TIDMIES

RNS Number : 1385N

Invinity Energy Systems PLC

28 September 2021

This announcement contains inside information

28 September 2021

Invinity Energy Systems plc

("Invinity" or the "Company" or the "Group")

Interim Results

Invinity Energy Systems plc (AIM:IES), leading global

manufacturer of vanadium flow batteries, is pleased to announce its

unaudited consolidated results for the six months ended 30 June

2021 (the "Period").

Invinity's management team will host a virtual results

presentation and interactive Q&A for shareholders on Thursday

30 September at 5 pm (UK Time). To register to join the session,

please do so via the registration page. Please note the deadline

for registration is 23:59 (UK Time) on Wednesday 29 September.

HIGHLIGHTS

Financial

-- Operating loss of GBP8.8m (H1 2020 GBP5.0m)

-- Inventory build-up of GBP8.6m (H1 2020 GBP0.1m)

-- Cash at 30 June 2021 GBP10.9m (H1 2020 GBP4.5m)

-- Loans and borrowings GBPnil (H1 2020 GBP0.9m)

Operational

The Period saw successful deployment of capital raised in

December 2020 to scale up Invinity's manufacturing and

organisational capabilities and progress with the delivery of key

strategic projects. Highlights include:

-- Expansion of Invinity's global manufacturing capabilities leading to a 100% increase in capacity.

-- Despite ongoing global supply chain disruption, significant progress toward the delivery of more than 16MWh of

key projects including:

o 5MWh Energy Superhub Oxford project - currently in commissioning

phase and scheduled for completion in Q4 2021. First stage

of commissioning expected to complete within weeks.

o 0.8MWh Scottish Water project - currently in delivery phase,

shipping expected to commence in early Q4 2021.

o 1.8MWh Flow + Hydrogen + Tidal project, Orkney Islands

- manufacturing phase nearing completion, delivery scheduled

to commence during Q4 2021.

o 8MWh Yadlamalka Energy solar-plus-storage power plant,

South Australia - manufacturing nearing completion, shipping

to site scheduled to commence later in Q4 2021. Delivery

remains contingent on the customer's receipt of local construction

approvals, which management have recently learned may require

more time. Due to this delay, Invinity anticipates that

the site may not be ready to receive delivery of product

until early 2022. Further updates in respect of this project's

timeline will be provided in due course.

o Various other projects for delivery across the USA and

Asia totalling 1.5MWh are in the final stages of manufacturing

with delivery expected to take place during Q4 2021 and

early 2022.

Commercial

Further to figures presented in the Group's 2020 Annual Report,

the Group's latest commercial opportunity pipeline as at 14

September 2021 is summarised below.

Base Upside Pipeline

--------------------------- -------- -------- ---------

14 September 2021 18.8 MWh 38.4 MWh 262.6 MWh

17 May 2021 (FY2020) 10.1 MWh 30.8 MWh 232.0 MWh

23 September 2020 (HY2020) 13.7 MWh 36.4 MWh 68.9 MWh

Year-on-Year Change +37% +5% +281%

--------------------------- -------- -------- -----------

Movements in the commercial opportunity pipeline primarily

reflect a significant increase in both the number and average size

of prospective projects that have been qualified by Invinity's

Commercial team over the course of 2021, driven in large part by

significantly increased inbound interest in the Group's products

and solutions. The number of opportunities categorised as either

"Upside" or "Base" has increased 40% since May 2021, whilst early

stage "pipeline" interest has continued to grow steadily, up 13%

over the same period.

Invinity remains encouraged by the volume of opportunities that

have progressed from "Pipeline", representing opportunities that

have met certain qualification thresholds, to the "Upside"

(expected to enter contracting in the near term) and "Base" (in

contracting) categorisations which include deals with significant

commercial traction and a high degree of certainty of near-term

close.

Key contracts closed during the Period included the 0.5 MWh sale

in California to Indian Energy LLC for a project supported by the

California Energy Commission announced on 17 May 2021. Cash

receipts for milestone payments during the Period totalled

GBP3.2m.

Further information is provided in the commercial update section

below.

Outlook

The global need for large-scale energy storage has become

clearer and more compelling since Invinity's last report, while

concerns about lithium-based systems are increasing, creating a

large market opportunity for a utility-grade alternative to lithium

storage. The Group is focused on establishing its position as the

leading provider of that alternative by developing and delivering

the Invinity VS3, our factory-built flow battery product.

Overcoming obstacles and delays, the Group has doubled its

manufacturing capacity, increased its product and project delivery

capabilities, instituted quality systems and scalable processes,

and advanced toward completion of signed projects.

Perhaps most significantly, the Group has entered into a Joint

Development and Commercialisation Agreement with Gamesa Electric

and Siemens Gamesa Renewable Energy to co-develop a next-generation

vanadium flow battery able to address projects at utility scale.

The gated development process is proceeding with the achievement of

the first milestone anticipated before the end of the year.

Finally, the Group has been progressing a number of sales

contracts, completion of which, management expect to be able to

announce soon.

Larry Zulch, Chief Executive Officer at Invinity said:

"We spent the Period building Invinity's ability to address the

global opportunities for non-lithium energy storage now and for

years to come. This vital 'behind the scenes' work is paying off as

we establish Invinity as foremost in providing a factory-built flow

battery product, progressing to our goal of being the global leader

in utility-grade energy storage. Our VS3 is finally shipping as a

standardized product into multiple projects, marking a highly

significant inflection point for the Group. I couldn't be more

pleased at the progress we've made, the size of the opportunity in

front of us, and our ability to address it."

Enquiries :

+44 (0)204 551

Invinity Energy Systems plc 0361

Larry Zulch, Chief Executive Officer

Peter Dixon-Clarke, Chief Financial Officer

Joe Worthington, Director of Communications

Canaccord Genuity (Nominated Adviser and Joint +44 (0) 20 7523

Broker) 8000

Henry Fitzgerald-O'Connor / James Asensio

VSA Capital (Financial Adviser and Joint Broker) +44 (0)20 3005

Andrew Monk / Simon Barton 5000

Hudson Sandler (Financial PR) +44(0) 207 796

Nick Lyon / Nick Moore 4133

STRATEGY UPDATE

During the first six months of 2021, the Group made tremendous

advances in its strategic goal of becoming the first battery

manufacturer to offer a truly viable alternative to existing

lithium-ion stationary energy storage systems. This strategy relies

on delivering a modular, value engineered, factory-built product -

not a prototype, one-off, custom installation, or experiment - and

doing so efficiently and in volume.

It is only when combined with energy storage that wind and solar

become a dispatchable asset rather than a periodic, and sometimes

unreliable, contributor to global energy needs. As wind and solar

take their proper place in the energy infrastructure, they must be

matched with utility-grade energy storage. Until Invinity unveiled

what we believe to be the industry's first flow battery delivered

as a turn-key, factory-built product, battery energy storage with

the following four primary characteristics was not available:

1) Safe. Utility grade storage must not pose a persistent fire

risk. Invinity's VS3 stores energy in an aqueous electrolyte which

simply cannot catch fire. Our products are designed with a "safety

in depth" philosophy.

