TIDMINS

RNS Number : 9867M

Instem plc

27 September 2021

Instem plc

("Instem", the "Company" or the "Group")

Half Year Report

Instem plc (AIM: INS.L), a leading provider of IT solutions to

the global life sciences market, announces its unaudited half year

results for the six months ended 30 June 2021.

Financial Highlights

-- Total Group revenues were up 41 % to GBP 19.8m (H1 2020: GBP14.0m)

-- Recurring revenue (annual support and SaaS) increased 18 % to

GBP 9.9 m (H1 2020: GBP8.4m) with SaaS increasing 29% to GBP4.9m

(H1 2020: GBP3.8m)

-- Organic revenue growth of 8 % to GBP 15.2m (H1 2020: GBP14.0

m ), excluding The Edge Software Consultancy ("The Edge") and

d-Wise Technologies Inc ("d-wise") acquisitions in March and April

2021, respectively

-- Revenue figures stated after a GBP0.65m fair value reduction

to acquired deferred revenue associated with the d-wise

acquisition

-- Organic constant currency revenue growth was 16-%

-- Profit performance

-- Adjusted EBITDA* increased 39% to GBP 4.2m (H1 2020:

GBP3.0m), representing an Adjusted EBITDA margin of 21.0% (H1 2020:

21.3%)

-- Profit before tax of GBP 1.2m (H1 2020: GBP1.9m)

-- Adjusted profit before tax** of GBP2.9m (H1 2020: GBP2.1m)

-- Basic and diluted earnings per share of 4.8 p (H1 2020: 9.5p) and 4.6p (H1 2020: 9.0p)

-- Adjusted basic and diluted earnings per share** of 12.8p (H1

2020: 10.7p) and 12.2p (H1 2020: 10.2p)

-- Profit figures also stated after the GBP0.65m fair value reduction

-- Net cash generated from operations of GBP4.1m (H1 2020 GBP2.8m)

-- Net cash balance*** at 30 June 2021 of GBP10.1m (H1 2020: GBP7.3m)

*Earnings before interest, tax, depreciation, amortisation and

non-recurring items.

**After adjusting for the effect of foreign currency exchange on

the revaluation of inter-company balances included in finance

income/(costs), non-recurring items, amortisation of intangibles on

acquisitions

Profit is adjusted in this way to provide a clearer measure of

underlying operating performance.

*** Gross cash of GBP17.9m less financial liabilities but pre-

IFRS16

Operational Highlights

-- Strong organic growth

-- Continued transition to the SaaS model further increased

earnings visibility and underlying margins across the business

-- The acquisitions of The Edge and d-wise, which transformed

the scale and reach of the business, are integrating well

o Increasing recurring revenues

o Strengthening relationships with clients

o Increasing routes to market and potential cross selling

opportunities

Post-period end Highlights

-- Acquisition of PDS Pathology Data Systems ("PDS") expected to

be immediately earnings enhancing

o Further extends Instem's Study Management and S market share

and deepening relationships with some of its largest clients

Analyst Presentation: 11:30 today

Management will be hosting a presentation via web conference

today at 11:30. Analysts wishing to join should

register their interest by emailing instem@walbrookpr.com or by telephoning 020 7933 8780.

Investor Presentation: 16:00 today

Management will be providing a presentation and hosting an

Investor Q&A session on the results and future prospects today

at 16:00, through the digital platform Investor Meet Company.

Investors can sign up for free and add to attend the presentation

via the following link

https://www.investormeetcompany.com/instem-plc/register-investor

Questions can be submitted pre-event and at any time during the

live presentation via the Investor Meet Company Platform.

Phil Reason, CEO of Instem plc, commented: "As a company, we are

focussed on growing both organically and by acquisition. We are

delighted with the transactions completed during and post the

period end as well as the performance of our existing operations.

We have a scalable platform in place and a highly leverageable

business model underpinning a number of growth opportunities in

existing and adjacent markets.

"We are delighted to have achieved strong organic growth, with

the additions of The Edge, d-wise and, most recently, PDS

underpinning a step change in the scale of the business. Market

conditions remain buoyant and we have a strong pipeline of

opportunities, with a significantly increased target market. The

improvement in our trading profitability in the first half has been

sustained post the period end and, as a result, we now expect

trading performance, excluding any negative impact of the fair

value adjustment to acquired deferred revenue, for the current

financial year to be slightly ahead of the Board's previous

expectations.

"My thanks go to our enlarged global team of over 480 staff, who

have continued to perform exceptionally well whilst working

remotely. We expect that an indefinite blend of home and hybrid

working will provide permanent operational efficiencies while

enhancing staff work-life balance."

For further information, please contact:

Instem plc Via Walbrook PR

Phil Reason, CEO

Nigel Goldsmith, CFO

Singer Capital Markets (Nominated

Adviser & Broker) +44 (0) 20 7496 3000

Peter Steel / Rachel Hayes / Alex

Bond (Investment Banking)

Walbrook Financial PR +44 (0) 20 7933 8780

Nick Rome instem@walbrookpr.com

Tom Cooper

Nicholas Johnson

About Instem

Instem is a leading provider of IT solutions & services to

the life sciences market delivering compelling solutions for Study

Management and Data Collection; Regulatory Solutions for

Submissions and Compliance; and Informatics-based Insight

Generation.

Instem solutions are in use by over 700 customers worldwide,

including all the largest 25 pharmaceutical companies, enabling

clients to bring life enhancing products to market faster. Instem's

portfolio of software solutions increases client productivity by

automating study-related processes while offering the unique

ability to generate new knowledge through the extraction and

harmonisation of actionable scientific information.

Instem products and services address aspects of the entire drug

development value chain, from discovery through to market launch.

Management estimate that over 50% of all drugs on the market have

been through some part of Instem's platform at some stage of their

development.

To learn more about Instem solutions and its mission, please visit www.instem.com

CHAIRMAN'S STATEMENT

In the half year period from January to June, and in the

immediate post-period to September, the shape and scale of our

operations has been transformed by the successful acquisition of

three businesses.

The acquisitions of The Edge and d-wise have significantly

extended the reach of our product and service portfolio, whilst the

acquisition of PDS ensures that our position in the preclinical

space is unrivalled. We are delighted to have added such strong

businesses to our Company.

In July 2020 we specifically raised funds to acquire businesses

that we believed would be transformational to the company by

extending our 'footprint' in the life sciences R&D space and

consequently provide a stronger platform for long term growth. I

believe that we can say this has been achieved in terms of

deploying those funds to increase our scale and provide a platform

for further growth.

We can already see the positive impact from the acquisitions of

The Edge and d-wise, which we are currently integrating into the

business. While they only contributed four and three months

respectively for the period under review, the resultant impact was

significant.

Financial Performance.

Whilst the COVID-19 pandemic affected a number of sectors,

Instem continued to deliver solutions remotely and with minimal

disruption. The Company's performance during the period was

underpinned by further strong organic growth and supplemented by

the contributions from The Edge and d-wise.

-- Revenue increased 41%

-- SaaS Revenue increased 29%

-- Adjusted EBITDA increased 39%

-- Net cash generated from operations of GBP4.1m

Growth in these financial metrics is stated after a GBP0.65m

fair value reduction to acquired deferred revenue associated with

the d-wise acquisition affecting revenue and profit reported in the

period by this same amount. This is discussed in further detail in

the Financial Review section below.

Looking Forwards

We expect that, like The Edge and d-wise, PDS will be earnings

enhancing with all three having brought strong management teams and

synergies to our existing business and client base. These additions

have extended the Company's reach from discovery to clinical trials

across the drug discovery and development lifecycle. The Company is

now even closer to becoming a one-stop shop for life sciences

companies looking for long term partnerships to assist them over

the drug discovery and development landscape.

