International Public Partnerships Financial Close on Rampion OFTO (4564S)

16 Noviembre 2021 - 1:00AM

UK Regulatory

TIDMINPP

RNS Number : 4564S

International Public Partnerships

16 November 2021

INPP reaches financial close on RAMPION Offshore Transmission

Project

16 November 2021

International Public Partnerships Limited, the listed

infrastructure investment company ('the Company', 'INPP') has

announced that Transmission Capital Partners, the consortium

comprising INPP, Amber Infrastructure Group and Transmission

Investment ('the Consortium'), has successfully reached financial

close for the long-term ownership and operation of the transmission

link to the 400MW Rampion offshore wind farm (the 'OFTO').

The project will be the Company's nineth OFTO investment and

relates to the transmission cable connection to the offshore wind

farm located approximately 13km off the Sussex coast. The wind farm

consists of 116 x 3.45MW wind turbine generators connected to an

offshore substation platform ('OSP') located within the boundaries

of the Rampion wind farm.

This investment will increase the Company's contribution to the

UK's transition to a zero-carbon economy. The Rampion OFTO has the

ability to transmit green electricity equivalent to around 350,000

UK homes, increasing the number of homes that could be powered via

the Company's OFTO portfolio to approximately 2.1 million

homes.

The Company takes no exposure to electricity production or price

risk but is paid a pre-agreed, availability-based revenue stream

over 20 years which is fully linked to UK inflation ('RPI').

The Company will make a c.GBP35 million investment for 100% of

the equity and subordinated debt in TC Rampion OFTO Ltd. Project

level senior debt will be provided by a group of banks to match the

maturity of the OFTO revenue period such that there is no

refinancing risk.

Other key investment highlights include:

-- An operational and immediately yielding asset with no construction or refinancing risk;

-- INPP will benefit from a 20-year availability-based revenue

stream with protected downside whereby maximum potential deductions

will be capped at 10% of base revenue in any year;

-- The operations and maintenance of the OFTO assets will be

subcontracted to a set of specialist contractors incentivised to

maximise availability of the transmission assets;

-- The returns generated from the Company's investment are

highly correlated to UK RPI and are not subject to any revenue or

penalty exposure to windfarm performance; and

-- Revenues are contracted by a subsidiary of National Grid, the

National Grid Electricity System Operator (NGESO rated Baa1

Moody's) in their statutory ring-fenced role as electricity systems

operator ('ESO').

The investment has been funded through the Company's GBP250

million revolving credit facility, which following the Rampion OFTO

investment, will be GBP108 million net drawn. The Company notes

that it is also preferred bidder on East Anglia One OFTO, with a

committed investment of c.GBP90 million.

Mike Gerrard, Chair of International Public Partnerships said:

"We are proud to report that our portfolio of OFTO investments,

following the completion of our nineth OFTO, helps provide over two

million UK households with clean energy helping the UK achieve net

zero. In addition, the long-term, inflation-linked revenue that

these investments deliver is consistent with the Company's

investment objectives and demonstrates its ability to continue

originating a strong pipeline of investment."

A copy of the Ofgem press release can be found at

https://www.ofgem.gov.uk/news-media/latest-news-press-releases

.

ENDS.

For further information:

Erica Sibree/Amy Edwards +44 (0)20 7939 0558/0587

Amber Fund Management Limited

Hugh Jonathan +44 (0)20 7260 1263

Numis Securities

Ed Berry/Mitch Barltrop +44 (0) 20 3727 1046/1039

FTI Consulting

About International Public Partnerships (INPP):

INPP is a listed infrastructure investment company that invests

in global public infrastructure projects and businesses, which

meets societal and environmental needs, both now, and into the

future.

INPP is a responsible, long-term investor in over 130

infrastructure projects and businesses. The portfolio consists of

utility and transmission, transport, education, health, justice and

digital infrastructure projects and businesses, in the UK, Europe,

Australia and North America. INPP seeks to provide its shareholders

with both a long-term yield and capital growth.

Amber Infrastructure Group ('Amber') is the Investment Adviser

to INPP and consists of over 150 staff who are responsible for the

management of, advice on and origination of infrastructure

investments.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRGPGUUGUPGPGA

(END) Dow Jones Newswires

November 16, 2021 02:00 ET (07:00 GMT)

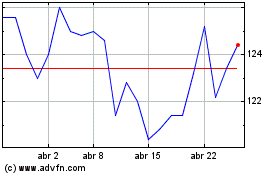

International Public Par... (LSE:INPP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

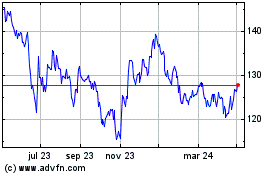

International Public Par... (LSE:INPP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024