

segments, all underpinned by long term structural growth

drivers:

- Inspired Energy - Energy Solutions (comprising two reporting

segments, Energy Assurance Services and Energy Optimisation

Services)

- Inspired Software - Software Solutions

- Inspired ESG - ESG Solutions

-- Completed the acquisitions of Businesswise Solutions Limited

("Businesswise") and General Energy Management Limited ("GEM") in

March 2021.

Board changes

-- Richard Logan appointed Non-Executive Chairman (previously an

Independent Non-Executive Director) with Mike Fletcher retiring

from the position of Non-Executive Chairman after more than nine

years on the Board.

-- Sangita Shah and Dianne Walker appointed to the Board as

Independent Non-Executive Directors post period end, bringing a

wealth of experience, complementing the skill sets of the existing

Non-Executives, Sarah Flannigan and Richard Logan.

Current trading and outlook

The Group made further strategic progress during the first half

of the year, with a strengthened platform capable of generating

long term growth as its markets continue to recover from the period

of reduced energy consumption during the pandemic

Trading in the year to date in the core Energy Assurance

Services business remains in line with management's expectations

and is consistent with the Group's energy consumption

assumptions.

The Group's Energy Optimisation Services business began to

recover in the second quarter after significant disruption was

caused by further lockdowns implemented in Q1, resulting in an

overall performance for the half year that was in line with

management's expectations. Demand for optimisation services is

continuing to recover in H2 2021 as clients' attention turns to the

reopening of premises.

Software Solutions and the recently launched ESG Solutions

divisions continue to gain traction. The increasing focus of

investors and businesses on Net Zero Carbon targets, combined with

mandatory requirements for businesses to make ESG disclosures from

2022, provides a favourable backdrop to the strategy for the

Inspired ESG division.

Whilst uncertainties relating to the global pandemic remain and

should not be discounted, the Board continues to be excited and

confident in the longer-term prospects of the Group, underpinned by

the secular trend towards greater ESG focus and sustainable energy

usage. The Board remains confident of achieving current market

expectations, assuming no further significant Covid-19

disruption.

Commenting on the results, Mark Dickinson, CEO of Inspired,

said: "The rebound in the first half results in 2021 reflects the

continuing recovery in energy consumption, along with a return to

being able to access client premises to deliver energy optimisation

services."

"We are pleased by the current execution of the business plans

within the Software Solutions and ESG Solutions divisions, which,

although at an early stage, are developing strongly and we expect

further progress during 2022.

"As we have transitioned from Inspired Energy PLC to Inspired

PLC, we are well positioned to evolve our purpose as we help our

clients respond to Climate Change whilst controlling their costs.

Our objective is to evolve into the leading provider of services to

help businesses to respond to climate change and meet their net

zero targets."

* The H1 2020 income statement and cash flow statement have been

restated to reflect the impact of treating the SME Division as a

discontinued operation.

**Adjusted EBITDA is earnings before interest, taxation,

depreciation, and amortisation, excluding exceptional items and

share-based payments.

***Adjusted profit before tax is earnings before tax,

amortisation of intangible assets (excluding internally generated

amortisation related to computer software and customer databases),

exceptional items, share-based payments, the change in fair value

of contingent consideration and foreign exchange gains/(losses) (A

reconciliation of this can be found in note 3)

****Adjusted diluted earnings per share represents the diluted

earnings per share, as adjusted to remove amortisation of

intangible assets (excluding internally generated amortisation

related to computer software and customer databases), exceptional

items, share-based payments, the change in fair value of contingent

consideration and foreign exchange gains/(losses).

For further information, please contact:

Inspired PLC www.inspiredplc.co.uk

Mark Dickinson, Chief Executive Officer +44 (0) 1772 689 250

Paul Connor, Chief Financial Officer

Shore Capital (Nomad and Joint Broker) +44 (0) 20 7408 4090

Edward Mansfield

James Thomas

Michael McGloin

Peel Hunt LLP (Joint Broker)

Mike Bell

Ed Allsopp +44 (0) 20 7418 8900

Alma PR +44 (0) 20 3405 0205

Justine James +44 (0) 7525 324431

David Ison Inspired@almapr.co.uk

Molly Gretton

Chairman's Statement

I'm delighted to report that in my first statement as Chairman

that your Board is pleased with the strategic progress delivered

during a period in which our customers' businesses, and the economy

more broadly, continued to recover. Whilst the financial

performance of the Group for H1 2021 continued to be impacted by

the legacy challenges caused by the pandemic, as conditions

normalise, the Group's underlying performance will continue to

strengthen.

Board changes

On 1 July 2021, I was pleased to assume the role of

Non-Executive Chairman having served as the senior independent

Non-Executive Director of the Group since 2017, succeeding our

retiring Chairman Mike Fletcher who had been a member of the Board

since the Group's IPO.. On behalf of the Board and all at Inspired,

I wish to thank Mike for his invaluable contribution throughout his

time on the Board.

Subsequent to the period end, the Board has been strengthened

and I am delighted to welcome Sangita Shah, who will chair the

Remuneration Committee, and Dianne Walker, who will chair the Audit

and Risk Committee, to the Board as independent Non-Executive

Directors with effect from 1 July 2021 and 4 August 2021

respectively. Both bring a wealth of varied and extensive

experience complementing the skill sets of our existing Board

members.

The Board now consists of two Executive Directors supported by a

Non-Executive Chairman and three independent Non-Executive

Directors , representing a broader mix of skills and diversity to

align with the Group's evolving strategy.