In the short term, we will concentrate on the successful

integration of the recently acquired businesses to ensure that we

take best advantage of the opportunities that this platform will

create.

Then, building on this new platform, the Board believes there

are three distinct and deliverable opportunities to enable the

continued and further development of the business:

-- Organic revenue growth from additional market penetration,

cross-selling and the introduction of new products and

services;

-- Margin improvement through conversion to SaaS deployment and extensively leveraging global infrastructure; and

-- Accretive M&A and strategic partnerships in existing

markets, as well as entry into related adjacent areas.

I would like to thank and congratulate our staff for their

performance and contribution during this period and look forward to

updating the market with further developments in due course.

We expect the momentum achieved during H1 and post period-end to

be maintained throughout the remainder of the financial year and we

continue to be excited by the significant potential of the

business. As I said, we are focused on fully integrating the

acquisitions and benefiting from the scale and opportunity they

provide as we look to maximise the potential of the enlarged

Group.

David Gare

Non-Executive Chairman

27 September 2021

CHIEF EXECUTIVE'S REPORT

Strategic Developments

The Company grew strongly during the period, both organically

and acquisitively, supported by a buoyant life sciences R&D

market.

The shift to SaaS continued, with SaaS subscription revenues

growing significantly faster than annual support fees for perpetual

licenses, benefitting from both first time SaaS revenue from new

clients and established clients switching from on-premise to SaaS

deployments. An increasing proportion of SaaS revenues has

bolstered Instem's earnings visibility as well as its underlying

margin through operating leverage. Despite the focus on SaaS,

increased industry study volumes contributed to significant growth

in many contract research organizations ("CROs"), resulting in

increased perpetual licenses orders from long-standing clients. In

the near-term, this will increase future annual support fees and

ultimately SaaS subscriptions as these clients transition from

on-premise deployment.

Significantly improved profitability contributed to the

Company's cash balance of GBP17.9m at the period end, highlighting

strong operational cash generation. This figure is post payment of

the initial acquisition considerations for The Edge and d-wise

transactions and represents a c.GBP3.9m improvement on the GBP14.0m

balance disclosed subsequent to the two transactions.

The Company also benefited from the integration of The Edge,

d-wise and post period end PDS, expanding its reach and

significantly enhancing its scale and growth opportunities.

Once again revenue growth was particularly strong in North

America and China, where successful early-phase R&D is starting

to deliver a healthy pipeline of drug candidates requiring a

significant increase in non-clinical development capacity, where

Instem solutions are particularly strong. Instem remains a

substantial market leader in China.

Market Review

The market backdrop remained favourable for the Group, with

global population growth and life expectancy underpinning increased

demand for successful innovation in life sciences. Growing levels

of investment in the biotech industry - with the pharmaceuticals

sector spending heavily in drug development - including the

provision of therapies and vaccines to treat or prevent COVID-19,

meant that Instem had a strong and growing target market, which was

further enhanced by the acquisitions completed during the

period.

In the pharmaceutical industry, which represents the largest

proportion of Instem's revenue, we refer again to the Pharma

R&D Annual Review, the 2021 version of which was released by

Pharma Intelligence in March 2021. This report shows that the

industry grew strongly in 2020 with a 4.8% increase (2019: 9.6%) in

the total number of drugs in the regulatory stages of global

R&D pipeline, continuing a multi-year growth trend that shows

no sign of abating. The vast majority of the growth in the pipeline

was within the preclinical market - which accounts for the majority

of Instem's business, with the number of drugs at this stage of

development rising 6% to 10,223.

Importantly, the Company grew its reach into the clinical trial

analysis and submission market during the period via the

acquisition of d-wise, further enhancing its capabilities and

potential to deepen relationships with existing clients and attract

new customers.

The modest negative COVID-19 related impact on revenue from the

academic market in FY2020, which was closed or remote for much of

the year, has largely normalized during 2021. However, site-based

professional services delivery for all of our customers remains

restricted, creating a healthy and growing backlog of business to

work through as and when restrictions ease.

Business Performance

Study Management and Data Collection

Strong study demand from the non-clinical CROs has fuelled

growth in licensed users for Instem's Study Management and Data

Collection solutions and encouraged existing clients to take

modules from our portfolio that they had not yet licensed. Clients

have also been upgrading to later versions of our products to

further increase their productivity. We have continued to benefit

from the transition towards SaaS with steady progress again being

made towards our goal of moving all existing on-premise enterprise

software clients to SaaS deployment by the end of 2023 (or having

firm commitments from them to do so).

The majority of the revenue associated with orders in excess of

GBP2.7m, announced for one of our largest clients on 15 December

2020 and in our 14 January 2021 Trading Update, was recognized in

H1 2021 and we continue to collaborate extensively with this

customer as they look for competitive advantage through technology

investment. Most of this additional revenue is study management

related but also includes new S related capabilities, much of which

will benefit the wider S community.

In March 2021 the Company completed the GBP8.5m acquisition of

Discovery technology solutions provider The Edge - broadening I

nstem's reach into the Discovery Study Management market - and

helping it to meet growing interest for the wider sharing of data.

The acquisition also provides scope for increased cross-selling

opportunities as well as enhancing the Company's product range and

routes to market - particularly in the Drug Metabolism &

Pharmacokinetics (DMPK) field.

The Edge extends the Company's reach within existing and new

clients and enhances its technology offering. It is already the

go-to partner for many of Instem's clients looking to revolutionise

their R&D processes, and the combined operations will be able

to provide a simplified service structure.

In Silico Solutions

Our computational toxicology business once again performed ahead

of management expectations as clients sought to leverage predictive

models to complement, or replace, laboratory-based studies.

Collaborations with industry and regulatory authorities continue to

provide high profile Instem thought-leadership in this area,

helping to drive current product adoption and the expansion of the

solution portfolio to introduce new, or materially enhanced,

predictive models. Initial engagements have been successfully

completed using the Predict(TM) In Silico Tox service, launched in

December 2020, and we see further opportunity to expand our

services in this area, some in combination with our KnowledgeScan

based, Target Safety Assessment ("TSA") services.

Growth of TSA Services moderated in H2 2020 and H1 2021 as a

result of the pandemic, but demand has picked up again during the

initial months of H2 2021. This is an area where we have

historically generated significant market awareness and sales

pipeline at scientific conferences, as both Instem staff and

reference clients present a new, "disruptive" approach to the

established method of assessing the potential safety issues of

modulating a biological target thought to offer therapeutic

benefit. We are eagerly awaiting the post COVID-19 return to in

person conferences, which have been further delayed by the Delta

variant. Although we will actively participate in the programme for

the influential "American College of Toxicology" remote annual

meeting in November 2021, the largest event of this type is the

"Society of Toxicology" annual meeting, which is scheduled to be

held in person in San Diego in March 2022.

Regulatory Solutions

The Company's regulatory S solutions lead the FDA (Food and Drug

Administration) mandated market and our leadership position has

been further enhanced with the acquisition of PDS, ranked number

two in the market. As industry familiarity and expertise with S has

improved, CROs in particular are doing more of the S creation work

in-house, the overwhelming majority with Instem technology.

Although this has moderated the volume of S creation out-sourced

services for submission purposes, business is growing for

conversion work for non-submission legacy studies, as clients look

to leverage harmonised data for insight generation. This is also

leading to increased opportunity for our advanced S analytics and

warehousing software solutions.

