TIDMIOF

RNS Number : 8235M

Iofina PLC

24 September 2021

D

24 September 2021

Iofina plc

("Iofina", the "Company" or the "Group")

(LSE AIM: IOF)

INTERIM 2021 RESULTS

Record revenue and profitability

Customer markets recovering

Iofina plc, specialists in the exploration and production of

iodine and manufacturers of specialty chemical products, is pleased

to announce its Interim Results for the six months ended 30 June

2021 (the "Period").

Record revenue and profitability

-- Revenue increased by 27% to $19.9m (H1 2020: $15.74m)

-- Gross profit increased by 10% to $5.4m (H1 2020: $4.90m)

-- EBITDA increased by 18% to $3.5m (H1 2020: $2.9m)

-- Operating profit increased by 22% to $2.6m (H1 2020: $2.2m)

-- Paycheck Protection Program loans of $1.1m were forgiven

-- Profit before and after tax increased by 164% to $3.5m (H1 2020: $1.3m)

-- Basic and diluted profit per share was $0.018 (H1 2020: $0.007)

Net debt further reduced

-- Net debt reduced by 27% from $9.9m (H1 2020) to $7.2m

-- Interest charges fell by 70% from $0.7m (H1 2020) to $0.2m

-- Well placed to finance our ongoing operational investment program

Iodine production

-- Met revised production target of 249.4 MT during H1 after

impact of extreme weather and reduced brine supply at two Iofina

plants

-- H2 production on track to meet 260-275MT target

-- In negotiations with targeted partners for Iofina to build

and operate IO#9, with additional expansion efforts beyond IO#9

also being evaluated

Commenting on today's results, Dr. Tom Becker, President and CEO

stated: " The Group has delivered an excellent performance in the

first half. Recoveries are underway in our customer markets and

with this we expect the demand for iodine and its end-use products

to continue to improve.

"Despite H1 iodine production being impacted by extreme winter

weather and lower brine supply from our oil and gas partners,

importantly we have had sufficient production and reserves to take

advantage of demand. Our chemicals division continues to excel with

its product range and capabilities, and is a vital driver of Group

sales and earnings. On the current trajectory, we are confident of

producing 260-275MT of crystalline iodine in the second half and

anticipate IO#9 construction to begin before year-end.

"With debt further reduced we are in an excellent position to

invest in our operations and continue to implement our growth

strategy. The US Government small business loans of $1.1m were also

forgiven in the period, further strengthening the Company's balance

sheet. As Iofina executes its growth plans and iodine prices

continue to increase, Iofina will be well positioned for success in

the future and to deliver shareholder value.

"I would once again like to thank our staff for their continued

efforts and dedication in a challenging environment, and our

shareholders for their continued support. Iofina has never been

stronger both operationally and financially and we remain confident

of achieving our goals for the rest of the year."

Enquiries:

Dr. Tom Becker

CEO & President

Iofina plc

Tel: +1 859 356 8000

Christopher Raggett/Tim Harper (Corporate Finance)

Tim Redfern (ECM)

finnCap Ltd

Tel: +44 (0)20 7220 0500

Media Contact:

Charles Goodwin/Joe Burgess

Yellow Jersey PR Limited

Tel: +44 (0)7747 788 221

Business Overview

Iofina plc ("Iofina" or the "Company") is the holding company of

a group of companies (the "Group") with unique, proven technologies

and competencies for producing iodine and halogen-based chemical

derivatives. The Group's business model involves producing a key

raw material, iodine, at a low cost and in as an environmentally

friendly way as possible, providing the Company's customers

vertical integration into high-quality iodine and other halogen

based chemical products.

The Company is committed to producing its products with minimal

effects on the environment. The Group's iodine is produced from

brine water waste streams co-produced with oil & gas production

in the United States. By utilizing a produced waste stream to

isolate iodine, Iofina is extracting a valuable resource from a

stream that would otherwise provide no use or value. Also, by

isolating iodine from these streams, Iofina avoids the additional

drilling and mining environmental impacts of many other iodine

producers.

Expertise in core halogen technologies, the vertical integration

of iodine into specialty products, and the diversity of iodine

production plants and specialty halogen-based products are key

business tenets for Iofina. The Directors are focused on continued

prudent growth of the Group, and the development and implementation

of business strategies for the continued improvement of Iofina in

our core areas.