Acquisitions and equity fundraising

In March 2021, the Board was delighted to conclude the

acquisitions of Businesswise and GEM, which are highly

complementary additions to the Group. The GBP35m fundraising

completed in July 2020 provided greater capacity and flexibility

with which to capitalise on acquisition opportunities, which were

carefully structured in light of the economic uncertainty. Both

acquisitions completed in the period increase our market share for

Energy Assurance services, broaden our customer base and

significantly increase our units of opportunity.

We are pleased to welcome the Businesswise and GEM teams to the

Group.

Dividend

Since its IPO in 2011, Inspired has established a track record

of delivering profitable and cash-generative growth which has

facilitated a consistent and progressive dividend policy.

The pandemic brought a temporary halt to dividend payments,

which were re-established with a 2020 interim dividend of 0.10

pence declared in September 2020 and a final 2020 dividend of 0.12

pence proposed in March 2021. The Board remains confident in the

Group's prospects and is therefore declaring an interim dividend of

0.12 pence (2020: 0.10 pence). The dividend aligns with the Board's

stated policy of a dividend cover of at least 3x earnings, with the

objective of delivering progressive dividend growth over time.

The interim dividend will be paid on 8 December 2021 to all

shareholders on the register at close of business on 15 October

2021. The shares will be marked ex-dividend on 14 October 2021.

Staff

On behalf of the Board, I would like to thank our employees who

continue to overcome the challenges that we have faced in what was

an unprecedented time. Their health and wellbeing remains our

priority. During this challenging time, we have continued to invest

in our valued team and the business and are well positioned for

growth as we emerge from the pandemic.

Richard Logan

Chairman

1 September 2021

CEO's Statement

I am pleased to report on the Group's results for H1 2021 as we

look to cement our position as the leading independent provider of

technology enabled services to help businesses respond to climate

change.

The first half of 2021 has seen a notable upturn in performance

of the Inspired Energy Solutions Division in Q2, with the easing of

lockdown restrictions that had continued to impact the first

quarter, and continued acquisition activity following the

completion of two transactions.

Proportionate recovery

The recovery in Group performance is correlated with the easing

of restrictions relating to the global COVID-19 pandemic. Q1 saw

restrictions remaining in place for longer than expected which had

a significant impact on the delivery of Energy Optimisation

Services, but otherwise the rate of recovery has been as expected

and we remain confident of meeting our full year market

expectations.

M&A execution

The completion of the acquisitions of Businesswise and GEM in Q1

2021 saw the conclusion of our accelerated M&A process for

Energy Assurance Businesses from our fundraising in 2020.

The Group has completed the integration of GEM into our core

Inspired Energy brand and the focus is now on providing additional

services to the GEM client base. Businesswise is being operated as

a challenger brand catering for clients who prefer a more boutique

service and is performing in line with our first-year expectations.

The introduction of Businesswise has allowed us to complete the

integration of E&CM (acquired via the acquisition of Inprova

Finance Limited in Dec 2018) and to realise the final identified

synergies through the restructuring of that business.

We continue to build and appraise our M&A pipeline with a

particular focus on adding further acquisitions to the Energy

Optimisation Services and Software Solutions divisions.

Energy Solutions Division

Energy Assurance Services

The Energy Assurance business continues to recover in line with

the general economy and is the cornerstone of the business both in

terms of heritage and scale. Record high energy prices have led to

delays in some contract renewals and a shortening of duration when

renewals are secured. Despite an absolute increase in the order

book due to the contribution of the acquired order books in the

period, high energy prices has led to a contraction of the

underlying order book in H1 2021, and is likely to continue into

H2. This is an expected cyclical impact when energy prices are

high, which we do not expect to impact revenues.

Energy Optimisation Services (Net Zero Carbon Solutions)

Our Energy Optimisation Services business was significantly

disrupted in Q1 2021 as the exit from lockdown was delayed.

However, we experienced a recovery in Q2 2021 and optimisation

services are expected, on a blended basis, to perform in line with

full year expectations.

The increasing focus of investors and businesses on Net Zero

Carbon is creating significant demand for our optimisation services

which in turn provides a significant and sustainable growth

opportunity as operating conditions normalise. In addition, Energy

Optimisation Services provides a balancing diversification of risk

in relation to the rising energy prices that create an element of

inertia in the Energy Assurance Services business as return on

capital for projects improves as energy prices rise.

Software Solutions Division

Our Software Solutions Division creates the proprietary software

used by the Group to underpin its technology enabled services, as

well as by third parties under a SaaS model. Currently the software

is supporting the following user base:

Account Type Number of companies CARO Users Unify Users

TPIs 58 10,719 1,649

-------------------- ----------- ------------

Private Sector 18 1,219 -

-------------------- ----------- ------------

Central Government 1 - -

-------------------- ----------- ------------

Education 38 1,068 -

-------------------- ----------- ------------

Health 23 87 -

-------------------- ----------- ------------

Local Authorities 119 14,172 -

-------------------- ----------- ------------

Police and Fire 7 49 -

-------------------- ----------- ------------

Other 1 - -

-------------------- ----------- ------------

Total 265 27,314 1,649

-------------------- ----------- ------------

CARO is the combined result of the STC and Systemslink

acquisitions creating proprietary software that allows the

collection, analysis, reporting and optimisation (CARO) of energy

and sustainability data. Unify is the applications platform which

allows CARO to be combined with latest solutions and developments

created by the division.

Providing software to c.50% of the public sector, a significant

growth opportunity exists to evolve the installed user base to the

Unify Platform. However, the primary growth opportunity for this

division is the ability to provide valuable data-led services to a

growing number of successful energy advisors whilst generating

recurring SaaS revenues. In the first half of 2021 the number of

TPIs that use the platform increased from 50 to 58.