S continues to expand and evolve, with Instem actively involved

in the standards consortium and taking a lead role during 2021 in

areas such as the "fit for use" pilot of the Developmental and

Reproductive Toxicology version of the standard. The FDA has

announced, after a long period tolerating variable S submission

quality (never a problem with Instem S conversions) while the

industry became more S-literate, that it will more strictly enforce

the S Technical Rejection Criteria, that commenced 15 September

2021. We expect that this can only enhance existing customer and

wider market demand for our industry-leading technology and

consulting services.

Clinical Trial Acceleration Solutions

In April 2021 the Company acquired d-wise for up to $31m and

established the Clinical Trial Acceleration Solutions division.

d-wise adds a market leading position to the Group in an attractive

adjacent area of clinical trial analysis and submission, with good

future visibility through recurring revenue streams and already

contracted, high value consultancy projects. The combined strength

of Instem and d-wise positions the enlarged Group as the foremost

authority and driving force in generating, analysing and leveraging

data from Discovery through late-stage Clinical Trials.

Initial integration of d-wise is largely complete, with a second

phase of integration scheduled for H1 2022 when the transaction

earn-out period has completed. In addition to the established

provision of productised statistical computing environments

("SCEs") for small-midsized pharma companies and CROs; and the

large, customised SCE solutions typically sought by the top 30-40

pharma and CROs, we have been advancing our next generation

solution Aspire(TM), which blends deployment of standardized, next

generation SCE components within custom configurations. We expect

this approach to accelerate the time to client deployment, reducing

client "cost of ownership", while increasing recurring revenue and

project profitability.

Strengthened Team

Carlos Frade recently joined Instem as VP of business

development. Carlos was formerly the VP of Non-clinical R&D at

Xybion and was one of the original architects of the competing

Pristima study management software solution. A highly respected

figure in the life sciences community, Carlos brings with him

decades of experience and success, working closely with customers

and regulators to help streamline their R&D processes.

Post-Period Acquisition

Earlier this month the Company completed the acquisition of life

sciences software company PDS for a total enterprise value of CHF

14.25m (c.GBP11.4m). PDS has been a direct competitor of Instem for

over 25 years, providing software for non-clinical study

management, and software and outsourced services for regulatory

submissions using S. The acquisition further extends Instem's Study

Management and S market share and deepens its relationships with

some of its largest clients with product rationalisation expected

to enhance clients' experience and increase operating margin.

Outlook

As a company, we are focussed on growing both organically and by

acquisition. We are delighted with the transactions completed

during and post the period end as well as the performance of our

existing operations. We have a scalable platform in place and a

highly leverageable business model underpinning a number of growth

opportunities in existing and adjacent markets.

We are delighted to have achieved strong organic growth, with

the additions of The Edge, d-wise and, most recently, PDS

underpinning a step change in the scale of the business. Market

conditions remain buoyant and we have a strong pipeline of

opportunities, with a significantly increased target market. The

improvement in our trading profitability in the first half has been

sustained post the period end and, as a result, we now expect

trading performance, excluding any negative impact of the fair

value adjustment to acquired deferred revenue, for the current

financial year to be slightly ahead of the Board's previous

expectations.

My thanks go to our enlarged global team of over 480 staff, who

have continued to perform exceptionally well whilst working

remotely. We expect that an indefinite blend of home and hybrid

working will provide permanent operational efficiencies while

enhancing staff work-life balance.

Phil Reason

Chief Executive Officer

27 September 2021

Financial Review

Key Performance Indicators (KPIs)

The directors review monthly revenue and operating costs to

ensure that sufficient cash resources are available for the working

capital requirements of the Group.

The primary KPIs at 30 June 2021 were:

6 months to 6 months to 12 months to % Change

30 June 2021 30 June 2020 31 Dec (H1 2020 to H1 2021)

GBP000 GBP000 2020

GBP000

Total revenue 19,826 14,047 28,217 41%

Recurring revenue 9,889 8,357 16,941 18%

Recurring revenue as a percentage of total

revenue 50% 59% 60% -900bps

Adjusted EBITDA 4,161 2,995 5,919 39%

Adjusted EBITDA margin % 21.0% 21.3% 21.0% -30bps

Cash and cash equivalents 17,850 9,132 26,724 95%

In addition, certain non-financial KPIs are periodically

reviewed and assessed, including customer and staff retention

rates.

Instem's revenue model consists of perpetual licence income with

annual support and maintenance contracts, professional fees,

technology enabled outsourced services fees, SaaS subscriptions and

consulting services fees.

There was fair value adjustment on the acquired deferred revenue

from d-wise of GBP0.65m (H1 2020: GBPnil). A provisional fair value

adjustment of GBP1.1m has been made to the opening balance for

d-wise acquired deferred revenue at the acquisition date, which is

being amortised on a straight-line basis during the remaining

period of the relevant customer contracts. The sum of GBP1.0m is

expected to be charged to the 2021 Income Statement, of which

GBP0.65m has been charged in H1. The calculation of the full year

adjustment is ongoing and will be completed during H2 2021. This is

a non-cash item and does not materially impact any period other

than 2021.

Total revenues in the period increased by 41% to GBP19.8m (H1

2020: GBP14.0m). Like-for-like revenues, excluding the impact of

The Edge and d-wise, which were acquired in March 2021 and April

2021 respectively, increased by 8%. Recurring revenue, derived from

support & maintenance contracts and SaaS subscriptions,

increased in the period by 18% to GBP9.9m (H1 2020: GBP8.4m).

Recurring revenue as a percentage of total revenue was 50% (H1

2020: 59%). In absolute terms, recurring revenue increased over the

prior year by GBP1.5m but its percentage of the total decreased due

primarily to the addition of d-wise consulting revenue, which is

shown as non-recurring.

Total operating expenses increased by 41% in the period

reflecting the ongoing investment in operational teams and the

inclusion of The Edge and d-wise costs. Like-for-like operating

costs increased by 3%.

Earnings before interest, tax, depreciation, amortisation,

impairment of goodwill and capitalised development and

non-recurring items (Adjusted EBITDA) increased by 39% to GBP4.2m

(H1 2020: GBP3.0m). For this measure of earnings, the margin as a

percentage of revenue decreased in the period to 21.0% from 21.3%

in H1 2020. Excluding The Edge and d-wise, like-for like Adjusted

EBITDA increased by 27.2% to GBP3.8m in the period.

Non-recurring costs in the period were GBP0.8m (H1 2020:

GBP0.05m), consisting of GBP0.06m for legal expenses associated

with historical contract disputes, GBP0.17m for share based

payments and GBP1.39m for acquisition costs, partially offset by

income of GBP0.8m ($1.1m) for US federal government COVID-19

support loans, which were forgiven during 2021.

The reported profit before tax for the period was GBP1.2m (H1

2020: GBP1.9m). Adjusted profit before tax (i.e. adjusting for the

effect of foreign currency exchange on the revaluation of

inter-company balances included in finance income/(costs),

non-recurring items, impairment of goodwill and capitalised

development plus amortisation of intangibles on acquisitions) was

GBP2.9m (H1 2020: GBP2.1m).

The Group continues to invest in its product portfolio.

Development costs incurred in the period were GBP2.3m (H1 2020:

GBP1.6m), of which GBP1.0m (H1 2020: GBP0.6m) was capitalised.

Basic and diluted earnings per share calculated on an adjusted

basis were 12.8p and 12.2p respectively (H1 2020: 10.7p basic and

10.2p diluted). The reported basic and diluted earnings per share

were 4.8p and 4.6p respectively (H1 2020: 9.5p basic and 9.0p

diluted).