2) Long life. Utility grade energy storage should last as long

as the renewable energy products it supports, which is generally 25

years for wind and solar products. The VS3 is designed to have a

25-year lifetime with no limitations on cycling.

3) Economical. The cost per unit of energy stored and discharged

must be lower than the alternatives. Based on research, the costs

per megawatt hour (MWh) of the Invinity VS3 are anticipated to be

less than lithium-ion systems over the lifetime of the battery.

4) Proven. Utility-grade energy storage must be proven in

operation in the field. Invinity has over 25 MWh installed or in

committed projects. We expect this "proven" quality to be

demonstrated upon the imminent completion of Energy Superhub

Oxford, the first of a number of projects the Group will complete

in 2021.

We don't believe any energy storage battery product without all

four of these characteristics can accurately call itself utility

grade. In this ability, Invinity stands alone.

Certainly, the timing is right to make utility-grade energy

storage available to the global market. In many of today's largest

energy markets, renewable penetration is currently constrained by

the inability to use all the energy produced when the wind is

blowing and the sun is shining, coupled with shortages when they

are not. The UK, for example, will require a three-fold increase

(an additional 200 GWh) to its grid capacity alone by 2050 to meet

its renewable targets. Utility grade energy storage is expected to

deliver a large proportion of this.

The amount of lithium needed to support the electrification of

transport will impact global supplies, reducing its availability

for the stationary storage applications where it would be in direct

competition with our flow batteries. Finally, increasing scepticism

about so-called "Blue Hydrogen" has propelled interest in "Green

Hydrogen" made from renewable energy, which requires energy storage

to provide a consistent electrical supply to the electrolysers as

demonstrated by the Group's announced project with EMEC, the

European Marine Energy Centre, which uses tidal power, smoothed by

our vanadium flow battery, to create Green Hydrogen.

Preparing the Group to properly meet this global opportunity for

stationary energy storage has been management's primary focus.

Overseen by a team with exceptional experience in flow batteries

and energy storage, the Group has deployed capital raised in

December 2020 to add employees in product development, project

management, quality systems, supply chain, manufacturing

operations, customer solutions, logistics, and more. We have

instituted systems, processes, and procedures to support the

GroupÕs ability to scale including progress toward ISO

certification. Plus we have efficiently built product now held as

inventory which will imminently convert to revenue.

The Group has been addressing ever-larger commercial

opportunities, progressing from hundreds of kilowatt hours (kWh) to

multiple megawatt hours (MWh). But to properly meet future global

demand for energy storage alternatives to lithium systems, the

Group must be able to address requirements measured in 100s of MWh

and even in gigawatt-hours (GWh).

Projects of this size are the goal of the Group's recently

announced Joint Development and Commercialisation Agreement (JDCA)

with Gamesa Electric and Siemens Gamesa Renewable Energy, leaders

in grid-scale power systems and wind turbines. Together, Invinity

and Gamesa Electric are developing the next generation of vanadium

flow batteries with an unprecedented ability to scale to meet the

largest, most significant requirements in the transition to a

renewable energy future. The joint development process progresses

as a sequence of defined milestones, the achievement of the first

of which is expected by the end of 2021. The Group has devoted

considerable resources to this effort and anticipates this

commitment to continue for the two years of joint product

development and the many years thereafter of joint

commercialisation.

The Group's efforts toward building a robust product and a

scalable organization will see its first external expression in

Energy Superhub Oxford and other projects the Group will deliver in

2021. Like many companies over the past 18 months, we have had to

overcome significant obstacles in completing and delivering our VS3

product. While the well-publicised global chip shortage, supply

chain disruptions, shipping issues, and component delivery delays

have put all our projects behind their original schedules, the

Invinity team has persevered and solved the issues, emerging

stronger and more confident than ever.

Everyone at Invinity is focused on realising the objective of

being the flow battery leader. Indeed, we believe we are at the

forefront of providing an alternative to lithium systems for

stationary battery storage, we are deploying a compelling product,

our market potential is of a very significant magnitude, our team

is experienced and dedicated, and we enjoy the support of our

shareholders and investors. We can't wait to show you what's

next.

COMMERCIAL UPDATE

2021 has been a year when energy shortages and grid disruptions,

from Texas to the UK, have repeatedly been front-page news.

Universally one of the best responses to instability is to build

resilience, meaning the addition of assets to the grid that can

overcome supply shortages and extreme weather. This has generated

significant discussion in our industry on the technical solutions

and business models that can be deployed in response. Few mature

energy storage solutions can deliver the same resilience and

flexibility to the electric grid as Invinity's safe, robust and

economical vanadium flow batteries.

As our market presence matures, Invinity is seeing an

ever-larger number of industry players adopt exactly this view. In

the days following the recent "thermal event" at a major battery

project in Southern California, for example, we saw a tremendous

increase in the number of enquiries seeking to understand how

Invinity's VFBs can provide an alternative long-duration,

high-throughput utility-grade energy storage solution with

significantly lower risk.

This growing awareness that our VFBs deliver capabilities above

and beyond those of other storage technologies in some of the

toughest, heaviest-duty applications is one of the major reasons

our commercial pipeline continues to grow. And while we continue to

have a healthy group of opportunities which we categorise as "Base"

(in contracting) and "Upside" (expected to enter contracting in the

near term), our customers, their engineers and constructors, and

the professionals who support them continue to manage the

disruptions of the last year, slowing the completion of new

contracts.

Nevertheless, we remain very positive about the opportunities in

the nearer categories of our pipeline and expect that several will

close before the end of 2021. There are some very exciting events

to come: As stimulus bills focused on infrastructure in the U.S.

and elsewhere become written into law, and as our lawmakers

themselves gather for COP26 a stone's throw away from Invinity's

newly expanded manufacturing facility in Bathgate Scotland, we

expect the impetus for existing and new customers to contract for

and to construct breakthrough storage solutions using Invinity's

VFBs will only accelerate.

Against that backdrop, our commercial opportunities as at 14

September are as follows:

Base Upside Pipeline

--------------------------- -------- -------- ---------

14 September 2021 18.8 MWh 38.4 MWh 262.6 MWh

17 May 2021 (FY2020) 10.1 MWh 30.8 MWh 232.0 MWh

23 September 2020 (HY2020) 13.7 MWh 36.4 MWh 68.9 MWh

Year-on-Year Change +37% +5% +281%

--------------------------- -------- -------- ---------

As we reported in our 2020 Annual Report, we continue to see an

increase in the average size of the opportunities in our commercial

pipeline, with the average opportunity value 17% higher than in May

2021. As noted at that time, those larger opportunities tend to

introduce complexities that present longer time horizons to close.

