TIDMIDHC

RNS Number : 4544K

Integrated Diagnostics Holdings PLC

02 September 2021

-Integrated Diagnostics Holdings Plc

1H 2021 Results

Thursday, 2 September 2021

Integrated Diagnostics Holdings Plc delivers exceptional growth

on the back of strong demand across its entire service

portfolio

(London) Integrated Diagnostics Holdings ("IDH," "the Group," or

"the Company"), a leading consumer healthcare company with

operations in Egypt, Jordan, Sudan and Nigeria, released today its

reviewed financial statements and operational performance for the

first half of 2021, recording revenue of EGP 2,293 million, up 141%

versus the comparable period of last year. Normalised EBITDA(1)

recorded EGP 1,203 million in 1H 2021, representing a 227%

year-on-year increase, while net profit expanded 283% year-on-year

to reach EGP 668 million for the period. In the second quarter of

2021, revenues reached a new record-high of EGP 1,164 million, up

3% from an already impressive first quarter of the year, with net

profit recording EGP 327 million and an associated margin of

28%.

Financial Results

EGP mn 1H 2020 1H 2021 Change

====================== ============== ================ =========

Revenues 950 2,293 141%

---------------------- -------------- ---------------- ---------

Cost of Sales (503) (988) 96%

---------------------- -------------- ---------------- ---------

Gross Profit 446 1,305 193%

---------------------- -------------- ---------------- ---------

Gross Profit Margin 47% 57% 9.9 pts

---------------------- -------------- ---------------- ---------

Operating Profit(2) 277 1,094 291%

---------------------- -------------- ---------------- ---------

Normalised EBITDA(1) 367 1,203 227%

---------------------- -------------- ---------------- ---------

EBITDA Margin 39% 52% 13.8 pts

---------------------- -------------- ---------------- ---------

Net Profit 175 668 283%

---------------------- -------------- ---------------- ---------

Net Profit Margin 18% 29% 10.8 pts

---------------------- -------------- ---------------- ---------

Cash Balance 719 1,587* 121%

---------------------- -------------- ---------------- ---------

*Cash balance prior to payment of US$ 29.1 million dividend for

year ended 31 December 2020, distributed on 29 July 2021.

Key Operational Indicators

1H 2020 1H 2021 change

=========================== ======== ======== =======

Branches 462 495 33

--------------------------- -------- -------- -------

Patients ('000) 2,890 4,673 62%

--------------------------- -------- -------- -------

Revenue per Patient (EGP) 329 491 49%

--------------------------- -------- -------- -------

Tests ('000) 11,234 16,318 45%

--------------------------- -------- -------- -------

Revenue per Test (EGP) 85 141 66%

--------------------------- -------- -------- -------

Test per Patient 3.9 3.5 -10%

--------------------------- -------- -------- -------

1 Normalised EBITDA is calculated as operating profit plus

depreciation and amortization and excluding one-off fees incurred

in 1H 2021 (EGP 29.0 million) related to the Company's dual listing

on the EGX completed in May 2021.

2 Operating Profit excludes one-off fees incurred in 1H 2021

(EGP 29.0 million) related to the Company's dual listing on the EGX

completed in May 2021.

Introduction

i. Financial Highlights

-- Revenue recorded EGP 2,293 million in 1H 2021, up a

remarkable 141% versus the comparable period of last year supported

by both IDH's Covid-19-related(3) tests and a sustained recovery in

the Group's conventional test offering. Top-line growth for the

first half of 2021 was dual-driven, as tests performed and average

price per test posted year-on-year expansions of 45% and 66%,

respectively. Covid-19-related tests contributed to 48% of IDH's

top-line during the first six months of the year compared to the 9%

contribution made during 1H 2020. Excluding Covid-19-related tests,

the Group witnessed a 38% year-on-year expansion in revenue

generated from its conventional test offering. The year-to-date

performance was buoyed by an impressive second quarter, which saw

IDH build on the strong momentum from the start of the year to

record revenues of EGP 1,164 million for 2Q 2021, up 159% versus 2Q

2020 and 3% from 1Q 2021.

-- Consolidated revenues continued to be supported by the

Group's house call service in Egypt and Jordan, which in 1H 2021

contributed to 23% of total revenue versus the 18% contribution

made this time last year. Through its house call service, IDH

served more than 646,000 patients in 1H 2021 (up 88% versus 1H

2020), performing more than 3.4 million tests (up 49% versus 1H

2020). Leveraging an expanded reach, IDH was able to carry out an

average of 3,600 house call visits per day in 1H 2021, up

significantly from the 1,900 visits per day performed in 1H

2020.

-- Gross Profit grew by 193% year-on-year in 1H 2021 to record

EGP 1,305 million with an associated margin of 57% versus 47% in

the same period last year. Improved gross profitability came on the

back of strong top-line growth and the subsequent dilution of fixed

costs for the period such as direct salaries and wages and other

expenses. Gross profit for the second quarter of 2021 recorded EGP

667 million, up 4% from the previous quarter and with a gross

margin of 57%.

-- Operating Profit recorded EGP 1,094 million, a 295%

year-on-year expansion, with an associated margin of 48% versus 29%

last year. The remarkable growth in operating profit was supported

by strong gross profitability, the dilution of SG&A outlays for

the period due to their relatively fixed nature, and a

normalisation of provisions booked in 1H 2021, which recorded EGP

10 million versus EGP 28 million in 1H 2020 to account for expected

credit losses in accordance with IFRS 9.

-- Normalised EBITDA(4) reached EGP 1,203 million in 1H 2021, an

increase of 227% from the comparable period of last year. EBITDA

margin expanded to 52% for the period versus 39% in 1H 2020. Solid

improvements in EBITDA profitability were driven by strong top-line

growth in 1H 2021 and the subsequent dilution of IDH's fixed costs

for the period. On a quarterly basis, normalised EBITDA recorded

EGP 603 million, up 267% year-on-year and largely in line with last

quarter's figure. Normalised EBITDA margin stood at 52% for the

quarter, down from the 53% margin recorded in 1Q 2021 as IDH booked

higher accounting fees (related to the EGX requirement to publish

quarterly reviewed financial statements) and additional bonus

payments to senior management during 2Q 2021.

-- Net Profit expanded 283% year-on-year to record EGP 668

million in 1H 2021, with a net profit margin of 29% versus 18% in

1H 2020. Net profit growth was supported by strong EBITDA level

profitability and comes despite IDH booking EGP 29 million in

one-off fees related to the Company's dual-listing in May 2021. In

2Q 2021, net profit stood at EGP 327 million with an associated

margin of 28%.

-- A dividend of US$ 29.1 million (US$ 0.0485 per share) for the

year ended 31 December 2020 was distributed to shareholders on 29

July 2021. This represents an increase of 4% compared to a final

dividend of US$ 28 million in aggregate in the previous financial

year.

3 Covid-19-related tests include both core Covid-19 tests

(Polymerase Chain Reaction (PCR), Antigen, and Antibody) as well as

other Covid-19-related tests which include a bundle of routine

inflammatory and clotting markers (which witnessed strong demand

following the outbreak of Covid-19) such as Complete Blood Picture,

Erythrocyte Sedimentation Rate (ESR), D-Dimer, Ferritin and

C-reactive Protein (CRP), among others.

4 Normalised EBITDA is calculated as operating profit plus

depreciation and amortization and minus one-off fees incurred in 1H

2021 (EGP 29 million) related to the Company's EGX listing

completed in May 2021.

ii. Operational Highlights

-- IDH's branch network stood at 495 branches as of 30 June

2021, up from 462 branches and 481 branches as of 30 June 2020 and

31 December 2020, respectively.

-- Total tests performed recorded 16.3 million in 1H 2021, up

45% year-on-year. Higher test volumes were supported by both IDH's

Covid-19-related(5) test offering as well as a sustained recovery

in the Group's conventional test offering, with the latter up 29%

versus the first six months of 2020. In 2Q 2021, IDH performed 8.3

million tests, up 2% from the previous quarter as IDH performed

both more Covid-19-related and conventional tests during the second

quarter of the year compared to the previous quarter. The

quarter-on-quarter expansion is particularly noteworthy as the

second quarter included the expected slowdown related to the holy

month of Ramadan and Eid vacation.