On 1 March 2021, Instem announced the acquisition of The Edge, a

study management software provider based in the UK. The Edge is

focused on improving the efficiency of early-stage drug R&D,

improving productivity and ensuring high-quality data capture. The

consideration payable is up to GBP8.5m, payable as GBP6.0m

initially, satisfied by GBP4.0m in cash from existing reserves and

GBP2.0m via the issuance of 391,920 new ordinary shares in Instem

plc, GBP0.5m of deferred consideration and up to a further GBP2.0m

payable contingent on The Edge's future trading performance, both

amounts payable in cash. In addition, the amount of GBP1.5m was

paid as a net cash adjustment after deducting the estimated debt at

the point of the acquisition.

On 20 March 2021, Instem exchanged contracts to acquire US-based

clinical trial technology & consulting leader d-wise

Technologies, Inc. (d-wise). The acquisition was completed on 1

April 2021. d-wise adds a market leading position to the Group in

an attractive adjacent area of clinical trial analysis and

submission, with good future visibility through recurring revenue

streams and already contracted, high value consultancy projects.

The combined strength of Instem & d-wise positions the enlarged

Group as the foremost authority and driving force in generating,

analysing and leveraging data from Discovery through late-stage

Clinical Trials. The total consideration is up to $31m comprising

$20m on completion, $8m of deferred consideration and up to a

further $3m which is payable contingent upon the future financial

performance of d-wise. The initial consideration on completion was

satisfied by $13m in cash and $7m via the issuance of 868,203 new

ordinary shares of 10p each in Instem plc. The initial cash payment

was funded from the Group's existing financial resources.

The period saw again strong net cash generated from operations

of GBP4.1m (H1 2020: GBP3.0m), largely due to cash inflows from the

newly acquired businesses, key contracts, outsourced services and

effective working capital management. The Group's cash resources

were used to accelerate the Group's acquisition strategy with the

acquisition of the Edge and d-wise. The net cash used in investing

activities includes the net cash payment of GBP10.6m for purchasing

those subsidiaries (net of cash acquired). The proceeds of GBP0.8m

($1.1m) which were part of the US federal government support for

businesses during the COVID-19 pandemic have been fully forgiven

during 2021. As a result of the above and the positive organic cash

generation achieved in the period, the cash balance decreased from

GBP26.7m to GBP17.9m .

The deficit on the Group's legacy defined benefit pension scheme

was GBP2.7m at 30 June 2021 (H1 2020: GBP4.0m) having improved from

a deficit of GBP3.9m at 31 December 2020. Liabilities decreased

from GBP16.4m at 31 December 2020 to GBP15.9m at 30 June 2021 and

Plan Assets have increased from GBP12.5m at 31 December 2020 to

GBP13.2m at 30 June 2021. The liabilities have fallen in value due

to the rise in corporate bond yields over the period, albeit offset

to some extent by an increase in expected future price inflation

and a modest increase in assumed life expectancy. Positive asset

returns combined with the deficit contributions paid over the

period led to a rise in the value of the Scheme's assets. The

latest triennial actuarial valuation of the Group's defined benefit

pension arrangement as at 5 April 2020, was completed in July 2021,

with the results to be reflected in the Group's Annual Report and

Accounts for the year ending 31 December 2021

Movements in share capital, share premium, merger reserve and

share based payment reserve reflect the exercise of share options

during the period, the fair value of share options granted being

charged to the statement of comprehensive income and the issue of

shares connected to the acquisition of The Edge and d-wise.

In line with previous periods and given our policy of retaining

cash within the business to capitalise on available growth

opportunities, the Board has not recommended the payment of a

dividend.

Principal risks and uncertainties

The principal risks and uncertainties remain unchanged from

those described in our 2020 Annual Report.

Post balance sheet events

On 1 September 2021, Instem announced the acquisition of PDS

Pathology Data Systems Ltd ("PDS"), a life sciences software

company with headquarters in Switzerland and offices in the United

States and Japan. PDS provides software for non-clinical study

management and software and outsourced services for regulatory

submissions using S (the Standard for the Exchange of Non-clinical

Data). The acquisition will enable Instem to concentrate investment

on a single line of S and preclinical study management products,

removing unnecessary duplication in the market. The combination of

technologies and highly experienced teams will enable the Company

to enhance the development and delivery of existing and new

solutions that provide higher value to our clients. The

consideration comprises CHF 8.2m payable to the sellers of PDS on

completion of the acquisition (the "Initial Consideration"), CHF

3.0m of seller loan repayments, CHF 2.0m to satisfy other net PDS

liabilities and CHF 1.0m of deferred consideration (the "Deferred

Consideration"). The Initial Consideration was satisfied by CHF

4.7m in cash (c. GBP3.8m) and CHF 3.5m (c. GBP2.8m) in new ordinary

shares of 10 pence each in the Company (the "Consideration

Shares").

The enlarged share capital of Instem is now 22,189,856 ordinary

shares of 10p each.

Nigel Goldsmith

Chief Financial Officer

27 September 2021

Instem plc

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2021

Unaudited Unaudited Audited

Six months ended Six months ended Year

30 June 30 June ended 31 December 2020

2021 2020 GBP000

GBP000 GBP000

Note

REVENUE 3 19,826 14,047 28,217

Employee benefits expense (11,504) (8,009) (16,508)

Other expenses (4,161) (3,043) (5,790)

EARNINGS BEFORE INTEREST, TAXATION,

DEPRECIATION, AMORTISATION AND

NON-RECURRING COSTS (ADJUSTED

EBITDA) 4,161 2,995 5,919

Depreciation (123) (76) (138)

Amortisation of intangibles arising on

acquisition (599) (332) (664)

Amortisation of internally generated

intangibles (397) (310) (736)

Amortisation of right of use assets (304) (272) (572)

OPERATING PROFIT BEFORE NON-RECURRING COSTS 2,738 2,005 3,809

Non-recurring costs 6 (817) (49) (606)

----------------- ------------------ ------------------------

OPERATING PROFIT AFTER NON-RECURRING COSTS 1,921 1,956 3,203

Finance income 7 22 67 38

Finance costs 8 (766) (124) (692)

----------------- ------------------ ------------------------

PROFIT BEFORE TAXATION 1,177 1,899 2,549

Taxation (154) (308) (275)

----------------- ------------------ ------------------------

PROFIT FOR THE PERIOD -1,023 1,591 2,274

================= ================== ========================

OTHER COMPREHENSIVE (EXPENSE)/INCOME

Items that will not be reclassified to

profit and loss account

Actuarial (loss)/gain on retirement benefit

obligations 785 (2,525) (2,537)

Deferred tax on actuarial gain & loss (149) 480 518

Deferred tax on share options - - 322

----------------- ------------------ ------------------------

636 (2,045) (1,697)

Items that may be reclassified to profit

and loss account:

Exchange differences on translating foreign

operations 24 77 10

----------------- ------------------ ------------------------

OTHER COMPREHENSIVE INCOME/(EXPENSE) FOR

THE PERIOD 660 (1,968) (1,687)

TOTAL COMPREHENSIVE INCOME/(EXPENSE) FOR

THE PERIOD 1,683 (377) 587

================= ================== ========================

PROFIT ATTRIBUTABLE TO OWNERS OF THE PARENT

COMPANY 1,023 1,591 2,274

================= ================== ========================

TOTAL COMPREHENSIVE INCOME/(EXPENSE)