ESG Solutions Division

During the first half of 2021 we reclassified some of the Energy

Optimisation Services Division activities that are more directly

focussed on ESG reporting into a new standalone ESG Solutions

business. This has led to a much cleaner organisational structure

and focus on solutions for the client.

In addition to providing services to existing clients, we have

found that our ESG offering has resulted in winning new clients,

with four public companies signed up since the start of the year,

representing a diverse range of sectors.

The ESG Solutions Division is benefiting from the regulatory

tail winds resulting from the increased mandatory disclosure

obligations.

Outlook

The second half of the year to date has continued in line with

management expectations. Whilst we need to remain cognisant of the

risks posed by a potential resurgence in the global pandemic, under

current market conditions we remain confident of meeting market

expectations for the year.

On behalf of the Board, I would like to thank our staff,

customers and wider stakeholders for their continued support.

Mark Dickinson

Chief Executive Officer

1 September 2021

CFO's Statement

H1 2021 has been a period in which we have seen a 31% increase

in revenue and 15% increase in Adjusted EBITDA, as we continue to

see energy consumption and economic activity recover from the

challenges presented by the pandemic. Following the significant

impact of the COVID-19 pandemic in the first half of 2020, Group

organic revenues showed a strong recovery in 2021, increasing 19%

(H1 2020: -5%) partly driven by a recovery in energy consumption by

our assurance customers and, as anticipated, the resumption of

optimisation projects in Q2 2021.

Divisional Performance

Energy Solutions Division

The Energy Solutions Division comprises of Energy Assurance

Services and Energy Optimisation Services.

2021 trading to date in the Energy Assurance Services business

remains in line with management's expectations and consistent with

the Group's energy consumption assumptions, being approximately 13%

below 2019 levels in Q1, and 9% below 2019 levels in Q2.

Energy Assurance Services generated 55% of Group revenues in H1

2021 (H1 2020: 62%) being GBP17.9 million (H1 2020: GBP15.4

million) an increase of 16%. Energy Assurance Services contributed

adjusted EBITDA of GBP8.3 million, an increase of 6% (H1 2020:

GBP7.8 million). In normal market conditions and post full

integration of acquisitions, management's view is that the division

will generate EBITDA margins of c.50%.

The Group's Energy Optimisation Services (part of the Energy

Solutions Division) business was more significantly disrupted in

Q1, as a result of further lockdowns. Q2 2021 has seen demand for

optimisation services beginning to recover with the blended

performance in H1 2021 in line with management's expectations.

Demand for optimisation services is continuing to recover in H2

2021 as clients' attention turns to the reopening of their

premises.

Energy Optimisation Services generated 40% of Group revenues in

H1 2021 (H1 2020: 33%) being GBP13.2 million (H1 2020: GBP8.3

million) an increase of 59%. Energy Optimisation Services

contributed adjusted EBITDA of GBP1.5 million (H1 2020: GBP0.4

million), with H1 2020 margins being heavily impacted by the

lockdowns in Q2 2020, following a strong start in Q1 2020. Despite

the disruption to the division, we have continued to invest in the

talent within the Optimisation Services team to accelerate the

growth of the division as the economy recovers.

The Energy Optimisation Services EBITDA margins have also

continued to recover in H1 2021. Once operating at full capacity,

management's view is that the division will generate EBITDA margins

of 20-25%.

Software Solutions Division

The Group's Software Solutions Division revenues grew by 15% to

of GBP1.2 million (H1 2020: GBP1.0 million) generating Adjusted

EBITDA of GBP1.0 million (H1 2020: GBP0.8 million), with the

division generating a strong sustainable EBITDA margin in excess of

80%.

ESG Solutions Division

The ESG Solutions division revenues relate to the provision of

sustainability related services, including Streamlined Energy and

Carbon Reporting (SECR), Energy Savings Opportunity Scheme (ESOS)

and Task Force on Climate-Related Financial Disclosures (TCFD). We

remain encouraged by the prospects of the Group's recently launched

ESG Disclosure product. The increasing requirements of Corporate

Businesses to make mandatory ESG disclosures in 2022 provides a

favourable back drop to our strategy for the ESG Solutions Division

and we will continue our organic entry into this market.

Order Book

The Corporate Order Book as at 30 June 2021 increased 12% year

on year to GBP69.0 million (H1 2020: GBP61.5 million). The

Corporate Order Book as at 31 December 2020 was GBP63.0 million,

increasing further to GBP73.0 million following the acquisition of

Businesswise Solutions and GEM in March 2021. Although Group

revenues and profits are not directly impacted by changes in energy

commodity prices, as expected, the timing at which assurance

customers contract, and the duration of those contracts, can be

affected. Market conditions, including record high commodity prices

in H1 2021, have led to customers delaying renewals of supply

contracts, which is predominantly the point at which assurance

customers contract with the Group. Management believes this is a

point of timing, not contraction of demand, with customer retention

remaining strong during the period.

As expected, PLC costs were GBP2.0 million (H1 2020: GBP1.5

million), in line with H2 2020 run rate resulting in an overall

adjusted EBITDA for the period of GBP8.8 million (H1 2020: GBP7.6

million). After deducting charges for depreciation, amortisation of

internally generated intangible assets and finance expenditure the

adjusted profit before tax for the year GBP6.0 million (H1 2020:

GBP5.1 million).