-- Average revenue per test expanded 66% year-on-year to EGP 141

in 1H 2021. Controlling for the generally higher value

Covid-19-related(4) tests, average revenue per test would have

increased 7% versus last year.

-- Total patients served reached 4.7 million in 1H 2021, a 62%

year-on-year increase. Meanwhile, average test per patient declined

to 3.5 in 1H 2021 from 3.9 last year as an increasing number of

patients visit the Group's labs for single Covid-19 tests (PCR,

Antigen and Antibody).

-- Revenue generated by IDH's Egyptian operations expanded 140%

year-on-year on the back of solid growth across both test and

patient volumes. On a service basis, top-line growth was supported

by both Covid-19-related(5) and conventional tests, and was further

bolstered by the Group's house call service which in 1H 2021 made

up 25% of Egypt's top-line versus 20% last year. Excluding

Covid-19-related contributions in 1H 2021, conventional tests

performed and revenue generated in Egypt expanded 29% and 38%

year-on-year, respectively.

-- Al-Borg Scan recorded revenue of EGP 20 million in 1H 2021,

an increase of 124% compared to last year. The number of radiology

tests performed during the first six months of 2021 reached 34,297,

more than double the tests performed last year.

-- Wayak turned EBITDA positive during 2Q 2021 on the back of

growing revenue and optimised overhead costs. On a year-to-date

basis, Wayak's revenue nearly tripled versus last year to reach EGP

4.3 million in 1H2021 supported by a growing customer base.

-- In Jordan, revenue increased 176% year-on-year on the back of

strong volume growth for the period. Top-line growth was supported

by Biolab's Covid-19-related test offering coupled with solid

growth in its conventional test offering, with the latter having

made a full recovery from last year's slowdown. In fact, excluding

Covid-19-related tests, the number of tests performed and revenue

generated would have increased 43% and 41%, respectively.

-- In August, Biolab was selected as the preferred bidder to

operate testing stations in Amman's Queen Alia International

Airport (QAIA). This landmark partnership will allow IDH to

continue playing a frontline role in the fight against Covid-19,

while helping to further expand Biolab's volumes and revenue in the

coming period.

-- In Nigeria, revenues continued their steady expansion,

growing 68% year-on-year (76% in NGN terms) in 1H 2021 supported by

a 47% increase in tests performed versus last year.

5 Covid-19-related tests include both core Covid-19 tests

(Polymerase Chain Reaction (PCR), Antigen, and Antibody) as well as

other Covid-19-related tests which include a bundle of routine

inflammatory and clotting markers (which witnessed strong demand

following the outbreak of Covid-19) such as Complete Blood Picture,

Erythrocyte Sedimentation Rate (ESR), D-Dimer, Ferritin and

C-reactive Protein (CRP), among others.

iii. Management Commentary

Commenting on the Group's performance for the six-month period,

IDH Chief Executive Officer Dr. Hend El-Sherbini said: "Halfway

through 2021, I am delighted with the Group's operational and

financial performance, which has seen us continue to build on an

impressive start to the year to deliver another set of

record-breaking results. Our revenues expanded an impressive 141%

versus last year on the back of growing patient and test volumes,

improved pricing and an increasingly optimised service mix. While

top-line growth continued to be bolstered by our

Covid-19-related(6) tests, I am happy to report that we have

continued to witness robust growth in our conventional test

offering for the second quarter in a row, signalling a sustained

recovery which we expect to continue even as Covid-19-related

volumes begin to taper off. It is particularly important to

highlight that the Group's conventional test volumes in 1H 2021

surpassed pre-Covid-19 levels, coming in 4% higher than test

volumes recorded in the same six months of 2019 after adjusting for

the impact of the 100 Million Healthy Lives Campaign(7) . This is

further evidence of the robust underlying demand for high quality

diagnostic services present across our markets of operation, and of

our continued ability to service this growing market."

"On a regional front, both our Egyptian and Jordanian operations

continued to report strong revenue growth supported by our

conventional and Covid-19-related service offering. Similar to the

trend witnessed at the consolidated level, across both geographies

we recorded robust growth in our conventional test portfolio

supported by a widespread recovery of economic activity coupled

with our multi-pronged efforts aimed at stimulating demand across

the entirety of our service roster. Top-line growth in both

countries was further buoyed by our home call services which

continue to grow in popularity especially in our home market of

Egypt, where tests performed directly in patient homes made up 25%

of the country's top-line in the first half of 2021. Our ability to

effectively ramp up the service in step with growing demand is

enabling us to perform up to five thousand house visits per day,

helping us to tap into new segments of the population while

boosting our tests per patient as patients enjoy the added comfort

of having the tests administered in their own homes. House call

services represent an important driver of future growth for the

Company well beyond the end of the Covid-19 crisis, and as such we

are continuing our efforts to expand and further streamline the

service. In parallel, we are also seeing growing contributions

coming from our radiology venture, Al-Borg Scan, which recorded

year-on-year revenue growth of 124% as tests performed more than

doubled in the first half of the year. To capitalise on the

attractive growth opportunities offered by the segment, we are

currently aiming to launch at least three new Al-Borg Scan branches

over the coming twelve months. Looking ahead, we expect to continue

recording growing contributions to consolidated revenue and

profitability as Al-Borg Scan's operations ramp up further."

"At our Nigerian operations, we witnessed sustained top-line

growth of 68% for the first half of this year. This comes as our

investments to revamp Echo-Lab's operations and strategic marketing

efforts continue to bear fruit, attracting an increasing number of

patients to our branches. This is a particularly noteworthy

achievement in light of the multiple political and pandemic-related

difficulties faced over the last year. Finally in Sudan, despite

recording an impressive 217% year-on-year revenue expansion in

local currency, the significant devaluation of the Sudanese Pound

in February 2021 continued to weigh on the country's results.

Despite this, we remain committed to the country in the long-term,

with management hard at work to continue driving sustainable

long-term growth beyond the current difficult operating

environment."

"Further down the income statement, we reported impressive

margin expansions at all levels of profitability supported by

strong top-line and the subsequent dilution of IDH's fixed costs.

Additionally, starting in the second quarter of this year we

recorded a decline in raw material as percentage of revenues to

16.8% compared to 19.3% in the previous quarter. This was partially

due to a decline in Jordan's Covid-19-positive cases requiring

confirmatory retests, and is also directly attributable to our

successful efforts to reduce PCR test kit costs. Overall, strong

top-line growth combined with increased cost efficiencies, higher

interest income, and lower provisions booked in the first half of

2021, helped drive a nearly fourfold increase in net profit for 1H

2021 which reached EGP 668 million with an associated margin of

29%."

"Heading into the second half of the year, our strategic

priorities remain unchanged as we aim to capitalise on the positive

momentum witnessed across both our operations and the wider

macroeconomic context. In the short-term we will continue to assist

governments in Egypt and Jordan in their fight against the Covid-19

pandemic providing our full roster of Covid-19-related services

across both our branches and through our expanded house call

service. On this front, I am very happy with our efforts to secure

multiple new partnerships over the last few months to offer PCR

testing to travellers in both Egypt and Jordan. Most importantly, I

am pleased to note that Biolab, our Jordanian subsidiary, has been

selected as the preferred bidder by Airport International Group

(AIG), the operator of Amman's Queen Alia International Airport, to

carry out PCR testing for passengers arriving in Jordan. As part of

the agreement, Biolab will also offer rapid PCR testing for

Covid-19 to departing passengers who were not able to do a PCR test

prior to reaching the airport. Through this landmark partnership,

we will be able to continue playing a frontline role in the fight

against the Covid-19 virus in Jordan while further expanding our

reach and patient base in the country. In parallel, we are looking

to sign additional strategic deals with international air carriers

to perform PCR tests for passengers similar to our existing

agreements with National Air Services (NAS) and Pure Health UAE

which see us conduct PCR testing for passengers flying from Egypt

to Kuwait and the UAE. Our ability to secure such partnerships is

proof positive of the strong reputation enjoyed by IDH both locally

and internationally, and further strengthens our offering for

international travellers which currently sees the Company offer

internationally-accredited PCR tests to travellers within and

outside the MENA region. Meanwhile, we are working tirelessly to

deliver on our post-Covid-19 growth strategy which will see us

leverage our expanded patient base, branch network, and service

offering to drive new sustainable growth in the years to come. To

this end, in the first six months of the year we successfully added

14 new branches in our home market of Egypt, keeping us on track to

meet our goal of 30 to 35 new lab rollouts for 2021 and helping us

to further cement our leadership position in the country's private

sector diagnostics market. In parallel, we continue to assess

potential growth opportunities across new African, Middle Eastern,

and Asian markets, and have secured a USD 45 million loan from the

International Finance Corporation (IFC) to finance our growth plans

in the coming period."