ATTRIBUTABLE TO OWNERS OF THE PARENT

COMPANY 1,683 (377) 587

================= ================== ========================

Earnings per share from continuing

operations

- Basic 5 4.8p 9.5p 12.3

- Diluted 5 4.6p 9.0p 11.6

Instem plc

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2021

Unaudited Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

Note GBP000 GBP000 GBP000

ASSETS

NON-CURRENT ASSETS

Intangible assets 43,098 18,122 18,023

Property, plant and equipment 637 252 238

Right of use assets 2,110 1,982 1,742

Finance lease receivables 105 165 128

TOTAL NON-CURRENT ASSETS 45,950 20,521 20,131

---------- ---------- ------------

CURRENT ASSETS

Inventories 54 39 50

Trade and other receivables 12,250 8,621 6,093

Finance lease receivables 42 19 41

Tax receivable 648 579 724

Cash and cash equivalents 9 17,850 9,132 26,724

---------- ---------- ------------

TOTAL CURRENT ASSETS 30,844 18,390 33,632

---------- ---------- ------------

TOTAL ASSETS 76,794 38,911 53,763

========== ========== ============

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 4,055 2,315 2,958

Deferred income 14,243 11,048 9,878

Tax payable - 425 -

Financial liabilities 4,515 749 268

Lease liabilities 1,079 461 608

Deferred tax liabilities 2,855 31 90

---------- ---------- ------------

TOTAL CURRENT LIABILITIES 26,747 15,029 13,802

---------- ---------- ------------

NON-CURRENT LIABILITIES

Financial liabilities 3,244 1,079 1,131

Retirement benefit obligations 2,729 3,985 3,868

Provision for liabilities and

charges 10 250 250 250

Lease liabilities 1,312 1,927 1,476

---------- ---------- ------------

TOTAL NON-CURRENT LIABILITIES 7,535 7,241 6,725

---------- ---------- ------------

TOTAL LIABILITIES 34,282 22,270 20,527

========== ========== ============

EQUITY

Share capital 2,178 1,667 2,048

Share premium 28,191 13,219 28,172

Merger reserve 9,359 2,432 2,432

Share based payment reserve 1,447 784 930

Translation reserve 116 159 92

Retained earnings 1,221 (1,620) (438)

---------- ---------- ------------

TOTAL EQUITY ATTRIBUTABLE TO OWNERS

OF THE PARENT 42,512 16,641 33,326

---------- ---------- ------------

TOTAL EQUITY AND LIABILITIES 76,794 38,911 53,763

========== ========== ============

Instem plc

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30

June 2021 Unaudited Unaudited Audited

Six months ended 30 June Six months ended 30 June Year ended 31 December

Note 2021 2020 2020

GBP000 GBP000 GBP000

CASH FLOWS FROM OPERATING

ACTIVITIES

Profit before taxation 1,177 1,899 2,549

Adjustments for:

Depreciation 123 76 138

Amortisation of intangibles 996 642 1,400

Amortisation of right of use

assets 304 272 572

Share based payment charge 517 130 427

Retirement benefit

obligations (380) (362) (512)

Finance income 7 (22) (67) (38)

US government loans forgiven 6 (805) - -

Finance costs 8 766 124 692

d-wise acquisition cost 12 809 - -

Loss on disposal of fixed

assets 6 - 2

------------------------- ------------------------- -----------------------

CASH FLOWS FROM OPERATIONS

BEFORE MOVEMENTS IN WORKING

CAPITAL 3,491 2,714 5,230

Movements in working capital:

(Increase) in inventories (4) (3) (14)

(Increase)/decrease in trade

and other receivables (151) (1,705) 742

Increase in trade, other

payables and deferred income 746 1,759 1,410

------------------------- ------------------------- -----------------------

NET CASH GENERATED FROM

OPERATIONS 4,082 2,765 7,368

Finance income 3 67 38

Finance costs (482) (124) (648)

Income taxes (485) 315 183

------------------------- ------------------------- -----------------------

NET CASH GENERATED FROM

OPERATING ACTIVITIES 3,118 3,023 6,941

CASH FLOWS FROM INVESTING

ACTIVITIES

Capitalisation of development

costs (922) (600) (1,272)

Purchase of property, plant

and equipment (37) (85) (141)

Payment of deferred

consideration - - (277)

Purchase of subsidiary

undertaking (net of cash

acquired) 11, 12 (10,567) (73) -

------------------------- ------------------------- -----------------------

NET CASH USED IN INVESTING

ACTIVITIES (11,526) (758) (1,690)

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from issue of share

capital 22 89 15,423

Proceeds from US government

loan - 901 810

Repayment of lease

liabilities (367) (327) (621)

Receipts from sublease of

asset 22 25 40

Repayment of lease capital - (15) (15)

------------------------- ------------------------- -----------------------

NET CASH (USED)/GENERATED

FROM FINANCING ACTIVITIES (323) 673 15,637

NET (DECREASE) /INCREASE IN

CASH AND CASH EQUIVALENTS (8,731) 2,938 20,888

Cash and cash equivalents at

start of period 26,724 5,957 5,957

Effect of exchange rate

changes on the balance of

cash held in foreign

currencies (143) 237 (121)

------------------------- ------------------------- -----------------------

CASH AND CASH EQUIVALENTS AT OF PERIOD 17,850 9,132 26,724

========================= ========================= =======================

Instem plc

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2021

Share based

payment

Share Share Merger reserve Translation Retained Total

capital premium reserve reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance as at 1

January 2020 -

(Audited) 1,662 13,135 2,432 654 82 (1,166) 16,799

Profit for the

period - - - - - 1,591 1,591

Other

comprehensive

income/(expense) - - - - 77 (2,045) (1,968)

---------- ---------- ---------- -------------- ------------- ---------- ----------

Total

comprehensive

income - - - - 77 (454) (377)

Shares issued 5 84 - - - - 89

Share based

payment - - - 130 - - 130

---------- ---------- ---------- -------------- ------------- ---------- ----------

Balance as at 30

June 2020

(Unaudited) 1,667 13,219 2,432 784 159 (1,620) 16,641

Profit for the

period - - - - - 683 683

Other

comprehensive

(expense)/income - - - - (67) 348 281

---------- ---------- ---------- -------------- ------------- ---------- ----------

Total

comprehensive

expense - - - - (67) 1,031 964

Shares issued 381 14,953 - - - - 15,334

Share based

payment - - - 297 - - 297

Reserve transfer

on lapse of

share options - - - (65) - 65 -

Reserve transfer

on exercise of

share options - - - (86) - 86 -

---------- ---------- ---------- -------------- ------------- ---------- ----------

Balance as at 31

December 2020

(Audited) 2,048 28,172 2,432 930 92 (438) 33,236

Profit for the

period 1,023 1,023

Other

comprehensive

income 24 636 660

---------- ---------- ---------- -------------- ------------- ---------- ----------

Total

comprehensive

income - - - - 24 1,659 1,683

Shares issued 130 19 6,927 - - - 7,076

Share based

payment - - - 517 - - 517

---------- ---------- ---------- -------------- ------------- ---------- ----------

Balance as at 30

June 2021

(Unaudited) 2,178 28,191 9,359 1,447 116 1,221 42,512

========== ========== ========== ============== ============= ========== ==========

NOTES TO THE FINANCIAL INFORMATION

For the six months ended 30 June 2021

1. General information

The principal activity and nature of operations of the Group is

the provision of world class IT solutions and services to the life

sciences research and development market. Instem's solutions for

data collection, management and analysis are used by customers

worldwide to meet the needs of life science organisations for

data-driven decision making leading to safer, more effective

products. Instem plc is a public limited company, listed on AIM,

incorporated in England and Wales under the Companies Act 2006 and

domiciled in England. The registered office is Diamond Way, Stone

Business Park, Stone, Staffordshire ST15 0SD, UK.