Financial Review

Summary

The Group achieved record half year turnover and profits in H1

2021. Sales increased by 27% ($4.2m) versus H1 2020, generating a

gross profit increase of $0.5m. This led to an 18% increase in

EBITDA to $3.5m, with administrative costs almost unchanged.

Paycheck Protection Program loans of $1.1m received in 2020 were

forgiven and have been included in non-EBITDA income. Interest

payable reduced by $0.5m, reflecting the debt refinancing finalised

in September 2020. The overall upshot was a $2.2m improvement in

profit before tax, which was $3.5m compared to $1.3m in H1 2020.

Net debt reduced by $2.7m from $9.9m in H1 2020 to $7.2m, after

capital expenditure of $0.8m on the Iofina Chemical plant.

Sales

Sales increased by $4.2m (27%) to $19.9m. Sales of iodine

products increased by 52% from $10.3m to $15.6m, while non-iodine

sales decreased by 24% from $5.5m to $4.2m. The average price per

kilogram achieved for sales of raw iodine was $33.45 up to 30 June

2021, compared to $35.49 for H1 2020. Since the period end, the

average price for July and August sales has exceeded $36 per

kilogram. Gross profit increased from $4.9m to $5.4m, with a

decrease from 31% to 27% of sales as a result of changes in product

mix.

Production and administrative costs

Iodine production was 249 metric tonnes, compared to 287 metric

tonnes for H1 2020. Average production costs per kilogram were

similar to H1 2020. Chemical plant manufacturing and fulfilment

costs were 9% higher than for H1 2020, in line with the budget for

the period. SGA administrative expense of $1.9m was slightly below

the 2020 level.

Finance expense

Interest payable was reduced by $0.5m from $0.7m for H1 2020 to

$0.2m, as a result of the reductions in debt and interest rates

that came out of the 2020 debt restructuring.

Cash flow

Inventories decreased by $1.5m and receivables increased by

$3.2m as the build-up of inventory at the end of 2020 turned into

sales. Cash balances reduced from $5.5m to $1.7m, mainly reflecting

$3m payments to reduce the revolving credit facility to mitigate

interest charges. Net debt decreased by $2.7m from $9.9m to $7.2m.

Capital expenditures were $0.8m, principally relating to

maintenance and development projects at the Iofina Chemical

plant.

Iofina Resources

Iofina Resources ("IR") identifies, develops, builds, owns and

operates iodine extraction plants, based on Iofina's WET(R)

IOsorb(R) technology. Iodide is isolated from a brine waste stream

produced from existing oil and gas operations, and without Iofina,

this resource would not be realised. The isolation of iodine from

this waste stream adds value to Iofina, its shareholders, and our

oil and gas partners and minimises environmental impact. Currently,

Iofina operates five iodine plants in western Oklahoma.

A production total of 249.4MT of crystalline iodine in the

Period was lower than expected due to two adverse factors. First,

an extreme polar vortex weather event in February, which struck our

production area, causing many oil & gas wells to be offline for

approximately two weeks, suspending the brine supplies IR needs.

The second factor was lower brine supply particularly at two of our

plants. Due to the pandemic's impact on oil and gas prices, oil and

gas partners have not reinvested in their fields (new drilling,

workovers, maintenance) at historical rates. More recently, Iofina

has become aware that oil and gas operators in our area are

beginning to reinvest now that hydrocarbon prices have recovered

and stabilised. New drilling has occurred near IO#8 and has

positively impacted brine flow to this site. While brine supplies

are still lower than expected at two sites, we are optimistic they

may improve in the second half. The Company expects to produce

260-275MT of crystalline iodine and IR is currently on track to

meet this target.

The Company continues to explore opportunities to sustainably

expand its iodine production and diversify its lines of brine

supply. It has identified several potential sites to build and

operate IO#9 which meet its requirements and is currently in

negotiations with the operators of these sites. The Company expects

to commence the construction of IO#9 by the end of 2021 and it is

likely to utilize equipment from decommissioned plants IO#1 and/or

IO#5. Additional expansion efforts beyond IO#9 are also being

evaluated.