"In light of our half-year results and the encouraging recovery

witnessed across our markets, I am confident that the Group is on

track to deliver a record-breaking performance in 2021, with

year-on-year revenue growth surpassing the 70% mark and a

normalised EBITDA(8) margin of 47% to 49%. We expect our full-year

performance to be supported by both our conventional test offering,

which in 1H 2021 continued to witness a robust rebound, coupled

with continued strong demand for our Covid-19-related portfolio.

Moreover, with Egypt expected to record a new wave of infections

later this year, we could see greater than forecasted demand for

our Covid-19-related offering in the second half of 2021, with the

segment potentially pushing consolidated top-line growth into the

80% range, with an EBITDA margin of around 50%."

6 Covid-19-related tests include both core Covid-19 tests

(Polymerase Chain Reaction (PCR), Antigen, and Antibody) as well as

other Covid-19-related tests which include a bundle of routine

inflammatory and clotting markers (which witnessed strong demand

following the outbreak of Covid-19) such as Complete Blood Picture,

Erythrocyte Sedimentation Rate (ESR), D-Dimer, Ferritin and

C-reactive Protein (CRP), among others.

7 The 100 Million Healthy Lives Campaign which ran from November

2018 through June 2019. As part of the Campaign, the Group

performed 2.4 million tests in 1H 2019.

(8) Normalised EBITDA is calculated as operating profit plus

depreciation and amortization and minus one-off fees incurred in 1H

2021 (EGP 29 million) related to the Company's EGX listing

completed in May 2021.

- End -

Analyst and Investor Call Details

An analyst and investor call will be hosted at 2pm (UK) | 3pm

(Egypt) on Monday, 6 September 2021.

Web conference access details

You can register for the call by clicking on this link , and you

may dial in using the conference call details below:

-- Dial-in Number: 820 8840 0136

-- Confirmation Number: 131242

Regular dial-in details

US dial-in number: +1 (646) 558-8656

UK dial-in number: +44 208 080 6592

Meeting ID: 820 8840 0136

Password: 131242

For more information about the event, please contact:

nancy.fahmy@idhcorp.com

About Integrated Diagnostics Holdings (IDH)

IDH is a leading consumer healthcare company in the Middle East

and Africa with operations in Egypt, Jordan, Sudan and Nigeria. The

Group's core brands include Al Borg, Al Borg Scan and Al Mokhtabar

in Egypt, as well as Biolab (Jordan), Ultralab and Al Mokhtabar

Sudan (both in Sudan) and Echo-Lab (Nigeria). A long track record

for quality and safety has earned the Company a trusted reputation,

as well as internationally recognised accreditations for its

portfolio of over 2,000 diagnostics tests. From its base of 495

branches as of 30 June 2021, IDH will continue to add laboratories

through a Hub, Spoke and Spike business model that provides a

scalable platform for efficient expansion. Beyond organic growth,

the Group's expansion plans include acquisitions in new Middle

Eastern, African, and East Asian markets where its model is

well-suited to capitalise on similar healthcare and consumer trends

and capture a significant share of fragmented markets. IDH has been

a Jersey-registered entity with a Standard Listing on the Main

Market of the London Stock Exchange (ticker: IDHC) since May 2015

with a secondary listing on the EGX since May 2021 (ticker:

IDHC.CA).

Shareholder Information

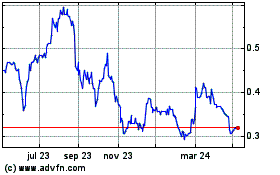

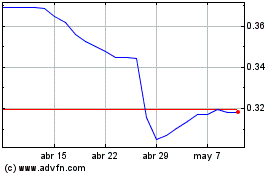

LSE: IDHC.L

EGX: IDHC.CA

Bloomberg: IDHC:LN

Listed on LSE: May 2015

Listed on EGX: May 2021

Shares Outstanding: 600 million

Contact

Nancy Fahmy

Investor Relations Director

T: +20 (0)2 3345 5530 | M: +20 (0)12 2255 7445 |

nancy.fahmy@idhcorp.com

Forward-Looking Statements

These results for the six-month period ended 30 June 2021 have

been prepared solely to provide additional information to

shareholders to assess the group's performance in relation to its

operations and growth potential. These results should not be relied

upon by any other party or for any other reason. This communication

contains certain forward-looking statements. A forward-looking

statement is any statement that does not relate to historical facts

and events, and can be identified by the use of such words and

phrases as "according to estimates", "aims", "anticipates",

"assumes", "believes", "could", "estimates", "expects",

"forecasts", "intends", "is of the opinion", "may", "plans",

"potential", "predicts", "projects", "should", "to the knowledge

of", "will", "would" or, in each case their negatives or other

similar expressions, which are intended to identify a statement as

forward-looking. This applies, in particular, to statements

containing information on future financial results, plans, or

expectations regarding business and management, future growth or

profitability and general economic and regulatory conditions and

other matters affecting the Group .

Forward-looking statements reflect the current views of the

Group's management ("Management") on future events, which are based

on the assumptions of the Management and involve known and unknown

risks, uncertainties and other factors that may cause the Group's

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by these forward-looking statements. The

occurrence or non-occurrence of an assumption could cause the

Group's actual financial condition and results of operations to

differ materially from, or fail to meet expectations expressed or

implied by, such forward-looking statements.

The Group's business is subject to a number of risks and

uncertainties that could also cause a forward-looking statement,

estimate or prediction to differ materially from those expressed or

implied by the forward-looking statements contained in this

communication. The information, opinions and forward-looking

statements contained in this communication speak only as at its

date and are subject to change without notice. The Group does not

undertake any obligation to review, update, confirm or to release

publicly any revisions to any forward-looking statements to reflect

events that occur or circumstances that arise in relation to the

content of this communication.

Group Operational & Financial Review

i. Revenue and Cost Analysis

Revenue

IDH reported revenue of EGP 2,293 million in 1H 2021,

up an impressive 141% from the comparable period of

last year driven by both its Covid-19-related(9) tests

and a sustained recovery in the Group's conventional

test offering. Year-on-year top-line growth continued

to be dually-driven as tests performed in 1H 2021 expanded

45% versus last year and average revenue per test increased

66% compared to the same six months of 2020. Although

strong and rising demand for IDH's Covid-19-related

test offering saw it make up nearly half of IDH's consolidated

top-line (48% in 1H 2021 vs 9% in 1H 2020), the Group's

conventional test offering also recorded robust year-on-year

growth of 38% of the period. Growth in conventional

business came on the back of a 29% increase in tests

performed and a 7% rise in average revenue per conventional

test.

Looking at the Group's Covid-19-related offering in

more detail, revenues generated from core Covid-19

tests (PCR, Antigen and Antibody) amounted to EGP 830

million in 1H 2021, making up 36% of consolidated top-line

for the period. In parallel, revenue generated by IDH's

other Covid-19-related tests reached EGP 275 million

in 1H 2021.

IDH's consolidated top-line was also supported by its

ramped-up house call service in Egypt and Jordan, which

contributed to 23% to consolidated revenue for 1H 2021

compared to 18% in 1H 2020. Through its house call

service, IDH served more than 646,000 patients in 1H

2021, up 88% versus 1H 2020, performing more than 3.4

million tests, 49% above the figure recorded in 1H

2021. Leveraging an expanded reach, IDH was able to

carry out an average of 3,600 house call visits per

day in 1H 2021, up significantly from the 1,900 visits

per day performed in 1H 2020.

The Group's year-to-date performance was bolstered

by a remarkable second quarter, which saw IDH build

an already strong first three months of the year. In

2Q 2021, IDH recorded revenue of EGP 1,164 million,

up 159% versus the previous year and 3% above revenue

recorded in 1Q 2021. As with the year-to-date performance,

growth was supported by IDH's full service roster,

with the number of conventional tests performed increasing

2.3% quarter-on-quarter despite the typical slowdown

associated with the holy month of Ramadan and Eid holiday

during 2Q 2021.