We are at the early stages of development of even larger and truly

exciting opportunities. As Invinity advances our VFBs to fulfil

their promise as the first batteries that are utility-grade at

utility-scale, we expect these enormous opportunities to become the

focus of our future efforts.

FINANCIAL REPORT

The six-months under review have been characterised by scaling

up manufacturing capability and expanding the business to service

the current and growing future demand for our product. To this end,

GBP11.2m of cash (GBP15.9m gross of receipts) was deployed in the

Period. Of this GBP15.9m, notably GBP8.6m was used to build the

inventory needed to deliver on our contracts and a further GBP3.9m

to continue building the leading team in our sector.

Income statement & balance sheet

The result for the six-month period was a loss of GBP8.8m

(against GBP5.0m loss for the comparative period and GBP24.3m loss

for the prior year).

With revenue on closed contracts not being booked until

commencement of delivery in the second half of this year, the

primary drivers of the result were administrative expenses of

GBP5.9m (H1 2020: GBP4.0m) and other items of GBP1.9m (H1 2020:

GBP1.0m). As ongoing product research and development is not

typically capitalised, it is included within administrative

expenses under the GroupÕs accounting policies.

Other items of GBP1.9m relates primarily to an increase in the

provision for onerous contracts, which is mainly due to global cost

increases in the supply chain being experienced by all

manufacturers over the last twelve-months, particularly for

shipping from China, which, for example, increased six-fold from

approximately $3,700 to $21,000 per 40-foot container from China to

Europe.

As planned, we have been deploying cash to deliver on contracts

and build our ongoing capabilities. The main balance sheet

movements have therefore been the GBP8.6m build of completed and

in-process Inventory, a GBP3.0m increase in contract liabilities

representing milestone payments on closed contacts received before

revenue can be recognised for accounting, and the GBP11.2m use of

funds (see table below).

Current terms of trade and the need for early orders for

long-lead items mean that inventory payments are initially recorded

as prepayments within other current assets until the goods or

services are transferred to the Group, at which point they are

classified as inventory until transferred to the customer. At the

Period end, GBP4.6m of inventory related payments were classified

as prepayments and GBP5.5m as inventory, before allocated contract

losses.

Use of funds

A summary of the payments and receipts during the six-month

period is as follows:

Payments and receipts GBP'm

--------------------------------------------- ------

Inventory (including ESO & Yadlamalka) 8.6

Property, plant and equipment 0.6

Product related expenditure (including R&D) 0.8

Payroll 3.9

Other 2.0

--------------------------------------------- ------

15.9

Receipts (4.7)

--------------------------------------------- ------

11.2

--------------------------------------------- ------

Payroll primarily reflects the investment in human resource

within the Group to support growth targets with employee headcount

increasing from 103 at the start of the Period to 132 at the end.

The increased headcount has allowed for the creation of a specific

Customer Operations department and all but one of the new hires

across the Group are product facing, as set out below:

Headcount 1 January 30 June

2021 2021

------------------------------------ ---------- ----------------

Operations 20 48

Commercial 17 17

Product development & technology 19 27

Solutions engineering and customer

operations 14 26

Other 13 14

------------------------------------ ---------- ----------------

103 132

------------------------------------ ---------- ----------------

Receipts include GBP1.0m from the exercise of warrants under the

Riverfort facility and GBP0.5m of UK Government grants. The GBP3.2m

balance relates to milestone payments on closed contracts.

Going concern

The Group is debt free and had cash balances of GBP10.9m and

GBP6.1m at the end of June 2021 and August 2021 respectively. It

has closed contracts to the value of approximately GBP13.5m, of

which GBP5.7m had been received by the end of June 2021 with most

of the GBP7.8m balance expected by the end of June 2022. Most of

the inventory payments required to deliver those contracts have

already been made.

The Group has a growing pipeline of future sales (see above)

with 57.2MWh of potential new contracts in Base and Upside and a

further 262.6 MWh in Pipeline. This continued increase has largely

been driven by the rapidly improving macro environment, both in

terms of total addressable market and active and growing government

support in its key markets.

The Group continually reviews its funding position and the

funding options that are available to it. Based on this ongoing

review and subject to the near-term rate of customer deliveries and

new closed contracts, the Group expects to require additional

finance within the next six months, assuming the continued rate of

growth. The expectation is that additional finance will be

available from both equity and non-equity sources or a combination

of the two.

Having taken all of the above factors into account, the

directors continue to believe it is appropriate to prepare these

financial statements on a going concern basis, noting the material

uncertainty arising from the need to secure additional funding

within the coming months.

Financial outlook

The outlook for the Group remains positive both at a Group level

and a macro level.

At the Group level, a further GBP7.8m of receipts are expected

on closed contracts and revenue for most of those contracts is

expected to be recognised in the second half of this year. Site

delays (see above) at Yadlamalka mean that the revenue, of about

GBP6.7m, is unlikely to be recognised on that contract until

2022.

At a macro level, the growing imperative for a utility grade

alternative to lithium places the Group in exactly the right place

to take full advantage both in the near term and beyond.

Unaudited, consolidated statement of comprehensive loss

For the six months ended 30 June 2021

Restated

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Continuing operations Note GBP'000 GBP'000 GBP'000

--------------------------------------------- ----- ----------- ------------ -------------

Revenue 3 15 67 406

Cost of sales 5 (756) (91) (1,221)

--------------------------------------------- ----- ----------- ------------ -------------

Gross loss (741) (24) (815)

Operating costs

Administrative expenses 6 (5,852) (3,848) (9,593)

Other items of operating income and

expense 7 (1,856) (1,047) (9,822)

--------------------------------------------- ----- ----------- ------------ -------------

Loss from operations (8,449) (4,919) (20,230)

Finance income - 1 1

Finance costs (17) (67) (2,298)

Loss on foreign currency transactions (343) (42) (1,744)

--------------------------------------------- ----- ----------- ------------ -------------

Net finance costs (360) (108) (4,041)

--------------------------------------------- ----- ----------- ------------ -------------

Loss before income tax (8,809) (5,027) (24,271)

Income tax expense - (1) -

--------------------------------------------- ----- ----------- ------------ -------------

Loss from continuing operations (8,809) (5,028) (24,271)

Loss for the year (8,809) (5,028) (24,271)

Other comprehensive loss

Items that may subsequently be reclassified

to profit or loss:

Exchange difference on the translation

of foreign operations 26 1,094 (2,162)

--------------------------------------------- ----- ----------- ------------ -------------

Total comprehensive loss for the year (8,783) (3,934) (26,433)

--------------------------------------------- ----- ----------- ------------ -------------

Basic loss per share in pence

From continuing operations 8 (10.1) (8.9) (44.3)

------------------------------- ---- ----------- ---------- -------

Diluted loss per share in pence

From continuing operations 8 (9.58) (8.9) (44.3)

--------------------------------- ---- --------- --------- -------

The above unaudited consolidated statement of comprehensive loss

should be read in conjunction with the accompanying notes.