IR continues to invest in its existing plants and its workforce.

Initiatives to improve crystalline iodine consistency and quality

have been successful. IR has also hired a new VP of Operations and

has appointed a new Environmental, Health and Safety manager.

Iofina Chemical

Iofina Chemical ("IC") is the specialty chemical subsidiary of

the Group and has been in business for 38 years producing a diverse

array of high-quality halogen-based chemicals for various

industries. IC is a globally recognised leader for halogen

chemicals. The Group continues to invest in IC to increase its

development capabilities to supply customers with existing and new

products. In addition to the halogen-based chemicals produced on

site at IC's facility in Covington, Kentucky, IC is the Group's

main sales and commercial arm, selling iodine directly to the

market and processing all external sales for the Group. While the

iodine production component of the business is generally well known

to investors, the Directors believe the importance of Iofina

Chemical, its diversity of products, and the value-add for iodine

derivative products is not as well recognised as a significant

contributor to the Group.

In the Period, IC exhibited record sales and profits. Demand for

both crystalline iodine and iodine derivatives led sales gains as

global manufacturing increased and economic expansion was evident

following the COVID-19 decreases in demand in H2 2020. Inventory

reductions from year-end levels contributed to increased sales in

the Period, as well as strong demand for a variety of products.

Some iodine-based products which saw increased demand include

crystalline iodine, methyl iodide and IPBC. Methyl iodide

applications include pharmaceutical applications and use as a

catalyst for acetic acid production. IPBC is used as a biocide in

paints, coatings and machine fluids as well as a preservative in

cosmetics and personal care products.

IC continues to invest it its current processes as well as new

R&D projects. Current products where upgrades were started or

completed in the Period include: trichloromelamine (a

disinfectant/sanitizer for hard surfaces and glassware), hydriodic

acid (teat dip and acetic acid applications), and methyl fluoride

(semiconductor etchant gas). New product R&D is ongoing which

includes specialty iodides for battery, oil/gas, and other

applications.

The diversity of the Group's halogenated products (iodo-,

chloro-, fluoro-) is key to both growth and stability for the

organization.

Hemp Seed Update

The Hemp and CBD market continues to recover from the impact of

COVID-19. Only 107,702 acres were registered for outdoor hemp

production for 2021 in the United States which is down 55% compared

to 236,732 acres documented in June 2020; down 75% from the 429,300

acres ultimately documented for 2020. Our sales partner continues

to field numerous inquiries and execute sales but these sales were

for smaller orders in the United States, with growers taking a more

"craft" approach, as opposed to large-scale farming of biomass. We

continue to look outside the USA for the sale of the Group's

certified organic hemp seeds. We have sold small quantities and

qualified two products lines of seeds in South Africa. One seed

variety performed excellent while the auto flower seed was not a

top performer in that geographic region. The plants react

differently in each region and therefore the seeds will be marketed

elsewhere. Having certified organic seeds is still very rare and

has an emerging following. The Group remains confident that the

seed investment will provide a positive return, but the timeframe

for realization is taking longer than anticipated in this new and

emerging market.

Iodine Market Outlook

Iodine prices and demand have increased from 2017 through H1

2020. Pandemic driven slowdowns in numerous markets did reduce

demand and prices during H2 2020. Spot prices of $32.5-36/kg at the

beginning of 2021 were approximately equivalent to prices at the

beginning of 2020, and slightly lower than mid-year 2020 prices.

However, through 2021 the iodine market has recovered faster than

the Company anticipated. By mid-year 2021, spot iodine prices had

moved higher and into the $35-37/kg range, and have continued to

rise, ranging now at $37-39/kg. Demand for end-use products seem to

be the main driver of prices higher, however, logistic delays and

increased shipping costs may also have contributed to some of the

pricing increases.

As markets continue to return to normal activity, Iofina

anticipates demand for iodine and its end-use products to remain

strong, whilst global logistic delays will also likely impact the

industry into 2022. The Group believes these factors will likely

lead to continued higher iodine prices for the rest of 2021 and

into 2022.

Business Outlook

Recoveries are underway in our end markets are we are seeing

demand for our products return towards pre-pandemic levels. Noting

that COVID-19 continues to linger, we are also conscious that

shipping, labour and input costs are rising across global markets,

but with iodine prices also significantly lifting we expect to

continue to make positive progress supported by our highly

efficient production and operations.