Detailed Consolidated Revenue Breakdown EGP mn 1Q 2020 1Q 2021 2Q 2020 2Q 2021 1H 2020 1H2021

------------------------- -------- -------- -------- -------- -------- -------

Total revenues 500 1,130 450 1,164 950 2,293

Conventional tests 495 594 367 595 862 1,189

Total Covid-19-related

tests 5 536 83 569 88 1,105

Core Covid-19

tests (PCR, Antigen,

Antibody) 5 399 26 431 31 830

Other Covid-19-related

tests 0 137 57 138 57 275

------------------------- -------- -------- -------- -------- -------- -------

Contribution to consolidated revenue

------------------------------------------------------------------------------------

Conventional tests 99% 53% 82% 51% 91% 52%

Total Covid-19-related

tests 1% 47% 18% 49% 9% 48%

Core Covid-19

tests (PCR, Antigen,

Antibody) 1% 35% 6% 37% 3% 36%

Other Covid-19-related

tests 0% 12% 13% 12% 6% 12%

9 Covid-19-related tests include both core Covid-19

tests (Polymerase Chain Reaction (PCR), Antigen, and

Antibody) as well as other Covid-19-related tests which

include a bundle of routine inflammatory and clotting

markers (which witnessed strong demand following the

outbreak of Covid-19) such as Complete Blood Picture,

Erythrocyte Sedimentation Rate (ESR), D-Dimer, Ferritin

and C-reactive Protein (CRP), among others.

Revenue Analysis: Contribution by Patient Segment

Contract Segment

At the Group's contract segment, revenue increased

149% year-on-year as test performed expanded 49% and

average revenue per contract test increased 68% in

1H 2021. This saw the segment's contribution to total

revenues reach 55% for the period versus 53% in the

same six months of 2020. Covid-19-related(10) testing

contributed 47% of contract revenues in the first half

of the year as the Company continued to witness strong

demand for its offering in both Egypt and Jordan. Excluding

Covid-19-related tests, the contract segment would

have recorded an 45% year-on-year increase in revenue

supported by a 33% rise in tests performed and a 9%

increase in average revenue per test.

The contract segment's results continued to include

contributions from IDH's agreement with Pure Health

UAE (EGP 57 million), which saw IDH become the first

lab to conduct PCR testing to screen passengers travelling

from Egypt. In 1H 2021, PCR tests for Covid-19 performed

as part of the agreement made up 5% of contract segment

revenues and 7% of total core Covid-19 tests (PCR,

Antigen, and Antibody) performed during the period.

Walk-in Segment

Revenue from IDH's walk-in segment recorded a 132%

year-on-year expansion in 1H 2021, contributing to

45% of consolidated revenues for the period versus

the 47% contribution in the comparable period of 2020.

In the first six months of the year, average revenue

per test at the walk-in segment increased 71% year-on-year,

while tests performed increased by 36% versus 1H 2020.

The walk-in segment's revenue was also bolstered by

the Group's Covid-19-related test offering, which in

1H 2021 contributed to just under half of the segment's

top-line at 49%. Controlling for contributions from

Covid-19-related tests in both periods, walk-in revenues

for 1H 2021 would have increased a solid 30% versus

last year on the back of a 17% rise in tests performed

and an 11% increase in average revenue per test.

Key Performance Indicators Walk-in Segment Contract Segment Total

=================== ======================= ======================== =========================

1H20 1H21 Change 1H20 1H21 Change 1H20 1H21 Change

=================== ====== ====== ======= ====== ======= ======= ======= ======= =======

Revenue^

(EGP mn) 443 1,029 132% 507 1,264 149% 950 2,293 141%

Covid-19-related

revenue

(EGP mn) 41 506 47 598 88 1,105

Patients

('000) 943 1,523 62% 1,947 3,150 62% 2,890 4,673 62%

% of Patients 33% 33% 67% 67%

Revenue

per Patient

(EGP) 470 676 44% 260 401 54% 329 491 49%

------------------- ------ ------ ------- ------ ------- ------- ------- ------- -------

Tests ('000) 3,063 4,164 36% 8,171 12,153 49% 11,234 16,318 45%

% of Tests 27% 26% 73% 74%

Covid-19-related

tests ('000) 161 758 372% 417 1,842 342% 577 2,600 350%

Revenue

per Test

(EGP) 145 247 71% 62 104 68% 85 141 66%

Test per

Patient 3.3 2.7 -16% 4.2 3.9 -8% 3.9 3.5 -10%

------------------- ------ ------ ------- ------ ------- ------- ------- ------- -------

1 (0) Covid-19-related tests include both core Covid-19

tests (Polymerase Chain Reaction (PCR), Antigen, and

Antibody) as well as other Covid-19-related tests which

include a bundle of routine inflammatory and clotting

markers (which witnessed strong demand following the

outbreak of Covid-19) such as Complete Blood Picture,

Erythrocyte Sedimentation Rate (ESR), D-Dimer, Ferritin

and C-reactive Protein (CRP), among others.

Revenue Analysis: Contribution by Geography

Egypt

In Egypt, revenues recorded EGP 1,935 million in the

first half of 2021, a 140% increase versus last year

supported by a 44% year-on-year rise in tests performed

and a 67% year-on-year rise in average revenue per

test. Revenue growth for the period was supported by

both Covid-19-related(11) test offering, which in 1H

2021 made up 47% of the country's revenue, and conventional

test offering. More specifically, when controlling

for contributions made by Covid-19-related tests, revenue

increased 38% versus 1H 2020 on the back of a solid

29% rise in conventional tests performed during the

period.

On a quarterly basis, Egypt recorded revenue of EGP

1,015 million in 2Q 2021, up 166% versus 2Q 2020 and

10% from 1Q 2021. During the quarter, IDH saw Covid-19-related

revenues in Egypt reach a new all-time high of EGP

504 million versus EGP 414 million in 1Q 2021 and EGP

273 million in 4Q 2020, as the second quarter coincided

with the peak of country's third wave of Covid-19 infections.

IDH's house call service, which throughout 2020 and

the first half of 2021 has been successfully ramped

up to capitalise on the service's growing popularity,

continued to make a growing contribution to revenues,

constituting 25% of Egypt's top-line in 1H 2021 (20%

in 1H 2020).

IDH's Al-Borg Scan recorded robust revenue growth during

the first half of 2021, with its top-line expanding

to EGP 20 million, a 124% year-on-year rise. This came

on the back of a 103% increase in the total number

of radiology tests performed, coupled with a 10% increase

in average revenue per test following the introduction

of the higher-priced PET-CT scan in late 2020.

Overall, IDH served 4.1 million patients in Egypt and

performed 14.6 million tests in 1H 2021, up by 56%

and 44% year-on-year, respectively.

Detailed Egypt Revenue Breakdown EGP mn 1Q 2020 1Q 2021 2Q 2020 2Q 2021 1H 2020 1H2021

------------------------- -------- -------- -------- -------- -------- -------

Total revenues 424 920 381 1,015 805 1,935

Conventional tests 424 507 314 510 738 1,017

Total Covid-19-related

tests 0 414 67 504 67 918

Core Covid-19

tests (PCR, Antigen,

Antibody) 0 277 10 366 10 643

Other Covid-19-related

tests 0 137 57 138 57 275

------------------------- -------- -------- -------- -------- -------- -------

Contribution to Egypt revenue

------------------------------------------------------------------------------------

Conventional tests 100% 55% 82% 50% 92% 53%

Total Covid-19-related

tests 0% 45% 18% 50% 8% 47%

Core Covid-19

tests (PCR, Antigen,

Antibody) 0% 30% 3% 36% 1% 33%

Other Covid-19-related

tests 0% 15% 15% 14% 7% 14%

11 Covid-19-related tests include both core Covid-19

tests (Polymerase Chain Reaction (PCR), Antigen, and

Antibody) as well as other Covid-19-related tests which

include a bundle of routine inflammatory and clotting

markers (which witnessed strong demand following the

outbreak of Covid-19) such as Complete Blood Picture,

Erythrocyte Sedimentation Rate (ESR), D-Dimer, Ferritin

and C-reactive Protein (CRP), among others.