Unaudited, consolidated statement of financial position

At 30 June 2021

Restated

30 June 30 June 31 December

2021 2020 2020

Note GBP'000 GBP'000 GBP'000

-------------------------------------- ------ ---------- ---------- ------------

Non-current assets

Property, plant and equipment 11 1,194 683 695

Right-of-use assets 967 881 1,014

Goodwill and other intangible assets 10 23,868 35,113 24,127

-------------------------------------- ------ ---------- ---------- ------------

Total non-current assets 26,029 36,677 25,836

Current assets

Inventories 15 3,379 689 905

Other current assets 13 6,965 1,201 1,414

Contract assets 4 2 - 5

Trade receivables 4,12 173 42 33

Cash and cash equivalents 14 10,942 4,503 21,953

-------------------------------------- ------ ---------- ---------- ------------

Total current assets 21,461 6,435 24,310

-------------------------------------- ------ ---------- ---------- ------------

Total assets 47,490 43,112 50,146

-------------------------------------- ------ ---------- ---------- ------------

Current liabilities

Trade and other payables 16 (3,340) (1,813) (2,468)

Contract liabilities 4 (5,656) (970) (2,644)

Lease liabilities (240) (167) (161)

Provisions 4 (2,462) (748) (1,927)

-------------------------------------- ------ ---------- ---------- ------------

Total current liabilities (11,698) (3,698) (7,200)

Net current assets 9,763 2,737 17,110

Non-current liabilities

Lease liabilities (514) (689) (595)

-------------------------------------- ------ ---------- ---------- ------------

Total non-current liabilities (514) (689) (595)

-------------------------------------- ------ ---------- ---------- ------------

Total liabilities (12,212) (4,387) (7,795)

-------------------------------------- ------ ---------- ---------- ------------

Net assets 35,278 38,725 42,351

-------------------------------------- ------ ---------- ---------- ------------

Share capital and share premium 163,399 138,544 162,415

Share based payment reserve 4,541 2,969 3,762

Accumulated losses (130,994) (102,942) (122,185)

Other reserves (1,668) 154 (1,641)

-------------------------------------- ------ ---------- ---------- ------------

Total equity 35,278 38,725 42,351

-------------------------------------- ------ ---------- ---------- ------------

The above unaudited consolidated statement of financial position

should be read in conjunction with the accompanying notes.

Unaudited consolidated statement of changes in equity

For the six months ended 30 June 2021

Share

capital Share-based

and share payment Accumulated Translation Other

premium reserve losses reserve reserves Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ----------- ------------ ------------ ------------- -------------- ------------

At 1 January 2021 162,415 3,762 (122,185) (1,680) 39 42,351

------------------------------ ----------- ------------ ------------ ------------- -------------- ------------

Total comprehensive

loss for the year - - (8,811) - - (8,811)

Other comprehensive

loss

Foreign currency translation

differences - - - (26) - (26)

------------------------------ ----------- ------------ ------------ ------------- -------------- ------------

Total comprehensive

loss for the year - (8,811) (26) (8,837)

Transaction with owners

in their capacity as

owners

Contribution of equity,

net of transaction

costs 975 - - - - 975

Exercise of share options 9 17 - - - 26

Share based payments - 762 - - - 762

------------------------------ ----------- ------------ ------------ ------------- -------------- ------------

Total contributions

by and distributions

to owners 984 779 - - - 1,763

------------------------------ ----------- ------------ ------------ ------------- -------------- ------------

At 30 June 2021 163,399 4,541 (130,996) (1,706) 39 35,277

------------------------------ ----------- ------------ ------------ ------------- -------------- ------------

Share

capital

and Share-based

share payment Accumulated Translation Other

premium reserve losses reserve reserves Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ --------- ------------ ------------ ------------ ---------- ---------

At 1 January 2020 109,192 2,250 (97,914) 482 (1,422) 12,588

------------------------------ --------- ------------ ------------ ------------ ---------- ---------

Total comprehensive

loss for the year - - (5,028) - - (5,028)

Other comprehensive

loss

Foreign currency translation

differences - - - 1,094 1,094

------------------------------ --------- ------------ ------------ ------------ ---------- ---------

Total comprehensive

loss for the year - - (5,028) 1,094 (3,934)

Transaction with owners

in their capacity as

owners

Contribution of equity,

net of transaction

costs 29,352 - - - - 29,352

Share based payments - 719 - - - 719

------------------------------ --------- ------------ ------------ ------------ ---------- ---------

Total contributions

by and distributions

to owners 29,352 719 - - - 30,071

------------------------------ --------- ------------ ------------ ------------ ---------- ---------

At 30 June 2020 138,544 2,969 (102,942) 1,576 (1,422) 38,725

------------------------------ --------- ------------ ------------ ------------ ---------- ---------

Share

capital Share-based

and share payment Accumulated Translation Other

premium reserve losses reserve reserves Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ----------- ------------ ------------- ---------------- ---------- ---------------

At 1 January 2020 109,192 2,250 (97,914) 482 (1,422) 12,588

----------------------------- ----------- ------------ ------------- ---------------- ---------- ---------------

Total comprehensive

loss for the year - - (24,271) - - (24,271)

Other comprehensive

loss

Foreign currency translation

differences - - - (2,162) - (2,162)

----------------------------- ----------- ------------ ------------- ---------------- ---------- ---------------

Total comprehensive

loss for the year - (24,271) (2,162) (26,433)

Transaction with owners

in their capacity

as owners

Contribution of equity,

net of transaction

costs 31,734 - - - - 31,734

Issue of ordinary

shares as consideration

for a business combination,

net of transaction

costs 21,403 - - - - 21,403

Exercise of share

options 86 - - - - 86

Fair value realisation

on note conversion - - - - 1,461 1,461

Share based payments - 1,512 - - - 1,512

----------------------------- ----------- ------------ ------------- ---------------- ---------- ---------------

Total contributions

by and distributions

to owners 53,223 1,512 - - 1,461 56,196

----------------------------- ----------- ------------ ------------- ---------------- ---------- ---------------

At 31 December 2020 162,415 3,762 (122,185) (1,680) 39 42,351

----------------------------- ----------- ------------ ------------- ---------------- ---------- ---------------

The above consolidated statement of changes in equity should be

read in conjunction with the accompanying notes.