A full reconciliation of the Group's adjusted profit before tax

to its reported profit before tax is included at note 3. The items

included in the reconciliation include substantial charges for the

amortisation of intangible assets as a result of acquisitions,

share based payment charges, fees associated with acquisitions,

restructuring costs and the changes in the fair value of contingent

consideration.

Cash generation

Underlying cash generated from continuing operations (excluding

the impact of deal fees, restructuring costs and repayment of Q2

2020 VAT deferrals) of GBP1.08 million (H1 2020: GBP7.21 million).

Cash conversion was materially impacted in the period by a GBP5.3

million increase in trade receivables in the period from delayed

payment by a small number of significant optimisation invoices,

predominantly from customers in the public sector.

Furthermore, H1 2021 saw an increase in accrued income on

Optimisation projects of GBP0.8m due to timing, with projects

restarting and progressing during Q2 2021, with the relevant

project invoices raised subsequent to the period end.

H1 2021 cash conversion was also impacted by the repayment of

GBP0.6 million of deferred VAT from Q2 2020. This compares to a

GBP2.7 million cash flow benefit received in H1 2020 comparative as

a result of the deferral of PAYE and NIC (GBP1.7 million) and VAT

(GBP1.0 million), plus the benefit received in H1 2020 from short

term cash flow management measures taken at the onset of the

pandemic.

Management expect cash conversion ratios in FY2021 and beyond to

remain consistent with the levels seen in FY2020.

We received contingent consideration from the disposal of the

SME division in December 2020 of GBP0.7m in the period.

Exceptional costs

Exceptional costs of GBP2.0 million (H1 2020: GBP0.3 million)

were incurred in the period, which GBP0.8 million of deal fees

associated with acquisitions completed in the period.

Restructuring costs of GBP0.2 million have been incurred in the

year, which includes termination payments from the restructuring of

the acquisitions completed in the previous periods.

Furthermore, a GBP0.9 million loss (equating purely to the

unwinding of discounting) from changes in the fair value of

contingent consideration (H1 2020: GBP0.1 million) were treated as

exceptional in the period.

These costs are considered by the Directors to be material in

nature and non-recurring and therefore require separate

identification to give a true and fair view of the Group's result

for the period.

Financial position and liquidity

As at 30 June 2021, the Group's net debt was GBP30.2 million. In

addition to cash and cash equivalents of GBP15.6 million on hand,

as at 30 June 2021, approximately GBP14.0 million of the Group's

GBP60.0 million Revolving Credit Facility is undrawn with an

additional GBP25.0 million accordion option available, subject to

covenant compliance.

In March 2021, the Board agreed with their lenders to amend the

definition of Adjusted Net Leverage to apply from the 1 July 2021,

to reverse the impact of the adoptions of IFRS 16 and the

definition of contingent consideration to only included deferred

consideration or crystalised contingent consideration.

Collectively, these amends significantly reduce the forecast

leverage of the Group for covenant purposes.

Dividend

The Board announced the reinstatement of dividend payments with

a 2020 interim dividend of 0.10 pence declared in September 2020

and a final 2020 dividend of 0.12 pence declared in March 2021

subsequent to the pandemic bringing a temporary halt to dividend

payments.

It follows that the Board is pleased to announce an interim

dividend of 0.12 pence per share (2020: 0.10 pence) in line with

the Groups' revised policy of paying dividends initially covered by

at least 3.0x earnings.

The dividend will be payable on 8 December 2021 to all

shareholders on the register on 15 October 2021 and the shares will

go ex-dividend on 14 October 2021.

In summary

The strategic and financial initiatives delivered in the period,

ensure the Group is well placed to endure the continued economic

uncertainty generated by COVID-19, and in turn facilitate the

effective implementation of our strategic growth plan as envisaged

prior to the COVID-19 crisis as the economic recovery

continues.

Paul Connor

Chief Financial Officer

1 September 2021

Group Statement of Comprehensive Income

For the six months ended 30 June 2021

Year ended

31 December

2020

Six months

Six months ended 30

ended 30 June 2020

June 2021 (unaudited

(unaudited) & restated) (audited)

Note GBP000 GBP000 GBP000

------------------------------- ----- ------------- ------------- -------------

Revenue 32,616 24,942 46,110

Cost of sales (8,525) (4,670) (7,210)

------------- ------------- -------------

Gross profit 24,091 20,272 38,900

Administrative expenses (22,562) (18,021) (40,723)

------------- ------------- -------------

Operating profit/(loss) 1,529 2,251 (1,823)

------------- ------------- -------------

Analysed as:

Earnings before exceptional

costs, depreciation,

amortisation and share-based

payment costs 8,819 7,644 12,767

Fees associated with

acquisition (803) (159) (1,366)

Restructuring costs (238) (73) (990)

Change in fair value

of contingent consideration (938) (90) (1,157)

Depreciation (937) (858) (1,173)

Amortisation of acquired

intangible assets (2,741) (2,571) (6,038)

Amortisation of internally

generated intangible

assets (1,069) (762) (2,268)

Share-based payment

costs (564) (880) (1,598)

------------- ------------- -------------

1,529 2,251 (1,823)

------------------------------- ----- ------------- ------------- -------------

Finance expenditure (644) (1,299) (2,678)

Other financial items 50 - (35)

------------- ------------- -------------

Profit/(loss) before

income tax 935 952 (4,536)

Income tax (expense)/credit (178) (209) 251

------------- ------------- -------------

Profit/(loss) for

the period from continuing

operations 757 743 (4,285)

------------- ------------- -------------

Profit/(loss) for

the period from discontinued

operations - 365 (6,740)