Jordan

Revenue generated by IDH's Jordanian operations grew

176% year-on-year in 1H 2021 to reach EGP 324 million.

Top-line growth was driven by a 79% increase in test

performed during the period and a 54% rise in Biolab's

average revenue per test. In the first half the year,

Covid-19-related tests (PCR, Antigen, and Antibody)

contributed to 58% of Jordan's revenue and to 24% of

Biolab's total tests performed. Meanwhile, controlling

for contributions made by the Group's Covid-19-related

offering, revenue grew by a robust 41% year-on-year

on the back of a 43% increase in conventional tests

performed in 1H 2021. Revenue generated by Biolab's

house call service more than doubled versus last year

to reach EGP 34 million in 1H 2021, continuing to make

a significant contribution to Jordan's top-line at

11% versus the 13% contribution made in 1H 2020. House

call's contribution to Jordan's top-line decreased

versus last year in light of the strong growth recorded

by Biolab's conventional business which had been impacted

by curfews and other Covid-19-related restrictions

during the comparable six months of last year.

On a quarterly basis, Jordan's revenue reached EGP

134 million, up 125% year-on-year but down 30% versus

1Q 2021. The quarter-on-quarter contraction comes as

Covid-19-related revenue continued to decline on the

back of lower infection rates as the country further

ramps up its vaccination campaign. When combined with

the strong recovery of Biolab's conventional test offering,

this saw the contribution made by Covid-19-related

tests to Biolab's top-line continue on its declining

trajectory from 71% in 4Q 2020, to 64% in 1Q 2021 and

48% in 2Q 2021.

It is also worth noting, that in August 2021, Biolab

was selected as the preferred bidder by Airport International

Group (AIG), the operator of Amman's Queen Alia International

Airport (QAIA), to operate testing stations in QAIA's

departure and arrival terminals primarily dedicated

to PCR testing for Covid-19. The main focus of the

testing stations will be to offer PCR testing for Covid-19

to passengers arriving in Jordan, as well as additional

diagnostic tests to patients including rapid Covid-19

testing for departing passengers and other, more generic

diagnostic tests. The agreement, which came into effect

on 1 August 2021, has a six-month duration with the

option to renew for additional six-month periods.

Detailed Jordan Revenue Breakdown EGP mn 1Q 2020 1Q 2021 2Q 2020 2Q 2021 1H 2020 1H2021

------------------------ -------- -------- -------- -------- -------- -------

Total revenues 58 190 59 134 117 324

Conventional revenue 53 68 44 69 97 137

Total Covid-19-related

revenue (PCR,

Antigen, Antibody) 5 122 16 65 21 187

Contribution to Jordan revenue

-----------------------------------------------------------------------------------

Conventional revenue 91% 36% 74% 52% 82% 42%

Total Covid-19-related

revenue (PCR,

Antigen, Antibody) 9% 64% 26% 48% 18% 58%

Nigeria

At the Group's Nigerian subsidiary, revenue recorded

EGP 25 million in the first half of 2021, up 68% from

EGP 15 million in the first six months of last year.

In local currency terms, growth was even more pronounced

with revenues up 76% year-on-year on the back of a

47% year-on-year expansion in tests performed (patients

served were up 25%) and a 14% increase in average revenue

per test. The steady rise in volumes recorded in the

last two years comes as a direct results of management's

strategic investments to revamp Echo-Lab's branches

coupled with effective marketing campaigns aimed at

stimulating demand for the venture's services. Moreover,

volumes are also benefitting from a gradual normalisation

of traffic following the easing of restrictive measures

enforced to curb the spread of Covid-19 throughout

2020, and the relative stability following protests

in the final weeks of last year. On a quarterly basis,

IDH's Nigeria operations reported revenues of EGP 13

million, more than double the figure recorded in the

second quarter of last year and 3% above revenues reported

in the first three months of 2021.

Sudan

In Sudan, IDH reported a 25% year-on-year decline in

revenues to EGP 9 million for 1H 2021. The country's

results were significantly impacted by the devaluation

of the Sudanese pound in early 2021 with the average

SDG/EGP rate in 1H 2021 standing at 0.07 versus 0.30

this time last year. Nonetheless, management's success

in increasing prices saw revenue in local currency

terms expand a remarkable 217% year-on-year in 1H 2021.

Revenue Contribution by Country 1H 2020 1H 2021 Change

========================= ======== ======== =======

Egypt Revenue (EGP

mn) 805 1,935 140%

Covid-19-related (EGP

mn) 67 918 1,260%

Egypt Contribution 85% 84%

========================= ======== ======== =======

Jordan Revenue (EGP

mn) 117 324 176%

Covid-19-related (EGP

mn) 21 187 804%

Jordan Revenue (JOD

mn) 5 15 177%

Jordan Contribution 12% 14%

========================= ======== ======== =======

Nigeria Revenue (EGP

mn) 15 25 68%

Nigeria Revenue (NGN

mn) 359 632 76%

Nigeria Contribution 2% 1%

Sudan Revenue (EGP

mn) 12 9 -25%

Sudan Revenue (SDG

mn) 41 129 217%

Sudan Contribution 1% 0.4%

========================= ======== ======== =======

---

Patients Served and Tests Performed by Country 1H 2020 1H 2021 Change

================================= ======== ======== =======

Egypt Patients Served (mn) 2.6 4.1 56%

Egypt Tests Performed (mn) 10.1 14.6 44%

Covid-19-related tests (mn) 0.5 2.3 318%

================================= ======== ======== =======

Jordan Patients Served (k) 160 502 214%

Jordan Tests Performed (k) 810 1,447 79%

Covid-19-related tests (k) 37 342 822%

Nigeria Patients Served (k) 60 75 25%

Nigeria Tests Performed (k) 92 136 47%

Sudan Patients Served (k) 59 33 -44%

Sudan Tests Performed (k) 188 104 -45%

================================= ======== ======== =======

Total Patients Served (mn) 2.9 4.7 62%

Total Tests Performed (mn) 11.2 16.3 45%

Branches by Country 30 June 2020 30 June 2021 Change

================ ============= ============= =============

Egypt 410 443 33

================ ============= ============= =============

Jordan 19 21 2

================ ============= ============= =============

Nigeria 12 12 -

================ ============= ============= =============

Sudan 21 19 -2

================ ============= ============= =============

Total Branches 462 495 33

================ ============= ============= =============

-Cost of Goods Sold

IDH's cost of goods sold increased 96% year-on-year

to EGP 988 million in 1H 2021, a much slower increase

than the 141% growth in revenues. As such, gross profit

for the period increased 193% year-on-year to EGP 1,305

million in 1H 2021, with an associated margin of 57%,

up 10 percentage points from 1H 2020.

COGS Breakdown as a Percentage of Revenue 1H 2020 1H 2021

============================= ======== ========

Raw Materials 15.9% 18.1%

============================= ======== ========

Wages & Salaries 17.0% 12.9%

============================= ======== ========

Depreciation & Amortisation 8.4% 4.2%

============================= ======== ========

Other Expenses 11.7% 7.8%

============================= ======== ========

Total 53.0% 43.1%

============================= ======== ========

Raw material costs, which include cost of specialized

analysis at other laboratories, recorded EGP 414 million

in 1H 2021, and continued to make up the largest share

of total COGS at 42%. As a share of revenue, raw material

costs increased to 18% in 1H 2021 compared to 16% in

the same period of last year. The increase is partially

attributable to the retesting of Covid-19 positive

cases at IDH's Jordanian subsidiary. Moreover, the

year-on-year growth also partially reflects the low

base effect resulting from a one-off discount granted

by suppliers during the comparable period of last year.

It is worth highlighting that in 2Q 2021, raw material

costs as a percentage of revenue declined to 16.8%

versus the 19.3% share recorded in the previous quarter.

The fall comes on the back of lower Covid-19-positive

cases in Jordan combined with management's success

in driving down PCR test kit costs. It should be noted

that Jordan's raw material costs contributed to around

26% of the consolidated raw material costs for 1H 2021

and to 20% in 2Q 2021. Meanwhile, Egypt's raw materials

made up 71% of total raw material costs in the six-month

period, with a stable raw material to revenues ratio

of 14%.