2. Basis of preparation and accounting policies

Basis of preparation

The Group's half-yearly financial information, which is

unaudited, consolidates the results of Instem plc and its

subsidiary undertakings made up to 30 June 2021. The Group's

accounting reference date is 31 December.

The consolidated financial information is presented in Pounds

Sterling (GBP) which is also the functional currency of the

parent.

The financial information contained in this half year financial

report does not constitute statutory accounts as defined in section

434 of the Companies Act 2006. It does not therefore include all of

the information and disclosures required in the annual financial

statements.

The financial information for the six months ended 30 June 2021

and 30 June 2020 is unaudited.

Instem plc's consolidated statutory accounts for the year ended

31 December 2020, prepared under IFRS, have been delivered to the

Registrar of Companies. The report of the auditors on these

accounts was unqualified and did not contain a statement under

Section 498 (2) or (3) of the Companies Act 2006.

Significant accounting policies

The accounting policies used in the preparation of the financial

information for the six months ended 30 June 2021 are in accordance

with the recognition and measurement criteria of international

accounting standards and are consistent with those which will be

adopted in the annual statutory financial statements for the year

ending 31 December 2021.

While the financial information included has been prepared in

accordance with the recognition and measurement criteria of

International Financial Reporting Standards (IFRS), these financial

statements do not contain sufficient information to comply with

IFRS's.

Instem plc and its subsidiaries have not applied IAS 34, Interim

Financial Reporting, which is not mandatory for UK AIM listed

groups, in the preparation of this half-yearly financial

report.

Significant judgement and estimates

The judgements and estimations that management have made for the

six months ended 30 June 2021 are consistent with those reported in

the annual statutory financial statements for the year ended 31

December 2020.

2. Basis of preparation and accounting policies (continued)

Going concern

The Directors continue to adopt the going concern basis of

accounting in preparing these financial statements, which the

Directors believe is appropriate given the Group's trading

performance and financial liquidity. At 30 June 2021, the Group had

cash balances of GBP17.9m together with GBP0.5m of unused banking

facilities.

The uncertainty regarding the impact on the Group of COVID-19

has been considered as part of the Group's adoption of the going

concern basis. In the period to 30 June 2021, we have not observed

any material detriment to our overall existing business or in the

level of new business opportunities that are being presented to us

in the markets in which we operate and we do not anticipate any

during the next 12 months.

Cash and cash equivalents

Cash and cash equivalents for the purposes of the Statement of

Cash Flows comprise the net of cash and overdraft balances that are

shown in the Statement of Financial Position in Cash and Cash

Equivalents.

3. Segmental Reporting

The business is organised into four operating segments to better

manage and report revenues; Study Management, Regulatory Solutions,

In Silico Solutions and Clinical Trials Acceleration. The fourth

segment was established after the d-wise acquisition on 01 April

2021.

Certain direct costs are allocated to the revenue streams whilst

the majority of costs are recorded and reported centrally,

primarily supporting Study Management and Regulatory Solutions.

Whilst the expectation in future years is to allocate more

centrally held operational costs to the individual segments, it

will take time for the allocations to be sufficiently accurate for

the Board to use segmental cost information for meaningful decision

making. A higher proportion of central costs were allocated to the

operating segments during H1 2021 compared with 2020.

The operations of the Group are managed centrally with

group-wide functions including sales, marketing, software

development, customer support, IT, human resources and finance

& administration .

Unaudited six months Study Management Regulatory In Silico Clinical

ended Solutions Solutions Trials Total

30 June 2021 Acceleration

GBP000 GBP000 GBP000 GBP000 GBP000

Total revenue 9,798 4,686 1,487 3,855 19,826

Direct attributable

costs (2,024) (1,113) (771) (2,477) (6,385)

----------------- ----------- --------------- -------------- --------

Contribution to indirect

overheads 7,774 3,573 716 1,378 13,441

Contribution to indirect

overheads % 79.3% 76.2% 48.2% 35.7% 67.7%

Central unallocated

indirect costs (9,280)

______

Adjusted EBITDA 4,161

Unaudited six months Study Management Regulatory In Silico Clinical

ended Solutions Solutions Trials Total

30 June 2020 Acceleration

GBP000 GBP000 GBP000 GBP000 GBP000

Total revenue 7,057 5,278 1,712 - 14,047

Direct attributable

costs (1,765) (980) (788) - (3,533)

----------------- ----------- ----------- -------------- --------

Contribution to indirect

overheads 5,292 4,298 924 - 10,514

Contribution to indirect

overheads % 75.0% 81.4% 54.0% - 74.9%

Central unallocated

indirect costs (7,519)

______

Adjusted EBITDA 2,995

Audited year ended Study Management Regulatory In Silico Clinical

31 December 2020 Solutions Solutions Trials Total

Acceleration

GBP000 GBP000 GBP000 GBP000 GBP000

Total revenue 15,054 9,839 3,324 - 28,217

Direct attributable

costs (3,516) (2,046) (1,630) - (7,192)

----------------- ----------- ----------- -------------- ---------

Contribution to indirect

overheads 11,538 7,793 1,694 - 21,025

Contribution to indirect

overheads % 76.6% 79.2% 51.0% - 74.5%

Central unallocated

indirect costs (15,106)

______

Adjusted EBITDA 5,919

4. Key performance measures

Unaudited Unaudited Audited

Six months ended Six months ended Year ended

30 June 2021 30 June 2020 31 December 2020

GBP000 GBP000 GBP000

a) Recurring revenue

Support fees 4,988 4,588 8,917

SaaS subscriptions 4,901 3,769 8,024

------------------- ------------------- -------------------

Recurring revenue 9,889 8,357 16,941

Licence fees 3,086 1,510 3,477

Product services 1,509 739 1,603

Outsourced services 2,594 3,441 6,196

Consulting 2,748 - -

------------------- ------------------- -------------------

Total revenue 19,826 14,047 28,217

b) Adjusted EBITDA

EBITDA 3,344 2,946 5,313

Non-recurring costs (see note 6) 817 49 606

------------------- ------------------- -------------------

Adjusted EBITDA 4,161 2,995 5,919

Adjusted profit after tax and bank balance performance measures

are detailed in notes 5 and 9.

5. Earnings per share

Basic earnings per share are calculated by dividing the profit

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the period. Diluted

earnings per share is calculated by adjusting the weighted number

of ordinary shares outstanding to assume conversion of all dilutive

potential shares arising from the share option scheme. The dilutive

impact of the share options is calculated by determining the number

of shares that could have been acquired at fair value (determined

as the average market share price of the Company's shares) based on

the monetary value of the subscription rights attached to the

outstanding share options.

a) Basic earnings per share

Unaudited Unaudited Audited

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2020

2021 2020

Profit after tax (GBP000) 1,023 1,591 2,274

------------ ------------ -------------

Weighted average number of

shares (000's) 21,145 16,662 18,421

------------ ------------ -------------

Basic earnings per share 4.8p 9.5p 12.3

============ ============ =============

b) Diluted earnings per share

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

Profit after tax (GBP000) 1,023 1,591 2,274

------------ ------------ -------------

Weighted average number of

shares (000's) 21,145 16,662 18,421

Potentially dilutive shares

(000's) 1,023 948 1,231

Adjusted weighted average number

of shares (000's) 22,168 17,610 19,652

------------ ------------ -------------

Diluted earnings per share 4.6p 9.0p 11.6

============ ============ =============

c) Adjusted earnings per share

Adjusted earnings per share is calculated after adjusting for

the effect of foreign currency exchange on the revaluation of

inter-company balances included in finance income/(costs),

non-recurring items and amortisation of intangibles on

acquisitions. Diluted adjusted earnings per share is calculated by

adjusting the weighted number of ordinary shares outstanding to

assume conversion of all dilutive potential shares arising from the

share option scheme. The dilutive impact of the share options is

calculated by determining the number of shares that could have been

acquired at fair value (determined as the average market share

price of the Company's shares) based on the monetary value of the

subscription rights attached to the outstanding share options.