------------- ------------- -------------

Profit/(loss) for

the period 757 1,108 (11,025)

------------- ------------- -------------

Attributable to:

Non-controlling interest - 1,025 1,448

Equity owners of the

company 757 83 (12,473)

------------- ------------- -------------

Other comprehensive

income:

Exchange differences

on translation of

foreign operations (760) 966 364

------------- ------------- -------------

Total other comprehensive

(expense)/income for

the year (760) 966 364

============= ============= =============

Total comprehensive

(expense)/income for

the year (3) 2,074 (10,661)

============= ============= =============

Total comprehensive

(expense)/income from

continuing operations (3) 1,709 (3,921)

============= ============= =============

Total comprehensive

income/(expense) from

discontinued operations - 365 (6,740)

============= ============= =============

Attributable to:

Non-controlling interest - 1,025 1,448

Equity owners of the

company (3) 1,049 (12,109)

Note

Diluted earnings per

share attributable

to the equity holders

of the Company (pence) 3 0.07 0.14 (1.34)

Adjusted diluted earnings

per share attributable

to the equity holders

of the Company (pence) 3 0.53 0.66 0.70

------------------------------- ----- ------------- ------------- -------------

Group Statement of Financial Position

At 30 June 2021

Six months Six months

ended 30 ended 30 Year ended

June 2021 June 2020 31 December

(unaudited) (unaudited) 2020 (audited)

Note GBP000 GBP000 GBP000

----------------------------- ----- ------------- ------------- ----------------

ASSETS

Non-current assets

Investments 898 897 898

Goodwill 6 73,730 52,559 63,776

Other intangible assets 6 18,027 17,454 16,351

Property, plant and

equipment 4 2,357 3,398 2,322

Right of use assets 5 3,142 3,651 2,593

98,154 77,959 85,940

Current assets

Trade and other receivables 7 26,981 30,225 18,960

Deferred contingent

consideration 6,217 - 6,925

Cash and cash equivalents 15,565 11,759 26,884

------------- ------------- ----------------

48,763 41,984 52,769

Total assets 146,917 119,943 138,709

------------- ------------- ----------------

LIABILITIES

Current liabilities

Trade and other payables 8 7,948 12,388 8,230

Lease liabilities 527 1,294 992

Current tax liability 2,497 2,615 2,456

Contingent consideration 7,551 1,470 7,741

18,523 17,767 19,419

Non-current liabilities

Bank borrowings 45,730 45,439 45,730

Lease liabilities 2,207 2,123 1,679

Contingent consideration 11,005 264 4,198

Deferred tax liability 2,032 2,040 1,278

Interest rate swap 80 156 130

61,054 50,022 53,015

Total liabilities 79,577 67,789 72,434

------------- ------------- ----------------

Net assets 67,340 52,154 66,275

============= ============= ================

EQUITY

Share capital 1,216 898 1,202

Share premium account 67,490 37,422 67,000

Merger relief reserve 20,995 15,535 20,995

Retained earnings (9,661) 6,802 (10,418)

Share based payments

reserves 5,913 4,403 5,349

Investment on own

shares (6,742) (6,742) (6,742)

Translation reserve (488) 873 272

Reverse acquisition

reserve (11,383) (11,383) (11,383)

Equity attributable

to shareholders 67,340 47,808 66,275

Non-controlling interest - 4,346 -

Total equity 67,340 52,154 66,275

============= ============= ================

Group Statement of Cash Flows

For the six months ended 30 June 2021

Six months

Six months ended 30

ended 30 June 2020 Year ended

June 2021 (unaudited 31 December

(unaudited) & restated) 2020 (audited)

Note GBP000 GBP000 GBP000

---------------------------------- ----- ------------ ------------ ---------------

Cash flows from operating

activities

Profit/(loss) before

income tax 935 1,317 (11,276)

Adjustments

Depreciation 937 880 1,173

Amortisation 3,810 3,339 8,306

Share based payment costs 564 880 1,598

Loss for the year from

discontinued operations - (365) 6,740

Finance expenditure 594 1,300 2,678

Exchange rate variances (377) (206) (323)

Other financial items 938 90 1,157

Cash flows before changes

in working capital 7,401 7,235 10,053

Movement in working capital

(Increase)/decrease in

inventories (254) 242 (43)

(Increase) / decrease

in trade and other receivables (6,490) (910) 154

(Decrease)/increase in

trade and other payables (1,165) 3,109 (925)

Dividends declared to

NCI - - (900)

Cash generated from operations (508) 9,676 8,339

------------ ------------ ---------------

Income taxes paid (313) (1,304) (2,222)

Net cash flows from operating

activities (821) 8,372 6,117

Cash flows from investing

activities

Purchase of property,

plant and equipment (393) (1,063) (1,925)

Payments to acquire intangible

assets (2,242) (1,533) (3,716)

Contingent consideration

paid (600) (3,250) (3,800)

Contingent consideration

received 708 - -

Provision of working

capital facility to discontinued

operation (300) - (250)

Acquisition of subsidiary,

net of cash (6,530) (120) (5,866)

Net cash flows from investing

activities (9,357) (5,966) (15,557)

Cash flows from financing

activities

New bank loans - 7,000 7,000

Finance expenses (764) (982) (2,273)

Repayment of lease liabilities (825) (305) (918)

Proceeds from issue of

new shares 504 6 29,848

Dividends paid to NCI - (1,650) (1,650)

Dividends paid - - (924)