Direct salaries and wages increased 84% year-on-year

to EGP 296 million in 1H 2021 and made up the second

largest share of total COGS for the six-month period

at 30%. The increase is largely attributable to a rise

in the share of profits allocated to direct salaries

and wages to EGP 87 million in 1H 2021 from EGP 26

million 1H 2020 following higher net profit recorded

at its Egyptian operations,(12) in addition to higher

bonuses/incentives paid during the period.

Direct depreciation and amortisation was up 22% year-on-year

in 1H 2021 to EGP 97 million, largely due to the incremental

amortisation of additional branches (IFRS 16 right-of-use

assets).

EBITDA

IDH's normalised EBITDA(13) grew a remarkable 227%

year-on-year to reach EGP 1,203 million in 1H 2021.

Normalised EBITDA margin expanded to 52% in 1H 2021

versus the 39% margin recorded in 1H 2020, on the back

of strong top-line growth and the dilution of fixed

costs. EBITDA growth was further bolstered by the normalization

of provisions booked during the first six months of

the year which in 1H 2021 stood at EGP 10 million versus

the EGP 28 million booked in 1H 2020 to account for

expected credit losses in accordance with IFRS 9. Normalised

EBITDA excludes one-off listing fees of EGP 29 million

incurred in 1H 2021 related to the Company's dual listing

on the EGX completed in May 2021.

On a quarterly basis, normalised EBITDA recorded EGP

603 million in 2Q 2021, up 267% year-on-year and largely

in line with the figure recorded in 1Q 2021. Normalised

EBITDA margin stood at 52% for the quarter, down from

the 53% margin recorded in 1Q 2021 as IDH booked higher

accounting fees (related to the EGX requirement to

publish quarterly reviewed financial statements) and

additional bonus payments to senior management during

2Q 2021.

In Egypt, EBITDA recorded EGP 1,075 million in 1H 2021,

up 223% year-on-year on the back of strong top-line

growth. EBITDA margin increased to 56% for the first

half of the year from 41% in 1H 2020.

IDH's Jordanian operations recorded a 240% year-on-year

rise in EBITDA to EGP 131 million for 1H 2021 on the

back of strong revenue growth for the six-month period.

In local currency terms, EBITDA grew 242% compared

to last year. EBITDA margin recorded 40% in the first

half of 2021, up from the 33% margin recorded in the

comparable period of 2020.

(12) According to IAS 1, 10% of Egypt's net profit

is allocated to direct wages and salaries.

(13) Normalised EBITDA is calculated as operating

profit plus depreciation and amortization and minus

one-off fees incurred in 1H 2021 related to the Company's

EGX listing completed in May 2021.

In Nigeria, EBITDA losses stood largely unchanged at

EGP 4.3 million in 1H 2021. However, it is important

to note that the figure includes a one-off adjustment

related to the previous year of EGP 3.2 million.

Finally, Sudan's EBITDA recorded EGP 0.7 million in

1H 2021, down 3% year-on-year with an EBITDA margin

of 8% compared to 6% last year. EBITDA for the period

was weighed down by the sharp SDG devaluation in February

of this year. However, in SDG terms, EBITDA more than

quadrupled to SDG 10 million supported by management's

pricing strategy aimed at mitigating the impacts of

the country's hyperinflationary environment.

Regional EBITDA in Local Currency Mn 1H 2020 1H 2021 Change

----------------- -------- -------- -------

Egypt EGP 332 1,075 223%

margin 41% 56%

Jordan JOD 1.7 5.9 242%

margin 33% 40%

Nigeria NGN -101 -108 7%

margin -28% -17%

Sudan SDG 2 10 309%

margin 6% 8%

Interest Income / Expense

IDH recorded interest income of EGP 45 million in 1H

2021, up 34% year-on-year on the back of higher cash

balances during the period.

Interest expense recorded EGP 54 million in the first

half of 2021 versus EGP 37 million in 1H 2020. The

year-on-year increase in largely attributable to the

loan-related expenses incurred by IDH during the period

as the Company secured a new eight-year US$ 45 million

facility with the International Finance Corporation

(IFC) in May 2021. During 1H 2021, IDH booked loan-related

expenses of EGP 12.5 million including a front-end

fee, syndication fee, and legal advisory fees. The

facility will be used to finance IDH's growth plans

across new and existing markets. The loan has a four

year grace period and availability period of two years.

Higher interest expenses for the period also partially

reflect higher interest on lease liabilities related

to IFRS 16 following the addition of new branches,

as well as higher bank charges resulting from increased

penetration of, and reliance on, POS machines and electronic

payments during the period.

Interest Expense Breakdown EGP Mn 1H 2020 1H 2021 Change

=============================== ======== ======== =======

Interest on Lease Liabilities

(IFRS 16) 26.4 28.9 9%

=============================== ======== ======== =======

Interest Expenses on

Borrowings(14) 6.9 4.8 -31%

=============================== ======== ======== =======

Loan-related Expenses - 12.5 N/A

on IFC facility

=============================== ======== ======== =======

Interest Expenses on

Leases 2.2 2.8 30%

=============================== ======== ======== =======

Bank Charges 1.2 5.4 337%

=============================== ======== ======== =======

Total Interest Expense 36.7 54.4 48%

=============================== ======== ======== =======

(14) Related to medium-terms loans for the Al Borg

Scan expansion (EGP 3.0 million) and the Group's new

headquarters in Cairo's Smart Village (EGP 1.7 million).

Foreign Exchange

IDH recorded a net foreign exchange loss of EGP 19

million in 1H 2021 compared to EGP 4 million in the

same six months a year ago. The figure largely reflects

FX losses on the back of the SDG devaluation versus

the EGP in February 2021.

Taxation

Tax expenses recorded in 1H 2021 were EGP 367 million

compared to EGP 95 million in the same period of last

year. The effective tax rate stood at 35% in the period

unchanged versus 1H 2020. It is important to note that

there is no tax payable for IDH's two companies at

the holding level, while tax was paid on profits generated

by operating subsidiaries.

Net Profit

IDH's consolidated net profit recorded EGP 668 million

in the first half of 2021, up an impressive 283% year-on-year.

Improving net profitability was supported by strong

revenue growth coupled with increased cost efficiencies,

higher interest income and normalising provisions for

the period. As such, net profit margin stood at 29%

in 1H 2021, up from 18% last year.

ii. Balance Sheet Analysis

Assets

Property, Plant and Equipment

IDH held gross property, plant and equipment (PPE) of EGP 1,365

million as at 30 June 2021, up from the EGP 1,247 million as of 31

December 2020. Meanwhile, CAPEX outlays represented around 5% of

consolidated revenues in the first half of the year.

Accounts Receivable and Provisions

As at 30 June 2021, accounts receivables' Days on Hand (DOH)

stood at 97 days compared to 144 days at year-end 2020, displaying

a sustained improvement in collections during the first six months

of the year versus 2020. Accounts receivables' DOH is calculated

based on credit revenues amounting to EGP 637.9 million during 1H

2021.

Provision for doubtful accounts established during the first six

months of 2021 amounted to EGP 10 million, down from the EGP 28

million booked in provisions in the comparable period of last year.

This comes as collection cycles continue to normalise following a

period of heightened uncertainty in the first stages of the

Covid-19 crisis.

Inventory

As at 30 June 2021, the Group's inventory balance reached EGP

142 million, up from EGP 100 million as at year-end 2020. Days

Inventory Outstanding (DIO) decreased to 54 days as at 30 June 2021

from 72 days as at year-end 2020. The decline is largely

attributable the high turnover of PCR testing for Covid-19.

Cash and Net Debt/Cash

IDH's cash balances increased to EGP 1,587(15) million as at 30

June 2021 compared to EGP 877 million as at 31 December 2020.

Net cash balance(16) amounted to EGP 904(17) million as at 30

June 2021, an increase of 181% compared to EGP 321 million as at 31

December 2020.

(15) The figure does not include dividend payments of US$ 29.1

million distributed to shareholders on 29 July 2021.

(16) The net cash balance is calculated as cash and cash

equivalent balances less interest-bearing debt (medium term loans),

finance lease and Right-of-use liabilities.

(17) Pre-dividend distribution.