Consolidated statement of cashflows

For the six months ended 30 June 2021

Restated

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Note GBP'000 GBP'000 GBP'000

--------------------------------------------- ----- ----------- ------------ -------------

Cashflows from operating activities

Cash used in operations 9 (11,497) (6,032) (10,885)

Interest received - - 1

Interest paid (1) (2) (32)

Income taxes paid - (1) -

--------------------------------------------- ----- ----------- ------------ -------------

Net cash outflows from operating activities (11,498) (6,035) (10,916)

--------------------------------------------- ----- ----------- ------------ -------------

Cashflows from investing activities

Acquisition of property plant and equipment 11 (609) (202) (349)

Acquisition of intangible assets 10 (19) - (9)

Net cash outflows from investing activities (628) (202) (358)

--------------------------------------------- ----- ----------- ------------ -------------

Cashflows from financing activities

Payment of lease liabilities (17) (82) (163)

Proceeds from the exercise of share

warrants 975 - -

Proceeds from the issue of share capital,

net of transaction costs - 7,350 28,915

Proceeds from the issuance of convertible

notes, net of transaction costs - - 1,944

Proceeds from borrowings - 862 -

Acquisition of cash through business

combination - 1,279 1,264

Proceeds from the exercise of share

options 1 - 37

--------------------------------------------- ----- ----------- ------------ -------------

Net cash inflows from financing activities 959 9,409 31,997

--------------------------------------------- ----- ----------- ------------ -------------

Net (decrease)/increase in cash and

cash equivalents (11,167) 3,172 20,723

Cash and cash equivalents at the beginning

of the year 21,953 1,243 1,243

Effects of exchange rate changes on

cash and cash equivalents 156 88 (13)

--------------------------------------------- ----- ----------- ------------ -------------

Cash and cash equivalents at the end

of the year 10,942 4,503 21,953

--------------------------------------------- ----- ----------- ------------ -------------

The above statement of consolidated cashflows should be read in

conjunction with the accompanying notes.

Notes

(forming part of the of the consolidated historical financial

information)

1 General information

Invinity Energy Systems plc (the 'company') is a public limited

company incorporated in Jersey under the Companies (Jersey) Law

1991. The company's registered address is 3rd floor, Standard Bank

House, 47-49 La Motte Street, St. Helier, Jersey, JE2 4SZ. The

company is listed on the Alternative Investment Market of the

London Stock Exchange with the ticker symbol IES.L.

The principal activities of the company and its subsidiaries

(together, the 'Group') relate to the manufacture and sale of

vanadium flow battery systems together with associated

installation, warranty and other services.

2 Summary of significant accounting policies

Basis of preparation

This unaudited condensed consolidated interim financial

information for the six-months ended 30 June 2021 (the 'interim

financial information') has been prepared in accordance with IAS

34, 'Interim financial reporting' as adopted by the European Union.

The financial information should be read in conjunction with the

Group's annual financial statements for the year ended 31 December

2020, that were prepared in accordance with International Financial

Reporting Standards as adopted by the European Union.

The annual report and financial statements for the year ended 31

December 2020 are available on the company's website

(www.invinity.com).

This interim financial information has been prepared using the

historical cost basis of accounting. The accounting policies

applied across all the Group's subsidiaries when preparing the

financial information are consistent with those adopted and

disclosed in the annual financial statements for the year ended 31

December 2020. The accounting policies have been consistently

applied across all Group entities for the purpose of producing this

interim financial information.

The financial information included in this document does not

comprise statutory accounts within the meaning of Companies

(Jersey) Law 1991. The comparative figures for the financial year

ended 31 December 2020 are not the company's statutory accounts for

that financial year within the meaning of Companies (Jersey) Law

1991. Those accounts have been reported on by the company's

auditors and delivered to the Jersey Financial Services

Commission.

The report of the auditors included in the annual report and

financial statements for the year ended 31 December 2020 was

unqualified. However, the auditors' report did contain an emphasis

of matter related to the application of the going concern basis of

preparation.

The Group's business activities, together with factors likely to

affect its future development, performance and position, are set

out in the operations and financial review sections of this

report.

The financial position of the Group, its cash flows and

liquidity position are described in the financial review

section.

Going concern

The Group is debt free and had cash balances of GBP10.9m and

GBP6.1m at the end of June 2021 and August 2021 respectively. It

has closed contracts to the value of approximately GBP13.5m, of

which GBP5.7m had been received by the end of June 2021 with most

of the GBP7.8m balance expected by the end of June 2022. Most of

the inventory payments required to deliver those contracts have

already been made.

The Group has a growing pipeline of future sales (see above)

with 57.2MWh of potential new contracts in Base and Upside and a

further 262.6 MWh in Pipeline. This continued increase has largely

been driven by the rapidly improving macro environment, both in

terms of total addressable market and active and growing government

support in its key markets.

The Group continually reviews its funding position and the

funding options that are available to it. Based on this ongoing

review and subject to the near-term rate of customer deliveries and

new closed contracts, the Group expects to require additional

finance within the next six months, assuming the continued rate of

growth. The expectation is that additional finance will be

available from both equity and non-equity sources or a combination

of the two.

Having taken all of the above factors into account, the

directors continue to believe it is appropriate to prepare these

financial statements on a going concern basis, noting the material

uncertainty arising from the need to secure additional funding

within the coming months.

Estimates and judgements

The preparation of interim financial information requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities and of items of income and

expense. Actual results may differ from these estimates.

In preparing this interim financial information, the significant

judgements made by management in applying the Group's accounting

policies were the same as those that applied to the consolidated

financial statements for the year ended 31 December 2020.

Similarly, the key sources of estimation uncertainty related to the

financial information were the same as those encountered when

applying the Group's accounting policies in relation to the

preparation of the consolidated financial statements for the year

ended 31 December 2020.

Principal risks and uncertainties

In preparing the condensed consolidated financial information

management is required to consider the principal risks and

uncertainties facing the Group. In management's opinion the

principal risks and uncertainties facing the Group are unchanged

since the preparation of the consolidated financial statements for

the year ended 31 December 2020. Those risks and uncertainties,

together with management's response to them are described in the

risk review section of the annual report and financial statements

for the year ended 31 December 2020.

Accounting policies

The accounting policies applied in this condensed consolidated

financial information are consistent with those applied in

preparing the financial statements for the year ended 31 December

2019.

Reclassification of prior year figures

Comparative figures for June 2020 have been restated, where

necessary, to conform with the presentation of this period and 31

December 2020 results.

3 Revenue from contracts with customers and income from

government grants

Segment information

The Group derives revenue from a single business segment, being

the manufacture and sale of vanadium flow battery systems and

related hardware together with the provision of services directly

related to battery systems sold to customers.

The Group is organised internally to report on its financial and

operational performance to its chief operating decision maker,

which has been identified as the three executive directors as a

group.

All revenues were derived from continuing operations.