------------ ------------ ---------------

Net cash flows from financing

activities (1,085) 4,069 31,083

Net (decrease)/increase

in cash and cash equivalents (11,263) 6,475 21,643

Cash and cash equivalents

brought forward 26,884 5,241 5,241

Exchange differences

on cash and cash equivalents (56) 43 -

------------ ------------ ---------------

Cash and cash equivalents

carried forward 15,565 11,759 26,884

============ ============ ===============

Group Statement of Changes in Equity

For the six months ended 30 June 2021

Share Merger Share-based Investment Reverse Total

Share premium relief payment Retained in own Translation acquisition Non-controlling shareholders'

capital account reserve reserve earnings shares reserve reserve interest equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1

January 2020 892 37,422 15,535 3,523 6,719 (6,742) (92) (11,383) 13,465 59,339

------- ------- ------- ----------- -------- ----------- ------------ ----------- --------------- -------------

(Loss)/profit

for the period - - - - (12,473) - - - 1,448 (11,025)

Other

comprehensive

income - - - - - - 364 - - 364

Total

comprehensive

income for the

period - - - - (12,473) - 364 - 1,448 (10,661)

Share-based

payment cost - - - 1,598 - - - - - 1,598

Shares issued

(2 June 2020) 6 - - - - - - - - 6

Shares issued

(10 July 2020) 89 10,620 - - - - - - - 10,709

Shares issued

(17 July 2020) 40 - 5,460 - - - - - - 5,500

Shares issued

(28 July 2020) 172 18,958 - - - - - - - 19,130

Shares issued

(15 September

2020) 3 - - - - - - - - 3

Acquisition of

subsidiary

undertaking - - - - (3,740) - - - (14,163) (17,903)

Disposal of

subsidiary

undertaking - - - 228 - - - - - 228

Dividends paid - - - - (924) - - - (750) (1,674)

------- ------- ------- ----------- -------- ----------- ------------ ----------- --------------- -------------

Total

transactions

with owners 310 29,578 5,460 1,826 (17,137) - 364 - (13,465) 6,936

------- ------- ------- ----------- -------- ----------- ------------ ----------- --------------- -------------

Balance at 31

December 2020 1,202 67,000 20,995 5,349 (10,418) (6,742) 272 (11,383) - 66,275

------- ---------------

Profit for the

period - - - - 757 - - - - 757

Other

comprehensive

income - - - - - - (760) - - (760)

Total

comprehensive

income for the

period - - - - 757 - (760) - - (3)

Share-based

payment cost - - - 564 - - - - - 564

Shares issued

(8 April 2021) 13 376 - - - - - - - 389

Shares issued

(22 June 2021) 1 114 - - - - - - - 115

---------------

Total

transactions

with owners 14 490 - 564 757 - (760) - - 1,065

------- ------- ------- ----------- -------- ----------- ------------ ----------- --------------- -------------

Balance at 30

June 2021 1,216 67,490 20,995 5,913 (9,661) (6,742) (488) (11,383) - 67,340

------- ------- ------- ----------- -------- ----------- ------------ ----------- --------------- -------------

1. Accounting Policies

Basis of preparation

The financial information set out in this announcement does not

constitute the statutory accounts of the Group for the period ended

30 June 2021. Whilst the financial information included in this

interim announcement has been computed in accordance with

International Financial Reporting Standards as adopted by the

European Union (IFRS). They have been prepared on an accrual basis

and under the historical cost convention except for certain

financial instruments measured at fair value. This announcement in

itself does not contain sufficient information to comply with

IFRS.

Details of the accounting policies are those set out in the

annual report for the year ended 31 December 2020. The accounting

policies in this announcement are consistent with those set out in

the annual report for the year ended 31 December 2020.

2. Segmental information

Revenue and segmental reporting

The chief operating decision maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Group's Executive Directors.

In previous years we reported under 2 operating segments, Corporate

and SME. Following the decision to dispose of the SME Division, the

Group has been restructured into 4 reporting segments, namely

Assurance, Optimisation, Software and ESG. The H1 2020 comparatives

have been restated to remove the SME segment and to report the

previous periods figures under the revised segmental structure.

Six months ended 30 June 2021 Six months ended 30 June 2020 (restated)

Assurance Optimisation Software ESG PLC Total Assurance Optimisation Software ESG PLC Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 17,877 13,174 1,179 386 - 32,616 15,397 8,292 1,024 229 - 24,942

Cost of sales (1,298) (7,195) (32) - - (8,525) (643) (4,014) (13) - - (4,670)

------------- --------- ------------ -------- ------ ------- -------- --------- ------------ -------- ------ ------- --------

Gross profit 16,579 5,979 1,147 386 - 24,091 14,754 4,278 1,011 229 - 20,272

------------- --------- ------------ -------- ------ ------- -------- --------- ------------ -------- ------ ------- --------

Overheads (8,467) (4,495) (173) (360) (4,320) (17,815) (6,977) (3,841) (176) (171) (2,665) (13,830)

------------ -------- ------ -------

EBITDA 8,112 1,484 974 26 (4,320) 6,276 7,777 437 835 58 (2,665) 6,442

------------- --------- ------------ -------- ------ ------- -------- --------- ------------ -------- ------ ------- --------

Analysed as:

Adjusted

EBITDA 8,321 1,484 974 26 (1,986) 8,819 7,838 450 835 58 (1,537) 7,644

Share-based

payments - - - - (564) (564) - - - - (880) (880)

Exceptional

costs (209) - - - (1,770) (1,979) (61) (13) - - (248) (322)

--------- ------------ --------- ------------ -------- ------ ------- --------

8,112 1,484 974 26 (4,320) 6,276 7,777 437 835 58 (2,665) 6,442

--------- ------------ -------- ------ ------- -------- --------- ------------ -------- ------ ------- --------

Depreciation (937) (858)

Amortisation (3,810) (3,333)

Finance

expenditure (644) (1,299)

Other

financial

items 50 -

-------- --------

Profit before

income tax 935 952

-------- --------

3. Earnings Per Share

The earnings per share is based on the net profit for the period

attributable to ordinary equity holders divided by the weighted

average number of ordinary shares outstanding during the

period.