In terms of investing for growth, the 2020 debt restructuring

and stronger balance sheet means the Group has more capacity to

invest in initiatives to increase production and product

innovation. As noted, the Group expects to commence the

construction of IO#9 by the end of the year and will provide

further updates on this in due course. The Group will continue to

explore opportunities for growth both organically and outside of

the current organisation.

Iofina has never been stronger both operationally and

financially and the Board believes the Group is well placed to meet

its commercial expectations for the full year.

IOFINA PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

FOR THE PERIODED 30 JUNE 2021

Unaudited Audited

Six months ended Year ended

30 June 30 June 31 December

2021 2020 2020

Note $ $ $

Continuing operations

Revenue 19,926,412 15,737,537 29,687,550

Cost of sales (14,555,537) (10,862,887) (21,282,945)

-------------

Gross profit 5,370,875 4,874,650 8,404,605

Administrative expenses (1,891,048) (1,927,503) (3,685,682)

----------------- ----------------- -------------

EBITDA - Earnings before

interest, tax, depreciation

and amortisation 3,479,827 2,947,147 4,718,923

Depreciation and amortisation (849,489) (793,295) (1,793,249)

Operating profit 2,630,338 2,153,852 2,925,674

Paycheck Protection Program

loans forgiven 1,089,900 - -

----------------- ----------------- -------------

Profit before finance expense 3,720,238 2,153,852 2,925,674

Finance income 457 14,478 15,145

Interest payable (210,689) (689,782) (1,114,108)

Interest swap valuation (10,162) - (69,314)

Loan arrangement fees - (154,004) (479,605)

Profit/(Loss) before taxation 3,499,844 1,324,544 1,277,792

Taxation 7 - - -

Profit/(Loss) for the period

attributable to owners of

the parent $3,499,844 $1,324,544 $1,277,792

----------------- ----------------- -------------

Profit/(loss) per share:

* Basic 4 $0.018 $0.007 $0.007

* Diluted 4 $0.018 $0.007 $0.007

----------------- ----------------- -------------

IOFINA PLC

CONSOLIDATED BALANCE SHEET

30 JUNE 2021

Unaudited Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

Note $ $ $

Intangible assets 552,594 732,594 642,596

Goodwill 3,087,251 3,087,251 3,087,251

Property, plant & equipment 18,785,675 19,205,075 18,781,803

-------------

Total non-current assets 22,425,520 23,024,920 22,511,650

------------- ------------- -------------

Inventories 8,178,240 8,599,239 9,656,019

Trade and other receivables 6,452,072 5,418,775 3,285,004

Investments 900,000 900,000 900,000

Cash and cash equivalents 1,679,358 5,509,820 3,481,332

Total current assets 17,209,670 20,427,834 17,322,355

------------- ------------- -------------

Total assets $39,635,190 $43,452,754 $39,834,005

------------- ------------- -------------

Trade and other payables 6,266,281 6,004,491 5,473,365

Term loan - due within one

year 5 1,428,571 - 1,428,571

Term loan notes 5 - 15,450,626 -

Paycheck Protection Program

Loans - - 1,089,900

Lease liabilities 126,847 131,385 140,650

Total current liabilities 7,821,699 21,586,502 8,132,486

------------- ------------- -------------

Term loan - due after one

year 5 7,500,000 - 8,214,286

Revolving credit facility - - 2,717,581

Term loan - interest swap

liability 5 79,476 - 69,314

Paycheck Protection Program

subsidies - 1,089,900 -

Lease liabilities - 111,413 45,501

Total non-current liabilities 7,579,476 1,201,313 11,046,682

------------- ------------- -------------

Total liabilities $15,401,175 $22,787,815 $19,179,168

------------- ------------- -------------

Issued share capital 6 3,106,795 3,106,795 3,106,795

Share premium 60,686,595 60,686,595 60,686,595

Share-based payment reserve 2,215,883 2,099,889 2,136,539

Retained losses (35,830,936) (39,284,018) (39,330,770)

Foreign currency reserve (5,944,322) (5,944,322) (5,944,322)