EGP million FY 2020 1H 2021

=================================== ======== =========

Cash and Investments at Amortised

Cost 876.8 1,587.0

=================================== ======== =========

Interest Bearing Debt ("Medium

Term Loans")(18) 96.5 86.0

=================================== ======== =========

Lease Liabilities Property 389.9 468.0

=================================== ======== =========

Lease Liabilities Equipment 69.1 128.8

=================================== ======== =========

Net Cash Balance 321.3 904.2

=================================== ======== =========

(18) IDH's interest bearing debt as at 30 June 2021 is split as

EGP 26 million related to its medium term facility with the

Commercial International Bank (CIB) and EGP 57 million to its

facility Ahli United Bank Egypt (AUBE).

Lease liabilities on property stood at EGP 468.0 million as at

1H 2021 versus the EGP 389.9 million booked in FY 2020. The

increase is attributable to the addition of new branches during the

first six months of 2021 as well as Al-Borg Scan's third branch

which is expected to come online in September of this year.

Meanwhile, financial obligations related to equipment recorded EGP

128.8 million as at 30 June 2021, up from EGP 69.1 million as at

year-end 2020. The increase comes following the renewal of the

Company's contracts and the addition of new equipment.

Liabilities

Accounts Payable

As at 30 June 2021, accounts payable balance stood at EGP 225

million up from EGP 178 million as at year-end 2020. However, the

Group's days payable outstanding (DPO) stood at 91 days as at 30

June 2021 down from 127 days as year-end 2020. The decline

primarily reflects the fact that PCR testing kit suppliers are paid

within a period of 15 days.

iii. Cash Flow Analysis

Net cash flow from operating activities recorded EGP 866 million

in the first half of 2021 compared to EGP 149 million in 1H 2020,

demonstrating the company's continued strong cash generation

ability.

iv. Dividend

A dividend of US$ 29.1 million (US$ 0.0485 per share) for the

year ended 31 December 2020 was distributed to shareholders on 29

July 2021. This represents an increase of 4% compared to a final

dividend of US$ 28 million in aggregate in the previous financial

year.

Principal Risks and Uncertainties

As in any corporation, IDH has exposure to risks and

uncertainties that may adversely affect its performance. The Board

and senior management agree that the principal risks and

uncertainties facing the Group include political and economic risks

in Egypt, the Middle East and Nigeria, foreign currency exchange

rate variability and associated risks, changes in regulation and

regulatory actions, damage to the Group's reputation, failure to

maintain the Group's high quality standards and accreditations,

failure to maintain good relationships with healthcare

professionals and end-users, pricing pressures and business

interruption of the Group's testing facilities, among others.

Other short-term risks include operational disruptions related

the Covid-19 pandemic; delays in branch openings and renovations in

Nigeria and difficulties in growing Echo-Lab's customer base;

prolonged political unrest in Sudan that can adversely affect

patient and test volumes, while further currency devaluation risks

will limit the compensatory effect of price increases.

Statement of Directors' Responsibilities

Responsibility statement of the directors in respect of the

half-yearly financial report

We confirm that to the best of our knowledge, the interim

management report includes a fair review of the information

required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of financial statements; and a description of

the principal risks and uncertainties for the remaining six months

of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

entity during that period; and any changes in the related party

transactions described in the last annual report that could do

so.

For and on behalf of the Board of Directors:

Dr. Hend El Sherbini

Executive Director

1 September 2021

- Ends --

INTEGRATED DIAGNOSTICS HOLDINGS plc - "IDH"

AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE SIX MONTHSED

30 JUNE 2021

Index to the condensed consolidated interim financial statements Pages

----------------------------------------------------------------------------- ------

Condensed consolidated interim statement of financial position 20

Condensed consolidated interim statement of profit or loss 21

Condensed consolidated interim statement of comprehensive income 22

Condensed consolidated interim statement of changes in equity 23

Condensed consolidated interim statement of cash flows 24

Report on review of the condensed consolidated interim financial statements 25

Notes to the condensed consolidated interim financial statements 26-43

Condensed Consolidated Interim Statement of Financial Position

as of 30 June 2021

(All amounts in Egyptian Pounds "EGP'000") 30 June 31 December

Notes 2021 2020

-------------------------------------------- -------- -------------- --------------

EGP'000 EGP'000

(Reviewed) (Audited)

ASSETS

Non-current assets

Property, plant and equipment 4 848,419 787,590

Intangible assets and goodwill 5 1,654,098 1,659,755

Right of use assets 6 415,717 354,688

Financial investments 7 10,282 9,604

Total non-current assets 2,928,516 2,811,637

-------------- --------------

Current assets

Inventories 141,559 100,115

Trade and other receivables 8 477,432 388,903

Investments at amortized cost 9 329,056 276,625

Cash and cash equivalents 10 1,257,983 600,130

Total current assets 2,206,030 1,365,773

-------------- --------------

Total assets 5,134,546 4,177,410

============== ==============

LIABILITIES AND EQUITY

Equity

Share Capital 1,072,500 1,072,500

Share premium reserve 1,027,706 1,027,706

Capital reserve (314,310) (314,310)

Legal reserve 51,641 49,218

Put option reserve (618,047) (314,057)

Translation reserve 155,760 145,617

Retained earnings 777,068 603,317

Equity attributable to the equity holders

of the parent 2,152,318 2,269,991

Non-controlling interest 152,110 156,383

Total equity 2,304,428 2,426,374

-------------- --------------

Non-current liabilities

Deferred tax liabilities 19-C 324,800 240,333

Provisions 3,479 3,408

Loans and borrowings 13 56,996 67,617

Long-term financial obligations 15 512,235 398,525

Long-term financial liability at fair

value 14 32,168 31,790

Total non-current liabilities 929,678 741,673

-------------- --------------

Current liabilities

Trade and other payables 11 473,515 383,623

Shareholders dividend 454,472 -

Short-term financial obligations 15 84,554 60,517

Short-term financial liability at fair

value 12 585,880 282,267

Loans and borrowings 13 25,946 25,416

Current tax liabilities 276,073 257,540

Total current liabilities 1,900,440 1,009,363

-------------- --------------

Total liabilities 2,830,118 1,751,036

-------------- --------------

Total equity and liabilities 5,134,546 4,177,410

============== ==============

These condensed consolidated interim financial statements were approved

and authorised for issue by the Board of Directors and signed on their

behalf on 1 September 2021 by:

____________________ ________________________________

Dr. Hend El Sherbini Hussein Choucri

Chief Executive Officer Board member of the audit committee

The accompanying notes on pages 26-43 form an integral part of these

condensed consolidated interim financial statements.

Condensed Consolidated Interim Statement of Profit or Loss for

the Three and Six Months Period Ended 30 June 2021

(All amounts in Egyptian

Pounds "EGP'000")

For the three months For the six months period

period ended 30 June ended 30 June

Notes 2021 2020 2021 2020

------

EGP'000 EGP'000 EGP'000 EGP'000

----------------- ------ --------------- ------------------------- --------------- -------------------------

(Reviewed) (Unaudited)/(Unreviewed) (Reviewed) (Unaudited)/(Unreviewed)

Revenue 23 1,163,632 449,931 2,293,170 949,687

Cost of sales (496,742) (246,969) (987,873) (503,490)

Gross profit 666,890 202,962 1,305,297 446,197

Marketing

and advertising

expenses (37,848) (20,677) (66,655) (45,675)

General and

administrative

expenses 17 (105,212) (53,654) (176,132) (103,263)

Impairment

loss on trade

and other

receivable (5,181) (28,281) (10,265) (28,281)

Other income 8,346 17,527 12,431 7,890

Operating

profit 526,995 117,877 1,064,676 276,868

--------------- ------------------------- --------------- -------------------------

Finance income 18 24,975 15,421 45,248 33,765

Finance cost 18 (39,212) (17,167) (74,900) (40,972)

Net finance

cost (14,237) (1,746) (29,652) (7,207)

--------------- ------------------------- --------------- -------------------------

Profit before

tax 512,758 116,131 1,035,024 269,661

=============== ========================= =============== =========================

Income tax

expense 19-B (186,142) (44,003) (366,814) (95,036)

Profit for

the period 326,616 72,128 668,210 174,625

=============== ========================= =============== =========================

Profit

attributed

to:

Equity holders

of the parent 320,410 74,856 646,440 178,768

Non-controlling

interests 6,206 (2,728) 21,770 (4,143)

326,616 72,128 668,210 174,625

=============== ========================= =============== =========================

Earnings per share (expressed

in EGP):

Basic and

diluted

earnings

per share 21

0.53 0.12 1.08 0.30

=============== ========================= =============== =========================

The accompanying notes on pages 26-43 form an integral part of

these condensed consolidated interim financial statements.