Revenue from contracts with customers

Restated

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

------------------------------------------------- ----------- ------------ -------------

Battery systems and associated control

systems - - 369

Integration, commissioning and other related

services 14 - 34

Other services 1 67 3

------------------------------------------------- ----------- ------------ -------------

Total revenue in the statement of comprehensive

loss 15 67 406

------------------------------------------------- ----------- ------------ -------------

Grant income other than revenue

The Group receives grant income to help fund certain projects

that are eligible for support, typically in the form of innovation

grants. The Group also received grant income related to operating

costs under government subsidy programmes as part of national COVID

response efforts. The total grant income that was received in the

year was as follows:

Restated

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Grant income received GBP'000 GBP'000 GBP'000

------------------------------------------ ----------- ------------ -------------

Business support grants against cost of

sales Ð COVID-19 - - 17

Business support grants against employee

costs Ð COVID-19 - - 240

Grants for research and development 471 147 203

Economic and social development grants - 35 35

------------------------------------------ ----------- ------------ -------------

Total government grants received 471 182 495

------------------------------------------ ----------- ------------ -------------

4 Contract related balances

Restated

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

---------------------------------------------- ---------- -------------- ------------

Amounts due from contract customers included

in trade receivables 173 42 33

Contract assets (accrued income for work

done and not yet invoiced) 2 - 5

Contract liabilities (deferred revenue

related to contract advances) (5,656) (970) (2,644)

---------------------------------------------- ---------- -------------- ------------

Net position of sales contracts (5,481) (928) (2,606)

---------------------------------------------- ---------- -------------- ------------

No revenue was recognised in the current or prior periods that

was recorded as a contract liability at the end of the previous

period.

Provisions related to contracts with customers

Provision

Warranty for onerous

provision contracts Total

GBP'000 GBP'000 GBP'000

------------------------------------------------ ------------ ------------- ---------

At 1 January 2021 824 1,103 1,927

Charged/ credited to profit and loss:

Provision created in the period 318 1,003 1,321

Unused amounts reversed/ unwind of provision (2) (353) (355)

Amounts used in the period (431) - (431)

------------------------------------------------ ------------ ------------- ---------

At 30 June 2021 709 1,753 2,462

------------------------------------------------ ------------ ------------- ---------

Provision

Warranty for onerous

provision contracts Total

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------ ------------- ---------

At 1 January 2020 95 - 95

Acquisition of subsidiaries 191 - 191

Charged/ credited to profit and loss:

Provision created in the period 136 358 494

Amounts used in the period (32) - (32)

--------------------------------------- ------------ ------------- ---------

At 30 June 2020 390 358 748

--------------------------------------- ------------ ------------- ---------

Provision

Warranty for onerous

provision contracts Total

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------ ------------- ---------

At 1 January 2020 95 - 95

Acquisition of subsidiaries 1,011 39 1,050

Charged/ credited to profit and loss:

Provision created in the period 340 1,084 1,424

Unused amounts reversed (51) - (51)

Amounts used in the period (571) (20) (591)

--------------------------------------- ------------ ------------- ---------

At 31 December 2020 824 1,103 1,927

--------------------------------------- ------------ ------------- ---------

Warranty provision

The warranty provision represents management's best estimate of

the costs anticipated to be incurred related to known warranty

claims from customers in respect of products sold that remain in

their warranty period. It also includes a best estimate of the

costs expected to be incurred in respect of claims that may arise

in the future related to products already sold to customers.

The estimate of future warranty costs is updated periodically

based on the company's actual experience of warranty claims from

customers. The element of the provision that is related to

potential future claims is based on management's experience and is

judgemental in nature. As for any product warranty, there is an

inherent uncertainty around the likelihood and timing of a fault

occurring that would cause further work to be undertaken or the

replacement of equipment parts.

A standard warranty of up to two years from the date of

commissioning is provided to all customers on products sold and is

included in the original cost of the product. Customers are also

able to purchase extended warranties that extend the warranty

period for up to a total of ten years.

Provision for contract losses

A provision is established for contract losses when it becomes

known that a commercial contract has become onerous. A contract is

onerous when the unavoidable costs of fulfilling the company's

obligations under a contract are greater than the revenue that will

be earned from the contract.

The unavoidable costs of fulfilling contract obligations will

include both direct and indirect costs. Any provision made for

contract losses will similarly include provision for both direct

and indirect costs to fulfil the company's remaining obligations

under a contract.

The creation of an additional provision is recognised

immediately in profit and loss. The provision is used to offset

costs that are incurred as the contract moves to completion.

5 Cost of sales

Restated

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------------------------------------- ----------- ------------ -------------

Movement in inventories of finished battery

systems - - 436

Production costs 318 91 374

Depreciation of production facilities,

equipment and intangibles 77 - 107

Movement in provisions for warranty costs 361 - 304

--------------------------------------------- ----------- ------------ -------------

Total cost of sales 756 91 1,221

--------------------------------------------- ----------- ------------ -------------

6 Administrative expenses

Restated

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

------------------------------------------ ----------- ------------ -------------

Staff costs 3,669 1,781 5,811

Research and non-capitalised development

costs 288 662 1,099

Professional fees 371 381 960

Sales and marketing costs 222 43 96

Facilities and office costs 358 557 787

Other administrative expenses 944 424 840

------------------------------------------ ----------- ------------ -------------

Total administrative expenses 5,852 3,848 9,593

------------------------------------------ ----------- ------------ -------------

7 Other items of operating income and expense

Restated

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

----------------------------------------------- ----------- ------------ -------------

Income

Gain on disposal of scrap inventory and

equipment - - 27

Expense

Merger transaction costs - (1,047) (1,412)

Provision for onerous contracts, net of

amounts unwound (700) - (1,064)

Impairment of inventory to net realisable

value (1,061) - (1,019)

Accelerated amortisation of development

costs - (6,138)

Impairment of property, plant and equipment - (56)

Impairment of obsolete inventory and disposal

of scrap inventory (95) - (8)

Abnormal unabsorbed production overheads - (152)

----------------------------------------------- ----------- ------------ -------------

Total other operating income and expense

(net) (1,856) (1,047) (9,822)

----------------------------------------------- ----------- ------------ -------------

8 Loss per share

The weighted average number of shares used to calculate basic

and diluted loss per share as presented in the consolidated

statement of comprehensive loss was as follows:

Restated

Six Six

months months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

------------------------------------------- ----------- ----------- -------------

In issue at 1 January 85,900,459 19,025,009 19,025,799

Shares issued in the year - weighted

average 807,258 25,374,448 40,180,789

------------------------------------------- ----------- ----------- -------------

Weighted average shares in issue at the

end of the period 86,707,717 44,399,457 59,206,588

Effect of employee share options and

warrants not exercised - - 431,089

Potentially dilutive 5,197,536

------------------------------------------- ----------- ----------- -------------

Weighted average number of diluted shares

at the period end 91,905,253 44,399,457 59,637,677

------------------------------------------- ----------- ----------- -------------

Additional potential shares used in the calculation of diluted

earnings per share primarily relate to potential shares that may be

issued in satisfaction of in-the-money employee share options. In

addition, potentially dilutive shares also relate to warrants to

subscribe for ordinary shares in the company that were issued for

services or related to financing transactions that have an exercise

price lower than the quoted share price and remain outstanding at

the relevant period end.