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

Profit after tax (GBP000) 1,023 1,591 2,274

Non-recurring costs 817 49 606

Amortisation of acquired intangibles

(GBP000) 599 332 664

Foreign exchange loss/(gain)

on revaluation of intergroup

balances (GBP000) 268 (181) 208

Adjusted profit after tax (GBP000) 2,707 1,791 3,752

------- ------- -------

Weighted average number of

shares (000's) 21,145 16,662 18,421

Potentially dilutive shares

(000's) 1,023 948 1,231

------- ------- -------

Adjusted weighted average number

of shares (000's) 22,168 17,610 19,652

------- ------- -------

Adjusted basic earnings per

share 12.8p 10.7p 20.4p

======= ======= =======

Adjusted diluted earnings per

share 12.2p 10.2p 19.1p

======= ======= =======

6. Non-recurring costs

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

Guaranteed Minimum Pension

(GMP) equalisation provision - - 5

Legal cost relating to historical

contract disputes 62 49 149

Share based payment 170 - -

US government loans forgiven (805) - -

Acquisition costs 1,390 - 452

817 49 606

------------ ------------ -------------

7. Finance income

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

Foreign exchange gains - 62 -

Right of use interest income 3 - 7

Other interest 19 5 31

------------ ------------ -------------

22 67 38

============ ============ =============

8. Finance costs

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

Bank loans and overdrafts 43 19 38

Unwinding discount on deferred

consideration 318 40 70

Net interest charge on pension

scheme 26 18 34

Right of use asset interest

cost 121 47 96

Foreign exchange losses 258 - 454

------------ ------------ -------------

766 124 692

============ ============ =============

9. Cash and cash equivalents

Unaudited Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

Cash at bank 26,848 18,130 35,722

Bank overdraft (8,998) (8,998) (8,998)

Bank balance 17,850 9,132 26,724

============ ============ =============

10. Provision for liabilities and charges

Unaudited Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

At beginning of the period 250 250 250

Movement in provision - - -

At end of period 250 250 250

============ ========== =============

The provision relates to potential costs arising from historical

contract disputes (see note 6 for associated legal fees).

11. Acquisition of The Edge Software Consultancy Ltd ('The Edge')

On 1 March 2021, Instem acquired 100% of the issued share

capital of The Edge. The acquisition has increased the group's

market share in the global Life Science Sector and complements the

group in continuing its expansion and development in this

industry.

Proportion

of voting

equity

interests

Date of acquired Consideration

Company Principal activity acquisition % GBP000

Provider of Discovery

Technology Solutions

software and services

to Life Science 1 March

The Edge sector 2021 100 9,230

Details of the purchase consideration, the net assets acquired

and goodwill are as follows:

Consideration

GBP000

Initial cash consideration 4,000

Initial share consideration 2,009

Deferred consideration - cash payable March

2022 500

Contingent consideration - cash payable by

June 2022 1,000

Contingent consideration - cash payable March

2023 1,000

Net cash adjustment (after deduction of estimated

debt) 1,500

Working capital and cash adjustment - cash

receivable March 2022 (67)

Total consideration 9,942

Discounting of estimated future cashflows (712)

Present value of consideration 9,230

The initial share consideration was satisfied by the issue of

391,920 new Instem plc ordinary shares at a value of GBP2.0m which

was based on the published share price. The premium arising on the

share issue of GBP2.0m has been credited to the merger relief

reserve.

The deferred consideration is not based on any performance

related conditions and is payable in March 2022. The contingent

consideration is based on certain performance related conditions in

the twelve- month period post-completion. The contingent

consideration in the table above is based on the forecast estimate

that the performance related conditions will be fully met and the

full consideration will be payable. The contingent consideration

was re-measured at the reporting date. The deferred consideration

had been discounted using Instem's estimated cost of borrowing and

the contingent consideration has been discounted using the Internal

Rate of Return ('IRR').

Acquisition related costs amounting to GBP0.2m have been

recognised as an expense within non-recurring items in the

Consolidated Statement of Comprehensive Income.

Fair value of assets acquired and liabilities recognised at the

date of acquisition

Fair Value

GBP000

Non-Current Assets

Customer relationships 2,550

Intellectual property 1,342

Brand 105

Right of use assets 37

Current Assets

Cash and cash equivalents 2,570

Trade and other receivables 407

Deferred tax asset 64

Current Liabilities

Trade and other payables (430)

Deferred income (555)

Lease liabilities (36)

Non-Current Liabilities

Deferred tax on acquisition (759)

Fair value of identifiable net assets

acquired 5,295

Goodwill arising on acquisition

GBP000

Consideration transferred 9,230

Less: fair value of identifiable

net assets (5,295)

Goodwill arising on acquisition 3,935

Goodwill

Goodwill of GBP3.9m primarily relates to the ability to generate

growth from new customers, synergies provided by the Group and the

skill and expertise of The Edge's staff.

Identifiable net assets

A provisional fair value exercise to determine the fair value of

assets and liabilities acquired has been carried out. Fair values

are provisional as they are within the twelve month hindsight

period to adjust fair values. No fair value adjustments have been

made to the assets and labilities acquired.

The fair value of intangible assets are:

-- Customer relationships of GBP2.6m calculated using the income

approach - excess earnings. Acquired customer relationships

consisting of ongoing relationships with companies to which The

Edge provides annual licenses, maintenance assistance and bespoke

services.

-- Intellectual property of GBP1.3m calculated using the income

approach - relief from royalty. Two proprietary software packages

were acquired, namely BioRails and Morphit.

-- Brands of GBP0.1m calculated using the income approach -

relief from royalty. 'The Edge' brand and sub-brands (principally

BioRails and Morphit) are considered in aggregate a separable

intangible asset and a driver of the overall business model.

Acquired receivables

The fair value of acquired trade receivables is GBP0.079m as no

loss allowance was required to be recognised on acquisition.

Impact of acquisition on the results of the Group

Profit for the half year includes a profit of GBP0.5m

attributable to the additional business generated by The Edge from

the date of acquisition. Revenue for the half year includes GBP0.8m

in respect of The Edge.

If this business combination had been effected at 1 January

2021, the revenue of The Edge would have been GBP1.0m and the

profit for the half year would have been GBP0.5m. These values do

not represent a measure of the performance of The Edge as the

company's accounting policy have been changed at the acquisition

date to comply with the policies of the Group.

Purchase consideration - cash outflow

GBP000

Outflow of cash to acquire subsidiary,

net of cash acquired

Initial cash consideration 4,000

Net cash adjustment (after deduction

of estimated debt) 1,500

Less: Balance acquired

Cash (2,570)

Net outflow of cash - investing

activities 2,930

12. Acquisition of d-wiseTechnologies, Inc

On 20 March 2021, Instem exchanged contracts to acquire the 100%

of the issued share capital of US-based clinical trial technology

& consulting leader d-wise Technologies, Inc ("d-wise"). The

acquisition was completed on 1 April 2021. The acquisition has

increased the group's market share in the global Life Science

Sector and complements the group by entering an attractive adjacent

area of clinical trial analysis and submission.