Year ended

31 December

2020

Six months Six months

ended 30 ended 30

June 2021 June 2020

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

------------------------------------ ------------- ------------- -----------------

Profit/(loss) attributable

to equity holders of the

Group 757 1,108 (11,025)

Loss on disposal of subsidiary

entities - - 6,740

Amortisation of acquired

intangible assets 2,741 2,571 6,038

Deferred tax in respect of

amortisation (465) (282) (1,025)

Changes in fair value of

contingent consideration 938 90 1,157

Foreign exchange variation (224) 353 253

Fees associated with acquisition 803 159 1,366

Share-based payments costs 564 880 1,598

Restructuring costs 238 73 990

Covenant reset arrangement - 110 -

fee/accelerated write off

of capitalised debt facility

arrangement fees upon refinancing

Adjusted profit attributable

to equity holders of the

Group 5,352 5,062 6,092

------------- ------------- -----------------

Weighted average number of

ordinary shares in issue

(000) 966,784 714,562 824,647

Dilutive effect of share

options (000) 44,674 51,810 49,107

------------- ------------- -----------------

Diluted weighted average

number of ordinary shares

in issue (000) 1,011,458 766,372 873,754

------------- ------------- -----------------

Basic earnings per share

(pence) 0.08 0.15 (1.34)

Diluted earnings per share

(pence) 0.07 0.14 (1.34)

Adjusted basic earnings per

share (pence) 0.55 0.71 0.74

Adjusted diluted earnings

per share (pence) 0.53 0.66 0.70

Year ended

31 December

2020

Six months Six months

ended 30 ended 30

June 2021 June 2020

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

--------------------------------- ------------- ------------- -------------

Profit/(loss) attributable

to equity holders of the

Group 757 1,108 (11,025)

(Profit)/loss from discontinued

operations - (365) 6,740

Underlying profit/(loss)

from continuing operations

attributable to equity holders

of the Group 757 743 (4,285)

------------- ------------- -------------

Weighted average number of

ordinary shares in issue

(000) 966,784 714,562 824,647

Dilutive effect of share

options (000) 44,674 51,810 49,107

Diluted weighted average

number of ordinary shares

in issue (000) 1,011,458 766,372 873,754

------------- ------------- -------------

Basic earnings per share

from continuing operations

(pence) 0.08 0.10 (0.52)

Diluted earnings per share

from continuing operations

(pence) 0.07 0.10 (0.52)

The weighted average number of shares in issue for the adjusted

diluted earnings per share include the dilutive effect of the share

options in issue to senior staff of Inspired.

Adjusted earnings per share represents the earnings per share,

as adjusted to remove the effect of the fees associated with

acquisition, amortisation of intangible assets (excluding

amortisation related to computer software and customer databases),

share-based payments and exceptional items which have been expensed

to the income statement in the period. Adjusted profit before tax

is calculated as follows:

Year ended

31 December

2020

Six months

Six months ended 30

ended 30 June 2020

June 2021 (unaudited

(unaudited) & restated) (audited)

GBP000 GBP000 GBP000

----------------------------------- ------------- ------------- -------------

Profit/(loss) before tax 935 952 (4,536)

Share-based payments costs 564 880 1,598

Amortisation of acquired

intangible assets 2,741 2,571 6,038

Foreign exchange variation (224) 353 253

Exceptional costs:

Fees associated with acquisition 803 159 1,366

Restructuring costs 238 73 990

Change in fair value of

contingent consideration 938 90 1,157

Adjusted profit before tax 5,995 5,078 6,866

------------- ------------- -------------

Acquisitional activity can significantly distort underlying

financial performance from IFRS measures and therefore the Board

deems it appropriate to report adjusted metrics as well as IFRS

measures for the benefit of primary users of the Group financial

statements.

4. Property, plant and equipment

Motor

Fixtures and fittings vehicles Computer equipment Leasehold improvements Total

GBP000 GBP000 GBP000 GBP000 GBP000

Cost

As at 1 January 2020 843 141 2,683 1,047 4,714

Acquisitions through

business combinations 22 - - - 22

Assets transferred to

disposal group (12) - (11) (17) (40)

Assets transferred to

intangible assets - - (1,338) - (1,338)

Foreign exchange

variations - 3 1 1 5

Additions 200 29 1,624 72 1,925

Disposals (116) (15) (547) (511) (1,189)

At 31 December 2020 937 158 2,412 592 4,099

Additions 2 - 418 - 420

Disposals - - (27) - (27)

At 30 June 2021 939 158 2,803 592 4,492

--------------------- --------- ------------------ ---------------------- -------

Depreciation

As at 1 January 2020 617 60 1,097 256 2,030

Charge for the year 221 21 75 254 571

Charge transferred to

intangible assets - - (380) - (380)

Assets transferred to

disposal group (10) - (10) (8) (28)

Disposals (85) (11) (144) (176) (416)

At 31 December 2020 743 70 638 326 1,777

Charge for the period 59 1 242 56 358

At 30 June 2021 802 71 880 382 2,135

--------------------- --------- ------------------ ---------------------- -------