-------------

Total equity $24,234,015 $20,664,939 $20,654,837

------------- ------------- -------------

Total equity and liabilities $39,635,190 $43,452,754 $39,834,005

------------- ------------- -------------

IOFINA PLC

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS'

EQUITY

Share Share Share-based Retained Foreign Total

capital Premium payment losses currency equity

reserve reserve

$ $ $ $ $ $

Balance at 31 December

2019 (Audited) $3,106,795 $60,686,595 $1,988,361 $(40,608,562) $(5,944,322) $19,228,867

Share-based expense - - 148,178 - - 148,178

----------- ------------ ------------ -------------- ------------- ------------

Total transactions

with owners - - 148,178 - - 148,178

Profit for the

year attributable

to owners of the

parent - - - 1,277,792 - 1,277,792

----------- ------------ ------------ -------------- ------------- ------------

Total comprehensive

income attributable

to owners of the

parent - - - 1,277,792 - 1,277,792

----------- ------------ ------------ -------------- ------------- ------------

Balance at 31 December

2020 (Audited) $3,106,795 $60,686,595 $2,136,539 $(39,330,770) $(5,944,322) $20,654,837

Share-based expense - - 79,344 - - 79,344

----------- ------------ ------------ -------------- ------------- ------------

Total transactions

with owners - - 79,344 - - 79,344

Profit for the

period attributable

to owners of the

parent - - - 3,499,834 - 3,499,834

-------------- ------------- ------------

Total comprehensive

income attributable

to owners of the

parent - - - 3,499,834 - 3,499,834

----------- ------------ ------------

Balance at 30 June

2021 (Unaudited) $3,106,795 $60,686,595 $2,215,883 $(35,830,936) $(5,944,322) $24,234,015

----------- ------------ ------------ -------------- ------------- ------------

IOFINA PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE PERIODED 30 JUNE

2021

Unaudited Audited

Six months ended Year ended

30 June 30 June 31 December

2021 2020 2020

$ $ $

Cash flows from operating activities

EBITDA - Earnings before interest,

tax, depreciation and amortisation 3,479,827 2,947,147 4,718,924

Share options expense 79,344 111,528 148,178

3,559,171 3,058,675 4,867,101

Changes in working capital

Trade receivables (increase)/decrease (3,167,068) 707,675 2,841,446

Inventories decrease/(increase) 1,477,779 (2,521,969) (3,578,752)

Trade and other payables increase/(decrease) 805,382 218,422 (353,762)

------------ ------------ -------------

Net cash inflow from operating

activities 2,675,264 1,462,803 3,776,034

------------ ------------ -------------

Cash flows from investing activities

Interest received 457 14,478 15,144

Asset disposal proceeds - - 4,468

Acquisition of property, plant

& equipment (763,362) (1,957,495) (2,448,642)

Net cash outflow from investing

activities (762,905) (1,943,017) (2,429,030)

------------ ------------ -------------

Cash flows from financing activities

Paycheck Protection Program subsidies

received - 1,089,900 1,089,900

Term loan notes repaid - (2,726,580) (18,177,209)

Term loan drawn - - 10,000,000

Term loan repayments (714,286) - (357,143)

Revolving loan facility drawn - - 3,000,000

Revolving loan facility net payments (2,717,581) - (282,419)

Refinancing and arrangement fees

paid - (350,100) (675,701)

Interest paid (217,527) (679,778) (1,055,134)

Lease payments (64,939) (61,298) (125,856)

Net cash outflow from financing

activities (3,714,333) (2,727,856) (6,583,562)

------------ ------------ -------------

Net decrease in cash (1,801,974) (3,208,071) (5,236,558)

Cash and equivalents at beginning

of period 3,481,332 8,717,890 8,717,890

Cash and equivalents at end of

period $1,679,358 $5,509,820 $3,481,332

------------ ------------ -------------

1. Nature of operations and general information

Iofina plc is the holding company of a group of companies (the

"Group") involved primarily in the exploration and production of

iodine and the manufacturing of halogen-based specialty chemical

derivatives. Iofina's principal business strategy is to identify,

develop, build, own and operate iodine extraction plants, with a

current focus in North America, based on Iofina's WET(R) IOsorb(R)

technology. Iofina has current production operations in the United

States, specifically in Kentucky and Oklahoma. The Group has

complete vertical integration from the production of iodine from

produced brine waters, to the manufacture of the chemical

end-products derived from iodine and sold to global customers.