Proportion

of voting

equity

interests

Date of acquired Consideration

Company Principal activity acquisition % GBP000

Provider of clinical

trial acceleration

solutions to Life 1 April

d-wise Inc Science sector 2021 100 18,904

Details of the purchase consideration, the net assets acquired

and goodwill are as follows:

Consideration

$000 GBP000

Initial cash consideration 13,000 9,437

Initial share consideration 7,000 5,044

Deferred consideration (1 April 2022) - To

be settled in cash 1,480 1,074

Deferred consideration (1 April 2022) - To

be settled in shares 408 296

Deferred consideration (1 April 20233) - To

be settled in cash 2,058 1,494

Contingent consideration (1 March 2022) -

To be settled in cash or shares 1,500 1,089

Contingent consideration (1 March 2023) -

To be settled in cash 1,500 1,089

Working capital adjustment - (Q3 2021) - To

be settled in cash 5 4

Total consideration 26,951 19,527

Discounting of estimated future cashflows (623)

Present value of consideration 18,904

The initial share consideration was satisfied by the issue of

868,203 new Instem plc ordinary shares at a value of $7.0m

(GBP5.0m) which was based on the published share price. The premium

arising on the share issue of GBP5.0m has been credited to the

merger relief reserve.

The deferred consideration is not based on any performance

related conditions and is payable in two instalments in April 2022

and 2023. The contingent consideration is based on certain

performance related conditions in the twelve-month period

post-completion. The deferred consideration has been discounted

using the interest rate as defined in the share purchase agreement

and the contingent consideration has been discounted using the

IRR.

The contingent consideration in the table above is based on the

forecast estimate that the performance related conditions will be

fully met and the full consideration will be payable. The

contingent consideration was re-measured at the reporting date.

An amount of $4.3m (GBP3.1m) which is contingent on the

continued employment of certain of the former d-wise management has

been excluded from the total purchase consideration and is instead

treated as an expense in non-recurring costs as it incurred. The

above treatment will not affect the Group's cash position as the

total consideration payable remains at $31m.

Acquisition related costs amounting to GBP1.2m have been

recognised as an expense within non-recurring items in the

Consolidated Statement of Comprehensive Income.

Fair value of assets acquired and liabilities recognised at the

date of acquisition

Fair Value

GBP000

3 Non-Current Assets

Customer relationships 5,770

Intellectual property 1,061

Brand names 1,134

Property, plant and equipment 491

Right of use assets 662

Current Assets

Trade and other receivables 5,766

Cash and cash equivalents 1,800

Current Liabilities

Trade and other payables (1,633)

Deferred income (2,693)

Financial Liabilities (48)

Lease liability (662)

Non-Current Liabilities

Deferred tax on acquisition (1,991)

Fair value of identifiable net liabilities

acquired 9,655

Goodwill arising on acquisition

GBP000

Consideration transferred 18,904

Less: fair value of identifiable

net assets (9,655)

Goodwill arising on acquisition 9,249

Goodwill

Goodwill of GBP9.2m primarily relates to the ability to enter an

attractive adjacent area of clinical trial analysis and submission,

generating growth from new customers, synergies provided by the

Group and the skill and expertise of the d-wise staff.

Identifiable net assets

A provisional fair value exercise to determine the fair value of

assets and liabilities acquired has been carried out. Fair values

are provisional as they are within the twelve month hindsight

period to adjust fair values. Except for the Deferred revenue no

other fair value adjustments have been made to the assets and

liabilities acquired.

The fair value of intangible assets are:

-- Customer relationships of GBP5.8m calculated using the income

approach - excess earnings. Acquired customer relationships

consisting of ongoing relationships with companies to which d-wise

provides hosting and consultancy services, support and maintenance

and product licences.

-- Intellectual property of GBP1.1m calculated using the income

approach - relief from royalty. Two proprietary software products

were acquired, namely Blur and Reveal.

-- Brands of GBP1.1m calculated using the income approach -

relief from royalty. The 'd-wise' brand is a separable intangible

asset and a driver of the overall business model in the fair value

measurement and the proportion of overall enterprise value

attributed to the brand. The brand has been trading since 2003 and

is well established within the pharmaceutical industry.

Acquired receivables

The fair value of acquired trade receivables is GBP5.1m as no

loss allowance was required to be recognised on acquisition.

Impact of acquisition on the results of the Group

Profit for the half year includes a loss of GBP0.3m attributable

to the additional business generated by d-wise from the date of

acquisition. The loss was incurred due to the fair value adjustment

on the acquired deferred revenue of GBP0.6m. Revenue for the half

year includes GBP3.9m in respect of d-wise.

If this business combination had been effected at 1 January

2021, the revenue of d-wise would have been GBP9.2m and the profit

for the half year would have been GBP0.4m. The directors consider

these values represent an approximate measure of the performance of

d-wise on a half year basis as the fair value adjustment on the

acquired deferred revenue was not determined to provide a reference

point for comparison in future years.

Purchase consideration - cash outflow

GBP000

Outflow of cash to acquire subsidiary,

net of cash acquired

Initial cash consideration 9,437

Less: Balance acquired

Cash (1,800)

Net outflow of cash - investing

activities 7,637

13. Subsequent Events

No adjusting events have occurred between the 30 June 2021

reporting date and the date of approval of this Interim Report.

The latest triennial actuarial valuation of the Group's defined

benefit pension arrangement as at 5 April 2020 was completed in

July 2021. The outcome of the valuation will be disclosed in the

Group's full year results for 2021. The next valuation of the

Scheme is due as at 5 April 2023.

On 1 September 2021, Instem announced the acquisition of PDS

Pathology Data Systems Ltd ("PDS"), a life sciences software

company with headquarters in Switzerland and offices in the United

States and Japan. PDS has been a direct competitor of Instem for

over 25 years. PDS provides software for non-clinical study

management and software and outsourced services for regulatory

submissions using SEND (the Standard for the Exchange of

Non-clinical Data). In the year ended December 2020, PDS had

unaudited, normalised profits before tax of CHF 0.75m (c. GBP0.6m)

on sales of CHF 6.5m (c. GBP5.1m), of which CHF 2.3m (c. GBP1.8m)

was recurring SaaS and software maintenance revenue. As at 31

December 2020, PDS had net liabilities of CHF 1.5m (c. GBP1.2m),

including loans from its shareholders of approximately CHF 3.0m (c.

GBP2.4m). These loans were settled in full out of the proceeds

received by PDS shareholders. The Acquisition will enable Instem to

concentrate investment on a single line of SEND and preclinical

study management products, removing unnecessary duplication in the

market. The combination of technologies and highly experienced

teams will enable the Company to enhance the development and

delivery of existing and new solutions that provide higher value to

its clients. The consideration comprises CHF 8.2m paid to the

sellers of PDS on completion of the Acquisition (the "Initial

Consideration"), CHF 3.0m of seller loan repayments, CHF 2.0m to

satisfy other net PDS liabilities and CHF 1.0m of deferred

consideration (the "Deferred Consideration"). The Initial

Consideration was satisfied by CHF 4.7m in cash (c. GBP3.8m) and

CHF 3.5m (c. GBP2.8m) in new ordinary shares of 10 pence each in

the Company (the "Consideration Shares"), equating to the issue of

359,157 shares at a deemed price of a 777 pence per share. The cash

payment, loan repayments and other net liabilities payments are

being funded from the Group's existing financial resources.

14. Availability of this Interim Announcement

Copies of the 2021 Interim Report for Instem plc will be

available from the Group's website at www.instem.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GGGDCRBDDGBR

(END) Dow Jones Newswires

September 27, 2021 02:00 ET (06:00 GMT)

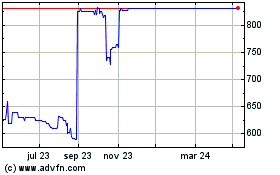

Instem (LSE:INS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Instem (LSE:INS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024