Net Book Value

At 30 June 2021 137 87 1,923 210 2,357

--------------------- --------- ------------------ ---------------------- -------

At 31 December 2020 194 88 1,774 266 2,322

--------------------- --------- ------------------ ---------------------- -------

5. Right of use assets

Fixtures and fittings Motor vehicles Property Total

GBP000 GBP000 GBP000 GBP000

Cost

As at 1 January 2020 472 319 3,869 4,660

Acquisitions through business combinations - - 156 156

Remeasurement of Finance lease - - (347) (347)

Asset transferred to disposal group - (66) - (66)

Disposals (5) (164) (352) (521)

Additions 23 225 - 248

At 31 December 2020 490 314 3,326 4,130

Acquisitions through business combinations - 5 114 119

Additions - 105 919 1,024

Disposals - (72) (49) (121)

At 30 June 2021 490 352 4,310 5,152

--------------------- -------------- -------- -------

Depreciation

As at 1 January 2020 69 103 778 950

Charge for the year 69 125 788 982

Asset transferred to disposal group - (56) - (56)

Disposals - (86) (253) (339)

At 31 December 2020 138 86 1,313 1,537

Charge for the period 38 67 474 579

Disposals - (57) (49) (106)

At 30 June 2021 176 96 1,738 2,010

--------------------- -------------- -------- -------

Net Book Value

At 30 June 2021 314 256 2,572 3,142

--------------------- -------------- -------- -------

At 31 December 2020 352 228 2,013 2,593

--------------------- -------------- -------- -------

6. Intangible assets and goodwill

Tangible

Computer Trade Customer Customer Customer other

software name databases contracts relationships intangibles Goodwill Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Cost

At 1 January

2020 11,945 115 1,654 17,210 7,511 38,435 61,627 100,062

Additions 3,615 - 101 - - 3,716 - 3,716

Acquisitions

through

business

combinations 37 - - 583 - 620 3,241 3,861

Transfer from

property,

plant and

equipment 1,338 - - - - 1,338 - 1,338

Impairment (188) - - - - (188) - (188)

Assets

transferred

to disposal

group (432) - (1,755) - - (2,187) (1,208) (3,395)

Foreign

exchange

variances - - - 283 - 283 116 399

At 31

December

2020 16,315 115 - 18,076 7,511 42,017 63,776 105,793

Additions 2,305 46 - - - 2,351 - 2,351

Acquisitions

through

business

combinations 9 - - 3,490 - 3,499 10,057 13,556

Disposals (110) - - - - (110) - (110)

Foreign

exchange

variance - - - (254) - (254) (103) (357)

At 30 June

2021 18,519 161 - 21,312 7,511 47,503 73,730 121,233

---------- --------- --------- --------- -------------- ----------- -------- -------

Amortisation

As at 1

January 2020 5,983 24 1,571 9,560 2,410 19,548 - 19,548

Charge for

the period 2,895 6 - 4,022 815 7,738 - 7,738

Charge for

the year

transferred

from

property,

plant and

equipment 380 - - - - 380 - 380

Assets

transferred

to disposal

group (429) - (1,571) - - (2,000) - (2,000)

At 31

December

2020 8,829 30 - 13,582 3,225 25,666 - 25,666

Charge for

the year 1,258 4 - 2,141 408 3,811 - 3,811

Disposals (1) - - - - (1) - (1)

---------- --------- --------- --------- -------------- ----------- -------- -------

At 30 June

2021 10,086 34 - 15,723 3,633 29,476 - 29,476

---------- --------- --------- --------- -------------- ----------- -------- -------

Net Book

Value

At 30 June

2021 8,433 127 - 5,589 3,878 18,027 73,730 91,757

---------- --------- --------- --------- -------------- ----------- -------- -------

At 31

December

2020 7,486 85 - 4,494 4,286 16,351 63,776 80,127

---------- --------- --------- --------- -------------- ----------- -------- -------

Computer software is a combination of assets internally

generated and assets acquired through business combinations.

Amortisation charged in the period to 30 June 2021 associated with

computer software acquired through business combinations is

GBP190,000. The additional GBP1,068,000 charged in the period

relates to the amortisation of internally generated computer

software.

7. Trade and other receivables

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

------------------ ------- --------- -------------

Trade receivables 12,282 7,651 6,995

Other receivables 1,179 1,635 416

Prepayments 3,620 2,648 2,764

Accrued income 9,900 18,291 8,785

------------------ ------- --------- -------------

26,981 30,225 18,960

------------------ ------- --------- -------------

8. Trade and other payables

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

-------------------------------- ------- --------- -------------

Trade payables 2,317 1,206 1,943

Social security and other taxes 2,626 5,739 4,162

Accruals 1,674 1,947 866

Deferred income 559 2,935 745

Other payables 772 561 514

-------------------------------- ------- --------- -------------

7,948 12,388 8,230

-------------------------------- ------- --------- -------------

9. Availability of this announcement

This announcement together with the financial statements herein

and a presentation in respect of the interim financial results are

available on the Group's website, www.inspiredplc.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAXNFEAXFEFA

(END) Dow Jones Newswires

September 02, 2021 02:00 ET (06:00 GMT)

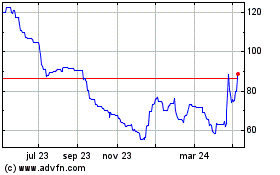

Inspired (LSE:INSE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

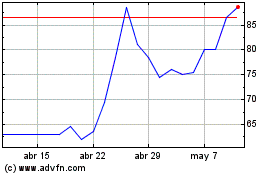

Inspired (LSE:INSE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024