Condensed Consolidated Interim Statement of Comprehensive Income

for the Three and Six Month Period Ended 30 June 2021

(All amounts in Egyptian Pounds

"EGP'000")

For the three months For the six months

period ended 30 June period ended 30 June

2021 2020 2021 2020

EGP'000 EGP'000 EGP'000 EGP'000

------------------------ ----------------- ------------------------- ------------- -------------------------

(Reviewed) (Unaudited)/(Unreviewed) (Reviewed) (Unaudited)/(Unreviewed)

Net profit 326,616 72,128 668,210 174,625

Items that may be

reclassified

to profit or loss:

Currency translation

differences (2,062) (6,074) 12,375 (21,790)

Other comprehensive

income

for the period net of

tax (2,062) (6,074) 12,375 (21,790)

----------------- ------------------------- ------------- -------------------------

Total comprehensive

income

for the period 324,554 66,054 680,585 152,835

================= ========================= ============= =========================

Attributed to:

Equity holders of the

parent 320,692 67,080 656,583 165,941

Non-controlling

interests 3,862 (1,026) 24,002 (13,106)

324,554 66,054 680,585 152,835

================= ========================= ============= =========================

The accompanying notes on pages 26-43 form an integral part of these

condensed consolidated interim financial statements.

Condensed Consolidated Interim Statement of Change in Equity for

the Six Month Period Ended 30 June 2021

Attributable to owners of the Parent

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Share Total attributable

(All amounts in Egyptian Share premium Capital Legal Put option Translation Retained to the owners Non-controlling Total

Pounds "EGP'000") capital reserve reserve reserve* reserve reserve earnings of the Parent interests equity

------------------------- --------- --------- ------------------- ---------------- -------------------- ------------------- -------------------- --------------------- ------------------ ----------------------

At 1 January 2021 1,072,500 1,027,706 (314,310) 49,218 (314,057) 145,617 603,317 2,269,991 156,383 2,426,374

--------- --------- ------------------- ---------------- -------------------- ------------------- -------------------- --------------------- ------------------ ----------------------

Profit for the period - - - - - - 646,440 646,440 21,770 668,210

Other comprehensive

income for the period - - - - - 10,143 - 10,143 2,232 12,375

Total comprehensive

income - - - - - 10,143 646,440 656,583 24,002 680,585

--------- --------- ------------------- ---------------- -------------------- ------------------- -------------------- --------------------- ------------------ ----------------------

Transactions with owners

of the Company

Contributions and

distributions

Dividends - - - - - - (454,472) (454,472) (21,998) (476,470)

Legal reserve formed

during the period - - - 2,423 - - (2,423) - - -

Movement in put option

liability - - - - (303,990) - - (303,990) - (303,990)

Restatement for impact

of hyperinflation - - - - - - (15,794) (15,794) (6,277) (22,071)

Total contributions

and distributions - - - 2,423 (303,990) - (472,689) (774,256) (28,275) (802,531)

--------- --------- ------------------- ---------------- -------------------- ------------------- -------------------- --------------------- ------------------ ----------------------

Balance at 30 June 2021

(Reviewed) 1,072,500 1,027,706 (314,310) 51,641 (618,047) 155,760 777,068 2,152,318 152,110 2,304,428

========= ========= =================== ================ ==================== =================== ==================== ===================== ================== ======================

At 1 January 2020 1,072,500 1,027,706 (314,310) 46,330 (229,163) 155,823 456,661 2,215,547 144,710 2,360,257

--------- --------- ------------------- ---------------- -------------------- ------------------- -------------------- --------------------- ------------------ ----------------------

Profit for the period - - - - - - 178,768 178,768 (4,143) 174,625

Other comprehensive

loss for the period - - - - - (12,827) - (12,827) (8,963) (21,790)

Total comprehensive

income - - - - - (12,827) 178,768 165,941 (13,106) 152,835

--------- --------- ------------------- ---------------- -------------------- ------------------- -------------------- --------------------- ------------------ ----------------------

Transactions with owners

of the Company

Contributions and

distributions

Legal reserve formed

during the period - - - 575 - - (575) - - -

Movement in put option

liability - - - - 19,348 - - 19,348 - 19,348

Restatement for impact

of hyperinflation - - - - - - (2,064) (2,064) 790 (1,274)

Non-controlling interest

cash injection in

subsidiaries during

the period - - - - - - - - 17,372 17,372

Total contributions

and distributions - - - 575 19,348 - (2,639) 17,284 18,162 35,446

--------- --------- ------------------- ---------------- -------------------- ------------------- -------------------- --------------------- ------------------ ----------------------

Balance at 30 June 2020

(Unaudited)/(Unreviewed) 1,072,500 1,027,706 (314,310) 46,905 (209,815) 142,996 632,790 2,398,772 149,766 2,548,538

========= ========= =================== ================ ==================== =================== ==================== ===================== ================== ======================

*Under Egyptian Law, each subsidiary in Egypt must set aside at

least 5% of its annual net profit into a legal reserve until such

time that this represents 50% of each subsidiary's issued capital.

This reserve is not distributable to the owners of the Company.

The accompanying notes on pages 26-43 form an integral part of

these condensed consolidate interim financial statements.

Condensed Consolidated Interim Statement of Cash Flow For the

Six Month Period Ended 30 June 2021

(All amounts in Egyptian Pounds 30 June

"EGP'000") Note 2021 30 June 2020

EGP'000 EGP'000

(Reviewed) (Unaudited)/(Unreviewed)

Cash flows from operating activities

Profit for the period before tax 1,035,024 269,661

Adjustments - -

Depreciation, property, plant

and equipment and right of use 105,745 87,814

Amortization 3,049 2,672

Gain on disposal of Property,

plant and equipment (45) (65)

Impairment in trade receivables 10,265 28,281

Interest expense 18 49,011 36,685

Interest income 18 (45,248) (33,765)

Equity settled shares financial

investments (678) (3,464)

ROU Asset/Lease Termination (464) -

Loss in hyperinflationary net

monetary position 18 1,204 (192)

Unrealised foreign currency exchange

loss 18 19,321 4,479

Net cash from operating activities

before changes in working capital 1,177,184 392,106

Change in Provisions 72 (851)

Change in inventory (41,444) (35,273)

Change in trade and other receivables (103,537) 34,429

Change in trade and other payables 74,710 (77,723)

Cash generated from operating

activities before income tax payment 1,106,985 312,688

------------------------- ---------------------------

Income tax paid during period (240,624) (163,571)

Net cash from operating activities 866,361 149,117

------------------------- ---------------------------

Cash flows from investing activities

Interest received 44,866 33,606

Decrease in restricted cash - 247

Payments for the purchase of short

term investments (309,835) (251,956)

Proceeds for the sale of short

term investments 257,404 221,617

Acquisition of Property, plant

and equipment 4 (86,530) (58,600)

Acquisition of intangible assets 5 (1,104) (1,770)

Proceeds from sale of Property,

plant and equipment 3,036 193

Net cash flows used in investing

activities (92,163) (56,663)

------------------------- ---------------------------

Cash flows from financing activities

Proceeds from borrowings 2,617 -

Repayments of borrowings (12,708) (5,612)

Interest paid (48,640) (35,743)

Dividends paid (21,998) -

Payment of finance lease liabilities (32,401) (43,869)

Injection of cash by non controlling

interest - 17,372

Net cash flows used in financing

activities (113,130) (67,852)

------------------------- ---------------------------

Net increase in cash and cash

equivalent 661,068 24,602

Cash and cash equivalent at the

beginning of the period 600,130 408,892

Effect of exchange rate fluctuations

on cash held (3,215) 33,935

Cash and cash equivalent at the

end of the period 10 1,257,983 467,429

========================= ===========================

The accompanying notes on pages 26-43 form an integral part of