Where additional potential shares have an anti-dilutive impact

on the calculation of loss per share calculation, such potential

shares are excluded from the weighted average number of shares used

in the calculation.

Additional potential shares are anti-dilutive where their

inclusion in the calculation of loss per share results in a lower

loss per share.

9 Cashflows from operating activities

Restated

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------------------------------------------- ----------- ------------ -------------

Loss after income tax (8,809) (5,028) (24,271)

Adjustments for:

Depreciation and amortisation 188 267 577

Impairment of property plant and equipment - - 56

Accelerated amortisation of intangible

asset - - 6,138

Loss on disposal of property plant and

equipment - - (6)

Impairment of inventory 1,156 - 1,027

Gain on disposal of scrap inventory - - 27

Taxation - 1 -

Equity settled share-based payment expenses 786 (207) 707

Equity issued in lieu of service - 61 68

Equity settled transaction costs on acquisition

of a subsidiary - - (456)

Equity settled interest and transaction

costs on convertible notes - - (592)

Fair value adjustment on convertible notes

and warrants - - 300

Net finance costs/ income 17 108 2,297

Net foreign exchange differences 62 - (1,220)

--------------------------------------------------- ----------- ------------ -------------

(6,600) (4,798) (15,348)

--------------------------------------------------- ----------- ------------ -------------

Change in operating assets and liabilities

Decrease in inventories (3,630) (99) (1,359)

Decrease in contract assets 3 - 53

(Increase)/ decrease in trade and other

receivables (140) (2) 115

Decrease in other current assets (5,551) (810) (750)

Increase/ (decrease) in trade and other

payables 874 (1,448) 3,348

Decrease in warranty provision (115) - (380)

Increase in onerous contract provision 650 463 1,060

Increase in contract liabilities 3,012 662 2,376

--------------------------------------------------- ----------- ------------ -------------

(4,897) (1,234) 4,463

--------------------------------------------------- ----------- ------------ -------------

Cash used in operations (11,497) (6,032) (10,885)

--------------------------------------------------- ----------- ------------ -------------

10 Goodwill and intangible assets

Software

Development Patents and domain

Goodwill costs and certifications names Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- --------- ------------ -------------------- ------------ ---------

At 1 January 2021

Cost 23,944 - 203 29 24,176

Accumulated amortisation - - (30) (19) (49)

-------------------------------- --------- ------------ -------------------- ------------ ---------

Net book amount 23,944 - 173 10 24,127

Period ended 30 June 2021

Opening net book amount 23,944 - 173 10 24,127

Effect of movements in foreign

exchange (254) - - - (254)

Additions - - - 19 19

Amortisation charge - - (20) (4) (24)

-------------------------------- --------- ------------ -------------------- ------------ ---------

Closing net book amount 23,690 - 153 25 23,868

-------------------------------- --------- ------------ -------------------- ------------ ---------

At 30 June 2021

Cost 23,690 - 203 48 23,941

Accumulated amortisation - - (50) (23) (73)

-------------------------------- --------- ------------ -------------------- ------------ ---------

Net book amount 23,690 - 153 25 23,868

-------------------------------- --------- ------------ -------------------- ------------ ---------

Software

Development Patents and domain

Goodwill costs and certifications names Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- --------- ------------ -------------------- ------------ ---------

At 1 January 2020

Cost 6,971 5,818 - - 12,789

Accumulated amortisation - - - - -

-------------------------------- --------- ------------ -------------------- ------------ ---------

Net book amount 6,971 5,818 - - 12,789

Period ended 30 June 2020

Opening net book amount 6,971 5,818 - - 12,789

Acquisition of subsidiaries 21,283 - - - 21,283

Effect of movements in foreign

exchange 651 390 - - 1,041

-------------------------------- --------- ------------ -------------------- ------------ ---------

Closing net book amount 28,905 6,208 - - 35,113

-------------------------------- --------- ------------ -------------------- ------------ ---------

At 30 June 2020

Cost 28,905 6,208 - - 35,113

Accumulated amortisation - - - - -

-------------------------------- --------- ------------ -------------------- ------------ ---------

Net book amount 28,905 6,208 - - 35,113

-------------------------------- --------- ------------ -------------------- ------------ ---------

Software

Development Patents and domain

Goodwill costs and certifications names Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- --------- ------------ -------------------- ------------ ---------

At 1 January 2020

Cost 6,971 5,818 - - 12,789

Accumulated amortisation - - - - -

-------------------------------- --------- ------------ -------------------- ------------ ---------

Net book amount 6,971 5,818 - - 12,789

-------------------------------- --------- ------------ -------------------- ------------ ---------

Year ended 31 December 2020

Opening net book amount 6,971 5,818 - - 12,789

Effect of movements in foreign

exchange (1,233) 320 - 1 (912)

Acquisition of subsidiaries 18,206 - 203 2 18,411

Additions - - - 9 9

Amortisation charge - - (30) (2) (32)

Accelerated amortisation - (6,138) - - (6,138)

-------------------------------- --------- ------------ -------------------- ------------ ---------

Closing net book amount 23,944 - 173 10 24,127

-------------------------------- --------- ------------ -------------------- ------------ ---------

At 31 December 2020

Cost 23,944 - 203 12 24,159

Accumulated amortisation - - (30) (2) (32)

-------------------------------- --------- ------------ -------------------- ------------ ---------

Net book amount 23,944 - 173 10 24,127

-------------------------------- --------- ------------ -------------------- ------------ ---------

Goodwill

The opening goodwill balance on 1 January 2021 represents

goodwill recognised in the year ended 31 December 2015 on the

completion of the step acquisition by the company of Renewable

Energy Dynamics Holdings Limited (REDH), the holding company for

the redT energy storage business and goodwill related to the

business combination transaction with Avalon that completed on 1

April 2020.

All goodwill is tested annually for potential impairment. At 30

June 2021, goodwill was tested for impairment using a fair value

less costs of disposal methodology by reference to the company's

quoted market capitalisation using the price of 117 pence per share

at that date. No impairment loss was identified in relation to

goodwill.

Patents and certifications

Patents and certification acquired in the 1 April 2020 merger

transaction with Avalon were stated at their assessed fair value in

the purchase price allocation used for consolidation accounting.

There have been no events or circumstances since the merger that

would indicate that the carrying value of patents and

certifications may be impaired at 30 June 2021.

Development Costs

The development costs represent costs associated with the redT

Gen 3 vanadium flow battery that has been superseded by the

Invinity VS3 battery system were impaired in full in the period

ended 31 December 2020.