.

The address of Iofina plc's registered office is 48 Chancery

Lane, London WC2A 1JF.

Iofina plc's shares are listed on the London Stock Exchange's

AIM market.

Iofina's consolidated financial statements are presented in US

Dollars, which is the functional currency of the operating

subsidiaries.

The figures for the six months ended 30 June 2021 and 30 June

2020 are unaudited and do not constitute full statutory accounts.

The comparative figures for the year ended 31 December 2020 are

extracts from the 2020 audited accounts (which are available on the

Company's website and have been delivered to the Registrar of

Companies) and do not constitute full statutory accounts. The

independent auditor's report on the 2020 accounts was unqualified

and did not contain statements under sections 498(2) or (3)

(accounting records or returns inadequate, accounts not agreeing

with records and returns or failure to obtain necessary information

and explanations) of the Companies Act 2006.

2. Accounting policies

The basis of preparation and accounting policies set out in the

Annual Report and Accounts for the year ended 31 December 2020 have

been applied in the preparation of these condensed consolidated

interim financial statements. These interim financial statements

have been prepared in accordance with the recognition and

measurement principles of the International Financial Reporting

Standards (UK adopted IFRS) that are expected to be applicable to

the consolidated financial statements for the year ending 31

December 2021 and on the basis of the accounting policies expected

to be used in those financial statements.

3. Segment reporting

(a) Business segments

The Group's operations comprise the exploration and production

of iodine with complete vertical integration into its specialty

chemical halogen derivatives business and are therefore considered

to fall within one business segment. In addition, the Group holds

an investment in Organic Vines OP LLC, which has produced and is

marketing hemp seeds. To date there has been no hemp trading

activity to record from the Group's perspective, and therefore

segment reporting below is limited to the separate recognition of

hemp assets.

3. Segment reporting (continued)

Unaudited Audited

Six months ended 30 June 31 December

2021 2020 2020

Assets $ $ $

Halogen Derivatives

and iodine 38,735,189 42,438,788 38,934,005

Hemp seeds 900,000 900,000 900,000

Hemp biomass - 113,965 -

------------- ------------ ------------

Total $39,635,189 $43,452,753 $39,834,005

------------- ------------ ------------

Liabilities

Halogen Derivatives

and iodine 15,401,167 22,787,815 19,179,168

Total $15,401,167 $22,787,815 $19,179,168

------------- ------------ ------------

(b) Geographical segments

The Group reports by geographical segment. All the Group's

activities during the period were related to exploration for, and

development of, iodine in certain areas of the USA and the

manufacturing of specialty chemicals in the USA with support

provided by the UK office. In presenting information on the basis

of geographical segments, segment assets and the cost of acquiring

them are based on the geographical location of the assets.

Unaudited Audited

Six months ended 30 June 31 December

2021 2020 2020

Total assets $ $ $

UK 127,700 266,876 63,121

USA 39,507,489 43,185,877 39,809,474

------------- ------------ ------------

Total $39,635,189 $43,452,753 $39,834,005

------------- ------------ ------------

Total liabilities

UK 188,900 15,503,142 201,800

USA 15,212,267 7,284,673 18,977,368

------------- ------------ ------------

Total $15,401,167 $22,787,815 $19,179,168

------------- ------------ ------------

Capital expenditures

UK - - -

USA 763,362 1,957,495 2,448,642

------------- ------------ ------------

Total $763,362 $1,957,495 $2,448,642

4. Profit/(loss) per share

The calculation of profit per ordinary share is based on profits

of $3,499,844 (H1 2020: $1,324,544) and the weighted average number

of ordinary shares outstanding of 191,858,408 (H1 2020:

191,858,408). After including the weighted average effect of share

options of 1,232,450 (H1 2020: 3,949,500) the diluted weighted

average number of ordinary shares outstanding was 193,090,858 (H1

2020: 195,807,908).

5. Term loan and revolving credit facility

2020 Revolving

2019 Term 2020 Term credit

loans loan facility

$ $ $

At 31 December 2019 $18,177,209 - -

Repaid 30 June 2020 (2,762,581) - -

-------------- ----------- ---------------

At 30 June 2020 15,450,628 - -

Repaid 16 September 2020 (15,450,628) - -

First Financial Bank facilities:

Term loan drawn 16 September

2020 - 10,000,000 -

Revolving credit facility drawn

16 September 2020 - - 3,000,000

Term loan instalment repayments - (357,143) -

Revolving credit facility net

payments - (282,419)

----------- ---------------

At 31 December 2020 - $9,642,857 $2,717,581

Term loan instalment repayments - (714,286) -

Revolving credit facility net

payments (2,717,581)

At 30 June 2021 - $8,928,571 -

Due within one year - 1,428,571 -

Due after one year - 7,500,000 -

--------------- ----------- ---------------

- $8,928,571 -

--------------- ----------- ---------------

The First Financial Bank facilities are fully secured, and the

principal terms are:

a) The $10 million term loan drawn down in September 2020 is

repayable in full by equal monthly instalments over the 7 years to

30 September 2027. There are accelerated repayments based on 25% of

2021 and 2022 surpluses of EBITDA over the total of capital

expenditure and debt payments of principal and interest, payments

to be made on 30 June 2022 and 2023 respectively. The interest rate

on $7 million of the loan has been fixed to maturity by a swap

contract at 3.99%, and the interest rate on the balance is variable

monthly at 2.50% above LIBOR, subject to a minimum LIBOR rate of

1.00%, and is currently 3.50%. Repayment of all or part of the loan

may be made at any time, subject to the cost or benefit of

unwinding the swap contract.

b) The revolving credit facility is for $8 million over a

two-year term, and may be drawn and repaid in variable amounts at

the Group's discretion, with the amount advanced at closing having

been $3 million. Amounts that may be drawn are subject to a

borrowing base of sufficient eligible discounted monthly values of

receivables and inventory, and compliance on a quarterly basis with

trailing 12 months financial covenant ratios of 1) a maximum

multiple of 2.5 total debt to EBITDA, and 2) a minimum multiple of

1.2 EBITDA net of capital expenditure to the total of principal and

interest payments on the total debt. The interest rate is variable

monthly at 2.25% above LIBOR, subject to a minimum LIBOR rate of

1.00%, and is currently 3.25%. Interest charges are reduced to the

extent funds are deposited into this account and reduce the balance

outstanding. At 30 June 2021 $3 million funds had been deposited

and therefore the net balance was Nil.

6. Share capital

Unaudited Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

Authorised:

Ordinary shares of

GBP0.01 each

-number of

shares 1,000,000,000 1,000,000,000 1,000,000,000

-nominal value GBP10,000,000 GBP10,000,000 GBP10,000,000

Allotted, called up and

fully paid:

Ordinary shares of

GBP0.01 each

-number of shares 191,858,408 191,858,408 191,858,408

-nominal value GBP1,918,584 GBP1,918,584 GBP1,918,584

7. Income tax

No income tax expense was recognised for the period due to

accumulated US tax losses of the Group that are expected to be

deductible from the taxable profits of the current period. A

deferred tax asset has not been recognised due to uncertainty over

the timing of the recovery of these tax losses.

8. Post balance sheet events

There were no post balance sheet events.

9. Cautionary Statement

This report contains certain forward-looking statements with

respect to the financial condition, results of operations and

businesses of Iofina plc. These statements are made by the

directors in good faith based on the information available to them

up to the time of their approval of this report. However, such

statements should be treated with caution as they involve risk and

uncertainty because they relate to events and depend upon

circumstances that will occur in the future. There are a number of

factors that could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements. Nothing in this announcement should be construed as a

profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QXLFLFKLLBBE

(END) Dow Jones Newswires

September 24, 2021 01:59 ET (05:59 GMT)

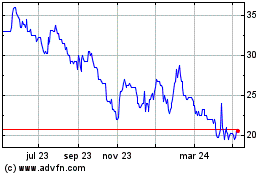

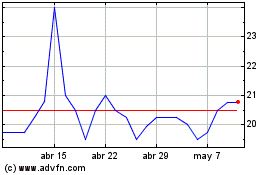

Iofina (LSE:IOF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Iofina (LSE:IOF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024