11 Property plant and equipment

Computer

and office Leasehold Vehicles

equipment improvement and equipment Total

GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2021

Cost 748 513 753 2,014

Accumulated depreciation and impairment (694) (357) (268) (1,319)

----------------------------------------- ------------ ------------- --------------- ---------

Net book amount 54 156 485 695

Period ended 30 June 2021

Opening net book amount 54 156 485 695

Effect of movement in foreign exchange - 1 3 4

Additions and transfers 60 23 526 609

Depreciation charge (22) (22) (70) (114)

----------------------------------------- ------------ ------------- --------------- ---------

Closing net book amount 92 158 944 1,194

At 30 June 2021

Cost 808 537 1,282 2,627

Accumulated depreciation and impairment (716) (379) (338) (1,433)

----------------------------------------- ------------ ------------- --------------- ---------

Net book amount 92 158 944 1,194

----------------------------------------- ------------ ------------- --------------- ---------

Computer

and office Leasehold Vehicles

equipment improvement and equipment Total

GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2020

Cost 747 302 105 1,154

Accumulated depreciation and impairment (595) (242) (63) (900)

----------------------------------------- ------------- --------------- --------------- -------------

Net book amount 152 60 42 254

Period ended 30 June 2020

Opening net book amount 152 60 42 254

Effect of movement in foreign exchange (1) 1 3 3

Acquisition of subsidiaries 22 86 289 397

Additions and transfers 4 53 145 202

Disposals (21) - - (21)

Depreciation charge (62) (58) (32) (152)

----------------------------------------- ------------- --------------- --------------- -------------

Closing net book amount 94 142 447 683

At 30 June 2020

Cost 741 451 543 1,735

Accumulated depreciation and impairment (657) (300) (95) (1,052)

----------------------------------------- ------------- --------------- --------------- -------------

Net book amount 84 151 448 683

----------------------------------------- ------------- --------------- --------------- -------------

Computer

and office Leasehold Vehicles

equipment improvement and equipment Total

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------- ------------ ------------- --------------- ---------

At 1 January 2020

Cost 747 302 105 1,154

Accumulated depreciation and impairment (595) (242) (63) (900)

----------------------------------------- ------------ ------------- --------------- ---------

Net book amount 152 60 42 254

Year ended 31 December 2020

Opening net book amount 152 60 42 254

Effect of movement in foreign exchange 2 (1) (1) -

Acquisition of subsidiaries 22 86 364 472

Additions and transfers 20 90 239 349

Disposals (6) - - (6)

Depreciation charge (136) (79) (103) (318)

Impairment charge - - (56) (56)

----------------------------------------- ------------ ------------- --------------- ---------

Closing net book amount 54 156 485 695

At 31 December 2020

Cost 748 513 753 2,014

Accumulated depreciation and impairment (694) (357) (268) (1,319)

----------------------------------------- ------------ ------------- --------------- ---------

Net book amount 54 156 485 695

----------------------------------------- ------------ ------------- --------------- ---------

The Group has no assets pledged as security. No amounts of

interest have been capitalised within property, plant and equipment

at 30 June 2021 (31 December 2020: GBPnil, 30 June 2020:

GBPnil).

For the period ended 30 June 2021 manufacturing equipment

includes GBP326,000 (31 December 2020: GBPnil, 30 June 2020:

GBPnil) of assets under construction that have not been put into

service and depreciated.

Impairment loss

The impairment loss related to vehicles and equipment recognised

in the year ended 31 December 2020 was due to assets taken out of

service, and hence written down, when new versions of the same

assets came into service. The impairment loss was recognised within

other items of operating income and expense in the consolidated

statement of comprehensive loss for the year ended 31 December

2020.

Acquisition of subsidiaries

Assets acquired in 2020 relate to the combination transaction

with Avalon that completed on 1 April 2020 .

12 Trade and other receivables

Restated

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------------------------------- ---------- --------- ------------

Trade receivables from contracts with

customers 173 59 33

Provision for doubtful receivables - (17) -

--------------------------------------- ---------- --------- ------------

Total trade and other receivables 173 42 33

--------------------------------------- ---------- --------- ------------

Trade receivables are amounts due from customers for sales of

vanadium flow battery systems in the ordinary course of

business.

Trade receivables do not bear interest and generally have 30-day

payment terms and are therefore classified as current. The actual

credit loss in the six months to 30 June 2021 was determined to be

0% of total sales (year ended 31 December 2020: 0%).

13 Other current assets

Restated

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

-------------------------------- ---------- --------- ------------

Prepayments and deposits 5,427 591 1,108

Government grants receivable 267 72 -

Tax credits Ð recoverable 371 126 127

Due from joint venture 436 - 168

Other receivables 464 412 11

-------------------------------- ---------- --------- ------------

Total other current assets 6,965 1,201 1,414

-------------------------------- ---------- --------- ------------

14 Cash and cash equivalents

Restated

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------------------------- ---------- --------- ------------

Cash at bank and in hand 10,752 4,208 21,760

Short term investments 190 295 193

--------------------------------- ---------- --------- ------------

Total cash and cash equivalents 10,942 4,503 21,953

--------------------------------- ---------- --------- ------------

Short term investments

Term deposits are presented as cash equivalents if they have a

maturity of three months or less from the date of acquisition and

are repayable with 24 hours' notice with no loss of interest .

15 Inventories

Restated

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

---------------------- ---------- ----------- ------------

Components and parts 3,330 336 698

Work in progress 49 186 207

Finished goods - 167 -

---------------------- ---------- ----------- ------------

Total inventories 3,379 689 905

---------------------- ---------- ----------- ------------

Included in parts and components are third-party custom

manufactured components, parts and electrolyte.

Total inventory, before impairment, is valued at GBP5,536,572

(31 December 2020: GBP2,001,561, 30 June 2020: GBP689,000).

Inventories recognised as an expense during the current period

amounted to GBPnil (31 December 2020: GBP436,461, 30 June 2020: GBP

nil). These were included in cost of sales.

Write-downs of inventories to net realisable value amounted to

GBP1,061,017 (31 December 2020: GBP1,045,232, 30 June 2020: GBP

nil).

16 Trade and other payables

Restated

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

-------------------------------- ---------- --------- ------------

Trade payables 1,818 710 498

Accrued liabilities 1,310 946 653

Accrued employee compensation 207 123 1,010

Government remittances payable 5 34 307

-------------------------------- ---------- --------- ------------

Total trade and other payables 3,340 1,813 2,468

-------------------------------- ---------- --------- ------------

Trade payables are unsecured and are usually paid within 30

days. The carrying amounts of trade and other payables are assessed

as being the same as their fair values due to the short-term nature

of the underlying obligation representing the liability to pay.

17 Events occurring after the reporting period

No events occurred after the end of the reporting period that

require disclosure in this unaudited condensed consolidated interim

financial information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFIIAFIDFIL

(END) Dow Jones Newswires

September 28, 2021 02:00 ET (06:00 GMT)

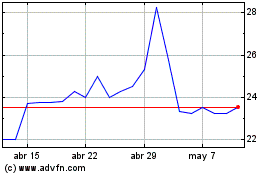

Invinity Energy Systems (LSE:IES)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Invinity Energy Systems (LSE:IES)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024